Line 1210 of the balance sheet “Inventories”

In line 1210 enter data on the total value of the company's inventories listed as of December 31, 2020. A breakdown of the data in line 1210 by groups and types of inventories listed in the organization is given in Section 4 of the Explanations to the Balance Sheet and the Income Statement. So, for example, the data could be given here:

- on the cost of raw materials and materials not written off for production, recorded in the debit of accounts 10 “Materials”, 15 “Procurement and acquisition of material assets”, 16 “Deviation in the cost of material assets”;

- on the cost of goods intended for resale, recorded in the debit of account 41 “Goods”;

- on the cost of finished products, recorded in the debit of account 43 “Finished products”;

- on the cost of finished products and goods shipped to customers, recorded as the debit of account 45 “Goods shipped”;

- on the amount of costs in work in progress recorded in accounts 20 “Main production”, 23 “Auxiliary production”, 29 “Service production and facilities”;

- on the amount of sales costs that were not written off to the accounts for accounting for sales revenue, recorded in the debit of account 44 “Costs of circulation”;

- on the amount of unwritten off deferred expenses recorded in the debit of account 97 “Deferred expenses”.

Raw materials

Raw materials include material assets that are the basis for the manufacture of a particular product, are included in its composition or are necessary components in its manufacture. In addition, raw materials are considered to be resources that are fully used in the process of the company's activities. According to the Chart of Accounts, these types of assets also include: purchased semi-finished products; finished components; fuel (oil, kerosene, gasoline, etc.) and lubricants; container; spare parts for repair of fixed assets; production waste (stumps, cuttings, shavings, etc.); inventory, tools and household supplies that are not included in fixed assets; special clothes.

Accounting for such property is regulated by PBU 5/01. According to paragraph 5 of the document, raw materials and materials are taken into account at actual cost.

Line 1210 includes the initial cost of raw materials and materials not written off for production as of December 31, 2020. It is recorded in the debit of account 10 “Materials”. This balance line shows the debit balance of this account as of the mentioned date.

Materials can be reflected both at actual cost and at accounting (planned) prices. When using the second option, their cost is formed using accounts 15 “Procurement and acquisition of material assets” and 16 “Deviation in the cost of material assets.” In this situation, line 1210 of the balance sheet indicates the debit balance of account 10 (accounting price of materials), 15 (cost of materials in transit) and 16 (deviations). If the balance of account 16 is credit, then it reduces the cost of materials at which they are reflected in the balance sheet.

The company has the right to create a reserve for depreciation of the cost of raw materials and materials. Its amount is taken into account in the credit of account 14 “Reserves for reduction in the value of material assets.” If there is a reserve, its amount reduces the cost of materials at which they are reflected in the balance sheet.

Formation of the actual cost of materials...

The actual cost of materials is based on all costs associated with the acquisition of this property (excluding VAT, if the company accepts it for deduction). According to paragraph 6 of PBU 5/01, such costs include, in particular:

- amounts paid to the materials supplier;

- expenses for information and consulting services related to the purchase of materials;

- customs duties accrued when importing materials into Russia;

- expenses for the services of the intermediary through whom the materials were purchased;

- costs for the procurement and delivery of materials to the place of their use;

- materials insurance costs;

- expenses for maintaining the company's procurement and warehouse division;

- interest costs on commercial loans provided by material suppliers;

- expenses for paying interest on bank loans received for the purchase of materials and accrued until the moment of their receipt;

- expenses for bringing materials to a state suitable for use for the intended purposes (for example, for their additional processing, sorting, packaging, improving technical characteristics);

- general business expenses directly related to the purchase of materials.

Like any other property, materials can be obtained in several ways. For example, purchased for a fee, manufactured by the company itself, received as a contribution to the authorized capital or free of charge, acquired as part of commodity exchange (barter) transactions, capitalized as a result of disassembly and dismantling of fixed assets. Depending on the method of acquiring materials, the company forms their initial cost.

https://youtu.be/aH6gWoiRYF0

Definition

Inventories 1210 are the organization's inventories (MPI) - assets:

- used as raw materials, materials, etc. in the production of products for sale (for performing work, for providing services);

- intended for sale;

- used for the management needs of the organization.

