Dividends, like all income received by residents of the Russian Federation, are taxed. Accordingly, an individual is obliged to transfer thirteen percent (the rate for personal income tax) of these funds to the state treasury. In this material, we will look at the details of taxation of dividends, and also find out what types of personal income tax codes exist on dividends.

KBK personal income tax on dividends

What interest must be paid on income?

In Russia, the standard rate of 13% is necessarily deducted from the income received by citizens (residents). For example, if, when hired, an employee signed an employment contract stipulating a salary of ten thousand rubles, then he will receive 8,700 rubles (minus 1,300 rubles as income tax). Most often, the candidate is offered the amount of labor income already taking into account tax deductions.

At the same time, for non-residents of the country, 30% has already been established, which will be deducted from the earned labor income. The personal income tax rate will be 13% only for the following categories of non-residents:

- visa-free migrants;

- residents of countries that are members of the Eurasian Economic Union;

- foreign specialists with a high level of qualifications;

- refugees.

Another type of income is profits received from equity participation in a company, or simply dividends. In our country, starting from 2020, they are taxed at 13% of the amount received (previously the tax figure was nine percent). For non-residents of Russia, this rate automatically increases to 15%.

We emphasize that a resident of Russia is considered a person who lives on its territory for at least 183 days over the next twelve months in a row. As an exception, the state allows short-term trips (not exceeding six months in a row) necessary for citizens to receive education or medical care, as well as work trips for the purpose of extracting hydrocarbon resources from fields in the seas. Absence from the country for more than a year without loss of resident status is permissible for three categories of payers:

- Military personnel in service.

- Employees of government or law enforcement agencies.

- Representatives of local government bodies.

Who is a tax resident of the Russian Federation? Our article will help you figure this out. In it we will look at what the tax status depends on, documents for confirmation, as well as the regulatory framework for residents and non-residents.

Concept of dividends

Dividends are profits received by individuals who have shares in companies, firms and societies. After the “net” money (after taxes, etc.) of the enterprise has been calculated, it is divided among the shareholders. According to the Tax Code of the Russian Federation, this money does not have to be earned in the country - receipts from other states are also allowed.

Article 43. Dividends and interest

Dividends are logically considered a citizen’s income, and therefore are subject to appropriate tax. Most often, the amount of personal income tax on dividends is calculated and paid by the tax agent company itself, in which the person has a share. If this does not happen, he must submit the declaration himself. In particular, this applies to dividends paid in kind. Since it is impossible to withhold personal income tax from them, the agent company must inform the inspectorate that the individual received income in kind and that it has relieved itself of responsibility for paying the fee in favor of the individual payer.

Dividends are a way to earn extra income

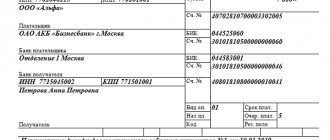

Purpose of payment in payment slip for payment of dividends sample

Important! If you incorrectly indicate the KBK for personal income tax on dividends in the payment order, you do not need to pay the tax again.

Do not issue another payment with the correct BCC. This is not necessary, the Federal Tax Service itself will redistribute the cash receipts to the desired address. The most important thing is to write the application on time.

Please also keep in mind that an error in the KBK for personal income tax may result in the accrual of penalties. But don't rush to pay them. If the Federal Tax Service clarifies your payment, all penalties will be removed. But this condition is only feasible if the payment order with an erroneous BCC was issued in a timely manner.

- If you have calculated the penalties yourself and pay them voluntarily. In this case, the basis will have a tax code, that is, voluntary repayment of debt for expired tax periods in the absence of a requirement from the Federal Tax Service.

- If you pay at the request of the Federal Tax Service. In this case, the base will have the form TP.

- You transfer based on the inspection report. This is the basis of payment to AP.

Payment of the tax must be made no later than one working day following the day the income is issued (Clause 6, Article 226 of the Tax Code of the Russian Federation). An exception is made for vacation pay and sick leave: tax on them must be paid no later than the last day of the month in which the employee was given the appropriate funds.

At the end of the reporting year, upon receipt of net profit after all tax fees have been paid, the general meeting of participants may decide to redistribute part of this income among existing shareholders based on their shares. All profits from the income of individuals, in each specific case, are subject to personal income tax on dividends. The corresponding condition is fully regulated by Article 208 of the Tax Code of the Russian Federation.

Article 43 of the Tax Code of the Russian Federation “Dividends and Interest” recognizes as dividends any income (even from sources outside Russia) that was received by a shareholder or participant in the distribution of the organization’s profit after taxation. In accordance with the current legislation of the Russian Federation, individuals must pay income tax on dividends received.

