For incoming goods for which containers can be weighed, upon their release from containers, a weighing procedure is carried out, during which the mass of the container is determined. The process is carried out by a special commission in the presence of interested parties; at the end, a certificate of packaging is drawn up to reflect the results. This form can be prepared using the standard unified form TORG-6. In the article we will tell you about TORG-6 Act on the curtain of containers, we will provide a form and a sample for downloading.

In the future, the act serves as the basis for reflecting data on the actual weight of containers in the register of goods and materials requiring a curtain of containers, TORG-7 and is transferred with other product documentation to the accounting department for further processing and storage.

What is a container curtain

The container weight is the difference between the weight of the container without goods and the weight according to labeling minus the norms of natural loss of goods; this difference represents a type of product losses subject to write-off. Some types of commodity or material assets tend to be absorbed into the surface of the container in which they are located, because of this, subsequently the weight of the empty container will be higher than that specified by the supplier upon delivery. The amount of excess will represent the curtain of containers.

Other natural losses may also occur, for example, for jam - these are losses from the mass sticking to the walls of the container, for vegetable oil - bottom sediment. These losses are also a curtain of packaging and are subject to write-off.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

https://youtu.be/zn_6JIVCUx0

Download vehicle weighing form

_____________________________ (name of the motor depot) ACCEPTANCE AND DELIVERY ACT dated “__” ____________ 19__

I, the head of the convoy (mechanic) __________________________, on the basis of the order for the motor depot dated “__” _________________ 19__.

N __________ handed over, and _____________________________________________ (communication worker, combining the duties of _________________________) accepted a car of brand ________ 19__.

The supplier in which. You can download an example and sample below. The fact of delivery of scrap metal at any collection point is the Supplier’s acceptance of the price determined in.

LLC "Right Target" cargo: literature and periodicals.

Model contract for the carriage of goods by road, sample contract of carriage. File: Sample act for delivery of goods. Sample claim for cargo delivery.

Sample of cargo acceptance and transfer certificate for. List of documents that are issued when delivering goods from the USA.

An example of defining a curtain of containers

The company receives 2 boxes of cherry jam. Gross weight (products with containers) of each box is 24 kg, net weight (excluding containers) is 20 kg, box weight is 4 kg. The container weight according to the supplier’s documents is 8 kg.

- After selling the jam, the empty boxes are weighed, resulting in their actual weight being 4.1 kg.

- The weighing results are reflected in the container weight certificate. 0.1 kg, by which the weight of the boxes has increased, will be the amount of containers to be written off from the financially responsible person.

This discrepancy is caused by the absorption of jam into the walls of the boxes; it does not exceed the norms of natural loss, representing a type of technological loss associated with the traditional features of this type of product. In this regard, no claim is made to the supplier.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Tip 1: How to write off containers

If packaging occurs in the main workshops, then write off to the debit of account 20 “Main production”, and if in the finished goods warehouse - to account 44 “Sales expenses”. 5 If you work in a trade organization, write off packaging depending on when the goods are packaged.

When packaging and packing at the time of purchase, attribute the cost of containers to the increase in the cost of goods (from the credit of account 41 to the debit of account 41, subaccount “Containers”), since the costs of bringing the goods to a state suitable for use are included in the actual expenses for the purchase. To write off packaging produced at the time of sale of goods, write off from the credit of account 41 to the debit of account 44, subaccount “Container” (distribution costs of a trading organization).

Where is the TORG-6 form used?

Companies that purchase inventory in containers that can be weighed after they are emptied (for example, after the goods are sold) must carry out an empty container screening to verify that the data in the supplier's documents is correct.

Identification of significant discrepancies between the tare weight indicated in the supplier's shipping document and the weight obtained after actual weighing allows the buyer to demand compensation from the supplier for the missing goods. A discrepancy may mean a shortage if it exceeds the norms of natural loss of goods due to its absorption into containers, precipitation, sticking and other traditional phenomena for certain types of values.

If the excess weight is within the limits of the norm of natural loss for a given type of inventory, then this is not recognized as a shortage.