Finished products are part of the inventory for sale (the final result of the production cycle, assets completed by processing (assembly), the characteristics of which comply with the terms of the contract or the requirements of other documents).

https://www.youtube.com/watch?v=ytabouten-GB

Goods are part of inventory purchased or received from other legal entities or individuals and intended for sale.

If you need to analyze reserves, you can create analytical tables by highlighting the lines:

- Materials;

- Animals for growing and fattening;

- Procurement and acquisition of material assets;

- Deviation in the cost of material assets;

- Primary production;

- Semi-finished products of own production;

- Auxiliary production;

- Defects in production;

- Service industries and farms;

- Goods;

- Finished products;

- Selling expenses;

- Goods shipped;

- Future expenses.

The enterprise does not necessarily have all of these lines. On the contrary, there are usually only a few lines (2-3).

For example, for retail trade of some tools - materials, goods, sales costs.

And if the company produces and sells food products, but also resells other people’s goods, there will be noticeably more lines.

The issue of inventory detailing must be approached carefully so as not to add extra lines or forget the necessary lines.

In real enterprises, the values of these lines are the debit balances of the following accounts:

- 10 “Materials;

- 11 “Animals in cultivation and fattening”;

- 15 “Procurement and acquisition of material assets”;

- 16 “Deviation in the cost of material assets”;

- 20 “Main production”;

- 21 “Semi-finished products of own production”;

- 23 “Auxiliary production”;

- 28 “Defects in production”;

- 29 “Service industries and farms”;

- 41 "Products";

- 43 “Finished products”;

- 44 “Sales expenses”;

- 45 “Goods shipped”;

- 97 “Deferred expenses”.

What reserves are included in the balance sheet?

To begin with, it is worth saying that the resources themselves for the production of products are only part of what is recognized as reserves, and what line 1210 of the balance sheet consists of. They are divided into several categories:

- Materials and raw materials used for the manufacture of goods or work.

- Financial costs for materials and raw materials. Materials for production also include fuel, repair tools, clothing and waste generated at the enterprise.

- Money for employee salaries, as well as social benefits.

- The number of products that are not yet completed in production.

- Finished products for sale, as well as services, works, animals. Before shipment they undergo mandatory quality checks.

- Expenses for new production equipment and its modernization.

- Depreciation expenses.

- Cost of gross output.

- Costs for customs duties.

- Taxes belonging to the non-refundable category.

- Funds paid by an enterprise to the seller of products for his services.

- Consulting services if the company's activities related to the sale and purchase of inventories.

- Transportation of goods, storage services in warehouses.

- Costs related to advertising.

The balance sheet reflects only general information about all these categories, without decoding. And all purchases, payments and sales of shipped goods must have documentary evidence. Inventory analysis is needed in order to optimize them, because a shortage is just as bad as an excess. The consequence of the first scenario is a delay in the production of goods, and the second is the withdrawal of money from the company’s turnover, which will be spent on the purchase of goods that were not included in production.

Rationing the consumption of inventories of material resources and factors influencing the amount of inventories

In terms of assessing the need for them, inventories can be classified on various grounds. Thus, a common approach is to divide reserves:

- for those that are necessary to ensure an assortment of goods or stable shipment of finished products under contracts (they are, as a rule, the least in volume);

- for those that are necessary to maintain the full production cycle (usually they are second in volume);

- for those needed to maintain production between deliveries of inventory from suppliers (it is assumed that there will be the most of them);

- for insurance - which are applied in the event of a supply interruption or an increase in the need for supplies not provided for by calculations (as a rule, they are about 10% of those that belong to the previous category).