INN and KBK details are the most important values in payments. If they are correct, then the payment will most likely go through. Period, payer status, priority - if there are errors in these fields (they didn’t make it in time), then payments almost always go through anyway, but it’s better not to take risks. There are no fines for filling out payment slips incorrectly (it’s your money), but the payment may not go through, in which case you will have to look for it, return it, and possibly pay penalties.

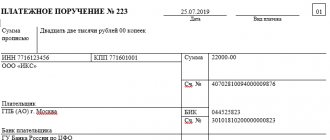

Where can I get a payment order for free? How to fill out a payment order? What types of payment orders are there? I will post here samples of filling out payment slips in Excel for 2018-2019, made using the free Business Pack program. This is a fast and simple program. In addition to payment slips, it also contains a bunch of useful documents.

Please indicate the amount in full rubles. The rule applies: transfer taxes to the budget in full rubles, rounding kopecks according to the rules of arithmetic: if less than 50 kopecks, discard them, and if more, round to the nearest full ruble.

All fields are required. The date and amount of the write-off are indicated in numbers and in words. Payment orders are numbered in chronological order.

Each field is assigned its own number. Let's look at the rules in more detail.

In 2020, personal income tax on dividends is paid to the standard BCC for the corresponding tax levy - 182 1 0100 110. In this case, no special BCC is provided.

This is the information that should be indicated in the space provided at the top of the document. In the main part of the order, all participants who are entitled to payments are fully specified.

The tax must be paid no later than the day immediately following the transfer of the amount of dividends in favor of the participant on the basis of Article 226 of the Tax Code.

It is worth noting that the purpose of the payment document may indicate the date of actual occurrence of income. Thanks to such information, representatives of territorial tax services can immediately verify the fact that there was no violation of the deadlines for payment of personal income tax.

The calculation itself is made for each individual receiving dividends and directly depends on whether the company itself received similar payments. Article 214. Peculiarities of paying personal income tax in relation to income from equity participation in an organization Article 275.

Features of determining the tax base for income received from equity participation in other organizations Examples of calculation To understand the features of calculating personal income tax on dividends, you need to familiarize yourself with the following typical example. for 2020, she received a net profit of 500,000 rubles.

is a resident.

Thus, dividends are payments in favor of, for example, the founder of a legal entity. Also, the recipient of dividends can be an organization (for example, an LLC) if it is a shareholder (participant) of another organization. There were no changes in this part in 2020.

In this case, the decision on the payment of dividends must be made by the general meeting of shareholders (participants) (clause 3 of Article 42 of the Law of December 26, 1995 No. 208-FZ, clause 1 of Article 28 of the Law of February 8, 1998 No. 14-FZ ). It must be documented in the minutes of this meeting.

There is no special document required to formalize the payment of dividends.

Attention

Therefore, you can use standard forms that are filled out when paying money from the cash register or when transferring funds from a current account. At the same time, keep in mind that dividends must be paid to shareholders in cash.

Breaking News

Home / News / Purpose of payment in payment slip for payment of dividends sample

personal income tax, the situation looks like this:

- line 100 is a direct payment of income through a cash register or to a bank card;

- line 110 is the date when income was paid and tax was withheld on the same day;

- line 120 - depends on who exactly transfers the tax (JSC or LLC).

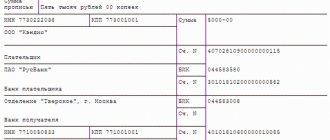

Formation of a payment order for transfer According to the new rules introduced by law in 2020, payment orders for the transfer of personal income tax on dividends must be filled out as follows:

- in field 101 indicate code 02 - tax resident;

- in field 104 (income on which personal income tax is paid), the KBK is entered - it is the same as when receiving ordinary income 182 1 0100 110;

- TP is entered in field 106 - current payment;

- in field 24 “Purpose of payment” you must write what exactly is being transferred to the budget.

However, in some cases, this action can be carried out by the individual himself, namely, provided that the business entity, for whatever reason, did not withhold the tax on its own or the individual received profit in the form of dividends from a source outside the territory of the Russian Federation. In this case, physical

= Dividends * rate%. This video will tell you what dividends and personal income tax on dividends are: Calculation with an example of calculation To calculate personal income tax on dividends, we will use the following conditions. The decision of the general meeting established the payment of dividends to the founder in the amount of 75,000 rubles.

If the profit is received, the decision on payments is made, then it needs to be made. And in this case, there is no special document that should be provided in this case. Therefore you can use the following:

- form for payment of money from the cash register or when transferring to an account;

- accounts to shareholders, payments to whom are made in non-cash form.

The following example shows a personal income tax payment from employee salaries. The fields marked with numbers are the details of the document about which questions arise. Their decoding can be found in the table below.

