Can a founder lend to his company?

Loan agreement with the founder: how to protect yourself from mistakes?

Loan repayment: what to consider first?

Returning an interest-free loan to the founder: which method to choose?

Loan repayment procedure: what other conditions should be taken into account and on which accounts should be reflected?

What to do if you can’t return the loan to the founder’s card?

Resolving the issue with a “stuck” loan

Results

Can a founder lend to his company?

The company and its founder, if necessary, can act as parties to a loan agreement - a mutual agreement on the transfer of funds or other property to the borrower from the lender into ownership.

Find out more about borrowed funds by following the link.

Borrowing relationships with the founder allow the company to urgently receive money or other items at the lowest cost:

- for carrying out current business activities;

- expansion of the material base;

- introduction of new technologies;

- for other purposes (for making a deposit for participation in a tender, paying off debts, etc.).

There are no special regulatory restrictions in relation to the company (borrower) and the founder (lender). Therefore, the founder can lend his company:

- money or any other property that has common generic characteristics (model, color, variety, etc.) - clause 1 of Art. 807 Civil Code of the Russian Federation;

- borrowed funds in any amount and for any period;

- with or without interest.

The borrowing company can borrow from the founder:

- regardless of the size of its share in the authorized capital;

- for specific purposes (targeted loan) or without specifying the purpose of the loan;

- subject to the obligation to return the borrowed funds received and to formalize the loan agreement in writing (Article 808 of the Civil Code of the Russian Federation).

You can follow the link for the loan agreement with the founder.

Loan repayment: property instead of money

In such cases, tax risks are likely. If the value of the property exceeds the terminated obligation, then the risks arise with the receiving party (the lender). Officials believe that in this situation the organization must reflect non-operating income on which it is necessary to pay income tax. This conclusion can be seen, for example, in Letters of the Ministry of Finance of the Russian Federation dated February 3, 2010 No. 03-03-06/1/42, Federal Tax Service of Russia for Moscow dated December 5, 2007 No. 19-11/116142.

By taxing this difference to income tax, the company will eliminate tax risks. It is important to know that the obligation is considered extinguished at the moment the compensation is provided, and not at the moment the agreement on it is signed. This means that on the date of concluding the agreement on the provision of compensation, the borrower’s obligation does not terminate.

To terminate the obligation, the actual provision of compensation, that is, the transfer of property, is necessary. Therefore, if the loan is interest-bearing, then interest accrues until the borrower transfers the property. And if real estate is provided as compensation, then the compensation agreement is considered executed only after state registration of the transfer of ownership of the real estate to the creditor. This conclusion follows from the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 17, 2014 No. 2826/14 in case No. A57-2430/2011.

And one more important point. Within the meaning of Article 409 of the Civil Code of the Russian Federation, unless otherwise follows from the compensation agreement, with the provision of compensation all obligations under the contract are terminated, including the obligation to pay a penalty (clause 3 of the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 21, 2005 No. 102).

This means that if the loan was interest-bearing, then with the compensation agreement all obligations are repaid, including the payment of interest. Unless, of course, otherwise provided in the agreement. Therefore, if the lender wants to receive his interest in cash, and the body of the loan itself is ready to receive “in kind,” then the corresponding procedure must be specified in the agreement. Otherwise, with the provision of compensation, the entire debt will be repaid, that is, the loan itself and the interest on it.

The tax base is defined as the value of the transferred property, calculated on the basis of prices determined in accordance with Article 105.3 of the Tax Code of the Russian Federation, and without including tax in them (clause 1 of Article 154 of the Tax Code of the Russian Federation).

According to paragraph 1 of Article 105.3 of the Tax Code of the Russian Federation, prices used in transactions in which the parties are persons who are not recognized as interdependent are recognized as market prices. In fact, this means that the value of the property that the parties agreed upon, excluding VAT, should be included in the VAT tax base. “By adding VAT on top (multiplying by 118%), we get the value of the property including VAT. It is this value that should be specified in the compensation agreement.

Loan agreement with the founder: how to protect yourself from mistakes?

The return of money under the loan agreement is one of the final stages of the borrowing relationship. It is preceded by such important procedures as:

- agreeing on the terms of the loan;

- drawing up a loan agreement;

- transfer of borrowed funds from the founder to the company and preparation of a supporting document (transfer and acceptance certificate, receipt, etc.);

- reflection in accounting of operations to obtain borrowed funds.

If mistakes are made in these steps, problems may arise at the loan repayment stage. Therefore, check in advance:

- whether the property transferred under the loan agreement has individual characteristics (for example, a car with a title and identification number cannot be the subject of a loan);

- currency of the monetary obligation - according to Art. 317 of the Civil Code of the Russian Federation, such an obligation must be expressed in rubles (foreign currency may appear in the loan agreement, but only as an equivalent at the rate of the Central Bank of the Russian Federation);

- whether the loan agreement provides for all its essential (subject of the loan and its repayment) and additional (repayment period, interest-free condition, etc.) conditions.