For each of these reserves, the optimal and, as a result, standard indicator of duration or volume is considered based on factors such as:

- dynamics of consumption of inventories (in relation, for example, to the dynamics of demand for manufactured goods);

- frequency of deliveries of materials from the supplier, completeness of deliveries;

- range of products.

Balance sheet

The balance sheet is one of the basic forms of accounting for commercial enterprises, thanks to which you can obtain information about:

- Property status of the company.

- Her financial stability.

- Liquidity.

- Solvency, etc.

The balance sheet consists of two parts - assets and liabilities, equal to each other in amounts. Inventories and expenses in the balance sheet are indicated in line 1210, and relate to the Assets part, subsection “Current assets”. There you can also find information about VAT on purchased assets, financial investments and receivables. But here it is worth recalling that all inventories are reflected in account 002, which is classified as off-balance sheet.

Line "Inventories" in the balance sheet

Now the balance sheet for accounting has a new form to fill out, which, according to accountants, has become simpler than the previous one. Now there is no need to detail the data, highlighting only the main thing. But they need to be filled out correctly, and for this you need to know the decoding of line 1210 of the balance sheet. Thus, to reflect information, the following manipulations are carried out with debit and credit account balances:

- 10, containing data on raw materials and supplies in the balance line, is added to 11 - it contains information about fattening animals. This category includes not only artiodactyls, but also birds, rabbits, bees, etc.

- The credit balance 14 is subtracted from the addition result.

- Add 15 – purchase of material assets.

- 16 is either added or subtracted, depending on the circumstances. Data on 15 and 16 should be entered only for stocks of raw materials and materials.

- The balances from 20, 21, 23, as well as 28 and 29 accounts are added to the result obtained.

- Then you need to find the balance of 41 and also add it.

- The credit balance of account 42 is deducted.

- The last steps are to add balance 43 - “Finished products”, as well as 44, 45 and 97. The latter includes only those expenses that were written off within one year.

After the calculations, an assessment is made. There are several methods available to an accountant to carry it out, for example:

- Calculate the average commodity cost.

- Accounting at cost of all production goods, etc.

The most commonly used method is one associated with recording the time of purchase of goods, since it is recognized as more convenient than others.

Wiring example

Talisman LLC is engaged in retail trade and for office needs purchased 5 waste baskets for 16,000 rubles with VAT 2000.

The purchase was paid for in the current month, so the transaction was displayed in the accounting documentation as follows:

- Dt10 Kt60: 14,000 rub. excluding VAT, goods received from the seller;

- Dt19 Kt60: 2,000 rub. VAT

- Dt68 subaccount “VAT calculations” Kt19 - 2,000 rubles. as a claimed VAT deduction from the cost;

- Dt60 Kt51: 16,000 rub. paid as payment for waste baskets.

https://youtu.be/zuiOX5IUnDw

Notes on future expenses

In order for the documents to reflect costs in subsequent periods, they must be described according to all the rules. This can be done on the balance sheet line, but this accounting procedure must be noted in the company’s accounting policy. For example, account 97 will allow you to create additional subaccounts in line 1210, which will contain information about expenses in the following purchasing periods.

All resources used for production are accounted for in the debit balance of account 10. For this, the initial price of those goods that will be written off before the end of the next reporting period is used. To simplify this process, accounts 15 and 16 are usually taken. The first reflects information about acquired and procured assets, the cost of material assets, the second - about deviations in their cost. This allows you to describe materials and raw materials, as well as reflect their accounting price in as much detail as possible.

Information about manufactured products is included in line 1210.

Here it is important to mention account 14. It will come in handy if production decides to create a reserve fund, with the help of which it will be possible to depreciate the total amount of inventory. Depreciation here is a decrease in the value of inventories.

So, in account 14, raw materials and supplies are recorded, minus the reserve for their depreciation. Subsequently, their cost should be several times lower than the initial one by the date of the report. To determine whether these conditions are met, an impairment test is performed:

- It is determined which assets are involved in testing.

- The value of the asset to be recovered is calculated.

- Impairment losses are determined.

