- What needs to be done when creating a separate division

- How to determine the need to register a separate enterprise

How does the registration procedure occur if an individual entrepreneur opens a separate division? This question worries many entrepreneurs. Successful commercial activity implies rapid expansion, and on “foreign” territory. Opening such an organization requires compliance with certain rules and payment of necessary taxes. How to register it? And what does an individual entrepreneur who wants to expand need to know?

What needs to be done when creating a separate division

A separate division is a branch that is not located where the workplaces are located, even if only one place has been created there.

It is subject to mandatory registration. It is created with the aim of attracting customers outside the region where the main division is located. Any branch of an enterprise that is not organized at the “main” address is considered separate.

Can an individual entrepreneur open a separate division? The procedure for its creation itself is simple, unlike a representative office or branch. Its opening implies the creation of jobs and, subsequently, their registration with tax authorities.

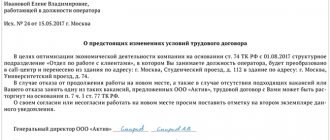

In order to register, you need to provide the tax authority with an identification card of the owner of the enterprise, a power of attorney if the documents are submitted by the owner’s deputy, as well as an application in the appropriate form.

If an individual entrepreneur opens a separate division, then documents must be submitted no later than one calendar month after its opening.

In case of late submission of documents or other violations, the owner of the enterprise is subject to a fine or penalty in the amount specified in the law on offenses.

- The enterprise is registered for tax purposes within 7 working days.

- If an entrepreneur for some reason changes the address of the organization or opens it in another city, the procedure for closing a branch and its subsequent registration in another city is considered mandatory, while the tax system that the entrepreneur chose for himself from the very beginning does not change.

- In addition to registration with the tax office, some separate enterprises must be registered with other funds. If an organization has its own balance sheet, bank account and issues payments and other cash bonuses to individuals, this procedure is mandatory.

To register with the Pension Fund, you must provide a certificate of tax registration (in the case of a legal entity), the legal entity’s notification of registration in extra-budgetary funds, documents that confirm the creation and activities of this branch and the application for registration itself.

In order to register with the social insurance fund, you need to provide to the relevant authorities a certificate of registration of a legal entity, a document confirming that the legal entity is registered with a local tax authority, documents indicating the creation and conduct of business activities, and a notice of registration of the policyholder .

Return to contents

Branches and representative offices

There are two forms of a separate unit (SU):

- Branch.

- Representation.

In the first case, the EP performs the functions of the organization. In the second, he represents and protects her interests. The OP does not act as an independent organization - it acts as established by the head of the parent organization. The company's documents include information about all OPs created by it.

https://www.youtube.com/watch{q}v=dlevjeqcmws

The Tax Code of the Russian Federation does not contain the concepts of “branch” and “representative office”. Only general - a separate division. The representative office does not conduct business activities. This is its main difference from a branch, for which a separate bank account is opened. The representative office is more dependent on the parent organization.

The signs of an OP, regardless of whether it is a branch or a representative office, are territorial isolation and the presence of a workplace. The OP is usually located in another city. Located in premises rented for at least a month.

Important! There are no strict limits regarding the number of employees in a remote office. A branch with only one employee is also an OP.

The organization is responsible for its OP, even if the charter says nothing about it. Can an individual entrepreneur open an additional branch in another city{q}

In 2020, no amendments were made to the law regarding the OP. It is unlikely that anything will change in the future. OP can only be opened by a legal entity. Moreover, if it does not work according to the simplified tax system. An individual will not be able to register an individual entrepreneur, which is one of the disadvantages of an individual entrepreneur. However, this does not mean that an entrepreneur does not have the right to open an additional office in another city.

Important! A legal entity is allowed to open representative offices in other cities. An individual entrepreneur does not have such a right. To open, you will need to register with local government agencies.

How to determine the need to register a separate enterprise

Registration of a separate subdivision of an individual entrepreneur is required if there is at least one stationary workplace that has existed for at least a month.

In this case, the entrepreneur must register a company and carry out other operations related to the labor activities of employees, based on the clauses of the Labor Code.

Warehouses intended only for storing raw materials or production items, where there are no permanent employees, are not considered a separate enterprise. Payment terminals, ATMs and other vending machines are not considered separate. Employees engaged in remote work are also not included in the list of employees of such organizations.

