In 2020, the minimum wage determines not only the calculation of remuneration for employees, but also the size of most social benefits and payments, including sick leave, maternity benefits, child care benefits up to 1.5 years old, and is also used in other cases .

The minimum wage is set at two levels: federal – across the country and regional – separately in each subject of the federation.

Sickness benefits are calculated based on the employee’s average earnings, calculated for the two calendar years preceding the year in which he fell ill. The average daily earnings for calculating temporary disability benefits are determined by dividing the amount of contributions subject to OSS payments accrued for the two calendar years preceding the year of sick leave by 730 (clause

3 tbsp. 14 Federal Law of December 29, 2006 No. 255-FZ).

Let us remind you that the amount of actual earnings should not exceed the maximum amount for which insurance premiums are calculated for each year of the billing period.

Articles on the topic (click to view)

- Is sick leave considered income?

- What to do if you have extended sick leave for pregnancy and childbirth

- What to do if your employer does not accept electronic sick leave

- What to do if you are not given sick leave

- How many days does it take for sick leave to arrive from the Social Insurance Fund?

- What to do if the place of work is not indicated on the sick leave

- Are sick leave taken into account when calculating maternity leave?

To determine the amount of sick leave benefits payable, the amount of the daily benefit is multiplied by the number of calendar days of illness indicated on the sick leave certificate.

Sick leave based on the minimum wage

The amount of temporary disability benefits cannot be less than the amount of benefits calculated from the minimum wage.

A benefit in the amount of no more than 1 minimum wage for a full calendar month of illness is also paid to those employees who have an insurance period of less than six months (Clause 6, Article 7 of the Federal Law of December 29, 2006 No. 255-FZ).

Therefore, it is necessary to determine the minimum earnings for two years. It is equal to the amount of the minimum wage established on the day of the insured event (onset of illness), multiplied by 24 months.

Expert opinion

Polyakov Pyotr Borisovich

Lawyer with 6 years of experience. Specialization: civil law. More than 3 years of experience in drafting contracts.

Then you need to compare two amounts: the amount of the employee’s actual earnings and the amount of the minimum earnings for two calculation years. The comparison is made through average daily earnings. To calculate benefits, you must choose the larger of these two values.

Insurance length when calculating sick leave

In the general calculation of sick leave for a citizen, the maximum value of the calculation base is established annually by the Government of the Russian Federation. The average value per day obtained in the calculation is compared with the average daily payment based on the 2020 minimum wage.

We recommend reading: What applies to Article 296 in 2020

Driver Rukavishnikov Andrey Nikolaevich got a job at Company LLC on 09/01/2020. This is his first job. On March 15, 2020, an employee fell ill. The incapacity for work continued until March 19. After returning to work, sick leave was handed in.

Sick days are paid based on the average daily earnings, which is determined taking into account the employee’s accruals for the two calendar years preceding the year in which the employee fell ill. For example, if an employee fell ill in April 2020, data for both 2020 and 2020 are taken into account to pay for disability.

Calculation of sick leave from the minimum wage: examples

Also, the minimum wage should be used if the employee has just returned from maternity leave. In this case, you can replace one or two years of the billing period (Part 1 of Article 14 255-FZ). Then the income may be higher.

- in the billing period the employee has no earnings or is less than the minimum. This is 187,200 rubles. for the previous two years, or per day - 256.44 rubles. (187,200 ₽: 730 days);

- The employee’s length of service is less than six months, so sick leave benefits for a full calendar month should not be more than the new minimum wage - 11,163 rubles. (as of May 1, 2020)

Therefore, for example, if an employee is registered with a company registered and located in the Far North region, but at the same time periodically travels to field work in other regions, when calculating the salary of such an employee, the regional coefficient of the region where he actually worked at that time must be applied. or another period.

Are regional coefficients and allowances for workers in the Far North subject to personal income tax?

The new minimum wage affects maternity benefits and child care benefits. All benefits assigned after the increase in the minimum wage are calculated at an increased rate. Thus, the allowance for caring for the first child, assigned from July, must be no less than 11163 x 40%.

Thus, in the regions of the Far North and equivalent areas, wage coefficients are provided, the amount of which is established by the Government of the Russian Federation (Article 315, Part 1 of Article 316 of the Labor Code of the Russian Federation). A similar rule is contained in Part 1 of Article 10 of the Law of the Russian Federation of February 19, 1993 No. 4520-1.

When to apply the regional coefficient

If the organization is located in an area with difficult climatic conditions, employees are paid increased wages.

So, if an employee had no earnings during the billing period or his insurance period is less than 6 months, the benefit is paid in the minimum amount (based on the minimum wage), and it must be increased by the regional coefficient.

Keep in mind that in other cases the regional coefficient is already taken into account in the actual earnings of the billing period.