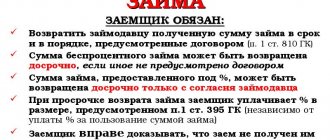

IMPORTANT! If the loan agreement does not contain provisions on interest or the absence thereof, the loan is considered interest-bearing. Interest is calculated based on the refinancing rate (clause 1 of Article 809 of the Civil Code of the Russian Federation). The contract also cannot stipulate that the loan is irrevocable. According to paragraph 1 of Art. 807 of the Civil Code of the Russian Federation, the lender is a priori obliged to repay the loan to the lender.

Find out what conditions are necessarily included in the purchase and sale agreement for an apartment from the material “Essential terms of the purchase and sale agreement under the Civil Code of the Russian Federation.”

Hocus pocus: loan repayment turned into delivery of goods

Hello, I have the following situation: the founder contributed funds to the development of the LLC for a year, which were formalized under the agreement as an interest-free loan, the time has come and it is necessary to repay the loan, but the LLC has no free funds, the founder agrees to repay the loan with materials available in the warehouse . Tell me if this is possible, what documents to formalize the transfer of materials and what records.

There will be records. mvf 07/02/2018, 13:37 Perhaps. How to sell materials and offset. alinas1010 07/02/2018, 1:38 pm but will it be necessary to issue an invoice and pay VAT? mvf 07/02/2018, 13:38 Of course. alinas1010 07/02/2018, 1:40 pm Clear, then it’s simply issued with a delivery note and an invoice. alinas1010 07/02/2018, 13:41 and what a booze.

Loan repayment: what to consider first?

Before deciding whether to return the interest-free loan to the founder on the card, you need to check:

- the founder-lender has no debt to contribute a share to the authorized capital - if the founder has not contributed his “authorized” share in a timely manner or has not transferred it to the company in full, the borrowed funds received will be used to pay off such debt, and there will be nothing to return to his card;

- the presence in the loan agreement of a condition allowing the use of a method of returning borrowed money to the founder’s card;

- compare the types of borrowed funds received by the company from the founder and the funds returned by it under the loan agreement.

If you received a batch of building materials under a loan agreement, then there can be no question of any return to the loan card in cash. Borrowing relationships presuppose a single rule: “what you borrow, return it” (Clause 1, Article 807 of the Civil Code of the Russian Federation).

Thus, having ensured against mistakes at the stage of agreeing on the terms of the loan agreement and having made sure that the loan can be repaid in money to the card of the founder-lender, you can proceed directly to the procedure for returning the borrowed funds (see below).

Repayment of a loan to the cash desk of an enterprise by an individual

You will have to repay the borrowed funds! Depending on who the creditor is and how long the debt was taken out for, the methods for repaying it may be different.

How to pay off your loan debt in 2020?

What it is

A loan is one of the ways to provide loans to the population under certain conditions. The main difference between a loan and a credit is that it can be either an oral or a written agreement, while a loan can only be a written agreement.

Microfinance organizations issue loans in small amounts for a short period of time. Both unemployed and officially employed citizens can receive it.

A huge advantage of MFOs over banking institutions is that loans are issued with a minimum set of documents. The conclusion of an agreement is possible online, without refusal and with a bad credit history.

These are completely legal organizations that receive a license to carry out their lending activities from the Central Bank of the Russian Federation and are also registered in the State Register.

Under a loan agreement, one party, which is the lender (in this case, an MFO), gives the other party, the borrower (this can be either a citizen or a legal entity), a certain amount of money for a certain period. After this period, the borrower is obliged to return the entire amount along with interest (as a rule).

Reflection in the law

The loan agreement is drawn up taking into account the norms of paragraph 1 of Chapter 42 of the Civil Code of the Russian Federation. And since loans are issued exclusively by microfinance organizations, it is worth relying on the norms of the Federal Law “On Microfinance Organizations” dated July 2, 2010 No. 151-FZ.

How to apply

To apply for a loan, you only need to take a few simple steps. First of all, you need to choose the organization that issues it on more favorable terms for a particular borrower. It is better to select several with similar issuance conditions at once in order to protect yourself in case of refusal.

Then you need:

| Register on the website of your favorite microfinance organization | this is not at all difficult to do, you only need to indicate your data, if the borrower has previously contacted this organization, then he needs to log into his personal account by entering his login and password |

| Then you need to select the desired borrowing conditions | The website always has comprehensive information about all current programs. You need to choose the one that suits you best |

| Apply now | which also won’t take much time, because you need to provide a minimum of information and wait for a response |

| If it is positive | then receive the required amount using the method that was chosen when filling out the application |

| In case of negative | which happens quite rarely, you should try contacting another microfinance organization |

There is another way to receive funds - personally visiting the company’s office and filling out an application in the presence of a manager. This method is somewhat more complicated, since you need to look for an office.

