Types of securities

According to Art. 142 of the Civil Code of the Russian Federation, a security is a document certifying property rights, the exercise or transfer of which is possible only upon presentation.

The circulation of securities means their purchase and sale and other actions leading to a change in the owner of the securities.

Any enterprise, joint-stock companies (JSC) and credit institutions have the right to issue securities.

Securities include shares of joint stock companies, bonds, certificates of deposit, bills, etc. The issue and circulation of securities are regulated by the legislation of the Russian Federation.

A share is a security confirming the contribution of funds by its owner to the authorized capital of a joint-stock company, giving the right to receive income from its activities, distribution of the remaining property upon liquidation of the company and to participate in the management of this company.

The promotion has no validity period and exists as long as the JSC operates. Shares can be registered or bearer; ordinary and privileged.

Registered shares contain the name of the owner and are recorded in the share registration book, indicating in it information about each registered share, the time of acquisition and the number of shares of individual shareholders.

For bearer shares, only their total number is recorded in the book; they do not contain the name of the owner.

Ordinary shares give the right to participate in the management of the joint-stock company and to receive dividends in the amount determined by the meeting of shareholders at the end of the reporting period.

Preferred shares provide the owner with a preferential right to receive dividends in the form of a firm fixed percentage, but do not give him the right to vote in the joint-stock company.

A bond is a security that confirms an obligation to compensate its holder for its nominal value with payment of a fixed interest.

The holder of the bond is a creditor of the joint-stock company or enterprise that issued the bonds.

Bonds can be issued registered or bearer, interest-bearing or interest-free, freely circulating or with a limited circulation.

The joint-stock company issues bonds only after full payment of all issued shares in the amount of no more than 25% of the authorized capital.

Interest on bonds is paid either periodically during the period for which they are issued or in a lump sum upon the maturity of the bond.

A bill of exchange is a security that certifies the unconditional obligation of the drawer to pay, upon maturity, a certain amount to the holder of the bill (the owner of the bill).

A bill of exchange is not only a convenient form of payment, but also a type of commercial loan, since payment of a bill does not occur immediately, but after a certain time, during which the amount of the bill is at the disposal of the drawer.

A bill of exchange is a unilateral monetary debt obligation in which only the drawer undertakes to pay the amount specified in it

Securities are a means of financing, lending, redistributing financial resources, and investing cash savings.

According to the nature of the object issuing securities, they are:

- government;

- non-state;

- securities of foreign issuers.

Depending on the nature of the operations and transactions hidden behind the issue of securities, as well as the purposes of their issue, they are divided into:

- stock, or monetary. These include stocks and bonds and securities derived from them that are traded on stock exchanges;

- commercial (capital), servicing the process of trade turnover and certain property transactions (bills, checks, mortgages, etc.).

Capital securities are issued for the purpose of forming or increasing the capital of an enterprise necessary for the development of production.

Valuation of securities

The following types of valuation of securities are distinguished: Nominal value - the amount indicated on the form of the security (CB). The total value of all shares at par value reflects the amount of the organization's authorized capital.

Exchange (market) value is the price determined as the result of the quotation of securities on the secondary market, i.e., reflects the real value based on supply and demand in a certain time interval.

Issue price is the selling price of a security during its initial placement. It may not coincide with the nominal value. The difference between the sale price and the nominal value constitutes the organization's share premium.

The book value of shares is determined according to the balance sheet by dividing the own sources of property by the number of issued shares, i.e., the value at which the securities are reflected in the balance sheet.

Book value is the cost at which securities are reflected in the accounting accounts.

Liquidation value is the value of the property being sold by a liquidated organization in actual prices paid per share or bond.

In accordance with the Regulations on Accounting and Reporting, financial investments are taken into account in the amount of actual costs for investors.

When a debt is considered uncollectible in accounting

A debt is considered uncollectible:

1) if the statute of limitations has expired;

2) if it is unrealistic for collection on other grounds. For example, if the obligation is terminated due to the impossibility of its fulfillment on the basis of an act of a government body or due to the liquidation of the debtor organization.

When writing off the difference, make the following entry:

Debit 91-2 Credit 62 (71, 73, 76...)

— bad receivables not covered by the reserve are written off.

