Nuances and rules for using the tariff schedule by category

Any enterprise, regardless of the form of business, pays its employees unequally, as indicated in the staffing table, but the ratio of employee salaries at the enterprise is fixed in the tariff schedule.

What is the tariff schedule by category?

When forming the tariff schedule, the following is taken into account:

- Intensity of workload;

- Harmfulness and danger of production;

- Length of working time and length of service of an employee in one position;

- Industry, since each type of production uses its own coefficients;

- Employee qualifications;

- Features of climatic conditions.

Important: the cost of an employee’s hour of work is always used as a basis in the tariff schedule.

The amount of work performed per shift can be taken into account, but it is subsequently still divided into the number of hours in a shift or working day. This leads to the calculation of the employee’s hourly rate in any production.

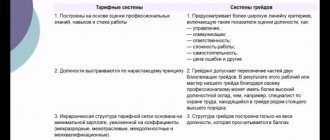

The differences between the tariff system and the grading system are discussed in this video:

Important: rates and increased salaries may not depend on categories. The tariff schedule is formed according to categories, usually 6 categories are used in its formation, this system is used mainly for budgetary institutions.

The salary of each employee depends on the coefficients used.

Application of tariff schedule in organizations

Remuneration for labor in production is formed in accordance with the legislation of Art. 143 – 145 of the Labor Code of the Russian Federation and when using tariff and qualification directories.

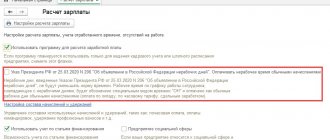

Labor Code of the Russian Federation Article 143. Tariff systems of remuneration

Tariff remuneration systems are remuneration systems based on a tariff system of differentiation of wages for workers of different categories. The tariff system for differentiating wages for workers of different categories includes: tariff rates, salaries (official salaries), tariff schedule and tariff coefficients. Tariff schedule is a set of tariff categories of work (professions, positions), determined depending on the complexity of the work and the requirements for the qualifications of workers using tariff coefficients. Tariff category is a value that reflects the complexity of work and the level of qualifications of the employee. Qualification category is a value that reflects the level of professional training of an employee. Tariffication of work - assignment of types of labor to tariff categories or qualification categories depending on the complexity of the work. The complexity of the work performed is determined based on their pricing. Tariffication of work and assignment of tariff categories to employees are carried out taking into account the unified tariff and qualification directory of works and professions of workers, the unified qualification directory of positions of managers, specialists and employees, or taking into account professional standards. These reference books and the procedure for their use are approved in the manner established by the Government of the Russian Federation. Tariff systems of remuneration are established by collective agreements, agreements, local regulations in accordance with labor legislation and other regulatory legal acts containing labor law standards. Tariff systems of remuneration are established taking into account the unified tariff and qualification directory of works and professions of workers, the unified qualification directory of positions of managers, specialists and employees or professional standards, as well as taking into account state guarantees for remuneration.

These directories are a list of activities and various professions that are available in enterprises and institutions. They fully contain the characteristics and qualifications, as well as the complexity of all types of professions. In addition, they indicate the requirements for the skills and experience of workers and determine their degree of responsibility.

Important: the directory is intended to determine and assign a rank to each employee.

Of course, at an enterprise, management has the right to develop its own tariff and qualification directory, taking into account the specifics of the organization’s activities.

Important: in this case, the guarantees and rights of the employee should not be infringed; in particular, work should not be paid below the minimum wage.

You can find out what the regional coefficient and the northern premium are and how they are calculated by following the link.

An example of a tariff schedule by category.

The labor evaluation process is established by order of the manager. In addition, all the nuances regarding tariffs can be specified in the collective agreement.

Unified tariff schedule for employees of budgetary organizations

Budgetary enterprises are required to use only directories developed by the state, since they use legalized salaries based on the example of the minimum wage, to which are added various allowances and other payments.

Important: if an employee has a decent amount of experience in this structure, then he has the right to receive increased bonuses and a high coefficient is used in calculating his salary.

