What it is?

Accounts receivable are obligations of third-party organizations for goods supplied by the company and services provided, employees for money issued on account, individuals for loans provided, and the like.

The appearance of such a debt is due to a discrepancy between the delivery time and the payment terms specified in the contract. That is, the company can deliver products on March 1, and the last date for receiving payment is April 1. All the time from March 1 to April 1, the amount of goods delivered is taken into account as a receivable.

Its types vary depending on several factors:

- Payment time: normal, that is, the approved payment deadline has not yet passed;

- overdue - it occurs when obligations are not repaid on time;

- doubtful - a subtype of overdue, appears when the debt amount is not secured by collateral;

- hopeless - formed when it is no longer possible to obtain funds.

- short-term, that is, payment is provided within a year;

- related to the sale of goods and other things, that is, arising as a result of payments for products, work, etc., including advances issued to suppliers;

Customer debt is accounted for in the debit of account 62. Regulated by PBU 9/99.

Accounts payable are obligations of an organization that arose to third-party enterprises, individual entrepreneurs, employees and individuals during settlements related to supplied goods and materials, wages, payments to the budget, etc.

It arises when obligations are formed before their payment has been made.

For example, a company bought goods on March 10, but the terms of the contract say that payment is possible until April 4. All the time from March 10 to April 4, the organization’s contract amount will be reflected as debt.

The classification of liabilities is similar to the division of the previous type of debt:

- By duration: short-term;

- long-term.

- normal, that is, not contrary to the terms of the contract;

- not related to the supply of goods and materials;

- ordinary, that is, debts to suppliers, subsidiaries, prepayments received and similar obligations;

Debt to suppliers is accounted for in accounts 60, 76. Legislation is regulated by PBU 10/99.

https://youtu.be/DtdE2dGjQpU

Preparation of transactions

To make the meaning of the postings clear, you should study the accounts by heart. It is necessary to strictly follow the plan:

- What?

- For what?

- To whom?

- Where?

- For what?

For example, if the supplier has not fulfilled its payment obligations - accounts receivable, the question is: for what and from where? So this is wiring Dt60.02 Kt51.

If there is an error in 1C - there is a credit, but in fact there is a debit and there is a reconciliation report, then according to this document, an accounting certificate is generated in the program: 60.1/91.1, that is, dividing by the amount of the difference to calculate income tax.

In this case, there is no need to write off the debt according to the reconciliation report; you just need to make adjustments to the accounting data according to the error that occurred. When paying with interest-bearing or discount bills, accounting is carried out in accordance with the provisions of PBU 19/02 and in accounting and has the following formation:

Payment has been transferred to the supplier - debit 58.2 credit 76 or debit 76 credit 62.1;

The buyer's debt was paid with a third party's bill of exchange - debit 76 credit 62.1, while the bill of exchange must be interest-bearing in order to be accounted for as part of financial investments.

Nuances of reflecting accounts receivable

Since 2020, the basis for determining profit tax is accounting information, which has led to increased attention to it from the tax authorities. Accounts receivable acts as its main part and everything seems to be simple here, but some nuances should be taken into account.

- It can be short-term - the normal cycle of debt repayment and long-term - when there is doubt about the return of money. Such debt must be reflected separately and in the period when it became known, with the exception of that part of it that will be repaid within the next 12 months.

- The next important part is the amount of fines, penalties, and interest that are provided for in contracts for the supply of goods. Such accruals are reflected in unprovided assets in a separate sub-account, which provide for economic benefits.

- You should be equally careful about the distribution of doubtful debts. Since accounts receivable is an asset, it is recorded in the balance sheet as net/realizable value. To calculate this, the amount of the reserve for doubtful debts should be determined on the reporting day.

Short-term and long-term debt

Important: as of 2020, line 1230 is no longer divided into long-term and short-term, but now it is necessary to provide a more complete breakdown of the lines.

Short-term debt is such debts, the amounts for which are planned to be repaid within a year, they can be clearly calculated, they are a normal cycle of settlement relations. These debts are reflected in line 690.

Long-term receivables on the balance sheet are debts whose repayment is in doubt; they extend over a period of more than a year and are reflected in line 520.

An example of reflecting accounts receivable on the balance sheet.

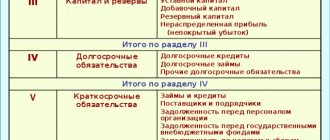

Form 1 of the balance sheet for 2020 consists of two interconnected parts - assets and liabilities.

Form 1 of the balance sheet can be downloaded here.

Important: long-term debt should be partially indicated in short-term debt, the volume that is planned to be repaid over the next year. The transfer of long-term debt to short-term debt is reflected in account 67 as a debit with account 66 as a credit.

