Home / Labor Law / Payment and benefits / Wages

Back

Published: 01/12/2018

Reading time: 9 min

0

5489

The organization of remuneration is an important element of the work of any enterprise, and each of them has its own approaches to solving this issue. The choice of one or another remuneration system depends on many factors: the field in which the company operates, the specifics of its activities, the number of employees, etc.

The characteristics of existing payment systems (tariff and non-tariff), as well as their advantages and disadvantages, will be discussed further.

- What is a wage system

- Tariff system Main elements Tariff rate

- Salary

- Tariff coefficient

- Tariff schedule

- Floating salary system

Dear readers! To solve your problem, call hotline 8 or ask a question on the website. It's free.

Ask a Question

Concept, signs and characteristics

A non-tariff remuneration system is an alternative to the tariff system, where it is based on a qualification level, set for each employee individually and revised if necessary.

This is the opposite version of the tariff system, implying a rate in monetary terms, although the workers will not have a salary and no idea what the salary will be at the end of the month worked.

The new system is being introduced today at many enterprises everywhere. Payment to employees directly depends on the amount of work performed.

The main features of a tariff-free system:

- close connection between the wage fund and the level of wages;

- establishing for each employee a coefficient directly proportional to the coefficient of labor participation and the qualification level of employees based on performance results;

- no payment for night hours, holidays and weekends;

- no bonuses for extra hours worked, although they can be made at the request of the employer.

On a note! If an enterprise switches to a tariff-free system, then this must be reflected in local documents. Employers must inform employees upon hiring or explain at the time of drawing up the employment contract how work will be paid under this system.

Fine tuning

Determining the criteria for evaluating labor has become one of the main components of the salary reform. “In this project we went from top to bottom. We started by developing standard approximate proposals for each of the budget sectors,” says Mikhail Kotyukov. “Initially it was assumed that the main contribution to the development of indicators would be made by the teams themselves.” The expectations were justified: according to Mr. Kotyukov, already 2.5 months after the start of the experiment, many of its participants developed the criteria for “fine tuning.”

School performance indicators include, for example, children’s participation and victories in olympiads and competitions, Unified State Examination results, publications by teachers, classroom design, successful mastery of new methods and educational programs, and additional classes with students. In sports institutions, compliance with standards and timely completion of medical examinations are taken into account.

“The criteria for the work of medical staff is to improve the quality and accessibility of medical care,” says Galina Katsyna, chief physician of the regional dermatovenerological dispensary, one of the participants in the experiment on the implementation of NSOT. — We do not award points to our employees if they receive complaints or violations of professional ethics occur. We evaluate how the sanitary and epidemiological regime is observed, all the requirements of supervisory authorities, as well as the quality of the prescribed treatment and its effectiveness.”

The most important thing in selecting performance evaluation criteria is not quantity, but transparency and the possibility of their quantitative measurement, and therefore objectivity. Information about the final indicators should be widely available. As Mikhail Kotyukov believes, each employee must clearly understand what exactly he receives money for, and realize that the salary for the general starting set of job responsibilities can vary significantly. In this regard, psychological problems come to the fore. “The transition to a new wage system in the public sector is more socio-psychological than economic-financial,” notes the former Minister of Finance.

Ms. Katsyna says about the same thing: “Our people are not used to the fact that, working in one position, you can get paid in different ways. If earlier it was possible to sit still and do nothing, receiving the same amount as those who conscientiously fulfill their duties, now salaries are calculated individually.”

Alexey Kleshko, deputy of the Legislative Assembly of the Krasnoyarsk Territory:

— Unlike the commercial sector, which is profit-oriented, and therefore wages here are initially a measure of the employee’s contribution to achieving this result, the public sector remained largely Soviet. Here they still rely on documents dating from the first half of the last century. At the same time, citizens are raising more and more questions about budgetary institutions, or more precisely, about the quality of their services.

