Double entry

The balance sheet of an enterprise contains two interrelated accounting objects. The changes that occur during business operations are of a dual nature. Due to the fact that accounts reflect the movement and state of accounting objects presented in the balance sheet, each business transaction should be reflected in at least two items. Moreover, they must be interrelated and show the same amount. The double entry indicates the address of this link. Thus, the correspondence of accounts is reflected. The table provides threefold information. It shows information:

- Reflecting changes in registered objects on interconnected accounts.

- About ongoing operations.

- Characterizing the directions of movement of objects.

https://youtu.be/rnEbhzQzH2U

Event registration

In accounting it is duplicated for control purposes. The transaction is first recorded as a fait accompli with documentary evidence in the chronological record. Then it is shown in the system documentation, distributed among the corresponding accounts. Cash books, special journals and other registers are used to reflect transactions in chronological recording. In system accounting they are shown in the accounting accounts. This process is the posting of transactions. Correspondence of accounting accounts, as a rule, does not contain the content of the event. It is replaced with a link to the corresponding transaction number. The results of posting events are expressed in one monetary unit.

Characteristics of account 70

Synthetic account 70 is used in accounting to reflect transactions for all existing types of payments for the work of individuals - wages, benefits, bonuses, vacation pay, allowances, additional payments, one-time payments, financial assistance, alimony, etc. In addition, account 70 in accounting accumulates information about the distribution of income to founders/shareholders who are employees of the organization.

Analytical accounting for account 70 is maintained for each individual employee. To accurately reflect information, individual sub-accounts are opened for all specialists of the enterprise, where payments are calculated for the period and amounts are issued by bank transfer or in cash. The financial balance sheet for account 70 for the reporting period shows the total amount of remuneration (accrued and issued), as well as the balance of debt owed by the organization or employee. Additionally, accountants generate payroll and settlement statements, a journal order for account 70, a citizen’s income card, and analysis of account 70 for reporting on insurance premiums and personal income tax.

Subaccounts to account 70:

- 70.1 – for accruals based on salary amounts.

- 70.3 – to reflect debts in salary amounts.

- 70.4 – to reflect amounts to be issued.

- 70.5 – to reflect amounts transferred to deposits.

- 70.6 – to reflect rounding amounts for salaries.

Note! The chart of accounts 70 does not break down the account into subaccounts; each enterprise has the right to independently approve the necessary analytics, taking into account the requirements of Order of the Ministry of Finance No. 94n dated October 31, 2000.

Control

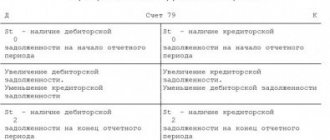

Correspondence of accounting accounts is used not only to implement the information function of documentation. Double entry has a greater control value. Correspondence of accounting accounts allows you to check the accuracy of transactions performed and the correctness of their reflection in the documentation. Control is carried out by reconciling credit and debit turnovers and balances. In this regard, two requirements that were formulated back in 1494 by Luca Pacioli are of key importance:

- The debit turnover amount is always identical to the credit indicator of one system of accounts. This provision expresses the essence of double entry.

- The amount for debit balances is identical to the indicator for credit balances of the same system of accounts. This rule expresses balance sheet equality.

If equality is not established, this indicates that errors were made during data registration.

Reasons for entry

The main correspondence of accounts is based on methodological, economic and legal coordination. This means that each completed operation has a completely unambiguous reflection. Correspondence of accounts is a relationship that is established in accordance with the legal and economic characteristics of the event and methodological methods of registration. Expression of a connection based on a specific business transaction is carried out by a special entry. When drawing up such wiring, you should adhere to the established logical diagram:

- Establish accounts and accounting objects that are affected by a business transaction, based on its economic content.

- Determine the nature of the items affected (passive or active).

- Establish debited and credited accounts in accordance with the specifics of changes in the composition of property or in the sources of its formation that occur during business transactions, as well as based on the specifics of the affected accounts.

Scope of application

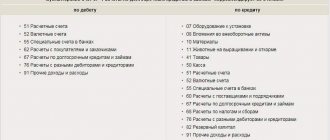

The chart of accounts is a list systematized on the basis of the economic content of each position included in it. The current list is a mandatory basis for drawing up a working chart of accounts for all organizations operating on the territory of the Russian Federation and maintaining accounting using the double entry method. The exception is banks and government agencies.

The double entry method is a registration system that involves simultaneous reflection of a transaction on two accounts: withdrawal ( credit ) of a certain amount of money from one and receipt ( debit ) of the same amount to another account .

Classification

Depending on the data reflected, the correspondence of accounts can be real or conditional. The first indicates the connection of articles to reflect data on operations and facts that lead to changes in objects. For example, “salary was issued from the cash register.” Conditional entries result from the recording methodology. In this case, the transaction was not actually carried out, but the correspondence of accounts was carried out.

Examples can be taken from the expense item. Thus, there is a record of including management costs in production costs. In this case, the expense is recorded in the general expenses account. When they are included in production costs, no business transaction occurs. Conditional account correspondence is performed to transfer data from one item to another. Depending on the method of reflection, the recording can be formulaic or graphic. The first provide, in addition to the name (and often instead of it) of the corresponding account, the affixing of its number (code). Thus, the following entry can be made: “return to the bank of unpaid wages - 1000 rubles.”

