Depositing authorized capital into a current account

A financial transaction can be carried out in one or more payments. The purpose of payment should indicate “formation of authorized capital”. A receipt indicating the fact of the event should be attached to the registration package of documentation. It should be noted that after completing the registration procedure, the temporary account to which the transfer was made is transformed into a permanent one.

The authorized capital is deposited by the founders of the company into its current account after the completion of registration activities. The fund must contain a minimum amount in monetary terms, the value of which corresponds to 10,000 rubles. Everything above can be contributed in monetary or property equivalent.

Acquisition of a share in the authorized capital

Based on the Instructions for the application of the Chart of Accounts for accounting the financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n, account 81 “Own shares (shares)” is intended to account for the share of a participant acquired by the company upon its exit from the LLC. On the date of receipt of an application from an LLC participant about his withdrawal from the company, the debit of account 81 in correspondence with the credit of account 75 “Settlements with founders” reflects the debt to this participant in the amount of the actual value of his share.

The participants of the company, in whose favor the share in the authorized capital transferred to the company was distributed, received income in kind, subject to personal income tax (clause 1 of article 210, clause 2 of clause 2 of article 211 of the Tax Code of the Russian Federation). The tax base, in accordance with paragraph 1 of Art. 211, art. 41 of the Tax Code of the Russian Federation (see also Letters of the Ministry of Finance of Russia dated December 19, 2007 N 03-04-06-01/444, dated October 25, 2007 N 03-04-06-01/360), is determined based on the actual value of the distributed shares.

Bought a share in the authorized capital from an individual - withhold personal income tax

June 25, 2008 June 25, 2008 If a company acquires from an individual a share in the authorized capital of another organization, then the purchasing company is a tax agent for personal income tax. This is the position of the Ministry of Finance, set out in letter No. 03–04–06-01/165 dated June 11, 2008. Russian companies from which the taxpayer received income are required to calculate, withhold and pay personal income tax to the budget (clause

1 tbsp. 226 of the Tax Code of the Russian Federation). The exception is income specified in Articles 214.1, 227 and 228 of the Tax Code. For this income, the taxpayer pays personal income tax and reports to the inspectorate independently. The Ministry of Finance once again noted that the taxpayer’s income in the form of the sale of a share in the authorized capital to the company does not relate to the income provided for by these articles of the Code.

Consequently, the company is obliged to calculate and pay personal income tax. However, one can argue with the opinion of the Ministry of Finance.

After all, individuals who receive income from the sale of property owned by these persons pay personal income tax on their own (Article 228 of the Tax Code of the Russian Federation). Tax experts do not agree with this argument.

In their explanations, they note: a share in the authorized capital of an organization is a property right, not property, and the provisions of clause 1 of Art. 228 of the Tax Code do not apply (letters of the Federal Tax Service of Russia dated September 13, 2007 No. 04-2-05/002286, Federal Tax Service of Russia for Moscow dated November 1, 2007 No. 28-11/104845).

Arbitration practice on this issue is ambiguous.

Some

Accounting entries when selling a company's share in the authorized capital

After the transfer of rights to a share in the authorized capital, income and expenses associated with the sale of the share will be reflected in account 91 “Other income and expenses”, subaccount 91-1 “Other income and 91-2 “Other expenses”, respectively.

In the accounting records of the selling company, records will be kept not on the date of advance payments, but on the date of transfer of ownership of the share. Advance payments, prepayment or deposit will be taken into account as accounts payable in account 76 (separately).

From a letter to the editor

The LLC has three founders.

In December 2020, one of the founders sells his share to the company under an agreement for 100,000 rubles. Subsequently, the company sells the share to one of the founders. How to reflect these transactions in tax and accounting? An LLC participant can sell his share in the authorized capital or part thereof, if it was previously paid (clauses 4, 7, article 93 of the Civil Code of the Russian Federation; clause 3, article 21 of the Law of February 8, 1998 No. 14-FZ). And another participant, the company itself or a third party can buy a share (clause 2, article 93 of the Civil Code of the Russian Federation; clauses 2, 4, article 21 of Law No. 14-FZ).

The company has the right to acquire a share if:

- purchasing a share for a company is a right, not an obligation;

- participants did not exercise their pre-emptive right to purchase;

- the charter gives the company an advantage when purchasing a share.

The price of the share is equal to (clause 4 of article 21 of Law No. 14-FZ):

- if it is established in the charter - then at this predetermined price (it cannot be lower than the predetermined price for participants);

- if the price is not established in the charter - then the price specified in the seller’s offer.

For the buyer, the purchase of a share does not entail any consequences for tax purposes.

In accounting, the purchase of a share is reflected as follows:

on the date of transfer of ownership of the share to the company:

DEBIT 81 “Own shares (shares)” CREDIT 75 “Settlements with founders” – a share was acquired from a participant;

on the date of settlements with the participant:

DEBIT 75 CREDIT 68 – personal income tax is withheld when making payments to an individual;

DEBIT 75 CREDIT 51 “Current accounts” (50 “Cash”) – paid to the participant for the share.

After making a payment to the withdrawing participant, the company retains a share (in the form of accounts receivable on account 81), which, in the order established by Law No. 14-FZ, must be:

- distributed among the remaining participants in proportion to their shares in the authorized capital;

- offered for purchase to all or some participants and (or), unless prohibited by the charter, to third parties;

- repaid if the share is not distributed or sold within a year after its transfer to the company.

In this case, the share is sold to a third party.

The sale of the company’s own shares can be reflected in the accounting records as a debit to account 75 and a credit to account 81. In this case, the difference between the costs of repurchasing own shares and the price of their sale is included in other income or expenses in correspondence with account 81.

