An employee’s right to rest is inalienable and protected by law. There are situations when, in the interests of the enterprise, it is necessary to interrupt the current weekend and send an employee on a trip on company business. If a business trip is unavoidable during vacation, the HR department and accounting department should know how to arrange and pay for it. This must be done with caution, strictly observing the nuances of the procedure according to programs and documents. Otherwise, the company cannot avoid fines and unpleasant inspections by the relevant authorities.

Basic Concepts

The obligation to provide an employee with annual paid leave is enshrined in Art. 114 of the Labor Code of the Russian Federation. The employee has the right to refuse, but the enterprise cannot prohibit the use of the legal number of days for rest. The period depends on the specifics of the work and position.

Business travel is a special type of employment. In Art. 166 of the Labor Code of the Russian Federation defines and describes the main differences:

- Departure of a hired employee to another location to perform his work duties;

- The destination must be located outside the boundaries of the municipality in which the direct workplace is located (another city, region, country);

- Shift work and the traveling nature of work (if this is stipulated in the contract) are not considered a business trip;

- A written order from the employer and official documentation are required.

A detailed description is given by the Decree of the Government of the Russian Federation No. 749 of October 13, 2008.

“On the peculiarities of sending employees on business trips.” The deadline is calculated by the employer. There is no maximum limit; it can be for one day or for a long period. The final decision is made depending on the specifics of the trip, the distance of the final destination and other factors. In Art. 166 of the Labor Code talks about the certainty of deadlines, so before leaving you need to set the start and end dates of the trip. It is not possible to send an employee on an indefinite business trip; if necessary, an extension with a new end date is issued. Specifics in this matter are also needed to calculate the advance payment and the amount of daily allowance.

Position of the Ministry of Finance

Actually incurred and documented targeted expenses for the employee’s travel to the place of business trip and back are not included in income subject to personal income tax on the basis of paragraph 3 of Article 217 of the Tax Code.

note

If, immediately after the end of a business trip, an employee is granted leave, which he spends at the place of business trip, there is an economic benefit provided for in Article 41 of the Tax Code.

This point of view was expressed by the Ministry of Finance in letter dated December 6, 2019 No. 03-04-06/94974.

Economic benefit arises in the form of payment by the organization for travel from the place where free time from work is spent to the place of work. In this case, payment by the organization for an employee of a return ticket with an arrival date later than the end of the business trip is the employee’s income received in kind. Therefore, such income is subject to personal income tax.

Review from vacation for business trip

In order to correctly display the trip and not violate the provisions of labor legislation, a number of mandatory conditions must be met. When a business trip is planned on vacation, the HR department and accounting department should know how to formalize it and “conduct” it according to the documents. If the company has not encountered such situations before, you should carefully study the issue - failure to respect employee rights entails serious consequences (inspections, fines, other sanctions).

Grounds for revocation

To call an employee back from legal leave, you must have compelling reasons. The activity of an enterprise does not stop if one of the employees goes on vacation, but different situations may arise. For example, the chief accountant is required to be on site during an on-site inspection from the Federal Tax Service. When taking inventory, the presence of a financially responsible employee is required. A system administrator may be needed in the event of an emergency breakdown.

The possibility of recalling an employee is enshrined in Part 2 of Art. 125 of the Labor Code of the Russian Federation. In this case, the type of leave does not matter - educational, additional, maternity and the like. Due to the fact that during vacation it is strictly forbidden to involve an employee in any of the possible activities of the enterprise, several conditions must be met. One of the most important is voluntary consent.

Employee consent

Before recalling, the head of the department or other person responsible for this must write a statement or memo indicating which employee should be called. A good reason is a must. After this, it is necessary to obtain the employee’s consent to take a break during vacation and a business trip.

Attention! You cannot call an employee without consent. The need for confirmation is enshrined in Art. 125 Labor Code of the Russian Federation. From a legal point of view, refusal to take leave is not a violation of labor discipline and does not entail any consequences. Although in practice, managers often put pressure on employees.

In what cases is it impossible?

However, in some cases it is impossible to recall an employee even with his consent. In part 3 of Art. 125 of the Labor Code of the Russian Federation directly indicates categories of employees who are prohibited from interrupting their vacation:

- Persons under the age of majority – 18 years old;

- Women who are “in position”;

- Employees whose contract service involves harmful and dangerous working conditions.

The rule is immutable; clarifications are given in the decision of the plenum of the Supreme Court of March 17, 2004.

Nuances of paperwork depending on the type of vacation

Before conducting and processing an employee's recall, his consent must be obtained in writing. Without official confirmation, orders and other documents of the enterprise have no legal basis (do not have legal force). However, there are certain nuances that depend on the type of vacation. If an employee, in addition to direct work, studies at an institute, he is given the necessary time for each session. The management can call him only if he passed the exams ahead of schedule.

