The concept of salary is regulated by the legislator as the remuneration due to the employee for his work and paid by the employer. The basis for carrying out work and receiving material remuneration is an employment contract, but labor relations can take place without it.

The law allows you for 3 days and then sign an agreement; in other cases, there is a formal approach to the employment contract or no one at all. But in any case, if there was an employment relationship, then the material remuneration is recognized by the court as salary.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 110-56-12 (Moscow)

+7 (812) 317-50-97 (Saint Petersburg)

8 (800) 222-69-48 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

The Labor Code states that the salary includes 3 parts of payments:

| Salary | It is a fixed part and depends on the amount of time worked (days, hours). Although this term is not commonly used in business, salary refers to the part of the salary that the employer and the hired employee agree on when concluding an agreement. |

| Compensation | This includes various additional payments that compensate for working conditions. For example, “for harmfulness”, “long service”, “overtime”, “holiday”, “northern”, etc. What payments a particular employer will make, he is obliged to record in his regulatory documents. |

| Stimulating to work | Bonuses, allowances and all kinds of additional payments to increase labor efficiency. This part of the salary can be paid by the employer at his discretion; the legislator does not say that it is mandatory to encourage the employee to work, but he can do it. The size of these payments is not limited, because the employer, based on its regulations, establishes a bonus system independently. Payments can be made regularly, perhaps monthly, or one-time when bonuses are timed to coincide with certain events. |

If an employee has arrears of wages, the court will side with him when his salary, compensation and regular incentive payments are not paid. The employer will be able to prove his innocence by providing legal grounds for deprivation of wages or changing its amount, which must be clearly stated in advance in the regulations at a particular enterprise.

An employer can pay a one-time bonus of his own free will by issuing a special order, so it is impossible to recover it by the court, even if previously these one-time bonuses were paid on the basis of orders on a monthly basis

Account 70 “Settlements with personnel for wages”

ACCOUNT 70 “PAYMENTS WITH STAFF FOR WAGES”

Account 70 “Settlements with personnel and wages” is intended to summarize information on settlements with employees of the organization for wages (for all types of wages, bonuses, benefits, pensions for working pensioners and other payments), as well as for the payment of income on shares and other securities of this organization.

In the credit of account 70 “Settlements with personnel for wages” the following amounts are reflected:

- wages due to employees - in correspondence with accounts of production costs (selling expenses) and other sources;

- wages accrued at the expense of the reserve formed in the prescribed manner for the payment of vacations to employees and the reserve of benefits for length of service, paid once a year - in correspondence with account 96 “Reserves for future expenses”;

- accrued social insurance benefits, pensions and other similar amounts - in correspondence with account 69 “Calculations for social insurance and security”;

— accrued income from participation in the capital of the organization, etc. — in correspondence with account 84 “Retained earnings (uncovered loss).”

The debit of account 70 “Settlements with personnel for wages” reflects the paid amounts of wages, bonuses, benefits, pensions, etc. income from participation in the capital of the organization, as well as the amount of accrued taxes, payments under executive documents and other deductions.

Amounts accrued but not paid on time (due to the failure of recipients to appear) are reflected in the debit of account 70 “Settlements with personnel for wages” and the credit of account 76 “Settlements with various debtors and creditors” (sub-account “Settlements for deposited amounts”). .

Analytical accounting for account 70 “Settlements with personnel for wages” is maintained for each employee of the organization.

ACCOUNT 70 “PAYMENTS WITH STAFF FOR WAGES”

CORRESPONDING WITH ACCOUNTS:

Payments to the FFOMS

Mandatory contributions are also contributions to compulsory medical insurance for employees. Paid at a rate of 5.1% . This type of contribution is transferred monthly without restrictions on the base. Calculation example Let's take the same organization and the same employees. The charges look like this:

- Kuznetsov A.T. — 1,530 rubles;

- Ivanov P.N. — 2,550 rubles;

- Kovaleva M.S. — 6,120 rubles.

Since there is no maximum base for accruals, the indicated amounts will be maintained throughout the year , in the absence of changes in wages.

