Withholding of accountable amounts upon dismissal

When making final settlements with an employee, deductions from the amount can only be made with the consent of the individual. In this case, it is also necessary to comply with the limit on penalties of 20% (stat. 137 of the Labor Code) of the salary. If an employee refuses to return the funds, the organization has the right to go to court. The deadline for filing a claim is 1 year from the date of expiration of the period for issuing money (stat. 392 of the Labor Code).

Note! A resigned employee has the right, at his own request, to repay the debt to the employer even after his dismissal. Debt can be repaid not only with money, but also with property, if an agreement is reached between the parties.

Read: Calculation upon dismissal: payment terms

Deduction of accountable amounts from wages - postings

Information on funds issued for reporting is accumulated in account 71 “Settlements with accountable persons”; in analytics, calculations are linked to specific employees. When a debt arises for employees, they must repay it; if this does not happen, the debt is transferred to a shortfall in account 94. The forgiven debt is written off by transferring its amount to other expenses while simultaneously recording it on the off-balance sheet account 007.

Example 1

The employee was given 14,500 rubles for reporting purposes. According to the advance report, the volume of confirmed expenses amounted to 7,300 rubles, 7,200 rubles are subject to refund. The employee agreed to the option of repaying the debt using accountable funds through deduction of them from wages. The following entries will be made in the accounting:

- D71 – K50 – 14,500 rubles, funds were issued for reporting;

- D20 – K71 – 7300 rubles, part of the accountable funds is recognized as a confirmed expense;

- D94 - K71 - 7200 rubles, the balance of accountable money is converted into the employee’s debt and is considered a shortage;

- D20 - K70 - 33,800 rubles, the employee who did not reimburse the accountable funds was accrued;

- D70 – K68/NDFL – 4394 rub. (33,800 x 13%), income tax is withheld from wages;

- The maximum amount of debt that an accountant can withhold from salary accruals for the past month is determined - 5881.20 rubles. ((33,800 – 4394) x 20%);

- D70 – K94 – 5881.20 rubles, the debt on accountable funds is partially withheld from the salary of the accountable person with his consent;

- D70 – K50 – 23,524.80 rub. (33,800 – 4394 – 5881.20), salary was paid through the cash register.

Since the deduction of unused accountable amounts from wages was not made in full, the employee decided to voluntarily return the balance of the debt to the cashier. How to reflect this in accounting:

- D73 – K94 – 1318.80 rubles, the remaining part of the debt that could not be withheld from the salary;

- D50 – K73 – 1318.80 rubles, the employee voluntarily deposited the balance of accountable funds into the cash desk.

Accounting of settlements with accountable persons.

Accounting for settlements with accountable persons is kept on account 71 “Settlements with accountable persons” (A-P). Analytical accounting of the account is maintained for each accountable person. After issuing the money to the employee, the accountant will make the following entry:

Debit 71 – money issued on account

Credit 50 (51)

Write-off of spent accountable amounts is carried out on the basis of the approved advance report and is reflected in the credit of account 71.

WRITTEN OFF BUSINESS EXPENSES

| Type of consumption | Wiring |

| − property acquired | D 10 (08, 41) – materials were capitalized (fixed assets, K 71 goods) purchased by an accountable person When purchasing valuables in retail trade, the employee must submit a sales receipt or invoice and cash register receipt to |

| − expenses related to the needs of the main, auxiliary or service industries | D 20 (23, 29) – the expenses of the accountable person are written off as expenses K 71 main (auxiliary, servicing) production |

| − expenses related to management activities | D 25 (26) – general production expenses K 71 (general business) expenses were paid by accountable persons. |

| − expenses related to the sale of finished products or goods | D 44 – expenses of accountable persons are taken into account in selling expenses K 71 |

| − expenses for non-production activities (for example, expenses for sporting events, recreation, entertainment, etc.): | of the person reporting to K 71 are taken into account as part of other expenses |

WRITTEN OFF TRAVEL EXPENSES

| Purpose of the trip | Wiring |

| − purchase, delivery of fixed assets (equipment, cars, etc.) | D 08 – business trip costs associated with the purchase, K 71 delivery of fixed assets |

| − purchase, delivery of materials | D 10 – business trip costs associated with the purchase, K 71 delivery of materials |

| − purchase, delivery of goods | D 41 – business trip costs associated with the purchase, K 71 delivery of goods |

| − concluding agreements on the sale of products, studying sales markets in other regions, participating in exhibitions | D 44 – expenses for a business trip related to sales of K 71 |

| − participation in training seminars, shareholder meetings, other goals related to production activities | D 26 - written off the costs of a business trip necessary for K 71 management needs of the organization |

| − warranty repairs of previously sold products (if a reserve for warranty repairs has been created) | D 96 – expenses for a business trip associated with the return, K 71, transportation of defective products were written |

| − business trip of a non-production nature (for example, checking a summer camp owned by an enterprise) | D 29 (91) – business trip expenses are written off, not directly To 71 related to production activities pre- acceptance |

| − elimination of consequences of emergency situations | D 91 – the costs of a business trip related to K 71 eliminating the consequences of an emergency situation |

