General procedure for making changes to LNA

Any local regulation requires periodic amendments.

The reasons for this are varied. The most common reasons for making amendments are errors in the document, changes in legislation, and internal reform of rules in the organization. For example, changes to the wage regulations may be required in connection with the establishment of different dates for payment of wages. The legislation does not establish the procedure for making adjustments to the LNA. Let's look at how to make changes to the organization's regulations.

You can make adjustments to existing acts in one of two ways:

- issue an order or order to make adjustments;

- draw up the LNA in a new version and approve it.

The employer himself chooses which way to do this. If the amendments are single, for example, only the salary payment dates change, then it is more convenient to make adjustments by order.

If there are many adjustments, then it will be more rational to approve the act in a new edition.

. .

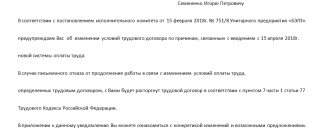

Additional agreement to the employment contract on salary changes for 2020

Business entities involve employees in their business activities by concluding employment agreements with them.

These contracts reflect in detail the basic working conditions of hired persons, including what remuneration they are entitled to for performing labor functions.

If there is a salary increase, the law requires that an additional agreement be drawn up to the employment contract regarding the salary change.

In what cases is a salary change made?

The basis for paying wages to a person working at an enterprise is the employment contract concluded with him, and the management order issued on its basis.

If an employee works the required period of time per month or produces a specified amount of product, then he is entitled to the amount minus mandatory withholdings (personal income tax).

As a rule, if an employee has a set salary, then it will be constant from month to month, provided that the working person carried out his work all the time.

The company's management has the right to periodically revise the staffing table in the direction of increasing salaries. It can do this both voluntarily and in accordance with the law.

The rules of law establish that the salary at the enterprise for employees with normal working hours per month should not be less than the minimum wage established in the region and in the country. Therefore, when government agencies increase it, the company also needs to implement a corresponding increase.

Attention! From 2020, all business entities that employ hired personnel under labor contracts must index wages once a year. It involves an increase in the current salary by an indexation coefficient determined by internal regulations when prices for consumer goods and services rise.

In addition, companies and entrepreneurs can independently decide to increase salaries if they have the financial capabilities and in order to increase the interest of employees in working for the enterprise.

Is it necessary to draw up an additional agreement and why?

Information on the amount of remuneration in an employment contract is one of the most important terms of the agreement, without which the contract may be considered inappropriately executed.

Important! Simply issuing an order to change employee benefits in a company is not enough. First, you need to reflect changes to the employment contract regarding salary changes in an additional agreement or draw up a new contract with the employee.

What exactly needs to be done is decided by the company administration in consultation with the employee. If you only need to change the salary, and all other conditions remain the same, it is recommended to draw up an additional agreement to the contract previously concluded with the employee.

When changes involve making significant adjustments to the old contract, it would be best to renew the new employment contract.

Only after this can management issue an order to increase wages, and the accountant will be able to accrue remuneration based on the new wages for employees.

What to consider when changing your salary

Parties to labor relations must remember that changes in the amount of remuneration can only be formalized in writing. At the same time, both the company management and the employee himself must sign either an additional agreement or a new employment contract.

In some cases, a change in salary may be accompanied by a decrease in salary. Cases when this can be done are strictly listed in the Labor Code of the Russian Federation, for example, changing the organizational structure. In this case, the company administration is obliged to warn the employee about this event at least two months in advance.

https://youtu.be/P8H1dt7-us8

For individual entrepreneurs, this period is reduced to two weeks. In this case, the employer must offer vacant positions to employees whose salary is expected to be reduced if there are vacancies.

Attention! Any official can initiate a salary change by submitting a report addressed to management. After signing the additional agreement and issuing the order, appropriate changes must be made to the company’s staffing table.

The procedure for changing salaries in 2020

The procedure for increasing salaries may be caused by annual indexation, or the manager may decide to reward an employee. This can be documented as follows:

Step 1. Drawing up a memo

An employee’s immediate supervisor can send a note to the company’s management with a request to increase the salary of a subordinate for success at work.

In the case of annual indexation, the responsible employee (usually the chief accountant) draws up a memo informing management about the need to comply with the requirements of the law. The director reviews the document and, based on it, gives orders to prepare the necessary forms.

Step 2. Determining the new salary amount

If annual indexation of wages is carried out, then it is necessary to recalculate the accruals by the established coefficient in order to determine new earnings.