Otherwise, the TORG-6 act is drawn up in two copies, one of which is submitted with a claim to the seller in order to compensate for missing valuables. If there is no shortage, then the act of sealing the containers is generated in one copy - for the accounting department of the buyer’s company.

Not for all groups of goods it is possible to curtain the container and separate it from the goods located in it; in such cases, weighing is not performed and the TORG-6 act is not generated. This is true in the case, for example, of fish products.

Also, the act is not drawn up when the goods are individually packaged.

1.1.3. The act of weighing a car

<Letter> Federal Tax Service of the Russian Federation dated 08/21/2009 N ШС-22-3/ [email protected] <On the direction of systematized materials for documenting operations during the transportation of goods> (together with the “Procedure for replacing (adjusting) essential information (goods, consignee, point... The form of the act is not currently approved. The forms and recommendations for their preparation specified in the General Rules for the Transportation of Goods by Road (approved by the Ministry of Automobile Transport of the RSFSR on July 30, 1971, as amended on May 21, 2007) can be used, since clause 2 of Art. 38 of the Charter of Motor Transport and Urban Ground Electric Transport (Federal Law of November 8, 2007 N 259-FZ) provides the following: “The procedure for drawing up acts and putting marks in the documents specified in part 1 of this article is established by the rules for the transportation of goods, the rules for the transportation of passengers "

- 1. For what types of transport is it used?

- 2. By what subject is it applied?

- 3. How many copies are compiled?

- 4. Compiled by whom

- 5. Mandatory document details

- 6. What confirms

- 7. Application procedure

- 8. Storage location

- 9. Use in mixed messages

- 10. Use in international traffic

- 11. Application diagram

- 12. Additional documents for the vehicle weighing report

- 13. Errors in document execution. Making changes to a document

- 14. Arbitration practice

- 15. Assessing the significance of indicators by the degree of tax control

Open the full text of the document

Who fills out the TORG-6 form

Filling out the act on the curtain of containers is carried out by a special commission formed, in which representatives of interested parties and the financially responsible person of the buyer’s company must be present.

Weighing is carried out upon receipt of valuables from the supplier at the time of unpacking the goods - the gross weight is determined, including the weight of the container and the goods. If this weight turns out to be greater than what the supplier indicated, a report is also drawn up for the supplier and submitted with a claim for compensation for the shortage.

As the goods are sold or packaged, empty containers are re-weighed. The results of this procedure are also reflected in the TORG-6 container curtain certificate; the following situations are possible:

- If the discrepancies are not significant and are within the normal range, then it is enough to issue one form of report for the accounting department, which will write off the curtain from the MOL. Perhaps the agreement with the supplier (on supply or sale) provides for the write-off of the container at the expense of the supplier, that is, the latter reimburses the buyer’s expenses;

- If the discrepancies exceed the natural loss of goods, then an additional copy is generated for the seller, to whom a complaint is also sent with a requirement to compensate for the excess shortage.

The completed form of the act is certified by the following persons:

- Members of the commission participating in the veil sign the bottom of the act;

- The head of the buyer's organization puts an approving signature at the top of the form.

The act on the curtain of containers TORG-6 is important, as it serves as the basis for the accounting department to write off excessively capitalized inventory items from the account of the materially responsible person.

Product quality check procedure

Many people believe that checking the quality of a product and examination are one and the same thing. This is wrong. Checking for compliance with the declared quality characteristics is a broader concept; it includes various actions, including conducting an expert assessment.

Subject composition

Both the seller and the buyer have this right. They can do this either personally or with the involvement of other persons and organizations:

- At the time of purchase, the consumer checks the product, evaluates the quality characteristics and completeness, and tests it in operation. This applies to all items of trade only if this is not prohibited or impossible for a given type of goods;

- The selling party, having accepted the goods with a claim, can independently conduct an inspection;

- Seller's representatives. Such a check can be carried out by store employees;

- Specialized organization. This could be a service center or a private expert organization. Such organizations are contacted when the knowledge and qualifications of the seller are not enough to objectively assess the quality of the product or the shortcomings are hidden;

- Authorized public or government organizations. Such an inspection, at the request of the buyer, can be carried out by public consumer organizations (unions, associations, associations). For this purpose, they have an expert position on their staff. Such an inspection can be performed by any department of Rospotrebnadzor, after the buyer’s request, as part of an initiated inspection of the seller’s activities.

