Reasons for making changes to the register

Every organization, from time to time, goes through various transformations. They may be related to:

- expansion or change of activities;

- moving to a new place;

- “redistribution” of shares of company participants, etc.

All significant changes must be reflected in the constituent documents, which, in turn, are a source of information for the state register of legal entities.

Thus, information about significant changes occurring in the enterprise must be conveyed to supervisory structures. These important changes include:

- removal from office and subsequent appointment of a new director;

- change of LLC participants.

This data is also required to be contained in the state. register and all metamorphoses associated with these persons must be taken into account in it.

Any person can check how reliable the information about him is in the Unified State Register of Legal Entities and, if any inaccuracies are found, file an objection.

For this, legislators developed form P34001.

You can declare unreliable information in the Unified State Register of Legal Entities using approved forms | Federal Tax Service

68 Tambov region

Date of publication: 06/03/2016 13:56

Order of the Federal Tax Service of Russia dated February 11, 2016 No. ММВ-7-14/ (hereinafter referred to as the Order) approved the grounds, conditions, methods of carrying out activities related to verifying the accuracy of information included or included in the Unified State Register of Legal Entities (hereinafter referred to as the Unified State Register of Legal Entities), and required document forms. This order comes into force on 06/05/2016.

The order contains the grounds for carrying out measures to verify the accuracy of information included or included in the Unified State Register of Legal Entities, including:

— the presence in the registration authority of a written objection from the interested person regarding the upcoming entry of information into the Unified State Register of Legal Entities, containing an indication of the circumstances on which it is based, with the attachment of documents confirming these circumstances;

— receipt by the registering authority of a statement from an interested person about the unreliability of the information included in the Unified State Register of Legal Entities, as well as other information about the discrepancy between the information contained in the Unified State Register of Legal Entities and the information received by the registration authority after inclusion of such information in the Unified State Register of Legal Entities.

Thus, from 06/05/2016, the unreliability of information included or included in the Unified State Register of Legal Entities can be reported using the approved forms:

— No. 38001 “Objection of an interested person regarding the upcoming state registration of changes to the charter of a legal entity or the upcoming entry of information into the Unified State Register of Legal Entities”;

— No. 34001 “Statement of an individual about the unreliability of information about him in the Unified State Register of Legal Entities.”

It should be noted that the application in form No. 34001 “Statement of an individual about the unreliability of information about him in the Unified State Register of Legal Entities” does not require verification of the accuracy of the information, since it is a sufficient basis for making a record in the Unified State Register of Legal Entities about the unreliability of the information about the legal entity contained therein. person (about its participant, about a person who has the right to act without a power of attorney on behalf of a legal entity).

In addition, we inform you that the above objections, received by the registration authority in violation of the procedure for its submission (direction), established by paragraph 6 of Art. 9 of the Federal Law of 08.08.2001 No. 129-FZ “On State Registration of Legal Entities and Individual Entrepreneurs”, and (or) not in the form approved in accordance with the specified Federal Law, are not subject to consideration.

www.nalog.ru

Who can submit an application on form P34001

Form P34001 is intended to be completed by individuals: directors or former directors, as well as participants or former participants of legal entities.

The nuance is that through it a person can convey information about the unreliability of information only about himself.

The exception is when the form is filled out by a citizen’s authorized representative, and then only on the condition that the principal’s representative has in his hands a power of attorney notarized according to all the rules.

Step-by-step instruction:

1. Submit an explanatory statement to the Federal Tax Service at your place of residence.

2. Come to a personal appointment for questioning under the protocol.

3. Fill out form P34001 about the unreliability of information in the Unified State Register of Legal Entities.

If everything is done correctly, then an entry will appear in the register that the legal entity has been excluded from the Unified State Register of Legal Entities. At the same time, you need to file a statement with the police that a company has been illegally registered in your name. As a rule, before such an incident, a passport disappears, so you should never be lazy and not write a statement about the theft of documents!

How to send

There are several ways to submit a statement about false information:

- The simplest and most reliable way is to go to the tax office in person and hand over the form to a specialist from the local inspectorate.

- It is allowed to submit an application with the help of a representative, having previously issued a power of attorney for it from a notary.

- Another method is to send the document via regular mail, registered mail with return receipt requested, or via courier service.

- And finally, you can use electronic means of communication - this method of conveying the necessary information to supervisory services has become widespread only recently.

What information can be changed using Form P34001?

The document does not apply to making changes to all items of information about a legal entity from the Unified State Register of Legal Entities.