It is obvious that changes are possible only if each employee feels that his work affects the quality of services of the entire institution, and therefore receives daily assessment not only from superiors and colleagues, but also from fellow citizens. After many years of equalization, it is not so easy to identify criteria for assessing the work of public sector employees, agree on them, and present management’s subjective ideas about quality in the form of a normative document. Therefore, I think our task is not to impose some models borrowed from scientific works, but to invite institutions and their teams to carry out creative work in the field of management.

Goals and objectives

The main goal of the tariff-free system is to motivate employees to improve the efficiency and quality of their own work. Each worker will receive a coefficient in the form of a salary, taking into account the general reserve fund of the enterprise.

The percentage may vary and depend on the qualifications and quality of work of each individual employee.

The goal of introducing a tariff-free system is to increase labor productivity and the quality of staff work. This form of payment is more understandable and simpler for workers when it directly depends on the labor coefficient.

But it is still more advisable to introduce BSOT in small enterprises (private firms), where the staff is small or performs temporary duties, when it is not burdensome to calculate the labor participation rate individually.

Salaries in growth

The transition to NSOT is carried out within the framework of the Law of the Krasnoyarsk Territory “On new systems of remuneration for employees of regional state budgetary institutions,” which was adopted at the end of October last year and was the result of long-term painstaking work by government structures at various levels. According to the ex-Minister of Finance of the region, who recently moved to work at the Ministry of Finance of the Russian Federation, Mikhail Kotyukov, the relevant committee of the Legislative Assembly for the preparation of the project literally “carried out this law in its hands.”

The law regulates the new procedure for remuneration. The salaries of state employees will now consist of three parts. Firstly, from a permanent salary: its size is determined by the employee’s position, level of qualifications and work experience. Secondly, from compensation payments: these are charges for harmful working conditions and other features of work. And finally, thirdly, from incentive payments that will be accrued depending on the qualitative and quantitative indicators of the employee’s work.

The law guarantees that as a result of the introduction of NSOT, wages in the public sector will not decrease. Her basic level of experience, education and category will be maintained. It is no secret that this is a small amount, but in general its size corresponds to the general state of affairs in the Russian economy, with its level of labor productivity and volume of goods produced.

However, while maintaining the basic level of salaries, the new remuneration system will significantly increase the material security of public sector employees. Thanks to incentive payments, their earnings can increase to 60–70%. Funds for this will be provided by the state and local authorities, and will also come from the extra-budgetary part of the income of budgetary organizations themselves. But this will not be the same increase for everyone; it all depends on the contribution of each employee and the results of his work.

“At first, workers were afraid that their wages would decrease. Therefore, there were cases when they refused to sign an agreement on the transition to NSOT,” says Marina Kuznetsova, Deputy Minister of Health of the Krasnoyarsk Territory for financial and economic issues. “However, after two months of work, the staff of the institutions became convinced that wages in the NSOT are not decreasing, and if desired, they can be increased.”

“When introducing the system, our main condition was met: the wage fund must be increased. We were heard. As a result, the regional government initially allocated 200 million rubles for incentive payments,” says Oleg Isyanov, chairman of the Federation of Trade Unions of the Krasnoyarsk Territory.

The role of trade unions in the process of transition to NSOT is difficult to overestimate. According to Mikhail Kotyukov, without trade union organizations, the experiment of transitioning to new principles of remuneration would be practically impossible. According to him, every line of the regulatory act was agreed upon in detail with the trade unions.

“We are satisfied that almost four years of work have been successfully completed,” says Oleg Isyanov. — The provisions and recommendations for the implementation of a new system of remuneration for public sector employees, which were implemented in the form of a law, were developed jointly with the Government of the Krasnoyarsk Territory and line ministries with our direct participation. As a result, all municipal sectoral institutions and budgetary organizations of the region received “guidance for action.”

Oleg Isyanov, Chairman of the Federation of Trade Unions of the Krasnoyarsk Territory:

— I see only advantages in this project. Firstly, the new remuneration system encourages everyone to do their work better, and we are all consumers of budget services. And secondly, the new rules allow those who do good work to get paid more. Trade unions play a very direct role in the transition to a sectoral system of remuneration for public sector employees, and it is good that the Government of the region understands this and listens to the opinion of trade union organizations.

