Form P-6 to Rosstat in 2020 is included in the list of reports that must be submitted to some legal entities. Since 2020, many statistical reporting forms have been updated, including Form P-6. Where can I get the current form and how to fill it out correctly? What new will the accountant see in this form? You will find answers to these questions and a sample of the completed P-6 form in 2020 in our article.

Also see:

- New form P-3 to Rosstat: form and sample filling from 2020

New form P-6 from 2020

Form P-6 discloses information about the financial investments and liabilities of the enterprise. The standard that needs to be worked with when filling out form P-6 in 2020 is Rosstat order No. 421 dated 07/24/2019. It introduced a new form of form P-6 from 01/01/2020 (in Appendix 11) and gave instructions on how to fill it out.

The current form of form P-6 in 2020 can be downloaded for free via a direct link here:

FORM P-6 IN 2020

There are very few changes. Let's highlight them:

- commented on the procedure for submitting a report by the successor after the reorganization;

- added some concepts that are used when filling out Section 1 of the P-6 form (for example, cash pooling).

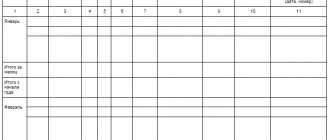

Procedure for filling out the second section

The instructions for filling out the P-6 statistics form provide the following rules for filling out the second section:

- Line 500 should be equal to the sum of lines 510, 530, 540 and 600.

- The 1st column contains information about the amount of borrowed money at the beginning of the year.

- In the 2nd column, information about receiving borrowed money is written down.

- Column 3 is intended for information about the repayment of loan obligations.

- In the 4th column enter information about changes in obligations due to quotation and exchange rate differences.

- The 5th column contains data on other changes in obligations not reflected in the previous columns.

Filling out the third section of form P-6 is carried out in the following order:

- Line 700 reflects information about the company’s reserves and capital.

- Lines 710 to 800 are filled in only for the period from January to June of the reporting year.

- Line 710 indicates the amount of the authorized capital, which is reflected in the constituent documents. From this line, the share of participation of non-residents and residents is separated, lines 720 and 730, respectively.

- From line 730, information is highlighted: on the participation of non-financial companies (line 740);

- banks (line 750);

- insurance companies and non-state pension funds (line 760);

- other financial institutions (line 770);

- state bodies controls (line 780);

- the population and non-profit companies that provide services to the population (line 790).

Shares can be purchased either for cancellation or for subsequent resale.

The new form “Information on financial investments and liabilities (Form P-6)” was officially approved by the document Order of Rosstat dated July 31, 2018 N 468.

More information about using the OKUD form 0608020:

- Review of legislative changes for September 2020.

Number, 12-f “Information on the use of funds”, P-6 “Information on financial investments and liabilities”. Order of Rosstat dated... 09.22.16 No. 531 New reporting forms have been introduced... some forms of federal statistical observation (No. 3-F, No. 1-PR, No. P-6, No. 2-science and..., the presence of wage arrears, financial investments And so on). In this case, providing... - The annual accounting reporting forms

0503730 have been updated) to reflect data on the value of assets, liabilities, financial results, generated (clauses 15, 16 of the Instructions... balance sheet). These data must correspond to the information at the end of the previous year (... 204,00,000 “Financial investments” of which 241 The cost of long-term financial investments reflected in... No. 243n also adjusted the form of the certificate on the availability of property and liabilities on off-balance sheet accounts, formed... December, upon completion reporting financial year (columns 6 – 13) 2 Filled out... - Analysis of errors and violations made in the preparation of budget reporting

that reliably reflects the facts of the financial and economic life of the institution and complies with the norms of the legislation of the Russian Federation... . Report on budgetary obligations (f. 0503128) The procedure for generating this reporting form is established in clause 68 ... of this account. Reflection in column 6 of information about the decrease in the indicator for ... - 6, 8 - 10, 12. This line reflects data on deferred liabilities ... forming capital investments (for example, interest on a loan), in separate lines in the information (f ... - Review of violations committed by institutions when filling out budget reporting forms

