In some situations, an entrepreneur needs to find out information about a company or confirm information about himself. This can be done using an extract from the Unified State Register of Legal Entities - the register of legal entities. However, when designing it, you need to take into account several important nuances.

In this article we will tell you how to independently obtain an extract from the state register of legal entities. You will learn how to order a paper statement from the tax office or an electronic one. You will also find out in what situations you will need an extract and what data it contains.

More information about the Unified State Register of Legal Entities and extracts from it

Unified State Register of Legal Entities, or the Unified State Register of Legal Entities, is a register in which all information about legal entities registered in Russia is entered. It is administered by the Federal Tax Service. Any company is required to have an entry in the register; without it, it has no right to operate. Companies are entered into the register during the process of registration or reorganization.

The entry in the register contains basic information about the company - type, date of registration, types of activities and others. Each legal entity is assigned a registration number - OGRN. If anyone needs information from the register, they can request an extract from it. The extract displays all the information about the company entered in the register.

The register of individual entrepreneurs, the Unified State Register of Entrepreneurs, is structured in a similar way. The Tax Service enters information about registered individual entrepreneurs into it. An entrepreneur in the register also receives a registration number - OGRNIP. From it you can get information on any entrepreneur in it.

The procedure for maintaining registers of legal entities and individual entrepreneurs is determined by Federal Law No. 129-FZ “On State Registration of Legal Entities and Individual Entrepreneurs”.

Another way to get information

As we have already said, a full statement about yourself can be obtained using a special Internet service on the Federal Tax Service website. In addition, the tax service website has the ability to obtain information from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs in the form of a simple printout (https://egrul.nalog.ru/). No special software or electronic signature is required for this. The service works as follows: the user is given a link, which, when clicked, opens a file containing data from the registry. This file can be viewed on your computer screen and printed. In this way, you can obtain information both in relation to yourself and in relation to other organizations and entrepreneurs. However, keep in mind that the printout is not an official document (although it contains almost all the same data as a full statement).

In conclusion, we note that receiving even a full extract from the Unified State Register of Legal Entities or the Unified State Register of Individual Entrepreneurs, according to tax authorities, does not indicate that the taxpayer took all the necessary precautions when choosing contractors (see “The Federal Tax Service reminded what due diligence measures taxpayers need to take when choosing selection of counterparties").

Why do you need an extract from the Unified State Register of Legal Entities?

An extract with information about the company may be needed by its manager or representative in the following situations:

- When opening a current account, taking out a loan or deposit

- When completing real estate transactions

- When participating in auctions, tenders and purchases

- When there is a change in the composition of the founders and a change of director

- Upon liquidation or reorganization of a person

- During legal proceedings, both the plaintiff and the defendant need

- For other purposes - for example, it may be required when making a seal or obtaining a license

This document replaces the certificate of registration of a legal entity, which is not issued since January 1, 2020. It also additionally confirms the relevance of information about the company.

An extract about another legal entity is necessary to verify it. It can be used to determine whether such a company is registered at all, by whom it was organized, what types of activities it is engaged in, whether it was reorganized or liquidated. Studying a statement for another company is an important element of checking the counterparty before cooperation.

Not only a company, but also an individual (including individual entrepreneurs) can receive an extract. Using the information in it, a person can study the company in more detail - for example, check the date of registration or the availability of licenses. Using the data from the document, you can further evaluate the reliability of the company before contacting it.

What is contained in the extract from the Unified State Register of Legal Entities

An extract from the register of legal entities contains all the basic information about the company:

- Information about the status of the company

- active or already closed - Basic information about the legal entity

: organizational and legal form, full and abbreviated names, TIN and KPP

Legal entity registration address- Information about the authorized capital

and its amount - Information about registration or reorganization

of the company - Information about the director and founders of the company

, information about shares in the authorized capital - Activity codes according to OKVED

- License information

(if any) - Information about registration in funds

- Information about branches and representative offices

(if any) - If a legal entity is liquidated or ceases its activities - information about liquidation or termination of activities

- Information on making changes

to the record of a legal entity, including correction of errors (if any)

There are several categories of statements. The standard one is issued at the tax office in paper form and with a blue seal. Electronically issued online and certified with a digital signature. Extended statements are issued only upon official request from government authorities. In addition to information from the standard statement, it contains information about the accounts of a legal entity, passport and registration data of managers, founders and co-owners.

