Contribution to the property of the company posting

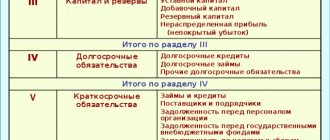

Contribution to the authorized capital - the entries for it are presented in our article - are mandatory in any commercial organization. Let's consider this issue from the perspective of the legal entity being created and the founder creating it. Analytics on account 80 (accounting capital account) is organized according to:

- stages of formation (in PJSC, JSC and business partnerships);

- types of shares (in PJSC and JSC).

- founders (participants);

Account 75 is the account for settlements with the founders.

The debit balance of its subaccount, reserved for settlements of contributions to the capital account, will show the amount of the unpaid capital account. A commercial legal entity can be created by both individuals and organizations.

At the same time, foreigners may be present among both. The easiest way to make a deposit is to pay it in money: to a current account or to a cash desk.

How to record the founder’s contribution to the property of an LLC

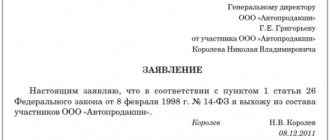

Participants make contributions to property in proportion to their shares in the authorized capital, unless another procedure is provided for in the charter (clause.

2 tbsp. 27 of the Law of February 8, 1998 No. 14-FZ). Situation: can the founding organization make a contribution to the property of the LLC with a value exceeding 3,000 rubles? Prohibition on the transfer of property worth more than 3,000 rubles.

between commercial organizations applies only to cases of donation of property (Article 575 of the Civil Code of the Russian Federation). The transfer of a contribution to the property of an LLC is not a gift. To avoid such qualification of the transaction, formalize the gratuitous transfer of property from the founding organization in the form of financial assistance or an interest-free loan agreement.

Accounting for a contribution to the property of a company that does not increase the authorized capital

Article 27 of Federal Law No. 14-FZ dated 02/08/1998 “On Limited Liability Companies” (hereinafter referred to as Law No. 14-FZ) establishes the obligation of company participants to make contributions to the company’s property if: - this is provided for by its charter; — a corresponding decision was made by the general meeting of the company’s participants.

Postings 75 of the account for contributions to the authorized capital: to the current account, in the form of fixed assets and intangible assets

The form of the authorized capital is regulated by law and directly by the organization’s charter.

The size of the authorized capital may include the following components:

- par value of shares issued by the organization;

- government investments;

- private shares;

- buildings, structures, equipment;

- the right to use the results of intellectual property.

To account for transactions involving the contribution of funds to the authorized capital by the founders and shareholders of the organization, account 75.01 is used. The contribution paid in cash through the cash register is reflected by posting Dt 50 Kt 75.01.

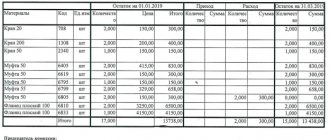

Let's look at the main transactions for payment of authorized capital using examples. The accountant of Megapolis LLC made the following entries:

Contribution to LLC property without increasing the authorized capital: transactions, taxes

- The participants make a unanimous decision on the acceptance/transfer of property.

- The conditions must be clearly stated in the company's charter;

Property transfer operations do not change the value of the nominal share of the contribution of company participants.

The transferred funds become the property of the company and increase its assets.

Financial resources can be spent both on current needs and to cover losses based on the results of the past year, if assistance was received in monetary terms at the end of the reporting period.

Helping hand from the founder

We'll tell you what you need to pay attention to so that you don't have to overpay taxes. However, there is another approach to accounting for such an operation: contributions to the company’s property must be taken into account as part of financial investments.

If the investor owns a share of less than 100%, then the contribution to the property of the investee will be made by all investors in proportion to their share in the investee. And each investor will reflect his contribution as described above, that is, as part of the investment.

1 clause 1 art. 264, sub. 2 p.

Features of a contribution to the property of an LLC without increasing the authorized capital

Let’s take a closer look at the possibility of making such a contribution, its legislative justification, correct accounting procedures and tax consequences.

Why should participants contribute funds to the company without increasing their share and authorized capital?

Such financing is intended to solve several problems simultaneously:

- increase the organization's net assets;

- acquire the necessary material or other property;

- add additional working capital;

- improve reporting indicators on the balance sheet.

Unless otherwise provided in the Articles of Association, capital is contributed in cash. The law does not prohibit authorization to make a contribution in any form, such as:

- things;

- share in the authorized capital of another organization;

- intangible assets (exclusive rights, licenses, patents, etc.)

