Procedure

The first step when changing the charter is to confirm the manager’s decision with the appropriate order.

If there are several executive persons, then the decision is applied at the general meeting and confirmed by the minutes. It is allowed to make a decision alone if others have given their consent. The next action is to make the appropriate changes, for example, a new name, the amount of authorized capital, adding OKVED, moving the business to a new address, etc. A tax officer can accept either a completely updated charter or amendments drawn up in a separate document.

The tax office recommends filling out a new document, but the decision remains at the discretion of the director of the company.

Then the manager informs about the change in the charter in form P13001, his signature certifies the document.

It is also confirmed by a notary (the service is paid), for this you will need to provide:

- OGRN certificate;

- current charter (before changes);

- internal passport;

- certificate of receipt of TIN and KPP;

- protocol or certificate of decision to make changes;

- a document that confirms the authority of the manager;

- taxation system (for example, UTII, OSNO).

At the end, the applicant pays a fee of 800 rubles and hands over the documents along with the check to the tax officer.

Actually, there are a lot of options for using it. Any change affecting the charter is the application of form P13001.

Let's break it down into its components to illustrate the changes being made:

- Page 001 - Information about the legal entity contained in the Unified State Register of Legal Entities. That is, legal. the person must already be properly registered. Clause 1 indicates the assigned OGRN and TIN, as well as the full company name (see the extract from the Unified State Register of Legal Entities, and from there everything is a carbon copy). In paragraph 2, a tick is placed if you bring the charter into compliance with 312-FZ or 99-FZ, although the first case is already extremely rare, and in the second, a new version of the charter is usually simply adopted.

- Sheet A. To be completed if you decide to change the corporate name of the legal entity. Accordingly, if you change both the full and abbreviated form, fill out paragraphs 1 and 2, if you change one or the other, fill out what is changing.

- Sheet B. Required to be filled out in the following cases:

— change of location of the company, if the charter specifies only the location;

— change of the company’s address if the address is specified in the charter.

- Sheet B. Must be completed if the size of the authorized capital changes. In paragraph 1, select the option that corresponds to your company (98%, which is the authorized capital), in paragraph 2, select the action - increase or decrease, in paragraph 3 - the amount of the authorized capital, which we contribute to the Unified State Register of Legal Entities. Points 4 and 5 relate to the reduction of the authorized capital; read about them in a separate article.

- Sheet G - information about the participant - a Russian legal entity. face. Applies if the share in the authorized capital belonging to such a participant changes, since other information is changed through P14001 (from July 2010, information about participants in the charter may not be indicated). The same applies to sheets D, E and J.

- Sheet 3 - information about a mutual investment fund, the property of which includes a share in the capital of your legal entity. faces. An extremely rare use case.

- Sheet I - information about the share in the management company owned by the company. It is used when registering the exit of a participant(s) to enter into the Unified State Register of Legal Entities information about the share transferred to the company, as well as information about its distribution among the participants, if this information must be indicated in the charter.

- Sheet K, with its help, information about a representative office or branch is entered into the charter and the Unified State Register of Legal Entities, if you decide to include them in the charter (not necessary, in the Unified State Register of Legal Entities is sufficient).

- Sheet L, information about OKVED codes, if they are specified in your charter, which again is not mandatory.

- Sheet M - just like page 001, is always filled out. The applicant for this type of registration is indicated here, which, most often, is the sole executive body (director).

The simplest action. Sheet 001, sheet A, sheet M are filled out. To P13001, a decision (protocol) on changing the name, a new charter in 2 copies, and a receipt for payment of the state duty are attached. The charter must contain the new name on the title page, as well as inside.

A separate issue is the execution of the decision (protocol) on changing the name. Formally, at the time of making the decision, the company’s name is old, which means we write the old name in the header. But according to the text, one of the issues on the agenda must contain a new company name, depending on which one is changing, full, abbreviated, in a foreign language, all at once.

Fill out page 001, sheet B, sheet M. Unfortunately, sheet B is imperfect, since from mid-2020 tax authorities require detailed filling out of all details of the address object, down to the floor, basement, room, etc. Because of this, “monstrous » options when, for example, when moving to an address in

This is not the most difficult option, the real “creativity” begins when you need to indicate “attic”, “ground floor”, “part of the room”, etc.

By the way, everything will be entered into the Unified State Register of Legal Entities, with the indicated abbreviations.