Officials in the letter under consideration noted: the final amount of benefits calculated on the basis of the minimum wage is adjusted by the regional coefficient.

This is important to know: Is sick leave paid on leave without pay?

That is, at the stage of comparing the actual average daily earnings and the average daily earnings based on the minimum wage, the regional coefficient is not taken into account.

Accrual of sick leave in 2020

Yekaterinburg belongs to the area where the regional coefficient is applied - 1.15 (Resolution of the State Committee for Labor of the USSR, the Secretariat of the All-Union Central Council of Trade Unions dated 07/02/87 No. 403/20-155 “On the size and procedure for applying regional coefficients to the wages of workers and employees for whom they are not established , in the Urals and in manufacturing sectors in the northern and eastern regions of the Kazakh SSR").

The accountant adheres to the position of the Federal Social Insurance Fund of the Russian Federation and did not increase the minimum wage by the regional coefficient when calculating the average daily earnings for comparison purposes. RUB 321.9 > 203.97 rubles, which means that the provisions of Part 1.1 of Article 14 of Law No. 255-FZ do not need to be applied. The benefit must be calculated based on the employee’s actual earnings, and not on the minimum wage. When calculating the actual average daily earnings, the regional coefficient was already taken into account (as part of the payments taken into account).

Case Study

Let's look at a specific example of how the regional coefficient is used when calculating sick leave in 2020. Let's take the real situation as a basis, when the actual average daily earnings of an employee were 163.85 rubles. (read here how the average salary for sick leave is calculated), and the figure calculated on the basis of the minimum wage turned out to be less - 151.59 rubles.

If the regional coefficient in the region is 1.15, then when multiplied by 151.59 rubles. the total is 174.33 rubles. This exceeds the actual average daily earnings.

Average daily earnings are calculated based on actual earnings or the minimum wage. The regional coefficient is taken into account in both indicators, because only under this condition will the comparison be correct. If the actual average daily earnings are less than the amount calculated on the basis of the minimum wage, then in such a situation the benefit should be calculated based on the minimum wage.

Payment of sick leave in the north in 2020

The amount of payment is also affected by the employee's length of service. There are certain requirements for the total duration of work, depending on which the payment will be made as a percentage:

We take into account “northern” features when calculating social insurance benefits

You can learn more about the features of calculating sick leave based on average earnings in the article “Average daily earnings for calculating sick leave in 2020-2020.” At the same time, the regional coefficient when calculating sick leave can still be applied if: 1. The employee has an insurance period that does not exceed 6 months. 2. The employee’s average monthly earnings for the 2 years preceding the year in which the sick leave is issued is less than the minimum wage. 3.

We recommend reading: The Bank Representative Has the Right to Enter with the Bailiff

- For greater convenience, we will take into consideration three completely different situations, for each of which the calculation is performed based on slightly different values, although the general algorithm of actions remains unchanged.

- Situation one : Your salary ultimately amounts to an amount less than that established by law throughout the state and in your region, if its regulatory legal acts increase the established amount.

- If there is such a case, the accounting department of the organization in which the citizen works, when calculating the monetary benefit due for payment, should proceed from the minimum amount of money established by the state for payment of labor activities, taking into account existing increasing coefficients, if they were established by the norms of regional social and labor law.

- The formula for calculation is standard - upon receiving the amount of earnings for the required billing period (using the amount of the minimum wage), the average daily earnings are calculated , from which the amount of daily benefits is subsequently calculated taking into account the length of service (if the given citizen has one) - it is this value and is of particular importance for the final hospital reimbursement amount.

Is the regional coefficient calculated on sick leave?

As we already know, the regional coefficient is an indicator by which the salary of an employee working in a region for which the corresponding coefficient is determined by law is multiplied. When calculating sick leave, such multiplication is generally not carried out: this is due to the fact that disability benefits are calculated based on actual earnings (which have already been calculated and paid taking into account the established coefficients).

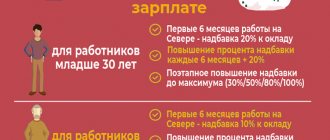

The regional coefficient is calculated on the salary regardless of the person’s work experience in general and in the region where the coefficient applies, in particular. This is the difference between the financial indicator under consideration and another similar in purpose - the percentage markup (often called the “northern markup”).

Calculation of sick leave according to the minimum wage

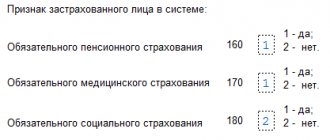

In the event that an employee is unable to work, he is paid a benefit. It is determined based on average earnings, which in some cases may be equal to the minimum wage. This calculation procedure is applied if there was no earnings in the billing period or during the same time its average monthly value turned out to be below the minimum wage (Part 1.1 of Article 14 of the Federal Law of December 29, 2006 No. 255FZ).