Writing off a bad debt is not canceling the debt. Therefore, within five years from the date of write-off, reflect it on the balance sheet in account 007 “Debt of insolvent debtors written off at a loss” (Instructions for the chart of accounts):

Debit 007

— written off receivables are reflected.

During this period, monitor the possibility of its collection if the debtor’s property status changes (clause 77 of the Regulations on Accounting and Reporting).

Concept and classification of financial investments

According to the Accounting Regulations “Accounting for Financial Investments” PBU 19/02, financial investments include investments of an organization in the authorized capital and securities of other organizations, costs of purchasing state and municipal securities, amounts of loans granted to other organizations, deposits in credit institutions, receivables acquired on the basis of assignment of the right of claim, etc.

To accept assets for accounting as financial investments, the following conditions must be simultaneously met:

- the presence of properly executed documents confirming the existence of the organization’s right to financial investments and to receive funds or other assets arising from this right;

- transition to organizing financial risks associated with financial investments (risk of price changes, risk of debtor insolvency, liquidity risk, etc.);

- the ability to bring economic benefits (income) to the organization in the future in the form of interest, dividends, increases in their value (in the form of the difference between the sale (redemption) price of a financial investment and its purchase value, as a result of its exchange, use in repaying the organization’s obligations, an increase in the current market cost).

The organization's financial investments do not include:

- own shares purchased by the joint-stock company from shareholders for subsequent resale or cancellation;

- bills issued by an organization (seller) when paying for goods sold, products, work performed, services rendered;

- precious metals, jewelry, works of art acquired for purposes other than normal activities;

- investments of an organization in real estate that has a tangible form, presented by the organization for a fee for temporary use in order to generate income.

Financial investments are classified according to various criteria:

- in connection with the authorized capital;

- forms of ownership;

- the time frame for which they were produced.

According to the form of ownership, government and non-government securities are distinguished.

Depending on the period for which the securities were issued, they are divided into:

- long-term, when their repayment period exceeds 1 year;

- short-term, when their repayment period does not exceed 1 year.

Evaluation of financial investments

Financial investments are accepted for accounting at their original cost. The initial cost of financial investments acquired for a fee is the amount of the organization's actual costs for their acquisition, excluding VAT.

The actual costs of acquiring assets as financial investments are:

- amounts paid in accordance with the contract to the seller;

- amounts paid for information and consulting services related to the acquisition of these assets;

- fees paid to an intermediary organization or other person through which assets were acquired as financial investments.

The initial value of financial investments made as a contribution to the authorized capital of the organization is recognized as their monetary value, agreed upon by the founders of the organization, and received by the organization free of charge - their current market value on the date of acceptance for accounting

The initial cost of financial investments, the cost of which upon acquisition is determined in foreign currency, is determined in rubles by converting foreign currency at the rate of the Central Bank of the Russian Federation on the date of their acceptance for accounting.

The initial cost of financial investments at which they are accepted for accounting may change.

For the purposes of subsequent assessment, financial investments are divided into 2 groups:

- financial investments by which the current market value can be determined;

- for which their current market value is not determined.

In the first case, financial investments in the financial statements at the end of the reporting year are reflected at the current market value by adjusting the valuation as of the previous reporting date. The organization can make this adjustment monthly or quarterly.

The difference between the assessment at the current market value as of the reporting date and the previous assessment of financial investments is attributed to the financial results (as part of other income or expenses) of commercial organizations in correspondence with account 58 “Financial investments”.

In accounting, the results of quotation (revaluation) are reflected in the following entries:

- with an increase in market price: D-t 58 K-t 91;

- when the market price decreases: D-t 91 K-t 58.

Example

In April, Vesta CJSC purchased shares worth RUB 100,000 on the stock exchange. In April, entries will be made: shares paid for: D-t 76 K-t 51 - 100,000 rubles. shares accepted for accounting: D-t 58 K-t 76 - 100,000 rub. In May, the market value of the shares increased and at the end of May it amounted to 115,000 rubles. The price of shares has been adjusted: D-t 58 K-t 91 - 15,000 rubles. (115,000 - 100,000).

Financial investments for which the current market value is not determined are subject to reflection in accounting and financial statements as of the reporting date at their original cost (debt securities).

For debt securities (bonds, bills) that are not quoted on the stock exchange, the difference between the original and nominal value is written off to other income or expenses evenly over the period of their circulation.