To the set of documents for changing the address, do not forget to attach the documents on the basis of which you are using this address - a copy of the lease agreement (if sublease, then the landlord’s consent to sublease), a letter of guarantee from the owner, a copy of the Civil Registration Certificate or a copy of an extract from the Unified State Register real estate). And the address details must be listed the same as in the specified documents.

According to the Federal Law “On LLC”, the authorized capital can be increased at the expense of contributions from existing participants, at the expense of new participants, at the expense of the company’s property, or by combining these capabilities together.

Fill out page 001, sheet B, about the amount of the authorized capital, sheets D, D, E or F, depending on the composition of participants, sheet I, if the share owned by the company appears or changes, and sheet M, for the applicant.

In the information about the participants, if nothing else changes about them, we indicate only the full name, tax identification number, and new information about the share in the management company (size and nominal value).

Since recently it is necessary to notarize the protocol on increasing the authorized capital (clause 3 of Article 17 of the Federal Law “On LLC”), and to certify the authenticity of the signature based on the decision of the sole participant, the question often arises: if, when increasing the authorized capital by the participants themselves, it is necessary Is it possible to notarize the “second” decision, which is about approving the results of increasing the authorized capital? The tax office believes that no, it is enough to certify only the “first” decision.

Also included in the set of documents will be a receipt for payment of the state duty, bills/receipts for payment of shares, a new charter in 2 copies, and a decision. Or two solutions, depending on whether the increase is at the expense of the participants, or at the expense of third parties. In any case, if a third party and participants are involved in the increase, the decision (protocol) will be the same.

A reduction in the authorized capital must be done in several cases - if you decide to pay off a share owned by the company, if the value of net assets for the year is less than the authorized capital. You can reduce it to the legal minimum - 10,000 rubles, if lower - then you can only liquidate.

The same sheets are filled out as during the increase, but P13001 is submitted at the final stage of the decrease, changing the charter to the new size of the authorized capital. Read separately about reducing the authorized capital.

In general, at the moment there is no such mark on page 001, there is simply “Bringing the charter into compliance with the law.” This was done after the adoption of 99-FZ dated 05/05/14, which obliged the charters of joint stock companies to be brought into compliance, and allowed to change the charters of LLCs. In particular, it is allowed to remove the address from the charter, leaving the location, and also add a provision on the corporate agreement.

In fact, it’s better not to check this box, and you can remove the address from the charter with any upcoming change.

Some organizations, in particular those associated with construction, restoration, and other similar activities, indicate types of activities with OKVED codes in the charter. To add/remove/change them, fill out page 001, sheet L, sheet M. A protocol (decision) on changing the OKVED codes, a new charter in 2 copies, and a receipt for payment of the state duty are attached to P13001.

This information also does not have to be indicated in the charter since June 2010. If you need to add/change/remove them, fill out page 001, sheet K, sheet M. Attach a receipt with paid state duty, a decision (protocol) and a new charter in two copies.

There are changes to the charter for which a separate sheet is not allocated in P13001. For example, changing the provisions on voting of participants in the General Assembly, or adding a provision on the withdrawal of a participant. To register these changes, we fill out only page 001 and sheet M. In the decision (protocol), we indicate exactly what changes are being made, and attach a new charter in 2 copies and a receipt with the state duty paid.

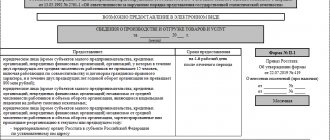

Sample of filling out the new form P13001

Here we have posted a universal sample of form P13001, relevant for 2020, which can be applied to various issues of changes to the charter by simply selecting the necessary sheets.

Sample of filling out form P13001 when changing legal address

In this case, take the attached filling sample and use the following sheets from it:

The applicant is a person performing the functions of the sole executive body.

Sample of filling out form P 13001 when changing name

To change the name, completed sheet A has been added to the sample form P13001. The remaining sheets to be filled out are page 001 and all pages of sheet M. The applicant is the director.

Sample of filling out form P13001 when increasing the authorized capital

Since information about the authorized capital is contained in the charter of the LLC without fail (Article 12 of the Federal Law “On LLC”), a change in this information entails the approval of a new version of the charter. Until July 4, 2013, such changes were made through two forms: the 13th and 14th. The new form P13001 has eliminated this drawback, and now for state registration of an increase in the authorized capital it is necessary to fill out only P13001:

What sheets should you use?

