For some categories of workers, the Labor Code provides for the opportunity to submit an application to the employer for travel payment. These cases do not apply to travel expenses: in accordance with Art. 168 of the Labor Code of the Russian Federation, the obligation to reimburse travel expenses lies with each employer, regardless of the organizational and legal form. We will talk about how to draw up an application for payment of travel in special cases.

When and who pays for travel, how to draw up a document in the name of the employer - the answers to these questions can be found below.

:

Application for travel payment

Example of an application for travel payment

General Director

of PJSC "RodionBank"

V.V. Viktorov

senior HR specialist

Levykin Bogdan Stepanovich

Application for travel payment

In accordance with Art. 173 of the Labor Code of the Russian Federation and a certificate of invitation from the higher educational institution “Tomsk State Economic Institute” dated December 25, 2016, I ask you to compensate the actual expenses incurred for travel to the place of study by correspondence in the specialty “anti-crisis management” in Tomsk.

Application:

- Help-call from the university dated December 25, 2016.

- Certificate confirming the fact that the session was completed in the period from January 15, 2017 to February 16, 2017.

- Receipt for the cost of air tickets from Surgut to Tomsk and back.

February 20, 2020 Levykin B.S.

Accounting

In accounting, reflect the costs of travel to the place of study and back on the credit of account 70 “Settlements with personnel for wages.” Depending on what department the employee works in and what functions he performs, when calculating compensation, make an entry:

Debit 20 (23, 25, 26, 29, 44.) Credit 70

– compensation for travel expenses to the place of study and back has been accrued.

You will pay compensation based on the summons certificate and travel documents. The form of the summons certificate was approved by order of the Ministry of Education and Science of Russia dated December 19, 2013 No. 1368. The student must receive them at his educational institution.

In accounting, reflect the payment of compensation by writing:

Debit 70 Credit 50 (51)

– compensation was paid for travel expenses to the place of study and back.

In what cases does an employee have the right to apply for travel payment?

The employee, as the least protected party in labor relations, has a number of guarantees. Among them is the opportunity to compensate for travel expenses incurred or receive an advance for a specified purpose.

First of all, when applying for a job, familiarize yourself with the local legal acts of the organization - Internal Rules, Regulations on Remuneration. It is possible that a collective agreement or other documents in the organization have adopted rules on the employer paying for travel, for example, to a place of vacation, for other reasons. Typically, such documents also contain an approved application form and requirements for submitted documents.

When there is no such act, the general norms of the Labor Code of the Russian Federation apply. The right to pay for travel to and from a vacation spot, baggage allowance in accordance with Art. Code 325 has:

- employees of organizations located in the Far North and equivalent areas: once every two years at the expense of the employer for the next vacation. Compensation is calculated according to certain rules, and not according to actual expenses, within the territory of Russia.

- employees of internal affairs bodies, law enforcement agencies and other employees of state bodies and extra-budgetary funds and institutions of the Russian Federation - in accordance with special standards and within the Russian Federation.

In accordance with Art. 348.6 of the Labor Code of the Russian Federation, athletes and coaches have the right to compensation for travel expenses to the location of the sports team of the Russian Federation and back, and associated with participation in sporting events as part of such a team.

Based on Art. 173, 173.1 and 174 of the Labor Code of the Russian Federation, students of accredited educational institutions who are successfully completing education in bachelor's, specialist's or master's programs via correspondence once a year pay for travel to and from the place of study at the expense of the employer upon presentation by the employee of the corresponding application. If an employee receives secondary vocational education, the employer compensates him for 50% of the cost of travel to the place of study and back for distance learning.

Special laws establish the right to payment for travel of workers who are classified as disabled as part of the use of a disability pension. But in such cases, you need to contact not the employer, but the social security authorities at your place of residence.

How can we properly arrange days for travel to and from the place of study?