At the moment, an industry tariff schedule is used, since its single version was canceled in 2007; according to this tariff schedule, each industry has its own base salary and coefficient.

How are wages regulated?

According to new developments regarding the spending of the wage fund on various incentive payments, professional state standards are used, according to which the work of each official or employee is assessed taking into account the effectiveness of his activities.

But the problem of inadequate assessment of work remains, since the old distinction between the manager and the employee works, and the professionalism of the latter is not taken into account.

In addition, officials are prone to misuse of funds for other purposes.

How and in what amount a salary advance is paid - read in this article.

Classification according to new standards

Classification in the tariff schedule is based on several components:

- Industry;

- Government and commercial organizations;

- Division within the enterprise.

In addition, rates are based on:

- A centralized act established by the authorities;

- Contractual basis – collective agreement.

In this case, a new remuneration system is applied, but taking into account the old principles.

Payment categories and coefficients.

Rank coefficients and rates for payment

The coefficients used may vary depending on the industry of application, but for budgetary organizations fixed indicators are used in almost any area.

For example, for budgetary organizations in medicine the following figures are used:

| 1 | 1 | 1 100 |

| 2 | 1,04 | 1 144 |

| 3 | 1,09 | 1 199 |

| 4 | 1,142 | 1 256,2 |

| 5 | 1,268 | 1 394,8 |

| 6 | 1,407 | 1 547,7 |

| 7 | 1,546 | 1 700,6 |

| 8 | 1,699 | 1 868,9 |

| 9 | 1,866 | 2 052,6 |

| 10 | 2,047 | 2 251,7 |

| 11 | 2,242 | 2 466,2 |

| 12 | 2,423 | 2 665,3 |

| 13 | 2,618 | 2 879,8 |

| 14 | 2,813 | 3 094,3 |

| 15 | 3,036 | 3 339,6 |

| 16 | 3,259 | 3 584,9 |

| 17 | 3,510 | 3 861 |

| 18 | 4,500 | 4 950 |

Important: in this case, if an employee works in a rural area, then 25% of the base salary is added to his salary.

If this is a deputy, then his salary is 10 - 20% lower than the manager, taking into account qualifications, degree, honorary title.

Examples of payment calculations

If time wages are used, then the number of hours worked is simply multiplied by the rate per hour.

The employee worked 150 hours in a month, his rate per hour is 134 rubles, it follows that he earned:

150 * 134 = 20,100 rubles per month.

Since he fulfilled the plan, according to the collective agreement he is entitled to a bonus in the amount of 20% of his earnings, that is:

- 20,100 * 0.2 = 4,020 rubles premium. Here you will find out the rules by which monthly bonuses are calculated for employees.

- 20,100 + 4,020 = 24,120 rubles earnings.

In addition, he has a 5th category, and this involves using a coefficient of 1.268, which indicates the employee’s earnings in a given month are 30,584.16 rubles.

Important: if an employee does not fulfill the plan, the employer has the right to deprive him of the bonus.

Conclusion

How to build an effective wage system in an enterprise - see here:

A tariff rate is... or everything about the tariff rate

Let's now figure out how to calculate the hourly tariff rate for working citizens with total accounting of working hours. The calculation takes into account the standard working hours established in the current year. For this reason, when answering this question, you must first look at the production calendar to find out the established hours for the current calendar year and each month. The hourly tariff rate can be calculated in 2 ways, but in any case, you need to know the monthly tariff rate.

We recommend reading: The bailiffs described the property in the apartment without parents in the presence of the child, they are right

Monthly rates are used in cases in which the employee’s working hours always and fully coincide with the norm provided for by the production calendar (i.e., when calculating the employee’s monthly salary, the actual number of days and hours worked per month is not taken into account). If a worker has worked a month in full, then when calculating his salary, the established monthly rate is used.

https://youtu.be/kMhTe7olEug

Tariff schedule for state employees for 2020

Each employee's salary is calculated individually. It directly depends on the number of hours worked and the amount of work completed. These indicators form the basis of the so-called tariff rate. The latter is used by accountants for monthly calculations. Each position in the employment contract has its own rate.