The title page is filled with information corresponding to those registered in the state register of legal entities:

- OGRN.

- TIN.

- Full name.

In case of bringing the LLC Charter in accordance with the law, it is required to put a sign in the appropriate field.

Sheet A: changing the name of the organization

Sheet A is filled out when changing the name of the organization and includes information about the name of the legal entity: full and abbreviated.

The name of the organization is indicated in the official form, observing punctuation. There is no hyphen: the divided word breaks off on one line and continues on the next. There are spaces between words. If the last cell of a line is filled with a letter, and the next line begins with a new word, then before this new word one cell should be left empty.

Sheet B: change of location

When changing the address of the executive body of a legal entity, it is necessary to fill out Sheet B. Only those fields that appear in the new address must be filled out.

Points such as “district” and “settlement” may be omitted if the legal entity is registered in a city for which a special field is provided.

The remaining fields are standard for records of this type: street, house number, building, building, office number, etc.

Sheet B: change in authorized capital

Sheet B is filled out in case of changes in information about the size of the authorized capital. To do this you need to specify:

- Code of the type of capital (authorized, share, mutual fund).

- Change made (decrease/increase).

- Set size.

- Date of decision to change.

In case of capital reduction, two dates for publication of decisions in the official publication are required.

Sheets G-Zh: changing information about the participant

The next 4 sheets - from G to G - are filled out selectively depending on the organizational and legal form of the participant whose data has changed:

- Russian legal entity (sheet D).

- Foreign legal entity (sheet D – 2 pages).

- Individual (sheet E – 2 pages).

- Russian Federation, constituent entities of the Russian Federation, municipalities (sheet G – 4 pages).

For each participant with changed data, the reason for the change is indicated:

- Entering information about a new participant.

- Entering information about termination of participation by one of the participants.

- Making changes to the information about an existing participant.

In addition to data on the name of the participant, address, INN, OGRN, the nominal size of the share in the authorized capital, the size of the share in percentage and in fractional terms are indicated.

Sheet G has additional pages that are intended for entering information about the following entities:

- The public authority exercising the rights of the participant.

- An individual exercising the rights of a participant.

Sheet 3: information on the inclusion of a share of the authorized capital in the property of a mutual investment fund

Sheet 3, as well as the previous sheets, is filled out in cases where there is a change in the composition of participants or the structure of the authorized capital. On page 1 information already contained in the Unified State Register of Legal Entities is indicated, on page 2 - information newly entered into the Register, as well as the nominal value and size of the share in the authorized capital of the legal entity.

Mutual fund information includes:

- The name of the mutual fund.

- Information about the management company, including OGRN, TIN, full name.

Sheet I: information about the share of the retired LLC participant

This sheet is filled out in the event of a decrease in the authorized capital of the LLC due to the redemption of a share owned by the company. This section indicates the nominal value of the redeemed part of the share, as well as its size in percentages and fractions.

Sheet K: branches and representative offices

Sheet K is filled in when information about branches and representative offices changes. Form No. P130001 does not differentiate between these two forms. For purposes of the form, they are used interchangeably and are listed as “branch/representative office.”

From a legal point of view, these concepts are different in the sense that a representative office has the functions of representing and protecting the interests of the represented legal entity, and the branch, in addition to these functions, performs a full range of works (services) in the same volume and with the same technologies as the parent legal entity face.

Sheet K indicates the reason for the changes: creation/termination of the branch's activities or change of its name/location address. On page 1 of sheet K, the previous data on the branch/representative office is entered. On page 2 – data newly entered into the Register.

Sheet L: OKVED codes

Each OKVED code can either be present or absent, so they can be changed in two ways:

- By introducing new codes (page 1).

- Eliminating old codes (page 2).

In this case, codes that are not included in either the first or second page are considered to be left in the Register.

Sheet M: information concerning the applicant

Sheet M is presented on three pages and may contain information about one of the possible applicants:

- Head of the organization.

- A person acting on behalf of an organization.

- A person acting under federal law.

The following information about the applicant must be filled in:

- Information about the management organization.

- Personal information about the applicant, including passport details, registration address, contact information.

On the third page of sheet M, the applicant makes an entry confirming the correctness and consistency of the information presented in the application. Here, the person authorized to perform a notarial act certifies the authenticity of the application with his signature and seal.

