Many people involved in business activities know that, in some cases, when purchasing a product or service, the buyer can request, in addition to the obligatory cash receipt, also a sales receipt, which contains more complete information on what and how much a certain amount of money was spent, but Despite this, few people know how to fill out a sales receipt; our article will be devoted to this issue.

Why do you need a sales receipt?

When making any purchase, the buyer must be given a cash receipt, that is, a document containing information about where and when a certain amount was paid. But quite often, only this information about the funds spent is not enough, if we also take into account the fact that most often in traditional checks only the transfer of purchase amounts is carried out, therefore, it is not entirely clear what the funds were spent on.

In the sales receipt, in addition to the amounts, it is written what and in what quantity was purchased. Consequently, a sales receipt is most often required to confirm the correct expenditure of funds, for example, when an employee purchases stationery for the office, such a document may be required.

But it should be remembered that the sales receipt performs only an auxiliary function, therefore, when attaching it, it is necessary to attach the cash receipt as well.

How to automate work with documents and avoid filling out forms manually

In the modern age of information technology, people are increasingly resorting to automating all kinds of processes. In the case of sales receipts, this automation is also possible.

There are several computer programs on the software market that allow you to synchronize cash register data with a personal computer, from which, in turn, sales receipts will be printed. In this case, there will be no need to fill out these documents manually; therefore, the possibility of making errors will be minimized.

These programs will be very useful for those sellers or service providers who work for the mass consumer. After all, issuing one or two sales receipts per day is not particularly difficult, however, if we are talking about thousands of customers per day, it is worth thinking about the need to automate the process.

Examples of automation can also be considered equipment that displays all the necessary information about a product and service in a cash receipt.

https://youtu.be/ZulgdPEgq2Q

Required details of a sales receipt

Based on the above, it has already become clear that the document in question is filled out in a random order, there are no strict requirements for its completion, but despite this there is a certain list of points that must be present in it, otherwise it will be considered invalid and cannot be used as proof of the purchase made.

So, the following elements must be present in the sales receipt:

- Naturally, the title of this document.

- Information about the individual entrepreneur (name, surname) or the name of the retail outlet to which the check was issued.

- Taxpayer's INN and enterprise number assigned to it upon registration.

- The address of the place where the check was issued, that is, the location of the retail outlet.

- Sales receipt number, numbering can begin again every day or month, it depends on what reporting period is accepted in the trading organization itself.

- The day of purchase and, therefore, will also be the date of issue of the check.

- The receipt indicates everything that was purchased by the buyer, down to the original.

- Purchase amount in numbers and words.

- At the end of the check, there must be a signature of the sales floor employee who filled it out and issued it.

This information must be present in each sales receipt, regardless of the specifics of the trading company’s activities; if necessary, additional items can be added to these items, those that are considered necessary.

https://youtu.be/pNM0h0fxwms

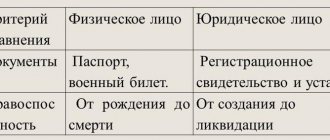

What kind of document is this

This document is known to many, but not everyone knows about the features of its use.

A sales receipt indicates that a purchase has been made and is an addition to the main document, which specifically indicates all purchased goods or services.

The sales receipt (PR) form is not approved, so the entrepreneur has a certain freedom in its production. The document itself does not belong to strict reporting forms, as it has auxiliary functions. Samples of a sales receipt can be found on the Internet and you can use any of them when working.

The entrepreneur is also free to make the form himself or contact any printing house or printing company. The latter can offer a variety of types of PM that reflect the specifics of a particular type of activity, or help develop an individual sample.

Let us note that some sources have recently expressed the view that this document is unnecessary, since many examples of cash register equipment print the full range of purchased goods on a cash register receipt. Of course, in this case the question of whether a sales receipt is needed disappears by itself.

At the same time, many business entities still have old cash registers, and here they cannot do without sales receipts. In addition, for entrepreneurs who are exempt from the mandatory use of cash registers, for example, those who are on UTII, PM is a document that they can provide to their clients when making a purchase.

Back to contents

Required details

Despite the fact that the form of a sales receipt is arbitrary, the legislation contains certain requirements that must be met when producing or issuing it. Otherwise, the document may be considered invalid and cannot be evidence of expenses incurred.

There are the following mandatory details:

- Title of the document.

- Last name, first name, patronymic of the entrepreneur.

- Entrepreneur's TIN

- Number – numbering can be carried out both daily and during the reporting period.

- Date of issue.

- Full name and quantity of goods or services purchased.

- Total amount in rubles.

Signature of the person issuing the check, indicating the surname, initials and position.

These details must be present on the form in any case, and it is also possible to place other information on it, at the discretion of the entrepreneur.

Back to contents

How to fill out a sales receipt for an individual entrepreneur?

There is nothing complicated about filling out a sales receipt for an individual entrepreneur.

As a rule, at each retail outlet there are forms on which the registration numbers of the organization trading or providing any services are already printed, therefore, the seller only has to write down on the form those names of goods and their quantities that the buyer purchased, sum up the purchase and, putting the date and your signature, give the document to the consumer.