Writing off debts by debit when adjusting debt

Debts for which the 3-year limitation period has expired or the debtor, for example, has been declared bankrupt, are subject to write-off.

The operation is performed using the line “Adjustment of debts”, in the “Write off” field the type of operation opposite the debtor is indicated.

Since 2011, the account for writing off receivables in the debt adjustment is 63, this is when there are provisions for doubtful amounts, when there is no formation, account 91.02, but here you should select the type of other income and expenses.

After drawing up the document, a posting is generated: Debit 63 Credit 62.01. or Debit 91.02 Credit 62.01.

The advantages of accounts receivable - watch this video:

Important: accounts receivable over 5 years are indicated on account off balance sheet 007 “Writing off the debt of an insolvent debtor at a loss.”

Debt adjustment is also performed to fix the offset or when transferring the debt to a third party.

What is 1230 in accounts receivable

Accounts receivable 1230 is a line for recording debts that were not closed as of this reporting date; it indicates the debit balance for all of the above lines from 60 to 76, minus 63 - doubtful debts.

Today it is a single line item for all types of debt, but the law requires assets to be classified by type.

So, when indicating debts in Appendices 3 and 5.1, it is necessary to indicate information about the movement of receivables and in the “Explanation” column make a link to the necessary explanation, and to clarify it, create additional lines.

Important: offsetting between asset and liability items is not allowed.

Accounts receivable

In order to see and understand what accounts receivable is, you should create a balance sheet. The debit balance on settlement accounts (such as 60, 62, 66-70, 73, 75 and 76) will be the receivable, that is, the amount owed to the company by other firms, individuals and funds.

Let's look at what accounts receivable includes:

| Accounts receivable | On what account is it reflected? |

| Debts of buyers, customers | 62 “Settlements with buyers and customers” |

| Debts of suppliers and contractors for advances transferred to them (prepayments), as well as recognized claims | 60 “Settlements with suppliers and contractors” 76 “Settlements with various debtors and creditors” |

| Debts of insurance companies for insurance claims, issuers of securities owned by the company, for dividends, etc. | 76 “Settlements with various debtors and creditors” |

| Debts of budgetary bodies and extra-budgetary funds for excessively transferred taxes and contributions | 68 “Calculations for taxes and fees” 69 “Calculations for social insurance” |

| Debts of employees on accountable amounts, loans, compensation for damage, etc. | 70 “Settlements with personnel for wages” 71 “Settlements with accountable persons” 73 “Settlements with personnel for other operations” |

| Debts of founders and participants on contributions to the authorized capital | 75 “Settlements with founders” |

The composition of accounts receivable will depend on how exactly it was formed. It can form when:

- sale of goods (work or services) on an advance payment basis (that is, the goods have already been shipped to the counterparty, but payment for it has not yet been received);

- purchasing products (raw materials) on an advance payment basis;

- overpayment of taxes and fees;

- issuance of accountable money.

General information

Accounts receivable, on the contrary, are the amounts that are owed to a given enterprise, all of them in general constitute the same amount of accounts receivable. Such debt is formed throughout the year and is reflected in the balance sheet in line one thousand two hundred and thirty.

Reference. Most often, debtors' debt to an enterprise is recorded in the asset section of the balance sheet, which reflects the full value of the enterprise's current assets.

What is included in line one thousand two hundred and thirty of the balance sheet?

As of the accounting date, the accounting line of the enterprise’s balance sheet reflects various changes in the amount of the debit balance, such reports:

- Number forty-six is the steps that have been completed in the work in progress;

- Number sixty – settlements with the supplier company and the contractor company;

- Number sixty-two – settlements with customers and settlements with customers;

- Number sixty-eight – tax calculations and fee calculations;

- Number sixty-nine – social settlements for insurance and security;

- Number seventy – payroll calculations with employees;

- Number seventy-one – settlements with accountable personnel;

- Number seventy-three - settlements with personnel involved in various operations;

- Number seventy-five – settlements with constituent companies;

- Number seventy-six – accounts receivable and accounts payable.

Line in the balance sheet – accounts receivable

Short-term debt

To correctly fill out line one thousand two hundred and thirty of the first form, you should take into account everything:

- Adding additional lines to the balance sheet form, they are necessary to separate accounts receivable into short-term debt and long-term debt.

- Advances that were listed earlier are written separately from the full amount of the loan for the sale of finished products, including work and services, only if this is significant.

- The amounts of advances that were transferred for a product, work, or service are written taking into account VAT, which must be deducted according to the law of the Russian Federation.

DZ, which is indicated in another currency or conventional units, must be recalculated into rubles at the official exchange rate of the central bank of our country, which was established on the last day of the reporting period. The only exceptions are advances that were listed earlier.