- movable property;

- securities;

- shares of any other company;

- real estate objects;

Accounting for authorized capital and settlements with founders (account 80 and 75)

Dear readers! The article describes typical situations, but each case is unique.

If you want to find out how to solve your particular problem, use the online consultant form in the lower right corner of the site or call direct numbers:

+7 Moscow - CALL St. Petersburg - CALL here - if you live in another region.

It's fast and free! In this article we will talk about how the accounting of authorized capital occurs, who the founders are, we will analyze two accounts: 80 Authorized capital and 75 Settlements with founders and reflect the necessary accounting entries.

Contribution of property to the authorized capital of LLC

First of all, let's figure out why participants should contribute to the property of an LLC without increasing the authorized capital, if this does not increase their share and the authorized capital as a whole. Such an event can help resolve several issues.

- Increase in the firm's net assets. Increasing the company's working capital. Assist in the acquisition of company property. Improvement of balance sheet indicators.

When drawing up the charter of an LLC or JSC, it is worthwhile to provide for the possibility of contributing funds both in monetary terms and in material form.

Source: https://152-zakon.ru/vznos-v-imuschestvo-obschestva-provodki-12444/

Legal regulation of deposits in the management company

The issue is very important and is subject to careful consideration and adjustment. Making a contribution to the fixed capital of an LLC will be accompanied by the re-registration of a large number of documents. You need to remember not only that during the consultation you should have a competent and qualified lawyer next to you, but also that you will have to simultaneously resolve current issues with the organization’s accountants and the tax office.

Legal aspects may concern both consent or denial of the contribution of additional funds to the authorized capital, and decisions regarding the replenishment of the authorized capital from the property of the enterprise itself. People who do not agree with this opinion always have the opportunity to leave the organization by receiving their funds that were previously invested for the purpose of functioning of the organization or enterprise.

All changes in the authorized capital must be legally secured

In case of any changes when increasing the authorized capital and so on, all the nuances must be legally established. Naturally, we can talk about both changing all existing agreements with the founders, and about creating a new sample agreement if we are talking about the entry of a new member into the organization.

Contribution to the property of the company is posted by the founder

The obligation to make contributions is borne by persons who had the status of shareholder on the date of the decision made by the general meeting.

If such a decision is made without introducing conditions on mandatory contributions into the charter, there is a possibility that the decision can be challenged. Similar situations were encountered in judicial practice in cases of making contributions to the property of an LLC.

EXAMPLE:

The meeting of participants decided to make contributions to the property of the LLC. One participant was against it, but the decision was made.

The plaintiff, when appealing to the court, asked that the decision be declared invalid, since the charter did not provide for the obligation of company participants to make contributions to the property.

The court decided that the provisions of the company's charter were of an informative nature and did not provide for an obligation to make contributions.

Contribution of the founder to the property of the posting company

Tax Code of the Russian Federation).

Tip : There is a way to not include the cost of the contribution to the property of the LLC in income.

To do this, draw up the minutes of the general meeting of the company's participants (shareholders), according to which the property is transferred to the organization to increase net assets (subclause 3.4, clause 1, article 251 of the Tax Code of the Russian Federation).

In this case, the size of the founder’s share in the authorized capital of the organization does not matter. The opportunity to take advantage of such a benefit became available on January 1, 2011 and applies to obligations arising from January 1, 2007 (clause

1 and 2 tbsp. 4 of the Law of December 28, 2010 No. 409-FZ).

For more information, see

Tax Code of the Russian Federation, is taken into account as part of other expenses in accordance with Article 264 of the Tax Code of the Russian Federation.

Note that contributions to the company’s property are still not a contribution to the authorized capital.

Therefore, the tax authorities may be against applying the norms of subparagraph 1, paragraph 3 of Article 170 of the Tax Code of the Russian Federation to this situation.

The participant will not have any problems with VAT restoration, since in this case the budget receives the funds. But the company that receives the property will most likely be denied the deduction.

Thus, when choosing a method for assessing VAT on transactions involving contributions to the company’s property, one should proceed from the final result.

If property is transferred at the cost at which it is recorded, then the amount of VAT paid will be equal to the same amount that must be restored in the case of a tax-free transfer.

In both cases, the amount is included in expenses.

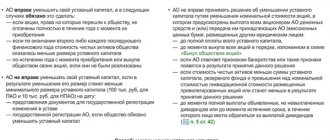

In addition, the authorized capital should not exceed net assets; this will require its reduction.

- Intra-group relations may develop in such a way that participants decide to contribute to property only by individuals or not in equal shares. When contributing to the authorized capital, such a decision will lead to a change in the shares of participants and their nominal value. Even a minority participant can make a contribution to the property.