Often in practice they are stapled together with a cash receipt, in this form they serve as detailed evidence of the intended use of the allocated funds.

What are they needed for?

Many stores issue receipts not with the exact name of the product, but impersonal. For example, when you buy a pack of A4 paper, you will receive a document with the description “Office”. You will get exactly the same if you buy a set of pens. To report to the accounting department, you need a detailed description of all purchased items, so upon request, the cashier will issue you a detailed sales receipt.

Note:

Not all entrepreneurs can have cash registers when carrying out business activities, so they issue sales receipts as a replacement for regular ones.

If you receive a sales receipt, you will need to submit it along with the cash receipt for reporting. And although the sales receipt is considered secondary, its presence can become critical in many cases related to the return or exchange of purchased goods.

In some cases, cash receipts are replaced with sales receipts. When does this happen? In Russia, according to the law on business activity, not everyone needs cash registers. For example, entrepreneurs working on UTII, simplified tax systems, and selling agricultural and handmade products work without devices. They simply must have sales receipts, which include the name of the product, its price, and the date of the transaction. After payment, the check is certified by the entrepreneur with a seal and signature, becoming an official document.

Sample filling

If, for some reason, filling out a sales receipt raises questions, this may well happen, if a person has just embarked on the path of trade and has not previously encountered such a task, then today any of the existing search engines.

Looking at these samples, seeing a clear example, all questions will immediately disappear. And in just a couple of minutes the warehouse will be filled.

Sales receipt form for individual entrepreneurs

There are no strict legal requirements for a sales receipt, except for the details that must be present in each of them. As for the forms for these documents, if previously they could only be ordered from printing houses, today this process can be solved on your own without spending additional financial resources on it.

To do this, you can either download ready-made forms on the World Wide Web and print them out, or make them yourself using one of the computer programs; with this method, it is possible to provide additional columns that are specific to a particular trade organization.

in Word file format (.doc).

Filling rules

There is no specific standard for filling out a sales receipt form. Online services for maintaining warehouse and business documentation can offer different forms, but in each of them it is necessary to comply with the legally required requirements for the content of the document.

There are five main points to consider when printing a blank check:

- The main information part includes information about the selling organization, the purchased product or paid service.

- Product warranty

- Apply a graphic image - a company logo or barcode.

- To compile the form, you need to be guided by samples from the Internet , but you can edit the form of the form at your discretion. Copy the printed form and use it when selling in your organization.

- The PM content is defined in the Rules for the sale of certain types of goods ... (dated 01/27/2009 No. 50). It may indicate a set of information about the properties of the product - grade, article, and so on.

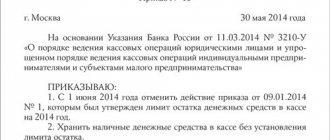

Individual entrepreneur sales receipt for UTII

The legislative acts of our country enshrine the right of entrepreneurs conducting their activities under the UTII system, that is, if this legal entity pays a single tax on imputed income, then in this case this trade organization has the right not to use a cash register in its work and when making a purchase by a consumer, a mandatory issuing a sales receipt.

In this case, the document must indicate the following details:

- The title of the document, that is, it must indicate that this is a sales receipt.

- Check number and date of issue.

- The name of the organization, if not, then information about the individual entrepreneur.

- The entrepreneur's TIN and identification number assigned to the organization upon its registration.

- A point-by-point listing of all goods purchased or services provided along with the quantity.

- The total amount indicating the monetary unit in which the payment was made.

- Information about the employee who filled out and issued this check (last name, first name and position held).

What are the requirements for sales receipts?

In order for this document to be correctly drawn up, entrepreneurs and sellers must carefully study the requirements for it. It certainly contains the following data:

- date of discharge;

- identification number of the form;

- name of the company or full name of the individual entrepreneur acting as a seller of goods or services;

- TIN of the company or entrepreneur;

- name of the product, its quantity and cost of one unit;

- the total amount spent on the purchase of goods, and it is indicated not only in numbers, but also duplicated in words;

- the seller’s signature, which must certainly be deciphered.

Important! If an entrepreneur or company works with a seal, then it is allowed to replace information about the TIN or the address of the activity with it.

The detail called “Name of the buyer” is not mandatory, however, if possible, it is advisable to enter the data, as this will avoid various problems and dissatisfaction on the part of tax inspectors.

Why do you need a sales receipt? Photo: russia-in-law.ru

The fact is that Federal Tax Service employees often refuse to accept documents without information about clients in the process of accounting for expenses and income. It is important to observe the sequence when using sales receipts, and this consists of continuous numbering, which should not be repeated.

It is the number of any primary document that is considered the main feature by which different accounting objects can be identified. Although there is no responsibility for the lack of continuous numbering, it is with its help that fraud on the part of buyers can be prevented.

You must fill out the sales receipt in duplicate in order to control all the issued documents. Important! Entrepreneurs can keep a special journal where all issued sales receipts are recorded.

What must be included in a sales receipt?