Employee qualification level

The qualification level is the basis of the tariff-free system, characterizing the actual productivity of employees.

Awarded to each team member individually. It is predetermined as a private number by dividing the actual salary for the past month by the minimum level of payment prevailing at the enterprise for the current month. The qualification level is predetermined for each group of personnel and is for:

- heads of departments - 3-6 points;

- workers - 3.1-1.8 points;

- employees without qualifications - 1 point with salary calculated as a percentage taking into account the total salary.

The tariff-free system provides unlimited opportunities for employees to grow their skills. Even without a rank, you can count on a quite decent salary, because the individual characteristics of the employees will play a role.

The qualification level may be modified by decision of the labor council, i.e. Earnings for some workers will increase, while for others they will decrease.

With a non-tariff wage system, 3 components are taken into account: the labor participation rate, the amount of time worked, and the qualification level.

The concept of a tariff-free wage system

The non-tariff system is an alternative to tariff wages and piecework methods of remuneration, where earnings are strictly tied to the number of hours worked, the volume of products produced, the qualifications of the employee, etc.

The tariff-free system is based on the employee’s qualification coefficient and the amount of labor contribution he makes. The qualification coefficient is an indicator of the personal effectiveness of a particular employee; it changes every 1-12 months and is determined by various methods.

In addition to the qualification coefficient, the following indicators influence an employee’s salary in a non-tariff system:

- actual time worked;

- wage fund size;

- labor contribution coefficient;

- number of employees in the organization;

- qualification level of other employees.

The level of education, specialization and work experience do not affect the size of the salary. The salary fund is common to all employees of the company and depends on the profit received and the total efficiency of the employees.

In addition, the governing bodies have the right to change the size of the salary fund depending on the economic situation at the enterprise.

Labor participation rate and relationship with the minimum wage

The tariff-free principle of salary calculations involves the use of a coefficient directly proportional to the share of the enterprise’s general fund.

The coefficient is calculated taking into account the following criteria:

- the worker's personal contribution to production;

- qualification level, the ratio of wages for the reporting period to the minimum wage rate for the same period;

- level of complexity of the work performed;

- number of operations performed, products produced.

It is permissible to increase the coefficient by several criteria at once. A single indicator or rating will reflect the level of performance of each employee individually.

The coefficient is assigned by the head of the enterprise or directly by the employees at a collective meeting. The main thing is to document this remuneration model.

Salaries are calculated according to the tariff system of remuneration according to the basic formula:

FZP / OKTU * KTU, in which the concept of minimum wage (minimum wage) is absent

Although, according to the Labor Code of the Russian Federation, this is an unacceptable fact in production, i.e. the non-tariff model for calculating wages must in one way or another be related to the minimum wage. Regardless of the amount of work performed, each employee must receive a minimum amount of money for payment.

Earnings when making payments using a tariff-free system are based on a certain amount of money earned by employees. Although this does not at all limit the management of the enterprise from rewarding workers with additional pay and bonuses.

First step

However, increasing wages, although of great importance, is not the end in itself of reforming the wage system. More important strategic objectives are to increase the efficiency of the public sector and make the procedure for providing services more transparent for all recipients. People who visit budgetary institutions should see that the salary of a doctor, teacher, kindergarten teacher, coach or social worker largely depends on them. The criteria for evaluating the work of public sector employees will take into account “feedback”: the presence of complaints, the results of surveys of visitors and other similar indicators.

“The introduction of NSOT is only the first step of a long journey,” says Mikhail Kotyukov. “It will be followed by other measures to reform the budgetary sector: the emergence of a new type of government institutions, expanding the scope of their powers and independence.” A bill on changing the types of budgetary organizations is currently being discussed at the federal level. Great importance is attached to the transition of some of them to autonomous status - there are already more than 50 such institutions in the region - which allows state employees to join the system of market relations: earn additional funds, implement their own development programs. Creating a competitive environment will ultimately lead to increased efficiency throughout the public sector. In the future, all budget organizations in the Krasnoyarsk Territory will transition to a sectoral wage system. This is about 300 thousand people, almost a third of the entire working population.

text: Tatyana Aleshina photo: Eduard Karpeikin Magazine “Adviser. Competent management"

Payroll distribution

The form of remuneration may be different, but directly depends on the specifics of the enterprise. Payroll distribution is carried out according to the following algorithm:

- the qualification level is multiplied by the labor participation coefficient and the number of hours worked;

- points are calculated by summing all team members;

- a quantitative indicator is calculated taking into account the wage fund, for which the amount of the fund is divided by the total indicator and the balance of employees in the aggregate;

- The share for each participant is determined by multiplying the cost of one point by the indicators of the work performed.

