What is it needed for

The main purpose of the journal is to record operations on the processing and transfer of personal information to the employees responsible for it, thereby promoting the safety of information. The advisability of maintaining such records is determined by the specifics, size and structure of the organization. As a rule, the larger the staff, the wider the list of employees who require access to confidential information to perform their official duties. For example, if controversial situations arise, an in-house lawyer can request an employment contract with a particular employee from the personnel department. When making a decision on personnel changes or promotion of an employee, the employee’s personal file may be requested by the head of the department. Often, personnel documents containing confidential information are required by trade union organizations to verify compliance with the terms of the collective agreement.

How to fill out KUDiR on the simplified tax system “Income”

On a simplified system with the “Income” object, you need to fill out sections I, IV and V.

Section I. Income and expenses

In this part, enter all business transactions in order, indicating the date and number of the primary document: payment order, sales receipt, act, invoice and others. Also write down the content of the transactions, and in column 4 indicate the amount of income.

Column 5 is usually not filled in. But if you received a subsidy to support small and medium-sized businesses, indicate the expenses that you paid with this money. You also need to display the subsidy in your income, but not at the same moment as you receive it. We spent part of the subsidy and added this amount immediately to income and expenses. We spent another portion and made entries again. And do this until you spend the subsidy completely.

Example of filling out Section I (display of subsidies)

Record income received only when money from the buyer is received at the cash register or in the bank account. Prepayment is also considered income, so it should also be entered in column 4. Even the prepayment returned to the buyer must be indicated in this column, only with a minus sign. There is no need to take the return into account as expenses and enter it in column 5, because it reduces taxable income.

Example of filling out Section I (return of prepayment)

Section IV. Tax-reducing expenses

In this section you need to enter those amounts by which your tax will later be reduced: insurance premiums for employees, contributions under voluntary personal insurance contracts and hospital benefits for the first three days of disability paid by the organization. Individual entrepreneurs must also indicate insurance premiums for themselves.

Record expenses as they are paid, and at the end of each quarter, add up the total in column 10 to compare the deduction with the limit and calculate the tax.

Example of filling out section IV. Tax-reducing expenses

Section V. Trade Fee Reducing Tax

In this section, add the trading fee amounts for each quarter. All taxpayers using the simplified tax system “Income” must fill it out, and not just those who are required to pay a trade tax.

If there is no trade tax in your region, indicate the reporting year, and put dashes in the indicators so that the tax inspector does not decide that you forgot to fill out the section.

If there is a trade fee in your region, indicate the serial number of the transaction, the date and number of the primary document, the period for which the payment was made, and the amount.

Example of filling out Section V. Amount of trading fee

Magazine form

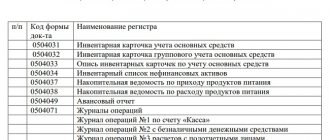

The obligation to maintain a personal data movement book is not provided for at the legislative level, which means there are no clear requirements for its preparation. However, there are recommendations that should be followed in order to solve the problem of preventing information leakage. So, it is recommended to include the following columns in the data transmission accounting book:

- Full name and position of the person or name of the body requesting personal data;

- purpose of issuing the document;

- date of issue of the document;

- date of return of the document;

- list of names of requested documents.

If the employer decides on the need to record the movement of personal data, then a sample personal data log is included in the package of standard documents for the protection of confidential information, and its form is approved by order. An order is also issued to appoint a person responsible for filling out the journal.

Book of movement of labor books

Home / Work book

| Table of contents: 1. General requirements for the log book 2. Instructions for filling out the book 3. Sample of filling out the accounting book 4. Corrections in the book + fines | Document: Download the book of accounting for the movement of labor books Download a sample book |

Current legislation obliges the employer to keep strict records of work records. For this purpose, Rules for maintenance and storage were developed, approved by Decree of the Government of the Russian Federation of April 16, 2003 No. 225 (hereinafter referred to as the Rules).

According to the Rules, each employer must, in the prescribed manner, keep a book of records of the movement of work books and inserts in them. In everyday life, this document is also often called a registration journal or a register of work books.

The accounting book records all movements of work books within the company:

- Receiving a work report from a new employee hired.

- Registration of a new book, if the document is created by the employer’s personnel service in the case where this is the first place of work for the hired employee.

- Issuance of a duplicate if the work book has been lost or has become unusable.

- Filling out the insert if the book runs out of pages.

- Issuance of a book against signature to a dismissed employee or to the employee’s relatives in the event of his death.

General requirements for the work record book

The book is filled out and stored in the administrative service of the organization, whose functions include the hiring and dismissal of personnel: personnel department, accounting, secretariat, etc.

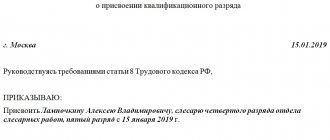

This register is maintained by an official appointed by order of the manager (IP), who is responsible for receiving, recording, storing and issuing work books.

Basic requirements for the appearance of the document:

1) Hardcover. The book has an extremely long shelf life - 75 years. A soft cover will not allow you to keep the document in a usable form for such a period.

2) Continuous numbering. Based on established practice, the magazine can be numbered either page by page or simply by sheet. Since both methods ensure the impossibility of removing individual elements from the document.