To pay for travel to and from the place of study, university students and students of secondary vocational education institutions must simultaneously fulfill the following conditions:

- the training program has state accreditation (Articles 173.174 of the Labor Code of the Russian Federation);

- the employee completes the training successfully (this condition applies only to university students) (Article 173 of the Labor Code of the Russian Federation);

- The employee receives education of this level for the first time or the employee has education of the corresponding level, but the company sends the employee to receive education on the basis of the terms of the employment contract or if there is an apprenticeship agreement between the employee and the company in writing (Part 1 of Article 177 of the Labor Code of the Russian Federation).

To pay for travel for graduate students, it is enough to complete only the last point.

It should be noted that there are no restrictions in the legislation on the length of service that gives the right to this compensation. This means that the company is obliged to pay for the employee’s travel, regardless of how long he has worked.

At the same time, there is a restriction regarding receiving several compensations if the employee studies in two educational institutions. According to Part 3 of Art. 177 of the Labor Code of the Russian Federation, compensation can be paid only for one of the educational institutions. In this case, the choice is made by the employee himself.

In order for an employee to be reimbursed for the cost of travel to the place of study and back, the accounting department must submit a certificate of summons from the educational institution and travel documents. The certificate form was approved by order of the Russian Ministry of Education and Science dated December 19, 2013. No. 1368.

A sample certificate is presented below.

Expenses for employee travel to and from the place of study are reflected in account 70 “Settlements with personnel for wages”. Expenses are debited to the expense account depending on the department to which the employee belongs.

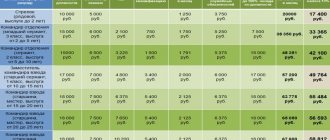

Postings | Decoding |

| Dt 20 (23,25,26, 44, etc.) Kt 70 | Compensation for travel to and from the place of study has been awarded |

| Dt 70 Kt 51 | Funds are transferred to the employee’s bank card |

In accordance with paragraph 3 of Art. 217 of the Tax Code of the Russian Federation, personal income tax is not charged for compensation of expenses to and from the employee’s place of study. Also, this payment is not subject to insurance premiums.

You can also duplicate the application (send a scanned copy) to the organization’s email and indicate in the email that the original was sent by mail and you require to receive, consider the application and give a response in writing. In the application itself, indicate your right to receive payment for travel, a link to an article of the Labor Code of the Russian Federation, and demand a written response.

N 125-FZ “On compulsory social insurance against accidents at work and occupational diseases” (hereinafter referred to as Law N 125-FZ). In accordance with paragraph 1 of Art. 7 of Law No. 212-FZ, paragraph 1 of Art. 20.1 of Law N 125-FZ, payments and other remuneration accrued (paid) in favor of individuals within the framework of labor relations are recognized as subject to taxation with insurance contributions.

At the same time, as stated in paragraph 1 of Art. 8 of Law No. 212-FZ, paragraph 2 of Art. 20.1 of Law N 125-FZ, the base for calculating insurance premiums is defined as the amount of payments and other remunerations provided for in paragraph 1 of Art. 7 of Law No. 212-FZ, paragraph 1 of Art. 20.1 of Law N 125-FZ accrued by the employer for the billing period in favor of individuals, with the exception of the amounts specified in Art. 9 of Law No. 212-FZ, in Art. 20.2 of Law No. 125-FZ. Subclause 2 of clause 1 of Art. 9 of Law No. 212-FZ and paragraphs. 2 p. 1 art.

We invite you to read: Article 152. Code of Civil Procedure of the Russian Federation Preliminary court hearing

In accounting, payment of the cost of travel to the location of the relevant organization carrying out educational activities and back, provided for by labor law, is an expense for the organization for ordinary activities. This is indicated by clause 5 of the Accounting Regulations “Expenses of the Organization” PBU 10/99, approved by the Order of the Ministry of Finance of Russia dated May 6, 1999.

Important

N 33n “On approval of the Accounting Regulations “Expenses of the Organization” PBU 10/99″. Based on the Instructions for the Application of the Chart of Accounts, approved, like the Chart of Accounts itself, by Order of the Ministry of Finance of Russia dated October 31, 2000.

