What is a balance sheet

Buh.

A balance sheet is a report that shows the financial performance of a company, namely the balances of its accounts as of any date. Most often, organizations prepare the following types of balance sheets:

- introductory (at the time of commencement of activity);

- current (as of a certain date, usually at the end of the year);

- liquidation (at the time of liquidation of the company);

- dividing (during reorganization in the form of division or separation);

- unification (in case of reorganization in the form of affiliation or merger; this balance sheet is introductory at the time the newly created legal entity begins its activities).

The balance sheet clearly shows the financial condition of the company. If you compare it with a similar report compiled, for example, a year ago, you can track the dynamics of the organization’s development.

Check the financial condition of your organization and its counterparties

https://youtu.be/hSbOWXh1EHU

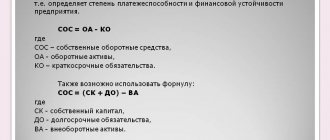

What are permanent liabilities of an enterprise

It is very important for any company to have sources of livelihood at its disposal. It is even better if such sources are your own and not attracted. This will ensure financial stability and operational stability of any organization.

These, our own, non-borrowed sources of financing are permanent or stable liabilities.

Permanent liabilities P4 must have two properties:

- They should not be obligations

- These should be funds that will not subsequently have to be paid to interested parties

Indicators of sustainable liabilities are not subject to standardization. The higher their value, the better for the company.

Indicators of permanent liabilities are reflected in the “Capital and Reserves” section of the balance sheet.

Balance Sheet Structure

In most cases, the balance sheet of an enterprise is a table divided into two parts: assets and liabilities.

A balance sheet asset is information about the property and liabilities that the company uses in its business activities. They may bring benefits in the future. Assets consist of two sections:

- Fixed assets. This includes property that is used for a long time. In particular, fixed assets, intangible assets, etc.

- Current assets: inventories, accounts receivable, VAT and more.

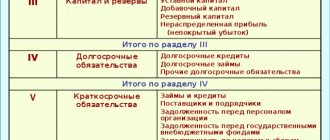

Balance sheet liabilities are the sources of funds that make up the asset. The passive has three sections:

- Capital and reserves. These include the legal entity’s own funds: authorized capital, additional capital and others.

- Long term duties. They show the company's accounts payable that have existed for a long time: bank loans received for a year or more; deferred tax liabilities and so on.

- Short-term liabilities. With their help, you can understand the size and structure of accounts payable, which is unstable and actively changing. Among other things, these are deferred income and bank loans received for up to a year.

IMPORTANT. The total amount of an asset is always equal to the total amount of a liability. The reason is that each transaction is reflected in accounting using the double entry method using two accounts: the first as a debit, the second as a credit. Lack of equality between asset and liability indicates an error.

If a balance sheet asset characterizes the composition of the organization’s economic assets

(fixed assets, inventories, finished products, current account, etc.), then the liability shows from what sources these funds were formed. Sources are divided into own and attracted. The main types of attracted sources are bank loans and accounts payable. The balance sheet liability is the amount of the organization's liabilities. For example, authorized capital is an obligation to the owner for fixed and working capital allocated to the organization. Bank loans are an organization’s obligation to banks for loans received for various purposes. Accounts payable are to counterparties: suppliers - for goods and materials received and services rendered; workers and employees - according to wages; budget - for income tax and other payments, etc. Various types of funds and reserves are the obligations of the administration to the organization’s staff as a whole for production and social development, etc. In the process of economic activity, the organization’s funds either increase (by the amount of profit received) or decrease (by the amount of loss received).

Balance sheet form (form)

Previously, the balance sheet bore the official name “Form No. 1”. But in 2011, the Ministry of Finance made changes, and now it is called simply “Balance Sheet”. However, the former name is still used among specialists.

The current form of the balance sheet was approved by order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n. There is an option that is generally used by all companies (given in Appendix No. 1 to this order). Each line is marked with a special code. For example, intangible assets - 1110, inventories - 1210, short-term borrowed liabilities - 1510, etc.