Using a unified form you can change:

- OGRN;

- TIN;

- Full name of the person;

- Passport details of the director or members of the company, as well as persons representing the interests of companies without a power of attorney.

Any typos in the name or numbers may be considered erroneous. Incorrect spelling of the letters “e” and “e” is taken as false information.

Features of filling out the form

Form P34001 is a unified standard document that is mandatory for use. When filling it out, you need to follow some simple rules.

Information on the form can be entered either by hand or on the computer.

If the second option is used, after filling out the form must be printed (each page is printed on a separate sheet of paper) and certified with a “live” signature of the notifier.

Information on the form must be entered only in capital letters, clearly and clearly (illegibility of data may serve as a reason for refusal to accept the application). If filling is done by hand, it is better to use a blue or black ballpoint pen.

Inaccuracies, mistakes, and blots cannot be made, but if they do happen, they do not need to be crossed out and corrected; it is better to fill out a new form.

You also need to carefully ensure that the information is reliable and accurate - if deliberately false information is discovered, sanctions may follow from regulatory authorities.

The application is prepared in one copy , but if necessary, you can make a copy of it, which, after the tax specialist marks it as accepting the document, you must keep.

Filling procedure

Filling out form P38001 begins with a title page, which consists of 5 points and answer options for them. Near each of them there is a special window, in which the applicant must indicate the corresponding number. It should be noted:

- subject of objection;

- what kind of information the filed objection concerns;

- in connection with which the objection was filed (with the presence of an objection or its withdrawal);

- against whom the objection is filed (a specific legal entity or an indefinite number of persons);

- who submits the document to the Federal Tax Service.

On sheet “A” you must indicate the OGRN and TIN encodings, as well as the full name of the organization in Russian, in respect of which changes are being made to the charter or Unified State Register of Legal Entities.

On sheet “B” you should display information about the documents, in connection with the provision of which an objection was submitted to the Federal Tax Service regarding changes to the charter or entering information into the Unified State Register of Legal Entities. Here we are talking about the date of submission of documents and their incoming number. If such documents are missing, the sheet is not filled out.

Sheet “B” contains information about the legal address, the inclusion of which in the Unified State Register of Legal Entities is being disputed. Here you need to display the following information: postal code, code of the subject of the Russian Federation, district, city, street, house or office number.

On sheet “D” you need to describe in detail the reasons for objections regarding information in the Unified State Register of Legal Entities, changes in the charter, etc. In the sample form P38001 you can see how to do this correctly.

Sheet “D” consists of four pages, which indicate information about the person who submitted form P38001. This may be an individual or an organization. Full name must be indicated on the last page. responsible person and must bear his signature.

Also on the last page of Form P38001, the method of notifying the applicant of the results of the consideration of the filed objection is indicated. Notice may be sent to the applicant:

- by email;

- by mail to the address indicated by the individual;

- by mail to the organization's address.

The sample below for filling out an objection on form P38001 can be taken as a basis. It will be useful to entrepreneurs and companies that are faced with the need to draw up this document for the first time.

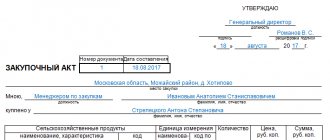

Sample of filling out form P34001

The form consists of several pages. The first indicates the OGRN of the enterprise, its tax identification number and full name (with a decoding of the abbreviation of the organizational and legal status). Below, in encrypted form, it is indicated in relation to which data the applicant expresses his disagreement (one of the three numbers “1”, “2”, “3” must be put in the corresponding cell).

The second page first contains personal information about the individual who is filling out the application. Here his last name, first name and patronymic, information about birth (date, place) is indicated.

Further (here on the second page) the document includes data from a passport or other document identifying the citizen. First, write the document type code (explanations on this point are at the bottom of the page), then its series, number, place, date of issue, department code. Also just below you need to include contact information: telephone number and email address.

In the last part of the document, on the third page of the form, the applicant puts his signature, which certifies the fact that all the information entered in the application is correct. If the application is submitted through a representative, this is also displayed on this sheet.

What information and documents are contained in the Unified State Register of Legal Entities?