You can also conclude such an agreement with the employer or founder. It can be either paid, that is, with the payment of interest on it, or gratuitous.

: loan repayment guarantee system

Loan return (repayment) procedure

The loan has a term of use. After this period, the borrower must return the borrowed funds along with interest for their use. Interest-free loans are found in practice, but much less frequently than reimbursable loans (that is, with interest).

You can return funds in several ways:

| Upon expiration of the borrowing period | lump sum for the entire amount |

| Annuity payments | that is, in equal parts over a certain period. Since we are talking about loans that do not have a long borrowing period, repayment, as a rule, occurs once a week or once every 2 weeks, less than once a month |

You can repay the debt:

| In cash | to the cash desk of a microfinance organization |

| By non-cash method | from the borrower's card or bank transfer |

The method of debt repayment is chosen by the client of the organization, taking into account the latter’s opinion. If the company does not provide a way to return the debt to an electronic wallet, then the client will not be able to return the funds this way.

To an individual from a legal entity

As a rule, the lender is a legal entity, and the borrower is a citizen. At the same time, the creditor can be not only an MFO, but also an employer.

Refunds from a citizen to a legal entity have several nuances:

| If the transfer is made by non-cash method | there are no restrictions on the amount of contribution |

| If in cash at the cash register | then no more than 100 thousand rubles at a time under one agreement. But, since we are talking about microloans, such huge amounts are not issued |

If the lender is a microfinance organization, then disbursement occurs only in cash. The debt must also be repaid in cash.

If the lender is, for example, an employer, then he can lend some property or a batch of his products. Such a loan will be considered interest-free, that is, the employer does not have the right to charge funds for the use of an item or property.

You can also repay either with your property or with cash. But, to do this, it is necessary to assess the value of the subject of the contract, and then return an amount equivalent to the value of the loaned property.

Sample requirement

The loan agreement must specify the repayment period. Otherwise, the loan will need to be repaid within 30 days after receiving a written request from the lender. This is a nuance that not all borrowers are aware of, and unscrupulous lenders can take advantage of it.

If such a situation occurs, then you should be careful. The request for repayment of the debt must be made in writing and handed over to the borrower against signature.

If this is not done, then the borrower is deemed not to have been properly notified. The court will take this fact into account if the lender decides to claim his debt in court.

For a debt repayment claim to have legal force, it must contain the following information:

| Intelligence | about both parties to the agreement and about the agreement itself |

| Debt amount | possible sanctions if the debt is not repaid on time |

There is no unified form of the requirement; you need to draw it up yourself, but without going beyond the scope of business etiquette.

Debt repayment schedule

If the debt is repaid by annuity, then it is necessary to draw up and approve a schedule of future payments. This document is an integral part of the contract. The payment schedule reflects the payment dates and amounts. It must be followed. For violation of repayment terms, the document specifies sanctions.

According to this schedule, the borrower can repay his debt ahead of schedule. To do this, he must notify the lender that on a specific date of a specific month he will be able to repay the entire amount. Then the borrower will recalculate interest on the entire amount of the remaining debt on the repayment date.

If you do not notify the lender, you will have to repay the debt along with interest calculated until the end of the contract.

What are the ways

Possible ways to repay the debt under the loan agreement must be spelled out in it. But before signing the document, the borrower must carefully read each of them in order to avoid unpleasant consequences.

The first surprise that a borrower can expect:

- The lender provided for repayment of the debt in a lump sum at the end of the loan term.

- The lender provided for the repayment of the debt by annuity.

The possibility of early repayment should also be specified in the contract. If such a clause is not specified, then early repayment may entail penalties, or it will be necessary to pay the entire amount of the debt, without recalculating interest.

You can repay the loan:

- in cash;

- goods;

- property.

From the company's cash register

This repayment method is relevant if the borrower is an entrepreneur or legal entity. It is important not only to repay the debt, but also to properly prepare accounting documents.

One option is to return funds from the company’s cash register. But you should be very careful! Finances received from the sale of products, or works, or services are not suitable for repayment.

Source: https://f-52.ru/vozvrat-zayma-v-kassu-predpriyatiya-fizicheskim-litsom/

Returning an interest-free loan to the founder: which method to choose?

A company can only have 2 legal “cash pockets”, from which it can transfer to the founder the funds borrowed from him:

- from a current account;

- from the cash register.

To transfer to the founder's card from a current account you will need:

- a description in the loan agreement (or in an additional agreement to it) of a similar method of debt repayment;

- indicating in it detailed bank details for transferring money to the card.

Note! When repaying a loan to the founder - an individual, there is no need to run a cash register check with the “expense” sign.

If a company does not have money in its current account, but it does have it in the cash register, it is important to consider the following:

- you cannot issue money from the cash register to repay a loan from proceeds (clause 4 of the Bank of Russia Instruction on the procedure for conducting cash transactions No. 3210-U dated March 11, 2014, Decision of the Moscow City Court dated December 14, 2012 in case No. 7-2207/2012);

- funds from the cash desk are deposited into the current account, and then a transfer is made to the founder on the card with a note in the purpose of payment “Return of funds under the loan agreement dated __ No. __”).