- In the case of current accounts numbered sixty, sixty-two, sixty-eight, sixty-nine, seventy, seventy-one, seventy-three, seventy-five and seventy-six, which have debit or creditor balances, are not offset against each other.

- The reserve for debts in which there are doubts should not be included in the full amount of the loan.

In what cases is it formed?

The key causal factor in the occurrence of debt is different dates for the fulfillment of obligations on the part of the parties to the agreement .

For example, the supplier has already shipped the product, but the buyer has not had time to pay for it. It turns out that the person purchasing the commodity units becomes a debtor to the person selling them.

The presence of debt is considered an integral part of any business . Of course, many entrepreneurs and corporations want to work on an advance payment basis and receive funds at the time of shipment, but in practice this is almost impossible.

The difference between accounts receivable and accounts payable

Accounts receivable represent what is rightfully due to the organization, but has not yet been received. And if the organization itself owes it, then this is already accounts payable.

Regardless of the repayment period of the receivable, it belongs to the current assets of the organization. Not all types of receivables are reflected in the corresponding line of the balance sheet. For example, the debt of suppliers and contractors under contracts for the purchase or creation of non-current assets is reflected in the “Non-current assets” section.

What documents are used

Information on remuneration is presented in the following documents:

- balance sheet (form No. 1) with annex (form No. 5);

- reports on income and expenses (form No. 2), on the flow of funds (form No. 4), on the intended use of money (form No. 6), etc.

How is the wage fund reflected on the balance sheet?

Salary accrual in accounting is displayed using the entry:

- Dt cch. (debit account) 20 “Main production” (25 “General production expenses”, 44 “Sales expenses”, etc.),

- K-t sch. (credit account) 70 “Settlements with personnel for wages.”

The total accrued but unpaid wages in the accounting report are reflected in the column “Debt to the organization’s personnel.”

Salaries accrued but not yet received by employees are reflected as deposited in account 76 “Settlements with various debtors and creditors.”

To reflect this article, it is also necessary to record “D-c. 70 “Settlements with personnel for wages”.

The amount of wages lost by employees is also reflected in the balance sheet in the article “Other creditors” in section No. 5 “Short-term liabilities”.

In order for the wage fund to be reflected correctly in the balance sheet, the accountant can help with his work by drawing up established samples of the following documents:

- working forms for monthly payroll;

- payroll statements for each employee with the results of calculating the advance payment, with a breakdown by cost centers, by net salaries, with general results and types of accruals and deductions (T-51);

- summary reports on taxes and fees, including breakdowns by type of accrual, corresponding statements for each employee;

- time sheets;

- payment orders;

- employee pay slips;

- bank registers in banking format;

- memorial orders;

- calculations of sick leave and vacations;

- calculation notes upon dismissal (single form T-61).

Types of accounts receivable

Types of receivables are distinguished based on their classification criteria:

| Criterion | Types of accounts receivable |

| In order of occurrence | Normal (arising within the framework of credit policy) Unjustified (arising from violation of requirements) |

| By timing of payment | Scheduled (repayment dates have not yet arrived) Overdue (repayment period has already arrived, but the debt has not been paid) |

| By length of delay | Overdue less than 45 days Overdue from 45 to 90 days etc. |

| According to the reality of collection | Real for collection Doubtful Hopeless |

Accounts receivable under a foreign exchange agreement

The formation of receivables under foreign exchange contracts has its own characteristics. Payment under such an agreement can be made in rubles at the exchange rate on the date of payment. In this case, it is necessary to take into account:

- reflect the debt at the foreign exchange rate on the date of transfer of ownership of the goods to the buyer;

- when preparing financial statements, or at the time of receipt of payment from the buyer, recalculate the debt at the exchange rate for that date;

- the resulting amounts of exchange rate differences (positive or negative) should be reflected as part of other income/expenses.

The exception applies to advances received in foreign currency. They are not recalculated and reflected at the exchange rate on the date of receipt.

To reflect exchange rate differences, the accountant makes the following entries:

- Debit 62 Credit 91.1. – in case of positive exchange rate difference;

- Debit 91.2. Credit 62 – in case of negative exchange rate difference.

Accounts receivable management regulations

How it will help: create an effective system of control, accounting and return of receivables.

Receivable - debt that is left unattended

How it will help: control accounts receivable for advances issued to suppliers

Doubtful accounts receivable

Debt that has a high probability of not being repaid on time and is not secured by any guarantees is considered a doubtful debtor. If such debt is identified, it is necessary to create a reserve in accounting. It is necessary to ensure that the company’s reporting shows the actual financial result, as well as the obligations of counterparties.