Fill out and print your balance sheet using the current form for free

For organizations that have the right to use simplified accounting methods and submit simplified reporting, a separate balance sheet form has been developed. It is given in Appendix No. 5 to Order No. 66n.

Liquidity ratios based on balance sheet indicators

There are three ratios that determine the liquidity of the balance sheet.

The most common is the current ratio , which is determined by the ratio of current assets to the value of short-term liabilities. This ratio shows how much the organization is able to pay its current debts at the expense of current assets. Its value should fluctuate between 2-3.

Another significant ratio is the quick liquidity ratio. It is defined as the ratio of current assets with high liquidity to short-term liabilities. Its value should be higher than 1. The coefficient shows whether the company will be able to cover its current debts if there are difficulties with selling products.

The current ratio is less common than the previous two ratios. Its value must exceed 0.2. The indicator is calculated by dividing the amount of cash and short-term financial investments by current liabilities. The ratio shows how much debt an organization can pay off immediately.

All indicators are calculated based on balance sheet data.

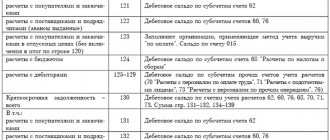

How to fill out a balance sheet using Form 1

In each balance line you must indicate the balance of the corresponding account, or the sum of the balances of several accounts. For example, in the line “Value added tax on purchased assets” the balance of account 19 with the same name is entered. In the line “Cash and cash equivalents” - the amount of balances in accounts 50 “Cash”, 51 “Cash accounts”, 52 “Currency accounts” and some others.

There are several basic rules that must be followed when filling out your balance:

- show debit and credit account balances in detail (do not “collapse”);

- fixed assets and intangible assets should be reflected at their residual value (that is, at their original cost minus depreciation);

- Show goods for resale at the purchase price (without trade markup), even if they are accounted for at the sales price;

- data on property and liabilities in the annual balance sheet must be confirmed by inventory results.

REFERENCE. Starting with reporting for 2020, data on balance sheet items is filled out strictly in thousands of rubles (previously it was possible in both thousands and millions). These amendments to order No. 66n were made by order of the Ministry of Finance dated 04/19/19 No. 61n.

Balance sheet liquidity: what is it and what is it for?

For any enterprise, the key points are its sustainability and solvency.

In order to determine how strong it is, it is necessary to analyze the balance sheet indicators and determine its liquidity.

Each organization has certain obligations to counterparties. The ability to pay obligations with one's own (assets) is called liquidity. Accordingly, the higher the liquidity ratio, the better. Low performance is a harbinger of bankruptcy.

The most liquid assets are money.

We present the classification of assets and liabilities by degree of liquidity in the table.

| ASSETS | PASSIVE | ||

| Asset code | Implementation time | Passive code | Maturity |

| A1 | The fastest selling assets | P1 | Fastest repayment period |

| A2 | Implemented at high speed | P2 | Repayable moderately |

| A3 | Implementation is slow | P3 | Repaid at a low rate |

| A4 | Such assets are difficult to sell | P4 | Permanent liabilities |

The fastest way to sell (or convert into money) cash is the hardest to work with non-current assets, which fall into group A4.

At the same time, accounts payable are easiest and fastest to repay, but the organization’s own liabilities are not repaid at all.

In this regard, the following criteria for balance sheet liquidity have been introduced:

- The most acceptable situation is when A1 is greater than P1. This means that the company can quickly and without any problems pay off urgent obligations

- The company can quickly pay off its debts. Moreover, A2 is greater than P2

- Loans that a company takes out for a long period of time, it can repay creditors using assets that are sold slowly. In this situation A3 is greater than P3

- In the case when the previous inequalities are satisfied, it automatically turns out that A4 is less than or equal to P4. This situation indicates that the company is reliable, it can quickly and without much difficulty pay off all its obligations.

| IMPORTANT! If the balance sheet indicators satisfy all the above conditions, then it is absolutely liquid |

Balance due dates

Legal entities are required to submit an annual balance sheet to the tax office. This must be done no later than three months after the end of the reporting year. This is stated in part 2 of article 18 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting” and in subparagraph 5 of paragraph 1 of article of the Tax Code of the Russian Federation.