To do this, the employee must submit the following documents to the company’s accounting department:

- a certificate of summons in the form approved by Order of the Ministry of Education and Science of Russia dated December 19, 2013 N 1368 “On approval of the form of a certificate of summons giving the right to provide guarantees and compensation to employees combining work with education”;

- an application for payment of compensation for travel expenses, written to the head of the company upon return from study leave;

- travel documents.

If all the required documents are provided and do not give rise to any claims, then the organization is obliged to compensate its employee for travel expenses, and the amount of compensation paid can be taken into account by the company for corporate income tax purposes.

Let us remind you that organizations that pay income tax keep tax records in accordance with the provisions of Chapter.

Attention

Due to the fact that the Labor Code of the Russian Federation obliges the employer to reimburse such students only half of the cost of travel, the excess amount paid to the employee qualifies as income received by the taxpayer in kind. Consequently, when paying an increased amount of compensation, the organization must withhold tax from the excess amount and transfer it to the budget.

As is known, the organization is a payer of insurance premiums for compulsory types of social insurance, the procedure for calculation and payment of which is regulated by the following standards:

- Federal Law of July 24, 2009 N 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund” (hereinafter referred to as Law N 212-FZ);

- Federal Law of July 24, 1998

We invite you to familiarize yourself with: Real estate tax for individuals, apartment tax for owners

Documents drawn up in personnel Based on the employee’s application, issue an order for granting leave (on form No. T-6, No. T-6a or a self-developed form). The order must be signed by the manager, the employee must be familiarized with the order for signature.

In accordance with the order, the accountant will draw up a note-calculation on granting leave to the employee (in Form No. T-60 or an independently developed form) and accrue vacation pay. The front side of the calculation note will be signed by an employee of the HR department, and the back side will be signed by the organization’s accountant.

If an employee is granted unpaid study leave, there is no need to prepare a calculation note. The fact is that this form is provided for calculating the payments that an employee is entitled to when going on vacation. And when an employee goes on unpaid study leave, vacation pay is not accrued.

Info

For employees who are sent for training by the employer or who independently enroll in state-accredited bachelor's degree programs, specialist programs or master's programs in part-time and part-time forms of study and who successfully master these programs, the employer provides additional leave with preservation of average earnings for: (as edited by Federal Law of July 2, 2013 N 185-FZ) (see the text in the previous edition) passing intermediate certification in the first and second years, respectively - 40 calendar days, in each of the subsequent courses, respectively - 50 calendar days (when mastering educational higher education programs in a shortened time frame in the second year - 50 calendar days); (as amended.

Federal Law of July 2, 2013 N 185-FZ) (see.

Separately, we draw your attention to the fact that if a company compensates its part-time student who is mastering a state-accredited educational program of secondary vocational education in full, then for tax purposes it will be able to take into account only 50% of the cost of travel.

Due to the fact that compensation for “travel” expenses is made to an employee who, as an individual, is a personal income tax payer, it is necessary to consider the issues of taxation of travel expenses with the specified tax. Let us recall that in Art. 217 of the Tax Code of the Russian Federation lists the income of the personal income tax payer, which is exempt from taxation, etc.

We invite you to read: Issuing a work book in the hands of an employee

As a general rule, an employer is not obliged to pay for vacation trips for its employees, except in cases provided for by the legislation of the Russian Federation. At the same time, if an employee of an organization receives an education, the company must compensate the student for travel expenses to the place of study and back.

We will talk about who has the right to such “student” benefits and how they are provided by the employer in more detail. Today, having student workers on staff is quite common for many companies. In addition to the general guarantees and compensation established by the Labor Code of the Russian Federation (hereinafter referred to as the Labor Code of the Russian Federation), labor law provides additional benefits to such employees. So, in accordance with the provisions of Ch.

How to apply for travel payment

The document is drawn up after confirmation of actual expenses incurred. The employee must take care of the availability of not only the tickets themselves, but also receipts and other financial documents.

For students of universities and educational institutions of secondary vocational education, they will additionally need to submit a certificate of completion of training, preferably a certificate of challenge. In such cases, payment for travel is the responsibility of the employer once a year, not more often. If local regulations do not establish additional travel compensation.