As for tax accounting, reserves for doubtful debts are created at will and taxable profit can be reduced by this amount. A reserve is created only if the delay exceeds 45 days.

How to decipher balance sheet asset lines

Before deciphering an asset item, let’s consider its code - it carries certain information. So, the first digit shows that this line refers to the balance sheet (and not to another accounting report); 2nd - indicates the section of the asset (for example, 1 - non-current assets, etc.); The 3rd digit reflects assets in increasing order of their liquidity. The last digit of the code (initially it is 0) is intended to help in line-by-line detailing of indicators considered significant - this allows you to fulfill the requirement of PBU 4/99 (clause 11).

NOTE! The requirement for detail may not be fulfilled by small businesses (clause 6 of Order No. 66n).

Read about what distinguishes accounting carried out by small businesses in the material “Features of accounting in small enterprises” .

The asset lines of the balance sheet with codes and explanations are shown in the table:

| Line name | Code | Decoding the string | |

| By order No. 66n | By order No. 67n | ||

| Fixed assets | 1100 | 190 | The total amount of non-current assets is reflected |

| Intangible assets | 1110 | 110 | The information reflected in lines 1110–1170 is explained in the notes to the statements (information on the availability of assets at the reporting dates and changes for the period is disclosed) |

| Fixed assets | 1150 | 120 | |

| Profitable investments in material assets | 1160 | 135 | |

| Financial investments | 1170 | 140 | |

| Deferred tax assets | 1180 | 145 | The debit balance of account 09 is indicated |

| Other noncurrent assets | 1190 | 150 | Filled in if there is information about non-current assets that are not reflected in the previous lines |

| Current assets | 1200 | 290 | The final result of current assets is determined |

| Reserves | 1210 | 210 | The total balance of inventories is given (debit balance of accounts 10, 11, 15, 16, 20, 21, 23, 28, 29, 41, 43, 44, 45, 97 without taking into account the credit balance of accounts 14, 42) |

| Value added tax on purchased assets | 1220 | 220 | Indicate account balance 19 |

| Accounts receivable | 1230 | 240 | The result of adding the debit balances of accounts 60, 62, 68, 69, 70, 71, 73, 75, 76 minus account 63 is reflected |

| Financial investments (excluding cash equivalents) | 1240 | 250 | The debit balance of accounts 55, 58, 73 (minus account 59) is given - information on financial investments with a circulation period of no more than a year |

| Cash and cash equivalents | 1250 | 260 | The line contains the balance of accounts 50, 51, 52, 55, 57, 58 and 76 (in terms of cash equivalents) |

| Other current assets | 1260 | 270 | Filled in if data is available (for the amount of current assets not indicated in other lines of the section) |

| Total assets | 1600 | 300 | Total of all assets |

You can see line-by-line comments on filling out the balance sheet, including asset lines, in the ConsultantPlus system. Get trial access to the system for free and proceed to the explanations.

Accounting receivables posting

Let's consider the main transactions for settlements with debtors and creditors, in which receivables arise:

| Business transaction | Wiring | |

| D | TO | |

| The supplier has received an advance payment | 60 | 51 (51) |

| Products have been shipped to the buyer | 62 | 90 (sub-account “Revenue”) |

| Sickness benefits accrued at the expense of the Social Insurance Fund | 69 | 70 |

| Employees were paid an advance | 70 | 50 (51) |

| The employee was given a sum of money to report | 71 | 50 (51) |

| A loan was issued to an employee | 73 | 50 (51) |

| The founder's debt to pay into the authorized capital | 75 | 80 |

| Interest accrued on the loan issued | 76 | 91 (sub-account “Other income”) |

Postings for writing off receivables must be distinguished from postings for repayment. Upon repayment, the debtor fulfills his obligation to repay the debt. And when the debt is written off, it is included in the financial result of the company. Thus, repayment by the counterparty of the debt on shipped products is reflected in the following posting:

D 51 (52) K62.

And, for example, writing off a debt on a loan issued to an employee (debt forgiveness):

D91 (subaccount “Other expenses”) K73.

When a doubtful debt for which a reserve was created is written off, the posting will be as follows:

D63 K62 (60).

Analysis and valuation of receivables

Valuation of receivables means establishing its market value as of the current date. The resulting value may not match the amount in the accounting data. This is necessary for management accounting purposes, during transactions involving the assignment of claims and conducting a comprehensive assessment of the company. If assessment data is required for external users, then professional experts are involved in the procedure.

Analysis of receivables is carried out by clarifying the total volume of customer debts, dividing them into groups and tracking the dynamics of changes. The results are entered into the table. An important element of the procedure is to identify the share of long-term debts, since their growth can undermine the financial stability of the company.