The Unified State Register of Legal Entities about a specific organization contains, in particular, the following information and documents (Clause 1, Article 5 of the Federal Law of 08.08.2001 No. 129-FZ):

- full and abbreviated corporate name of the organization;

- organizational and legal form;

- address of the location of the organization;

- E-mail address;

- TIN, KPP and date of registration with the tax authority;

- OKVED2 codes;

- size of the authorized capital;

- information about the founders (participants) of the organization, in relation to a JSC, also information about the holders of registers of their shareholders, in relation to an LLC - information on the size and nominal value of shares in the authorized capital;

- last name, first name, patronymic and position of the person who has the right to act on behalf of the organization without a power of attorney, his passport details, TIN;

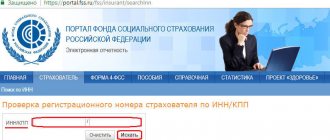

- number and date of registration of a legal entity as an insurer in the Pension Fund of Russia, Social Insurance Fund;

- information about licenses obtained by the organization;

- information about branches and representative offices;

- method of formation of a legal entity (creation or reorganization);

- information that the organization has made a decision to change its location;

- the original or a notarized copy of the constituent document or information that the organization operates on the basis of a standard charter;

- information on legal succession (for organizations created or terminated their activities as a result of reorganization, as well as organizations whose constituent documents are amended in connection with the reorganization);

- method of termination of a legal entity (by reorganization, liquidation or exclusion from the Unified State Register of Legal Entities);

- information that the legal entity is in the process of liquidation or reorganization;

- information about the initiation of bankruptcy proceedings of the organization and about the procedures carried out in connection with this;

- information that the organization is in the process of reducing its authorized capital.

How to file objections to exclusion

Form P38001 consists of nine pages, but not all of them need to be filled out. There is no separate document with rules for filling out the form. All tips and necessary codes are located right on the form.

Like any other form intended for the Federal Tax Service, form P38001 can be filled out by hand or printed out. When filling out manually, blots and errors are possible. Erasures and the use of corrector are not allowed. And corrections must be certified. If you make a mistake, it’s easier to rewrite the entire sheet. If you fill out the form on a computer, this problem will not arise.

Start filling out with the title page. In section 1, indicate code “2” – an objection regarding the upcoming entry of information into the Unified State Register of Legal Entities.

In section 2, indicate one of the codes:

- 1 – if the tax authorities made an entry in the Unified State Register of Legal Entities about the unreliability of the company’s legal address,

- 3 – if the decision on the upcoming liquidation is made for other reasons. For example, the company did not submit reports, so the inspectors considered the organization inactive.

In sections 3 and 4, enter code “1”; leave section 5 blank.

Then look at the footnote at the bottom of the title page. Since we indicated code “1” in section 2, it is necessary to fill out sheets A, B, D and E. Sheet B does not need to be filled out and included in the report. We simply remove it from the form. If you indicated code “3” in your section 2, then fill out sheets A, B, D and E.

Sheet A contains only three fields:

- OGRN,

- TIN,

- Full name in Russian.

We fill in information about the organization that the tax authorities are planning to exclude from the Unified State Register of Legal Entities.

On sheet B, fill in the legal address of the organization. Indicate the address that is contained in the Unified State Register of Legal Entities and the accuracy of which the tax authorities doubted.

If the disputed address is truly inaccurate, then you do not need to fill out Form P38001. In this case, the inspectors' claims are fair. To prevent the company from being excluded from the Unified State Register of Legal Entities, submit application P14001 with the correct address.

On sheet D, in free form, state the essence of your objections. Please note: the text must make it clear why the applicant is an interested party. Otherwise, tax officials will not conduct an audit.

Sheet D includes four sheets, fill in only the necessary information. In section 1 of sheet D, indicate who the interested party is:

- 1 – individual,

- 2 – head of the interested legal entity,

- 3 – representative of the interested legal entity, acting by proxy.

If in your case the interested party is a legal entity, then fill out sections 2, 3 and 5 of sheet D. If the interested person is an individual, for example, the founder or director of a company, fill out sections 4 and 5.

In section 4, indicate the details of the individual interested in establishing the reliability of the Unified State Register of Legal Entities:

- Full last name, first name and patronymic without abbreviations,

- Date and place of birth,

- Identity document code. Take the codes from Appendix No. 3 to the Requirements approved by Order of the Federal Tax Service dated June 9, 2014 No. ММВ-7-14 / [email protected] The Russian passport is indicated by the code “21”,

- Series, number, date of issue of the identity document and name of the authority that issued the document.

In section 5 of sheet D, select the method in which the Federal Tax Service will inform you about the results of consideration of objections. In subsection 5.1, indicate your current phone number. Tax authorities should be able to quickly contact you to resolve any issues that may arise. This will speed up the verification of objections and decision making.

If you want to receive the result of the review by email, fill out subsection 5.2. Tax officials can send the result of the review by mail to the address of an individual. To do this, you need to fill out subsection 5.3 of sheet D. If the interested party is a legal entity, the tax authorities can send the result of the review by mail to the legal address.

