In 2020, an Order from the Federal Tax Service of the Russian Federation was approved, which approved new procedures for settlement with the budget of the Social Insurance Fund for paid contributions. These rules establish the procedure for the administration by tax authorities of all social payments - pensions, benefits for pregnancy, childbirth, and disability. Therefore, reports are now submitted to the tax office, and contributions are included in a single calculation form. The FSS also administers and accepts reports on contributions related to occupational diseases and accidents (version 4-FSS was specially created for them). What is not included in Social Security expenses?

Who needs to submit reports?

Since the beginning of last year, a new procedure has been in place for reporting on contributions made to the FSS budget. The rules provide for the procedure for administering these payments by tax authorities. Pension funds and commissions involved in calculating benefits for pregnancy, childbirth, and temporary disability of persons must submit reports.

The FSS still has control over the issues of administration and receiving reports on some production contributions. But for them now the 4-FSS form is used.

The FSS, as before, checks the correctness of spending the paid contributions. Further from this review, you will learn about when you should submit applications to the Social Insurance Fund and the tax office, what documents you will definitely have to provide, and what types of certificates and applications exist.

Law 165 Federal Law “On the Basics of Compulsory Social Insurance” can be found here.

Documentation

In 2020, enterprises are experiencing confusion about when and which authority should contact them for reimbursement of benefits, since the new laws are not yet fully familiar, and the old procedures no longer apply. So, the policyholder submits documents to the Social Insurance Fund for payment of compensation if the insured event (for example, the onset of disability) occurred before December 31, 2020. The list of documents required for provision includes:

- Application for allocation of funds.

- Detailed calculations of contributions made to the budget, as well as benefits paid.

- Copies of documents that prove the validity of directing the funds spent specifically for social security purposes (sick leave certificates, certificates, birth certificates, death certificates, place of work of the second parent, registration for pregnancy and childbirth).

The Social Insurance Fund accepts reports for payment of compensation until December 31, 2016.

The Social Insurance Fund of the Russian Federation (FSS RF) is one of the state extra-budgetary funds created to provide compulsory social insurance for Russian citizens. Created on January 1, 1991. The activities of the fund are regulated by the Budget Code of the Russian Federation and the federal law “On the Fundamentals of Compulsory Social Insurance,” as well as other legislative and regulatory acts.

Income

The funds of the Social Insurance Fund are formed from:

− insurance premiums of enterprises, institutions, and other economic entities, regardless of their form of ownership;

− insurance contributions of citizens engaged in self-employment and required to pay social insurance contributions in accordance with the law;

− insurance contributions of citizens who work under other conditions and have the right to receive state social insurance established for employees, subject to their payment of insurance contributions to the Fund;

− income from investing part of the Fund’s temporarily available funds;

− voluntary contributions from citizens and legal entities;

− allocations from the federal budget of the Russian Federation to cover expenses related to the provision of benefits (benefits and compensation) to persons affected by the Chernobyl disaster or radiation accidents at other nuclear facilities for civil or military purposes and their consequences, as well as in other cases established by law;

− other income (amounts received in the prescribed manner for trips paid for from the Fund; funds reimbursed to the Fund as a result of fulfillment of recourse claims to policyholders and others).

The main share of FSS income comes from insurance premiums. Insurance premiums are calculated at a rate, the amount of which is established by federal law.

Payers of contributions are:

− organizations that are legal entities, regardless of organizational and legal forms, including foreign organizations operating on the territory of the Russian Federation through permanent representative offices;

− citizens, including foreigners, hiring under an employment contract, using the labor of hired workers in their personal households.

Public organizations of disabled people and enterprises, institutions and associations owned by these organizations and created to implement their statutory goals are not payers of insurance contributions to the Social Insurance Fund.

Payers do not transfer to the FSS budget the entire accrued amount, but the difference between the amount of accrued contributions and the amount of funds used by payers to pay benefits for temporary disability, pregnancy, childbirth, burial, sanatorium treatment, physical education and recreational activities and other purposes to their employees .

In addition, policyholders pay other payments to the Fund. These include in particular:

− expenses not accepted for offset against insurance premiums;

− amounts for compensation of benefits paid for work injuries and occupational diseases;

− penalties, fines;

− hidden amount of remuneration;

− partial payment for vouchers.

The income of the Social Insurance Fund depends on the rate of insurance contributions and the size of the wage fund in the national economy of the country, which is equal to the product of the average wage and the size of the working population. Both of these indicators decline during the years of reform, which is also facilitated by the growth of the shadow economy. The level of social insurance contribution rates has remained virtually unchanged in recent years. As a result, the total income of state extra-budgetary funds in real terms is constantly declining.