Analysis of the company's receivables using the example:

| Criterion | End of 2014 | End of 2020 | End of 2020 | Growth rate, % | Absolute deviation | |||||

| thousand roubles | % | thousand roubles | % | thousand roubles | % | 2015/2014 | 2016/2015 | 2015/2014 | 2016/2015 | |

| Long-term debts | 0,00 | 0,00% | 0,00 | 0,00% | 0,00 | 0,00% | 0,00% | 0,00% | 0,00 | 0,00 |

| Short-term debts, including: | 170,70 | 100,00% | 162,70 | 100,00% | 191,40 | 100,00% | 95,00% | 118,00% | -8,00 | 28,70 |

| - settlements with customers | 152,00 | 89,00% | 144,00 | 89,00% | 188,00 | 98,00% | 95,00% | 131,00% | -8,00 | 44,00 |

| - settlements with suppliers | 10,00 | 6,00% | 10,00 | 6,00% | 0,00 | 0,00% | 100,00% | 0,00% | 0,00 | -10,00 |

| -settlements with the Federal Tax Service and Social Insurance Fund | 5,20 | 3,00% | 5,30 | 3,00% | 2,20 | 1,00% | 102,00% | 42,00% | 0,10 | -3,10 |

| -accountable amounts | 0,20 | 0,00% | 0,00 | 0,00% | 0,00 | 0,00% | 0,00% | 0,00% | -0,20 | 0,00 |

| -expenses deferred | 3,30 | 2,00% | 3,40 | 2,00% | 1,20 | 1,00% | 103,00% | 35,00% | 0,10 | -2,20 |

The table data shows that the largest volume of accounts receivable falls on buyers, and the amount of unpaid goods increases every year. For other positions, there has been a trend towards a stable reduction in debts. At the next stage, we need to consider in detail the state of settlements with customers (this is the largest group):

| Criterion | End of 2014 | End of 2020 | End of 2020 | Absolute deviation | ||||

| thousand roubles | % | thousand roubles | % | thousand roubles | % | 2015/2014 | 2016/2015 | |

| Settlements with buyers: | 152,00 | 100,00% | 144,00 | 100,00% | 188,00 | 100,00% | -8,00 | 44,00 |

| Company 1 | 10 | 7,00% | 0 | 0,00% | 5 | 3,00% | -10,00 | 5,00 |

| Company 2 | 25 | 16,00% | 22 | 15,00% | 20 | 11,00% | -3,00 | -2,00 |

| Company 3 | 70 | 46,00% | 100 | 69,00% | 125 | 66,00% | 30,00 | 25,00 |

| Company 4 | 2 | 1,00% | 0 | 0,00% | 2 | 1,00% | -2,00 | 2,00 |

| Company 5 | 45,00 | 30,00% | 22,00 | 15,00% | 36,00 | 19,00% | -23,00 | 14,00 |

The analysis showed that the main source of growth in receivables is Company 3. If receivables were not insured under an agreement with this buyer, then the risk of financial damage increases. At the next stage, settlements with the problematic counterparty and other companies are detailed, taking into account the deferments granted to them:

| Buyer name | End of 2020 | By duration of education, thousand rubles | Delay, days | ||||

| thousand roubles | % | 0-30 days | 30-60 days | 61-180 days | more than 181 days | ||

| Settlements with buyers: | 188,00 | 100,00% | 47,00 | 27,00 | 51,00 | 63,00 | |

| Company 1 | 5 | 3,00% | 5,00 | 0,00 | 0,00 | 0,00 | 30,00 |

| Company 2 | 20 | 11,00% | 18,00 | 2,00 | 0,00 | 0,00 | 60,00 |

| Company 3 | 125 | 66,00% | 2,00 | 10,00 | 50,00 | 63,00 | 60,00 |

| Company 4 | 2 | 1,00% | 2,00 | 0,00 | 0,00 | 0,00 | 30,00 |

| Company 5 | 36,00 | 19,00% | 20,00 | 15,00 | 1,00 | 0,00 | 60,00 |

Company 3 remains problematic. Only this company did not meet the debt repayment deadlines, even taking into account their extension. Further work consists of establishing a dialogue with this counterparty; if there is no response, you can go to court.

PBU and other regulations

There are several regulatory forms :

- Federal Law No. 129;

- Tax Code of the Russian Federation (parts 1 and 2);

- Civil Code of the Russian Federation;

- Decree of the President of the Russian Federation No. 2204;

- Decree of the Government of the Russian Federation No. 817;

- PBU 3/2000, 9/99, 10/99.

As you can see, there are a large number of regulations regulating this activity and ensuring its regulation. They reflect the procedures for recording and action in case of violations, as well as other controversial issues related to the subject of consideration.