In this case, the benefit calculated on the basis of the minimum wage is calculated taking into account the regional coefficient. This is stated in paragraph 11(1) of the Regulations on the specifics of the procedure for calculating benefits for temporary disability... (approved by Decree of the Government of the Russian Federation of June 15, 2007 No. 375).

However, a feature of calculating sick leave based on the minimum wage is that you need to compare the value of this indicator with the employee’s average daily earnings. Therefore, the question arises: is it possible to multiply the minimum wage by the regional coefficient to make such a comparison?

Let's consider how officials and judges respond to it.

What is the regional coefficient?

The regional coefficient is a special type of cash surcharge that exists in the Russian Federation. Basic rules for such payment:

- Rule one. The regional coefficient is not widespread, but only in some parts of the country. These include regions where a harsh climate prevails and there are environmental problems (for example, regions of the Far North and those nearby). Since these factors negatively affect human health and complicate his work life, the government introduced a regional coefficient.

- Rule two. It is legally established that the regional coefficient is not affected by the total length of service and regional wages.

This is important to know: Is it possible to take sick leave after dismissal?

This coefficient is accrued to employees in addition to their basic labor earnings, which includes the following monetary privileges:

- Pay for work that depends entirely on the employee's specialty, the amount of work performed and the environment in which it was performed.

- Monetary compensation. These include incentives that compensate for the employee’s labor expended in places where environmental indicators deviate greatly from climate standards (for example, they are constantly in severe frost), or they work at radioactively contaminated sites.

- Bonuses, allowances and other incentive cash rewards.

Each region independently regulates this coefficient, that is, it increases it depending on the individual climatic indicators of the area. In this case, payments already come not only from the government budget, but from the budget of the constituent entity of the Russian Federation and municipal spheres.

The overestimated indicator applies to the following entities:

- government bodies of the Russian Federation, which includes the Ministry of Internal Affairs, administrations, etc.;

- government institutions of the Russian Federation;

- local government bodies;

- municipal institutions.

At the legal level, a subject of the Russian Federation may be assigned a maximum amount of regional surcharge. It is standardly established by municipalities located in the region of the Russian Federation.

How is sick leave with the regional coefficient calculated?

This procedure is purely individual for each subordinate, as it takes into account many nuances. If an illness, injury of any severity or quarantine has caused the need to undergo sanatorium-resort, inpatient rehabilitation or rehabilitation after prosthetics, the size of the coefficient is affected by work experience:

- If the experience is 8 years or more, then the additional payment is 100%, that is, it is identical to the salary.

- If an employee has 5 to 8 years of experience, the coefficient is slightly lower - 80% of the salary.

- And if an employee has worked for only 5 years, then the additional payment for sick leave is only 60% of the standard salary.

In addition to information about percentages, when calculating sickness benefits, the average salary per day and how many days the temporary disability lasted are taken into account.

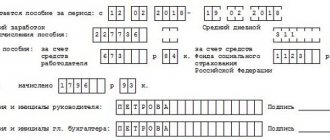

Before calculating the amount of the benefit with the regional coefficient, it is necessary to calculate the employee’s earnings per day. To do this, use the following formula: SDZ = Zp2/730 .

The designations are deciphered as follows:

- SDZ is the average wage per day;

- Zp2 is the employee’s salary for the two previous years.

After this calculation is completed, they begin to calculate the regional coefficient. The formula used is: PVN = (SDZ × KD) × RV + RK.

Let's understand the notation:

- PVN is sickness benefit;

- SDZ – a person’s salary for the previous two years;

- CD – the sum of days during which the employee was temporarily disabled;

- РВ – payment of benefits based on length of service;

- RK is the regional coefficient.

Expert opinion

Polyakov Pyotr Borisovich

Lawyer with 6 years of experience. Specialization: civil law. More than 3 years of experience in drafting contracts.

An example of calculating PVN. Let's take the following information. The employee was sick for 14 days – this is a sickness period. We take 60% for RV, and 15% for RK. SDZ is known from the previous calculation. Further:

- Calculate (SDZ × CD) – 1897.26 × 14 = 26561.64.

- We make the final calculation: (SDZ × KD) × RV + RK – 26561.64 × 0.6 + 0.15 = 15937.134.

As a result, it turns out that the benefit for temporary unemployment due to illness is equal to 15,937.134 rubles for two weeks for this prospective employee.

This is important to know: Registration of an electronic sick leave certificate in 2020

Northern coefficient, regional bonuses and increasing the minimum wage

Check the salaries of employees who have reduced working hours. Based on the minimum wage, determine the acceptable salary based on the employee’s rate. Make sure you pay the employee the same amount or more.