Description of wage arrears

The concept of salary is regulated by the legislator as the remuneration due to the employee for his work and paid by the employer. The basis for carrying out work and receiving material remuneration is an employment contract, but labor relations can take place without it.

The law allows you for 3 days and then sign an agreement; in other cases, there is a formal approach to the employment contract or no one at all. But in any case, if there was an employment relationship, then the material remuneration is recognized by the court as salary.

The Labor Code states that the salary includes 3 parts of payments:

It is a fixed part and depends on the amount of time worked (days, hours). Although this term is not commonly used in business, salary refers to the part of the salary that the employer and the hired employee agree on when concluding an agreement.

This includes various additional payments that compensate for working conditions. For example, “for harmfulness”, “long service”, “overtime”, “holiday”, “northern”, etc. What payments a particular employer will make, he is obliged to record in his regulatory documents.

Stimulating to work

Bonuses, allowances and all kinds of additional payments to increase labor efficiency. This part of the salary can be paid by the employer at his discretion; the legislator does not say that it is mandatory to encourage the employee to work, but he can do it. The size of these payments is not limited, because the employer, based on its regulations, establishes a bonus system independently. Payments can be made regularly, perhaps monthly, or one-time when bonuses are timed to coincide with certain events.

If an employee has arrears of wages, the court will side with him when his salary, compensation and regular incentive payments are not paid. The employer will be able to prove his innocence by providing legal grounds for deprivation of wages or changing its amount, which must be clearly stated in advance in the regulations at a particular enterprise.

What kind of reporting is submitted?

If you are an individual entrepreneur and work in a simplified taxation system, filing payroll reports will not be particularly difficult.

Income and expenses of the wage fund are traditionally reflected in the corresponding book.

In the seventh column of the document, income received during the month and expenses that the company incurred in the same period , and the resulting difference is taken into account.

The book is submitted for control in December of each financial year.

Quarterly reporting on payroll involves filling out forms from the social insurance fund and pension fund. But there is no .

Calculation by categories of this fund is also submitted to the Pension Fund.

If your company operates in a general taxation system , reporting will be more difficult.

You will have to draw up a balance sheet, report on funds received and losses incurred, and at the end of the reporting period, submit an appendix to the balance sheet, reports on the flow of money and the intended use of all funds.

When reporting wages, you can use the same forms as individual entrepreneurs working under a simplified method .

The only difference will be in the timing of reporting.

When a delay may occur

The legislator has established that salaries must be paid in installments at least 2 times a month with approximately equal time intervals. The parts of the salary, including compensation and salary, should also be approximately equal to each other.

Based on the results of work, only bonuses are paid, so they can be accrued for 1 or several months at once, for a year. When receiving wages in cash, employees sign the pay slip; if it is transferred to bank cards, documents are requested from the bank to confirm payment.

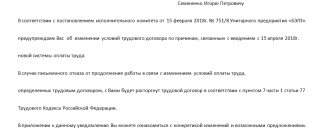

The specific numbers when the employer provides for payments, he indicates in the internal Labor Regulations and contracts concluded with employees. Therefore, wages at a particular enterprise must be paid on time, and if these days fall on weekends or holidays, then the day before. For the payment of vacation pay, the deadline is 3 days before the start of the vacation, and settlement pay on the day of dismissal.

Debt in insurance premiums most often arises as a result of accounting errors and misinterpretation of innovations in this area.

How to act if a debt arises in a bank is explained in detail in the article at this link.

Wage arrears can be current, the payment period of which has not yet arrived, but it has already been accrued, and overdue, when the numbers (for example, 1 and 15) provided for by the internal documents of the enterprise are missed. Personal income tax is already included in the salary when it is calculated.

Overdue wages will include the balances of wages that the employer has not paid as of the reporting date, minus those paid (advances). If there is arrears in wages that come from the budget, then all organizations will be in arrears at the same time, regardless of the items for which financing is provided.

Although the employer must pay wages after 14–16 days . i.e. 2 times a month, he can legally do this no later than 7 days after the end of the time interval.