What is the tariff schedule

The system has been used since Soviet times. The mesh is used both in budgetary institutions and in commercial ones. The tariff schedule is a fixed pattern in the form of a table between the employee’s rank and the tariff rate . Using these indicators, the employee's salary is calculated.

One of the components of the system is the discharge . It means the professional classification of an employee, which is determined using different categories (level of education, job responsibilities, length of service, etc.). The category shows the real possibilities of using personnel in production, and also allows you to optimize labor productivity in the enterprise.

Application algorithm

Staff salaries are calculated in accordance with regulations at the federal and regional levels, in particular Art. 143-145 of the Labor Code of the Russian Federation. The employee’s rank is determined using a unified tariff and qualification directory . It contains a list of various professions and their evaluation characteristics. The requirements for the employee’s professional skills and level of responsibility are also indicated.

The legislation does not prohibit the development of your own directories, which take into account the specifics of the enterprise’s activities. The employee certification process begins with an order from the manager . In this case, all the nuances are discussed in the collective agreement of the enterprise. These local acts should not infringe on the rights of employees, and the level of wages should not be lower than the minimum wage.

Budgetary organizations use only state directories; they do not have the right to use others.

Unified tariff schedule for public sector employees

Previously, wages for public sector employees were calculated according to a single tariff schedule . It provided for 18 working categories and coefficients from 1 to 10.7. The base rate was set by the Government of the Russian Federation. In 2007, this accrual system was modernized.

Regulation of wages

New amendments to the Labor Code of the Russian Federation affected wages, which included incentive payments. As before, bonuses for public sector employees are calculated based on the results of work performed for a specific period. Money for this is allocated from the wage fund, which is formed based on the staffing table of the enterprise .

The budgetary institution distributes incentive payments among employees in accordance with Order of the Ministry of Health and Social Development of the Russian Federation No. 822 dated December 29, 2007. The director of the enterprise signs an order appointing a commission, which includes at least 3 people. At the same time, a trade union member must be present.

The purpose of the meeting is to evaluate the quality of work of each employee by assigning points. However, the criteria that will be used for this analysis must be specified in the collective agreement. You can calculate the price of one point for an employee as follows :

- set the size of the incentive fund;

- summarize all points received by employees;

- the fund amount is divided by the total number of points;

- the resulting fixed cost is multiplied by the employee’s result.

The commission's findings are recorded in the minutes . After this, incentive payments are distributed among employees, according to the conclusion made. The size of the bonus for each employee is prescribed in the order. After signing this document, the accounting department calculates payments.

The following requirements apply to the work of the commission:

- Objectivity: Employee performance must be fairly assessed.

- Adequacy . The amount of the premium must correspond to the conclusion of the commission.

- Transparency . Each employee has the right to know what evaluation criteria the commission used and what amount of incentive payments he is entitled to.

- Timeliness . Bonuses, allowances and other required payments specified in the appendices to the collective agreement must be accrued to the employee immediately after the work done.

Classification according to new standards

It is recommended to carry out tariffication of work and establish the professional level of blue-collar professions according to the state unified tariff reference book. It contains the most complete list of job characteristics, their complexity, correct requirements for the level of knowledge and skills of workers, etc.

This classifier is divided into several sections , each of which is dedicated to a specific industry. Moreover, all parts of the directory were approved by orders of the relevant ministries. Here some articles are approved by the State Committee for Labor of the USSR or the Ministry of Labor of the Russian Federation. Despite the fact that the directory is periodically updated, it still has many standards for types of work that were developed a long time ago.

The qualifications of management employees are also unified . A unified qualification directory of positions for managers, specialists and employees is dedicated to these labor categories. It contains the main types of positions . The latter are divided into the following categories:

This guide is divided into 2 parts. The first covers production areas of business, the second concerns design, research and development areas of activity. Job characteristics include the following sections :

- job responsibilities, that is, the main job functions of the employee;

- level of knowledge, including standards relating to the activities of the enterprise;

- work experience and professional training.

