Home / Private Law / Payment for Preferential Leave Abroad

As always, we will try to answer the question “Payment for Preferential Leave Abroad”. You can also consult with lawyers for free online directly on the website without leaving your home.

Non-budgetary organizations reduce the “profitable” tax base for the costs of paying employees for travel to the place of use of vacation and back on the territory of the Russian Federation, paid in the manner prescribed by the employer and enshrined in a local regulation, collective or labor agreement, including in the case when the employee I was on vacation abroad and presented a certificate from the airline about the cost of the flight to the extreme point in Russia. To document expenses, in addition to a certificate, you will also need a boarding pass or a confirmation certificate issued by the airline

RULE 1. The employee has the right to pay for travel simultaneously with the right to receive annual paid leave for the first year of work in the organization. Therefore, there is no need to wait for the expiration of 2 years of work to provide benefits.

What amount to compensate

If a structural unit of an organization is located in such a region or locality, but the organization itself is not, then the employees of this structural unit need to pay for travel on vacation. And vice versa, if the organization is located in the North, but its structural unit is not, then the employees of such a structural unit need to pay for travel no need for vacation.

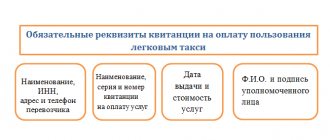

When traveling to the place of vacation outside the territory of the Russian Federation by air without landing at the airport closest to the place where the state border of the Russian Federation is crossed, the employee must provide a certificate issued by the transport organization that carried out the transportation about the cost of transportation across the territory of the Russian Federation, included in the cost of the transportation document ( ticket).

More to read —> New Rules for Hiring Drivers in 2021

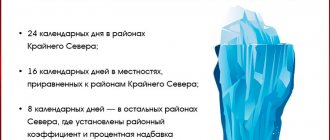

In accordance with the Labor Code of the Russian Federation, persons working in organizations financed from the federal budget located in the Far North and equivalent areas have the right to pay the cost of travel to their vacation destination in Russia and back once every two years at the expense of the employer , as well as to pay the cost of baggage transportation. In addition, such expenses are also compensated for their family members, which include non-working spouses and minor children.

GUARANTEE:

By the decision of the Supreme Court of the Russian Federation of May 23, 2021 No. AKPI13-407, left unchanged by the Determination of the Appeal Board of the Supreme Court of the Russian Federation of October 3, 2021 No. APL13-389, paragraph 2 of these Rules was recognized as not contradicting the current legislation in the part providing for compensation of expenses only when using annual paid leave

In the second, a citizen can only count on compensation for travel within Russia. For example, he goes to Moscow, from where he flies to Turkey. The employer will reimburse the cost of tickets to Moscow. If an employee flies directly from his city to Turkey, then compensation is not provided for him.

Who is entitled to pay for travel on vacation?

In Art. 325 of the Labor Code of the Russian Federation specifies persons who have the right to have their employer pay for their travel on vacation. These persons include:

- working in organizations in the Far North region and in areas equivalent to them. Payment for travel on vacation within the territory of the Russian Federation and back is made once every 2 years.

- federal government employees bodies, state extra-budgetary funds of the Russian Federation, federal state. institutions have the right to pay for travel on vacation in the Russian Federation and back by any type of transport, with the exception of taxis. In addition, in addition to the employee, travel expenses will also be paid to a non-working family member of the employee.

In addition to the above persons, the following have the right to pay for travel on vacation:

- police officers

- contract military personnel

For residents of the Far North

Russian legislation provides for the possibility of free travel on vacation for a number of Russian citizens. This procedure is carried out by receiving monetary compensation from the employer. This right is assigned to employees by the Labor Code (Article 325). The document establishes that the following categories of citizens can use it:

Categories of citizens who are entitled to compensation for travel on vacation

Labor law of the Russian Federation distinguishes preferential categories of workers who are entitled to payment for travel on vacation in 2021. Most of them are law enforcement officers and workers working in unfavorable climatic conditions. In addition, the Government of the Russian Federation prepared and approved changes in this area, which may affect all other employees of government agencies.

