What is the correct salary, bonus or time-based bonus?

- plan overfulfilment;

- achieving the established quantitative indicator;

- strict compliance with or reduction of required deadlines;

- absence of complaints, violations, complaints;

- compliance of manufactured products with certain quality criteria.

At the same time, the employer is obliged to offer the employee all vacancies available in the given locality that meet the specified requirements. The employer is obliged to offer vacancies in other localities if this is provided for by the collective agreement, agreements, or employment contracts. If there is no specified work or the employee refuses the offered work, the employment contract is terminated in accordance with paragraph 7 of part one of Article 77 of this Code. How to correctly introduce a salary-bonus system of remuneration? If the employer unlawfully refuses to pay the due bonus, the employee has the right to complain and demand payment of legal remuneration for his work.

Advantages and disadvantages of the salary payment system

The wage rate is the determining point in establishing the industrial relationship between employer and employee. The time-tested relevance of using salaries testifies to the advantages of the system, including:

- Simplicity and transparency of accrual. The salary system uses a simple formula when working out a month incompletely:

| Salary for a month not fully worked | = | Fixed salary per month of work | : | Number of working days in accordance with the enterprise work schedule | * | Total number of days worked |

If the month is worked in full, then the salary, in the absence of additional payments, is equal in numerical terms to the established monthly official salary, which eliminates the complexity of calculations for accounting and does not raise questions among employees.

- Stability and minimal staff turnover. When entering into a relationship, both parties understand what to expect from each other and have no illusions. In the event of inflation processes and an increase in the consumer price index, the staffing table is subject to revision, and the minimum within the minimum wage is provided for in Article 133 of the Labor Code of the Russian Federation.

- Standardized working hours. The emphasis in the salary system is on time worked, and overtime is paid at a double rate.

- Predictability of volumes and requirements. In the normal mode, a constant volume is provided without surges associated with seasonality, emergency situations and dependence on the final performance indicators of the enterprise as a whole.

- Planning performance results. Official salaries are included in the constant component of production costs. An enterprise can pre-calculate the break-even point, predict the result, increase or decrease the variable component thanks to wages known in advance, and award bonuses to employees in order to minimize payments to the profit budget.

- The difference between an employment contract and a civil contract

Disadvantages include the lack of motivation of workers and a collective focus on the team’s results, leading to “serving duty” in the form of working hours and reluctance to creative solutions, both their own and third-party. Any changes and movement forward can irritate employees, since in addition to the usual routine, it will require the involvement of a thought process that has become stagnant.

Time-based salary

Typically, this method of calculation is used in direct sales, various trade organizations, and some manufacturing enterprises. With a mixed form of payment, the employee is more interested in the final result. Typically, a fixed percentage due to the employee is established on the volume of goods sold or products produced.

Namely, in those types of activities where exceeding the plan is not required. The time-based wage system is the most common and effective. Currently used in most developed countries of the world.

What is the correct salary, bonus or time-based bonus?

- In local acts, collective agreements and contracts. The introduction of a salary and bonus calculation procedure can be formalized in one local act, or several regulations can be issued (for example, “On remuneration” and “On bonuses”). In them, when settling bonus issues, it is necessary to provide (clause

Question from practice: how to draw up an additional agreement if a change in the terms of an employment contract affects almost all of its contents. In some cases, a change in the terms of an employment contract may affect almost all of its contents. For example, a change in an employee’s job function may lead to a change in his rights and obligations, remuneration conditions and many other provisions of the employment contract. Therefore, if too many changes are made to the employment contract, it may become difficult to understand. To make the terms of such an agreement clear, you can use the following method.

How to draw up a salary clause?

To draw up a Regulation, you first need to decide on its content.

The document will most likely look like this:

- terms and wording used in this document. Here it is necessary to give a brief definition of all specific terms to prevent ambiguity in the interpretation of the document;

- description of the remuneration system. It is important to write this section very carefully and think through all the situations that may arise. This section contains a detailed description of the system in force in the organization: features for persons of different positions, the procedure for accrual;

- payment terms. May be different for each category of workers. Usually specific numbers are set, and a period can be specified. It is important to remember that according to labor law standards, salaries are transferred at least twice a month;

- employer's liability for late payment of wages. Possible compensation to employees for overdue wages is indicated here. You can duplicate in this section the labor legislation regulating this issue;

- validity period of the document;

- national, regional and industry regulations, based on which the document was drawn up.