In accounting, when selling shares, the following entries are made:

DEBIT 75 CREDIT 81 – reflects the cost of the sale of the LLC’s own shares;

DEBIT 50 (51) CREDIT 75 – funds received as payment for shares;

DEBIT 91, subaccount “Other expenses” CREDIT 81 – reflects the difference between the costs of repurchasing one’s own shares and the price of their sale;

or

DEBIT 81 CREDIT 91, subaccount “Other income” - reflects the difference between the costs of repurchasing own shares and the price of their sale.

Let us note that when distributing or selling a share, the size of the company’s authorized capital does not change, therefore, no accounting entries are made in correspondence with account 80 “Authorized capital”. In tax accounting, this operation is also not associated with the receipt of a contribution to the authorized capital of the company.

If, when a participant leaves the company, the organization buys out his share and then sells it, the organization receives non-operating income, which is taken into account minus the expenses associated with the acquisition and sale of this share (letter of the Ministry of Finance of Russia dated January 21, 2010 No. 03-03- 06/2/5). Income is reduced by the actual value of the share paid by the company to the withdrawing participant (letter of the Ministry of Finance of Russia dated January 28, 2011 No. 03-03-06/1/32).

Professional press for accountants

For those who cannot deny themselves the pleasure of leafing through the latest magazine and reading well-written articles verified by experts. Select a magazine >>

If you have a question, ask it

Practical encyclopedia of an accountant

All changes for 2020 have already been made to the berator by experts. In answer to any question, you have everything you need: an exact algorithm of actions, current examples from real accounting practice, postings and samples of filling out documents.

Acquisition of a share in the authorized capital of another posting organization

The authorized capital is the initial and main source of formation of the company's property. A company participant who has fully paid part of his share in the capital can sell it. A company can also purchase shares of another organization, thus becoming a member of it. In this article, we will use examples to look at the reflection of transactions for the purchase and sale of a share of the authorized capital in accounting.

Prioritet LLC acquired a stake in the authorized capital of Fregat JSC. The transaction was carried out in accordance with the commission agreement through the intermediary Service Plus LLC. Prioritet LLC purchased 34 shares at a price of RUB 7,250/piece. Remuneration for Service Plus LLC - 3250 rubles.

Purchase and sale of shares of the authorized capital in accounting

Let us consider the reflection in the accounting of transactions for the purchase and sale of a share of the authorized capital using examples.

Purchase of a share of the authorized capital

Prioritet LLC acquired a stake in the authorized capital of Fregat JSC. The transaction was carried out in accordance with the commission agreement through the intermediary Service Plus LLC. Prioritet LLC purchased 34 shares at a price of RUB 7,250/piece. Remuneration for Service Plus LLC - 3250 rubles.

The following entries were made in the accounting of Priority LLC:

| Dt | CT | Description | Sum | Document |

| 58_1 | 76 Settlements with intermediaries | The acquisition of a share in the authorized capital of Fregat JSC was taken into account (34 shares * 7250 rubles) | RUB 246,500 | Commission agreement |

| 91_2 | 76 Settlements with intermediaries | The intermediary's commission is reflected in other expenses | RUB 3,250 | Commission agreement |

| 76 Settlements with intermediaries | 51 | The cost of payment for shares including remuneration was transferred to Service Plus LLC (RUB 246,500 + RUB 3,250) | RUB 249,750 | Payment order |

Sale of a share in the authorized capital in favor of the organization

The authorized capital of Prioritet LLC is 124,000 rubles. It is divided into shares between the participants of the company:

- — founder Sidorov P.R. – 98,000 rub.;

- — Director Muratov K.L. – 13,500 rub.;

- - member of the society Petrenko V.S. – 12,500 rub.

Petrenko V.S. announced his desire to sell the stake. The charter of Prioritet LLC prohibits the sale of a share of the authorized capital to third parties, and therefore the demand to buy out the share was presented directly to the organization. The actual cost of the share, which is 9,800 rubles, was paid to Petrenko through the cash desk in accordance with the decision of the board.

The following entries were made in the accounting of Priority LLC:

| Dt | CT | Description | Sum | Document |

| 81 | 75 | Reflection of the transfer of the share of the authorized capital owned by Petrenko in favor of Priority LLC | 9,800 rub. | Minutes of the board's decision |

| 75 | 50 | Payment to Petrenko of the actual value of the share | 9,800 rub. | Account cash warrant |

Sale of a share in the authorized capital to a third party

Magnit LLC owns a share in the authorized capital of Symbol JSC. The par value of the shares owned by Magnit LLC is RUB 98,500. Magnit LLC enters into an agreement with Bereg LLC to sell its share in Symbol JSC at the nominal value of the shares.

The fact of sale of a share of the authorized capital was reflected in the accounting of Magnit LLC as follows:

| Dt | CT | Description | Sum | Document |

| 76 | 91_1 | Reflection of proceeds from the sale of a stake in JSC Symbol | RUB 98,500 | Contract of sale |

| 91_2 | 58_1 | Write-off of the share in Symbol LLC at its nominal value | RUB 98,500 | Contract of sale |

| 51 | 76 | Crediting funds received from Bereg LLC as payment for the purchased share in the authorized capital of Symbol JSC | RUB 98,500 | Bank statement |

saldovka.com

Question

An organization using the simplified tax system (income) sold its share of participation in another organization for an amount much less than what was invested and accounted for in the accounting department.

How to correctly reflect it in accounting? Do I have to pay tax? Is this income?

Answer

In accounting, the sale of one’s share in the capital of another organization is reflected by the following entries:

- Dt 76 – Kt 91.1 – reflects other income from the sale of a share in another organization;

- Dt 91.2 – Kt 58. 1 – the cost of the sold share is written off;

- Dt 51 – Kt 76 – payment received from the buyer of the share.

Income from the sale of a share in the management company of another organization is taxed according to the simplified tax system. Expenses for the acquisition of a share (if the organization applies the taxation object “income minus expenses”) are not taken into account for tax purposes.