An application for travel payment in cases where such a benefit is directly provided for by the legislation of the Russian Federation must be satisfied by transfer to a bank card or issuing cash, otherwise you can file a complaint with the labor inspectorate or the prosecutor's office.

Personal income tax and insurance premiums

Regardless of what tax system the organization uses, compensation for travel expenses to the place of study and back established by law is not subject to:

- Personal income tax (clause 3 of article 217 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated July 24, 2007 No. 03-04-06-01/260);

- contributions for compulsory pension (social, medical) insurance (subparagraph “e”, paragraph 2, part 1, article 9 of the Law of July 24, 2009 No. 212-FZ, letter of the Ministry of Health and Social Development of Russia dated April 20, 2010 No. 939-19 );

- contributions for insurance against accidents and occupational diseases (clause 2, part 1, article 20.2 of the Law of July 24, 1998 No. 125-FZ).

Also, do not withhold personal income tax from income in the form of payment for travel to and from the place of study for employees under the age of 18 studying in Russian general educational institutions (schools, gymnasiums, etc.). Tax exemption is possible if these establishments have a license. This conclusion follows from paragraph 45 of Article 217 of the Tax Code of the Russian Federation.

Situation: is it necessary to withhold personal income tax, as well as charge insurance premiums from the amount of compensation to the employee for travel expenses to the place of study and back. Is the employee studying in a program that does not have state accreditation?

If the educational program in which the employee is studying does not have state accreditation, then the organization has the right, but is not obligated, to compensate the employee for travel expenses to the place of study and back. She can pay such compensation if this condition is provided for in the labor (collective) agreement (part 6 of article 173, part 6 of article 174 of the Labor Code of the Russian Federation).

In turn, only compensation established by current legislation is exempt from payment of personal income tax and insurance premiums (clause 3 of Article 217 of the Tax Code of the Russian Federation, subparagraph “e”, clause 2, part 1, article 9 of the Law of July 24, 2009 No. 212 -FZ, clause 2, part 1, article 20.2 of the Law of July 24, 1998 No. 125-FZ). Legislatively, compensation for travel expenses to and from the place of study is provided only for employees who study within the framework of educational programs that have state accreditation (Part 3 of Article 173, Part 3 of Article 174 of the Labor Code of the Russian Federation). Therefore, in the absence of such accreditation, personal income tax must be withheld from the amount of compensation for travel costs and insurance premiums must be charged (clause 1 of Article 210 of the Tax Code of the Russian Federation, part 1 of Article 7 of the Law of July 24, 2009 No. 212-FZ, part 1 of Art. 20.1 of the Law of July 24, 1998 No. 125-FZ).

A similar conclusion can be drawn from the clarifications contained in letters from the Ministry of Finance of Russia dated March 7, 2012 No. 03-04-06/9-60, dated July 24, 2007 No. 03-04-06-01/260 and the Ministry of Health and Social Development of Russia dated 20 April 2010 No. 939-19.

Payment for travel on study leave

Final year students of correspondence educational institutions of higher professional education, taking a theoretical course for one semester according to the curriculum and participating in one examination session, are granted leave in half the amount. 9. Leave for the period of passing final state exams is granted, as a rule, at a time. And only when the final exams are held in 2 terms - in parts. But even in this case, study leave should not exceed the duration specified for it by law. 10. When applying Article 173 of the Labor Code of the Russian Federation, it should be taken into account that additional vacation time is paid based on average earnings, calculated in the manner established for annual vacations (see commentary to Article 139). eleven.

simplified tax system

The tax base of organizations that pay income tax will not be reduced by the amount of compensation for travel expenses for employees to the place of study and back (clause 1 of Article 346.18 of the Tax Code of the Russian Federation).

Organizations that pay a single tax on the difference between income and expenses can include compensation provided for in collective (labor) agreements as part of labor costs. Simplified organizations must take into account these expenses in the same manner as income tax payers (subclause 6, clause 1, clause 2, article 346.16 of the Tax Code of the Russian Federation).