A woman who is on maternity leave can also be called for an urgent business trip (unlike a pregnant girl). In addition to classic consent, it is necessary to familiarize her with all rights. For example, that there is an opportunity to refuse without consequences.

https://youtu.be/rwlnu9-ZPwY

In order to interrupt an annual vacation, it is necessary to obtain the traditional written consent of the employee. You also need to determine for what period the rest of the vacation after the business trip will be transferred - the dates are chosen by the employee.

Weekends at your own expense or without pay are provided at the request of the employee. Sometimes an employee needs to stay where the business trip was for additional time. The manager decides whether there is such an opportunity or whether it is necessary to return to his workplace.

It is important to know! Some categories of citizens must be granted leave at their own expense upon request. These include disabled people, combatants and pensioners.

There are some nuances to consider when working part-time. In this case, the main employer is not obliged to pay or change anything. It turns out that going on vacation is unprofitable from a financial point of view, although purely theoretically everything is possible.

Business trip during part-time vacation

An employee who works part-time may also be sent on a trip. Such an employee goes on a business trip during his free time from his main activity. It is worth considering that the legislative level has not resolved the issue of what to do with the main place of activity of an employee holding a joint position if he goes on a trip.

It is quite possible that he can get leave at his own request for this time, but the employer is not obliged to provide it to him. If he does receive it, he will lose wages. As a result, external part-time work, when it comes to business trips, is almost impossible to implement. Both the employee and the employer must understand this.

Extension of vacation

An unused or interrupted rest period should be transferred to another convenient time. This rule is enshrined in Art. 124 of the Labor Code of the Russian Federation. For example, they extend the current vacation if possible and convenient. If necessary, it is transferred (attached to another annual).

Attention! By agreement, unused days can be compensated. However, there are many limitations to consider here. For example, payment is made only for periods over 28 days.

An extension that goes from a business trip to a vacation is the most popular and easiest way. The employee rests longer for exactly the number of days for which the trip was booked.

https://youtu.be/CBfdLXA3n5c

Calculation of vacation and travel allowances

Before the start of the vacation, the employee receives appropriate payments, which are calculated from average earnings. As holidays are shortened, some of the money must be returned.

Attention! You cannot forcibly deduct these funds from your salary. The appropriate consent must be obtained from the employee in writing.

It is easy to recalculate vacation pay: the value for one day is taken from previously carried out calculations and multiplied by the number of days of the business trip. This amount must be returned.

Another point is that the employee performs his duties, and, therefore, must receive daily allowance and third-party expenses. The calculations are no different from the usual ones - there are no nuances. Payment for travel from a business trip to vacation is independent of the date (after all, this money would have been transferred anyway).

A work trip requires proper and correct registration. Call an employee only if absolutely necessary. How to arrange a business trip while on vacation should be presented before the procedure begins. If all the details are not followed, the company will be subject to administrative liability.

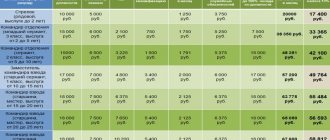

Travel expenses within normal and above normal limits

Expenses reimbursed by the employer to an employee during a business trip (Article 168 of the Tax Code of the Russian Federation) are reflected in the reporting of insurance premiums.

According to clause 2 of article 422 of the Tax Code of the Russian Federation, paragraph 12 of clause 3 of art. 217 of the Tax Code of the Russian Federation, expenses during a business trip are not subject to insurance contributions and personal income tax if they:

- Do not exceed 700 rubles for each day of a business trip within the Russian Federation;

- Do not exceed 2,500 rubles for each day of a business trip outside the Russian Federation.

If the employer sets daily allowances in a larger amount than specified in the Tax Code of the Russian Federation, then he will need to withhold personal income tax from the excess amounts and charge insurance contributions.

To display expenses on a business trip within normal limits in 1C ZUP 3, you must enter an accrual with the following settings (Fig. 7):

Rice. 7.1. Setting spending within normal limits

Rice. 7.2. Setting spending within normal limits

The accrual is carried out by the document “Income in kind” (Fig. 8):

Rice. 8 Expenses during the business trip are within the normal range in the document “Income in kind”

To reflect expenses for a business trip period in excess of the norm in 1C ZUP 3, you must enter an accrual with the following settings (Fig. 9):

Rice. 9.1 Setting up excess spending

Rice. 9.2 Setting up excess spending

The accrual is carried out by the document “Income in kind” (Fig. 10):

Rice. 10 Expenses in excess of the norm in the document “Income in kind”

The calculation of insurance premiums for travel expenses accrued in excess of the norm is carried out in the document “Calculation of salaries and contributions”.

Useful courses on 1C Become a professional in the 1C: ZUP program

We will teach you how to use the program professionally in the course “Using conf. “Salaries and personnel management” (user modes) ed. 3″

Learn more about the course, see more courses