Rationale

A share in a company, the founder of which is an organization, is taken into account by it as part of financial investments at an initial cost equal to the amount of the contribution to the authorized capital of the LLC, and is reflected in account 58 “Financial investments”, subaccount 58-1 “Shares and shares” (clause p. 2, 3, 8, 9 Accounting Regulations “Accounting for Financial Investments” PBU 19/02, approved by Order of the Ministry of Finance of Russia dated December 10, 2002 No. 126n.

When selling a share in a company, an organization reflects in its accounting the disposal of a financial investment and other expenses from the disposal of this asset in the amount of its original cost (clauses 25, 27 PBU 19/02, clause 11 of the Accounting Regulations “Expenses of the Organization” PBU 10/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 No. 33n). In this case, an entry is made to the debit of account 91 “Other income and expenses”, subaccount 91-2 “Other expenses”, and to the credit of account 58, subaccount 58-1.

At the same time, the organization recognizes other income from the sale of a share in the LLC in the amount of the sale price of the share (clauses 7, 16 of the Accounting Regulations “Income of the Organization” PBU 9/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 No. 32n). This income is reflected in the credit of account 91, subaccount 91-1 “Other income”, and the debit of the account for accounting for settlements with the buyer of the share, for example, 76 “Settlements with various debtors and creditors”.

On the date of receipt of funds from the buyer of the share, the organization recognizes income (revenue) from the sale of the share in the company in the amount actually received (clause 1 of Article 346.15, clause 1 of clause 1 of Article 248, clause 1 of Article 346.17 of the Tax Code of the Russian Federation ). A similar conclusion follows from Letter of the Ministry of Finance of Russia dated January 10, 2014 No. 03-11-11/116. In this case, the paid cost of the share is not included in the expenses, since this type of expense is not named in the closed list of expenses taken into account when forming the tax base established by clause 1 of Art. 346.16 Tax Code of the Russian Federation.

| She answered the question: Lyudmila Mikhailovna Zolina, Consultant at IPC "Consultant+Askon" |

www.ascon-spb.ru

Postings when selling a share in the authorized capital of an LLC

- Other participants.

- To third parties, unless the charter contains a prohibition on this and the LLC or its participants have not exercised their priority right to purchase.

- For the LLC itself, if there is a ban on sales to third parties, not all owners agree with the sale to a third party, there are no other buyers, there is a demand for redemption from the participant, or he leaves this status and needs to pay the cost of his share.

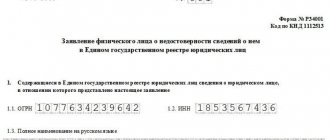

A purchase and sale agreement concluded with a third party must be notarized. It is mandatory to inform other participants in advance of the intention to sell the share to third parties. If a share is sold to one of the participants, the consent of the remaining participants to this transaction is not required. The fact of acquisition of a share by the company is registered in the Unified State Register of Legal Entities.

Purchase of a share in the authorized capital of LLC transactions

N. KOVALEVA, accountant Changing the owner of an organization is a situation that is becoming more common in modern business. Therefore, issues related to recording transactions for the purchase and sale of shares in the authorized capital require special attention. This article examines the entire sequence of actions when selling a share in an LLC - from concluding a transaction to reflecting this operation in accounting and tax accounting. In accordance with Art. 21 of the Federal Law of 02/08/1998 N 14-FZ “On Limited Liability Companies” (hereinafter referred to as the LLC Law), an LLC participant has the right to sell or otherwise assign his share or part thereof to one or more of its participants (Clause 1, Article 21 ), as well as to third parties, unless this is prohibited by the charter of the LLC (clauses 2, 4 of Article 21). The sold share (part of the share) must be fully paid, since “the share of a company participant can be alienated before it is fully paid only in the part in which it has already been paid” (Clause 3 of Article 21 of the LLC Law). The share purchase and sale agreement must be drawn up in simple written form. True, the company’s charter may stipulate a mandatory requirement for a notarial form. Under this condition, the agreement must be concluded with the assistance of a notary. Otherwise, the contract may be declared invalid. Let's consider a situation where an organization that is a participant in an LLC sells its share in the authorized capital of the LLC to a third party. ACCOUNTING The accounting for this transaction will be as follows. In accordance with clause 3 of PBU 19/02 “Accounting for financial investments”, the share in the authorized capital of an LLC owned by an organization is taken into account in the accounting records of this organization as part of financial investments and is reflected in account 58 “Financial investments”. According to clause 7 of PBU 9/99 “Income of the organization”, income from the sale of assets, including shares in the authorized capital, are taken into account as part of operating income, and the book value of the asset being sold is taken into account as an operating expense (clause 11 of PBU 10/99 “Expenses” organization"). The accounting entries will be as follows. The organization that sells the share: Debit 91/2 - Credit 58 - reflects the write-off of the book value of the sold share; Debit 62 (76) - Credit 91/1 - reflects the debt of the buyer of the share; Debit 51 (50) - Credit 62 (76) - reflects the repayment of the buyer's debt. The organization that purchases the share: Debit 58 - Credit 60 (76) - reflects the acquisition of a financial investment (share in an LLC); Debit 60 (76) - Credit 51 (50) - payment was made for the acquired share in the LLC. Note! When a share in the authorized capital is transferred from one person (individual or legal) to another, the company itself, the share in which is being sold, does not participate in the calculations. The change of owners is reflected by the company only in the analytics to account 80 “Authorized capital” (internal entries are made to account 80). At what point does this happen? Clause 6 of Art. 21 of the LLC Law establishes: “The company must be notified in writing of the assignment of a share (part of a share) in the authorized capital of the company with the presentation of evidence of such assignment. The acquirer of a share (part of a share) in the authorized capital of a company exercises the rights and bears the obligations of a participant in the company from the moment the company is notified of the specified assignment.” Consequently, a change of owner is reflected in the company’s records on the date of receipt of notification of the transfer of a share from one person to another. VALUE ADDED TAX Regarding VAT, the norms of the Tax Code of the Russian Federation are clear and unambiguous. Subclause 12, clause 2, art. 149 of the Tax Code of the Russian Federation states: “The sale... on the territory of the Russian Federation is not subject to taxation:... shares in the authorized (share) capital of organizations...”. Thus, when selling a share in an LLC, the object of VAT taxation does not arise. That's a plus. But where there is a plus, there is also a minus. The downside is that when selling a share (i.e., when carrying out a transaction not subject to VAT), the task of separately accounting for VAT transactions immediately arises if the organization that sells the share carries out other operations in this tax period that are subject to VAT in the general manner ( Clause 4 of Article 170 of the Tax Code of the Russian Federation). When selling a share, the object of VAT taxation does not arise, but there is an obligation to keep separate records of “input” VAT. income tax Let's look at the income tax in relation to this transaction in more detail. In particular, we will consider the procedure for calculating income tax on transactions completed before January 1, 2006 and after this date. This is due to changes in legislation that came into force on January 1, 2006. But first things first. Until January 1, 2006