When disposing of financial investments for which the current market value is not determined, the following valuation methods are used:

- at the initial cost of each accounting unit;

- at the average initial cost;

- at the original cost of the first financial investments acquired (FIFO method).

When disposing of financial investments for which the current market value is determined, their value is determined by the organization based on the latest assessment.

Examples of using valuation methods when disposing of financial investments (table).

1. Valuation method based on average initial cost.

The cost of securities being written off is determined by multiplying the number of securities being retired by the average initial cost of one security of this type.

The average initial cost of one security of a given type is calculated as the quotient of dividing the value of securities by their quantity, respectively, consisting of the value and quantity of the balance at the beginning of the month and of securities received in that month.

1) Average initial cost of one security: (100,000 rubles + 50,000 rubles + 66,000 rubles + 96,000 rubles): 290 = 1075.86 rubles.

2) Value of the balance of securities at the end of the month: 130 X 1075.86 rubles. = 139,862 rub.

3) Cost of retiring securities:

312,000 rub. — 139,862 rub. = 172,138 rub., or

160 X 1075.86 rub. = 172,138 rub. 2. FIFO method.

Valuation of securities using the FIFO method is based on the assumption that they are sold within a month in the order in which they were received. The valuation of securities in balance at the end of the month is carried out at the actual cost of the most recent acquisition, and the sale price takes into account the cost of the earlier securities.

1) The cost of the balance of securities at the end of the month, based on the cost of recent purchases:

(80 X 1200) + (50 X 1100 rub.) = 15.1 000 rub.

2) Cost of retiring securities: RUB 312,000. — 151,000 rub. = 161,000 rub.

3) Unit cost of retiring securities:

161,000 rubles: 160 = 1006.25 rubles.

Reserves for reduction in the value of material assets

In the article, the author tries to determine the importance of keeping records of reserves for reducing the value of material assets.

Key words: material assets, reserves for the reduction of material assets, accounting.

The accounting regulation “Accounting for inventories” PBU 5/01 determines that the actual cost of inventories in which they are accepted for accounting is not subject to change, and recognition of a decrease in the value of inventories is possible only through the formation of an assessment reserve. One of the types of these quantities is reserves for the reduction of material assets, account 14 “Reserves for the reduction of the value of material assets,” according to the Chart of Accounts for the accounting of financial and economic activities of organizations from 2000 [3]

Reserves for reduction in the value of material assets belong to the category of valuation reserves formed to clarify the value of inventories on the balance sheet. They provide a transition from the initial value of assets in accounting to their value relevant at the reporting date, while the value of inventories at which they are reflected in accounting remains unchanged.

The creation of a reserve is caused by compliance with the requirement of prudence. In paragraph 7 of PBU 1/2008 “Accounting Policy of an Organization,” the requirement of prudence is defined as a greater readiness of an organization to recognize expenses and liabilities in accounting than possible income and assets. [4]

The organization is obliged to form a reserve for reducing the cost of inventories, since such a procedure is provided for in clause 25 of PBU 5/01. [5]

PBU 4/99 “Accounting statements of an organization” requires that numerical indicators in the balance sheet be reflected in a net assessment, in other words, minus regulatory values. [6]

PBU 10/99 “Expenses of the organization”, approved by Order of the Ministry of Finance of the Russian Federation dated 05/06/1999 No. 33 classifies reserves for depreciation of inventory items as other expenses. Consequently, they should be accounted for as the debit of account 91 “Other income and expenses” and the credit of account 14 “Reserves for reduction in the value of material assets.” [7]

The amount of the reserve is determined as the difference between the current market value of the product and its actual cost. And at the same time, the organization must provide confirmation of the calculation of the market current value, in accordance with paragraph 7 of clause 20 of the Methodological Guidelines for the Accounting of Inventory. [2]

And at the same time, the procedure for determining the current market price of the cost of inventories is not established by law. According to paragraph 3 of clause 29 of the Methodological Guidelines for the Accounting of Fixed Assets, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91, the determination of the market price can be carried out in the manner prescribed for the valuation of fixed assets, i.e. information about the level prices available from state statistics bodies, trade inspectorates, the media, special literature, etc. This procedure must be enshrined in the Accounting Policy of the enterprise, in accordance with PBU 1/2008, approved by the Order of the Ministry of Finance of Russia dated October 6, 2008. No. 106 n.