Some organizations combine the Remuneration Regulations and the Bonus Regulations into one document. Then the final part of the document should contain tables explaining the procedure for calculating bonuses, additional payments, allowances, compensation and other payments.

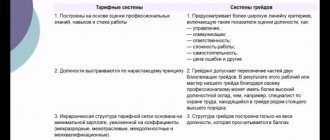

Time-bonus system or salary-bonus system

The tariff system is a set of standards that determine the amount of wages for various groups of workers. The most important elements of the tariff system are the tariff schedule, the first category tariff rate and the tariff-qualification reference book.

The recommended ratio between basic salary and bonus for employees not directly involved in decision-making at the enterprise level as a whole is 2:1 (i.e. 2/3 of earnings is the basic salary, and 1/3 is the bonus).

How to apply for a salary bonus system

When is it advisable to use time-based bonus payment? Like a simple “time-based” payment, this method of organizing the payment of remuneration is established when the enterprise does not have the opportunity to clearly correlate labor results with time worked, that is, standardization is difficult for objective reasons. This situation is created in many professional fields, for example, in education, management, many production processes, etc. The time-bonus regime is convenient because, in addition to all the advantages of time-based wages, it includes additional benefits of bonuses.

This will allow you to avoid problems in the future when submitting financial statements to the Pension Fund and the Federal Tax Service. The documents are signed, we hire the employee, fill out his personal card (this is done in the accounting program). The employee starts work and prepares to receive his salary. A few words about remuneration systems. There are a salary-bonus system and a piecework-bonus system.

Time-based form of remuneration

Despite the fact that with any form of remuneration, the employer is obliged to keep records of the working time actually worked by each employee (Article 91 of the Labor Code of the Russian Federation), it is the work time sheet under the time-based wage system that is the main document on the basis of which wages are calculated .

We recommend reading: Payments at the labor exchange during layoffs 2020

With a time-based wage system, wages are calculated based on the salary. Salary is a fixed amount of remuneration for an employee for the performance of labor (official) duties of a certain complexity for a calendar month, excluding compensation, incentives and social payments (Article 129 of the Labor Code of the Russian Federation). The employer can set not a monthly salary, but an hourly rate, which is especially convenient for employees with a flexible schedule or part-time workers. We discussed the specifics of calculating earnings for hourly wages in a separate consultation.

Building a mechanism for an effective remuneration system

Existing labor legislation allows you to set wages by making it up of several independent parts (Article 129 of the Labor Code of the Russian Federation):

- payments for the work directly performed;

- additional payments for special conditions in which this work is performed;

- incentive payments.

If the conditions for applying the first 2 parts are largely subordinate to the provisions of the Labor Code of the Russian Federation and other acts of the legislative level created in the development of these provisions of the Labor Code of the Russian Federation, then the legislator reserves the right to develop all aspects of the incentive system to the employer (Article 135 of the Labor Code of the Russian Federation). That is, each employer can create its own employee incentive system, which allows it to most effectively influence the employee’s interest in the results of his work, his desire for professional achievements and behavior in the team.

While giving the employer complete freedom to establish such a reward system, the legislator establishes only a few general restrictions in relation to it:

- it is required to document the decision to include incentive payments in the salary structure (Articles 129, 135 of the Labor Code of the Russian Federation);

- it is necessary to develop rules for the incentive system, creating them taking into account the opinions of representatives of the workforce (Article 135 of the Labor Code of the Russian Federation);

- Each employee must be familiarized with the approved rules for calculating incentive payments against his signature, since such incentives become part of his salary (Article 57 of the Labor Code of the Russian Federation).

Time-based bonus wages are

In this case, the employee will receive money only for how much he has completed, in accordance with the set prices. For example, for a unit of output a person receives 30 rubles. To earn 30,000, you need to create 10 thousand manufactured items. If a subordinate can, he has the right to increase or decrease his earnings.

