Current and non-current assets: what is the difference

The structure of the balance sheet involves reflecting information about the organization’s property, broken down into current and non-current assets. Both of these categories inherently relate to the assets of the company and, as a result, appear on the left side of the reporting document.

The main difference between current and non-current assets is the period of use and the degree of liquidity, that is, the ability to convert into cash equivalent in the shortest possible time. Non-current assets are used by the company for at least one year. They include fixed assets (capital buildings and structures, machinery and equipment), as well as unfinished construction and long-term liabilities. As for the company's current assets, this indicator is diametrically opposite. Accordingly, this category of valuables must be consumed within one production cycle or within one year.

Current assets are characterized by the ability to easily convert into cash equivalent, that is, they are as liquid as possible. What cannot be downloaded about non-current assets.

However, not every component of working capital has a high degree of liquidity. Overdue accounts receivable and a large number of unused goods in production are characterized by a low level of liquidity and, as a result, high risks for the organization.

The ratio of current and non-current assets

Composition and classification of current assets reflected in the balance sheet

Current assets of the enterprise include:

- productive reserves;

- work in progress - products or work that have not passed all stages of the technological process, or products that have not passed technical tests;

- deferred expenses with a maturity date;

- finished products in warehouses - products that, after going through the entire technological process, arrived at the enterprise’s warehouse;

- shipped products - those that have been sent to the buyer, but have not yet been paid for by him;

- accounts receivable - debts due to be returned to the enterprise by other economic entities or individuals;

- short-term financial investments;

- “input” VAT on acquisitions;

- funds - in the cash register of the enterprise and in bank accounts.

Depending on which characteristics are used as classification, all current assets are divided into the following groups:

1. By source of education:

- formed at the expense of equity capital (authorized or reserve, retained earnings);

- acquired using borrowed funds (bank loans, accounts payable).

2. By degree of controllability:

- normalized - current assets that ensure a continuous production process and contribute to the efficient use of available resources (inventories, deferred expenses, finished goods or work in progress);

- non-standardized - current assets that are in circulation (except for finished products) and do not have an impact on the production process (cash, accounts receivable, shipped products).

Classification based on other criteria is also possible.

For more information about the current assets of an enterprise, read the article “Current assets of an enterprise and their indicators (analysis).”

Reflection of current assets in the balance sheet

The reporting procedure in Russia establishes the need to disclose information about the company’s property in the reporting accounting documentation.

To reflect information about working capital, the second section of the balance sheet is used. For this purpose, the following document lines are used:

- Company reserves – page 1210

- “Input” VAT – line 1220;

- Accounts receivable – line 1230;

- Financial investments expressed in non-monetary equivalent – line 1240;

- Monetary resources – p.1250;

- Other current assets – line 1260;

- Section totals – line 1200.

Let us consider in more detail what applies to other current assets.

Conclusions about what a change in indicator means

If the indicator is higher than normal

Not standardized

If the indicator is below normal

Not standardized

If the indicator increases

Usually a positive factor

If the indicator decreases

Usually a negative factor

Notes

The indicator in the article is considered from the point of view not of accounting, but of financial management. Therefore, sometimes it can be defined differently. It depends on the author's approach.

In most cases, universities accept any definition option, since deviations according to different approaches and formulas are usually within a maximum of a few percent.

The indicator is considered in the main free online financial analysis service and some other services

If you need conclusions after calculating the indicators, please look at this article: conclusions from financial analysis

If you see any inaccuracy or typo, please also indicate this in the comment. I try to write as simply as possible, but if something is still not clear, questions and clarifications can be written in the comments to any article on the site.

Best regards, Alexander Krylov,

The financial analysis:

- Other non-current assets 1190 Definition Other non-current assets 1190 are assets whose circulation period exceeds 12 months and which are not reflected in other lines of Section I of the balance sheet. To them…

- Value added tax on acquired assets 1220 Definition Value added tax on acquired assets 1220 is the balance of VAT on acquired inventories, intangible assets, capital investments, works and services, which does not...

- TOTAL for section I 1100 Definition of TOTAL for section I 1100 is the sum of indicators on the lines of the balance sheet with codes 1110 - 1170 - the total value of the organization’s non-current assets:...