Step 3. Registration of the staffing table

It is necessary to reflect future salary changes in the document. Depending on the scope of the corrections, you can formalize changes to the current form (if the salary changes for only a few employees), or develop a new staffing table.

Step 4. Issuing an order to increase wages

It is necessary to issue an order to increase the salary. This must be done both for a single change and for indexing. This order can also approve a new staffing table, or change the existing one, give instructions for drawing up additional agreements, etc.

salary change order

Step 5. Drawing up an additional agreement

Each employee affected by the promotion must enter into an additional agreement to their employment contract. This document will fix the new salary amount and determine from what date it will be effective.

How to draw up an additional agreement to an employment contract on salary changes

When drawing up an additional agreement, three parts are conventionally distinguished: introduction, text part and conclusion.

In this case, the text part can include not only information that the employee’s salary will change from a certain date, but also any other information necessary for the change.

This will make it possible not to draw up several additional agreements for the same employment contract with different changes.

The introductory part briefly, but at the same time succinctly, sets out all the necessary conditions under which the additional agreement is signed. In particular, it is in this part of the document that it is necessary to indicate the legal grounds upon which the contract is changed.

Mandatory for use in the introductory part are:

- Place and date of execution of the agreement;

- Full details of the parties - full name. employee and manager, or entrepreneur;

- Their exact positions.

The additional agreement always indicates exactly the same number of parties as there are in the main agreement. If the quantity differs, then the additional agreement can be declared invalid and the changes made to it illegal.

Also in this section it is necessary to indicate the date from which the additional agreement comes into force. When the salary changes, it can be either the 1st day of the current month or the next. This item actually determines from what month the employee will actually have a new salary.

At the end of the introductory part, you also need to indicate information about the order or other document that serves as the basis for the changes, as well as information on the concluded employment agreement.

The next part is the main text of the agreement. The conditions that need to be changed, supplemented or deleted are indicated here. When describing the conditions, it is necessary to describe in as much detail as possible where the data to be replaced is located, and what exactly it needs to be replaced with.

https://youtu.be/Xl0D7_wyvEg

In particular, reference must be made to the number of the item in which the information being replaced is located. When specifying numerical expressions, only Arabic characters must be used.

If the salary is changed, it is necessary to indicate the number of the item being changed, as well as its new content.

The final part contains the details of each party to the agreement:

- For an organization, its name, TIN, KPP, OGRN codes, and location address are indicated;

- For the employee, his full name, information about the identity document, and address of residence are entered.

Attention! In addition to the required signatures, a seal is placed on the agreement if it is used by the organization. Also on the form there should be a reference to the fact that there is a second copy of the document, and that the employee received it in person.

Source: https://buhproffi.ru/dokumenty/dopolnitelnoe-soglashenie-k-trudovomu-dogovoru-ob-izmenenii-oklada.html

Changes to position

The document on making corrections to the LNA must contain:

- justification for the amendments made;

- list of adjustments made;

- the date from which the document comes into force.

Since changes are being made to the provisions relating to the regulation of labor relations, and if the LNA was adopted taking into account the opinion of the representative body of workers (trade union), then adjustments to it can only be made taking into account the opinion of this body (Article 372 of the Labor Code of the Russian Federation).

How things can change

There can be as many wage regulations as there are organizations. This document is a local regulatory act that is adopted by each organization separately. And it can also be edited at the discretion of the manager.

Naturally, when making changes, the norms of the labor code and other laws must be observed. In addition, employees must also agree to accept the changes that are planned to be made. So, the text of the provision may change as follows:

- A paragraph, paragraph or subparagraph may change completely. In the text of the order, this can be read as “Clause 2 shall be stated in the following wording...”.

- Be supplemented by a paragraph, subclause or entire clause of the agreement.

- A piece of text (clause, chapter, paragraph, subclause, etc.) may lose its power completely. It is simply not spelled out in the new version of the regulations.

The procedure for making changes to the wage regulations

Is it possible to make changes to the wage regulations? Yes, you can. This document is subject to change at the discretion of the organization's management.

How to correctly make changes to the salary regulations

Corrections to the salary document must be executed in the same way as the original document itself was approved. If this regulation was approved by a decree or order, then a corresponding decree or order is issued to make corrections.

An order to change the wage regulations is issued in the same way as any order to adjust the LNA. It must indicate the reasons for the changes being made, list the corrections being made, and set the start date for the order.