When does it become necessary to make a contribution to the authorized capital?

Practice shows that in most cases, contributing additional funds to the authorized capital is nothing more than the need to develop and move forward. For the most part, money is required for the development and promotion of a company that is already operating on the market.

Both funds and real estate, as well as various technical equipment, can also be accepted as a contribution to the authorized capital.

We also recommend the article: Where can people with average income start investing money?

Often capital increases due to the fact that a new participant joins the organization. This is possible if there is no corresponding prohibition. The new participant in the organization must make the contribution to the authorized capital clearly within the agreed period - usually no later than 6 months.

If we are talking about replenishing the amount of the authorized capital by depositing money from existing participants, then we can talk about increasing the share of each of the investors. If there are people who are against making additional contributions to the authorized capital, then they always have the opportunity to leave the organization and receive the amount of funds that their contribution currently corresponds to.

The authorized capital can also increase due to the property that the organization itself has. In this case, the participants’ shares will not be redistributed, but their nominal value will increase.

Capital increases due to the fact that a new member joins the organization

In order to make a decision to increase the authorized capital through the property of the enterprise, only two-thirds of the votes of the participants themselves are necessary. The decision to perform such work will be made based on the accounting reports for the previous year.

Posting a property contribution from the founder

The authorized capital is the starting amount of funds with which a legal entity begins its activities.

After completion of all activities for making contributions to the authorized capital, postings begin with the corresponding entry made on the date of its registration.

It should reflect the accrual of the full amount of the capital city, provided for by the charter, in correspondence with the debt of the founders on contributions to it: Dt 75 - Kt 80. Analytics on account 80 (the capital account accounting account) is organized according to:

- founders (participants);

- stages of formation (in PJSC, JSC and business partnerships);

- types of shares (in PJSC and JSC).

Account 75 is the account for settlements with the founders. The debit balance of its subaccount, reserved for settlements of contributions to the capital account, will show the amount of the unpaid capital account. To learn how the capital account will be reflected in the accounting records, read the article “Procedure for drawing up a balance sheet (example).”

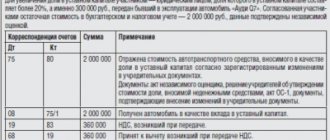

When using account 75, reflect transactions for receiving a contribution to the organization’s property as follows: Debit 75 Credit 83 - reflects the debt of the founder for the contribution to the organization’s property; Debit 50, 51, 52 (08, 10, 41...) Credit 75 – the founder’s debt on contribution to the organization’s property has been repaid. An example of how to reflect in accounting the monetary ruble contribution of a participant to the property of an organization. The authorized capital of Torgovaya LLC is 400,000 rubles. It is divided into shares between two participants: 60 percent of the authorized capital belongs to A.V. Lvov, and 40 percent - Alpha LLC. The Hermes charter states that the founders are required to make contributions to the organization’s property. On April 16, the general meeting of founders decided to invest 50,000 rubles in the organization’s property within a month.

How is a contribution to the authorized capital made through the cash desk?

In this case, the company will manage the funds without transferring them to the current account. It is possible to contribute up to 10,000 rubles in cash to the authorized capital. If this limit is exceeded, you can deposit the money into a current account.

Remember, if mistakes were made during a cash transaction, you should expect a fine of about 50,000 rubles. Note that the organization itself determines at what limit of funds it should stop, considering the amount of money that is in the cash register. If there is an excess, you need to withdraw it to your current account.

Contribution to the authorized capital is mainly made through the cash desk

Exceptions are days of payment of wages, holidays, and non-working days. Naturally, the contribution to the authorized capital with fixed assets will be reflected a little differently.

Contribution to property under the agreement by the transferring party accounting

This conclusion is confirmed by arbitration practice (for example, Resolution of the FAS of the East Siberian District dated January 18, 2002 N A33-10307/01-S2-F02-3445/01-S2).

The conclusion about the gratuitous nature of the contribution to the property seems unfounded even in the case when the company’s activities are unprofitable and the contributions of participants to the company’s property are aimed at covering current losses (for example, if the losses are due to the marketing strategy of the company, which assumes unprofitability of business operations at the initial stage of activity, due to the promotion new product and the desire to capture a market segment). The Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated August 24, 1999 N 1987/98 concluded that the gratuitous receipt of funds is a circumstance of economic relations and depends on the will of its participants.

Features of a contribution to the property of an LLC without increasing the authorized capital

Subtleties in accounting for property that does not increase the capital of the company The process of investing property in the capital of the company must be provided for by the charter.