Clause 20 of the Methodological Guidelines for Accounting for Inventories states that “a reserve for reducing the value of material assets is created for each unit of inventories accepted in accounting. Allowed for certain types (groups) of similar or related inventories. It is not allowed for such enlarged groups (types) of inventories as basic materials, auxiliary materials, finished products, goods, stocks of a certain and operating segment.”

Reserves for reducing the value of material assets can only be created for accounting purposes; tax legislation does not provide for such a possibility.

A reserve is formed if the following conditions are met:

− MPZ are morally outdated and/or have completely or partially lost their original quality. The source of such information may be internal notes from technical specialists, on the basis of which an order is created to recognize the industrial equipment as obsolete or having lost its original quality. Next, a commission is created that determines the possibility of further use of the mineral reserves and the amount of the reserve;

− reduction in the current market value of inventories. Such confirmation may be the fact of the acquisition of similar inventories at a lower cost during the period from the end of the reporting year until the signing of the financial statements;

− reduction in the cost of selling inventories. Confirmation may be the fact that prices have been reduced by other sellers. Also on the basis of internal memos from sales department specialists with attached price lists from suppliers, on the basis of which a manager’s order is created on the need to create such a reserve.

Also, in accordance with paragraph 20 of Methodological Instructions No. 119 n, if in the period following the reporting period the current market value increases, then the corresponding part of the reserve is included in the reduction in the cost of material expenses recognized in the period following the reporting period. It follows that organizations need to monitor the state of market prices. However, nowhere in the legislation does it indicate in what period and with what frequency. The organization can independently establish the frequency in the Accounting Policy.

Failure to create a reserve affects the quality and reliability of reporting. In the absence of a reserve, material assets are reflected in the statements at the purchase price, and not at the actual valuation. This, in turn, affects indicators such as enterprise profitability and earnings per share. Deliberate non-creation is a unique way of artificially inflating the value of assets on the balance sheet and regulating financial results.

Methodological issues of forming valuation reserves at the legislative level are not sufficiently developed. Forming a reserve for reducing the cost of inventories is a rather labor-intensive area. First, when preparing the annual report, it is necessary to identify materials with signs of impairment. Next, draw up an order for a commission that will evaluate such materials. Accordingly, it is necessary to determine and confirm the current market value, which is quite difficult and time-consuming.

According to T. G. Arbatskaya, if inventories remain idle for a long period, and it is not possible to sell them, then such inventories should be written off. [1]

As one of the options, a reserve for the reduction of material assets can be created for each unit of material stock on the basis of an order, which will indicate that 100% of the reserve includes material stocks that have not moved for more than 12 months. The order approves a permanent commission for the creation and write-off of the reserve. The reserve can be restored once a quarter, that is, 4 times a year, or some other deadlines can be specified.

Materials are carefully inspected during inventory before drawing up annual financial statements. The accountant, on the basis of the balance sheets, reviews the movement of all inventories and, in the absence of movements for 12 months on such inventories, a reserve is created using a calculation certificate based on the order. At the same time, the sales market for the sale of materials that falls under the reserve criteria is studied.

Since there is no unified form for the movement of materials in reserve, you can use a self-developed form, for example:

In our example, for the 1st quarter of 2020, coupling 50 (code 6805) in the amount of 2 pieces in the amount of 300 rubles was written off for production:

Dt 20.01 “Main production” Kt 10.01 “Materials”.

Next, a posting is made to restore the reserve, that is, we reduce the amount of the reserve by 300 rubles 00 kopecks:

Dt 14 “Reserve for reduction in value.

Clutch 50 (code 6805) has been written off from reserve.

A reserve was created for the coupling with 50 wires:

Dt 91.02 “Other expenses” Kt 14 “Provision for reduction in the cost of inventory and materials.”

In order not to create such a reserve, it is necessary to ensure careful control over the purchase of materials and their disposal. When purchasing materials, as an option, you can draw up a memo indicating from whom and for what purposes the material is required to be purchased. In the future, the financially responsible person is obliged to write out this material, install it and write it off, and so on. This method eliminates the “hanging” of materials in the warehouse, which ensures that there is no need to create a reserve. When auditors check the inventory of inventories under account 10 “Materials,” auditors must check the availability of inventory under account 14 “Reserve for reduction in the cost of goods and materials.” An inventory list of the reserve is compiled in any form, since there is no unified form. In this inventory it is necessary to indicate the balance at the beginning of the year, the movement of the reserve during the year, and the balance at the end of the year. If the reserve was not created, you need to indicate why. For example, due to the lack of materials that fall under the criteria for creating a reserve of inventory items.