If the regulations were approved by using the stamp “Approved”, then corrections should be made to them by issuing the provisions in a new edition.

Since it is much easier to formalize changes to the regulations by order in the case of single corrections, employers often use this option.

Results

Regulations on wages are necessary for both employees and the employer. With the help of this internal document, it is easier for the taxpayer to defend to the tax authorities the validity of reducing the tax base for income tax or the simplified tax system for various salary payments. And employees will be confident that they will not be deceived when calculating their salaries and they will be able to receive legal bonuses and compensation (including through legal proceedings).

https://youtu.be/ijx5mvS1mUM

This document does not have a legally established form; each employer has its own form. Its validity period is set by the employer independently. The provision may be revised as necessary or remain in effect indefinitely.

What to pay attention to

A wage regulation is a legal regulation that establishes rules for remuneration of workers. Therefore, all amendments to it are made in accordance with labor legislation. If this regulation is an annex to the collective agreement, amendments to it are made in accordance with Art. 44 of the Labor Code of the Russian Federation - taking into account the opinion of the employee representative. If the regulations are a separate document, then corrections are made to it in accordance with Art. 372 of the Labor Code of the Russian Federation - taking into account the opinion of the trade union organization. That is, the employer, in any case, must notify the other party about the amendments being made and obtain consent to this or draw up a protocol of disagreements for their further resolution.

Any amendments made to the LNA must not change the position of employees for the worse, compared to legislative norms, and must comply with current legislation. At the same time, it is possible to improve any conditions. For example, changes to the wage regulations can be made to increase the amount of additional payment for night work (according to the Labor Code of the Russian Federation - 20%, and the LNA can establish an additional payment of 50%).

Any adjustment made to the LNA must be informed to employees against signature (Article 22 of the Labor Code of the Russian Federation).

How to draw up an order to switch to an effective contract

By order of the Government of the Russian Federation dated November 26, 2012 N 2190-r, the Program was approved, which marked the transition to an effective contract in the social sphere.

From now on, employers in the public sector (culture, healthcare, education) began to introduce an updated form of employment contract, designed to improve the quality of services provided and improve the system of remuneration for employees.

The basis for such innovations in the organization is the corresponding order, the contents and features of which you will learn from the article.

ConsultantPlus TRY FREE

Get access

This is a type of employment agreement for public sector employees, which clearly stipulates:

- job functions of a specific employee;

- a method for assessing the effectiveness of its activities;

- terms of remuneration and reward system based on labor results;

- social support measures.

State reform pursues many goals, the main of which are to ensure a decent level of wages and increase the prestige of public sector professions, as well as improve the quality of the services they provide. When making the transition to this type of contract, the employer must focus on the following regulations:

- Decree of the President of the Russian Federation of May 7, 2012 No. 597;

- Order of the Government of the Russian Federation dated November 26, 2012 N 2190-r, which approves the Program for the gradual improvement of the wage system in government institutions until 2020 and contains a sample contract;

- Order of the Ministry of Labor of Russia dated April 26, 2013 No. 167n, which contains general recommendations for formalizing labor relations;

- action plans developed for various areas of activity at the federal, regional and local levels;

- evaluation criteria and recommendations for the development of performance indicators in various fields of activity, approved in regions and enterprises.

Based on current legislation, in order to switch to an effective contract, it is necessary to use a new form of contract when hiring or enter into additional agreements with existing employees. In the second case, it is necessary to obtain the written consent of the employee.

How is the transition carried out?

To carry out this process, first of all, it is necessary to focus on the regulatory documents listed above. To switch to an effective contract, the employer must go through several stages.

- Delivery of a corresponding notice to each employee, which will describe in detail all the innovations - no less than 2 months before the transition to the new remuneration system.

- Drawing up and signing an additional agreement to the current employment contract, which will set out new conditions (the form can be downloaded at the end of the article).

- Issuance by the management of the organization of an order to introduce a new remuneration system.

It is worth noting that when introducing a new system in educational, health and cultural institutions, an additional agreement is concluded only after the approval of the criteria for assessing effectiveness in this particular institution.

For this purpose, a special commission is created, which then makes these changes to the local acts of the organization: collective agreement, internal labor regulations, job descriptions, regulations on wages, etc.

The additional agreement should indicate:

- reasons that led to changes in the terms of the employment contract (Order of the Government of the Russian Federation dated November 26, 2012 N 2190-r);

- specific functionality of the employee;

- employee performance indicators and evaluation criteria;

- the procedure for remuneration and incentive payments;

- information about social insurance and other support measures.