From quantity to quality

Despite the fact that the results of the introduction of NSOT in Russia are assessed differently, statistics clearly speak in favor of the reform. According to monitoring data from the Ministry of Health and Social Development of Russia, which analyzed the situation in almost 11,000 federal budgetary institutions of the country, over the year (from October 2008 to September 2009), the average monthly salary of public sector employees increased by 18% and amounted to 25.3 thousand rubles. It is interesting that, according to Rosstat, in October 2009 the average salary in the country as a whole reached only 18.65 thousand rubles. “Salary scales” swung in the other direction for the first time.

The Krasnoyarsk Territory is still at the very beginning of its journey. However, it is already possible to evaluate the positive aspects of innovations.

Irina Perevalova, director of Lyceum No. 7, participating in the experiment, Fr.

“Over two months, the increase in wages at the regional dermatovenerological dispensary ranged from 1 to 40%,” says Galina Katsyna. — In general, we can say that the situation of workers has not worsened, and for some it has improved. I would like to note that it is now unprofitable for medical staff to work together. This is not bad: if previously it was necessary to increase the amount of work, now it is enough to work at one rate, which means improving the quality of patient care.”

Marina Kuznetsova makes general conclusions about how the NSOT “takes root” in medical institutions of the region: “Already the first results of implementing the system in health care institutions (5 regional and 1 municipal) showed that there was an objective increase in workers’ wages: from significant (the increase amounted to 3.5 thousand rubles) to the minimum (120 rubles). The wage fund was increased by 20%. Under the UTS, wages would be increased equally for everyone. And in the conditions of NSOT, everything depends on the work of a particular employee. Considering that every employee of a medical institution in his place contributes to medical and preventive care for the population, ultimately the health of the nation improves.”

Of course, the very status of the experiment means that it also reveals problematic aspects of the reform. “Of course, the system needs adjustment, and, for example, it is clear that its introduction in multidisciplinary medical institutions will not be easy. For now, I think it’s too early to draw global conclusions,” says Galina Katsyna.

Marina Kuznetsova o. However, the ministry’s specialists are ready for difficulties and consider the introduction of NSOT to be a requirement of the time.

The Federation of Trade Unions assesses the progress of the reform optimistically. “It is logical that we will test the innovations during the experiment. Since a fundamentally new system is used in remuneration, nuances are possible, believes Oleg Isyanov. “But no serious contradictions have yet been identified. It seems to me that we overcame the main difficulties at the preparatory stage, and I don’t see any big problems or risks associated with the transition to NSOT.”

Vasily Kuimov, deputy mayor of the city, head of the social policy department:

— In Krasnoyarsk, 9 budget organizations are participating in the experiment on the transition to NSOT. These are schools, a hospital, youth and sports organizations. I must say that we prepared for the experiment very seriously. The decision was made jointly with trade union organizations and labor councils, each employee gave his written consent.

A lot of work is being done at all levels. Now the experiment is going through the next verification stage, and we can say that it is going well. We recently visited Lyceum No. 7 and School No. 55, where the transition to NSOT turned out to be very effective and brought the work teams together even more. Our commission also visited the 7th hospital; there were some comments, but they should be eliminated soon. The main task we face today is to ensure that all representatives of the public sector work efficiently, the results of their work are noticed, and the work itself is rewarded according to its merits and benefits the entire society.

Stages and difficulty levels

Qualification levels of complexity provide great opportunities for stimulating personnel to perform high-quality work. So, for example, an employee with a higher rank who is not happy with his salary will be able to earn much more in the new system.