State social insurance funds are allocated to:

1) payment of benefits:

− due to temporary disability;

− for pregnancy and childbirth;

− a one-time benefit for women registered in medical institutions in the early stages of pregnancy;

− one-time benefit for the birth of a child;

− monthly benefit for the period of parental leave until the child reaches the age of one and a half years;

− social benefit for funeral;

2) sanatorium-resort treatment and health improvement of employees and members of their families, as well as for other purposes of state social insurance provided for by law:

− partial maintenance of sanatoriums, sanatoriums and health camps for children and youth;

− therapeutic (dietary) nutrition, partial financing of activities for out-of-school services for children, payment for travel to and from places of treatment and recreation, and others;

3) creation of a reserve to ensure the financial stability of the Fund at all levels.

The procedure for forming the reserve and providing funds from it (on a repayable basis or free of charge) is determined by the instructions on the procedure for accrual, payment, expenditure and accounting of state social insurance funds, approved by the Fund jointly with the Ministry of Labor of the Russian Federation, the Ministry of Finance of the Russian Federation, the State Tax Service of the Russian Federation and with the participation of the Central Bank of the Russian Federation;

4) ensuring current activities, maintaining the Fund’s management apparatus;

5) financing the activities of divisions of executive authorities that provide state protection of workers’ labor rights, labor protection (including divisions of supervision and control over labor protection) in cases established by law;

6) conducting research work on issues of social insurance and labor protection;

7) implementation of other activities in accordance with the objectives of the Fund, including explanatory work among the population, encouraging freelance workers of the Fund who are actively involved in the implementation of social insurance measures;

participation in the financing of international cooperation programs on social insurance issues.

participation in the financing of international cooperation programs on social insurance issues.

Fund funds can only be used for targeted financing of these activities. It is not allowed to transfer social insurance funds to the personal accounts of the insured.

The largest share in the expenses of the Social Insurance Fund of the Russian Federation is occupied directly by social insurance payments.

Budgets of compulsory health insurance funds, features of their formation and use at the federal and regional levels.

Compulsory health insurance funds are independent state non-profit financial and credit institutions that implement the Law on Health Insurance and implement state policy in the field of compulsory health insurance for citizens.

Currently, in the Russian model, healthcare financing combines budget financing and the insurance functioning of the following health insurance funds: voluntary and compulsory .

Compulsory health insurance is an integral part of state social insurance and provides all citizens of the Russian Federation with equal opportunities to receive medical and pharmaceutical care provided at the expense of compulsory health insurance and on conditions corresponding to compulsory health insurance programs.

Voluntary health insurance is an addition to compulsory health insurance, it is carried out on the basis of voluntary health insurance programs and provides citizens with additional medical and other services in addition to those established by compulsory health insurance programs. It can be collective and individual.

The funds included in the compulsory medical insurance system are managed by the Federal Compulsory Medical Insurance Fund and territorial compulsory medical insurance funds.

The Federal Compulsory Health Insurance Fund (FFOMS) implements state policy in the field of compulsory health insurance for citizens as an integral part of state social insurance.

Financial resources of the Federal Fund are federal property, are not included in budgets or other funds and are not subject to withdrawal.

Financial resources of the Federal Fund are generated from:

— parts of insurance premiums (deductions) of business entities and other organizations for compulsory health insurance in the amounts established by federal law;

— allocations from the federal budget for the implementation of federal target programs within the framework of compulsory health insurance;

— voluntary contributions from legal entities and individuals;

— income from the use of temporarily available financial resources;

— normalized insurance reserve of the Federal Fund;

— receipts from other sources not prohibited by the legislation of the Russian Federation.

Also, financial resources of the federal fund are generated through:

— receipts of voluntary contributions from legal entities and individuals;

— income from the use of temporarily available financial resources and normalized safety stock;

— receipts from other sources not prohibited by law.

Compulsory medical insurance participants are:

1) insurers (for the non-working population - the state represented by local executive authorities, for the working population - enterprises, institutions and organizations, regardless of their form of ownership and economic and legal status);

2) insured - all citizens of the Russian Federation, as well as citizens of foreign countries permanently residing in Russia;

3) territorial and federal compulsory medical insurance funds (specialized non-profit financial and credit institutions implementing state policy in the field of compulsory medical insurance);

4) medical insurance organizations licensed to operate under compulsory medical insurance;

5) medical institutions licensed to provide medical care included in the compulsory medical insurance program.

Sources of compulsory medical insurance funds are:

1) parts of the unified social tax at the rates established by the legislation of the Russian Federation;

2) parts of the single tax on imputed income for certain types of activities in the amount established by law;

3) other income provided for by the legislation of the Russian Federation.