Important: in order for Rospotrebnadzor to begin an inspection of the seller’s activities, it is necessary to first comply with the complaint procedure. Bypassing it, they contact Rospotrebnadzor directly if they purchase a product whose characteristics violate safety requirements.

Rules and process

The inspection is carried out in order to establish the reasons why the product does not meet its quality characteristics. In addition, the seller usually wants to make sure that the product is really of poor quality. The quality of the product may have suffered as a result of improper use by the consumer.

Checking the quality of a product means establishing its compliance with:

- Legislative acts;

- Clauses of the agreement;

- The usual requirements for this type of goods;

- Purposes of use;

- Instructions.

Procedure:

- Visual inspection by assessing the external characteristics of the product, opening the case;

- Establishing compliance of quality characteristics with the declared ones;

- Check the performance according to the product instructions.

Sample application for quality control in the presence of the consumer

Sample of filling out the act on the curtain of containers

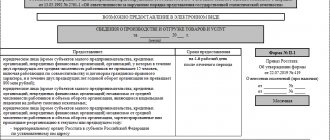

The standard TORG-6 form is presented on one sheet, with general information at the top and information on the weighing results in the table. The title part of the TORG-6 form is filled in with the following information:

- The name of the organization that received the goods in containers requiring the definition of a curtain;

- The name of the structural unit, if the packaged goods are delivered to a specific unit;

- Basic information about the buyer’s organization – OKPO, main activity;

- Name, OKPO and contacts of the supplier company;

- Number and date of execution of the act (form TORG-6 is filled out upon acceptance of the goods and measurements of its weight along with the container, as well as as the container is emptied of the valuables in it);

- Name of the product located in containers requiring weighing;

- Details of the document on the basis of which a representative of the supplier company was invited;

- Place for placing an approval mark by the head of the buyer's organization.

Filling out the tabular part of the TORG-6 form:

| Column number | Information to be filled in |

| 1, 2 | The number and date of the shipping document, which indicates the name of the incoming goods and materials, the weight of the goods with and without containers (bill of lading TORG-12, bill of lading 1-T). |

| 3 | Name of the product and the container in which it is located. |

| 4 | Product code in accordance with the product classifier. |

| 5, 6 | Name of the unit of measurement and code according to OKEI. |

| 7 | The quantitative indicator for this position is indicated in accordance with the unit of measurement. |

| 8 – 10 | Weight of position according to documentary data:

|

| 11-13 | The weight of the item based on the results of weighing, the weight of goods, containers and total gross weight are similarly given. |

| 14-16 | Curtain – weight, unit price and total amount to be written off. |

The completed report form is certified by each member of the commission that carried out the measurements, after which it is approved by the director of the enterprise. An approval mark is placed at the top of the TORG-6 form and means the manager’s agreement with the amount of money to be written off.

Only after approval, the document is submitted to the accounting department along with the goods report to remove excess goods from the MOL's reporting. Before transferring the act to the accountant, it is registered in a special journal TORG-7, where information is collected on incoming goods and materials that require packaging. The journal is maintained throughout the year and contains consistent summary information on all goods for which packaging is screened during the reporting period.

Documentation and accounting of losses when selling bulk goods.

Concept, regulatory regulation of losses of goods during their sale.

Documentation of the fact of the curtain of containers.

Reflection in the reporting of sellers of documents on commodity losses from containers.

Features of accounting for commodity losses at an enterprise.

Application of program 1c: Accounting in the organization of accounting for losses of inventory items.

The program's capabilities for generating documents on commodity losses.

Features of the formation of accounting entries for losses of valuables from containers.

Proposals for improving the information used about the containers contained in the cumulative register for management accounting purposes.

Creation of the document “Act on the curtain of containers”

3.1 Development and structure

3.2 Development of the document form

3.3 Development of procedures and functions of the document module.

3.4 Development of tables for printing a document.

Introduction

Conclusion

List of used literature

Introduction.