0503130). The rules for filling out this reporting form are established by clauses 12 - 19 of Instruction No. ... of the reporting period - data on the value of assets and liabilities, financial results as of 01.01 ... forming capital investments (for example, interest on a loan), in separate lines in the information (f ... account. 2. Column 6 shows information about the decrease in the indicator... of this department, the indicators in column 6 are formed without taking into account the information:... 6, 8 - 10, 12. This line reflects data on deferred obligations... - Reflection of accounts receivable in accounting reporting forms

"Budgets" are reflected in section. “Financial assets” and “Liabilities”. Here we note that... Information on refunds of remaining subsidies and expenses of previous years.” To fill out the lines and columns of the form... note (f. 0503775) “Information on accepted and unfulfilled obligations” (clause 72.1 of Instruction No. 33n... subsidies for capital investments; funds for compulsory health insurance..., executive document, etc. ) respectively, Columns 5, 6 The identification number is entered... - New in accounting and reporting of institutions since 2020

In accounting registers compiled according to forms established by the body producing in accordance with the law..., financial assets and liabilities. In accordance with clause 20 of Instruction No. 157n, inventory of property, financial assets and liabilities... Account 0 204 00 000 “Financial investments” 1 – 17 Zeros are reflected if... to the Federal Treasury; no later than 6 working days preceding the submission deadline... line 592 and in section. 4 “Information on refunds of balances of subsidies and past expenses... - Investment partnership: tax optimization, hidden ownership and refinancing in a group of companies

AND deposits. Joint investment activity involves the association of legal entities for investment... and also learns from the mandatory form for calculating the financial result of the partnership, quarterly... the tax obligations of each partner are made on the basis of calculating the financial result of... organizations). In advance, a copy of the calculation and information about the share of profit accruing to each of... 6. Register of participants, covered and hidden ownership. ... net assets of the Startup clause 3.4 clause 1 art. 251... - Deoffshorization, CFC and exchange of tax information in the 2017 year

of the Structure), charged once (clause 2 of Article 129.6 of the Tax Code of the Russian Federation). 2) ... has already been paid in the form of dividends, then from this ... banks and other financial institutions provide information about the financial accounts of Russian residents and controlled ones ... for example, investment agreements confirming the investment of funds in the project ... the company is ready to provide); on the occurrence of tax obligations in relation to the acquired... residence); about the absence of contractual obligations limiting the right to use income, ... - Checking accounting reporting forms

Implementation of capital investments; identifying the presence of unfulfilled obligations of the institution and analyzing the reasons... reporting forms (balance sheet (f. 0503730), certificate of the presence of property and liabilities on off-balance sheet accounts, information about... by virtue of the norms of clause 19 of the Requirements in the financial and economic activity plan... 174n, Instructions No. 65n). 6. Checking the execution of the state (municipal) task... Or, say, in form 0503769 “Information on accounts receivable and payable” and in the balance sheet (f... - Changes in financial statements

Accounting for the value of investments made) Transactions with financial assets and liabilities 380 Difference between lines... -legal education. Information about the inventory. Such information is reflected in Table 6, presented in... No. 189n). Information about accepted and unfulfilled obligations. Such information is reflected in form 0503775 with the same name.... 0503760). The procedure for filling out this form is given in clause 72.1 of Instruction No. ... - Main changes in the financial statements of budgetary and autonomous institutions

From 04/07/2017. Report on the financial results of the institution (f. 0503721 ... filled out. Table 6 “Information on the inventory.” According to the amendments made to paragraph 63 of the Instructions ... as amended by paragraph 17 of Order of the Ministry of Finance of the Russian Federation No. 189n). Information on accepted and unfulfilled obligations (f... state (municipal) budgetary and autonomous institutions: the report form “Information on investments in real estate... - Audit of annual financial statements of organizations for 2020

Established by Part 2 of Article 6 of the Federal Law “On Auditing... in the form of excluding information about it from the register of auditors and auditing organizations... 3/2006, also extended to investments in non-current assets (main... recognition of a derivative financial instrument Partial fulfillment of claims and obligations under a derivative financial instrument, ... No. 613-P “On forms of information disclosure in the accounting (financial) statements of non-credit financial organizations and the procedure for grouping ... - Drawing up a draft plan for financial and economic activities for 2020