Literature:

- Arbatskaya, T. G. International accounting. Access mode: cyberleninka.ru/…/aktualnye-voprosy-formirovaniya-rezerva-pod-snizhenie-stoimosti.

- Guidelines for accounting of inventories (approved by Order of the Ministry of Finance of the Russian Federation No. 119n dated December 28, 2001).

- Chart of accounts for accounting financial and economic activities of organizations and instructions for its application dated 2000.

- Accounting Regulations “Accounting Policy of the Organization” 1/2008 (approved by Order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n.

- Accounting Regulations “Accounting for Inventories” 5/01 (approved by Order of the Ministry of Finance of Russia dated 06/09/01 No. 44).

- Regulations on maintaining accounting and financial statements in the Russian Federation (approved by Order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n.).

- Accounting Regulations “Organization Expenses” 10/99 (approved by Order of the Ministry of Finance of Russia dated May 6, 1999 No. 33n (as amended on March 30, 2001 No. 27).

Accounting for financial investments

To account for the presence and movement of investments of organizations in government securities, shares, bonds, in the authorized capital of other organizations, as well as loans provided to other organizations, use account 58 “Financial investments”. The account is active, balance.

The debit of account 58 reflects the financial investments made by the organization in correspondence: D-t 58 K-t 51, 52, 91, 90.

For the loan, accounts 58 reflect the repayment (redemption) and sale of securities in correspondence: D-t 91 K-t 58, as well as the repayment of loans in correspondence: D-t 51, 52 K-t 58.

To account for the costs of acquiring financial investments, use either a separate subaccount to account 58 “Financial investments”, or a subaccount to account 76 “Settlements with various debtors and creditors” - 76/8 “Settlements for the acquisition of securities”, with the subsequent capitalization of financial investments directly to account 58 (subject to transfer of ownership of securities).

— When prepaying expenses for the acquisition of securities, the following entries are made in accounting:

- Dt 76, subaccount 8 “Calculations for the acquisition of securities” Kt 51 - for the amount of the transferred advance;

- Dt 58 Kt 76, subaccount 8 “Settlements for the acquisition of securities” - securities are capitalized.

— When receiving securities under a simple partnership agreement: D-t 58 K-t 80.

— When securities are received free of charge, an entry is made at their market value: D-t 58 K-t 98/2.

The exchange rate difference from the additional valuation of securities due to changes in the exchange rate is reflected in the form: D-t 58 K-t 91.

The following subaccounts can be opened for account 58:

58/1 “Units and shares”; 58/2 “Debt securities”; 58/3 “Loans provided”; 58/4 “Deposits under a simple partnership agreement.”

Analytical accounting of financial investments is carried out by type of investment (shares, shares, bonds) and the objects in which these investments are made (organizations that sell securities, organizations that borrow).

When using the journal order form of accounting, entries on the credit of account 58 are made in journal order No. 8. Debit entries are reflected in journal orders No. 2, 2/1, 8 in correspondence: D-t 58 K-t 51, 52, 76.

All securities held at the enterprise must be registered in the securities book. The book must be numbered, laced, sealed and signed by the manager and chief accountant.

Postings with examples

The creation of reserve points is traditionally carried out before drawing up the annual balance sheet. The amount is usually calculated for each item number or name, and sometimes for groups of similar values.

Reserve amount = (US - TS) * CMC, where

US – accounting value indicator, TC – current value, KMC – number of material assets.

Reserves are not created if the actual cost is high at the reporting date. The account is active-passive. The formation of the reserve is subject to reflection on the credit of the account. Below are the main transactions for this account:

- Dt 91 Kt 14 – formation of a reserve. The basis for regulation is an accounting certificate and an order from the manager.

- Dt 14 Kt 91. The invoice is generated on the basis of the same types of documentation. The operation means writing off and restoring the reserve amount for inventories.

- Dt 60 Kt 41 – acceptance of commodity items for accounting. Actions are carried out on the basis of the consignment note.