Accounts receivable: invoice and movement reflection

The table provides a list of accounting accounts in which receivables can be accounted for (which account to use depends on who the debtor is).

NumberName

| 60 | Settlements with suppliers and contractors |

| 62 | Settlements with buyers and customers |

| 68 | Calculations for taxes and fees |

| 69 | Social insurance calculations |

| 70 | Payments to personnel regarding wages |

| 71 | Accounting for imprest amounts |

| 73 | Accounting for other personnel transactions |

| 75 | Settlements with founders |

| 76 | Settlements with various debtors and creditors |

The amount of increase in the liability is reflected in the debit, and the decrease - in the credit. At the reporting date, the amount that the company's counterparties are obliged to pay to it is reflected as a debit balance.

If there is a risk of non-repayment of the debt by the debtor, it is necessary to create a reserve in accordance with clause 70 of Order of the Ministry of Finance dated July 29, 1998 No. 34n.

The amount of the reserve is reflected in account 63. When created, the amount of doubtful debt is included in other expenses:

Debit 91 Credit 63.

Listing debt on the balance sheet in certain columns

Accounts receivable in the balance sheet are clearly divided into:

Dear readers! Our articles talk about typical ways to resolve legal issues with debts, but each case is unique. If you want to find out how to solve your particular problem, please use the online consultant form on the right or call . It's fast and free!

- Short-term – column 1231;

- Long-term – column 1232.

In Form 1, these two types should be correctly distributed, both in terms of time and liquidity of assets.

Important: the correctness of filling out the balance affects the analysis and further planning.

This debt is considered a highly liquid asset, especially in terms of payment. Advances that are difficult to liquidate, such as for construction, must have an explanation, in this case it will be displayed in the line “Unfinished construction”.

How to analyze accounts receivable?

Accounts to reflect entries

Accounting for accounts receivable is maintained according to the following accounts:

- 60 – advance payment for the supply of products for settlement with the performers of the work;

- 62 – account for settlements with buyers and customers: provision of services in favor of future payment;

- 68 – overpayment of taxes and fees;

- 69 – payment of social insurance and security;

- 70 – remuneration of workers;

- 71 – financial transactions for dealing with non-return of accountable amounts:

- 73 – unrepaid loans and credits from the workforce;

- 75 – debt on the part of the founders for capital contributions;

- 76 – debts on debit and credit: non-payment of insurance, dividends, claims in favor of the enterprise.

Important: according to the Instructions for using accounts, all debts that cannot be repaid are reflected in subaccount 91 - 2 “Other expenses”. If the debtor has repaid the receivables, account 62 is intended to perform this operation.

Lines to display

In the accountant's report, debits should be grouped by date of origin:

- Short-term debt – 12 months from the date of the report, expectation of a refund – line 240;

- Long-term – more than 1 year of waiting for the amount to be returned from the date of report generation – line 230.

When filling out these lines, it is important to indicate the debit balance of the expanded plan in the balance sheet asset, which contains separate information on debts of any persons to the organization for goods and services in lines 231 and 241 and is indicated as the debit of account 62.

This video will tell you more about reflecting accounts receivable on the balance sheet:

https://youtu.be/7qrb9WcP8rk

If debts to the company have not been repaid

Liabilities do not remain in the organization's books indefinitely. When the statute of limitations expires, they are considered uncollectible and are subject to write-off. The limitation period is established by Article 196 of the Civil Code of the Russian Federation and is 3 years. Liabilities are also subject to write-off if the company's counterparty is liquidated. In this case, accounts receivable write-off account 91 “Other income and expenses” is used. The wiring should be done as follows:

Debit 91 Credit 60, 62, 68, 69, 70, 71, 73, 76.

If a reserve for doubtful debts was previously created, then the liability is written off to it:

Debit 63 Credit 62, 76.

How to write off accounts receivable in the absence of a reserve

How can an organization record the write-off of accounts receivable with an expired statute of limitations in the absence of a provision for doubtful debts?

According to the accounting data of the organization (lessor), on account 62 “Settlements with buyers and customers” there is a receivable for rent from a third-party organization (tenant), to which the property was previously leased, in the amount of 200 rubles. The rent was not received from the tenant within the period specified in the lease agreement.

Due to the expiration of the statute of limitations, on the basis of an order from the manager, the tenant's receivables were written off.

At the time of writing off these receivables, the reserve for doubtful debts created by the lessor for accounting purposes was used.

Providing property for rent relates to the current activities of the lessor.

General provisions

The limitation period is the period for protecting the right under the claim of a person whose right has been violated. In this case, the general limitation period is 3 years, but for certain types of claims the Civil Code and other legislative acts establish special limitation periods <*>.