- Deferred tax assets 1180 Definition Deferred tax assets 1180 are an asset that will reduce income taxes in future periods, thereby increasing after-tax profits. The presence of such an asset...

- Intangible assets 1110 Definition Intangible assets 1110 are: works of science, literature and art; programs for electronic computers; inventions; utility models; breeding achievements; production secrets (know-how); commodity...

- Inventories 1210 Definition Inventories 1210 are the organization’s material and production inventories (MPS) - assets: used as raw materials, supplies, etc. in the production of products for sale (for performing work, for...

- Financial investments (except for cash equivalents) 1240 Definition Financial investments (except for cash equivalents) 1240 are financial investments of an organization, the circulation (maturity) of which does not exceed 12 months: state and municipal securities;…

- Tangible exploration assets 1140 Definition Tangible exploration assets 1140 - costs of searching, evaluating mineral deposits and exploring mineral resources in a certain subsoil area. As a result of their implementation...

- Intangible exploration assets 1130 Definition Intangible exploration assets 1130 - costs of searching, assessing mineral deposits and exploring mineral resources in a certain subsoil area: the right to perform work...

- Profitable investments in material assets 1160 Definition Profitable investments in material assets 1160 - investments of an organization in property, buildings, premises, equipment and other material assets provided by the organization for a fee for a temporary...

Other current assets: what they include

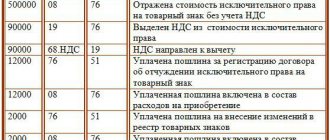

As mentioned above, the requirements for the design of Russian accounting forms require the reflection of other current assets (line 1260) in the balance sheet. What should be included in this category?

Other current assets on the balance sheet are, first of all, the organization's resources that are not reflected in the basic lines of the section devoted to the company's current assets.

In accordance with PBU 4/99, if an indicator in its value does not exceed 5%, that is, it is insignificant for assessing the economic condition of the company, the values of such indicators can be reflected generally (total amount) without detail.

Other current assets (balance sheet line 1260) should take into account such types of assets as:

| p/p | Index |

| 1 | Income from the sale of property that has actually been transferred to the buyer, but ownership has not yet been registered; |

| 2 | VAT that has been accrued but temporarily cannot be taken into account; |

| 3 | The cost of damaged materiel, identified shortages, for which the persons responsible for compensation have not yet been identified; |

| 4 | VAT on advances and excise taxes, for which reimbursement is planned in the near future; |

| 5 | The cost of securities acquired for resale purposes; |

| 6 | Amounts under construction contracts that have been accrued but not billed for payment. |

Having determined which indicators other current assets include, you should consider how the dynamics of changes in the value of other current assets (line 1260 in the balance sheet) reflects the current financial condition of the company.

Line 1260

The second section of the balance sheet includes important reporting lines that are filled out accurately and in line. The economic resources of the company that are not subject to reflection in the main lines of the report of the 2nd section are entered in line 1260. If the company considers the balance sheet indicators to be insignificant, then they are reflected in “Other current assets”. This list may include:

- Unfinished stages of work;

- VAT accrued upon shipment of goods;

- Amounts of unwritten shortfalls;

- The cost of damaged but not written off material assets;

- Amounts of excise taxes that are subject to deductions in the future;

- Accrued but not presented for payment revenue, etc.

Important ! Before filling out line 1260, read the regulatory documents: pp. 1, 2, 17, 23 PBU 2/2008; para. 2 paragraph 7 of the letter of the Ministry of Finance of Russia dated November 12, 1996 N 96 “On the procedure for reflecting in accounting certain transactions related to value added tax and excise taxes,” paragraphs. 2 p. 1 art. 167 Tax Code of the Russian Federation, clause 34 PBU 4/99; Art. 200-201 Tax Code of the Russian Federation; clause 1 clause 1 art. 167 Tax Code of the Russian Federation, clause 12 PBU 9/99); para. 2 clause 9 art. 165, para. 21 clause 7 art. 198 Tax Code of the Russian Federation, para. 2 letters from the Ministry of Finance of Russia dated May 27, 2003 N 16-00-14/177.