When opening a separate division of an individual entrepreneur, first of all, it is necessary to clarify that the newly created organization is not a representative office or branch. It is necessary to clarify whether the created workplace is stationary and whether there is a permanent employee. If the organization meets all the necessary criteria, then within a calendar month it must be registered with the local tax authority and with the funds. The merchant will pay taxes at the place of registration of the main enterprise.

If for some reason an entrepreneur decides to close this company, he is obliged to report this to the tax authority. Within 3 days, he must submit documents in person or send by mail.

Do not forget about offenses and subsequent punishment. Therefore, an entrepreneur must be careful about running his business. If some questions arise, the best option would be to contact a specialist in a timely manner, who will give an objective assessment of a particular situation and explain the action plan.

A separate division is a branch of an entrepreneur that is not located at the place of registration of the company. This branch must be equipped with workplaces in accordance with the requirements of regulatory authorities. Those managers who want to get new clients in other regions, thereby increasing the flow of profit, decide to open such a division. The opening process is regulated by Article 23 of the Tax Code of the Russian Federation.

Registration

Individual entrepreneurs have the right to create jobs in any region of Russia. But certain tax regimes require additional registration with the local tax office. If an entrepreneur hires employees for a new branch, and this is inevitable, he will have to pay contributions from their salaries. That is, you also need to register with the Social Insurance Fund and Pension Fund.

https://www.youtube.com/watch{q}v=QXBj7qmzpA8

If an entrepreneur works under a “simplified” system, in another city he can conduct activities under a patent (if this type of activity is included in the list of those to which the PSN applies). Two applications must be submitted to the tax office. The first is about registration. The second is about obtaining a patent.

The declaration is submitted at the place of residence. The entrepreneur pays for the patent in the region where the additional office is opened. An entrepreneur maintains two UDR books: USN and PSN. The latter reflects only income.

With “simplified” taxes are paid at the place of registration. It does not matter in which cities the commercial activities are carried out. Tax base is the totality of income received over a certain period, regardless of geography. There should be one UDR book.

Where to submit reports to an entrepreneur who plans to open a business in another city that requires payment of UTII {q} In the city in which this type of business activity is carried out, within five days from the date of opening the branch.

An entrepreneur submits a declaration under the simplified tax system at his place of residence. According to “imputation” - in the tax authority where he is registered as a UTII payer. If other types of activities, except those under UTII, are not conducted, you need to submit a zero declaration under the simplified tax system to the tax office at your place of residence.

In this case, the entrepreneur must register a company and carry out other operations related to the labor activities of employees, based on the clauses of the Labor Code.

Warehouses intended only for storing raw materials or production items, where there are no permanent employees, are not considered a separate enterprise. Payment terminals, ATMs and other vending machines are not considered separate. Employees engaged in remote work are also not included in the list of employees of such organizations.

When opening a separate division of an individual entrepreneur, first of all, it is necessary to clarify that the newly created organization is not a representative office or branch. It is necessary to clarify whether the created workplace is stationary and whether there is a permanent employee. If the organization meets all the necessary criteria, then within a calendar month it must be registered with the local tax authority and with the funds. The merchant will pay taxes at the place of registration of the main enterprise.

If for some reason an entrepreneur decides to close this company, he is obliged to report this to the tax authority. Within 3 days, he must submit documents in person or send by mail.

Do not forget about offenses and subsequent punishment. Therefore, an entrepreneur must be careful about running his business. If some questions arise, the best option would be to contact a specialist in a timely manner, who will give an objective assessment of a particular situation and explain the action plan.

Individual entrepreneurs belong to a special category of business participants. They are individuals and are registered with the tax authorities at their place of official residence. After organizing their business, many individual entrepreneurs plan to expand their activities by opening stores and offices in other regions.

Opening procedure

The procedure for opening a unit is quite simple and will not take much time. An important point is the creation of jobs and their registration with the tax office. The entrepreneur brings his passport and an application for opening a new location to the tax authority at the place where a new unit is opened. By the way, you can first open a branch and then register it, but no later than one month after opening, otherwise problems cannot be avoided. Those who applied later will face fines and penalties.