Its participants at the general meeting adopt a positive conclusion in favor of the increase, and the contribution must be made by all participants in the company in an amount proportional to the nominal share of each.

A sole decision provides for a change in capital if the company is owned by one participant.

It is permissible to make a contribution not only in cash. In accordance with the article of the Civil Code of the Russian Federation, article 66, paragraph 6, it is allowed to deposit securities, property, and property rights of claim.

Contribution to LLC property without increasing the authorized capital: transactions, taxes

- VAT on the transfer of property to increase the company’s net assets, No. 23

- Help from participants: farewell to benefits, No. 23

- Price control when buying and selling shares in an LLC, No. 17

- If net assets have become lower than the authorized capital, No. 13

- Payment of dividends in the absence of profit or money, No. 8

- Dividends due to withdrawal from LLC are not paid, No. 7

- Monthly payment of dividends in an LLC: possible or not, No. 7

- A participant leaves the LLC without money, No. 6

- LLC pays dividends to residents, No. 4

- Filling out LLC certificate 2-NDFL on dividends for 2020, No. 4

- 2016

Helping hand from the founder

Alpha’s accounting and tax records reflect the following data:

- the initial cost of the fixed asset is 120,000 rubles;

- the residual value of the fixed asset at the time of transfer to the joint activity is RUB 100,000;

- the amount of accrued depreciation is 20,000 rubles.

The fixed asset was transferred to a simple partnership on March 31 on the basis of an act in form No. OS-1. Operation of the property transferred to the joint venture began in April.

Transactions related to the transfer of fixed assets to a simple partnership are reflected in Alpha’s accounting records as follows. March 31: Debit 02 Credit 01 subaccount “Disposal of fixed assets” – 20,000 rubles.

– depreciation accrued on the fixed asset transferred to the joint activity is written off; Debit 58-4 Credit 01– 100,000 rub. – contributed to joint activities; Debit 58-4 Credit 91-1– 50,000 rub.

Contributions to LLC property without increasing the authorized capital (Denisova m.o.)

Option A. Accounting entry: Debit 91, Credit 01, 10, 51 - material assets and cash were transferred as a contribution to the property of the company. Option B. Analysis of norms p.

2 PBU 19/02 “Accounting for financial investments” allows us to conclude that it is necessary to accept a contribution to the company’s property for accounting from a company participant as a financial investment, since all the necessary conditions are met: the presence of properly executed documents confirming the existence of the organization’s right to financial investments (charter of the company, decision of the general meeting of company participants); transition to the organization of financial risks associated with financial investments (risk of the company’s entrepreneurial activities); the ability to bring economic benefits (income) to the organization in the future (increase in the actual value of the participant’s share at the expense of the company’s retained earnings).

Contribution to the company's property: accounting

EXCHANGE OF EXPERIENCE FOREIGNERS Oleg Valerievich Chief specialist of the international financial reporting department of JSC “Hals-Development” “If an organization (investor) owns 100% of the shares in the authorized capital of another organization (investment object), then the investor’s contribution to the property of the investment object in the investor’s reporting (and according to IFRS, and according to Russian PBU) is reflected as part of the investment (financial investment). That is, a contribution to the company’s property (as well as material assistance to a subsidiary, a contribution to increase net assets, etc.) is reflected in exactly the same way as a contribution to the authorized capital. Indeed, the user of the investor company’s reporting does not care at all whether changes were made to the constituent documents (priority of content over form). All that matters to him is that the investee has received additional assets and will use them in its activities to make a profit.

Therefore, no income arises from this operation. What about VAT? In recent appeals, tax officials limit their explanations to what, in this case, is the transfer of ownership and use rights. Accordingly, the obligation to calculate and pay VAT remains.

Source: https://dolgoteh.ru/vklad-v-imushhestvo-po-dogovoru-u-peredayushhej-storony-buhgalterskij-uchet/

How to record the founder’s contribution to the property of an LLC

If an organization has received materials, goods, intangible assets or property rights, then do not take their market value into account when calculating income tax. This is due to the fact that such values are recognized as received free of charge (clause 2 of article 248 of the Tax Code of the Russian Federation). In tax accounting, the value of the listed property is formed only by the organization’s actual expenses associated with their receipt (if any). For example, costs for delivery of materials. This procedure follows from paragraph 2 of Article 254, paragraph 3 of Article 257, subparagraph 2.1 of paragraph 1 of Article 268, paragraph 2 of Article 320 of the Tax Code of the Russian Federation.