If the amounts for reporting are insignificant, then when filling out the declaration it is possible to enter a single figure with explanations for the balance sheet; this corresponds to paragraph. 3 clause 11 PBU 4/99 information on certain types of assets. “Other current assets” of the balance sheet cannot reflect current assets, information about which is material.

What is included in other current assets and how is the indicator formed?

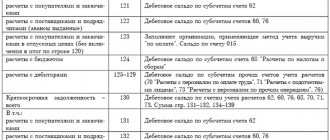

Each section of the balance sheet is formed by summing up the balances of business accounting accounts. Thus, other current assets (line 1260) should reflect the balances on the following accounts:

- Account 45 – shipped commodity values;

- Account 46 – unfinished stages of work;

- Account 62 – settlements with clients;

- Account 68 – calculations of tax payments;

- Account 81 – securities of other companies;

- Account 94 – losses identified in the form of shortages, defects or damage to property assets.

Thus, when reflecting other current assets in the balance sheet, accounting accounts should be used based on the results of the period under review.

Section II “Current assets” of the balance sheet

Details Category: Selections from magazines for an accountant: 02/09/2015 00:00

Source: Glavbukh magazine

Section II “Current assets” of the balance sheet includes seven lines. They, in particular, reflect the cost of inventories and costs not written off at the end of the reporting period, the amount of “input” VAT not accepted for deduction, accounts receivable, the cost of short-term financial investments, and the amount of the organization’s funds.

Let's consider the order of filling out each of these lines in detail.

https://youtu.be/dn1giNQJ5EM

line 1210, line 1220, line 1230, line 1240, line 1250, line 1260

Line 1210 “Inventories”

Line 1210 should reflect information about materials, goods, finished products and work in progress. Inventories also include household equipment, inexpensive office furniture, stationery and other property of the organization that has not been written off at the end of the reporting period.

The data on line 1210 primarily includes the debit balance on account 10 “Materials”. Here the cost of materials, purchased semi-finished products, components, fuel, packaging and spare parts that are not written off for production is indicated.

An organization can keep records of raw materials and supplies on account 10 at accounting prices. Then actual costs are reflected in the debit of account 15 “Procurement and acquisition of material assets”, and the deviation of actual costs from accounting ones is reflected in account 16 “Deviation in the cost of material assets”.

With this accounting procedure, when filling out line 1210, to the balance of account 10, you must either add the debit balance on account 16 (if the actual cost of materials exceeds the accounting one), or subtract the credit balance on this account (if the actual cost of materials is lower than the accounting one).

If an organization creates a reserve for the depreciation of inventories, then when filling out line 1210 from the debit balance of account 10, the credit balance of account 14 “Provisions for the reduction of the value of material assets” is subtracted.

Line 1210 reflects the cost of products that did not go through all stages of processing, as well as work that was not accepted by customers. To fill out this line, manufacturing firms summarize their account balances:

– 20 “Main production”; – 21 “Semi-finished products of own production”; – 23 “Auxiliary production”; – 29 “Service industries and farms”; – 44 “Sales expenses”;

– 46 “Completed stages of unfinished work.”

Trading companies show on line 1210 transportation costs that relate to the balance of unsold goods. If the accounting policy provides that transportation costs are included directly in the cost of purchased goods, then such expenses are reflected in account 41 “Goods” and are also included in these lines 1210 of the balance sheet, but as part of the cost of goods.

To reflect balances of finished products and goods in the balance sheet, the debit balance of accounts 41 “Goods” and 43 “Finished Products” is transferred to line 1210. If an organization accounts for goods at sales prices, then from the debit balance in account 41 the credit balance in account 42 “Trade margin” is subtracted. That is, in line 1210 of the balance sheet, goods are reflected at actual cost.

Manufacturing enterprises indicate in line 1210 the actual or standard cost of finished products.

In addition, line 1210 reflects the cost of products or goods transferred to customers, the proceeds from the sale of which cannot be recognized in accounting.

For example, if the transfer of ownership of goods occurs not at the time of shipment, but after payment.