The tax office registers the new unit within 1 week. If an individual entrepreneur moves his branch from one city to another, then the procedure for closing the old branch is mandatory.

Separate divisions are registered not only with the tax authority, they are also required. This cannot be avoided by those who have an open bank account from which payments to employees are made.

Separate divisions are registered with the Pension Fund and the Social Insurance Fund.

You can not register a division only if there is not a single workplace there. If there is at least one, then legal registration is inevitable. The following are not considered separate divisions:

- Warehouses without workers.

- ATMs.

- Terminals.

Taxes are paid locally, despite the fact that a separate organization will be located in another region.

"Separate" status

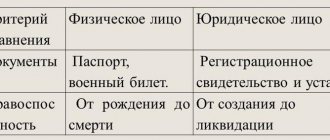

Before answering the main question - can an individual entrepreneur have a separate division?

– let’s give a general definition of who an individual entrepreneur is.

According to the law, this is any individual who:

- wants to conduct commercial activities;

- must register itself with the tax office accordingly.

Let us say right away that a person registered as a businessman is not equated to a legal entity. This:

- different concepts;

- miscellaneous documentation;

- different business opportunities.

Let us define a separate division. It refers to a certain structure that is related to the main organization. In other words, these are branches, representative offices or other parts of the company that report directly to the head office. They cannot conduct completely independent activities, since all decisions are made by the general management. This follows from Article 55 of the Civil Code of the Russian Federation.

The Tax Code provides an additional definition of a separate division and also describes its main distinguishing features. Article 11 states that:

- the structural unit must be located in a separate building; it cannot be located in the same place as the head office;

- in the “isolation” there must be stationary workplaces, that is, established for a period of more than 1 month.

Even one employee who works in a remote office, but on a permanent basis, can be considered a separate unit. For example, an in-house correspondent for a publication who works in another country.

Separate division for individual entrepreneurs

A separate division means a branch of a company that is located geographically in a different location from the parent organization, and jobs are organized in it for a period of more than 1 month. An individual entrepreneur is one single individual who cannot inherently be divided. Therefore, individual entrepreneurs cannot be equated to legal entities, and the provisions of Art. 55 of the Civil Code of the Russian Federation and Art. 11 of the Tax Code do not apply to them. Consequently, the answer to the question: can an individual entrepreneur have a separate division - negative. Opening branches, representative offices and other separate divisions, registering them with the tax authorities is the exclusive right of legal entities, but not of individuals.

Many businessmen, when discussing whether an individual entrepreneur can open a separate division, are not based on the legally approved concept of a division. Their ideas are based on the idea of commercial activity as an extensive network structure of many branches operating on one behalf.

However, individual entrepreneurs are not limited in any way in their ability to conduct commercial activities in all regions of the country, including other municipalities. In fact, an individual entrepreneur can open a separate division in the form of additional warehouses, points of sale, stores, points of service provision, but he does not need to submit an application to the Federal Tax Service. From the point of view of legislation, such points of sales, production and provision of services of various formats will not have the status of branches, representative offices and will not be endowed with the corresponding powers. Accordingly, the individual entrepreneur will pay personal income tax from the salaries of his employees, insurance premiums, VAT and other taxes in the region at the place of his official registration, and not at the place of actual business.

A separate issue concerns the use of cash registers at remote points of sale and where they must be registered. Many individual entrepreneurs believe that if they opened a store in another area, then the cash register should be registered there. An individual entrepreneur, no matter how many cash registers he has according to the number of points of sale, must register all of them with the same Federal Tax Service at his place of residence. This is stated in paragraph 15 of the Decree of the Government of the Russian Federation No. 470 of July 23, 2007 “On the registration and application of cash register systems.”

A right that doesn't exist

Now let's get to the heart of the matter. According to the Tax and Civil Codes, divisions are created only by legal entities. That is, a businessman, being always an individual, does not have such a right.

Thus, the answer to the question is whether an individual entrepreneur can open a separate division

- definitely not. However, the law does not prohibit him from creating some kind of branches, representative offices and other structural divisions that are necessary to conduct business and maintain it. But legally they will not have the legal status of separate units.

Special rules for individual entrepreneurs

Often, businessmen believe that it is enough to create a branch in another city and it can already be considered a separate division. At the same time, they are guided not by legal norms, but simply by a general idea of working with an extensive network.