On transactions related to the acquisition of shares in the authorized capital of LLC from individuals

Answer Accounting

Accounting Regulations “Accounting for Financial Investments” PBU 19/02, approved. Order of the Ministry of Finance of the Russian Federation dated December 10, 2002 No. 126n (hereinafter referred to as PBU 19/02) establishes the rules for the formation of information on the organization’s financial investments in accounting and financial statements.

Financial investments of an organization include, among other things, contributions to the authorized (share) capital of other organizations (clause 3 of PBU 19/02).

Based on paragraph 2 of PBU 19/02, for the purposes of these Regulations, in order to accept assets for accounting as financial investments, the following conditions must be simultaneously met

:

availability of properly executed documents confirming the existence of the organization’s right to financial investments

and to receive funds or other assets arising from this right;

transition to organizing financial risks associated with financial investments

(price change risk, debtor insolvency risk, liquidity risk, etc.);

ability to bring economic benefits (income) to the organization in the future

in the form of interest,

dividends

or an increase in their value (in the form of the difference between the sale (redemption) price of a financial investment and its purchase value as a result of its exchange, use in repaying the organization’s obligations, an increase in the current market value, etc.).

Financial investments are accepted for accounting at their original cost

(clause 8 of PBU 19/02).

In accordance with paragraph 9 of PBU 19/02, the initial cost of financial investments acquired for a fee is recognized as the amount of the organization’s actual costs for their acquisition,

with the exception of value added tax and other refundable taxes (except for cases provided for by the legislation of the Russian Federation on taxes and fees).

The actual costs of acquiring assets as financial investments are:

amounts paid in accordance with the contract to the seller;

amounts paid to organizations and other persons for information and consulting services related to the acquisition of these assets. If an organization is provided with information and consulting services related to making a decision on the acquisition of financial investments, and the organization does not make a decision on such acquisition, the cost of these services is included in the financial results of a commercial organization (as part of other expenses) or an increase in the expenses of a non-profit organization of that reporting period when the decision was made not to purchase financial investments;

remuneration paid to an intermediary organization or other person through which assets were acquired as financial investments;

other costs directly related to the acquisition of assets as financial investments.

General and other similar expenses are not included in the actual costs of acquiring financial investments, except when they are directly related to the acquisition of financial investments.

Thus, in financial accounting, an investment in the form of a share in an LLC will be recognized based on its price established by an agreement between the Organization and an individual.

In accordance with the Instructions for using the Chart of Accounts[1], financial investments are accounted for in account 58 “Financial investments”.

In this regard, in the situation under consideration, the acquisition of a share in the LLC will be reflected in the Organization’s accounting with the following entries

:

Dt 58 Kt 76

– the share in the LLC is accepted for accounting;

Dt 76 Kt 51

- payment has been made according to the agreement.

Income tax

According to subclause 2.1 of clause 1 of Article 268 of the Tax Code of the Russian Federation, when implementing

property rights

(shares

, shares), the taxpayer

has the right to reduce income from such transactions by the purchase price of these

property rights (

shares

, shares) and by the amount of expenses associated with their acquisition and sale.

In accordance with paragraph 1 of Article 252 of the Tax Code of the Russian Federation, for the purposes of this chapter, the taxpayer reduces the income received by the amount of expenses incurred (except for the expenses specified in Article 270 of this Code).

Expenses are recognized as justified and documented expenses

(and in cases provided for in Article 265 of this Code, losses) incurred (incurred) by the taxpayer.

Justified expenses mean economically justified expenses, the assessment of which is expressed in monetary form.

Documented expenses mean expenses supported by documents,

drawn up in accordance with the legislation of the Russian Federation, or documents drawn up in accordance with business customs applied in the foreign state in whose territory the corresponding expenses were incurred, and (or) documents indirectly confirming the expenses incurred (including a customs declaration, order about a business trip, travel documents, a report on work performed in accordance with the contract). Any expenses are recognized as expenses, provided that they are incurred to carry out activities aimed at generating income.

Taking into account the above, in tax accounting the price of the acquired share is taken into account in expenses on the date of its sale.

In this case, the price of the acquired share must be confirmed by relevant documents (for example, a share purchase and sale agreement and a payment order).

Personal income tax

According to paragraph 1 of Article 209 of the Tax Code of the Russian Federation, the object of personal income tax taxation for individuals who are tax residents of the Russian Federation is income received by taxpayers from sources in the Russian Federation and (or) from sources outside the Russian Federation.

When determining the tax base, all income of the taxpayer received by him, both in cash and in kind, or the right to dispose of which he has acquired, is taken into account, as well as income in the form of material benefits, determined in accordance with Article 212 of the Tax Code of the Russian Federation (clause 1 of Article 210 of the Tax Code of the Russian Federation).