Do not neglect cash restrictions, otherwise you may suffer financially - according to Art. 15.1 of the Code of Administrative Offenses of the Russian Federation, the fine for this type of cash violations is up to 50,000 rubles.

Which “cash” requirements are dangerous to ignore is stated in the material “Procedure for conducting cash transactions in 2020.”

Taxation

You will need to pay tax when you receive income. If an agreement on an interest-free loan is drawn up as a rule, then neither party will have a material benefit and, accordingly, there will be no need to pay taxes.

There are a number of cases when liability to pay taxes still arises:

- Loan payments are made in arrears, and the agreement provides for the accrual of fines and penalties in case of late payments. Fines received by the lender will be counted as income and tax must be paid on them.

- If property was provided to repay the loan, then everything will depend on its value. Providing unequal compensation entails tax consequences. When the compensation is higher than the cost of the loan, the lender benefits from the difference in costs. If the property is cheaper, then the borrower receives income.

Loan repayment procedure: what other conditions should be taken into account and on which accounts should be reflected?

When repaying a debt to the founder under a loan agreement and transferring money to his card, do not forget about the need:

- compliance with the loan repayment schedule stipulated in the loan agreement;

- full repayment of the borrowed debt no later than one month from the date specified in the agreement (if a payment schedule is not provided).

When you cannot do without schedules in your current business activities, learn from the materials posted on our website:

- “How to correctly draw up a schedule for the implementation of professional standards?”;

- “What does this mean - a rotational work schedule?”;

- .

In accounting, reflect the repayment of the loan to the founder’s card by writing:

Dt 66 (67) Kt 51 - repayment of the loan to the founder’s card under the loan agreement.

Apply:

- account 66 “Settlements for short-term loans and borrowings” - if you borrowed funds from the founder for a period of less than 12 months;

- account 67 “Settlements for long-term loans and borrowings” - if the loan agreement provides for a longer borrowing period (over a year).

The bank statement will confirm:

- the fact of repayment of debt to the founder;

- volume and details of transfers.

If you are repaying the loan in parts, apply all of the above recommendations for each part of the debt being repaid.

What is important to consider when repaying a debt

The founder can issue money for the needs of his company with or without interest. In any case, it is necessary to draw up and sign a loan agreement.

Since one of the parties is a legal entity, it must be concluded in writing.

The loan is repaid within the period specified in the agreement with or without interest, as specified in the agreement.

Important! The loan agreement is considered concluded not from the moment it is signed, but from the moment the funds are transferred. The same applies to loan repayment - obligations under the agreement terminate when the borrower returns the money to the lender.

The loan can be issued in both rubles and foreign currency. However, repaying a loan to a non-resident founder in foreign currency can cause many problems for the chief accountant.

A foreign currency loan must be repaid in rubles at the exchange rate of the Central Bank of the Russian Federation on the day of repayment. Interest is also expressed in foreign currency, but is accepted for accounting in rubles.

If the founder issues a loan with interest, then their amount and payment procedure must be specified in the agreement. If the amount of interest is not specified in the agreement, then it is considered “by default” to be equal to the refinancing rate of the Central Bank of the Russian Federation on the day the interest is paid.

If the agreement does not specify the payment procedure, the borrower must pay them monthly throughout the entire term of the agreement.

In the case where the lender is both the founder and director of the borrower company, the agreement must be drawn up in the same way as with any other borrower.

Only the director will need to sign twice - the first time as the lender, and the second time as the director of the borrower.

The lender can also issue a targeted loan, for example, for the purchase of equipment. At the same time, other founders must ensure that the borrower spends the money specifically for these purposes.

The loan is repaid with or without interest within the period specified in the agreement. If this period is not specified, then the loan must be repaid within 30 days after the borrower receives the repayment notice.

The notice must be in writing and signed by the lender.

The founder can issue both short-term and. – this is a loan for a period of up to 12 months, respectively, long-term – for a period of more than a year.

What to do if you can’t return the loan to the founder’s card?

Repayment of borrowed funds is a mandatory condition of the loan agreement. However, it may be impossible to return the debt to the founder on the card for a number of reasons, for example:

- there are no funds in the current account;

- The bank account is blocked by the tax authorities;

- in other cases (the bank’s license was revoked, etc.).

If financial difficulties are temporary and sooner or later the company will have the opportunity to transfer the debt under the loan agreement to the founder’s card:

- agree with the lender on the extension of the loan repayment period, review the payment schedule;

- formalize the revision of the terms in an additional agreement to the loan agreement, attach an adjusted payment schedule to it;

- check whether, due to the extension of terms, the loan has become a long-term loan - detailed analytics in this matter allows you to correctly fill out the explanations for the accounting statements and provide its users with complete and reliable information about the company’s borrowed obligations.