On the same line, the cost of valuables that are transferred to other organizations for sale under a commission agreement is recorded. Thus, the debit balance of account 45 “Shipped Goods” is entered in line 1210.

Line 1220 “Value added tax...”

Line 1220 is dedicated to input VAT. This line of the balance sheet should show the balance of VAT amounts that suppliers and contractors presented to the company.

At the same time, as of December 31, your organization did not accept tax as a deduction or did not include VAT as an expense in the cost of purchased assets (work, services).

For example, this is possible if invoices have not yet been received, there is an error in them, when releasing goods with a long production cycle, or when selling products taxed at a zero rate.

Input VAT may remain accounted for, provided that it is deducted only after the transfer. For example, when a company performs its duties as a tax agent for VAT. In line 1220 enter the debit balance of account 19 “Value added tax on acquired assets,” which is recorded as of the reporting date.

Line 1230 “Accounts receivable”

Line 1230 about accounts receivable. The following debts are included in accounts receivable:

- buyers for goods supplied to them, services provided, work performed;

- suppliers for advances transferred to them;

- accountable persons for the money given to them;

- budget and extra-budgetary funds for overpayments of taxes or contributions, etc.

Accordingly, in line 1230 enter the debit balance of accounts for accounting settlements: 60 “Settlements with suppliers and contractors”, 62 “Settlements with buyers and customers”, 68 “Settlements for taxes and contributions”, 69 “Settlements for social insurance and security”, etc. .d.

Line 1240 “Financial investments (except ...)”

In line 1240, reflect data on short-term financial investments. Here we are talking about assets with a circulation or maturity period of no more than 12 months. For example, these are loans issued for a period of less than a year, bills or bonds with a maturity of no more than 12 months. Data on long-term investments are indicated in line 1170 of the first section of the balance sheet.

In line 1240 enter the debit balance of account 58 “Financial investments” (in terms of short-term investments).

If a company creates a reserve for reducing the cost of financial investments, then the indicator in line 1240 of the balance sheet is reflected minus contributions to this reserve.

That is, when filling out line 1240, the credit balance of account 59 “Provisions for impairment of financial investments” is subtracted from the debit balance of account 58.

Information about interest-free loans is not indicated in line 1240. Such loans are not financial investments. Therefore, their amount is taken into account as part of accounts receivable on line 1230 of the balance sheet.

And further. Line 1240 does not reflect information about cash equivalents. Their amount is given in line 1250 of the balance sheet.

Line 1250 “Cash and cash equivalents”

Line 1250 indicates information about the company’s money - both in rubles and in foreign currency. So, on line 1250 of the balance sheet they reflect:

- money in the company's cash desk, as well as the cost of monetary documents (for example, postage stamps, paid travel tickets, vouchers, etc.);

- money in bank accounts

- money in foreign currency held in foreign currency accounts in banks;

- other funds, for example money held in special bank accounts, transfers in transit, etc.

Funds in deposit accounts opened for the purpose of generating income are not shown in line 1250. Depending on the term of the deposit, they are reflected either on line 1170 (long-term) or on line 1250 (short-term) of the balance sheet.

The cost of funds in foreign currency is converted into rubles at the official exchange rate of the Bank of Russia as of the reporting date. To fill out this line, use data on the organization’s cash balances reflected in bank statements and the cash book.

The organization's cash equivalents are also entered in line 1250 of the balance sheet. These are short-term (for a period of no more than 3 months) and highly liquid investments that are not subject to the risk of changes in value, which can be converted into a predetermined amount of money. For example, this is a cash equivalent - this is a bank deposit on demand.

Thus, in line 1250 the debit balance is entered for accounts 50 “Cash”, 51 “Cash accounts”, 52 “Currency accounts”, etc.

Line 1260 “Other current assets”

In line 1260 it is necessary to reflect information about other assets that are not shown in lines 1210-1250 of the balance sheet and information about which is not significant. In particular, these may be amounts of VAT accrued upon shipment of goods, the proceeds from the sale of which were not recognized in the reporting year, amounts of shortages that were not written off, etc.