Sample of filling out the PP for payment of personal income tax on employees' wages

Recipients of dividends and procedure for receiving them

Based on annual results, all shareholders of the company expect to receive additional profit. At the same time, both legal entities and individuals can be the owners of shares. Thus, profit tax is withheld from legal entities, and personal income tax is withheld from individuals.

Depending on how it is reflected in the company's charter, the division of profits between participants occurs in a specific order. The most common variant of “division” is from proportion to share. If it is decided differently, the company will inevitably face a dispute with the tax authorities. Community members who were accepted later than others, according to the share they purchased, receive payments.

How are payments made?

Dividend payments are deducted at the moment when the organization has already covered all necessary expenses. That is, participants receive unallocated money (for example, not needed to pay for something or to maintain the work in an efficient state). The very fact of receiving dividends indicates that the business is performing excellently and is being managed wisely. That is, shareholders must be interested in the company’s income generation and its stable activities.

Payments themselves cannot have a fixed schedule. Shareholders or management of the company decide together at what time (or at what interval) dividends will be transferred. For this purpose, general meetings of shareholders are held, at which the following are decided by a majority vote:

- What part of the profit will be sent as dividends?

- How the profit will be divided among the shareholders.

- When will payments be made?

When a decision is made, a protocol is drawn up confirming that such and such shareholders were present at the meeting, made such and such a decision and contains their personal signatures. You must understand that changing it often or just like that is undesirable, since it affects accounting and interaction with the tax office.

Video - Why pay dividends?

KBK for payment of personal income tax on dividends in 2020

Profit is divided between participants in accordance with the procedure reflected in the charter of the legal entity. Most often this distribution is made in proportion to the share of participation. Newly admitted participants can also count on payment of dividends according to their available share.

Concept of dividends

The transfer of tax to the LLC budget must be done in accordance with clause 6 of Art. 226 of the Tax Code of the Russian Federation no later than the day following the day of payment. The tax can be transferred in one payment, regardless of the number of dividend recipients.

Please indicate the amount in full rubles. The rule applies: transfer taxes to the budget in full rubles, rounding kopecks according to the rules of arithmetic: if less than 50 kopecks, discard them, and if more, round to the nearest full ruble.

Personal income tax accrual

Dividend payments are made by a legal entity, which is also a tax agent. Therefore, the responsibilities of such a company include not only determining the amount and timing of payment, but also:

- Calculation of personal income tax.

- Withholding the amount of personal income tax from all “shareholders” until payments.

- Creation and transmission of relevant documents to the tax office.

- Payment of funds to the state treasury.

When filling out documents on dividends, the agent company will certainly encounter the BCC of income tax on them. But since this will happen at the last stage, it is important to calculate everything correctly at the first stage.

How to fill out a personal income tax payment form

In field 105 OKTMO is indicated in accordance with the All-Russian Classifier, which was approved by Order of Rosstandart dated June 14, 2013 No. 159-ST. From April 25, 2017, payment orders must indicate the 8-digit OKTMO code.

When to pay

Props 21 indicates the order. It is determined in accordance with Article 855. Civil Code of the Russian Federation. When transferring tax, the values “3” and “5” can be indicated. They determine in what order the bank will carry out operations if there are not enough funds in the organization’s account. When transferring personal income tax on a monthly basis, the value “5” is indicated in field 21. If you transfer tax at the request of the Federal Tax Service, then indicate the value “3”.

This is interesting: Latest news 2020 about waiting lists in Moscow

The protocol indicates how much payment is due to each founder, based on the share participation of each. If there is only one founder, then neither a meeting nor minutes are needed, and the founder makes all decisions himself, documenting them with an appropriate resolution.

Dividend accruals

Let's look at an example of how a company calculates dividends for investors. Mr. Sergeev and Mrs. Andreeva created the limited liability company “Dog and Cat”. Sergeev contributed 60% to the authorized capital, Andreeva - 40%. During the quarter they earned one hundred thousand rubles of retained earnings. Accordingly, Andreeva will receive forty thousand rubles as dividends, Sergeev – sixty thousand.

Now “Dog and Cat”, as a tax agent, must calculate and withhold personal income tax amounts. According to the letter of the law, the income tax rate is 13 percent. That is, personal income tax for Sergeev will be equal to 7,800 rubles, for Andreeva – 5,200 rubles. These amounts will be withheld in favor of the state, and citizens will receive 52,200 rubles and 34,800 rubles, respectively.

The Dog and Cat tax agent must transfer the above amounts the next day after withholding them from payments. To do this, a legal entity must fill out a payment order, which contains a special field for specifying the BCC. Let's figure out what this means.