- Dt 91 Kt 14 – creation of a reserve. It is carried out on the basis of the manager’s order and certificate.

- Dt 99 Kt 68. Permanent tax liability.

- Dt 62 Kt 90 – reflection of revenue received during the sale of commodity items.

- Dt 90 Kt 68. The operation is traditionally regulated by an invoice and involves the accrual of VAT on sales.

- Dt 90 Kt 41. Interim operation, which reflects the write-off of cost. The consignment note serves as an indicative regulatory document.

- Dt 14 Kt 91 – the reserve amount is written off.

- Dt 68 Kt 99 – introduction of a tax asset on an ongoing basis.

Accounting for investments in the authorized capital of other organizations

Financial investments in the authorized capital (shares) represent the amount of assets invested in the property of another organization to ensure its authorized activities.

You can make a contribution to the authorized capital of a joint-stock company only by purchasing its shares. You can transfer money or transfer property to pay for shares.

Contributions to the authorized capital of joint-stock companies are kept on account 58, subaccount 1 “Shares and Shares”, and are reflected as a debit to account 58/1 in correspondence with cash accounts:

D-t 58/1 K-t 51, 52.

When making a contribution to the authorized capital with property, the transferred objects are valued at the contract value (based on current market prices) and are reflected in the credit of accounts 90 “Sales” and 91 “Other income and expenses” and the debit of the same accounts - at the residual value (for fixed assets and intangible assets) and at actual cost (for goods and finished products).

The difference in debit and credit turnover on accounts 90 and 91 reflects the primary financial result of investments in shares.

If a contribution to the authorized capital of another organization is made with property, then the transferring party will make the following entries:

- D-t 58/1 K-t 90, 91 - the amount of the contribution is reflected in accordance with the constituent agreement;

- D-t 90 K-t 43, 41 - reflects the actual cost of finished products, goods transferred as a contribution to the authorized capital;

- D-t 02 K-t 01 - the amount of accrued depreciation on an object transferred as a contribution to the authorized capital of another organization is written off;

- D-t 91 K-t 01 - the residual value of the transferred fixed asset item is written off;

- D-t 91 K-t 99 (D-t 99 K-t 91) - reflects the financial result from the transfer of property or: D-t 90 K-t 99 (D-t 99 K-t 90).

Shareholders receive dividends on them, i.e. income that is paid from profits by the joint-stock company.

The accrual of dividend amounts is reflected by the entry:

D-t 76 K-t 91, receipt of dividends: D-t 51 K-t 76.

If the organization whose shares (shares) the enterprise has is liquidated, the following entries should be made:

- D-t 91 K-t 58/1 - the book value of the share (share) in the authorized capital of the liquidated organization is written off;

- D-t 01 (10, 41, 51, ...) K-t 91 - property and funds remaining after liquidation were received and distributed in favor of our organization;

- D-t 91 K-t 99 (D-t 99 K-t 91) - reflects the financial result from the write-off of shares in the authorized capital.

Example 1.

JSC Kosmos made a founding contribution to the joint Anglo-Russian venture in the amount of 250,000 rubles.

The entry will be made as follows: D-t 58/1 K-t 51 - 250,000 rubles.

Example 2.

Transferred as a contribution to the authorized capital of another organization:

- fixed assets at an agreed value (based on current market prices) in the amount of RUB 400,000;

- cash - 300,000 rubles.

Based on the results of work for the year, dividends were accrued in the amount of 72,000 rubles.

Reflection of transactions in accounting:

1) for the amount of cash and fixed assets contributed to the contribution to the authorized capital of another organization:

Dt 58/1 Kt 91 - 400,000 rubles, Dt 58/1 Kt 51 - 300,000 rubles;

2) accrual of income:

D-t 76 K-t 91 - 72,000 rub.;

3) receipt of income:

D-t 51 K-t 76 - 72,000 rub.

EXAMPLE No. 1

In 2020, the organization purchased 200 m of fabric at a price of 50 rubles per 1 m for sewing garments. 50 m of fabric were spent on sewing the products. There were 150 m of fabric left in the warehouse.

At the end of the year, due to changes in market conditions, fabric can be purchased at a price of 40 rubles per 1 m. The organization creates a reserve to reduce the cost of inventories. The reserve amount will be 1,500 rubles [(50 rubles x 150 m) - (40 rubles x 150 m)]. In the balance sheet at the end of the year, materials will be reflected at a cost of 6,000 rubles [(50 rubles x 150 m) – 1,500 rubles].