Financial resources of territorial compulsory health insurance funds (hereinafter referred to as territorial funds) are generated from:

1) parts of the unified social tax at the rates established by the legislation of the Russian Federation;

2) parts of the single tax on imputed income for certain types of activities in the amount established by law;

3) insurance premiums for compulsory medical insurance of the non-working population, paid by executive authorities of constituent entities of the Russian Federation, local governments, taking into account territorial compulsory medical insurance programs within the limits of funds provided for in the relevant budgets for healthcare;

4) other income provided for by the legislation of the Russian Federation.

The main functions of the FFOMS are:

1) equalization of financial conditions for the activities of territorial compulsory health insurance funds within the framework of the basic compulsory health insurance program;

2) development and, in accordance with the established procedure, submission of a proposal on the amount of contributions for compulsory health insurance;

3) implementation in accordance with the established procedure for the accumulation of financial resources of the Federal Fund;

4) allocation in the prescribed manner of funds to territorial compulsory health insurance funds, including on a non-refundable and repayable basis, for the implementation of territorial compulsory health insurance programs;

5) jointly with the territorial compulsory health insurance funds and the Federal Tax Service authorities, monitoring the timely and complete transfer of insurance contributions (deductions) to the compulsory health insurance funds;

6) exercising, together with territorial compulsory health insurance funds, control over the rational use of financial resources in the compulsory health insurance system, including by conducting relevant audits and targeted inspections;

7) implementation, within its competence, of organizational and methodological activities to ensure the functioning of the compulsory health insurance system;

making, in accordance with the established procedure, proposals to improve legislative and other regulatory legal acts on issues of compulsory health insurance;

making, in accordance with the established procedure, proposals to improve legislative and other regulatory legal acts on issues of compulsory health insurance;

9) participation in the development of a basic program of compulsory health insurance for citizens;

10) collecting and analyzing information, including on the financial resources of the compulsory health insurance system, and submitting relevant materials to the Government of the Russian Federation;

11) organization, in the manner established by the Government of the Russian Federation, of training specialists for the compulsory health insurance system;

12) study and generalization of the practice of applying regulatory legal acts on issues of compulsory health insurance;

13) ensuring, in the manner established by the Government of the Russian Federation, the organization of research work in the field of compulsory health insurance;

14) participation, in the manner established by the Government of the Russian Federation, in international cooperation on issues of compulsory health insurance;

15) annually, in accordance with the established procedure, submitting to the Government of the Russian Federation draft federal laws on approval of the budget of the Federal Fund for the corresponding year and on its implementation

The Territorial Fund carries out:

1) financing of medical insurance organizations according to differentiated average per capita standards for payment of medical care within the framework of the territorial compulsory medical insurance program;

2) payment for medical services provided to citizens insured by the territorial fund (in the case of compulsory health insurance provided by the territorial fund);

3) financing of healthcare activities within the framework of regional target programs approved in the prescribed manner for medical institutions operating in the compulsory medical insurance system;

4) the formation of a standardized safety stock intended to ensure the financial stability of the compulsory health insurance system in the territory of a constituent entity of the Russian Federation;

5) the formation of funds intended to provide them with managerial functions according to the standard established by the executive director in agreement with the board of the territorial fund as a percentage of the amount of all received funds without taking into account the balance of financial resources at the beginning of the year.

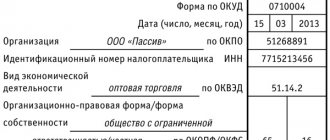

Defining a new calculation certificate

Instead of the old form 4-FSS, a new form is used to submit reports - it is called a certificate-calculation. The certificate is included in the package of documents required to receive compensation in 2020. If the FSS has doubts about the figures provided by the policyholder, they can request confirmation of the correctness of the information from the tax office.

There is no approved uniform form for the calculation certificate, but you can draw up the document yourself. The main thing is that it reflects the following indicators:

- assessed contributions;

- debt on insurance premiums for a certain stage of the billing period;

- additionally accrued amount of contributions;

- expenses that were not taken into account;

- compensation from the Social Insurance Fund received previously;

- funds of the policyholder, which he spent on social benefits.

Decoding of expenses in the Social Insurance Fund sample 2020

In addition to the calculation certificate, the organization will need to submit a breakdown of expenses to the fund. This document is similar to the data in Table 2 of Form 4-FSS. It reflects benefits by type. For example, due to the employee’s incapacity for work, maternity, children’s, etc. Moreover, in column 5 you must indicate the amounts of those benefits that are reimbursed only from the federal budget. For example, payment for days off provided to parents of a disabled child.

In what cases is a settlement certificate issued by the Federal Social Insurance Fund of Russia in 2019? Is such a certificate required? Here is a sample certificate for reimbursement with a transcript.