Let us note that the provisions of Article 224 of the Tax Code of the Russian Federation for individuals – residents of the Russian Federation in relation to income received from the sale of shares in the authorized capital of an LLC, set a rate of 13%.

It follows from subparagraph 1 of paragraph 1 of Article 220 of the Tax Code of the Russian Federation that when determining the size of the tax base in accordance with paragraph 3 of Article 210 of the Tax Code of the Russian Federation, the taxpayer has the right to receive a property tax deduction when selling a share (part thereof) in the authorized capital of an organization.

When selling a share (part thereof) in the authorized capital of an organization, the taxpayer has the right to reduce the amount of his taxable income by the amount of expenses actually incurred by him and documented in connection with the acquisition of these property rights (subclause 2 of clause 2 of Article 220 of the Tax Code of the Russian Federation).

Thus, when determining the tax base for personal income tax, the amount of income received by an individual from the sale of a share in the authorized capital of an organization can be reduced by the amount of documented expenses associated with the acquisition of the specified share.

A similar position is set out in Letter of the Ministry of Finance of the Russian Federation dated 06/09/15 No. 03-04-06/33309:

“According to paragraph 3 of Article 210 of the Code, for income in respect of which the tax rate established by paragraph 1 of Article 224 of the Code is provided, the tax base is defined as the monetary expression of such income subject to taxation, reduced by the amount of tax deductions, in particular property tax deductions provided for in Article 220 of the Code.

The second paragraph of subparagraph 2 of paragraph 2 of Article 220 of the Code establishes that when selling a share (part thereof) in the authorized capital of an organization, the taxpayer has the right to reduce the amount of his taxable income by the amount of expenses actually incurred by him and documented expenses associated with the acquisition of these property rights.

Taking into account the above, the amount of income received from the sale of a share in the authorized capital of the organization can be reduced by the corresponding documented expenses for its acquisition

, including expenses in the form of additional contributions to the authorized capital, subject to state registration of its increase.”

Please note that, in accordance with paragraph 17.2 of Article 217 of the Tax Code of the Russian Federation, income received from the sale (redemption) of participation shares in the authorized capital of Russian organizations, as well as shares specified in paragraph 2 of Article 284.2 of this Code, are not subject to taxation (exempt from taxation), if provided that on the date of sale (redemption) of such

shares

(shares of participation) they were continuously owned by the taxpayer on the right of ownership or other property right for more than five years

.

When selling shares (shares, shares) received by the taxpayer as a result of the reorganization of organizations, the period of ownership of such shares by the taxpayer is calculated from the date of acquisition of the shares (shares, shares) of the reorganized organizations. When selling shares of a joint stock company received by a taxpayer as a result of the reorganization of a non-state pension fund, which is a non-profit organization, in accordance with the Federal Law of December 28, 2013 No. 410-FZ “On Amendments to the Federal Law “On Non-State Pension Funds” and certain legislative acts Russian Federation", the period of ownership of such shares by the taxpayer is calculated from the date of making a contribution (additional contribution) to the total contribution of the founders of the reorganized non-state pension fund.

Thus, if an individual, as of the date of sale, has continuously owned a share in the LLC for more than 5 years, then the income from the sale is not subject to personal income tax.

Based on paragraphs 1, 2 of Article 228 of the Tax Code of the Russian Federation, individuals independently calculate and pay tax amounts based on the amounts received from the sale of property rights[2].

Based on the norms of paragraph 3 of Article 228 and paragraph 1 of Article 229 of the Tax Code of the Russian Federation, such taxpayers are required to submit a corresponding tax return to the tax authority at the place of their registration.

The tax return is submitted no later than April 30 of the year following the expired tax period, unless otherwise provided by Article 227.1 of this Code.

According to paragraph 4 of Article 229 of the Tax Code of the Russian Federation, in tax returns, individuals indicate all income received by them in the tax period, unless otherwise provided by this paragraph, sources of their payment, tax deductions, tax amounts withheld by tax agents, amounts of advance payments actually paid during the tax period payments, tax amounts subject to payment (additional payment) or refund based on the results of the tax period.

Taxpayers have the right not to indicate in the tax return income that is not subject to taxation (exempt from taxation) in accordance with Article 217 of this Code (with the exception of income specified in paragraphs 60 and 66 of Article 217 of this Code), as well as income on receipt of which the tax is fully withheld by tax agents, unless this prevents the taxpayer from receiving tax deductions provided for in Articles 218 - 221 of this Code.

Thus, an individual is required to file a personal income tax return regarding income from the sale of a share in an LLC, indicating the amount of income and the amount of tax deductions.

If, as of the date of sale, an individual has continuously owned a share in the LLC for more than five years, then the individual has the right not to file a declaration[3].

College of Tax Consultants, June 27, 2020

[1] Approved By Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n.

[2] except for the cases provided for in paragraph 17.1 of Article 217 of the Tax Code of the Russian Federation, when such income is not subject to taxation.

[3] In relation to income from the sale of a share in an LLC.

Back to section

Sale of a share in the management company of the transaction

At the first stage, you need to introduce a new Participant to the Founders. This is the Buyer of the Organization. He makes an additional contribution to the Authorized Capital of the Company and becomes its Member with a share proportional to this contribution. In the event that you end up with only one Owner (Participant), the amount of his contribution does not matter much, but, as a rule, it is made equal to the second participant or all other participants combined.

In accounting, funds received under a loan agreement are not recognized as income of the organization and are reflected as accounts payable (clause 2 of PBU 9/99 “Income of the organization”, clause 2 of PBU 15/2008 “Accounting for expenses on loans and credits”).

Sale of share of transaction

Unfortunately, the court has already imposed a ban on both the shares and the land. Lawyers said that this is all super illegal. By the way, you confirmed that they were right, although, in my opinion, they have little experience. But these are the features of the coastal arbitration system. The raiders kick open the doors to the judges, one day make an injunction on the disposal of the right to perpetual use (which is already impossible under the land code), do not give the opportunity to re-register the rights to a land plot for rent, and even prohibited the sale of all shares. And all this quickly, without court hearings. Tomorrow I’ll go with my lawyers to fight off the bans, maybe another judge will take pity...