From the moment the reporting date for payment was missed, the debt will be considered overdue, i.e. on the next day. Regardless of whether wages at the enterprise have not been paid in whole or in part, the entire balance of the debt will be attributed to the arrears on the balance sheet.

A delay in payment can occur for various reasons, but the main one is considered to be the company’s lack of funds, when receivables are high and counterparties do not return funds for a long time.

In another case, a large amount of accounts payable has formed and needs to be repaid urgently, as well as other cases. At the same time, according to the balance sheet, salaries are accrued on time, but they do not reach the employees. If the salary is paid later than the terms stipulated by the employment contract and legislative acts, or is not paid at all, this indicates a violation of the Labor Code by the employer.

If we are talking about regular bonuses, then the employer could violate labor laws and not pay them. When he decided not to pay the bonus to the employee and did not properly record the fact of violation of discipline in the documents, this will also be a violation; according to the law, the employee is entitled to payment. In this case, the court recognizes that the employer did not have the right to deprive the employee of a bonus or reduce its size, and therefore is obliged to return the debt for the bonus and material compensation for its delay.

The legislator has established that in any case, if there is a delay in payment of wages, the employer has committed a violation and must bear financial responsibility, because the fact of non-payment of wages to employees cannot depend on:

- selfish intent or not of the employer;

- the presence or absence of funds in the company’s account;

- problems with cash in the bank;

- illnesses of accounting workers or cashiers;

- other factors.

Is it possible to collect wage arrears?

Late payment of wages has long become commonplace in many enterprises. Employers abuse their position due to impunity and grossly violate the labor rights of Russian citizens.

Often, wages are underpaid month after month, and each employee has a large debt. The legislator assures that the collection of arrears of wages is possible; citizens are recommended to go to court, which is the most effective method of protecting labor rights.

But first you should try to resolve the issue peacefully:

- by sending a complaint to the management of the employing company;

- by contacting the labor inspectorate;

- by writing a complaint to the prosecutor's office;

- by preparing a statement of claim in court and notifying the employer that it will be filed.

After contacting the labor inspectorate, it is obliged to respond and send an unscheduled inspection to the enterprise to determine the reason for the debt to the employee. Typically, inspectors take the side of the injured person, and a fine may be imposed on the employer.

In some cases, management is affected by a statement that litigation is pending. If he loses, he will additionally pay legal costs. When the issue is not resolved peacefully, you will have to file an application in court.

Based on the court ruling, the plaintiff will receive:

- unpaid salary debt;

- compensation for moral damage;

- interest for overdue payments will be accrued for each day.

The applicant employee will not have to pay a state fee for filing a claim.

Contributions to the Pension Fund

If the employer is an individual entrepreneur, then he makes payments to the Pension Fund both for himself and for each employee . These deductions do not overlap in any way. did not change in 2015 . For the Pension Fund of Russia it is 22% . The maximum base in 2020 is set at 711,000 rubles. After reaching this amount, 10% of the employee’s salary . For entrepreneurs and organizations that operate in production conditions that are harmful and/or dangerous to the life and health of workers, there are increased contribution rates. In 2020, their size increased even more and is:

- 9 % - for the categories described in clause 1, part 1, art. 30 of the Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”;

- 6 % - for the categories described in clause 2 - 18 part 1 art. 30 of Law No. 212-FZ.

When reassessing working conditions, as a result of such a check, the rate of additional contributions may be reduced from 0 to 8% , which is directly dependent on the assigned subclass of working conditions. Just like in 2014, the additional tariff is payable without restrictions on the amount of payments received by the employee. Example of calculation The organization employs three employees: Kuznetsov A.I. with a salary of 30,000 rubles, Ivanov P.N. with a salary of 50,000 rubles and Kovalev M.S. with a salary of 120,000 rubles. In January, contributions will be transferred to each employee at a rate of 22% , i.e.:

- Kuznetsov A.I. — 6,600 rubles;

- Ivanov P.N. — 11,000 rubles;

- Kovaleva M.S. — 26,400 rubles.

These calculations, provided that there are no changes in wages, will remain in place until June . In June, citizen Kovaleva reached the maximum base for payments, and further deductions will be made at a rate of 10% , i.e.