More to read —> What is the payment for Labor Veterans in Smolensk

However, often during air travel, the checkpoint across the state border and the place of its actual crossing are separated by more than one hundred kilometers. Some organizations calculate the distance that an employee traveling to a holiday destination abroad flies over the territory of Russia, from the place of departure to the place of actual border crossing. Based on this distance, the cost of a flight “over Russia” is calculated, for which the organization does not charge insurance premiums.

The procedure for paying travel on vacation by the employer

Payment for vacation travel by the employer is made in the following order:

- An employee submits an application for travel payment

- The employer makes payment no later than 3 working days before the employee goes on vacation, taking into account the approximate cost of travel

- After arriving from vacation, the employee provides tickets and other documents regarding travel expenses

- The employer makes the final payment

Military personnel receive compensation for travel expenses on vacation based on travel tickets and a submitted compensation report.

Police officers, like military personnel, receive compensation, i.e. first they purchase tickets and submit a compensation report, and then receive compensation, usually after their vacation. When an employee arrives at the destination, he must put a mark on his travel documents within 3 days at the nearest police station

How to confirm your status as a northerner?

- Transbaikalia;

- Amur region;

- Altai;

- Buryatia;

- Perm region;

- Primorsky Krai;

- Krasnoyarsk region;

- Tyva;

- Tomsk region;

- some regions of the Irkutsk, Arkhangelsk, Sakhalin regions, Krasnoyarsk, Khabarovsk territories, Komi and Karelia.

Benefits provided

An employee going on vacation is required to submit supporting documents at least three days before his departure. Recalculation is also allowed after his return from vacation in order to accurately determine moving expenses.

05 May 2021 uristgd 80

Share this post

- Related Posts

- Deadlines for receiving maternity capital under an apartment purchase and sale agreement 2021

- Payment of the state duty on the Statement of Claim What status to put in the Payment Order

- Okof-2 Hard Drive

- Okopf 65 What is it

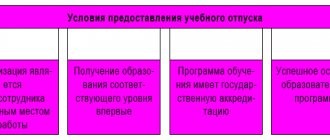

Documents for paying for travel on vacation

In order for an employee to be paid for travel on vacation, he must submit the following documents:

- Application for payment or report for compensation

- Travel documents or plane boarding tickets

- Payment documents

- Certificate of family composition

- Child's birth certificate or passport

- Marriage certificate

- If you are traveling in a personal car, you must include a driver’s license, vehicle title and receipts from gas stations

Not all the documents listed above may be needed, for example, if the child does not go on vacation with his parents, then there is no need to attach a birth certificate.

Is it possible to use travel after dismissal?

A possible situation is when an employee resigns. Can such an employee benefit from travel compensation after dismissal? The answer to this question will be negative, since compensation is provided to employees who, after finishing their vacation and returning to work, provide the necessary documents about travel expenses while on vacation.

However, if an employee goes on vacation with subsequent dismissal, then he must be paid for travel on vacation.

Is it possible to receive compensation for unused travel? No, you cannot receive compensation for unused travel, since compensation for travel does not relate to salary and is intended specifically to compensate the employee’s expenses for travel on vacation. If the employee did not use travel while on vacation, i.e. If he didn’t go on vacation, he has nothing to compensate. If the employee was paid compensation in advance and he did not travel anywhere and, accordingly, did not provide reporting documents on expenses, then he is obliged to return the funds received, otherwise they can be recovered from the employee through the court, since unjust enrichment occurs on the employee’s side.

PLEASE NOTE : it may be that it is not a vacation that is needed, but the dismissal of an employee, read more at the link and watch the video

Who is entitled to payments?

If an organization is registered in the North, but actually operates and is located in a region that is not classified as an area with a special climate, this benefit will not be provided to employees.

Payment of compensation to government employees

A commercial enterprise is engaged in the production and supply of equipment to the regions, the monthly financial turnover is several million. According to internal rules, employees are entitled to voluntary collective life and health insurance, as well as preferential travel vouchers throughout the Russian Federation.