This publication will tell you in which line to reflect borrowed capital.

If the company’s financial situation does not improve in the near future and there is no possibility of repaying the debt to the founder under the loan agreement, it is necessary to consider other ways to resolve the issue with the hanging debt. Find out about one of these methods in the next section.

Ways to return money to the founder

There are several ways to repay the loan to the founder:

- through the cash register;

- goods;

- from a current account through a cash register;

- property.

Each method has its own advantages and pitfalls.

From a current account via cash register

You can return the loan to the founder by withdrawing money from the current account of the borrower company and disbursing it through the cash desk. Do not forget that when withdrawing money from a current account by check, the check must indicate “repayment of the loan to the founder.”

When registering the issuance of money through the cash register, the cash receipt order also indicates that this is a “repayment of the loan to the founder,” and 66 or 67 is indicated in the corresponding account, depending on whether the loan is being returned - short-term or long-term.

Product

According to, if the borrower does not have the funds to repay the debt, he can return it to the borrower in the form of goods. Products can be either our own production or purchased for resale.

In any case, this is the borrower's own property. Ah, according to. , the gratuitous transfer of goods into the ownership of another person is a sale.

Therefore, depending on which taxation system the borrower uses, the following must be paid from the proceeds from sales:

- income tax

- single tax in a “simplified” form.

Through the cash register

According to clause 2, cash from the cash register, which is sales proceeds for goods sold, services provided or work performed, can only be used in the following areas:

- salary and other social benefits (sick leave or maternity leave);

- payment of insurance compensation to individuals under insurance contracts with individuals;

- issuing money to employees on account;

- payment for goods, works or services.

As can be seen from this list, repayment of the loan to the founder from the proceeds is not provided for in this list. Therefore, the proceeds from the sale of goods cannot be used to repay the loan to the founder.

You can first hand it over to the bank, and then withdraw it with the indication “return of the loan to the founder”, and issue it from the cash desk using cash settlement services.

Property

The situation is similar to that when the loan is repaid in goods. Property is the property of the borrower, and its transfer to repay the loan is an operation of transferring ownership, which, in accordance with Art. 39 of the Tax Code of the Russian Federation is revenue from sales. This method is common if the loan is returned to the founder upon exit from the LLC.

The value of this property is determined by agreement of the parties. Most often, it is equal to the amount of the loan for which it is transferred.

On this proceeds, the borrower will have to pay all necessary taxes, which depend on the tax system he applies.

For example, returning a loan to the founder with a car, which is the property of the borrower. Its approximate cost will pay off the debt to the lender.

Cash

As mentioned above, repayment of the loan to the lender in cash from the cash desk is not possible, according to clause 2 of the Bank of Russia Directives dated October 7, 2013 No. 3073-U.

Even if the lender, when issuing a loan, deposited money in cash, according to these Instructions, the borrower must hand it over to the bank on the same day.

Upon expiration of the loan term, he must withdraw money from the account, indicating the reason “return of the loan to the founder”, and then issue it from the cash desk on the same basis, only according to cash settlement. Personal income tax

The lender must pay personal income tax only if it issues an interest-bearing loan. Income tax is paid only on interest on the loan, since the main debt is the founder’s money, and he receives his money back in due time.

And interest on a loan is the lender’s income, for which he must pay tax to the state in the amount of 13% of the amount received.

If the loan is long-term and interest is paid every year, then the lender must pay personal income tax at the end of each year.

A loan from the founder is a fairly common thing. This is more convenient for both the enterprise – the borrower, and the founder – the lender. The main thing is to draw up a loan agreement correctly. It must be in writing.

Resolving the issue with a “stuck” loan

Any loan burdens the balance sheet liability - it increases the total amount of the company's debts and affects individual financial ratios, as well as the overall financial position.

Find out what calculations the company’s debt capital indicator involves in the article “Financial leverage ratio - formula for calculation.”

This situation can be easily resolved by the lender himself - the founder of the company. He has the power to relieve his company of the debt burden by forgiving the debt under the loan agreement.

If the founder decides to forgive his company’s debt, he must:

- take into account the fulfillment of the requirements of Art. 415 of the Civil Code of the Russian Federation - the founder can forgive the company’s debt if this does not violate the rights of other persons in relation to the creditor’s property;

- formalize debt forgiveness by agreement or other document;

- reflect the forgiven debt in accounting: in accounting by including the forgiven debt in other income (Dt 66 (67) Kt 91);

- in tax accounting, take into account the amount of debt in non-operating income if the share of the founder who has forgiven his debt to the company does not reach 50% (subclause 11, clause 1, article 251 of the Tax Code of the Russian Federation); if his share is 50% or more, the income is not reflected in tax records.

The founder can forgive both part of the debt under the loan agreement and the entire amount of the interest-free loan.

The loan was returned with goods, what should I do?