In accounting, the formation of a reserve is reflected in the following accounting entries:

| Contents of a business transaction | Debit | Credit | Amount, in rubles |

| A reserve has been created to reduce the cost of material assets | 91-2 | 14-10 | 1 500 |

| A permanent tax liability is reflected Calculation: 1,500 rubles x 20% | 99 | 68-2 | 300 |

Important!

The provisions of Chapter 25 of the Tax Code of the Russian Federation do not provide for the creation of reserves for reducing the value of material assets for profit tax purposes.

Since a reserve is not created in tax accounting, then in accordance with PBU 18/02 “Accounting for calculations of corporate income tax”, approved. By Order of the Ministry of Finance of the Russian Federation dated November 19, 2002 No. 114n (hereinafter referred to as PBU 18/02), a permanent tax liability is formed for the amount of the reserve. When the reserve is restored, a permanent tax asset is formed.

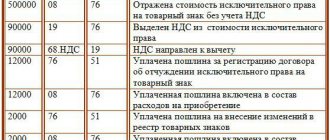

Accounting for the costs of purchasing bonds

Bonds are classified as debt securities and are accounted for in account 58, subaccount 2 “Debt securities”. An organization's costs for purchasing bonds and other similar securities often do not equal their face value. In these cases, there is a difference between actual costs (sales value) and nominal value. This difference must be amortized so that by the time the bond matures, the actual value equals the face value.

According to the Regulations on Accounting and Reporting, the difference between the amount of actual costs for the acquisition of bonds and their nominal value during their circulation period is applied evenly (monthly) to other income (expenses).

If the actual value of the bonds is greater than their nominal value, then the difference is charged to expenses by posting: D-t 91 K-t 58/2, and if the acquisition cost is less than their nominal value, then it is charged to the organization’s income: D-t 58/2 K-t 91. Thus, by the time of maturity, the actual value of the bonds reaches the nominal value.

Example.

CJSC Luch purchased bonds for 40,000 rubles, their nominal value was 34,000 rubles. The maturity of the bond is 2 years. The annual percentage of income is 30%.

In accounting, these transactions will be reflected in the following entries:

1) when registering D-t 58/2 K-t 76 - 40,000 rubles;

2) payment of bonds D-t 76 K-t 51 - 40,000 rubles;

3) the difference between the actual and nominal value will be: 40,000 - 34,000 = 6,000 rubles.

This difference must be repaid in 2 years. The amount of monthly depreciation will be: 6,000 rubles. : 2 : 12 = 250 rub. A monthly entry is made for the amount of depreciation: D-t 91 K-t 58/2 - 250 rubles;

4) for the amount of accrued annual income: D-t 76 K-t 91—RUB 10,200. (34,000 x 30%);

5) Receipt of income to the current account: D-t 51 K-t 76 - 10,200 rubles.

Using count 14

Account 14 “Reserves for reduction in the value of material assets” is used to summarize information about reserves for deviations in the cost of raw materials, supplies, and fuel resources from the actual market indicator.

This direction is also used to summarize information about reserves for reducing the cost of other assets - work in progress, finished products, commodity items, etc. The formation of the corresponding reserve is directly reflected in account 14. Here it is accounted for as a loan, and next to it in double entry there is usually a debit of 91, which means other deductions and receipts.

In the next reporting period, as the material assets for which the reserve was formed are written off, the amount is restored and a reverse entry is made Dt 14 Kt 91. Similarly, the operation is displayed in the case of an increased market value of material assets.

Analytical accounting within the operation is carried out separately for each of the reserves. When an enterprise records materials, goods, and finished products, this does not at all indicate the need to create a reserve. It does not occur in all cases, but only in the presence of certain factors.

Conventionally, these include the following areas:

- the fact of inventory obsolescence;

- significant damage;

- reduction in sales costs.

An important role in the accounting process is played by the costs of purchasing inventories, which include the following groups:

- cost at purchase prices;

- customs duties, payment of duties, etc.;

- remuneration to intermediaries;

- costs of preparation and delivery of inventories;

- transportation and procurement costs.

While inventories are not used by an organization, their actual market price may be subject to change. And if there is a decrease in it, the actual cost cannot be changed.