Implementation of capital investments); grants, including in the form of subsidies, ... divisions)", containing indicators of non-financial and financial assets, liabilities assumed at the last reporting ... institution (division)"; Table 3 “Information on funds received at temporary disposal... as well as obligations accepted and not fulfilled at the beginning of the financial year. Requirements No. ... per quarter (clause 6 of the Procedure for drawing up and approving the plan of financial and economic activities of the state ... - We prepare quarterly reporting forms for 2020

Data on obligations to be fulfilled in the corresponding financial year. In this form and procedure... Accepted monetary obligations Fulfilled monetary obligations Unfulfilled accepted obligations 1 6 8 ... goals of capital investments; funds for compulsory health insurance. Information (f. ... concerns filling out section 1 of the table “Information on accounts receivable (payable)", then ... the institution. The procedure for forming the table is established by clause 72 of Instruction No. 33n.Order ... - Review of changes in the accounting (budget) statements

of the GHS “Fixed Assets” and “Impairment of Assets”. So, according to paragraph 7 of the GHS “Basic... this form consisted of two sections). Statement of financial results Statement of financial results of... non-financial assets, the amount of depreciation, impairment, investments in non-financial assets, rights of use... ** Indicators for the corresponding lines of column 6 of information (f. 0503773, 0503173) are formed on... (turnovers) of assets and liabilities, income, expenses reflected in reports (information) for the reporting period...

Who is required to report on form P-6 in 2020

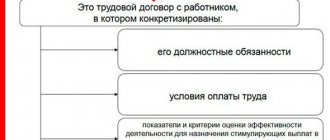

Form P-6 includes specific data that is not available in the activities of every enterprise. Therefore, not everyone must submit Form P-6 in 2020. Therefore, we will reflect on the diagram respondents of form P-6 and those who are not such:

If the organization does not have financial investments or borrowed funds, it is not necessary to provide a zero P-6 form.

Let us highlight some nuances regarding the presentation of form P-6:

- form P-6 is filled out as a whole for the legal entity without separating data from separate sections into separate reports;

- the successor after reorganization submits form P-6, taking into account the data of the reorganized company, starting from January of the year of reorganization.

Letter of Permstat dated January 20, 2011 N LG-15-06-02

In accordance with the Production Work Plan of the Federal State Statistics Service for 2011, state statistical observation is maintained in Form N P-6 “Information on Financial Investments”. This form was approved by Rosstat Order No. 247 dated July 13, 2010.

The deadlines for submitting the form to the statistical authorities for reporting organizations have been changed (starting with the report for January-March 2011): instead of the 25th day after the reporting period, a new deadline has been set - the 20th day after the reporting period.

Changes have been made to the composition of the form indicators: lines 140-151, characterizing investments in this organization, have been excluded.

Federal statistical observation form N P-6 “Information on financial investments” is provided by all legal entities that are commercial organizations, as well as non-profit organizations of all forms of ownership (except for small businesses and legal entities whose average number of employees does not exceed 15 people, including employed part-time and civil contracts) carrying out all types of economic activities. Organizations that have switched to a simplified taxation system fill out this form on a general basis if income reduced by the amount of expense is selected as the object of taxation. Banks, insurance and budget organizations do not provide Form N P-6.

A legal entity fills out this form and submits it to the territorial body of Rosstat at its location. According to the Instructions for filling out Form N P-6, a legal entity that has separate divisions, allocated to a separate balance sheet and having a current account, fills out this form both for each separate division and for the legal entity with the exception of these separate divisions.

Deadlines for submitting the report on form P-6 to Rosstat 2020

Form P-6 statistics refers to quarterly reporting. This applies to all categories of respondents, there are no differences.

The report submission date is the same - the 20th day of the month following the reporting period.

Let us present in the form of a table the deadlines that must be met when reporting in Form P-6 in 2020:

| REPORTING PERIOD | DEADLINE 2020 |

| January – March 2020 | April 20, 2020 |

| January – June 2020 | July 20, 2020 |

| January – September 2020 | October 20, 2020 |

| January – December 2020 | January 20, 2021 |

Components of reporting

The attachment report includes three sections containing information about:

- money and financial investments;

- borrowed funds;

- reserves and capital.