If we talk about reporting for 2020, then it must be submitted no later than March 31, 2020.

ATTENTION. Previously, the balance also had to be submitted to the statistical authorities. But starting with reporting for 2020, this obligation has been abolished. In 2020, balance sheets and other financial statements will only need to be submitted to the Federal Tax Service.

Prepare, check and submit financial statements to the Federal Tax Service via the Internet Submit for free

Current assets: definition of the concept

Current or current assets are all funds that are converted into money during just one production cycle. This is, in fact, money, goods ready for sale, accounts receivable, components, inventories and other material assets. Current assets are the basis of the production process.

The degree of liquidity of property assets depends on the speed of their turnover into money. In the balance sheet, current items are placed in descending order of liquidity.

Presentation methods

In previous years, organizations had a choice of how to submit their balance sheet to the Federal Tax Service: on paper or via the Internet.

But as of reporting for 2020, there is no such choice. From now on, companies have only one option - to submit their balance online (via telecommunications channels through an electronic document management operator). An exception is made only for small businesses. They have the right to report for 2020 both on paper and according to the TKS. They will submit their balance sheet for 2020, like everyone else, online. Such changes were made to the Accounting Law by Federal Law No. 444-FZ dated November 28, 2018.

Having received the report, inspectors analyze it. They examine assets and liabilities and compare them with information reported on tax returns. The structure of the balance sheet allows employees of the Federal Tax Service to get a general idea of the state of affairs of the company.

Balance sheet liability: definition and rules for filling

Liability is a set of systematized final indicators about the sources of profit creation. In the report they are divided into groups with further detail. The criterion for dividing into categories is the origin of capital. The content of balance sheet items is regulated by PBU 4/99. The liabilities of the balance sheet are grouped:

- Capital.

- Liabilities of an enterprise of a long-term nature.

- Liabilities that must be repaid in the short term.

Liabilities consist of sections that are formed by groups of balance sheet items. Balance sheet items are represented by report lines intended for individual indicators. They are needed to reflect the values at the reporting dates of the enterprise’s property, its sources of origin and the company’s outstanding obligations.

Aggressive model for increasing assets and liabilities

With a significant amount of cash, the company continuously increases the volume of inventories and finished products. In addition, due to the increase in current assets, a direct relationship appears in the form of an increase in liabilities. In turn, the production process itself is quite lengthy, and the turnover of material assets is slow.

By choosing such a management policy, we can say with confidence that the risk of technical failure of the production process will be minimal in this case, as well as economic profitability.

An aggressive management model increases current liabilities through short-term borrowings that ensure sufficient levels of inventory and cash flow. In turn, a large amount of accrued interest acts as a financial lever, which increases costs and reduces profitability. The risk of loss of asset liquidity is also high.

Conservative working capital management

The capital management policy is based on maintaining a sufficient level of current assets by attracting financial sources. Depending on what goals are pursued when running a particular business, three main models for managing current assets and liabilities can be identified.

The conservative management method assumes the presence of a fairly low number of current assets. At the same time, the turnover period of funds is also reduced to a minimum. This policy is convenient for companies that clearly know the time frame of the production cycle. Products are manufactured for a specific consumer, so the volume of reserves is strictly limited. The manufacturer has no doubts about the timing of receipt of payments, and therefore there is no need to purchase materials for future use.

In conditions of extreme savings, a sufficiently high indicator of asset liquidity is achieved, and, as a result, an increase in production profitability. But with such business tactics, there is a high risk of unforeseen situations when payments are not received on time and the material base is at zero.

The main distinguishing feature of conservative management is that current liabilities in the form of short-term loans have a very low share in the mass of all liabilities. All activities of the enterprise are carried out at the expense of its own working capital.