If the employee has an unspent balance of the advance payment , then within 3 days allotted for drawing up the advance report, it must be returned to the cash desk using a cash receipt order. In accounting, such an operation is formalized by posting:

D 50 – the balance of the advance from the accountable person is returned to the cashier

K 71

If an employee has reasonably spent money in an amount greater than the advance payment issued, then the amount of overspending is reimbursed to him from the organization’s cash desk on the basis of an approved advance report. This operation is formalized by posting:

D 71 – the employee is reimbursed for expenses exceeding the amount of the advance payment issued

K 50

If the employee does not return the accountable amount within the prescribed period, then within a month (the statute of limitations) by order of the head of the enterprise, it must be withheld from the employee’s salary. This operation is executed by transactions:

D 94 – the accountable amount not returned on time is reflected

K 71

D 70 – unreturned accountable amount was withheld from the employee’s salary

K 94

As long as the amount not paid on time is registered with the employee, it is regarded as a loan provided to him. In this case, the material benefit from the use of borrowed funds must be calculated. If the debt is written off at the expense of the organization, then this amount must be included in the employee’s total income and personal income tax must be withheld from it.

Accounting for settlements with personnel for other operations.

is maintained on account 73 “Settlements with personnel for other operations” (A - P). Sub-accounts can be opened for the account: 73-1 “Settlements for loans provided”;

73-2 “Calculations for compensation for material damage”;

73-3 “Payments for goods provided on credit”;

73-4 “Insurance calculations”, etc.

Don’t know how to solve or complete a coursework or dissertation? Order a solution

Didn't return the report on time - pay personal income tax

Accountable amounts not returned by the employee on time are reflected as his debt to the company. This debt may be attributed to the employee before the expiration of the statute of limitations in accordance with Article 196 of the Civil Code of the Russian Federation. They are not the employee’s income and are not subject to personal income tax, which a company can withhold only in two cases:

- if it forgives the employee’s debt for unrepaid amounts;

- if the statute of limitations for debt collection has expired.

But if a subordinate does not return the unspent account for a long time, does not provide accounting documents confirming expenses, and the company does not take any action to collect the debt, then with a high degree of probability the tax authorities will recognize this debt as the employee’s income and charge personal income tax.

An example of this is the latest ruling of the Supreme Court, which stated: if there are no documents to confirm expenses on the issued report, then personal income tax must be withheld from unaccountable amounts (determination dated February 3, 2020 No. 310-ES19-28047).

Personal income tax must be withheld from an unreturned report even from the director

Read more…

Let us add that tax can be charged on an unreturned report no earlier than the limitation period of three years has expired (letter from the Federal Tax Service of the Moscow Region dated September 14, 2020 No. 16-10 / [email protected] ).

What documents to use to formalize retention?

If the employee does not return the amount of the unspent advance on time, then withhold this money from his salary. To do this, the head of the organization issues a collection order in any form. The order is drawn up no later than one month from the day the deadline established for the report expires. It is possible to recover amounts from an employee if he does not dispute the basis and amount of deductions. Therefore, obtain the employee’s written consent to deductions. Otherwise, the debt can only be collected through court. Such rules are established in Articles 137, 248 of the Labor Code of the Russian Federation and confirmed in the letter of Rostrud dated August 9, 2007 No. 3044-6-0.

conclusions

On the topic of deducting unspent accountable amounts from salaries, we will draw several main conclusions:

- An employee can deposit the amount of debt voluntarily through the enterprise's cash desk using a cash receipt order.

- You can deduct a debt of no more than 20% of your monthly salary. A percentage is withheld from accrued wages minus personal income tax.

- To maintain accountability, it is necessary to obtain the employee’s consent and issue an appropriate order.

- If there is no desire to pay the debt, the employer has the right to collect it through a judicial authority. Then deductions will be made on the basis of the writ of execution.

When an employee must return accountable money

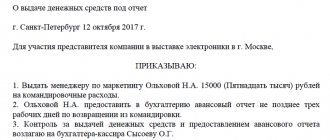

Accounting funds are issued to an employee either on the basis of his application or on the basis of an order from the head of the company.

The basis document must reflect the manager's order on the period for which the report is issued. Within three days after the expiration of this period, the employee must submit an advance report along with documents confirming the expenses incurred.

If an employee does not spend them during the period for which he received the funds, then he must immediately return them to the organization.

How to reflect the non-return of an accountable amount in accounting

Unreturned accountable amounts are considered:

- amounts for which the advance report was not submitted within the prescribed period;

- amounts for which the advance report is not reasonably approved by the manager;

- the unused balance of the accountable amount according to the approved advance report, which is not submitted to the cashier on time.

If such amounts are discovered, make the following entry (Instructions for using the Chart of Accounts):

| Contents of operation | Debit | Credit | Primary document |

| Unreturned accountable amount reflected | 94 | 71 | Accounting information |

Is it possible to deduct accountable amounts from wages?