What does the statement look like (using the example of the Excellent Cash company)

How to get an extract

There are three ways to obtain information from the registry:

- At the tax office

. Here you will need to submit an application, pay the state fee and wait for the document to be produced. You will receive a paper version with a blue stamp - it has legal force and will be accepted in any authority - Online on the Federal Tax Service website

. To do this, just register on the website and send a request to the tax service. There is no need to pay state duty here. The electronic document is certified with a digital signature of the Federal Tax Service - Through a specialized company or online service

. Employees of such a company will themselves generate a request to the tax service and collect information about the legal entity. Such services often offer comprehensive verification services for various parameters. The services of such companies are paid, and the statements you receive may not have legal force.

Let's take a closer look at the first two methods.

Receiving a paper statement

You can obtain an extract from the register of legal entities on paper at any branch of the tax service. It is not necessary to contact the branch where you are registered. This can also be done at the MFC.

A paper statement can be standard or urgent. The standard one is issued 5-7 days after submitting the application, the urgent one - the very next day. At the same time, the state fee for obtaining an urgent extract is twice as high.

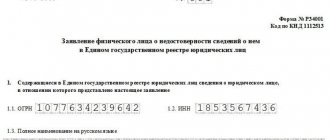

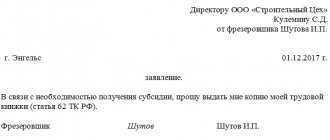

At the branch or MFC you need to write an application to provide information about the legal entity you need. The form can be obtained from a tax officer. In the application, you need to indicate the name, OGRN and TIN of the company for which you want to issue the document, and whether it is required urgently.

Sample application form

How to get an extract from the Unified State Register of Legal Entities using OGRN or TIN online and check it

Public information from the database can be checked free of charge and online. To do this you need:

- Go to the website of the Federal Tax Service tax.ru (https://www.nalog.ru);

- Select the “Electronic services” tab;

- Find the register through the item “Checking the counterparty and yourself.”

The name of the service was not given to it by chance. It reflects possible risks associated with a person’s safety from making dubious transactions and mistakes. Anyone can check information about a legal entity by indicating its INN or OGRN.

After completing the first three steps, you must:

- Select the type of business entity of interest;

- In the field, enter its TIN, OGRN or name of the subject;

- Enter captcha (protection against spam robots);

- Click the “Search” button and get all the available information if the subject exists.

https://youtu.be/QdUbYHxIIdg

Questions and answers

How long is an extract from the Unified State Register of Legal Entities valid?

Laws establish a specific validity period only for the following situations:

- When participating in tenders for placing government orders - 6 months

- When confirming a transaction on the alienation of authorized capital - 10-30 days

- When submitted to an arbitration court - 30 days

In other situations, there are no legal restrictions on the validity period of the extract. However, some companies (for example, banks) may set their own requirements for the validity period. It is also advisable to order a fresh statement when checking a counterparty.

Is an electronic statement equal to a paper one?

An electronic statement has the same legal force as a paper one only when it is certified by a digital signature of the Federal Tax Service. Otherwise, it can only be for informational purposes. A printed electronic or scanned paper statement also has no legal force.

Is there a difference in the data provided in urgent, standard and electronic statements?

All three types of statements contain the same information - information about the legal entity, registration data, a list of activity codes, and others. The difference is only in the method and speed of receipt.

In what situations can an extended statement be issued?