- The loss is recognized as a gain or loss from impairment over a specified period of time.

- An analysis of the resulting calculations is being prepared.

- All data is documented.

- Reporting is completed.

Thanks to this process, it is possible to reduce the price of consumed resources several times, thereby stopping overconsumption in further periods.

The company's reserves noted in the documentation allow us to assess its material security. The availability of resources must be maintained at a certain level so that there is no shortage or overexpenditure in the reserve. The balance sheet stability of an organization's inventory indicates its competent management policy and good marketing, since the income of the entire enterprise depends on the speed of inventory turnover.

Results

Material reserves are the resources of an organization on the basis of which a surplus product is created, or used as a surplus product. All organizations, including budget ones, must keep inventory records. Working with inventories, as a rule, involves determining the business entity’s need for them, as well as analyzing the effectiveness of inventory management.

You can learn more about inventory management in an enterprise in the following articles:

- “Other material reserves - what applies to them?”;

- "Inventory of inventories."

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Conclusions about what a change in indicator means

If the indicator is higher than normal

Not standardized

If the indicator is below normal

Not standardized

If the indicator increases

A positive factor if revenue and profit growth occurs faster. Negative if it's the other way around.

If the indicator decreases

A positive factor if there is an increase in revenue and profit. Negative if revenue and profit fall faster than inventory reduction.

Notes

The indicator in the article is considered from the point of view not of accounting, but of financial management. Therefore, sometimes it can be defined differently. It depends on the author's approach.

In most cases, universities accept any definition option, since deviations according to different approaches and formulas are usually within a maximum of a few percent.

The indicator is considered in the main free online financial analysis service and some other services

If you need conclusions after calculating the indicators, please look at this article: conclusions from financial analysis

If you see any inaccuracy or typo, please also indicate this in the comment. I try to write as simply as possible, but if something is still not clear, questions and clarifications can be written in the comments to any article on the site.

Best regards, Alexander Krylov,

The financial analysis:

- Cost of sales 2120 Definition Cost of sales 2120 is part of the expenses for ordinary activities and includes expenses associated with the manufacture of products and the sale of products, the acquisition and sale of goods, ...

- Other current assets 1260 Definition Other current assets 1260 are other current assets that are not reflected in other lines of Section II of the balance sheet: the cost of missing or damaged material...

- Selling Expenses 2210 Definition Selling Expenses 2210 is a separately allocated portion of a business's cost of sales in the form of selling expenses. Organizations conducting production activities reflect on this line...

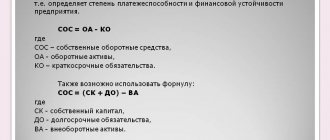

- Indicator of coverage of short-term liabilities of the inventories Definition The indicator of coverage of short-term obligations of the inventories is an indicator that answers the question of how much short-term obligations of groups P1 and P2 can be covered with funds that can...

- Balance sheet equality Definition Balance sheet equality (basic accounting equation) is a mandatory coincidence of balance sheet assets (line 1600) and balance sheet liabilities (line 1700). In other words, there should always be a check...

- Inventory coverage ratio with net working capital Definition Inventory coverage ratio with net working capital is an indicator that characterizes what proportion of inventories is financed by net working capital. That is, it shows what share of reserves, and this...

- Interest payable 2330 Definition Interest payable 2330 is the interest that the organization had to pay in the reporting period: interest paid on all types of borrowed obligations of the organization (in ...

- Deferred income 1530 Definition Deferred income 1530 is deferred income received in the reporting period, but relating to the following reporting periods: amounts of budget funds for financing capital...

- Administrative expenses 2220 Definition Administrative expenses 2220 are a separately allocated part of the cost of sales of an enterprise in the form of general business expenses. Administrative expenses may include the following expenses: administrative and management expenses; on the…

- Research and development results 1120 Definition Research and development results 1120 are funds spent on research and development work that yielded a positive result. The works for which the results were obtained are taken into account:...