Rank coefficients and payment rates

According to labor legislation , 18 work categories are provided for public sector employees ; the current minimum wage is usually used for the monthly (basic) tariff rate. As of January 1, 2020, its size was 11,280 rubles. An example grid might look like this:

| Discharge | Tariff coefficient, % | Monthly rate, rub. |

| 1 | 1,00 | 11 280 |

| 2 | 1,10 | 12 408 |

| 3 | 1,23 | 13 874,4 |

| 4 | 1,36 | 15 340,8 |

| 5 | 1,51 | 17 032,8 |

| 6 | 1,67 | 18 837,6 |

| 7 | 1,84 | 20 755,2 |

| 8 | 2,02 | 22 785,6 |

| 9 | 2,22 | 25 041,6 |

| 10 | 2,44 | 27 523,2 |

| 11 | 2,68 | 30 230,4 |

| 12 | 2,89 | 32 599,2 |

| 13 | 3,12 | 35 193,6 |

| 14 | 3,36 | 37 900,8 |

| 15 | 3,62 | 40 833,6 |

| 16 | 3,90 | 43 992 |

| 17 | 4,20 | 47 376 |

| 18 | 4,50 | 50 760 |

Each industry has its own coefficients and rates, but the wage calculation scheme is the same for all public sector employees.

Legal basis

The calculation of wages for employees of budgetary and commercial organizations is regulated by the Labor Code of the Russian Federation, in particular Chapter 21. The new system of calculating wages for budgetary employees was approved by Decree of the Government of the Russian Federation of August 5, 2008 No. 583.

The rules for calculating incentive amounts (bonuses, allowances, etc.) are described in Order of the Ministry of Health and Social Development of the Russian Federation No. 822 dated December 29, 2007. In addition, it is necessary to take into account local regulations that apply to budgetary organizations.

If difficulties arise in the area of calculating wages, it is recommended to contact the regulatory authorities. The latter often identify them during regular inspections of enterprises.

You can learn more about tariff schedules in the video below.

The base rate and tariff schedule for calculating salaries of public sector employees have been established

The Council of Ministers established the base rate, as well as the tariff schedule for remuneration of employees of budgetary and equivalent organizations, which will begin to operate on January 1, 2020.

This was done by Resolution No. 138 of February 28, “On remuneration of employees of budgetary organizations,” published today on the National Legal Portal.

In particular, the base rate will be 180 rubles. There will be 18 tariff categories, with the coefficient for category 1 being 1.00, and for category 18 – 3.00.

| Discharge | Coeff. | Discharge | Coeff. | Discharge | Coeff. |

| 1 | 1,00 | 7 | 1,47 | 13 | 2,17 |

| 2 | 1,07 | 8 | 1,57 | 14 | 2,31 |

| 3 | 1,14 | 9 | 1,68 | 15 | 2,47 |

| 4 | 1,21 | 10 | 1,79 | 16 | 2,63 |

| 5 | 1,29 | 11 | 1,91 | 17 | 2,81 |

| 6 | 1,38 | 12 | 2,03 | 18 | 3,00 |

The said resolution also instructed to determine the terms of remuneration for employees of government agencies who are not civil servants and military personnel, or employees of paramilitary organizations who have special ranks.

With the exception of employees providing operations and maintenance of government agencies, and employees of the Department of Humanitarian Activities of the Presidential Administration who are not civil servants.

This item must be completed by June 1, 2020. The Ministry of Labor and Social Protection will carry out the task.

Resolution of the Council of Ministers No. 138 was adopted in pursuance of subclause 16.1 of clause 16 of Presidential Decree No. 27 of January 18 “On remuneration of employees of budgetary organizations.”

This decree changes the system of calculating salaries for public sector employees from January 1, 2020.

In particular, instead of the first category tariff rate, a base rate is introduced. Its size was to be determined by the Council of Ministers by March 1. It was planned that it would be close to the subsistence level budget.