3) Firmware. The journal must be stitched and sealed with a wax seal or sealed. This requirement is clearly stated in clause 41 of the Rules, therefore the standard fastening of the free ends of the threads using a pasted sheet of paper containing a certification note will in this case cause complaints from the inspection authorities.

4) Certification record. Done on the back cover of the book and must contain:

- document's name;

- number of sheets (pages), written in numbers and in words;

- log start date;

- signature of the responsible person with a description of the position and full name.

Please note: the head of the organization (IP) must sign the back of the book. The person responsible for maintaining the register does not have the authority to affix a certification signature.

Unlike most accounting journals, the book is not created for one reporting period, but is used from year to year until the pages run out. Upon completion of the current book, a new one is issued.

Instructions for filling out the accounting book

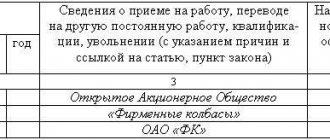

The unified accounting book form was approved by Resolution of the Ministry of Labor dated March 10, 2003 No. 69 (Appendix No. 3) and is a table of 13 columns, which are filled out as follows:

| Column ordinal number | Content |

| 1 | The serial number of the record is indicated |

| 2, 3, 4 | The date of entry is indicated in the format: DD.MM.YYYY |

| 5 | Fill in the full name of the owner of the work book. It is prohibited to indicate initials; first and middle names (if any) must be entered in full |

| 6 | The details of the work book or its insert are indicated. In this case, the details of the insert need to be written down only if it was issued by this company. If a newly hired employee submits a work report containing an insert issued at one of his previous places of work, only the number and series of the book itself are indicated. Details may vary depending on the year the form was issued: from 1938 to 1974 - the unified forms did not have a series or number, so when filling out the details you need to put a dash or write “b/n”; from 1974 to 2003 – work books of the AT-I – AT-X series with a 7-digit number were issued; from 01/01/2004 to the present - work book forms have the series TK, TK-I - TK-V (inserts - VT, VT-I), the number also consists of 7 characters |

| 7 | The employee’s position is filled in strict accordance with the employment contract (hiring order, minutes of the general meeting) |

| 8 | Indicate the short name of the employer and the name of the structural unit (service, department, etc.) in which the employee will work |

| 9 | The details of the employment order or other document on the basis of which the employee takes office are entered. When filling out the insert for the work book, a dash is placed in this column |

| 10 | The signature of the official responsible for maintaining the journal is affixed |

| 11 | The amount contributed by the employee to pay for the new form is indicated. If the employer’s regulations do not provide for charging employees for new forms or the entry is not related to the preparation of a new work book or an insert for it, a dash is placed in this column |

| 12 | The last working day of the employee in this organization is indicated. If an employee went on vacation with subsequent dismissal and received a paycheck and work book on the last working day, you need to write down the date of dismissal according to the order (in this case, such a date will be the last day of vacation) |

| 13 | Depending on the situation:

|

Note: sometimes a new personnel employee, appointed responsible for maintaining work books, discovers that the company’s accounting book was not kept.

In this case, it is necessary to notify the head of the organization (IP) about the identified violation in writing (for example: draw up a report), create a journal and enter in it in chronological order information about all work books stored in the organization.

In this case, there is no need to sign in column 10, since the new responsible employee did not personally accept these labor documents from the employees.

A sample of filling out a book for recording the movement of labor books

How to make corrections to a book

Corrections to the accounting book are entered in the same way as accounting registers are adjusted:

- On the blank line immediately below the erroneous entry or after the last entry, o is entered;

- The line below makes a new entry containing reliable information;

- Under the correct entry, the full name, position and signature of the person who made the changes, as well as the date of the transaction, are indicated.

Responsibility for non-compliance with accounting rules

For non-compliance with the Labor Code of the Russian Federation and other normative acts of labor law, administrative liability is imposed under Art. 5.27 Code of Administrative Offenses of the Russian Federation:

- warning or imposition of a fine on the responsible official (individual entrepreneur) in the amount of 1,000 to 5,000 rubles;

- warning or imposition of a fine on the organization in the amount of 30,000 to 50,000 rubles.

Read in more detail: Book of movement of labor books

Did you like the article? Share on social media networks:

- Related Posts

- Title page of the insert in the work book

- Power of attorney to obtain a work record book

- Entry of transfer in the work book: sample

- Entry of employment in the work book

- Work book: instructions for filling out 2020

- Corrections in the work book

- How to calculate length of service using a work book

- Application for an insert in the work book

Leave a comment Cancel reply

Procedure for maintaining, storing and destroying

Since the personal data log is not a mandatory document, the employer, at his own discretion, determines the procedure for manipulating it. It is advisable to develop appropriate internal regulations that specify the storage location of the data transfer ledger, as well as instructions for its maintenance.

As for the storage periods for the journal, they are also set by the head of the organization. When determining them, it is recommended to rely on Art. 22.1 of the Federal Law of October 22, 2004 No. 125-FZ “On Archival Affairs in the Russian Federation”, according to which personal files of employees are subject to storage for 75 years. It is logical that a document recording the movement of confidential employee data should be kept for the same period. Whatever the storage period for the journal, its destruction must be accompanied by the drawing up of an appropriate act.