But as we said above, according to Art. 11 of the Tax Code of the Russian Federation and Art. 55 of the Civil Code of the Russian Federation, “separate buildings” can only be registered by an organization. But an individual entrepreneur is still a physical person. Therefore, individual entrepreneur is a separate division

Can't open it at all.

There is also a legal norm. It is written down in Article 23 (clauses 1 and 3) of the Civil Code and describes the activities of individual entrepreneurs. Among other things, it is stated that:

From the last line, for example, it follows that an individual entrepreneur cannot create separate divisions, as companies do.

Can an individual entrepreneur have a separate division?

An individual entrepreneur is a citizen who has registered with the tax authority for the purpose of carrying out commercial activities and receiving regular income, without creating a legal entity.

The concept of “separate division” is reflected in paragraph. 17, 19 paragraph 2 art. 11 of the Tax Code of the Russian Federation, as well as in Art. 55 of the Civil Code of the Russian Federation and contains a number of distinctive features, namely:

- is a division of the organization;

- is located on a territory separate from the legal entity;

- has permanently equipped workplaces created for a period of more than 1 month.

Based on the above provisions, it is incorrect to classify the commercial activities of a citizen, carried out by him in various places, as a separate division of an individual entrepreneur.

An individual has the right to register as an individual entrepreneur (Part 1 of Article 83 of the Tax Code of the Russian Federation):

- at your residence address (registration);

- finding real estate or transport belonging to him;

- another location, which may include the place of actual activity of the entrepreneur.

In addition to registering as an individual entrepreneur with the Federal Tax Service, a person is required to register with the Pension Fund and the Social Insurance Fund. In this regard, reporting and transfer of taxes and mandatory contributions will be carried out according to the details of these authorities.

Divisions not provided for by law

Many people are interested in whether an individual entrepreneur can have a separate division

. Theoretically, yes. Only in the case of individual entrepreneurs, this does not need to be somehow enshrined in law or coordinated with government agencies.

Anyone who has their own business can develop it by creating a network. We can talk about:

- additional offices;

- opening of stores;

- maintenance of official representatives, etc.

In fact, these are also separate divisions. And you can call them whatever you want. But at the same time, there is no need to submit documents to the relevant authorities and register and declare them.

The names of such structures can be anything. But, as a rule, they should contain:

- reference to the name of the relevant businessman;

- connection to the area.

EXAMPLE

“Representation of IP Ivanov I.I. in Rostov." "Ryazan Manufactory IP Zhadova Yu.P." "IP Khlynov N.S. - branch in Volgograd."

The activities of such structural units depend entirely on the will of their owner, that is, the entrepreneur. It is partially regulated by the legislation of a particular locality.

If you find an error, please select a piece of text and press Ctrl+Enter

.

The concept of a separate division in the legislation of the Russian Federation applies only to legal entities. However, this aspect is not specified in any way in the context of individual entrepreneurship.

Since an individual entrepreneur is an individual, it cannot have a legally regulated separate division.

But this fact does not interfere with the main entrepreneurial activity of individuals. faces. And it is worth more clearly formulating the concept of commercial activity in any region of the country and using various forms of regulation.

Is it possible

In order to understand whether an individual entrepreneur can have one, one should distinguish between the concept of such a department and an extensive network.

According to paragraphs 1.2 of Article 11 of the Tax Code of the Russian Federation, Article 55 of the Civil Code, a separate division of a legal entity is an object that is a branch, representative office or other department. In this case, the location of this object should not coincide with the main one.

From this definition it follows that there are no separate facilities for individuals. Therefore, from a legal point of view, the creation of such organizations will not be legally supported.

It is also stipulated that a separate enterprise has jobs for a period of one month. For an individual entrepreneur, this point does not matter. Since from the moment of establishment of the enterprise, it can operate in any region and hire employees anywhere.

Moreover, any actions from the legal side will be regulated in the plane of individual entrepreneurship, and not a separate enterprise.