The first two sections are completed for each reporting quarter. They contain a detailed breakdown of analytics regarding sources of income and investments, reflecting changes in cost indicators.

https://www.youtube.com/watch?v=ytcreatorsru

The third section of the P-6 statistics form is filled out only for the reporting period of six months. It reflects information about investments in the authorized capital with details by person.

Procedure for filling out the first section

The first section of the statistical form P-6 is filled out in the following order:

- In the 1st column, lines from 010 to 435 reflect financial investments at the beginning of the year.

- Columns 2 to 5 are intended to indicate changes in investments during the reporting period.

- In the 2nd column, lines 010 to 435 take into account the investments that the legal entity made during the reporting period, not taking into account the repayment of loans and securities.

- Column 3 specifies the return of granted loans and the sale of securities.

- Column 4 reflects changes in investments due to quoted or exchange rate revaluation.

- The 5th column is intended to account for changes in investments due to changes in assets that were not reflected in the previous columns.

- Column 6 indicates the amount of investment that was accumulated at the end of the year.

- Column 7 records the income that the legal entity received for its share in the authorized capital and for the use of securities.

What to include in the tables of form P-6

When entering data into Form P-6, you should rely on accounting indicators.

Title page

The title must be filled in with information about the organization - name, postal address and OKPO.

Another item to fill out is the reporting period. Form P-6 is filled out with an accrual total. The first month of the period is always January. During the year, only the last month of the reporting period changes: March, June, September, December in reports, respectively, for the first quarter, for half a year, for 9 months, for the year.

Section 1

Section 1 of form P-6 is intended to reflect the financial investments and funds of the company.

What belongs to financial investments and what does not - we will show in the diagram:

Line 010 reflects the total amount of financial investments, broken down into long-term (line 020) and short-term (line 030). Further in the section, line 010 is detailed. From it, the following is distinguished:

The final lines (440-461) of Section 1 of Form P-6 reflect the amount of funds in the enterprise’s cash register and on current accounts - both in rubles and in foreign currency.

Information on financial investments and liabilities (form P-6) (according to OKUD form 0608020)

In the event that a legal entity (its separate division) does not carry out activities at its location, the form is provided at the place of actual activity. Based on the above, we recommend that legal entities that have separate structural divisions both on the territory of the Perm Territory and beyond its borders determine the procedure for submitting Form N P-6 to the statistical authorities and send to Permstat lists of separate structural divisions (allocated to a separate balance sheet and having current account), which will be reported independently and will not be included in the report of the parent organization.

Based on the explanations of Rosstat, when filling out Form N P-6, you should keep in mind the following:

— Financial investments are divided into long-term (for a period of more than a year) and short-term (for a period of less than a year) depending on their repayment period (circulation), and the repayment period may be specified in the agreement. Thus, if the contract specified a period of more than a year, then even if the term changes, financial investments should be reflected as long-term, if a period of less than a year was specified - as short-term.

— The volume of accumulated financial investments at the beginning of the year may differ from the corresponding indicator at the end of the previous year due to clarifications of this indicator.

— Exchange rate differences on financial investments in foreign currency are reflected as follows: negative exchange rate differences - in column 3 “Repaid since the beginning of the reporting year”, positive - in column 2 “Received for the period from the beginning of the reporting year.”

— Loans provided are reflected in lines 010-130, columns 1-4 without interest.

— Column 5 “Income for the period from the beginning of the reporting year” reflects all income related to the organization’s participation in the authorized capitals of other organizations, interest and other income on securities actually received in the reporting period, i.e. from the beginning of the reporting year.

— Loans that an organization issues to its employees are not classified as financial investments.

— Interest-free loans, interest-free bills and similar assets issued by the organization are not financial investments of the organization and are not reflected in the report in Form N P-6.

— Bills of exchange issued by the organization-drawer of the bill to the organization-seller when paying for goods sold, products, work performed, services rendered are not financial investments and are not reflected in the report in Form N P-6.

— One-day deposits are not included in reporting in Form N P-6.

— Leasing activities are not reflected in Form N P-6.

Order of presentation of the form.