Also, among other things, a uniform differentiation of tariff rates is established through the introduction of an 18-bit tariff scale instead of a 27-bit one with a difference between the coefficients of at least 6 percent.

Salaries for public sector employees in 2020 in Russia

In each region, the number of representatives of the public sector makes up the bulk of the population. Not all regional budgets are today capable of fulfilling the task set by the “May Decrees”. The government promises a radical change in the situation with salaries of public sector employees in 2020 in Russia.

- Moscow – 18,742 rubles;

- Moscow region – 13,500 rubles;

- St. Petersburg – 17,000 rubles;

- Tula region – 13,000 rubles.

- Nenets Autonomous Okrug - 14,260 rubles;

- Magadan region – 19,500 rubles;

- Republic of Sakha – 17,388 rubles;

- Kamchatka Territory - 16,910 rubles;

- Yamalo-Nenets Autonomous Okrug - 16,299 rubles;

- Sakhalin – 15150 rub.

We recommend reading: Up to what limit is the child deduction available in 2020?

A new salary calculation scheme has been invented for state employees. The Ministry of Labor explained what will change

January 19, 2020 at 21:22 FINANCE.TUT.BY Starting in 2020, a new wage scheme will be introduced for public sector employees. The main change is that the first category tariff rate will be replaced by a base rate, which they intend to increase to the subsistence level. At the same time, the authorities promise that the salaries of public sector employees will not decrease due to the planned changes.

The photo is for illustrative purposes only. Photo: Anzhelika Vasilevskaya, TUT.BY

What will the salary of state employees consist of?

Starting from 2020, the salary of public sector employees will consist of salary, incentive payments - allowances and bonuses, as well as additional payments, the Ministry of Labor reports. “The amount of these payments will be determined from the salary or the base rate. Various types of coefficients and increases will be excluded from wages. The number of allowances and additional payments will be reduced as much as possible,” the department clarifies. They intend to bring the size of the base rate closer to the size of the subsistence level budget. This figure has been 214.21 rubles since November 1 last year. “This will strengthen the tariff part of wages,” the Ministry of Labor explains. The size of the base rate, as now the size of the first category tariff rate, will be determined annually by the government. As a rule, from January 1. The government must approve the base rate by March 1 of this year, which will be in effect from January 1, 2020. Note that previously it was planned to bring the tariff rate closer to the size of the subsistence level budget by 2020. This was provided for by the general agreement between the government, the republican association of employers and trade unions for 2020–2018. However, this plan failed to be carried out. The last time the tariff rate of the first category for calculating the salaries of employees of budgetary organizations was increased from October 1, 2020 - from 34 to 35.5 rubles.

What payments will public sector employees be able to claim in addition to salary?

At the same time, public sector employees will be centrally established with bonuses for length of service in budgetary organizations in the following amounts from the base rate for length of service: up to 5 years - 10%; from 5 to 10 years - 15%; from 10 to 15 years - 20%; from 15 years and above - 30%. In addition to bonuses for length of service, state employees will be able to receive bonuses

5% of the salary,

a one-time payment for health improvement

(0.5 of the employee’s salary, unless another amount is established), as well as

financial assistance

(0.3 of the employee’s average monthly salary). At the same time, the specific amounts of bonuses, one-time payments for health improvement and financial assistance, as well as their procedure and payment conditions will be established by the heads of budgetary organizations. State employees will also receive allowances and surcharges. For example, an allowance for working under a contract form of employment, additional payment for an academic degree and academic title, for working overtime, on holidays, public holidays, weekends, as well as for working in harmful or hazardous working conditions. Earlier, the Ministry of Labor noted that the current system of remuneration for employees of budgetary organizations is a “cumbersome system” that is already several decades old. The minister clarified that the payment system for public sector employees has become overgrown with a large number of allowances and has turned out to be unbalanced.

How will the unified tariff scale change?