On page 4 of sheet D, fill out only one field: “Please notify me of the results of the consideration of this objection.” Leave the remaining fields blank. If the application is submitted personally by the head of the company, he will sign in the presence of the tax inspector. If the application is sent by mail or transmitted through a proxy, then the manager’s signature is affixed in the presence of a notary.

Sample application P34001

The document has three sheets. The first page contains two items:

- Information about the organization. Here you should enter the OGRN, INN and full name of the company. The name is indicated in quotation marks, for which it is also necessary to allocate a cell.

- Incorrect information about an individual (manager or participant) indicated in the Unified State Register of Legal Entities. In this paragraph, you should enter a number from 1 to 3. The first number is written if the specified information about the person who has the right to act without a power of attorney is incorrect. 2 – if false information about the participant or founder is provided. 3 – other information about the individual is incorrect.

Attention! You cannot enter multiple symbols in one cell.

The second and third pages contain information about the applicant, that is, about the head of the organization.

There are seven points in the block:

- Full name. Separate lines are provided.

- Birth information (exact date and place). In this case, it is not advisable to abbreviate the designation of the point (city, district, village, town).

- Information about the identity document (passport). One cell is skipped between the series and the number. The place of issue must be identical to the passport, including abbreviations. An empty cell is intended for the point. Entering punctuation marks and letters together is prohibited.

- Information for contacting the applicant. You should enter your phone number or email address here.

- The surname, first name, patronymic and signature of the applicant are indicated in full, separated by spaces.

- Position, signature, surname and initials of the Federal Tax Service employee who received the application in paper form by mail.

- Position and TIN of the person who confirmed the signature of the representative (notary or his deputy).

At the bottom of the page there are two footnotes - explanations for the indication of the patronymic and the code of the identity document. The code of a passport issued to a citizen of the Russian Federation is 21.

Each page must be signed. The empty space intended for filling by the tax office is not filled.

Interesting fact! The document does not provide for a clause on making changes to the company’s registered address. For such changes, an application should be filled out in form P34002.

Deadlines for providing information

https://www.youtube.com/watch?v=ytpressru

The Regulations establish the following deadlines (clause 18 and clause 109 of the Regulations):

- the tax office must send information or copies of documents no later than five days from the date of receipt of a regular request or on the next business day after receiving an urgent request;

- the authorized organization is obliged to provide access to the registers no later than five days from the date of receipt of the request;

- an electronic extract from the register must be ready no later than the day following the day of registration of the request in the Internet service on the Federal Tax Service website.

34001 consequences form for the director download

In this case, a decision to exclude an inactive legal entity from the unified state register of legal entities is not made.

5. The procedure for excluding a legal entity from the unified state register of legal entities provided for by this article also applies in the following cases: a) it is impossible to liquidate a legal entity due to the lack of funds for the expenses necessary for its liquidation and the impossibility of assigning these expenses to its founders (participants); b) the presence in the unified state register of legal entities of information in respect of which an entry was made about their unreliability, for more than six months from the date of making such an entry.

but since the legal entity has debt

There is an unpaid tax debt (fines) of 35tr.

such an exception from the Unified State Register of Legal Entities seems impossible.

2.

What information can be objected to?

Form P38001 allows you to challenge upcoming changes to the company’s charter or to the unified state register of legal entities. The disputed information is divided into several groups:

- Changes to the charter,

- Changes in the Unified State Register of Legal Entities,

Where should I file a complaint about false information? Shipping methods

The Tax Service accepts the document in paper form. It is served in three ways:

- in person at the tax authority in the area where the organization was registered;

- in writing by mail;

- through a legal representative.

Remote submission of an application through State Services or in the personal account of the Federal Tax Service is not yet provided.

For prompt reception to the Federal Tax Service, a legal entity should first make an appointment using the request “Reception/issuance of documents”. When contacting in person, minor comments, such as affixing a date and signature, are eliminated.

If the application is sent by mail, the applicant must be sure that it is completed flawlessly. It is best to send by registered mail with acknowledgment of receipt.

How can I submit an application to the tax office?

There are several ways to file a Form 38001 objection:

- In person at the tax office. In this case, you will have to stand in line, but there is no need to have the documentation certified by a notary.

- With the help of a representative. This option will allow you to delegate this task to another person. It is necessary to issue a power of attorney and have the documentation certified by a notary.

- Submit online. This method is fast, but requires an electronic digital signature.

- By post. The documentation must be certified by a notary and sent to the address of the tax authority. We would not recommend this method, as sometimes it takes quite a long time for the shipment to arrive.