The limitation period begins from the day when the person learned or should have learned about the violation of his right, with the exception of cases established by legislative acts. For obligations with a certain period of performance, the limitation period begins at the end of the performance period <*>.

If the statute of limitations expires, the amount of the tenant's registered receivables for leasing the property may be recognized by the organization as uncollectible <*>.

Accounting

The basis for recognizing receivables as uncollectible are the results of an inventory of settlements with the debtor and a written justification for the impossibility of collecting the debt. The write-off of uncollectible receivables from settlement accounts is carried out in accordance with the order of the head of the organization and is drawn up by the PUD, developed by the organization independently in accordance with the requirements established by law and approved by the accounting policy of the organization (for example, an accounting statement-calculation) <*>.

The legislation of the Republic of Belarus obliges organizations to create reserves for doubtful debts for accounting purposes. The organization does not have the right in its accounting policies to provide otherwise (different from the established procedure) <*>.

In the situation under consideration, the reserve for doubtful debts created for accounting purposes in accordance with the requirements of Chapter. 6 of Instruction No. 102 was used at the time of writing off the tenant’s receivables.

Since the provision of property for rent relates to the current activities of the lessor, the amount of written off receivables, recognized as uncollectible due to the expiration of the statute of limitations, is reflected in the accounting records as the debit of subaccount 90-10 “Other expenses for current activities” and the credit of account 62 “Calculations with buyers and customers" <*>.

Accounts receivable for which the statute of limitations has expired are recognized in accounting as an expense on the date following the day of expiration of the statute of limitations (in the absence or insufficiency of the reserve for doubtful debts), in the amount in which this debt was reflected in the accounting records of the organization <*>.

Receivables written off from the accounts receivable, within 5 years from the date of write-off, are subject to accounting on off-balance sheet account 007 “Written off uncollectible accounts receivable” <*>.

VAT

For the purposes of calculating VAT, the write-off of accounts receivable is not recognized as an object of taxation <*>.

Income tax

Losses from the write-off of receivables for which the statute of limitations has expired are taken into account when taxing profits as part of non-operating expenses on the date following the day of expiration of such period <*>.

Accounting Entry Table

| Contents of operations | Debit | Credit | Amount, rub. | Primary document |

| Accounts receivable are written off as expenses for current activities <*> | 90-10 | 62 | 200 | Order, accounting certificate-calculation |

| The amount of written off receivables is reflected on the balance sheet | 007 | 200 | Accounting certificate-calculation | |

| ——————————— <*> Taken into account when taxing profits as part of non-operating expenses <*>. | ||||

Read this material in ilex >>*

* following the link you will be taken to the paid content of the ilex service

Accounting

All mutual settlements of the organization with individuals and legal entities are required to be reflected in accounting. Transactions within a business should also be recorded using accounts.

You can find out all the detailed information about this procedure and its nuances from the following video:

Transactions with suppliers

Any company in the course of its activities enters into agreements with other organizations. The subject of such contracts may be:

- supply of products and other materials;

- provision of services, for example, consumption of electricity, water, transport delivery, etc.;

- performing work, for example, major repairs, installation of equipment, installation, etc.

All transactions are recorded separately for each supplier using account 60 .

Accepted payment obligations are accrued as a credit, and advances issued to counterparties are accrued as a debit. Therefore, at the end of the reporting period, account 60 may have two balances.

OperationDebitCredit

| Equipment to be installed has been accepted | 07 | 60 |

| Transport services are included in the cost of non-current assets | 08 | 60 |

| Materials accepted for accounting | 10 | 60 |

| Accepted for VAT accounting on received materials | 19 | 60 |

| Goods have arrived | 41 | 60 |

| Advance received from supplier | 51 | 60 |

| A claim has been made to the supplier | 76 | 60 |

Transactions with buyers and customers

Payment can be made by buyers after receiving materials or in the form of an advance payment.

Accounting is carried out for all customers separately. Postings are made using account 62 . The prepayment received is reflected as a credit, and the money transferred from customers is reflected as a debit. Account 62 at the reporting date may have a double balance.

OperationDebitCredit

| Accrued sales income | 62.1 | 90 |

| Accrued income from the sale of fixed assets, intangible assets, inventory items | 62.1 | 91 |

| Payment received | 51 | 62.1 |

| Advance received | 51 | 62.2 |

| Settlement of advance payment | 62.2 | 62.1 |

| Received a bill of exchange for payment | 62.3 | 62.1 |

| The bill has been repaid | 51 | 62.3 |

| The nominal value exceeded the contract amount | 62.3 | 90.1 |

Transactions with accountable persons

Sometimes an enterprise needs to pay some expenses in cash, for example, purchasing office supplies or sending an employee on a business trip. In such cases, the required amount is given to the employee for reporting. The person must report the funds spent by drawing up an advance report.