Currently, accounting at enterprises of all forms of ownership is becoming more and more automated. The most common accounting automation system is software products (“1C: Accounting”, “1C: Enterprise”, “1C: Trade + Warehouse”, “1C: Salary + Personnel”, etc.).

The program system provides ample opportunities for maintaining automated accounting at enterprises, organizations and institutions, regardless of their type of activity and form of ownership, with varying levels of accounting complexity. It also allows you to organize effective accounting, personnel, operational trade, warehouse and production accounting, payroll, and tax accounting

The works and textbooks of Russian authors on the automation of accounting and tax accounting in enterprises of all forms of ownership using programs were used as the theoretical basis for the study.

The structure and scope of this work consists of an introduction, 3 chapters, a conclusion, and a list of references.

Documentation and accounting of losses when selling bulk goods.

Concept, regulatory regulation of losses of goods during their sale.

The main component of retail turnover is the sale of goods to the public for cash, and the volume of sales is determined by the revenue for goods sold. At a retail trade enterprise, one of the most important parts of accounting is the accounting of goods and containers.

When registering goods received in containers (for example: caviar, jam, jam in barrels), the net mass of goods is determined by subtracting the container mass from the gross mass according to the marking. After the sale of such goods, the released container is weighed, and it may turn out that the actual weight of the container is greater than that indicated on the label due to the absorption of the goods into the container. The resulting difference between the actual tare weight and the tare weight indicated on the label is called the tare curtain. This means that less goods were sold than were capitalized. Due to the fact that the loss of containers occurs not due to the fault of the financially responsible person, but for objective reasons, the amount of the loss of containers is written off as excess capitalized goods. The curtain of containers is formalized by a special act. The timing of its preparation is established by the delivery conditions. If the period is not specified, then the act must be drawn up no later than ten days after the container is released, and from semi-liquid goods and with brine - immediately after its release. When drawing up a report, a mark is made on the container indicating the date and number of the report to prevent repeated weighing of the same container.

Products for which container curtains are possible are registered in a special journal, which indicates the name of the supplier and the product, the date and number of the document, the weight of the goods according to the supplier’s documents (separately gross, net, tare weight). Depending on the terms of the contract with the supplier, containers are written off differently. If the write-off occurs at the expense of the supplier, then a claim letter is sent to him with a copy of the act on the collection of containers and on the basis of this letter a claim is presented to the supplier, while the containers are written off from the financially responsible person at accounting prices, and the purchase price of the goods is recovered from the supplier. If it is impossible to make a claim to the supplier (the document on the packaging was untimely or incorrectly drawn up), then these losses are attributed to the perpetrators. If the culprits cannot be identified, the container load may be written off at the expense of the retailer.

Accounting for commodity transactions of an enterprise is regulated both by general regulatory documents on the organization of accounting, and by special ones that reflect the characteristics of the trade sector:

· Rules for the sale of certain types of food and non-food products (approved by the Government of the Russian Federation dated October 8, 1993, No. 995);

· On the norms of natural loss for food products (order of the Ministry of Trade of the Russian Federation dated May 21, 1987 No. 085);

· Basic provisions for accounting for containers at enterprises and organizations (approved by the USSR Ministry of Finance dated September 30, 1985, No. 166);

· On the protection of consumer rights (RF Law of 02/07/92 No. 2300-1 as amended on 06/02/93);

· On the formation of free (market) retail prices (approved by the State Committee for Prices of the Russian Federation dated September 24, 1993, No. 01-17/1199-23).

Documentation of the fact of the curtain of containers.

Receipt of material assets from suppliers is carried out on the basis of business agreements concluded between buyers and suppliers (Appendix 1). Agreements concluded between suppliers and buyers stipulate: types of supplied inventory items, commercial terms of delivery, quantitative and cost indicators of inventory items, terms of contract execution, payment procedure (payment terms), as well as the parties’ responsibility for improper execution of the agreement .

The acquisition of inventory items externally can be carried out in two ways. In the first option, the company appoints its own attorney to purchase inventory assets externally. He is given an account of cash with the rights to receive goods and immediate payment for them, or a power of attorney by which he can receive inventory and material assets, on account of an agreement that takes place between enterprises in the form of a supply agreement or a letter of guarantee with a visa of the supplier’s manager (independently paid for in goods). material assets in advance or not). Delivery of goods in such cases is carried out by pick-up, regardless of the geographical location of the buyer and supplier. In the second option (distance of the supplier from the recipient, and/or constancy of supplies), deliveries are carried out by an intermediary - a transport company or the supplier directly.