When making changes to the form, not all sheets are filled out:

- Title. If an organization changes its name, the title page is filled out, information is entered into sheets A and M. On the first page, basic information about the organization is entered: OGRN, INN and address, which is registered in the Unified State Register of Legal Entities.

- Sheet A. This page contains columns for changing the name of a legal entity. Article 1473 of the Civil Code establishes that any LLC is required to have a full name and also has the right to establish an abbreviated equivalent. If the name does not fit on one line, the hyphen is not added when writing on a new line.

- Sheet B. This page is filled out when changing the address. It is enough to indicate only the locality.

- Sheet B. The page is drawn up when the authorized capital is changed; for this, the following data is entered:

- type of funds (share, charter, etc.);

- type of updates;

- new amount;

- update day.

- Sheets G-Zh. Required when changing the legal form, be sure to include:

- page D is filled out by Russian organizations of any form;

- D is filled in by foreign enterprises (any state);

- E is filled out by individuals;

- F is issued by municipalities of the Russian Federation.

Location

The Civil Code establishes the concept of the location of a legal entity. He understands by it the city or other locality in which information about the company was entered into the Unified State Register of Legal Entities. In fact, the law does not require the exact address to be indicated in the charter, including zip code, city, street, house, office number.

At the same time, the task of determining location becomes:

- record the permanent location of the executive body of the company so that it can be found, served with documents, asked questions, and held accountable;

- establish a place where the company will be guaranteed to receive legally significant documents (claims, offers, notifications of inspections).

Obviously, just pointing to the city does not solve this problem. The charter must include full coordinates, which is what tax officials usually insist on. When changing the legal address, sample form 13001 allows you to enter data into the register specifically related to the change in the charter and reflecting complete information in it.

Requirements for the form

The general requirements for document preparation are similar for all forms:

- When filling, the font Courier new 18 pt is used. Capital letters, black ink.

- When filling out the “series and document number” indicator, first indicate the series, and then, through an empty space, the number. If there is a space in the series or document number, when filling out such details, the space is displayed as an empty character space.

- For digital values, the integer part is aligned to the right edge of the cell, and the fractional part is aligned to the left. If there is no fractional part, zeros are not entered.

- No hyphens are needed when filling out text fields. Multiple trailing spaces are converted to one. If a word ends in the last cell of a line, then the next line should begin with a space.

- The presence of corrections, additions (additions) in the application is not allowed

- Only those sheets that contain completed fields should be used. When creating a package of documents, blank sheets are not attached.

- Continuous three-digit numbering for completed sheets.

- The applicant's signature must be certified by a notary.

- The section “For official marks of the registering authority” on page 001 by the applicant and the person certifying the authenticity of the applicant’s signature in a notarial manner is not filled out or crossed out, otherwise registration will be refused.

The requirements are contained in the Order “On approval of forms and requirements for the execution of documents submitted to the registration authority during state registration of legal entities, individual entrepreneurs and peasant (farm) farms.” It came into force relatively recently – on July 4, 2013. Therefore, in this review we will look at the main points that will greatly simplify filling out P13001.

The form can be filled out either manually or using a program. Everyone chooses what is more convenient for them. This does not matter when registering.

Fill out the form in Courier new font, size 18. Use only capital letters and black color. When writing manually, we write in printed, legible letters.

Be sure to indicate the series first, then the document number. There should be a space between them. Problems often arise with numbers and fractions. Everything is very simple here - two fields are separated by an oblique line (a regular fraction) or a dot (a decimal fraction). The numerator is aligned on the right and the denominator is aligned on the left.

The same rule applies to monetary units, rubles before the point, and kopecks after it. If the number is an integer, then zeros are not placed after the dot. The telephone number is indicated without spaces or dashes. Plus, brackets are written in a separate place for each character.

When filling out the text, there are no hyphens, just continue filling out the form on a new line. If a word or several words are moved to the next line, but there are several empty cells left on the previous line, then they are counted as one space.

Please note that if all the cells of a line are filled and the word ends, then the next line begins with a space.

You should not file any sheets that are left blank with your application. Attach only those that have at least one completed column.

After you have filled out the form, you need to number the pages at the top of each sheet, the numbering is continuous. Three cells with the page number must be filled in, that is, the first page is 001, the second is 002, and so on. Under no circumstances should anything be corrected or added to. Double-sided printing is also prohibited.