The employer can fix the list of persons to whom funds can be issued on account by issuing an order (although this is not necessary). Any employee of the enterprise can become an accountable person.

Funds against the report can be issued to employees in cash or in non-cash format to a bank account. Once the funds are received, the employee will have to account for them.

Such a report means the employee providing the employer with documentary evidence of the amount of expenses and returning unspent accountable amounts to the employer. If the accountable amounts were issued in cash, then the employee must provide a report within 3 working days after the expiration of the period for which they were issued to him or from the day the employee returns to work (for example, after his return from a business trip). This requirement is specified in clause 6.3 of the Central Bank Directive of 2014 No. 3210-U.

The law does not prohibit issuing accountable amounts to employees, even if they have not reported on previous ones.

The employer independently approves the deadlines for issuing accountable amounts and enshrines them in local regulations (for example, in the internal Regulations on settlements with accountable persons).

With regard to reportable amounts that were issued in non-cash form, the employer must decide in advance on two aspects: for what period the reportable amounts are issued, and what is the final date for reporting by employees.

If the employee has not reported on the accountable amounts given to him, then the employer can withhold them from his salary. At the same time, he needs to take into account some legislative nuances. The procedure for withholding accountable amounts is regulated by Art. 137 Labor Code.

The issuance of money to employees on account is regulated by Central Bank Directive No. 3210-U dated 2014, which establishes the procedure for conducting cash transactions.

What to do if an employee submits an advance report without supporting documents?

Late submission of an advance report is a minor nuisance for an accountant. But what to do if this report does not contain primary expenses confirming? How to write off accountable amounts without documents?

According to the letter of the Federal Tax Service of the Russian Federation No. SA-4-7/23263 dated December 24, 2013, if an employee, having received money on account, did not provide documentary evidence of the expenditure of the specified amounts, then, on the basis of clause 1 of Article 210 of the Tax Code of the Russian Federation, the specified funds are to the extent that they are not confirmed by documents, are included in the income of the reporting person and in the tax base for personal income tax. But this is only possible if the employee did not solve the specified problem - and did not take care of restoring the original documents.

In a similar manner, many companies decide the fate of those accountable amounts, the expenditure of which was confirmed by documents that cannot be legally recognized as primary.

In accordance with Article 9 of Federal Law No. 402-FZ “On Accounting”, the primary documents used to document all business transactions must contain a closed list of mandatory details. And if at least one of the specified details is missing, then the document cannot be recognized as primary and serve as the basis for recognizing expenses and confirming the funds spent.

This means that an advance report, accompanied by such documents, can be approved by the management of the enterprise for an amount less than what the accountable person spent. Those. within the limits of those amounts that are confirmed by correctly executed documents.

As a result, the employee develops a debt to the company, but until the employee himself makes attempts to eliminate it. For example, require suppliers or contractors to provide correctly executed documents.

However, the issue of incorrect execution of primary documentation accompanying the expense report is quite controversial:

- Documents are attached to the expense report as proof only of the payment made by the employee (!) for goods, work, and services. Such evidence is primarily served by strict reporting forms and cash receipts provided for cash payments. At the same time, these documents must comply not with the requirements of Law No. 402-FZ, but with Law No. 54-FZ of May 22, 2003 “On the use of cash register equipment.” And such compliance will be sufficient to recognize the obligations of the accountable person as fulfilled, even if the invoices and other forms attached to these payment documents were prepared in violation of Article 9 of Law No. 402-FZ;

- In order to accept payments made by an accountable person as expenses, payment documents alone are not enough. This will require other documentation, which clearly shows the relationship between expenses and the business activities of the enterprise. This conclusion was made in letter No. ED-4-3/11515 of the Federal Tax Service of the Russian Federation and in Article 252 of the Tax Code of the Russian Federation. But this conclusion does not apply to confirmation of the fact of payment reflected in the advance report. Even if this report is not accompanied by invoices, but only cash receipts, then the checks alone will be enough for the accountant to accept the expense report. He can request the remaining documents to acknowledge the expenses himself or oblige the accountable person to do so. As a result, taxable personal income tax does not arise if only payment documents are attached to the advance report, and even the debt of the accountable person to the enterprise does not arise. But the primary document (invoices and other documents) drawn up in violation of Law No. 402-FZ only affects the possibility of recognizing expenses as expenses for accounting and tax accounting purposes.

It’s another matter when an employee has no documents at all that would confirm the expenditure of accountable amounts. And even an advance report submitted on time does not matter. In this case, the enterprise must:

- first try to restore the primary account to the expense report;

- if this fails, then the debt owed to the employee must be recognized at the end of the period during which the advance report should have been submitted;

- then make every attempt to collect the debt from the employee;

- if it was not possible to collect funds even through the court, then this debt should be recognized as hopeless and written off as a loss;

- and only after this does the employee have taxable personal income tax income!