What else should you pay attention to? The last type of piecework form of cash accrual is the indirect piecework system. What does she mean? This is a kind of synthesis of piecework and time-based payment. It is usually used to calculate monetary compensation for employees representing secondary personnel. Those who help the main production.

What is the correct salary, bonus or time-based bonus?

Labor Code of the Russian Federation, terms of remuneration (including the amount of salary (official salary) of the employee) are conditions that must be included in the employment contract. The employee's salary is established by the employment contract in accordance with the employer's current remuneration systems (part one of Article 135 of the Labor Code of the Russian Federation). Accordingly, to change the terms of remuneration (namely, reduce the salary), just making changes to the local regulatory act (regulations on remuneration) is not enough; it is necessary to make changes to the employment contract.

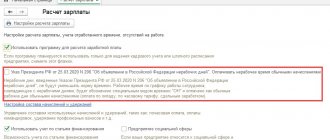

Question How to correctly follow the procedure for the Organization’s transition from a salary-based system of remuneration to a time-based bonus system? Answer Both the employee and the employer can initiate changes to the terms of the employment contract. In any case, it is necessary to conclude an additional agreement to the employment contract. You will find important information about time wages in the material here.

What you should know about the salary system of remuneration for employers - the main nuances and features

The procedure for appointing and changing the established wage system requires mandatory indication of information about it in the local regulations of the organization itself, as well as directly in the employment contract with the employee.

If these changes must be made to a previously concluded employment contract, the employer should prepare an additional salary agreement, which is signed by both parties to the relationship on a purely voluntary basis - however, if the employee refuses to sign and refuses to occupy other positions in the enterprise, he may be fired.

The salary system for shift work also has certain regulatory nuances. It is not preferable for the employer in this case - a transfer to an hourly wage would look much more profitable and convenient for all parties to the labor relationship. However, if you need to use the salary for shift work, you should first calculate the number of shifts per month. If they increase, it is recommended to recalculate the salary volumes, while if they decrease, such recalculation is unacceptable.

The very procedure for assigning a salary system requires the compulsory drawing up of a tariff schedule regulating the amounts of salaries and wages for workers with different skill levels and in different positions. The salary-bonus payment system may also imply the presence at the enterprise of a provision on bonuses or other internal regulatory document regulating the procedure for assigning bonuses and additional payments to employees.

The law prohibits setting employees' wages below the minimum wage, but the employer can be held liable only if there has been a failure to pay the employee the appropriate amount of money for a certain period of work. Thus, the salary itself may be lower than the minimum wage, provided that the difference is compensated through other payments and bonuses

In this connection, it is possible to introduce bonus wages

Each bank card corresponds to an account that the bank opens for the employee. On the day of salary payment, funds are transferred from the company's current account to the employees' accounts. We recommend reading about the types and forms of remuneration at this link. To make changes to personnel documents, the employee must submit a written application to the employer with a request to make such changes to the accounting documents and provide supporting documents (marriage certificate, divorce certificate, passport). Next, the HR employee issues an order to make changes to the accounting documents in connection with the change of the employee’s last name. The form of the order is not established by law, so it can be drawn up in any form.

This conclusion allows us to draw part 1 of Article 67 of the Labor Code of the Russian Federation. If the organization keeps a log of employment contracts, then record in it the issuance of a copy of the additional agreement to the employee.

How to apply for a salary bonus system

On the issue concerning the use of incentives and compensation payments in organizations financed from the federal budget, there are Methodological recommendations for improving the organization of wages for employees of institutions, organizations and enterprises receiving budgetary funding, based on the use of a unified wage scale, approved by a resolution of the Ministry of Labor of Russia dated November 11, 1992 No. 32. These Methodological Recommendations guide the use of additional payments, allowances and incentives for employees of public sector organizations to take into account the individual qualities of the employee, ensuring high personal productivity of his work.

The Regulations on Bonuses should disclose the methodology for calculating bonuses and other additional remuneration both for the company as a whole and for structural divisions. Bonus indicator systems and bonus amounts must be clearly thought out for each specialty or group of employees. It is better to provide for a floating bonus amount (from and up to), either as a percentage of salary, or in absolute terms. We recommend drawing up an Order on the internal work schedule of the company (start and end of work, meal breaks and technological breaks, smoking areas, recommendations on appearance, etc.).