Solution of the problem

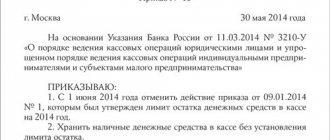

Individual entrepreneurs cannot open separate divisions. Only organizations have the right to create branches and open representative offices. This follows from the definition of a separate division given in paragraph 2 of Art. 11 Tax Code of the Russian Federation:

a separate division of an organization is any division territorially isolated from it, at the location of which stationary workplaces are equipped. Recognition of a separate division of an organization as such is carried out regardless of whether its creation is reflected or not reflected in the constituent or other organizational and administrative documents of the organization, and on the powers vested in the specified division. In this case, a workplace is considered stationary if it is created for a period of more than one month.

If an individual entrepreneur plans to conduct activities in several places, there is no need to separately notify the tax authority about this, unless the tax system applied by the individual entrepreneur requires it.

legal information

The Civil Code of the Russian Federation defines two types of separate divisions - branches and representative offices. Based on this, these branches will not be considered separate legal entities, but will carry out their activities in accordance with the constituent documents of the main company.

The management of such departments can be carried out through a designated manager - by. The Tax Code indicates that such an institution submits reports not at its location, but together with the main office.

By its very nature, the enterprise becomes isolated automatically. Next, management must collect the necessary package of documents and submit it to the relevant control authorities.

The Labor Code also makes adjustments - each separate department must have a stationary workplace. Therefore, when working from home, even under an employment contract, from the legal side, the unit will not be considered separate.

The moment the unit starts operating is the date of its registration. Preparing premises, equipment and creating jobs cannot be the beginning of an activity.

When creating divisions, this fact must be recorded in the constituent documents. All actions must be within the framework of the Federal Law of August 8, 2001 No. 129-FZ “On State Registration of Legal Entities and Individual Entrepreneurs.”

If you do not register such an object with the tax authority, you may receive fines. Penalties of 10 to 20 percent of revenue are applied here. You can liquidate a department by filling out the appropriate application.

Separate division: create and register

A newly created LLC quite often does not have its own or rented office and is listed only at its legal address. This may be the home address of the manager (founder) or an address with postal and secretarial services. While no real activity is being carried out yet, and correspondence intended for the LLC, especially from official bodies, arrives in a timely manner, this situation is normal. But, sooner or later, the LLC begins to work, which means it must “materialize” somewhere in space.

You can get answers to any questions about registering LLCs and individual entrepreneurs using the free business registration consultation :

Free registration consultation

Sometimes the nature of the activity allows you to conduct business from home or with the help of remote workers, but if an LLC opens a store, warehouse, office, production facility, or in some other way begins to operate at an address other than its legal address, then it is necessary to create and register a separate division .

There is an important condition here - the criterion for creating a separate unit is the presence of at least one stationary workplace , and it is recognized as such if it is created for a period of more than one month. The concept of a workplace is in the Labor Code (Article 209), from which we can conclude that:

- an employment contract must be concluded with the employee;

- the workplace is under the control of the employer;

- the employee is constantly in this place in accordance with his job duties.

Based on this, a storage warehouse that does not have a permanent employee will not be considered a separate unit. Vending machines, payment terminals, ATMs, etc. are not considered as such. Remote (remote) workers also do not fall under the concept of a “stationary workplace”, therefore concluding employment contracts with them does not require the creation of a separate unit.

Please note that individual entrepreneurs should not create and register separate divisions . Individual entrepreneurs can operate throughout the Russian Federation, regardless of the place of state registration. If they work under the UTII regime or have purchased a patent, they only have to additionally register for taxation at the place of business.

What should a separate division be like for an organization to have the right to the simplified tax system?

Article 346.12 of the Tax Code of the Russian Federation prohibits the use of a preferential simplified taxation system for organizations that have branches (the requirement for the absence of a representative office has already been abolished). Of course, the question arises - how to register a separate division so that it is not recognized as a branch, and at the same time the organization retains the right to the simplified tax system? To understand this, you will have to refer to the provisions of three codes: Tax, Civil and Labor:

- The Tax Code (Article 11) gives the concept of a separate division of an organization as “... any territorially separate division from it, at the location of which stationary workplaces are equipped.” However, the Tax Code of the Russian Federation does not provide a description of the types of separate divisions.

- The Civil Code (Article 55) characterizes a separate division only in the form of a representative office and a branch . That is, from these provisions it is also unclear what other separate divisions, besides a representative office and a branch, can be.