Application for reimbursement

In addition to the calculation certificate, you will need to provide an application to receive compensation. There is also no single form for its preparation, but there is a sample that can be taken into account when preparing the document (look for it on the websites of regional branches of the FSS). The application contains information about the policyholder, bank details for payment of compensation and the amount . Check the correctness of the specified data so as not to encounter unnecessary problems in the future. Be sure to indicate at the end of the application that it is provided with a certificate of calculation and breakdown of expenses. It is allowed to draw up an application for compensation, as well as a certificate of calculation, in free form.

FSS pilot project: application form and example of completion (sample)

The form and procedure for filling out the application for the FSS pilot project were approved by FSS Order No. 578 dated November 24, 2017. You can download it on our website.

You can fill out the application manually (in block letters using black ink, or with a gel, capillary, or fountain pen) or on a computer. Tips for completing individual lines and fields are provided in the footnotes below the application form. To make it easier for you to fill out the application, we have made a sample of it.

Submit the application and other documents to the Social Insurance Fund within 5 calendar days from the date of receipt from the employee. Make and attach an inventory to them in the form presented below.

Social insurance also submits a register of information for calculating benefits, which you can find out about.

Provide the employee who goes with the documents to the fund with a power of attorney. The Social Insurance Fund must check the information received, calculate and pay benefits to the employee within 10 days.

Payment terms

In accordance with the provisions of Article 4.6 No. 255-FZ dated December 29, 2006, funds must be transferred to the policyholder’s account within 10 days (provided that you have submitted a complete package of documents). The FSS also has the right to carry out an audit to determine the validity of the expenses that the applicant indicated in the application. Also at this stage you may be asked for additional supporting documents. Based on the results of the check, you may receive a refusal from the FSS. This decision must be motivated.

If you receive a refusal rather than a payment, you always have the opportunity to appeal it. In this case, the situation will be referred to the court (you will need to file an appeal for payment of compensation to the appropriate authorities).

Necessary documents and procedure for reimbursement of benefits from the Social Insurance Fund in 2020

The procedure according to which benefits are reimbursed from the Social Insurance Fund in 2020 is regulated by the Tax Code of the Russian Federation (clause 2 of article 431) and Federal Law No. 255 (part 2 of article 4.6), issued on December 29, 2006. According to the documents, the employer can reduce the amount of insurance premiums to be transferred by the amount of the benefit paid.

- the amount of FSS debt at the beginning and end of the period;

- insurance premiums accrued for three months and the entire period;

- additional charges;

- expenses that were not taken into account;

- funds reimbursed by the Social Insurance Fund;

- insurance premiums paid in excess to the fund;

- funds spent on insurance cases for the entire period and the last three months;

- insurance premiums paid;

- written off debt of the Social Insurance Fund to the employer.

We recommend reading: PFR payments to large families

What does the reduction of insurance contributions for compulsory social insurance apply to?

Article 431 of the Tax Code of the Russian Federation provides for the possibility of reducing the amount of monthly contributions. When determining the amount of payments to budgets, the policyholder can deduct expenses incurred by him to pay various benefits to employees. This is help for:

- various types of temporary disability;

- maternity benefits;

- birth of a child;

- registration before 12 weeks of pregnancy;

- child care allowance for up to one and a half years;

- burial.

That is, the policyholder can ease the burden of compensating for social security costs by reducing the size of the next contribution. If the payment amount is greater than the contribution, you will need to contact the Social Insurance Fund to resolve the dispute.

When contacting the tax authority, the policyholder reflects his expenses in the provisions of the new reporting form.

Reimbursement for the previous year

To receive compensation for the period before January 1, 2017, the following procedure applies. The policyholder must contact the regional department of the Social Insurance Fund with the following documents:

- A statement drawn up in free form and containing a complete list of information on the issue.

- Calculation of contributions according to Form 4-FSS for the accounting year.

- Copies of documents confirming expenses.

The FSS checks the received package of papers; if inconsistencies are identified, an on-site inspection may be scheduled. We remind you that this procedure applies to payments before January 1, 2020. Based on the results of the inspection, the policyholder receives compensation for the full amount or a reasoned refusal. The Social Insurance Fund may provide the Federal Tax Service with personal data about the policyholder as part of interdepartmental interactions.

Providing documents after 01/01/2017

If your application relates to the period after January 1, 2017, the list of documents will be as follows:

- Statement.

- Settlement certificate.

- A detailed breakdown of all expenses aimed at social security purposes.

The inspection is usually carried out desk-based, but can also be carried out on-site. During the consideration of the application, the FSS requests additional data from the Federal Tax Service on the submitted reports. Based on the results, the policyholder receives a decision - this will be either approval of the declared expenses for payment, or their non-acceptance for offset. After this, it will be possible to fill out an application for a refund and send it to the territorial treasury office. The average refund period is 3 business days.

If the credit amount does not match the contribution amount, you will need to make up the difference.