Thank you, however, the whole difficulty is that in a literal reading of Article 13 of the Law “On LLC”, state registration is important for third parties only when there are changes in the constituent documents, and a change of director formally does not mean this. As for the limitation of only 7% - thank you for the hint, I will develop this topic with my lawyers in court. I hope they catch this development...

How to reflect in the accounting of an organization the acquisition of a share in the authorized capital of an LLC from a legal entity

Proceeds from the sale of a share in the authorized capital of the LLC are included in other income (clause 7 of the Accounting Regulations “Income of the Organization” PBU 9/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 32n). Such income is recognized (accounted for) on the date of fulfillment of the conditions specified in clause 12 of PBU 9/99, which in this case is the date of making the corresponding entry in the Unified State Register of Legal Entities, since on this date the share passes from the organization to its buyer (clause 16 of PBU 9/ 99).

On the date of transfer of the share to the acquirer, the conditions for its recognition as a financial investment, defined in clause 2 of PBU 19/02, are simultaneously terminated, and therefore the disposal of the share from the financial investment is reflected (clause 25 of PBU 19/02).

Purchasing a share of the transaction

The sale of the company’s own shares can be reflected in the accounting records as a debit to account 75 and a credit to account 81. In this case, the difference between the costs of repurchasing own shares and the price of their sale is included in other income or expenses in correspondence with account 81.

An LLC participant can sell his share in the authorized capital or part thereof, if it was previously paid (clauses 4, 7, article 93 of the Civil Code of the Russian Federation; clause 3, article 21 of the Law of February 8, 1998 No. 14-FZ). And another participant, the company itself or a third party can buy a share (clause 2, article 93 of the Civil Code of the Russian Federation; clauses 2, 4, article 21 of Law No. 14-FZ).

Purchasing a share in another organization's holdings

The founder can terminate participation in the business for various reasons - this is his legal right.

However, you cannot withdraw from the membership of the company at any time, regardless of the consent of its other participants.

Today we will look at two ways to terminate participation in a limited liability company: - selling your share in the authorized capital; - withdrawal from society.

These options differ in both legal and tax implications.

Selling a share

Legislation

The right of an LLC participant to transfer his share in the authorized capital to another person is defined in Art. 93 Civil Code of the Russian Federation. Let us remind you that, by virtue of Art. 48 of the Civil Code of the Russian Federation, the founders do not have ownership rights to the property of the company. It belongs to the society itself - see paragraph 1 of Art.

66 of the Civil Code of the Russian Federation, and therefore the sale of a share must be considered as an exercise of property rights. This means that it is necessary to apply the general provisions on the sale and purchase agreement (clause 4 of Article 454 of the Civil Code of the Russian Federation) regardless of how the share sale agreement is named.

The transaction in question must be concluded with the participation of a notary. Failure to comply with the notarial form of the transaction entails its invalidity (Clause 11, Article 21 of the Law on LLCs (Federal Law of 02/08/1998 N 14-FZ “On Limited Liability Companies”)).

Notarization is not required: - when the company itself acquires a share in the authorized capital; — when distributing shares between company participants; - when selling a share to all or some members of the company or third parties in accordance with Art. 24 of the LLC Law.

Only in these cases, the transfer of the share is considered completed from the moment of making changes to the Unified State Register of Legal Entities, in the rest - from the moment of notarization of the transaction.

The notary is obliged to check the competence of the seller - he must present either a notarized agreement under which he previously acquired this share, with an extract from the Unified State Register of Legal Entities, or other acceptable documents.

After he has certified the transaction, the notary must, within three days, submit to the tax authorities an application for making appropriate changes to the Unified State Register of Legal Entities, signed by the buyer, and an agreement on the transfer of the share to the buyer.

The notary must also send copies of these documents within three days from the moment he certifies the transaction to the company whose share in the authorized capital has changed ownership. The rights and obligations of the founders during the transfer of shares in the authorized capital are regulated by the provisions of the LLC Law.

The founder has the right to sell or otherwise assign his share in the authorized capital of the company to other participants.

As a rule, the consent of the other founders is not required. The remaining founders enjoy the preemptive right to purchase shares. They can buy back the share being sold at the offer price to a third party. However, it can be stated in the company's charter that the founders have a preemptive right to purchase a share at a price predetermined by the company's charter. The price can be either fixed or determined on the basis of some calculation (for example, based on net assets). But that's not all. The charter can provide that if none of the founders wanted to buy a share, then the right of first refusal passes to the company at a price no lower than for the founders. Of course, in order to exercise the pre-emptive right, reasonable time limits must be established. To establish such redemption options and record them in the charter, a unanimous decision of all participants in the company is needed. To cancel them, two thirds of the society's participants are sufficient.

In general, the founders and the company are given 30 calendar days to make a decision (unless otherwise stated in the charter). If during this period they do not take advantage of their right of first buyers, then the founder can sell the share to a party.

for sales cannot be lower than the price at which it was proposed to buy out the share to other participants or the company. What to do if the company’s charter contains a ban on the sale of shares to third parties (Clause 2, Article 21 of the LLC Law), and all other participants in the company refused to purchase the share and their refusal was documented? Then the founder has the right to demand that the company itself buy the share from him and pay its actual value (Clause 2, Article 23 of the LLC Law). According to paragraph 7 of Art. 23 of the LLC Law, the proposed share passes to the company at the moment when the founder makes a demand for redemption. After this, within three months from the date the obligation to repurchase arises, the company must pay the participant the actual value of his share in the authorized capital, determined on the basis of the financial statements for the last reporting period preceding the day the company participant made the corresponding request. The share can be paid either in money or property. However, if a decrease in the authorized capital of the company may lead to its size becoming less than the minimum specified in the law, then the actual value of the share will be paid only from the difference between the value of the company’s net assets and the specified minimum amount of the authorized capital of the company. This is stated in paragraph 8 of Art. 23 of the LLC Law.