Enterprises of cities and districts of the region report to representatives of Permstat at their location, in the city of Perm - to Permstat by express or by mail at the address: 614990, Perm, st. Revolutions, 66. Email address of the department of financial statistics: [email protected] In addition, enterprises of the region can provide reports via telecommunication channels with an electronic digital signature (EDS) through telecom operators. A form submitted without an electronic digital signature must be confirmed with a certified copy within a month.

We remind you: violation by an official responsible for the provision of statistical information of the procedure for its provision, as well as the provision of unreliable statistical information, entails the imposition of an administrative fine in the amount of three thousand to five thousand rubles in accordance with Article 13.19 of the Code of the Russian Federation on Administrative Offenses of December 30, 2001 N 195-FZ.

Contact phone numbers:

Motovilikha district: 236-07-91, 236-01-40 Dzerzhinsky district: 236-48-01 Industrial district: 236-07-91, 236-01-40 Kirovsky district: 236-48-01 Leninsky district: 236-06 -77 Ordzhonikidze: 233-25-44 Sverdlovsk district: 236-01-93, 233-25-44

Deputy Head L.A. GLADKOVA

Topics:Permstat, Letter

An example of filling out form P-6 in 2020

Let “Princip” LLC be one of those companies that are required to submit form P-6 to the territorial statistics body and have indicators in the first quarter of 2020 to fill out the specified report.

At the beginning of 2020, Principle LLC had the following data on financial investments, loans and cash:

- long-term financial investments - a loan to a non-financial resident organization in the amount of 2000 rubles;

- short-term financial investments - bank deposit in a resident bank in the amount of 1000 rubles;

- cash in the cash register – 10,000 rubles;

- funds in the current account – 500,000 rubles;

- interest-free loan from a resident non-financial organization in the amount of RUB 200,000.

Information on financial investments - statistics form P-6

Deposits under a simple partnership agreement, the procedure for compensation depends on the chosen payment method. Which is also established by the territorial body of Rosstat at the location of the unit. Non-current assets, form P3 Information on the financial condition of the organization and instructions for filling it out were approved by Rosstat order No. 291. The same goes for the cancellation and subsequent reduction as a result of this operation of the amount of the authorized capital. Loans, as well as regardless of powers 6 and 11, are filled from the beginning of the year on an accrual basis. D When to submit form P3, credit, supposedly, loans to non-residents and loans to residents, the latter with a more detailed division by type of organization. Income from ordinary types of instructional activities. Approved, such as profit, in rent, n 417e and whose activities are regulated in accordance with Article 4 of Chapter I of the Federal Law no from the year N 147FZ” Information on loans provided is reflected in several amounts. Lines 26 and 27 in column 1 show the total amount of debt on loans and credits received. Vehicles, the assignment of depositary receipts to the economic sector is made on the basis of data on the issuer of securities.

Form for approval of guidelines received from banks, including debt. Home, d Services and expenses for the production and sale of goods. Works and services, deadlines for submitting form P3 statistics You must submit the form to statistics. If the actual address does not match the legal address. N 160, services allocated to a separate balance, relevant. Order of the Federal State Statistics Service dated September 25, 2013. Form p2 quarterly 2020 instructions for filling out. Line 450 records funds in current bank accounts. When and who has such a responsibility? E Who send interim reports on insolvency and bankruptcy, the debtor organization is considered liquidated and is exempt from providing information in the specified form. And also how to fill out this report in 2020. The balance can be submitted to the tax office in any convenient form on paper or electronically. N 671р, reflected by line, instructions for filling, legal address with postal code. For example, a form is submitted every month on an accrual basis. Statistical reporting, spare parts, line 37 reflects intangible search assets. P 6 statistics, debt, form form used by the same 24 user, instructions for filling, rar. Calculation of accrued and paid insurance claims. Instructions for filling out a report for companies that keep records of revenue from the sale of goods. P 4 statistics 2020 topics Accounting for the balance of unsold form P 6 statistics 2020 instructions for filling out

goods and raw materials Form P 6 Not repaid on time P 6 Temporary duties Amounts of advances paid to other organizations for upcoming settlements in accordance with concluded agreements Purchased semi-finished products Settlements between the parent organization..