- Kuznetsov A.T. — 6,600 rubles;

- Ivanov P.N. — 11,000 rubles;

- Kovaleva M.S. — 12,000 rubles.

After dismissal

When making payments to an enterprise, the employer is obliged to pay wages on the day of dismissal. If the payment is due immediately after the vacation, then all finances must also be received on the last working day.

If an employee has been denied payment, he needs to remember that the employer violated labor laws and his rights. The fact of illegal dismissal is disputed in court. Cases that make it possible to collect debt payment from an enterprise include overdue debt when there is no threat of dismissal.

In other cases, when:

- delays in wages and threat of dismissal;

- dismissal without an order, issuance of labor and payment;

- illegal actions of the employer.

Upon dismissal, according to the law, the employee receives a salary for the period worked, a debt on it, if any, with interest for late payment, compensation for unspent vacation. If this was not done, the payment was made late or partially, the citizen does not agree with the amount received, he has every right to appeal the employer’s actions in court.

According to the Criminal Code of the Russian Federation, when wages are not partially paid for 3 months. and more, then the head of the enterprise can:

- face a fine;

- removal from position for 1 year;

- imprisonment for up to 1 year;

- forced labor for up to 2 years.

When an overdue debt is not paid for more than 2 months due to selfish goals pursued by the manager, the amount of a fine can be imposed on him in the range of 100–500 thousand rubles. . as well as other measures, according to the Criminal Code

Statute of limitations

The legislator does not recommend delaying filing an application to court if the issue is not resolved peacefully, because the statute of limitations for labor disputes expires after 3 months .

The three-month period begins from the moment the employee learns that his rights have been violated by the employer, which means that it cannot always be determined precisely. If the applicant misses the deadline that the legislator provides for his defense in court, the debts will not be repaid.

But missing the established period may occur for a good reason, for example, illness, then, according to the Labor Code, the period will be restored in court. To do this, you will have to submit the relevant documents, to which the court is very demanding, and also convince the judges that the applicant can exercise his right to restore the 3-month period for filing an application for overdue debt.

At an enterprise, overdue debts to employees for wages are reflected in a special balance sheet account until they are paid or written off at the end of the statute of limitations.

Required documents

To file a statement of claim in the form established by the legislator, the applicant must contact the territorial branch of the court according to registration.

In addition to the application, the package of documents must include:

- contract or employment agreement;

- job description;

- orders on hiring and dismissal;

- income certificate;

- calculation of overdue debts;

- documents that can indirectly confirm the applicant’s correctness.

Recovery percentage

When calculating the total amount of salary arrears, it is necessary to take into account that deductions from it do not exceed 20% . The employee can be returned 50% of the amount due on the basis of the law, even if the collection occurs under several writs of execution.

This article cannot be applied to deductions from wages when the employee is serving time in a correctional colony, paying child support, or paying damages. In this case, deductions from his salary cannot exceed 70% .

You can find out the debt to the Pension Fund by submitting a corresponding request to the local body of the Pension Fund of the Russian Federation.

You can find out what a sample debt notice looks like from this article.

15.3. Synthetic and analytical accounting of wage calculations

When organizing wage accounting and reflecting the corresponding transactions in accounting accounts, it is necessary to separate payments included in the cost of products (works, services) and payments reimbursed from other sources.

The cost of production includes the cost of remunerating workers employed in the production sector - manufacturing products, performing work - or servicing production. An organization may make payments that are not included in the cost of products (works, services), but are reimbursed from the social insurance fund, retained earnings, targeted financing, etc. Payments from these sources are compensatory or incentive in nature. These include temporary disability benefits paid from the social insurance fund; bonuses paid from the reserve fund and targeted revenues; financial assistance; payment to employees for vacations additionally provided under the collective agreement, etc.

Organizations maintain synthetic accounting of wage settlements on account 70 “Settlements with personnel for wages”, in the development of which corresponding sub-accounts can be opened. On the credit side, account 70 reflects the amounts of accrued wages, bonuses, temporary disability benefits, on the debit side payments to employees, amounts of withheld tax, advances not returned by accountable persons in a timely manner, amounts for material damage caused, defects, in repayment of debt on loans issued, on executive orders. documents in favor of various legal entities and individuals.

