KBC transport tax 2020 for organizations and individuals is different. You can get information about it from the payment slip for transferring the fee. This will prevent you from confusing the code of a given payment, fine or penalty. If there is an error or inaccuracy in the indication of the KBK, they can be corrected. To do this, you need to submit an application for clarification indicating the correct BCC for transport tax for 2020 for organizations.

Structure of the BCC for transport tax for 2020 for organizations

The code itself has 20 meanings, each character is responsible for transmitting some information. Below are the possibilities:

- Tax is paid on vehicles

- Funds are sent to the regional budget

- Basis of payment - KBK penalty, current tax or fine

- Payment is made by a legal entity

- Tax information about the location of the vehicle. For water bodies - at the registration address, for air bodies - at the address of the legal entity that owns the transport. In other situations - at the company address where the property is registered.

KBK transport tax 2020 for individuals

Individuals who own vehicles must pay the tax by December 1st. They are exempt from submitting reports until February 1. Their main responsibility is to pay the fee in full and on time. As a rule, each car owner receives a receipt for payment. It is issued by the regional Tax Service. This receipt can be paid at a bank or through the websites of banking institutions. The receipt already indicates the budget classification code.

KBK transport tax in 2020 from individuals – 182 1 0600 110

You can check its correctness on the Tax Inspectorate website. If the payment is not made on time, the individual will be charged a penalty. They are paid according to a separate budget classification code.

KBK transport tax penalty 2020 for individuals – 182 1 0600 110

The individual will also be fined. It must be paid for separately.

KBK fine for transport tax 2020 for individuals. persons – 182 1 0600 110

There is a separate KBK for paying interest for incomplete or late payment of tax fees - 182 1 0600 110.

The tax is not paid in cases of termination of ownership rights, theft of a vehicle, or the presence of benefits and preferences. All these circumstances require documentary confirmation. It is better to do this in advance to avoid penalties if the tax has already been assessed.

https://youtu.be/LRqyrSF3PFs

Consequences of KBK errors regarding transport tax

The budget classifier code is indicated in field 104 of the payment order. If an error is made, even in one figure, the tax will be sent to another tax office, the budget will be lost in unclear payments.

If payment is late even by 1 day, the tax service will begin to charge penalties. Its value is as follows:

Codes for companies

All companies that own transport, regardless of the taxation system they choose, are required to pay tax on this transport. They must calculate the amount of tax to be paid independently. Payment can be made quarterly, or in one payment at the end of the tax period. However, reporting must be submitted only once a year (before the first of February of the year following the reporting year).

The main codes are:

- 182 1 0600 110 – used for tax transfers;

- 182 1 0600 110 – for transfer of penalties by legal entities;

- 182 1 0600 110 – used to transfer fines.

An important feature of classification codes for organizations is that the accountants of this organization who are involved in drawing up payment orders are required to search for the necessary codes themselves on the Internet.

Codes change almost every year, so accountants must be very careful.

You can read more about the BCC on transport tax for organizations in the article.

New KBK in 2020

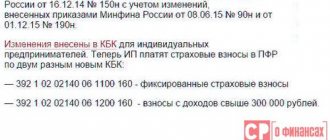

The Cabinet of Ministers of the Russian Federation approved 12 additional BCCs for the current year. Of these, 9 relate to excise duties and taxes, 2 – to state duties, and one more – for property taxes of individuals. But the number of BCCs for insurance premiums was reduced. The government has made adjustments to the codes for penalties and fines on insurance premiums for additional penalties. Now they do not depend on special assessment.

It is important to understand that if the amount transferred to the budget is not reflected in the personal account of the taxpayer, it will not be considered paid for a specific tax. If you correctly indicate the name of the recipient's bank, it is possible to avoid paying penalties. To do this, you just need to clarify the payment on the date of transfer and send the corresponding application to your tax service. This provision is established by the Tax Code of the Russian Federation (Article 45, paragraph 7).

From December 1, 2020, tax authorities must track unspecified payments and report errors made by payers. If the inspector notices an erroneous BCC, he is obliged to inform the taxpayer about this and offer to clarify the details of the payment (if the BCC does not exist, it is assigned code 01).

The tax authorities must make a decision to clarify the payment within 10 days from the date of receipt of the company’s application or from the date of signing the settlement verification report. This is indicated by the Tax Code of the Russian Federation in Article 78, paragraph 6.1. Within 5 working days, the tax service must inform the company about the decision made on the TKS, by mail or through your personal account.

Clearing up misunderstandings

When entering a twenty-digit BCC, there is a danger of entering one or more numbers incorrectly. In this case, the money will be sent to another tax service, will remain at the place of arrival in “unexplained payments” or will end up in the wrong budget.

This situation is not hopeless. The contribution is considered paid even if the money did not arrive in the recipient’s current account due to an erroneous BCC. The taxpayer must submit an application to the local Federal Tax Service to clarify the payment. The decision on the application is made by employees of the Federal Tax Service within 10 working days. days from the date of submission. The tax authorities are required to inform the applicant about the decision made within 5 working days.