Simple and complex entries

Account correspondence can be expressed by several types of formulas. The simplest ones are shown by credit and debit. In cases where two accounts are affected by a completed transaction, the accounting entry is called a simple one. In the process of financial and economic activity of an enterprise, events may occur in which several items are used. In this case, one account can be debited and several accounts can be credited. Such records are called complex. Regardless of the number of accounts that are involved in such posting, the amount of debit and credit turnover must be equal (identical). Consider the entry:

The salary of the company's personnel was accrued - 100 thousand rubles, including:

- workers in production - 60 thousand;

- support staff (repair crew) - 15 thousand;

- management staff - 25 thousand.

In this case, three simple correspondence accounts can be drawn up for a completed business transaction. You can also perform one complex recording. In the latter case, several accounts will be debited, and one account will be credited. A complex entry must include at least three entries.

The initial data are presented in Fig. 16.7.

1. Go to Sheet 2,

By clicking on

the Sheet 2 shortcut,

a new blank sheet of the e-book will open.

2. On Sheet 2

create a table for calculating total revenue using the sample.

In cell A4, set the date format as in Fig. 16.7 (Format/Cells/Number/Date numeric

format

,

select the date type with the month entry as text – “May 1, 2004”). Next, autocopy the date down the column.

3. Type the words “Division 1” in cell V3 and copy them to the right into cells N3 and D3.

4. Select the area of cells B4:E24 and set the currency format to two decimal places. Enter numeric data.

5. Make calculations in column “E”.

Formula for calculation

Just in a day

=

Department 1 + Department 2 + Department 3,

in cell E4 enter the formula =

B4 + C4 + D4.

Copy the formula to the entire table column. Remember that calculation formulas are entered only in the top cell of the column, and then they are copied down the column.

Rice. 16.7. Input data for task 16.2

6. In cell B 24, calculate the sum of the data values in column “B” (sum in the column “Division 1”). To perform summation of a large amount of data, it is convenient to use the AutoSum

(X) on the toolbar. To do this, place the cursor in cell B24 and double-click with the left mouse button on the X button. The data in column “B” will be added.

7. Copy the formula from cell B24 to cells C24 and D24 by autocopying using the autofill marker.

8. Draw lines around the table and format the created table and header.

9. Rename the Sheet 2 shortcut,

giving it the name "Revenue".

To do this, double-click on the shortcut and enter a new name. You can use the Rename

in the context menu of the right-click shortcut.

10. As a result of the work, we have an electronic book with two tables on two sheets. Save the created e-book in your folder named “Calculations”.

Additional tasks

Task 16.3. Fill out the table, make calculations and format the table (Fig. 16.8).

Formulas for calculation:

Total for the workshop

=

Order No. 1 + Order No. 2

+

Order No. 3;

Total = the sum of the values in each column. Brief information. To perform an autosum, it is convenient to use the Autosum

(X) on the toolbar or the SUM function. As the first number, select a group of cells with data to calculate the amount.

Rice. 16.8. Input data for task 16.3

Task 16.4. Fill out the table, make calculations and format the table (Fig. 16.9).

Brief information. Adding sheets of an e-book is done using the Insert/Sheet command.

Rice. 16.9. Input data for task 16.4

Formulas for calculation:

Supplement amount

=

Percentage bonus

x

Salary amount.

Note. In the “Percentage of Surcharge” column, set the percentage format for the numbers.

Graphic expression

Such correspondence of accounts reveals the typification of articles. In this regard, graphic records are used, as a rule, in the process of developing programs for automated registration. In this case, any accounting entry represents an algorithm for a certain business transaction. The relationships between articles are shown in the form of a network graph. The code (number) of the corresponding account is indicated inside it. The sides of the graph express the very relationship of the articles in accordance with the direction of the arrow. It contains the business transaction number. The arrow points to the debited account from the credited one.

Structure of the chart of accounts

Each section of the plan contains two types of accounts:

- Synthetic;

- Analytical (sub-accounts).

Synthetic accounts are first-order accounts; they consist of two numbers (from 01 to 99) and are required to be filled out.

Sub-accounts are opened to synthetic ones as needed to reveal them in more detail. They are indicated by several numbers: first comes the synthetic number, and then after a dot the subaccount number (for example, 57.3 - Transfers on the way from the bank).

Graph diagram

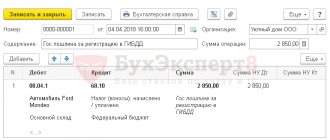

For example, you can take postings for salary:

1. Salaries have been accrued to the company’s personnel, including:

- production workshop worker;

- support staff;

- employees of the company's management staff.

2. Tax deductions are withheld from employee salaries.

3. Salary paid to the company’s personnel.

The above diagram reflects the logical relationship between the accounts used. It allows you to understand the economic essence of the transactions performed. It should be noted that accounting does not contain impersonal entries. They are not allowed in the documentation, since in this case the economic meaning of the business transactions themselves will be lost.