If the employee does not agree to work under the new conditions, the employment contract with him may be terminated in accordance with clause 7 of part 1 of Art. 77 Labor Code of the Russian Federation.

Sample order for the introduction of an effective contract

Current legislation does not establish a unified form, however, it is recommended to indicate the following information in the document:

- name of the institution and details of the order (date, number);

- a list of regulations that served as the reason for the transition to a new payment system;

- the composition of the commission that will develop performance indicators and criteria, as well as new employment contracts and additional agreements;

- an indication of the need to conduct explanatory work with employees regarding the transition to new contracts.

- date of transition to effective contracts;

- a person who controls the execution of an order in an organization.

Depending on the stage at which the order is issued, it may approve the indicators developed by the commission, the incentive procedure and the form of the new contract.

https://youtu.be/YQNdWza-dVM

The order and all related documents (regulations on labor performance assessment and incentive payments, forms for new contracts, etc.) must be posted on the official website of the institution for review by all interested parties.

Additional agreement form

Source: https://ppt.ru/forms/effektivniy-contract/obrazec-prikaza

Do I need to notify employees?

Corrections to the wage regulations must occur in accordance with the procedure established by law:

- if the amendments concern the terms of the employment contract, the consent of the employees is required (Article 72 of the Labor Code of the Russian Federation);

- if corrections are made due to organizational or technological changes in the employee’s working conditions, the employer makes them unilaterally, warning the employees in writing 2 months in advance (Article 74 of the Labor Code of the Russian Federation).

If the amendments to the regulations do not concern the mandatory terms of the employment contract, for example, the positions of the persons mentioned in the document have been renamed, then the consent of the employees to these amendments is not necessary.

Additions to the wage regulations are drawn up in the same manner.

Tabular part of the position

In the structure of the position from the example considered, all additional payments, compensations and bonuses are placed in separate tabular sections. This is not necessary - the text form of presentation can also be used. In this case, this method of structuring information was used for the purpose of clarity and ease of perception.

For information about what payments form the remuneration system, read the article “Art. 135 of the Labor Code of the Russian Federation: questions and answers.”

The “Additional payments” table contains a list of those salary supplements that are applied by the employer. For example, these could be additional payments related to overtime work, for night work or the employee’s work on a holiday, and other additional payments.

For each type of additional payment, the corresponding interest rates are indicated in the table. For example, for night work the surcharge is 40% of the hourly rate (for hourly workers). The necessary explanatory data is indicated in a separate column of the table (it may be called “Note”). For example, for additional payment for night work, this column shows the period considered night: from 22:00 to 6:00.

The structure of the “Compensation” table is similar to that described above. The listed compensations (for example, for harmful and dangerous working conditions, upon dismissal, reduction, etc.) are supplemented with the corresponding amount or calculation algorithm.

The “Additions” table is present in the regulations only if this type of monetary supplement to the employer’s salary exists. An example is the bonus for length of service. In this case, it is necessary to explain in detail for what period what amount of the premium is due. For example, for work experience from 4 to 7 years, the salary increase will be 12%, from 7 to 10 - 15%, and over 10 years - 18% of the accrued salary.

The remaining tables are filled in the same way.

You can see a sample regulation on wages and bonuses for employees - 2020 on our website.

Document Sections

- Fundamental terms with definitions;

- familiarization with the remuneration system;

- intervals of money transfers and salary forms. boards;

- guarantee for late payments;

- the period of validity of the provision;

- tabular texts (“Additional payments”, “Compensations”, “Allowances”, “Bonuses”, “Other payments to the employee”).

The main section includes points where you can familiarize yourself with the regulatory documents on which the provision is based. Afterwards there is an analysis of the basic theses and the terminology used in the statement.

This paragraph allows each employee to easily understand the full meaning of the document. It also states which employees are referred to in the regulations.

The next section is directly about the wage system itself (SOT) , which is divided into time-based and piece-rate. It is also possible that each type of worker has its own SOT.

The third area is intended to describe the terms and forms of salaries; the numbers when earned money is accrued (advance, settlement) are also placed here.

The same part more broadly describes the forms of labor payments (cash, via bank card) and the non-excluded percentage of income.

The other part reflects information about the employer’s responsibility for late payments. The provision can indicate the cost of compensating for the misunderstanding.

And the last paragraph dates the validity period of the provision and prescribes, if necessary, some conditions.