- The Labor Code (Article 40) indicates that “... a collective agreement can be concluded in the organization as a whole, in its branches, representative offices and other separate structural units .” Thus, only here can one see that separate divisions can be something other than a branch and representative office.

As a result, we are dealing with some elusive concept of another separate division, therefore, when creating such a division, we must simply avoid the criteria that characterize it as a branch or representative office. These characteristics in the law are more than meager:

- a representative office is a separate division of a legal entity located outside its location, which represents the interests of the legal entity and protects them;

- a branch is a separate division of a legal entity located outside its location and performing all or part of its functions, including the functions of representative offices;

- representative offices and branches are not legal entities, and information about them must be indicated in the Unified State Register of Legal Entities, and therefore in the organization’s charter.

It is no coincidence that we understand this issue in such detail, because non-compliance with these requirements (sometimes implicit) can deprive an organization of the opportunity to work on the simplified tax system, and unexpectedly. For example, the manager believes that the created separate division is not a branch, so the organization continues to work on a simplified system, although it no longer has the right to do so.

In such cases, the organization will be recognized as operating under the general taxation system from the beginning of the quarter in which a separate division with the characteristics of a branch was created. And the loss of the right to simplification leads to the need to charge all general taxes: profit tax, property tax, VAT, and it is with the latter that the most problems can arise. VAT must be charged on the cost of all goods, works and services sold for the current quarter, and if the buyer or customer refuses to pay it additionally, then the tax will have to be paid at their own expense.

Signs of a branch and representative office

Considering what unpleasant consequences recognition of a separate division as a branch can lead to for the simplified tax system payer, you need to know what its signs may be:

- The fact of the creation and commencement of activities of a branch or representative office is reflected in the charter of the LLC (from 2020 this is not necessary).

- The parent organization approved the regulations on the branch or representative office.

- A head of a separate division has been appointed, who acts by proxy.

- Internal regulatory documents have been developed to regulate the activities of a separate division, as a branch or representative office.

- A branch or representative office represents the interests of the parent organization before third parties and protects its interests, for example, in court.

Thus, in order to retain the right to the simplified tax system, it is necessary to ensure that the created separate division does not have the indicated characteristics of a branch. In addition, it is necessary to indicate in the Regulations on a separate division that it does not have the status of a branch or representative office and does not conduct the business activities of the organization in full (for example, a store is engaged only in the storage, sale and delivery of goods). The creation of a separate division is within the competence of the head of the LLC; it is not necessary to include information about this in the charter.

Important regulations

Requested documents

The creation of a separate department involves submitting a package of documents to the tax service. Initially, you should fill out form C-09-3-1. Next, it is submitted to the Social Insurance Fund at the place of registration.

When going to the tax office in person, you should have with you:

- passport;

- if the documents are submitted not by the general director, but by a representative, a power of attorney;

- application on form S-09-3-1 in completed form;

- photocopy of the application - to receive a mark on acceptance of the document.

A number of interdistrict institutions require additional paperwork to register the department.

The most common among them are:

- Photocopy of the legal statement. persons to be registered with the tax authorities, with certification by a notary.

- Papers that confirm the creation of the department. They can be lease agreements for premises, orders for creation.

- A document of any type for an accountant and manager.

- Power of attorney. It must be issued for any representative of the company, except the general director.

If you need to register a branch for tax purposes, you should collect the following documents:

- Papers that relate to the creation of a unit. They can be constituent documents.

- Data from the ERGUL on recognition of the creation of a separate department.

- The regulation that establishes the work of a unit within a legal entity.

- An order or order for registration of a department, signed by the head of the main office.

Form form S-09-3-1:

What you need to know

Since the new division is being created in another city, its main goal is to attract the attention of new users to the company. A separate division of an individual entrepreneur means only jobs. If available, the department should be registered with the Social Insurance Fund.

You need to understand that failure to complete registration actions in a timely manner may result in penalties from the tax service.

Thus, a complete package of documents must be provided to the relevant authorities no later than one month from the opening of the department.

It is necessary to remember the following design points:

- The total period for registration with the tax office will take up to 7 working days.

- If the location of the department changes, the entrepreneur must close it and go through the full registration procedure in another city. The tax system does not need to be changed during these actions.