12. The Resolution of the Constitutional Court of the Russian Federation of February 9, 2021 N 2-P states the following. The regulatory provisions of Part 8 of the commented article presuppose the obligation of employers who are not related to the public sector and who carry out entrepreneurial and (or) other economic activities in the regions of the Far North and equivalent areas to compensate the persons working for them for the cost of travel and baggage transportation to place of use of vacation and back and at the same time allows you to establish the amount, conditions and procedure for this compensation based on the balance of interests of the parties to the employment contract, taking into account its intended purpose (to maximize the employee’s travel outside the unfavorable natural and climatic zone), and also taking into account real economic opportunities of the employer, which, however, cannot serve as a basis for a complete refusal of compensation or its unjustified understatement.

For example, a collective agreement may provide for payment to employees of the cost of baggage transportation based on its actual weight, without a limit of 30 kilograms, or compensation for the cost of travel on vacation to all non-working family members of the employee living with him.

More reading —> Can a schoolchild from the Moscow region get a social card?

In what type and amount is compensation paid to the place of vacation?

The payments provided for in this article are targeted and are not cumulative in the event that the employee and members of his family do not timely exercise the right to pay the cost of travel and baggage transportation to and from the place of vacation use.

An employee receives the right to pay for transportation costs after 1 year of work in the organization and every second year thereafter (fourth, sixth, and so on), without taking into account the time of actual use of the right to rest.

Reimbursement for transportation costs is issued to the employee before leaving on vacation based on preliminary transportation costs, and the final payment is made based on the provided travel documents upon the employee’s (his family members) return home.

Features of paying for discounted travel

- in the amounts established in contracts (labor, collective), Regulations on days of rest;

- with the frequency specified in contracts or regulatory documents of the enterprise (at least once every 2 years);

- when providing a list of supporting documents established by the collective agreement or other documents of the organization.

A selection of the most important documents on request Payment for travel on vacation (regulatory acts, forms, articles, expert consultations and much more). “Labor Code of the Russian Federation” dated December 30, 2001 N 197-FZ (as amended on July 3, 2021) (as amended and additionally

7) the cost of travel for employees to the place of vacation and back and the cost of carrying luggage weighing up to 30 kilograms, paid by the payer of insurance premiums to persons working and living in the regions of the Far North and equivalent areas, in accordance with the legislation of the Russian Federation, legislative acts of the constituent entities of the Russian Federation Federation, decisions of representative bodies of local self-government, labor contracts and (or) collective agreements. In case of vacation by the specified employees outside the territory of the Russian Federation, the cost of travel or flight (including the cost of luggage weighing up to 30 kilograms), calculated from the place of departure to the checkpoint across the State Border of the Russian Federation, including the international airport, is not subject to insurance premiums. in which workers undergo border control at the checkpoint across the State Border of the Russian Federation.

The Far North no longer pays either insurance premiums or personal income tax

The legal topic is very complex, but in this article we will try to answer the question “Payment for preferential travel on vacation for dependents in the Far North 2021 Taimyr”. Of course, if you still have questions, you can consult with lawyers online for free directly on the website.

May 09, 2021 uristgd 62

Share this post

- Related Posts

- Can bailiffs describe the property if you pay 50 percent for the debt?

- Standards for Electricity Consumption for Kursk in 2021

- From what period is the discounted travel for pensioners on the train valid?

- Bauman Master's Scholarship

Refusal to reimburse travel for vacation

An employer may refuse to compensate an employee for travel on vacation if, for example, the employee does not have the right to compensation for travel on vacation, if he has not provided documents confirming travel expenses, etc.

However, denial of compensation may be unlawful. In this case, it is necessary to try to find out the reasons for the employer’s refusal to provide compensation. If you cannot resolve this issue with the employer, then you can contact the labor inspectorate or the prosecutor’s office to conduct an investigation into the legality of the employer’s refusal to compensate for travel.

If you are sure that you are entitled to compensation and you have all the necessary documents, the results of your appeal to the labor inspectorate and the prosecutor’s office did not lead to action on the part of the employer, then you can go to court with a claim and recover the due compensation in court.

Our labor dispute lawyer at the Law Office “Katsailidi and Partners” in Yekaterinburg will help in protecting your rights as an employee. Call us right now!