The applicant or authorized person signs the form; if several applicants are included in the form, then the signature of each of them is required. The authenticity of the signature must be certified by a notary, with the exception of one case - if an individual entrepreneur or the head of a farm submits the form to the registration authority in person, presenting a passport.

You can read information on how to calculate maternity leave in 2016 here. You can see what a sample agency agreement for finding clients looks like in this article.

A special template has been approved for notification of changes in the company’s activities. You can use the current sample in 2018 on our website.

The Federal Fiscal Office provided clarification on how to fill out an application on form p13001. Order No. MMB-7-6-25 approved in January 2012.

Rules for filling out the form:

- You can enter data by hand or using computer technology.

- Put block letters, write with black ink.

- If data is entered via computer, Courier New font is used, height eighteen.

- Please indicate the company name in full. Example: Limited Liability Company “Pasker. Ltd."

- Avoid mistakes. One mistake means you have to start filling out again.

- Place letters, numbers, and quotation marks in the boxes.

- Make continuous numbering.

- Stop using duplex printing.

- Have the signature certified by a notary.

Important! You can do without notarization if the entrepreneur applies in person. To confirm your identity, you must have your passport with you.

You can specify multiple transformations at the same time. For example, changing the type of activity, as well as increasing the authorized capital.

The standard requirements for the form are as follows:

- it is required to use the font Courier new 18 pt, each letter is capitalized, printed in black;

- when registering personal passport information, first put the series, then a space, then the number (the space is a mandatory familiarity);

- when entering any numbers, the integer part is placed closer to the right side, and the fractional part is placed closer to the left (if the number ends in the last cell in the column, the next line is filled in with a space);

- it is prohibited to correct or add information to the document;

- It is allowed to use only those pages that have completed lines; blank pages do not need to be attached when printing the document;

- Continuous three-digit numbering is placed on completed sheets;

- the manager’s signature is additionally certified by a notary;

- The form defines a section for official marks, which is filled out by the notary; crossing out or filling out other columns on this sheet is prohibited, otherwise the tax office will refuse registration and the state duty will not be refunded.

Form P13001 is filled out using a computer or manually using only a pen with black ink. Computer registration of the application is carried out using Courier New font size 18.

With computer design, there may be no empty cells, provided that the filled cells are in their original places. Manual filling should be carried out carefully, without going beyond the cells, in printed capital letters.

All entered data is left aligned (that is, starts from the leftmost cell), with the exception of fractions. The whole and decimal parts of the fraction are aligned with respect to the separating point: the fraction parts must not have empty cells between the dividing point and the digits. The same applies to simple fractions: alignment occurs relative to the “/” sign. The same rule applies to filling in monetary amounts with a separator symbol.

Page numbers are filled in sequentially with three characters, starting with “001”.

Difference between P13001 and P14001

Not everyone knows how the P13001 and P14001 formats differ from each other. The first one must be prepared and submitted if the transformations occurring in the company are related to changes to the charter. This category includes:

- adoption of the new edition;

- change of name;

- introduction of new activities;

- change of legal address, if it is indicated down to the street or house number;

- bringing the charter into compliance with current legislation;

- change in participants

R14001 needs to be prepared if, in accordance with the law on state registration, new entries need to be made in the Unified State Register of Legal Entities, while the charter remains unchanged.

Typical cases include:

- change of executive body;

- moving to another location if changing the main document is not required.

Filling out an application for registration of the chairman of the SNT form p14001

The authorities of the Federal Migration Service themselves will transmit the changes to the tax authority, which will enter the necessary data into the Unified State Register of Legal Entities (Federal Law No. 129-FZ, Chapter II, Article 5, Clause 4, fifth paragraph).

If no response is received from the participants at all, this will be considered consent to the alienation of the share. — sample of filling out P14001 when donating a share of an LLC. P14001 inheriting a share of an LLC. Form P14001 is used when inheriting a share of an LLC.

We recommend reading: If the Alimony Debtor is Registered in Another City, What to Do

https://youtu.be/nv5DVJ8_2rQ

How to fill out

State registration of an enterprise and entering information into the Unified Register (USRLE) is carried out on the basis of statutory documents, in accordance with Federal Law No. 129-FZ “On Registration of Legal Entities and Individual Entrepreneurs” dated 08.08.2001. The law provides a list of information that is entered into the register when registering an enterprise.

This list includes the address of the legal entity within its location. Therefore, information about the change in legal address and the basis on which the company made such a decision must be entered into the register.