An employee’s level can be significantly increased throughout their career and regardless of whether they have special education or not.

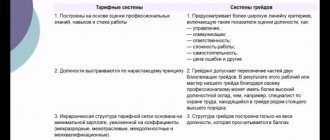

For each group of qualified workers, its own level is directly established. Let's look at the table to see what the stages and levels of complexity look like in a non-tariff wage system:

| Qualification group | Qualifying score |

| Head of the company | 4,5 |

| Chief Engineer | 4,0 |

| Leading specialists | 2,6 |

| Highly qualified workers | 2,5 |

| Unaccredited workers | 1,0 |

Many enterprises today are switching to a rating system of remuneration, which is based on the share distribution of the fund, taking into account the contribution of each employee to the results of the organization's activities. The following are taken into account:

- experience;

- the ability to use your knowledge and experience in practice;

- educational level.

Legislative justification

On August 5, 2008, the Government of the Russian Federation adopted a Resolution according to which, from December 1, 2008, public sector employees belonging to certain industries, and above all, education, will switch from the unified technical system to the NSOT. This document highlights general issues related to the new approach to the labor remuneration system in public sectors.

In Art. 144 of the Labor Code of the Russian Federation covers the procedure for documentary regulation of the payment system and other working conditions at each level of distribution of budget funds:

- federal-level institutions must reflect this procedure in collective agreements, additional agreements to employment contracts or other local regulations provided for by federal legislation;

- in regional government agencies - in the same documents, but taking into account the specifics adopted at the legislative level of the constituent entities of the Russian Federation;

- at the municipal level it will be necessary to take into account the intricacies of local government.

This law actually gives priority in establishing a remuneration system directly to the employer, that is, to the management of a budgetary institution.

Use in foreign countries and in Russia

The system is not suitable for large enterprises, where calculating coefficients for each employee is cumbersome.

The greatest effect is observed for calculating wages for employees in small enterprises or when working on a rotational basis. Abroad, a similar system with the drawing up of collective agreements at enterprises regulated by law is quite developed. For example, in England, earnings are accrued based on the results of work done. In Sweden and Denmark, many employees successfully work using a tariff-free payment system.

The process is being introduced in Germany, Italy, Greece, where the minimum wage is not established by law. The largest number of collective agreements is in Italy, since they reflect the individual achievements and quality of work of each individual employee.

In Russia, this method of calculation is still experiencing some difficulties. It is suitable exclusively for small companies and trading firms.

Options for calculating salary using a formula

The tariff-free system is suitable for use in small companies just starting their activities, where stimulation of performance plays a big role, plus the development of each employee is important.

The formula used for this is as follows:

Payroll / K (total amount) * KTU (individual employee)

Calculation occurs monthly. In this case, the size of the coefficient should be determined by a meeting of specialists, recording the result and issuing an appropriate order.

Example 1

In January, the payroll at MMM was 40,000 rubles. The team consists of 4 workers of different skill levels with the corresponding coefficients: 1.2, 1.4, 1, 1.8. The total odds are 5.4.

As a result, the salary of each employee is equal to:

- 40,000 / 5.4 * 1 = 7,407.41 rubles

- 40,000 / 5.4 * 1.2 = 8,888.88 rubles

- 40,000 / 5.4 * 1.4 = 10,370.37 rubles

- 40,000 / 5.4 * 1.8 = 13,333.33 rubles

https://youtu.be/UuEChFL_6m8

Advantages and disadvantages

Advantages of a tariff-free system:

- motivating employees to increase their own salaries;

- the ability to objectively track the growth of qualifications;

- convergence of nominal and real wages;

- the ability to maintain productivity growth even during a period of impending inflation;

- the ability to distribute salaries directly proportional to the fund, tracking the growth of qualifications of each employee.

Flaws:

- the subjectivity of the process of establishing the coefficient for each participant;

- calculating wages based on basic indicators, which also shows “equalization”;

- impossibility of issuing a full assessment of the qualification level of team members due to incomplete distribution of money from the salary fund.

https://youtu.be/9-VnF4wyDHg