Although there is no standardized form, the document must certainly contain certain mandatory details. These include:

- name of the company or full name of the entrepreneur;

- TIN of the company or individual entrepreneur;

- registration number;

- address of the company or place where the entrepreneur carries out activities;

- the name of the goods or services purchased by the buyer or client;

- their number;

- price of a unit of goods or one service;

- the total cost of the entire purchase;

- the seller’s signature, as well as its decoding.

Important! A sales receipt acts as a document that contains detailed information about the purchase. All fields must be filled in, and if there is an empty space, a dash is placed there, which ensures that there is no opportunity to enter information after the document is issued.

At the bottom of the sales receipt there should be a total amount to be paid, and it is written not only in numbers, but also in text, which also reduces the possibility of fraud. If situations arise when you need to indicate too many items on a check, then this problem can be solved in two ways:

- several sales receipts are issued, each with a special mark indicating that it is a continuation;

- Several forms are filled out, each of which relates to a specific batch of goods, and each one indicates the total amount, after which all these amounts are added up.

You can even fill out this document using a computer, if the store or office has a computer with the necessary programs installed.

How to fill out a sales receipt, watch in this video:

https://youtu.be/ug85Qtdw5YI

Specifics of drawing up a sales receipt under different taxation systems

Individual entrepreneurs and companies have the right to use different taxation regimes. In some of them, it is allowed to use sales receipts instead of cash receipts. Others require the issuance of these two payment documents at the buyer's request. Features include:

- IP on UTII. It is allowed not to use the cash register during operation. A sales receipt is a document confirming a transaction and passed to the buyer as evidence. If it relates to the BSO, then all the mandatory details contained in the regulatory act must be entered into it, otherwise the operation is considered undocumented.

- IP on the simplified tax system. It is imperative to use a cash register, so cash receipts are issued to customers and clients, and a cash receipt order is also drawn up. A sales receipt is considered auxiliary and is therefore used only to decipher purchased goods.

- IP on OSNO. When issuing a sales receipt, a cash payment document must also be provided, otherwise it will not be considered valid.

- IP on PSN. When applying a patent, it is allowed not to use a cash register, so sales receipts are issued without cash registers.

Thus, sales receipts are considered important payment documents. They are mandatory for entrepreneurs who use patents or UTII in the process of work. Sellers are required to know how to correctly draw up this document, otherwise significant fines cannot be avoided during an audit by the tax inspectorate.

Under other taxation systems, the document is used exclusively to decipher all purchased goods. The forms may have different types, but they certainly indicate the required details for proper completion.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now: +7 (Moscow) +7 (St. Petersburg) It's fast and free!

Individual entrepreneur sales receipt on the simplified tax system

Quite often, novice entrepreneurs choose a simplified taxation system, the reason for this popularity is explained by:

- Economic efficiency.

- Permission to carry out activities without a cash register.

Economic efficiency is explained by a lower tax of 6% for beginners, which is quite a significant support.

And the fact that you can work without a cash register makes the activity even easier; the only thing that needs to be taken care of in this case is that employees are aware of how to fill out a sales receipt, since when working with this system, its attachment to each purchase is mandatory.

Filling out this document is no different from those sales receipts described above, so dwelling on this would be an unnecessary repetition.

Are you here

Companies and individual entrepreneurs who are payers of UTII are allowed, in accordance with current legislation, not to use cash registers. In this regard, many of them do not punch cash receipts. Therefore, for these sellers, the role of the sales receipt increases, which becomes the main document confirming the purchase.

In order for an employee to be able to account for the cash issued to him for the purchase of material assets, issuing only a cash receipt is not enough. It is necessary to decipher the purchase by item, quantity and unit price. For these purposes, responsible persons in stores draw up sales receipts.

Do I need a stamp on an individual entrepreneur's sales receipt?

For individual entrepreneurs, it is not necessary to put a stamp on a sales receipt; this is not required by the legislator; however, for the trading organization itself, that is, for an individual entrepreneur, putting a stamp on this document can create additional guarantees.

So, for example, in the event of a product return or any other conflict situation, the presence of a seal will mean that the product was actually purchased at this retail outlet, and not somewhere else. After all, anyone can fill out a sales receipt without a stamp by hand, so in order to create greater guarantees both for yourself and for your clients, it is better to certify the sales receipt with a seal.

Sales receipt from an individual entrepreneur without a cash receipt

Today, individual entrepreneurs who pay a single tax on imputed income have the legal right to work without cash registers; accordingly, when purchasing any goods at such points, traditional receipts are not issued.

Instead, the buyer receives a sales receipt filled out in accordance with established rules as confirmation of his purchase. This document must not be lost, since in the event of a dispute, its presentation is mandatory.

Many ordinary citizens probably consider a sales receipt to be a simple piece of paper, but the information presented in the article indicates the opposite. Therefore, if suddenly in one of the small departments you are given only a sales receipt, you should not doubt the legality of these actions. This fact once again demonstrates that modern life requires being informed in all matters, only in this way a person will not find himself in an absurd situation and everything will always work out for him.