The Federal Tax Service is responsible for updating the Unified State Register of Legal Entities databases. According to Law No. 129-FZ, the owner of the company is obliged to notify the territorial tax authority of a change of legal address within three working days. If you don’t have time to visit the tax office in person, use the Glavbukh Assistant service.

Today, form P13001 is used, approved as an annex to the order of the Federal Tax Service of the Russian Federation dated May 25, 2016 No. ММВ-7-14 / [email protected]

If there is only one participant, then he alone makes the decision. When a decision is made by several participants, a protocol is drawn up.

It is important to know! Information about the company changes, which means that the charter also needs to be changed. A new edition is adopted or a separate annex with amendments is drawn up.

7 useful design tips:

- Fill out sample P14001 when information changes that are not related to changes in the statutory documents.

- Use the address classifier (KLADR) to avoid errors when specifying the address.

- Enter the subject index and code.

- Use acceptable abbreviations. Explanations are contained in the appendix to the order of the Federal Tax Service No. SAE-3-13 / [email protected] , dated November 2005. For example, the words “house”, “apartment”, “alley” are not abbreviated.

- Use form P14001 when the passport details of the participants have changed and the authorized capital remains the same.

- Use a separate sheet for each participant: Russian and foreign companies, citizens, government organizations.

- Enter data only to the manager or management organization.

Finally, the desired method of obtaining the certificate is indicated.

A sample of filling out P13001 when changing your legal address will help you sort out all the issues that raise questions. The document itself consists of two parts - the application and its annexes. Each of the applications is named by letters of the alphabet, from A to M. Some of them consist of several sheets. When submitting to the Federal Tax Service, the following must be filled in:

- statement;

- an application corresponding to the type of changes being registered;

- sheet M containing information about the applicant.

On the first page, the OGRN and TIN of the company will be filled in without abbreviations. The form of ownership and name are indicated in full. Particular attention should be paid to point 2 on the first page.

The simplest change option is to update the name. To do this, on page A it is enough to enter the full name in the first paragraph, and the abbreviation, if any, in the second paragraph.

When a legal entity changes its address, Sheet B is drawn up. For correct registration, you need to know the index and code of the subject of the Russian Federation. The address is entered in the specially designated fields.

When the manager fills out fields from three to six, he enters the abbreviations established by the order. When filling out columns 7, 8 and 9, the full names of address objects are used; abbreviations are not allowed.

If there have been changes in the authorized capital, page B is drawn up. First, the method of capital formation that the manager chose when registering the organization is indicated. Then the type of change is prescribed, that is, in which direction the capital is changing (more or less).

If there are no kopecks in the authorized capital, there is no need to put zeros after the period. Points 4-5 are intended to reduce capital. If the amount increases, these sections remain empty.

From time to time, every enterprise or organization improves its activities, develops, and rationalizes production, because progress never stands still. It is almost impossible to do without changes in the constituent documents. This means that they also need state registration in form P13001.

Let's figure out what this form is.

The form, widely known as P13001, is fully called an application for state registration of changes made to the constituent documents of a legal entity. That is, it is a special form in which all significant changes relating to legal entities must be made.

This form can be called one of the most common after the form for the registration of a legal entity itself. After all, the constituent documents contain all the information about the name, location of the legal entity, management of its activities and other similar information.

When filing an application for state registration of changes, the moment when these changes gain legal force for third parties is also important. There are two cases:

- from the date of their state registration;

- from the moment of notification to the relevant registration authority.

Names of the organization. Addresses of the organization. Amount of authorized capital. Information about participants. Information about branches and representative offices. Information about OKVED codes.

You do not need to fill out all 23 sheets. Only pages containing information amended in the constituent documents that are subject to state registration must be completed.

All entered data is left aligned (that is, starts from the leftmost cell), with the exception of fractions.

The whole and decimal parts of the fraction are aligned with respect to the separating point: the fraction parts must not have empty cells between the dividing point and the digits.

The same applies to simple fractions: alignment occurs relative to the “/” sign. The same rule applies to filling in monetary amounts with a separator symbol.

Mandatory documents and the cost of amending the Charter

Change of company address

Documentation:

- director's passport (original),

- participant’s passport, if it is the only one (copy),

- certificates of OGRN and TIN of the company (originals),

- Charter (original),

- extract from the Unified State Register of Legal Entities (original),

- certificate of registration of ownership of the premises (copy),

- lease agreement (copy).