Settlements on short-term loans and borrowings 62 “Settlements with buyers and customers 118,000 VAT accrued on advance payment (RUB 118,000 x 18/118) 62 “Settlements with buyers and customers 68 “Settlements on taxes and fees”, subaccount “VAT 18,000” On the date of delivery of goods Reflected revenue from the sale of goods 62 “Settlements with buyers and customers 90 “Sales”, sub-account “Revenue 118,000” Written off cost of goods sold 90, sub-account “Cost of sales 41” Goods 90,000 VAT charged 90, sub-account “VAT 68, subaccount “VAT 18,000 Accepted for deduction of VAT accrued from advance payment 68, subaccount “VAT 62” Settlements with buyers and customers 18,000 *** For more information about other types of new obligations, read: 2012, No. 17, p. 63; 2012, no. 20, p. 29 In one of the upcoming issues, read about how to repay debt under a loan agreement by providing compensation.

The goods received are considered paid for on the date of signing the novation agreement, and they must be taken into account in the amount of the obligation that was terminated by the novation.2. The cost of goods can subsequently be taken into account in expenses.

23 clause 1 art. 346.16, paragraph 2 of Art. 346.17 Tax Code of the Russian Federation. Accrued interest for tax purposes is included in income on the date of signing the novation agreement. 1 tbsp. 346.15, paragraph 1 of Art. 346.17, paragraph 6 of Art. 250 Tax Code of the Russian Federation. The transfer/repayment of a loan is not an income/expense when calculating tax under the simplified tax system, therefore, when signing a novation agreement, no tax obligations arise. 1 clause 1.1 art. 346.15, subd. 10 p. 1 art. 251, art. 346.16 of the Tax Code of the Russian Federation 1. To calculate tax under the simplified tax system, income from the sale of goods is recognized on the date of signing the novation agreement. 1 tbsp. 346.17 Tax Code of the Russian Federation.2.

Information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 21, 2005 No. 102, Resolution of the Federal Antimonopoly Service of the North-Western District dated March 16, 2012 in case No. A56-30457/2009). Therefore, the borrower can set the value of the transferred property either higher or lower than his debt.

In this case, the parties must decide whether the transfer of “unequal property” will satisfy the obligation to repay the loan in full? Or “will it cover the debt only partially (in terms of the value of the transferred property)? The fact is that if this point is not reflected in the compensation agreement, then by default it is considered that the obligation is terminated completely (clause 4 of the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 21, 2005 No. 102). Transferred the property? Add VAT! The transfer of property (whether goods, products or fixed assets) as compensation is recognized as a sale for VAT purposes.

- Substitution of direct resuscitation of the creditor, No. 14

- Reanimation of the creditor, No. 14

- The counterparty has forgiven the debt: what about the income tax?, No. 12

- Writing off bad debt based on the statute of limitations: what's new?, No. 9

- The bank burst, but questions remain, No. 5

- Assessing the solvency of one’s own and others, No. 4

- Is there no price in the contract? Look for other sources, No. 4

- Accounts receivable management, No. 3

- 2018

- Do you doubt your debtors? Create a reserve!, No. 21

- Hocus Pocus: Loan repayment turned into delivery of goods, No. 19

- Reserve for doubtful debts: counter creditor is not a hindrance, No. 13

- The contract was terminated: we return the advance payment, No. 3

- They decided not to return the mistakenly received advance: what about taxes, No. 3

The purchase price of goods sold can be recognized as expenses if these goods are paid for. 23 clause 1 art. 346.16, paragraph 2 of Art. 346.17 Tax Code of the Russian Federation. Interest that “accumulated before the signing of the agreement is included for tax purposes, within the limits of the standard, as part of expenses on the date of signing of the agreement, sub-clause. 9 clause 1 art. 346.16, paragraph 2 of Art. 346.17, sec. 1, 1.1 art. 269 of the Tax Code of the Russian Federation. The transfer/repayment of a loan is not income/expense for tax purposes, which means that when signing the agreement, tax obligations do not arise. 1 clause 1.1 art. 346.15, subd. 10 p. 1 art. 251, art. 346.16 Tax Code of the Russian Federation Example. Accounting innovations / condition / Yablonya LLC issued a loan to Gooseberry LLC in the amount of 115,000 rubles.

The parties decided to update the obligation to repay the loan and pay interest on the obligation to supply goods. At that time, the amount of accrued interest was 3,000 rubles.

Loan of goods, return in money according to the Civil Code of the Russian Federation

Results

Borrowed funds can be returned to the founder’s card only by transfer from the company’s current account and provided that the loan was provided in money. This method of loan repayment must be specified in the contract or additional agreement to it.

Sources:

- Tax Code of the Russian Federation

- Civil Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Return of an interest-free loan to the founder

Methods for repaying an interest-free loan must be specified in the contract.