The extended statement contains information that is not publicly available. Therefore, it is provided only to the legal entity itself or to government agencies upon their request. It cannot be obtained from another person.

How many times a year can requests be submitted to the registry?

You can receive statements, both for yourself and for other legal entities, an unlimited number of times. Pay attention to the speed of receiving the document and, if you receive it in paper form, the amount of the state fee.

Where can I find out the OGRN and INN of the company for which I need to request information?

You can find out this information in the database of registered organizations on the Federal Tax Service website. To do this, just search for a company by its official name.

Types of certificates and the possibility of obtaining them

Depending on the method of receipt, they are divided into extracts:

- On paper. A document officially provided by the service, composed of connected numbered pages, certified by the official seal.

- In electronic format. A file with data from an information base, including publicly available information. It does not have legal force and cannot act as an identification document in government agencies.

BY THE WAY! There are many websites on the Internet that provide services for obtaining statements. But this version contains only general information that is of a public nature and is in the public domain.

The statement received online is an official document. Photo: argumenta.ru

The official version of the statement may be:

- Regular. Includes publicly available data and is available to any applicant. It does not contain personal data and contacts of the founders and the head of the organization, as well as financial data;

- Extended. Contains comprehensive information about the company. Issued at the request of government authorities and extra-budgetary funds. It is issued to the organization itself upon its registration or adjustment of the statutory documentation;

- Urgent. Prepared within one day from the date of submission of the application;

- Not urgent. Issuance takes place within five days;

- Provided free of charge;

- Issued on a paid basis.

Receive an online tax statement

An electronic version of the certificate can be requested on the tax portal. It is provided free of charge. To obtain information you will need:

- Go to the website and register on it. For this purpose it is necessary:

- Login to the registration section;

- In the account register, enter your email name and password;

- Specify the user's full name;

- Enter verification data and continue the process;

- A notification about activation of the account line is sent to the specified email address;

- After confirming your address using the link received, log in to the service using your details.

- Create a new application, enter organization codes.

- The applicant is sent a notice of registration of the request.

- Enter the list of applications. The help will be prepared within several hours depending on the server load.

- When the information is prepared, the status of the request will change. It can be downloaded here.

What is an extract from the Unified State Register of Legal Entities, watch in this video:

https://youtu.be/8O_Qo-uTkm0

BY THE WAY! The information will be prepared in the form of an Excel file and contain public information. They do not include passport details, places of residence of the founders and bank account details. It must be remembered that an extract in electronic format cannot be considered a full-fledged document, since it is not certified by the seal of the service and the signature of the employee.

In a situation where information about a company is urgently needed, it will be very useful. IT IS IMPORTANT TO KNOW! An applicant who has an electronic digital signature that allows him to certify any documentation can order an extract online using the service of the Federal Tax Service of the Russian Federation.

To do this, you will need to select the appropriate region and the tab with legal entities on the portal, enter the necessary data, read and confirm your agreement with the terms. The answer will be presented in a way convenient for the applicant. The document received in this way is certified by the digital signature of the tax authority and has legal force as its paper counterpart.

Validity period of an extract from the register of legal entities

The validity of the certificate may vary depending on the authority presenting it and the situation in which it is required. These may be cases:

- Certification of a property transaction at a notary office. Thus, the sale of part of the authorized capital of an LLC is accompanied by the presentation of an extract, the validity of which is no more than thirty days before contacting a specialist. And notarization of a copy of the agreement certifying the powers of the subject to alienate is carried out upon presentation of a certificate drawn up no earlier than ten days before visiting the office.

- When submitting an application for participation in tenders/purchases organized by government agencies and municipalities, an extract received no more than six months before the event is submitted in the documentation package.

- Submitting a claim to the Arbitration Judicial Bodies is accompanied by the attachment of a certificate, which was drawn up no earlier than a month.

What does an extract from the Unified State Register of Legal Entities look like when received online? Photo: spark-interfax.ru