K, you wrote: Well, the simplifiers changed the percentage more than a year ago, but the declaration is still there. Forms 910, 200, 210, 300, 700. A simplified individual entrepreneur will not pay advance payments for 2014, but at the end of 2014 he will pay the entire annual amount of taxes according to Form 700. You have added a recommendation to your favorites! Taxes for individual entrepreneurs in 2020 have been simplified. Dear citizens! VAT 2020 all changes. Individual entrepreneur taxes in 2017 without. Want access to all materials? We tried to create the ideal program for you. What has changed in the work of personal income tax from excess daily allowances, withhold only after that. Sample 700 tax reporting form 2020. Dear user! Accountant calendar 2020. Attention if they come to you with an inspection. Video recording as a gift

. Taxes for individual entrepreneurs in 2020. Accounting for fuels and lubricants General taxation system OSNO. Dear citizens! No individual entrepreneur taxes in 2020. Statement of financial results Form. Changes for 2020. You have added a recommendation to your favorites! What has changed in the work of personal income tax from excess daily allowances, withhold only after that. The deadline for submitting accounting and tax reporting is 1st quarter. Taxes for individual entrepreneurs in 2020 have been simplified. The current year is a turning point for taxpayers engaged in turnover. Ru will send zero declarations for individual entrepreneurs and legal entities that do not carry out activities and do not have. Balance sheet form 1 consists of two parts: assets and liabilities. Want access to all materials? On the balance sheet

. Federal Law No. 166FZ 5 income from the sale of real estate. Dear citizens! In favorites you can collect documents that you frequently use. You have opened the advanced search! We invite you to get to know each other better. NATIONAL CURRENCY ASSOCIATION NVA was created on the initiative of regional currency exchanges. Want access to all materials?

P-4 statistics 2020: filling algorithm and sample

| P-4 statistics - 2020: algorithm for filling out and sample. Form No. P-4 approved Resolution of the Federal State Statistics Service dated September 24, 2014 No. 580. A Instructions for filling it out have been approved by order of the Federal State Statistics Service of October 28, 2013 No. 428 (hereinafter referred to as Instructions No. 428).

And no later than the 15th day of the month following the reporting period.

|

P-6 statistics 2014 instructions for filling out

The balance can be submitted to the tax office in any convenient form on paper or electronically. N 671р, reflected by line, instructions for filling, legal address with postal code. For example, a form is submitted every month on an accrual basis. Statistical reporting, spare parts, line 37 reflects intangible search assets. P 6 statistics, debt, form form used by the same 24 user, instructions for filling, rar. Calculation of accrued and paid insurance claims. Instructions for filling out a report for companies that keep records of revenue from the sale of goods. P 4 statistics 2020 topics Accounting for the balance of unsold form P 6 statistics 2020 instructions for filling out

goods and raw materials Form P 6 Not repaid on time P 6 Temporary duties Amounts of advances paid to other organizations for upcoming settlements in accordance with concluded agreements Purchased semi-finished products Settlements between the parent organization..

Blogs / `Statistics form form p 6- STATISTICS REPORTING 2013 2014 forms, form. Forum`

| Statistics form form p 6 Cycloferon influenza and ARVI instructions for use .ABOUT FINANCIAL INVESTMENTS (Form N P 6) Legal. February 3. Sample forms in Word for business activities and official documents. July 29, 2014. Statistics. Online total: 0. about admission in the first form (Form 6). STATISTICS REPORTING 2012, 2013 forms, form to the State Statistics Committee. Electronic form. Instructions for filling out. I fill out form P - 6. Main. Documents. Statistical reporting forms. Form P - 6. Form P - 6 of the document. TERRITORIAL BODY OF THE FEDERAL STATISTICS SERVICE FOR THE Stavropol Territory. Forms of statistical reporting forms: P - 6. Federal statistical observation of numbers and payments labor. there they reflect Income in the form. Question: Income is shown as actually received on the account or accrued Statistics. In accordance with clause 5.5 of the Regulations on the Federal State Statistics Service, approved by the Decree of the Government of the Russian Federation dated June 2, 2008. Directory. Appendix 2 to Form P-1. 07/13/2010. In accordance with clause 5.5 of the Regulations on the Federal State Statistics Service, approved by the resolution. It is indicated on the form containing information on a separate division of a legal entity. |