Abbreviation KBK

Stands for budget classification code. A code is a set of non-random numbers that help group funds entering the country’s treasury. The concept of BCC was introduced in 1998 according to the Budget Code of Russia. Tax codes make life much easier for tax authorities, helping them to distinguish and systematize income coming into the budget. The preparation of documents for payers and control activities for supervisory and statistical authorities have become easier. When the BCCs were adopted, it became possible to easily compare data, calculations and final conclusions.

KBK allow you to streamline tax collections

Codes are used only when financial transactions are related to the state budget, that is, the country is the second party involved or the recipient of the payment. Payers enter the BCC in the appropriate fields of payment orders, not only when they are going to make a payment, but also to reimburse penalties imposed due to late or non-payment of taxes.

Any bookmaker code consists of twenty digits and is divided into four main blocks.

Table 1. KBK blocks

| Block | Compound |

| first | Administrative The first block by which you can understand the purpose of the payment is to find out the government structure to which the money is sent. We are considering the tax on dividends and the payment, accordingly, will go to the Federal Tax Service of the Russian Federation, whose code is 182. |

| Second | The second block talks about the type of deduction, defining: the nature of the income (group of incoming funds), what the payment is (duty, payment of a tax fee or fine), the item (the figure is determined by the income classifier) and the element (the budget of what level the deduction is intended - federal , regional and so on). |

| Third | The third block of software makes it clear that the payment is a penalty, a tax deduction, a monetary penalty, and the like. |

| Fourth | The last three blocks systematize incoming funds according to their economic indicator - money for the provision of services, funds forcibly seized by bailiffs, tax revenues, funds received from property, and so on. |

By combining the above blocks, the payer receives a digital continuous sequence, which he will enter into the required field of the payment order. Of course, citizens do not need to calculate and “assemble” code sequences on their own. All codes have long been recorded and provided in official documents. It’s even easier to find the code you need by asking Internet search engines. It is important to clarify the year in which you fill out the paperwork and look for the CBC.

The BCC for dividends has not changed in recent years. The twenty numbers that must be indicated in the payment documents look like this: 182 1 0100 110.

Correctly fill out field “107” in the payment order

When filling out a payment slip for transferring personal income tax on dividends received, special attention must be paid to filling out field “107”, which indicates the frequency of tax transfer or a specific date for the payment. The frequency of payment refers to the tax period for which the payment is transferred (it can be 3, 6, 9 or 12 months). It is important to correctly display this period in the payment document.

The "107" field consists of ten characters, which include two separating periods (the third and sixth characters).

The first two characters must consist of letters:

- “MS” – for monthly payments;

- “KV” – for quarterly payments;

- “PL” – for semi-annual payments;

- “GD” – for annual payments.

Next, indicate the number of the month (quarter or half-year) and year. If the payment is made for the year as a whole, zeros are indicated in the previous characters. The payment order is signed by the head of the organization, accountant or other authorized person, after which a stamp is affixed if the organization works with a seal. If an order is sent electronically, an electronic digital signature is sufficient.

Please note: personal income tax on dividends that were paid by an organization to several individuals can be paid in one payment.

Accordingly, for this you do not have to generate separate payment documents. The main thing is to indicate the correct amount and all other related details. The only caveat is that for such a generalized payment it is necessary to have supporting accounting documents that will allow, if necessary, to identify each recipient of income on which taxes were paid.

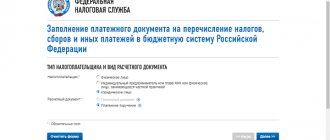

Please note that today you can easily fill out a payment order form using a special web service of the Federal Tax Service. To do this, you just need to go to the portal and, following the prompts, step by step enter the data to generate a payment.

Thus, the correctness of the payment identification and the timely payment of taxes depend on the correct completion of the payment document when transferring the amount of personal income tax from dividends received.

Let's sum it up

Dividends, as a form of income, serve as the financial basis for withholding and deducting personal income tax. Dividends, like wages, bonuses and other official means of receiving money, are taxed at a thirteen percent rate. Despite the fact that a citizen may not be employed in the company from which he receives dividends, their payment is controlled by the state and must occur in any case - if not by the agent company, then by the individual himself.

Payment of tax on dividends is documented and transferred to the state budget using the BCC. The budget classification code serves to facilitate reporting and accounting for the receipt of tax funds into the country's treasury. Taxpayers do not experience any difficulties associated with the KBK, because this is a small line entered into the document once and does not need to be calculated independently. But, as often happens, this small addition plays a significant role - if you do not enter the BCC or mix up the combination of numbers, the payment risks not reaching its destination, which will entail a fine from the tax office.