- The need to register with other organizations (except tax authorities) arises when creating a separate balance sheet, bank account or calculating wages and bonuses. Then the Pension Fund, Social Insurance Fund and other institutions are added to the tax office.

General rules and restrictions

According to the law, an individual entrepreneur can create a division separate from the main office, but it will not need to be coordinated with government agencies. Since this action will be aimed at business development.

Such structural changes may include:

- arrangement of new office premises;

- opening of individual retail outlets;

- sending official company representatives to the regions.

The law allows an individual entrepreneur to open such divisions without appropriate registration or filing applications. Typically, the names of such departments may be different, but they reflect the name of the individual entrepreneur, the name of the businessman and the location of the facility.

Regulation of the activities of such divisions is carried out only by the entrepreneur himself. However, it is worth considering the laws of local authorities. Since they may have peculiarities in terms of doing business in a particular region.

Registration required

If a separate division of an individual entrepreneur has at least one place to work for at least a month, it must be registered. In addition to registering a company, it is also necessary to employ workers in accordance with the norms of the Labor Code.

At the same time, warehouses that only store raw materials or production equipment, and also that do not have permanent employees, cannot be considered a separate enterprise. ATMs, terminals and other devices also cannot be considered separate. In addition, remote employees also do not count.

Should a new department register an individual entrepreneur? When opening a separate division, it is necessary to emphasize that the organization does not have the status of a representative office or branch. At the same time, it is necessary to clarify the availability of a stationary place and a permanent worker.

If all the conditions are present, then within a month the division must be opened and registered with the tax and other structures. Moreover, taxes will be paid at the place of registration of the main company and taking into account its taxation system. It could be or.

The procedure for opening a separate subdivision of an individual entrepreneur

A separate division is usually opened in other regions in which the entrepreneur wants to get new customers and increase profits. At the same time, the opening process is described in detail in Article 23 of the Tax Code of the Russian Federation.

The procedure itself is not very complicated and takes minimal time. First, it is necessary to create direct jobs and register them with the tax authorities. And at the place where a new unit is opened, the entrepreneur must provide a passport and a written statement indicating the purpose - opening a new unit.

The law allows the option of creating a branch and its subsequent registration. It must be legalized no later than a month after opening, otherwise penalties may be applied in the form of financial penalties and penalties.

The unit will be registered with the Federal Tax Service within a week after submitting the documents. If the open branch is subsequently moved to another locality, then before that it is necessary to close the old enterprise.

Separate divisions are subject to registration not only with the tax office, but also with the Pension Fund and the Social Insurance Fund. These authorities must be completed by those who have an open bank account from which payments to employees are made.

You can not register only when there is not a single workplace. And when closing a division, you must submit the relevant documents to the tax office within 3 days.

How to pay taxes

Each division involves paying taxes separately from the main office. According to the Tax Code of the Russian Federation, paragraph 2 of Article 346.28, the opening of any unit by a temporary worker implies registration with the tax office under UTII.

This type of taxation depends on municipalities and urban districts. This is stated in paragraph 1, article 346.26 of the Tax Code of the Russian Federation. Paragraph 3 of the same article allows these regional municipal bodies to establish different basic income ratios. Because of this, documentation and accounting in the two regions will be prepared differently.

However, the Ministry of Finance says that you can register only at the main branch and submit reports to one tax service. This is also evidenced by the information contained in the Tax Code of the Russian Federation, paragraph 2, article 346.28.

But in this case, disagreements with the FSS may arise. Therefore, it is worth considering such a moment as location. When opening a separate department in one city, areas may differ. Then there is no need to register a separate imputation.

In other situations, separate accounting is required. It will help avoid confusion and disputes with tax authorities. Since 2013, enterprises can voluntarily choose UTII. In this regard, a businessman can use either one taxation system for all departments, or different ones in each individual case.

On what basis does an individual entrepreneur have the right to conduct his business in another location?

Despite the fact that the rules on branches and representative offices do not apply to individual entrepreneurs, that is, an individual entrepreneur cannot have separate divisions, he can carry out his activities anywhere in the country, while creating jobs.