Instead of a 27-bit unified tariff scale, an 18-bit tariff scale will be introduced. This grid is used to determine the amount of remuneration for employees of budgetary organizations. The government must approve a new tariff schedule by March 1 of this year, which will come into effect on January 1, 2020. At the same time, salaries of public sector employees, as planned, should not fall after the introduction of changes. “With the introduction of a new wage system from January 1, 2020, a reduction in the amount of accrued wages (without bonuses) for employees of budgetary organizations that were in effect at the time of the introduction of new wage conditions is not allowed,” the Ministry of Labor notes. *** If you work in the public sector and are ready to talk about your income and expenses for journalistic material, then write to an e-mail marked “public sector”.

Public sector employees' salaries in 2020: will there be an increase?

Salaries immediately increased for 3 million workers, of whom about 50% are employed in budgetary organizations. The Ministry of Labor noted that increased salaries are now being received by employees in the education sector (approximately 18% of them previously received wages below the subsistence level), medical workers (junior staff), employees of federal cultural and scientific institutions, as well as those who serve the activities of budgetary organizations (for example, engineering and technical personnel, plumbers, programmers, electricians, mechanics, cleaners).

According to officials, the incomes of Russians representing public sector sectors will soon be as close as possible to the level of average salaries in the country. It was announced that by 2020 the government is going to introduce a number of innovations, including the following points:

A new tariff schedule and base rate have been established for public sector employees. Salaries shouldn't fall

The government has approved a new tariff schedule and base rate for remuneration of public sector employees. Let us remind you that starting from 2020, the first category tariff rate, which is currently used to calculate salaries for employees of budgetary organizations, will be replaced by the base rate. Now the authorities have established that the base rate will be 180 rubles.

The photo is for illustrative purposes only. Photo: Alexander Chuguev, TUT.BY

This year, wage increases for public sector workers are planned for May and September of this year. Finance Minister Maxim Ermolovich announced this today, Interfax.by reported. The year 2020 for public sector employees began with a drop in average salaries; in January they were 112.4 rubles less compared to December.

The average salary of public sector employees in Belarus at the end of 2020 was expected to increase, according to government forecasts, to 760 rubles. In fact, it was not possible to reach the forecast figure, as in 2020, although the authorities increased the earnings of employees of budgetary organizations. I planned to reach the average salary in budgetary organizations at the level of 80% of the national average, but at the end of 2020 this figure was 77%.

The new tariff schedule and base rate for remuneration of public sector employees were established by Resolution of the Council of Ministers No. 138 of February 28, 2020.

Earlier, the Ministry of Labor reported that they intend to bring the base rate closer to the size of the subsistence level budget. This figure has been 216.9 rubles since February 1.

“This will strengthen the tariff part of wages,” the Ministry of Labor explains. Previously, it was planned to bring the tariff rate closer to the size of the subsistence level budget by 2020. This was provided for by the general agreement between the government, the republican association of employers and trade unions for 2016–2018. However, this plan failed to be carried out.

The size of the base rate, as now the size of the first category tariff rate, will be determined annually by the government. As a rule, from January 1.

Resolution of the Council of Ministers No. 138 also sets out a new tariff schedule, which will come into effect on January 1, 2020. Let us remind you that instead of a 27-bit unified tariff scale, an 18-bit tariff scale will be introduced. This grid is used to determine the amount of remuneration for employees of budgetary organizations.

Previously, the Ministry of Labor noted that when new wage conditions are introduced, a reduction in the existing level of salaries of public sector employees is not allowed.

If you work in the public sector and are ready to talk about your income and expenses for journalistic material, then write to an e-mail marked “public sector employee”.

Determination of the minimum tariff rate of the 1st category

2. As the basis for calculations, you can choose the minimum monthly wage established by the Government of the Russian Federation, or the minimum tariff rates established in the constituent entities and municipalities of the Russian Federation for remuneration of public sector workers.

We recommend reading: Benefits for labor veterans in 2020 Stavropol for travel to Tolyatti

The first stage of developing intra-production tariff conditions is to determine the minimum tariff rate of the 1st category,

i.e., the minimum level of wages per unit of time for performing work of the lowest level of complexity, the smallest group of importance for the enterprise, under normal conditions and with normal intensity.