Each business transaction, including the receipt of goods, must be documented. In accordance with paragraph 7 of the Regulations on Accounting and Reporting, any document must have the following basic details:

· name of the document (form);

· form code;

· Date of preparation;

· content of a business transaction;

· meters (in quantitative and monetary terms);

· names of positions of persons responsible for carrying out business transactions and the correctness of its execution;

· personal signatures and their decoding.

· Additional details may also be included. Documents are drawn up at the time of the operation, and if this is not possible, immediately after the end of the operation.

To receive goods and containers from suppliers, a representative of the enterprise (forwarder) is issued a power of attorney (Form No. M-2) (Appendix 2). All powers of attorney are registered at the time of issue in a special journal. A power of attorney is issued only by an accountant to a specific individual, indicating the validity period and the names of the assets expected to be received. The power of attorney requires a signature from the forwarder, which must be certified by the signatures of the accountant and manager with the imprint of the company's seal. With a power of attorney, a representative of the enterprise can receive the goods directly from the supplier with the issuance of shipping documents at the same time.

The main documents on the basis of which goods are received are invoices, waybills and trade and procurement acts. Invoices are issued when goods are delivered by road (Appendix 3); in other cases, invoices are issued. Invoices are recorded in the sales ledger and in the purchase ledger. Invoices (Appendix 4) are drawn up by the supplier enterprise in the name of the buyer enterprise in two copies, the first of which, no later than ten days from the date of shipment of goods or prepayment (advance payment), is presented by the supplier to the buyer and gives the right to offset (reimbursement) amounts for tax on Additional cost. The second copy of the invoice (copy) remains with the supplier to be reflected in the sales book.

The invoice must indicate:

· serial number of the invoice, date of submission;

· name and registration number of the supplier of goods;

· name of the recipient of the goods;

· cost (price) of goods;

· amount of value added tax;

The invoice is signed by the manager and chief accountant of the supplier, as well as by the person responsible for the release of goods and affixed with the seal of the organization.

Erasures and blots are not allowed on the invoice. Corrections are certified by the signature of the manager and the seal of the supplier's company, indicating the date of correction.

Received and issued invoices are stored separately in the invoice register for a full five years from the date of their receipt. They must be filed and numbered.

Buyers of goods keep a log of invoices received from the supplier and a purchase book. The purchase book is intended for registering invoices for the purpose of determining the amounts of value added tax. Invoices presented by suppliers are subject to registration in the purchase book in chronological order as the purchased goods are paid and posted. The purchase book must be laced, its pages laced and sealed. Control over the correctness of maintaining the book is carried out by the head of the enterprise or a person authorized by him. The purchase book is kept by the buyer for a full five years from the date of the last entry.

Depending on the nature of the goods, documents confirming the quantity of goods or their quality (quality certificates, certificates, certificates of laboratory test results) may be attached to waybills or invoices.

Typical errors in filling out the TORG-6 form

A serious mistake in filling out the act of sealing containers would be the absence of certifying signatures of the commission members. An uncertified document will not be valid, and therefore each member of the commission involved in measuring the curtain must sign at the bottom of the TORG-6 form.

Members of the commission, when signing the act, must understand that the information reflected must correspond to reality and the results of actual measurements.

Errors may be made in calculating the veil. Its value is determined as the difference between the weight of the container according to the marking or stencil and the actual weight determined after the container is released from the goods. Indicators about documentary data (columns of the table of the TORG-6 form from 8 to 10) are taken from the papers accompanying the goods and received by the buyer from the supplier (waybill, invoice, waybill).

Possible results

Upon expiration of the period, the buyer must receive from the opposite party reliable information about the results and the decision made. Based on the results, the seller draws up a document - an Act or Conclusion, the contents of which he introduces to the buyer. Options for further developments:

- Establishment of inadequate quality of the goods and the seller’s agreement with the stated requirements of the buyer. In this case, the parties come to an agreed solution, and the seller satisfies the requirements of the claim;

- Establishing the fact that the cause of defects in the goods was the actions of the buyer, other persons or force majeure.