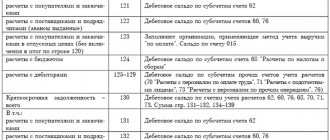

Accounting entries on account 70 “Settlements with personnel for wages” are presented in table. 15.1.

Correspondence of invoices for accounting of settlements with personnel for wages

Contents of the fact of economic activity

Reflects arrears of wages to employees directly related to the creation of fixed assets

Reflects arrears of wages to employees engaged in the production of products, performance of work, provision of services to the main and auxiliary industries

An organization can create reserves to pay for vacations, pay benefits for long service and based on the results of work for the year.

The organization creates a reserve for future payment of vacations (including the unified social tax) for employees in order to evenly include the costs of paying for vacations in the cost of production. To calculate contributions to the reserve, information about the annual wage fund and the amount of planned vacation pay is used. Contributions to the reserve are calculated as a percentage of accrued wages. When employees go on vacation, the reserve is reduced by the amount of pay accrued to them. For vacations not used by the end of the year, the reserve is transferred to the next year.

Accounting for the formation and use of the reserve is kept in account 96 “Reserves for future expenses”, subaccount “Reserve for future payment of vacations”. The credit of account 96 reflects the creation of the reserve, and the debit reflects its use; the balance can only be a credit balance.

The organization creates reserves for the payment of remuneration for length of service and based on the results of work for the year based on the amount of payments and deductions for these remunerations of the unified social tax expected in the coming period. Payments are made monthly. The created reserves are used in full in the month in which remuneration is paid to the organization’s employees. Reserves are accounted for in account 96 “Reserves for future expenses”, subaccounts “Reserve for the payment of remunerations for long service” and “Reserve for the payment of remunerations based on the results of the year”. These reserves are fully used in the reporting year.

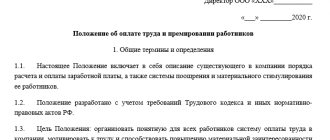

The formation of reserves for vacation pay, payment of benefits for length of service and based on the results of work for the year must be provided for in the administrative document on the accounting policy of the organization for the coming year.

Accounting records for accounting for the formed reserves are presented in table. 15.2

Correspondence of accounts to account for reserves for future expenses

Contents of the fact of economic activity

Deductions to reserves for future expenses are reflected (for vacation pay, payment of benefits for long service, based on the results of work for the year)

Deductions for social insurance are reflected from the amounts of payments to employees, the costs of which were reserved (for vacation pay, payment of benefits for long service, based on the results of work for the year)

Reflects the debt to employees for payments, the costs of which were reserved (for vacation pay, payment of benefits for long service, based on the results of work for the year

To summarize data for each employee, workshop, department and organization as a whole on accrued wages, deductions made, deductions and payments, and the status of wage settlements, the accounting department maintains the following accounting registers.

A personal account is an analytical accounting register and is filled out for each employee of the organization. It reflects calculations for wages and other charges in favor of the employee. A personal account is opened on the basis of an employment order (instruction). The personal account indicates the last name, first name, patronymic of the employee, the number of children, the structural unit where he was hired, his personnel number and other information. At the end of the month, the personal account contains information about accrued amounts by type of payment, about deductions and deductions, about amounts payable or debt of the employee to the organization. A personal account is opened for a year. At the end of the year, the personal account is closed and a new one is opened the following year. When filling out personal accounts, the following primary documents are used:

· orders for piece work, reports on production, sheets on downtime, etc.;

· savings cards for wages for calculating piecework wages;

· timesheets for recording the use of working time (for calculating time wages and salaries), additional payments for night hours and overtime;

· decisions of judicial authorities on deductions based on writs of execution;

· statements from employees regarding transfers from wages for charitable purposes;

· tax cards for recording income and personal income tax.

Based on personal account data, a settlement or payroll statement is filled out; average earnings are determined; pensions are calculated. The shelf life of personal accounts is 75 years.