Calculations in such situations are recorded in the transaction journal using account 71 .

OperationDebitCredit

| Money issued on account | 71 | 50 (51) |

| The remaining amounts were returned to the cashier | 50 | 71 |

| Travel expenses are written off as cost | 20 (25, 26, 44) | 71 |

| Materials purchased for accountable amounts | 10 (41) | 71 |

| Unreturned money reflected | 94 | 71 |

| These funds have been deducted from your salary. | 70 | 94 |

Postings

To account for receivables, appropriate accounting entries are made for each transaction (see also how to effectively manage receivables).

The amount of debt arising from the sale of goods and services is reflected by posting:

Debit 62 Credit 90.01 (Revenue)

Let's look at an example:

sold equipment in the amount of 212,400 rubles, including VAT of 32,400 rubles. The manufacturing cost was 126,000 rubles.

The shipment to the buyer is reflected in the following entries:

- Debit 62.1 Credit 90.1 - the buyer’s receivables and sales revenue are reflected - 212,400 rubles;

- Debit 90.2 Credit 41 - cost of goods sold is written off - 154,000 rubles;

- Debit 90.3 Credit 68.2 - VAT accrued for payment to the budget - 32,400 rubles;

- Debit 90.9 Credit 99.1 “Profits and losses” - reflects the financial result from the sale of goods - 54,000 rubles. (212,400 – 32,400 – 126,000).

Thus, accounts receivable are reflected in the balance sheet on line 1230 in the amount of 212,400. The accrued amount of VAT payable is 32,400 rubles, profit on shipment is 54,000 rubles, on which income tax is paid. In this case, there may not yet be a receipt of funds from the buyer.

When funds are received from the buyer, the accountant makes the following entry:

Debit 50 (51) Credit 62.

How to account for accounts receivable in management accounting

How it will help: ensure high-quality management accounting of accounts receivable

How to revalue accounts receivable in management accounting

How it will help: develop rules for revaluation of accounts receivable in management accounting.

Example of display in line 1230 of the balance

The contents and requirements for drawing up a balance sheet can be read in PBU 4/99. The item “accounts receivable” is displayed in the balance sheet on line 1230 as part of current assets. Current assets are the material and financial property of an organization that can be written off, sold or turned over in current accounts during the year.

For example, Solovushka LLC has account balances that are reflected in the balance sheet.

Table No. 2. RAS account balances RAS number

Debit balance

Loan balance

| 60 | 20 000 | 10 000 |

| 62 | 30 000 | 12 000 |

| 63 | 10 000 | |

| 70 | 40 000 | |

| 76 | 5 000 | 3 000 |

According to the requirements of Order No. 66 n, amounts in the balance sheet must be in thousands or millions of rubles according to OKEI codes, which means line 1230 will look like:

Line 1230 of the balance = 60 account + 62 account – 63 account + 76 account = 20+30-10+5 = 45 thousand rubles.

Thus, all debt to the company is included in reporting Form No. 1.

Balance: component lines 1230

Balances of working capital are reflected in line 1230 of the balance sheet. They are summarized from the results of economic activity obtained at the end of the year as of December 31.

The amount thus obtained reflects the total amount of accounts payable and receivable and is the total financial result of all the company’s activities during the year:

All working capital balances on the company’s accounts can be conditionally classified into several categories:

- balances of debt on trade operations with legal entities;

- balances of the enterprise's debt to individuals and the debt of individuals to the enterprise;

- balances of debt to the budget;

- balances of funds after settlements with debtors and creditors.

In addition, when determining the balance of working capital in a company’s account, the funds that the founder contributes to its authorized capital are of particular importance.

Remaining debts to legal entities

As mentioned above, all these types of debt are distributed across different accounts of the balance sheet.

In cases where we are talking about debt balances to legal entities, we mean funds that are reflected in two accounts No. 60 and 62.

Account No. 60 records the balances resulting from settlements with suppliers and contractors. At the same time, account No. 62 reflects the results obtained after settlements with buyers and customers. In fact, these two accounts display the results of the entire work of the enterprise.

Remaining debts to individuals

Balances owed to individuals are displayed on a number of accounting accounts, each of which is an integral part of the overall whole.

These accounts include accounts that display the wages of the company’s employees and the amounts issued to employees on account.

Remaining wage arrears

The balance of wage arrears reflected in account No. 70.

The debit balance in this account is formed as a result of the payment of wages and vacation pay to employees for the current month, however, they are not yet reflected in the accounting documents of the current month and will be recorded only in the reports for the next month.