The company generally does not have the right to pay the actual value of the share if at the time of this payment it meets the signs of insolvency (bankruptcy) or as a result of this payment the company will have these signs.

How to formalize and reflect in accounting the acquisition of shares (shares) of other organizations

Costs directly related to the acquisition of securities can also be taken into account in accounting not at their original cost, but as a lump sum as part of other expenses of the organization. The organization has the right to do this if the amount of costs for the acquisition of securities (except for their cost) does not significantly deviate from the amount of their acquisition. Expenses, the amount of which is recognized as insignificant, can be recognized as other in the reporting period in which the security was accepted for accounting, that is, capitalized on account 58-1 “Units and shares”. This procedure is established by paragraph 11 of PBU 19/02 and the Instructions for the chart of accounts.

Hermes takes into account non-essential costs for the acquisition of financial investments as part of other expenses. The materiality criterion established in the accounting policy of the organization is 5 percent of the cost of the acquired financial investment. The accounting unit for financial investments is a share.

Legal assistance

In the course of business activities, the size of the authorized capital may be increased or decreased. The decision to change the amount of capital is made by the board of the organization, followed by mandatory introduction of the changes made into the registration documents.

- if it is established in the charter - then at this predetermined price (it cannot be lower than the predetermined price for participants);

- if the price is not established in the charter - then the price specified in the seller’s offer.

Features of transactions for the purchase and sale of shares in the authorized capital

Authorized capital is understood as the amount of funds (in monetary or property form) that were initially invested by the owners (founders) in order to ensure the activities of the organization.

In the course of business activities, the size of the authorized capital may be increased or decreased. The decision to change the amount of capital is made by the board of the organization, followed by mandatory introduction of the changes made into the registration documents.

The share of the authorized capital belonging to its founder (participant) can be sold by him:

- to a third party who is not a member of the company (unless this is prohibited by its charter);

- persons who are founders (participants) of the company;

- directly to the organization.

If one of the company's participants expresses a desire to sell his share, but the company's charter prohibits the sale of the share to third parties, then the ownership of the sold part of the authorized capital passes directly to the organization. In this case, the person leaving the organization’s membership is paid the actual value of his share.

At the same time, an organization can become the owner of a share in the authorized capital of another company by formalizing the transaction with a purchase and sale agreement. The acquired share is accounted for at the initial cost of the financial investments received and includes the cost of shares (shares), remuneration of intermediaries (if the purchase was made under a commission agreement), acquisition costs (consulting, information and other services).

How to sell a share of the authorized capital of another organization

If anyone has encountered this, please tell me - On account 58.11 there is a share in the authorized capital of a foreign company. The management decided that it needed to be sold. How to do this? Apparently there are no specialized documents for this, but people find it difficult to even decide on the wiring they need. Google is also silent about such exotic operations. All hope is in the experts.

58.11 – are these units or shares? We provide standard correspondence of accounts for transactions of sale of units/shares. K+ offers a ton of consultations. For example, here: In accounting, the sale of a share is reflected as a transaction with financial investments

Sale of share of transaction

The authorized capital of each organization consists of contributions from participants. A participant can sell his share in whole or in part if it is paid (clause 4 of article 93 of the Civil Code of the Russian Federation, clauses 2 and 3 of article 21 of the Federal Law of 02/08/1998 N 14-FZ “On Limited Liability Companies” ( hereinafter referred to as Law No. 14-FZ)). Read more about how to correctly sell a share in the authorized capital from a legal point of view.

An individual can reduce such income by the amount of documented expenses associated with the acquisition of a share (clause 1, clause 1, article 220 of the Tax Code of the Russian Federation, Letters of the Ministry of Finance of Russia dated September 18, 2012 N 03-04-08/3-306 and dated June 28, 2011 N 03-04-05/3-452, Federal Tax Service of Russia dated December 12, 2012 N ED-4-3/ [email protected] ).

Accounting and taxation when selling a share in an LLC

A fairly simple way to replace the owners of a company is through a purchase and sale transaction of a share in an LLC .

Changing the owner of a company by selling the enterprise as a single complex of property is quite lengthy and difficult to complete.

But changing the owners of a company by selling shares in the authorized capital (hereinafter referred to as the authorized capital) of the company is completed quite quickly and easily, which contributes to the popularity of just such transactions when changing business owners.

At the same time, of course, there are certain features regarding accounting and taxation of transactions with shares of companies, which depend on the type of transaction under the Civil Code of the Russian Federation (sale, exchange, donation, assignment of rights).

Legal concept of LLC

LLC is understood as a legal entity - a commercial business company, in terms of organizational and legal form - a limited liability company (Article 87 of the Civil Code of the Russian Federation and clause 1 of Article 2 of the Federal Law of February 8, 1998 No. 14-FZ “On LLC”).

As a rule, an LLC is established by a single founder or several individuals or legal entities. In an LLC, the management company is divided into shares. The organization's Charter specifies the exact size of shares.

The size of the share is calculated as a percentage or as a simple fraction, which reflects the ratio of the value of the share to the total value of the company's capital (for example, 1/2 or 1/3).

Concept and legal nature of LLC shares

Members of an LLC do not own shares by right of shared ownership.

According to the law, the full owner of all property rights and property that makes up the company’s management company is a legal entity (Clause 1, Article 66 of the Civil Code of the Russian Federation).

A share in a management company by its nature is the right of claim of the owner of the rights to a share against a legal entity. Clause 1 of Art. 8 and art. 26 Federal Law “On LLC” gives the shareholder a number of rights:

- participate in the division of the company's profits;

- alienate shares to third parties;

- upon liquidation of the company, receive part of the property that will remain after paying all debts to creditors, or its equivalent value;

- If the founder leaves the LLC , the founder has the right to receive part of the company’s property. The value of the transferred property must be correlated with the value of the share.