An interest-free loan implies a return of the same amount that was borrowed. When repaying an interest-free loan, this amount is not recognized as an expense of the organization, which reduces the tax base for income tax. This is discussed in paragraph 12.

When issuing an interest-free loan, the borrower experiences savings in the form of savings on interest. However, these savings are not included in the income that increases the tax base when taxing profits.

Debt repayment

The legislation provides for several legal ways to repay debt, which answers the question of whether it is possible to return the loan to the founder from the cash register.

It is proposed to consider the more common ones.

Products or goods

The legislation establishes a ban on the return of the loan subject in kind, however, carrying out offsets does not contradict the current norms of the law.

In other words, an enterprise can supply the lender with its products in an amount equal to the amount of borrowed funds with mutual offset of financial claims;

Through the cash register

By making a money transfer from an open account to the cash desk. The legislation sets a limit on the amount of repayment of borrowed funds for legal entities at 100 thousand rubles.

There are no restrictions for individuals. When answering the question whether it is possible to repay a loan from proceeds, you should refer to Directive of the Central Bank of the Russian Federation No. 3073-U, according to which such operations are prohibited.

Otherwise, the sanctions provided for in Article 15.1 of the Code of Administrative Offenses of the Russian Federation will be applied.

Transfer of property

The Civil Code of the Russian Federation in Article 409 provides for the possibility of release from obligations in the event of transfer of compensation by mutual agreement of the parties.

In this case, the essence of the loan agreement loses legal force, and mutual obligations are considered fulfilled.

Important aspects

There are interest-bearing and interest-free loans. A loan agreement is possible.

In the second case, despite the fact that funds are issued without accruing interest, there are situations when the debt will have to be repaid with additional penalties, namely:

- the funds were not given within the period specified by the agreement;

- the loan payment was late at least once. The content in the terms of the loan agreement of a clause on the payment of a certain percentage for services provided by the lender;

- If the procedure for calculating interest on an overdue loan is not prescribed, then the fine will be accrued every month or every week.

If there is at least one case of violation of the terms of the loan agreement, the accrual of interest on the principal debt has legal grounds.

It is necessary to carefully study the terms of the gratuitous loan so that the accrual of interest under the agreement does not come as a surprise to the borrower.

What it is

A gratuitous loan implies a financial transaction in which the lender gives the borrower a certain amount of money for a certain period without additional interest.

Repayment of a gratuitous loan can be made at any period, by annuity payments or in another manner, depending on the terms of the agreement on the loan obligation.

The borrower and the lender draw up a special agreement that satisfies the requests of the two parties. To confirm that the transaction has been completed and the client has received money, a third party is invited, who must also sign the document.

This witness is needed to confirm that the borrower has received the money. The lender may be a company, banking organization, founder or other lending company.

Where to contact the borrower

The parties to a gratuitous loan agreement can be any person, regardless of whether they are borrowers or lenders. Loans between individuals can be issued using a contract with a receipt and an agreement.

If the main document is a receipt, then it is written and signed only by the person being credited. The document contains all the main terms of the loan, and the agreement also refers to the gratuitous nature of the loan.

Repayment of a gratuitous loan to an individual can be made in cash, or by transferring money to an account or card that belongs to the lender.

If at least one party to the loan is a legal entity, then the document must be drawn up in writing. A gratuitous loan can be issued:

- subsidiary organization;

- a company that is engaged in work related to the activities of the lender to maintain or produce the necessary goods;

- another company.

A loan between companies can be targeted, that is, aimed at achieving a desired task or general purpose.

Most often, targeted loans are issued to legal entities. A sample agreement differs from a document drawn up between individuals only in the initial part, which consists of a description of the parties to the agreement.

Loan agreements between an individual and a company are drawn up in writing. If the lender is a person and the borrower is an organization, then the gratuitous loan agreement is drawn up differently.

In the opposite case, that is, the person being loaned is a person, and the lender is a company, the gratuitous loan agreement will also look different.

Legal basis

According to the current legislation, a lending agreement is an agreement according to which the lender transfers money or things to the borrower, and he undertakes to return the entire loan or borrowed thing.

In Art. 809 of the Civil Code of the Russian Federation talks about an interest-free loan agreement - a lending agreement is considered gratuitous if it is signed between the parties for an amount that does not exceed 50 minimum wages and is not related to commercial activity, and also if the subject of the agreement is things.

In other situations, the loan is considered interest-bearing. It should be noted that for calculating payments for civil law relations, 1 minimum wage is equal to 100 rubles.

Thus, an agreement can only be gratuitous if an agreement is signed for an amount not exceeding 5 thousand rubles.

Features for the founder of the enterprise

The company can take out a loan from the founder if there is a lack of its own funds to carry out its activities. It is issued with or without interest. The transaction is formalized by a written agreement, which specifies in detail all its terms.

If there is no repayment period in the document, the company is obliged to repay the debt at the first request of the creditor; it must be repaid within a month.