The payroll reflects wage settlements with the personnel of the department or the organization as a whole. The payroll is a journal consisting of main and loose sheets. The number of loose-leaf sheets depends on the period for which the magazine is designed (quarter, half-year, year). The main sheets indicate the surname and initials of each employee; reference data is provided (personnel category, profession or position, tariff category, tariff rate or salary), and also for the first month of the quarter, half-year or year the number of days (working, weekends and holidays) and hours, the amount of accrued wages from the payroll fund are shown labor and other sources, temporary disability benefits and how much accrued in total, withholding (personal income tax, under writs of execution, etc.), the amount to be paid or the employee’s debt to the organization. The insert sheets contain data on hours worked, accruals, deductions and the amount payable or debt for the subsequent months of the period (quarter, half-year, year) for which the payroll is opened. This statement is filled out according to personal account data.

Summary

There are many types of wages, depending on the qualifications of employees, working hours, working conditions, rest periods and other factors. wage fund Wages are classified based on minimum and actual tariffs. In some regions, there are territorial coefficients that increase the wage fund from 15 to 100%. For example, the Ural coefficient is 15%. It is also worth remembering that there is a minimum level of employee benefits established by law and 30% of insurance premiums must be charged on all staff income. With the right approach to the wage fund and constant monitoring of wages, it is possible to effectively stimulate employees , while at the same time leaving reserves for the growth of staff income.

We welcome your comments!

Maintaining salary on account 70

It takes into account all settlements with personnel:

- on wages, including basic and additional wages, as well as incentive and compensation payments;

- for the calculation and payment of financial assistance. benefits and compensations;

- for payment of vacation pay and compensation for unused vacation;

- on deductions from wages to compensate for losses from marriage, shortages, theft, damage to material assets, etc.;

- on payment by employees of trade union dues, utilities and other services;

- on deductions from wages based on writs of execution based on a court decision, etc.

By credit, the entries in account 70 display the amount of debt of the enterprise/organization to the employee, by debit - the reduction of such debt due to the payment of wages or other amounts due to employees in accordance with the law, or the occurrence of debt by the employee to the enterprise.

Analytical accounts for account 70 can be opened for groups of employees (by divisions) and for each employee separately.

The main corresponding accounts to account 70 when calculating salaries are determined by the type of activity of the enterprise (organization):

- in production – count 20 (for workers in main production), count 23 (for workers in auxiliary production), 25 (for workers involved in the management and maintenance of workshops and/or sections), 26 (for factory management workers and specialists), 29 (for workers of service industries and farms);

- in trade and service sectors - score 44.

When calculating benefits, accounts intended for settlements with extra-budgetary funds are used (sub-accounts of account 69). When calculating vacation pay and amounts of remuneration for long service, accounting account 96 is used, etc.

All listed accruals are made on the debit of the indicated accounts and on the credit of account 70.

Get 200 video lessons on accounting and 1C for free:

See step-by-step instructions for calculating and paying salaries in 1C 8.3:

Average, minimum and actual

To objectively assess an employee’s work, it is possible to use indicators of minimum and average wages . In accordance with the laws of the Russian Federation, the minimum monthly wage (MROT) is 5965 rubles. This indicator is the basis for state regulation of personnel income. It is also used to calculate benefits related to temporary disability, pregnancy and childbirth. The minimum wage is adjusted every year to the rate of inflation for the period. The average salary reflects the amount that specialists in a particular field receive. It is calculated as the sum of all incomes of a given type of worker divided by the number of specialists. There is also an average wage for all workers. The indicator is calculated at the federal and regional levels. It is not recommended to take the federal rate as a basis , because employee incomes vary greatly from region to region. It is advisable to set wages based on the average rate in the region . For example, in the Perm Territory this figure is 27 thousand rubles, and in the Khanty-Mansiysk Okrug - 56 thousand. The actual wage can be calculated based on the minimum and average wage rates. It reflects the amount accrued to the employee at the end of the period (excluding bonuses and other payments). For highly skilled personnel, it is recommended that actual wages be charged above the regional average, while low-skilled workers may receive income below the average rate.