It happens that the money was deposited on time, but was transferred to the tax authority’s bank account after the payment deadline had expired, and the Federal Tax Service assessed late fees. However, when the payment is received in the recipient's bank account, all penalties are canceled automatically.

Compliance with the deadlines for paying contributions for taxable items and carefully filling out the payment order form will allow you to avoid unforeseen situations.

How to check the KBK for transport tax in 2020 for organizations

In order to correctly enter information into a payment order and avoid errors, you need to find out the correct BCC, BIC, individual tax number, correspondent account, as well as the tax service checkpoint. To do this, you can use the program on the official website of the Federal Tax Service. It will allow you to accurately and accurately generate a payment order.

In the dialog box on the tax service page, you need to click on the inscription “Legal entity”, then click on “Payment order”. At the next step, click “Next”.

Who pays vehicle tax?

The discussed deduction for transport to the country's treasury is required to be paid by representatives who own transport vehicles that have undergone the registration procedure in accordance with legislative norms, in addition, recognized as objects subject to taxes, presented in a specialized list.

In addition, transport tax must also be paid to those persons who received a car or other means of transportation in accordance with a power of attorney issued to them, the date of issue of which was any day before the 29th day of July.

Note! The Civil Code of the Russian Federation clearly states that a power of attorney for a vehicle is valid for no more than three years, after which it requires renewal. It turns out that when the indicated 36 months after its registration have passed, even if the power of attorney was issued before the date indicated above, the obligation to pay the tax falls on the shoulders of the actual owner of the transport, that is, the owner indicated in the documents.

Article 186 of the Civil Code of the Russian Federation, establishing the validity period of the power of attorney

The collection of data on holders of mobility devices is sent to the Federal Tax System by transport registration authorities.

Video - Transport tax 2020

Transport tax for legal entities – payment deadlines in 2018

As a rule, the deadlines for transferring TN for reporting periods are approved before the last day of the next calendar month. For example, in the Rostov region. advances for the 1st, 2nd and 3rd quarters must be paid before 05/03/18, 07/31/18, 10/31/18. Moreover, if the last date of the month falls on a weekend or official holiday, the payment date is shifted to the first working day.

The final payment for TN for 2020 must be made by legal entities no earlier than 02/01/18. The deadlines adopted by the regional authorities are mandatory for all taxpayers. In case of violation, penalties are charged on the amount of arrears in accordance with the requirements of tax legislation for each day of delay. How is transport tax calculated for legal entities? More on this below.

Where to pay transport tax for legal entities

Transfer of TN based on the results of the year and quarters (in case of approval of reporting periods in a separate subject of the Russian Federation) is carried out to the regional budget at the address of the vehicle location (clause 1 of Article 363). The last address for all means of transportation, except for water ones, is the address of the location of the enterprise or OP (Article 83). If an organization is obligated to pay advances under the Taxpayer Agreement, such amounts reduce the total tax for the year.

The timing of the transfer of transport fees is regulated by the regions of the Russian Federation. In this case, the final payment date cannot be approved in the subject earlier than February 1 of the next year (clause 1 of Article 363). Here is a link to the stat. 363.1, which discusses the procedure for submitting a declaration. Accordingly, in the region, the deadline for transferring TN should not be set earlier than the date of filing the declaration, that is, earlier than February 1 (clause 3 of Article 363.1).

Where to get payment details

In the taxpayer’s personal account on the Federal Tax Service website you will find not only the amount payable, but also the generated payment order (receipt). All the necessary details are indicated there, including the KBK.

As for the Platon system, payment there is made by replenishing your account:

- in your personal account on the operator’s website;

- through a mobile application;

- via a terminal (for example, QIWI);

- in person at the Service Center;

- Bank transaction.

If you do not deal with the Platon system, you did not create an account on the tax office website, and the notification was lost in the mail, generate a payment document on the Federal Tax Service website:

Don’t worry: you don’t need to know the details for paying transport tax in 2019.

It is enough to find “Property taxes” on the page for selecting the type of payment and mark the name of the one you need. The KBK will be filled in automatically. comments powered by HyperComments

Does the individual entrepreneur pay transport tax?

Often, in their business activities, businessmen use their own transport. In this case, who is obliged to pay the TN state – an entrepreneur or a citizen? To understand the issue, you need to carefully study the registration documents for the object. Since when registering a car, the certificate indicates an individual and not an individual entrepreneur, an ordinary person also becomes a taxpayer. Consequently, the entrepreneur pays property taxes, including transport and land taxes, on behalf of the citizen, without indicating the legal status of the individual entrepreneur.

Conclusion - we looked at how transport tax is paid by legal entities in accordance with legal requirements. To remain a bona fide taxpayer, an organization must independently calculate and pay the car tax according to the rates and deadlines accepted in the region. In case of violations of regulations, administrative and tax penalties may be applied to the enterprise.

Tax rates for individuals

Transport tax rates are set in rubles per unit of horsepower.

Here are the rates offered by the Tax Code. Let us remind you that each region has the right to set its own rates.