We recommend reading: Certificate of return of goods by a legal entity

Remuneration systems: tariff, time-based, piecework, bonus

The Labor Code of the Russian Federation (hereinafter referred to as the Labor Code of the Russian Federation) gives different definitions of the terms “remuneration” and “wages” (Article 129 of the Labor Code of the Russian Federation):

“Payment is a system of relations related to ensuring that the employer establishes and makes payments to employees for their work in accordance with laws, other regulations, collective agreements, agreements, local regulations and employment contracts.

This is important to know: Forecast of the minimum wage for 2020 - 2021

“Wages are remuneration for work depending on the qualifications of the employee, complexity, quantity, quality and conditions of the work performed, as well as compensation and incentive payments.”

The tariff system is a set of legal norms and acts adopted in a centralized (legislative, social-partnership) and local manner, ensuring differentiation of wages for various categories of workers depending on the complexity of the work performed, working conditions, intensity and nature of work. The complexity of the work performed is determined based on their tariff. For public sector employees, the tariff system is established on the basis of a single tariff schedule, and in other organizations the tariff system can be determined by collective agreements, agreements, taking into account uniform tariff and qualification reference books and state guarantees for wages.

The tariff system consists of the following elements: tariff and qualification reference books, tariff schedules, tariff rates, allowances and surcharges, lists (lists) of work with difficult and harmful working conditions.

The Unified Tariff and Qualification Directory of Work and Professions of Workers (UTKS) contains tariff and qualification characteristics of workers' professions, grouped into sections by industry and type of work.

Qualification category is a value that reflects the level of professional training of an employee. The category of worker is established by tariff and qualification commissions. The higher the rank, the higher the wage, which is determined according to the tariff schedule.

Qualification reference books for employees consist of three parts: I - managers; II - specialists; III - technical performers. Qualification reference books are approved at the centralized level. They are the legal basis for the development of job descriptions in organizations that define the labor functions of workers and employees. The work of managers, specialists and employees is paid according to official salaries, which are established in the organization. Tariff schedule is a set of tariff categories of work (professions, positions), determined depending on the complexity of the work and the qualification characteristics of workers using tariff coefficients.

A tariff rate is a fixed amount of remuneration for an employee for fulfilling a standard of work (job duties) of a certain complexity (qualification) per unit of time (hour, day, month). The rate of the 1st category cannot be lower than the minimum wage; the rates of other categories are determined by multiplying the rate by its per-grade coefficient. According to Art. 144 of the Labor Code, the employer has the right to establish various bonus systems, incentive payments and allowances, taking into account the opinion of the representative body of employees. The purpose of the bonuses is to stimulate work in certain areas, localities, in certain professions, as well as the employee’s skill. With the help of additional payments, increased labor intensity is compensated (for example, when combining professions).

Allowances and additional payments can be of three types: 1) centralized - established by law (northern allowances, regional coefficients (for workers in the Far North), for work in the field (geologists, surveyors), for title, class, academic degree); 2) local - established in a specific organization (for professionalism, severity and harmfulness of working conditions, etc.); 3) under a specific employment contract, by agreement of the parties.

Salary systems are a way of calculating payment to an employee depending on the meter of his work.

The main salary systems are time-based and piece-rate. The organization may also introduce a bonus system.

1. In case of time-based payment, the labor meter is the working time worked by the employee. Payment time accounting can be hourly, daily or monthly. The time-based system can also be simple time-based and time-based premium.

2. Under the piecework system, wages are calculated based on the quantity of products produced by the employee of appropriate quality. Types of piecework remuneration system: simple piecework, piecework-bonus, piecework-progressive, piecework, indirect. The chord system is payment for a set of works. It is used in construction and road repair work (for example, payment for repairs of 1 km of track). In addition to the basic salary systems, an enterprise may use a bonus system. As a rule, the provision on the bonus system is an annex to the collective agreement.