Should northern bonuses be included in the salary when comparing it with the minimum wage?

A part-time employee works in his free time from his main job. Therefore, each salary - at the main place of work and part-time - must be compared with the minimum wage. Since part-time work involves part-time work, the payment for such work is also compared with the minimum wage in proportion to the time worked.

The employee was sick from December 25, 2020 to January 11, 2020. On December 29, he violated the regime. The doctor made a note about this on the certificate of incapacity for work. The employee's work experience is 9 years. Earnings for 2020 and 2020 - 580,000 rubles.

- written statement from the policyholder

- calculation in form 4-FSS for the period confirming the accrual of expenses for the payment of insurance coverage

- copies of supporting documents

- certificate - a calculation submitted when applying for the allocation of funds for the payment of insurance coverage (submitted starting from January 1, 2020) (Order of the Ministry of Labor dated October 28, 2020 No. 585n).

We recommend reading: Federal Law 203 under Article 228

Calculation and payment of sick leave in 2020

Komova V.N. fell ill on June 30, 2020. On this day, she was granted sick leave. The sick leave was closed on July 11, 2020. The employee’s earnings in 2020 amounted to 56,000 rubles; in 2020 – 89,000 rubles. Komova's insurance experience is 5 years.

So, in particular, Article 133 of the Labor Code of the Russian Federation states that the enterprise is obliged to pay wages not lower than the minimum wage approved by law to every worker who has worked the required hours in a month. That is, at the legislative level, based on the actual working population, a certain amount of material support is established, thanks to which the worker will be able to provide himself with everything necessary and below which the employer has no right to pay.

Who calculates the amount of benefits and pays the funds to the employee?

The benefits are paid either by the manager himself or by the Social Insurance Fund of the Russian Federation.

If the employer pays:

- The employer pays for three sick days. At the same time, he uses company funds.

- After four days of illness, sick leave is also paid by the manager, but in this case the Social Insurance Fund of the Russian Federation compensates for losses.

- If sick leave is issued due to injury, then the employer pays for the entire period of incapacity for work.

The benefit is paid by the Social Insurance Fund of the Russian Federation after four days of illness of the employee. The fund compensates for the employer's losses. After four days from the moment of illness and from the first day after the injury of the employee, the FSS of the Russian Federation pays benefits in the following cases:

- if at the time the employee went on sick leave the company dissolved and ceased to exist;

- if the employer does not have excess funds to pay benefits, that is, the funds for such expenses are simply not available in the company’s account;

- if the manager is unable to pay the required amount because the company is facing bankruptcy in the near future.

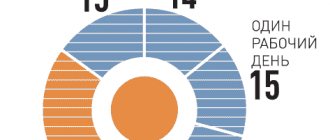

Remember that at the legislative level there are deadlines for when benefits with a regional coefficient for sick leave are received:

- The manager assigns benefits and pays them in one of two options. Option one – after ten days after the payment is assigned. Option two - on payday.

- The Social Insurance Fund of the Russian Federation pays benefits ten days after the request.

The legislative framework

The following legislative framework regulates the regional coefficient:

- “Labor Code of the Russian Federation”, Article No. 129 and Article No. 316;

- Federal Law No. 255 of December 29, 2006;

- Decree of the Government of the Russian Federation No. 512 of May 29, 1992;

- Order of the Government of the Russian Federation No. 176 of January 29, 1992.

You can also learn about the basic rules for paying the regional coefficient in the following video:

The regional coefficient is an excellent monetary compensation for citizens of the Russian Federation working in regions with a harsh climate and poor ecology. This coefficient is usually not calculated on sick leave, but there are exceptions to the rules that allow employees to receive involuntary unemployment benefits due to illness.

Who should calculate and pay sick leave benefits?

Payment of temporary disability benefits is carried out as follows:

| Payer | Terms of payment | A comment |

| Employer | First 3 days of illness | At my own expense |

| From the 4th day of illness | At your own expense, but with subsequent reimbursement of expenses from the Social Insurance Fund | |

| Work injury | At your own expense for all days of illness | |

| FSS | From the 4th day of illness | Reimburses expenses to the employer |

| From day 4 of illness and work injury (from day 1) |

|

Common mistakes when calculating sick leave

The main errors when calculating temporary disability benefits are:

- periods that must be taken into account are excluded from the insurance period;

- this takes into account periods that, in accordance with the law, are excluded from the insurance period;

- they do not take into account that time to care for a sick family member is limited;

- do not take into account annual employee income restrictions;

- the earnings of a part-time worker are calculated without taking into account other places of work;

- they do not take into account that sick leave for dismissed employees is 60% of their average earnings, regardless of length of service;

- do not take into account the percentage of employee experience;

- employees with less than 6 months of experience are considered benefits according to the general rules;