So, by the sale of a share of an LLC we mean a paid assignment of the right of claim to a legal entity (Articles 382-390 of the Civil Code of the Russian Federation). Also the Civil Code of the Russian Federation in paragraph 4 of Art. 454 allows the application of the provisions of the law governing the contract of sale of things to contracts the subject of which is the alienation of shares.

General procedure for alienation of LLC shares

The owner of a share in the company can sell or in any other way alienate the share (part of the share) to other co-founders of the company (Clause 1, Article 21 of the Federal Law “On LLC”).

At the same time, if the share is alienated within the company, then there is no need to obtain consent to complete the transaction from the other founders, unless the Charter of the LLC contains another provision. By the time of alienation, the seller must fully pay the cost of the share in the company's charter capital.

Until the owner of the share does this, he will not receive the right to sell the share. If a share is partially paid, only the paid part can be sold.

If the Charter of the LLC does not prohibit, then the share can be sold not only among the co-founders, but also to outsiders, unless the co-founders decide to exercise the right of pre-emption of the alienated share (clause 2 of Article 93 of the Civil Code of the Russian Federation, clauses 2 and 4 of Article 21 of the Federal Law " About LLC").

Since the company’s charter may contain a ban on the sale of shares to outsiders, it must be carefully studied before the transaction.

The company's charter may give the right to preferentially acquire a share not only of other founders, but also of the legal entity itself, if the other founders do not exercise this right.

The seller of the share is obliged to notify the company in writing about the planned transaction by sending a notice by mail to the legal address of the organization specified in the charter.

The letter along with the notification must be valuable, contain a list of enclosed documents, and a receipt must be attached to it.

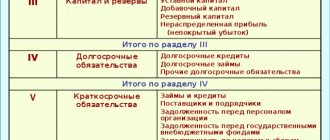

Formation of authorized capital: accounting entries

The increase in the authorized capital is carried out at the expense of net assets, additional and contributions from third parties. It is allowed to use several sources simultaneously. Let's look at how the formation of the authorized capital is displayed; we won't ignore the entries in the accounting system either.

How is the formation of authorized capital reflected in accounting? Postings depend on the sources of funds. To account for the authorized capital, accounts 80 and 75 are used. Receipts of funds are reflected in credit 75, and write-offs are shown in debit 75. The entry drawn up when forming the authorized capital in joint-stock companies looks like this: DT75 KT80 - the debt of the founders is reflected in the Criminal Code. Each owner must contribute to the capital in accordance with his share. Profits will then be distributed in the same ratio.

Accounting for contributions to the authorized capitals of other organizations

Thus, as a result of the transfer of a fixed asset as a contribution to the authorized capital of another organization, no income (expenses) are generated in the accounting records of the transferring party in the form of the difference between the balance sheet (residual) value of the transferred object and the monetary value of the contribution in accordance with the constituent documents.

According to Article 251 of the Tax Code of the Russian Federation, when determining the tax base for profit tax, income in the form of property that is received within the limits of the initial contribution by a participant of a business company or partnership upon leaving (disposal) from the business company or partnership is not taken into account.

Accounting entries for contributions to the authorized capital

> > > February 28, 2020 Contribution to the authorized capital - the entries for it are presented in our article - are mandatory in any commercial organization. Let's consider this issue from the perspective of the legal entity being created and the founder creating it. Commercial legal entities (PJSC, JSC, LLC, business partnerships, state unitary enterprises, municipal unitary enterprises) are created with the mandatory formation of an authorized capital (MC).

The size of the management company, the share of participation in it of each of the founders, payment terms, form of contributions and assessment of non-monetary contributions are stipulated in the constituent agreement.

The authorized capital is the starting amount of funds with which a legal entity begins its activities. After completion of all activities for making contributions to the authorized capital, postings begin with the corresponding entry made on the date of its registration.

It should reflect the accrual of the full amount of the capital city, provided for by the charter, in correspondence with the debt of the founders on contributions to it: Dt 75 - Kt 80. Analytics on account 80 (the capital account accounting account) is organized according to:

- types of shares (in PJSC and JSC).

- stages of formation (in PJSC, JSC and business partnerships);

- founders (participants);

Account 75 is the account for settlements with the founders. The debit balance of its subaccount, reserved for settlements of contributions to the capital account, will show the amount of the unpaid capital account.

Read the article about how the management company will be reflected in accounting reports.

A commercial legal entity can be created by both individuals and organizations. At the same time, foreigners may be present among both.

Purchase of fixed assets from an individual (nuances)

Accounting Expand the list of categories Subscribe to a special free weekly newsletter to keep abreast of all changes in accounting: Join us on social media.

networks: VAT, insurance premiums, simplified tax system 6%, simplified tax system 15%, UTII, personal income tax, penalties We send letters with the main discussions of the week > > > October 19, 2020 The purchase of a fixed asset from an individual who is not an individual entrepreneur is not often found in the activities of organizations.

Therefore, the accountant may have problems with the correct execution of such a transaction. In this article we will consider the main legal, accounting and tax nuances.

If one of the parties to the transaction is a legal entity, then the agreement, regardless of the amount, must be concluded in writing. This is stated in paragraph 1 of Art. 161 Civil Code of the Russian Federation.

The document states the following:

- payment procedure;

- number of OS;

- signatures of the parties.

- information about the supplier and buyer;

- description of the subject of the contract;

- requisites;

You can also enter other provisions. An act is drawn up for the agreement, in which specific information about the fixed asset is entered, or the text of the agreement states that it is an acceptance and transfer act.

In order to capitalize the fixed asset received from an individual in accounting, the accountant needs to draw up an act in the form. You can use document forms independently developed by the organization.