Cost of changing a company address:

According to Form 13001:

- 2,000 rub.

- service, - 800 rub.

— state duty, - 1,400 rub.

- notary.

According to Form 14001:

- 1,500 rub.

- service, - 1,400 rub.

- notary.

Change of company name

Documentation:

- director's passport (original),

- participant’s passport, if it is the only one (copy),

- OGRN and TIN certificates of the company (originals),

- Charter (original),

- extract from the Unified State Register of Legal Entities (original).

Cost of changing a company name:

- 2 000

rubles - service, - 800

rubles - state duty (it may not exist, depending on the date of the last Charter) - 1 400

rubles - notary.

Change of company director

Documentation:

- passport of the new director (original),

- certificates of OGRN and TIN of the company (originals),

- Charter (original),

- extract from the Unified State Register of Legal Entities (original).

Cost of changing a company director:

- 1 500

rub. - service, - 1 400

rub. - notary.

Changing the type of company activity

Documentation:

- passport (original) of the director,

- OGRN and TIN certificates of the company (originals),

- Charter (original),

Cost of changing the type of activity:

- 1 500

rubles - service, - 1 400

rubles - notary.

Change of authorized capital

Documentation:

- passport (original) of the director,

- participant’s passport, if it is the only one (original),

- certificates of OGRN and TIN of the company (original),

- Charter (original),

Cost of changing the authorized capital:

- 2 000

rub. - service, - 800

rub.

How to submit

Article 5 of the Law “On State Registration” establishes that the manager has 3 days to notify the Unified State Register of Legal Entities about changes.

However, there are no exact deadlines for contacting the Tax Inspectorate. Presumably, the manager has the right to submit the form later, but then problems will arise with the unified register.

Form P13001 is an officially approved state document for amending the Charter of legal entities. There is no need to fill out all the pages of the document, since the tax service only checks the information that is relevant to the individual situation.

Payment of the fee is the responsibility of the applicant. A receipt can be generated through the tax department website. The amount to be paid is 800 rubles.

Advice! You can avoid overpayments if you report several changes affecting the company at once.

After paying the fee, the package of documents is submitted to specialists of the multifunctional public service center (MFC) or tax inspectors. The application is accompanied by a new charter or changes to the old one, a lease agreement when the address changes.

It is necessary to notify government officials no later than three days from the date of the decision. The deadline is established by Art. 5 of the Law “On State Registration”.

If the documentation is completed correctly, then after six days a certificate is issued with another copy of the charter.

The certificate is issued in the manner chosen by the applicant when filling out sheet M.

When should changes be made?

There are no specific deadlines during which changes are made to the register at the legislative level. As a rule, registration is required within 3 days after changing the Charter as part of a general meeting of shareholders or founders. This period may be slightly exceeded, but all changes must be made before the end of the next tax reporting period, otherwise penalties may be applied to the organization by the tax service.

Changes to the Unified State Register of Legal Entities are made after 5 working days from the date of acceptance of the application and its acquisition of legal force. The applicant must take into account that acceptance of the application and giving it legal force is possible only upon submission of a complete set of documents that have the appropriate design. The tax service notifies the applicant upon receipt of documents, as well as changes. You can also get acquainted with them yourself by studying open data in a single registry.

https://youtu.be/EMlj0i7eG4s

Changes come into force for third parties - suppliers, partners, clients of the company, immediately after they acquire legal force - after the application is accepted by the tax service, and not after changes are made to the register.

This must be taken into account when preparing reports, as well as when performing other legal actions related to the company’s commercial activities and serving the interests of third parties.

Standard forms provided by the tax service are necessary to speed up work with legal entities and form a unified database of legal entities and companies for further interaction. Filling out the form and preparing other documents will not require much time, and if the correct package of documents is generated, registration will be completed within the time limits established by law.

Signing and certification

The application is always signed by the executive body. In his absence for a good reason - vacation, illness, business trip, this task can be assigned to a person appointed by order to perform duties and who has the appropriate power of attorney. If the documents are submitted by a person - a courier, a lawyer, a company registration employee who has a power of attorney, then his data is entered in section 2.

When performing this operation, the employees of the notary office will not only verify the identity of the director and his powers, but will also sew together all the sheets of the document, putting an identification inscription on the back. Tax inspectors will not accept documents prepared in any other way.

Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.