The regulations indicate: bonus indicators (i.e., for which the employee can be awarded a bonus); bonus conditions; conditions for deprivation of bonuses (deprivation or partial deprivation of bonuses). An employee can claim a bonus (except for a one-time bonus) through a claim. Remuneration based on the results of work for the year (annual bonus, or “13th salary”) is established by the collective agreement in addition to the salary systems established at the enterprise. This premium is paid from a fund that is formed from the profits earned by the organization. The amount of the bonus is determined taking into account the employee’s labor results in the past year and the length of continuous work experience in this organization. The regulations on the procedure for paying remuneration based on the results of annual work are approved by the administration of the organization in agreement with the trade union committee. All employees who have worked for a full calendar year have the right to receive remuneration based on the results of work for the year in full. The regulation also establishes the grounds for depriving employees of remuneration in whole or in part (absenteeism without good reason, arrest for hooliganism, etc.).

47. Remuneration for deviations from normal working conditions. In heavy work, in work with harmful working conditions and in work in areas with difficult climatic conditions, it is established, as stated in Art. 82 Labor Code, increased wages. Essentially, the Decree of the Government of the RSFSR dated November 15, 1991 established that the amount of additional payments for working conditions is determined by the organization independently, but they should not be lower than the amount established. according to the decisions of the Russian Government. The lower limit of additional payments for working conditions is not defined in the legislation of the Russian Federation. It was not mentioned in the previous union legislation (only the upper limit of such additional payments was mentioned there - 12 and 24% of the rate (salary) depending on the degree of severity and harmfulness of working conditions). =>, organizations introducing additional payments for working conditions are not bound by any specific amount. An increase in the wages of workers employed in unfavorable climatic conditions is carried out using regional coefficients and bonuses to the wages of slaves working in certain regions of the country. The regional coefficient determines the size of the increase in the wages of workers of enterprises located in certain areas. Such regions, in particular, include the regions of the Far East, Eastern Siberia, etc. The size of the regional coefficient ranges from 1.1 to 2.0. It is calculated on the actual earnings received by the worker in a given month. Earnings include additional payments and allowances, payment for overtime work, bonuses determined by the wage system, etc. Increased pay for night work. time (from 10 pm to 6 am) is realized through additional payments to the basic salary of a worker for each hour of the night. work. Determining the amount of these additional payments is within the scope of local rule-making - they must be named in the collective agreement or in the regulations on remuneration developed and adopted in the organization. Work overtime (see Article 54 of the Labor Code) is compensated by increased payment according to the standards established. Art. 88 Labor Code. It should be borne in mind that Art. 88, a lower limit for overtime pay is established - for the first two hours the amount of payment is not high. Working on a holiday is not paid

This is important to know: Designer remuneration system

Transition to a time-based bonus wage system

The procedure would be similar if the terms of the employment contract with the employee were changed in accordance with Art. 72 of the Labor Code of the Russian Federation, that is, by agreement of the parties. Namely, at the time of signing the additional agreement, the employee would already have to fully understand the entire future procedure for calculating his wages in order to express his consent to the conclusion of an additional agreement to the employment contract.

Based on the analysis of the norm of Art. 74 of the Labor Code of the Russian Federation, the employer, when notifying the employee about changes in the terms of the employment contract, must convey to him information about the changes to such an extent and form that the employee has the opportunity to fully assess the upcoming changes and decide whether to continue working under the new conditions or to refuse it. Thus, at the time of notifying the employee about the change in the remuneration system to a salary-bonus system, the employer must already have developed the provisions of a local act containing all the constituent elements, including formulas for calculating bonuses and additional payments.

Other remuneration systems

As already mentioned, all wage systems are based on either a time-based or piece-rate system. However, each system has its own characteristics. Let's look at them.

Bonus wage system

This remuneration system is similar to the time-based bonus system.

Wages under the bonus system also consist of two parts: salary and bonus. However, the amount of the bonus (in percentage) for each employee must be clearly defined. It depends on the revenue received directly by the employee, the total income or profit of the organization. The bonus remuneration system is used, for example, for workers in trade or the service sector. In other words, for those on whose work the income or profit of the organization directly depends.

EXAMPLE 3

For the RV seller Zakharova has established a bonus wage system. Her salary is 4,000 rubles, and her bonus is 5% of the monthly revenue received from customers.