Source: https://otchetonline.ru/art/buh/44453-razdel-ii-oborotnye-aktivy-balansa.html

Other current assets and their analysis

In order to assess the dynamics of an organization’s financial indicators, it is enough to analyze the turnover of the company’s assets. The higher the value of the indicator of other current assets reflected on line 1260, the more stable and rational the organization’s activities are. However, in order to get a complete picture of the economic state of an economic entity, it is advisable to consider the components of current assets in full, and not just the indicators of other assets.

Thus, all indicators of working capital, that is, assets with a short period of use that are not reflected in the basic lines of the second section and are not characterized by significant amounts, should certainly be included in a generalized format in line 1260 of the accounting document.

Similar articles

- Classification of working capital of an enterprise

- The increase in current assets indicates

- Working capital in the balance sheet, line

- Share of working capital in assets formula

- Current assets

Features of the funds

When discussing other current assets, information may be included in the footnotes and notes to the company's accounts. Explanations may be necessary, for example, when there is a noticeable change in other current assets from one period to the next.

Other current assets are expected to exit this category during the year or be transferred to another form. As such, their value can vary greatly from year to year, depending on the company's financial health and how it spends its money.

Important! It is important to determine how significant these assets are because they may distort the firm's liquidity.

When funds in other current assets increase to a significant level, the account becomes important enough to be included in the main current accounts on the balance sheet.

It is recommended to conduct a special analysis of the asset turnover of the company's balance sheet according to turnover ratios in order to understand the dynamics of the growth of the company's funds.

The result of such an analysis may be an increase in the indicators that are included in line 1260. This will mean that the organization uses funds rationally and its activities are characterized by stability.

The concept of own working capital

The company's current assets represent the monetary value of:

- working capital (raw materials, fuel, components);

- circulation funds (finished products, goods shipped but not paid for).

Using your own current assets, you can determine the degree of solvency and financial stability of any enterprise.

Practical use

“Other current assets” is information that is not included in other lines. These amounts do not fit into other sections and are accounted for separately. If there is a need to detail these figures, then line 12605 “Future expenses” is used.

In order to correctly fill out the balance, you can use the debit balance of accounts when creating a line about other working capital: 45, 46, 62, 68, 69, 81, 94. The value of the indicator on line 1260 also depends on the balances on analytical accounts 62-VAT, 68 ( excise taxes), 76-VAT and 45-VAT at the reporting date. Also, depending on the type of assets, information and lines 1450 “Other liabilities” should be reflected in other assets, which also cannot reflect significant long-term liabilities.

Other current assets include amounts of value added tax on goods shipped to the final buyer, when the proceeds from sales from these transactions cannot yet be recognized for accounting in the company’s accounting department for a number of reasons:

- Additional terms of the agreement have been introduced;

- Barter transactions are carried out;

- Availability of intermediaries for product sales.

Standard indicator of own working capital

The indicator of own working capital of any company can be positive and negative:

- According to the standard, the indicator must be a positive value, which means that current assets are greater than short-term liabilities.

- A negative value of the indicator of own working capital characterizes the company from the negative side. True, there are exceptions when successful enterprises operate with a negative value of their own working capital indicator (for example, McDonald's, where this ratio is covered by a very fast cycle of converting inventories into revenue).

When analyzing the indicator of own working capital, it must be compared with the value of the enterprise's reserves.

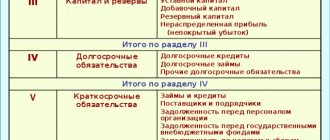

Formula for own working capital on balance sheet

The formula for own working capital on the balance sheet requires balance sheet data, which is the main source of information for analyzing the activities of any organization.

The general formula for own working capital on the balance sheet is as follows:

CoC = OA – KO

Here CoC is own working capital,

OA – the amount of current assets,

KO – the amount of short-term liabilities.

If you use the new balance sheet, then the formula for own working capital on the balance sheet looks like this:

CoC = line 1200 – line 1500

The same value can be determined in a second way:

CoC = SK + DO VA

Here SK is the amount of equity capital,

VA - non-current assets,

TO – the amount of own liabilities.

Based on the balance sheet lines, this formula looks like this:

CoC = line 1300 + line 1530 – line 1100