You can take out a loan online from Bystrozaim on a card anywhere in Russia, without leaving your home or in nature, and without even taking time off from important matters. Read about a targeted loan for maternity capital from Rosselkhozbank here.

The founder deposits the amount specified in the agreement in cash at the organization's cash desk or transfers it to the bank account by bank transfer.

The agreement must specify the loan repayment terms, the payment plan, and interest on the use of money; in their absence, this fact must also be reflected.

The loan can be issued in rubles or foreign currency, but the debt is always repaid in Russian money at the current exchange rate on the date of repayment.

From current account to card

In most cases, the funds are returned to the founder by transferring them from a bank account to his card. This method and the necessary details must be reflected in the contract. If such a clause has not been drawn up, an additional agreement must be drawn up.

In this document, both parties agree that the borrower's obligations are considered repaid at the moment when the money is credited to the founder's card account. The details of the recipient and the current account from which the transfer is made are also recorded in the additional agreement.

Through the cash register

Based on the legislation of the Russian Federation, cash received from the sale of goods and provision of services can only be used for certain purposes:

- for the issuance of earnings and social benefits;

- for the payment of insurance under relevant contracts with citizens;

- for issuing accountable amounts to employees;

- to pay for products and services.

From the above list it follows that the loan cannot be returned to the founder from the proceeds received at the cash desk. The organization has the right to hand over the proceeds received from sales to the bank. Then they can be withdrawn by indicating on the check that they are intended for settlements with the founder. Money from the cash register is issued to the creditor according to an expenditure order.

Cash

The law prohibits repaying the debt to the founder in cash. Sometimes the manager repays the loan from his own earnings. It is not prohibited to do this. But if a conflict arises between the parties to the transaction, it will be difficult to prove that payments have been made.

To avoid risks associated with spending personal funds, you should request the bank to write off the amount to repay the loan and issue the money from the company’s cash desk.

Paying off debt with proceeds is considered an administrative offense. If it is discovered by the inspection authorities, the manager will be fined.

For legal entities, cash payments under one agreement should not exceed 100 thousand rubles; this restriction does not apply to individuals. Any amount can be returned to the founder in a lump sum.

We lend correctly and repay correctly

If the agreement does not directly stipulate that the borrower pays interest for the use of funds and the borrower’s obligation is limited only to repaying the loan amount, then this is a gratuitous loan agreement. However, the lender, even in this case, is entitled to interest. According to Art. 809 of the Civil Code, if there is no provision in the agreement on the amount of interest, their amount is determined by the bank interest rate (refinancing rate) existing at the lender’s place of residence on the day the borrower pays the debt amount or its corresponding part.

How to apply

Regarding interest-bearing lending, the agreement must include the following points:

- Method of making a loan. The loan can be provided and repaid in non-cash form, or in the form of cash;

- Deadlines for fulfillment of loan obligations. In this case, the agreement can stipulate a specific term for the loan. In this case, it is necessary to record the period for which the lender must be reimbursed by the borrower upon first demand;

- The size of the lending rate and payment formats. The lending rate must be indicated in the interest agreement, or in this situation the agreement may be recognized as interest-free;

- Repayment of interest-bearing loan. It is necessary to establish an algorithm for loan repayment in the format of a separate clause of the agreement.

How and when is the loan repaid under the agreement?

The repayment of the loan must be documented; this will help prevent possible disagreements between the parties to the transaction. There are several options for confirming debt reimbursement under the contract.

You must act in accordance with the following instructions:

- If the debt amount is repaid in full in one payment, the lender draws up a receipt for receipt of money, which indicates:

- who transfers funds and to whom;

passport details and addresses of the parties;

- contract details.

- If necessary, you can resort to the help of witnesses. In front of them, you need to count and transfer the money to the lender, and they will sign the receipt and indicate their data.

- To confirm the repayment of the debt, a transfer and acceptance certificate is drawn up. It will be an annex to the main agreement. The document indicates who, when, and to whom the money was transferred, its amount and contract details. A separate clause stipulates the absence of mutual claims between the parties to the transaction.

- If the loan is repaid in installments, a payment schedule can be drawn up and attached to the agreement. By agreement of the parties, each transfer of money is confirmed by a receipt or act.

- A table may serve as proof of payment. The parties to the transaction draw up the transaction independently and enter the dates and amounts of payments. A separate column must be provided for the creditor's signatures.

The more information there is in the receipt, the easier it is to prove to third parties that the terms of the agreement have been fully fulfilled.

If the debt repayment period is not specified in the agreement, the creditor has the right to put forward a demand for its repayment. The borrower has 30 days from the date of receipt of the paper to pay the required amount.

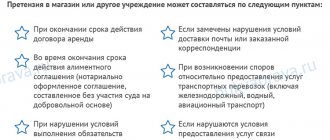

If the borrower fails to fulfill his obligations under the loan agreement, the lender may try to resolve the conflict out of court. To do this, a claim is filed against the debtor.