- Before filing a claim, the consumer must objectively assess the circumstances under which the product failed. If there is a possibility of his guilt and this is established during a quality check, he will suffer additional material losses in the form of payment for the work of an expert, storage and transportation of the goods themselves.

Elements of the act

The act is drawn up on one side of the sheet. It looks like a table, and if necessary, its lines can be moved to the next sheet along with the ending. In the upper right corner of the paper there is a link to Resolution of the State Statistics Committee of Russia No. 132 of December 25, 1998. Previously, it was relevant, as it established mandatory forms of primary documents. Since 2013, all such documentation is advisory in nature.

Below the link to the law there is information about the code according to OKUD (it is immediately entered in the form - 0330206), OKPO, and the type of activity code according to OKDP. Also, at the very beginning, the amount of the container is written down with the signature and position of the manager, who signs it as a sign of agreement with familiarization with the act. The following must be specified when filling out:

- name of the organization and its structural unit,

- name of the supplier and his contact details,

- document number, date of its preparation,

- what product was the container from?

- how the supplier’s representative was called, the number and date of the document about this.

In continuation of the act on the curtain of containers there is a tabular part. The table columns are required and must include information such as:

- date and document number of the sender (1st and 2nd columns),

- code and name of the container, its characteristics (3 and 4),

- unit of measurement, OKEI code (5 and 6),

- quantity of containers (7th column),

- the mass of material that was received according to the supplier’s documents (8, 9 and 10),

- mass actually received (11, 12 and 13),

- which specific curtain is subject to write-off, its weight, amount and price (14, 15 and 16).

At the end of the table there is a line “Total”. It covers columns 7 to 16. If, after filling out the document and reflecting all the facts, there are empty lines, then you should cross them out. At the very end are the signatures of all commission members.

If there is an error in the text of the document, then the correct thing to do is to cross it out with one line (while maintaining visibility) and sign the correct data next to it. The signatures of all commission members should be nearby.

ACT OF CONTROL WEIGHING AND PACKING OF PRECIOUS METALS

dated "___" ____________ 20___ N ________

| This act is drawn up to the effect that | |||

| (the basis for conducting the control | |||

| weighing and packaging of precious metals) | |||

| IN | |||

| (number and (or) name of the room where control weighing and packaging were carried out) | |||

| (positions, surnames, first names, patronymics of the workers who performed control weighing and packaging) | |||

| control weighing performed | |||

| (type of precious metal) | |||

| in quantity | total ligature mass | ||

| (in numbers and words) | |||

| grams | |||

| (in numbers and words) | |||

| Control weighing was carried out at | |||

| (brand, model, serial number of the product | |||

| measurements of precious metals and the name of the manufacturing organization, date and number of the verification certificate, other information) | |||

| in the presence | |||

| (positions, surnames, first names, patronymics of workers present during control weighing and packaging) | |||

| Checkweighing data corresponds to specification data | |||

| taking into account the limits of permissible error. | |||

| (specification numbers) | |||

| Precious metals are packaged according to specifications | |||

| (specification numbers) | |||

| V | |||

| (type of packaging) | |||

| which are sealed/have punch imprints | |||

| (cross out what is not necessary) | (details of impressions of seals, punches) | ||

| Note: | |||

| (job title) | (personal signature) | (surname, initials) | |

| (job title) | (personal signature) | (surname, initials) | |

| (job title) | (personal signature) | (surname, initials) | |

Not to be filled in when carrying out control weighing and packaging of precious metals when combining specifications.

To be completed when new specifications are issued.

For incoming goods for which containers can be weighed, upon their release from containers, a weighing procedure is carried out, during which the mass of the container is determined. The process is carried out by a special commission in the presence of interested parties; at the end, a certificate of packaging is drawn up to reflect the results. This form can be prepared using the standard unified form TORG-6. In the article we will tell you about TORG-6 Act on the curtain of containers, we will provide a form and a sample for downloading.