In such a situation, the law requires registration in the region in which the entrepreneur actually conducts his business only if he acquires a patent (Chapter 26.5 of the Tax Code of the Russian Federation) or uses the UTII system (Chapter 26.3 of the Tax Code of the Russian Federation). It is worth noting that UTII is a type of taxation that has not been mandatory since 2013, and will be abolished altogether from 01/01/2021.

So, if an individual entrepreneur uses the simplified taxation system (STS), then planning to carry out, for example, trading activities on UTII or provide services under a patent in another region, he must additionally declare this to the Federal Tax Service of this area.

In this regard, at the place of opening an additional business, the individual entrepreneur is obliged to contact the Federal Tax Service of the region (city, district) and, depending on the chosen taxation system, take the following actions:

- when applying UTII: register;

- submit a reporting declaration;

- pay tax;

- register;

If an individual entrepreneur uses the simplified tax system exclusively, then no matter how many regions he carries out his commercial activities, he does not need to additionally register in these areas.

So, let's conclude:

- an individual entrepreneur has the right to conduct his business simultaneously in different cities and regions;

- the implementation of such activities does not relate to a separate division of an individual entrepreneur, and accordingly, is not subject to the norms of the law on branches and representative offices;

- In addition, it is necessary to register as an individual entrepreneur only if he/she uses a patent taxation system or UTII.

Accounting for UTII

The calculation of the amount must be completed starting from the first day of creation of the unit. Moreover, if an organization is removed from UTII, then the calculation is made for the period from the first day of registration until the end of using the system.

There are situations in which the department was registered not on the first day of the month. Then the calculations will be carried out using a different formula.

With UTII, the amount per month is calculated from the basic profitability multiplied by the physical indicator. This figure should be divided by the number of days in the month multiplied by the number of days the enterprise actually operates.

The opening of a separate department in the same region where the main office is located will change the physical indicator. In this case, records are kept from the beginning of the month. Everything must be paid by the 25th of the month following the reporting period.

From the point of view of legal norms and legal acts, individual entrepreneurs cannot have separate enterprises. But this does not mean that in practice an entrepreneur is prohibited from having representatives or opening new retail outlets. You don’t even need to notify government agencies for this.

It is not uncommon for an accountant, when paying a certain amount to an employee, to ask the question: is this payment subject to personal income tax and insurance contributions? Is it taken into account for tax purposes?

An individual entrepreneur is an individual. Registration of an individual as an individual entrepreneur does not equate him to legal entities. As a result of this, an individual entrepreneur cannot have a separate division in the sense given to it by civil and tax legislation. However, this does not prevent an individual entrepreneur from carrying out commercial activities in any place using various forms of organization of activities.

Entrepreneur and separate division

Entrepreneurs, wondering whether an individual entrepreneur can have a separate division (hereinafter also referred to as an OP), often do not proceed from the legally established concept of an OP, but are based on some idea of a form of entrepreneurial activity with an extensive network, carried out on behalf of one person.

Therefore, in order to dispel illusions and eliminate misunderstandings in this matter, it is necessary to refer to the definition of the concept of “separate division”, which is established by the legislation of the Russian Federation.

From paragraphs 1, 2 of Article 11 of the Tax Code of the Russian Federation and Article 55 of the Civil Code of the Russian Federation, it follows that a separate division of a legal entity is understood as a branch, representative office or other division of an organization, the location of which does not coincide with the parent organization.

Thus, the creation of a separate division in the sense given to it by civil and tax legislation is the prerogative of legal entities, not individuals.

It should also be taken into account that, on the basis of paragraphs 1, 3 of Article 23 of the Civil Code of the Russian Federation, from the moment of appropriate registration as an individual entrepreneur, an individual has the right to carry out commercial activities and is subject to part of the norms of civil legislation regulating the activities of organizations. However, based on the essence of legal relations for the creation of an OP, the corresponding rules are not applicable to individual entrepreneurs.

Can an individual entrepreneur have a separate division?

Related publications

Individual entrepreneurs belong to a special category of business participants. They are individuals and are registered with the tax authorities at their place of official residence. After organizing their business, many individual entrepreneurs plan to expand their activities by opening stores and offices in other regions. Therefore, the main question of many businessmen at the stage of economic growth is whether an individual entrepreneur can have a separate division, and what is needed to register it.