For what purposes do travel allowances exist?

As a rule, a person goes on a business trip not out of his own desire and the dictates of his heart, but at the request of the employer. Naturally, he has the right to expect to be compensated for all the inconveniences that he will encounter on the road. So, the accounting department must pay for it:

- round trip fare;

- accommodation (hotel or apartment rental for daily rent);

- various other payments that may be associated with the preparation of documents: passports, visas and other papers.

As a result, 2020 international travel expenses will be higher than those classified as regional. In most cases, per diem is calculated and paid to the employee in advance, i.e. he is already leaving with this money. And this is justified, because There are few workers who will voluntarily pay themselves and expect to receive compensation later. In this situation, it will be quite problematic for the employer to find employees.

In addition to travel allowances, a person who goes on a trip for official reasons is also paid a daily allowance. These are payments that should compensate the employee for the costs of various household items. Unlike general travel allowances, for which a full and detailed account is provided, daily travel allowances have certain parameters and are not accountable. That is, the organization independently calculates the amount of daily payments for the employee and immediately issues them to him.

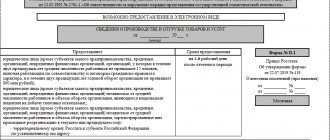

Filling out the form

Completing the cover page of Form 12-F includes making entries about:

- The name of the organization submitting the declaration (including full and short names);

- Address of the location of the enterprise;

- OKPO code of the organization. Note that the OKPO code, like other statistics codes, can be found on the state statistics website by indicating there your taxpayer identification number or ORGN;

- The year for which the report was compiled.

After filling out the title page, we proceed to filling out the form itself, which consists mainly of listing expenses, that is, how the company’s funds were spent in the reporting year.

Expenses are divided into main groups and their subgroups.

These main spending groups include: (click to expand)

- Entertainment expenses;

- Business maintenance expenses;

- Employee benefits;

- Financing investments on a long-term basis.

For each expense item and its subitem, you must indicate the amount of money spent by the legal entity.

Important!

In this form of statistical observation, you need not only to indicate the presence and amount of money spent, but also to separate from the amount of expenses the amount of money spent from net profit.

We sign Form 12-F by the director of the organization or another person who is appointed as the unified executive body of the organization and is responsible for submitting statistical reports.

font size

ORDER of Rosstat dated 12-09-2012 492 ON APPROVAL OF STATISTICAL INSTRUMENTS FOR THE ORGANIZATION OF FEDERAL STATISTICAL... Relevant in 2020

How is the amount of such payments determined?

Each company independently determines the optimal amount of travel allowances for itself. It should be understood that the parameters specified at the legislative level apply to budgetary organizations. Private companies can independently determine the amount of payments to their employees on the field. In this case, it is worth considering a certain nuance. For example, the maximum daily travel expenses for 2020 is about 700 rubles. If a company assigns an amount to its employee that exceeds this figure, everything that is accrued in excess must be subject to income tax.

The concept of the minimum amount of travel expenses in Russia in 2016 is not in the Russian Labor Code - it was removed a long time ago, because didn't make any sense. On average, business trips are paid as follows: about 300 rubles per day when traveling within your region, no more than 700 rubles. when traveling within Russia, up to 2500 rub. when traveling abroad.

What time periods are taken into account in payment?

The standard for reimbursement of travel expenses also considers such issues as which days should be paid. So, in 2016, as in all others, a seconded employee of the company receives money for all days spent away from his workplace. Among them:

- weekend dates;

- days from the holiday category;

- time spent by a person on the road;

- various types of forced stops that arose through no fault of the employee;

- sick leave, etc.

Payment of travel expenses in 2020 is no different from other periods. It can be done either in cash or by transfer to a card. Everything directly depends on the form of payment provided by a particular company.

Payments of this kind raise certain questions when traveling abroad. After all, daily allowances are calculated in rubles, and then transferred at the rate and used in the currency that is used in the country where the posted employee is sent. In the opposite direction, reimbursement will be made at the exchange rate that is valid at the time of the trip. All this must be confirmed by papers and relevant documents.

Rates

Methodological recommendations for filling out the “TEB-annual” form

I. _ Registration information of the organization

In the column “Full name of the organization” the full name of the organization (at the end of the reporting period) is indicated in accordance with the constituent documents registered in the prescribed manner, with a short name in brackets. The address part of the form indicates the legal address with postal code. In the column “Registration number” the registration number in the Unified State Register of Legal Entities is indicated. In the column “Main OKVED” the code of the main type of activity according to registration documents is indicated. The column “Additional OKVED” indicates the types of activities in the fuel and energy sector, selected from Appendix 1. The digital code of the administrative-territorial entity is entered in the column “OKATO” The column “Administrative affiliation” indicates the name of the locality and municipality (urban district or municipal district) in which the fuel and energy complex facilities are actually located.

If the organization has facilities located in different municipalities, reporting forms are filled out separately for each of these entities. The data is provided in the units of measurement indicated on the approved form. II . Completing Section 1 “Information on the production and supply of thermal energy”

In this section it is necessary to indicate: - volumes of thermal energy, both generated by the organization’s own energy equipment and received from other energy supply organizations (ESOs) carrying out activities for the transfer and sale of heat;

— consumption of thermal energy for the boiler house’s own technological needs; — losses of thermal energy in heating networks; — useful supply of thermal energy to both end consumers and other ESOs. The basis for filling out is accounting documents for the reporting year. Information on the production and supply of thermal energy (clauses 1, 2, 3, 4). The column “Thermal energy production by boiler houses, total” (clause 1) provides information on the amount of thermal energy generated by the organization’s energy equipment during the reporting period. If there are several boiler houses on the balance sheet of the organization located in one territorial entity (city, district), the data provided must correspond to the amount of output of each of the boiler houses for the reporting period (clause 1 of the “Boiler House” form). If the boiler houses of a given organization are located in different territorial entities, it is necessary to fill out reporting forms for each of the territories. Information is entered according to the readings of verified metering devices (if any) or based on calculations. When preparing information, it should be taken into account that the total volume of output cannot exceed the value calculated using the following formula: Q output. total.. = In t.t. × Q r.t. _ × η avg.; η av = Σ Q cat. i × ηcat. i / Σ Q cat. i , where Q vyb. total – total thermal energy production, Gcal;

Watts – total equivalent fuel consumption, tons of reference fuel, which is calculated as the sum of all types of fuel in conventional terms in clause 21.2 of Section 3 “Information on fuel receipt and consumption”; Q r u.t. – calorific value of standard fuel equal to 7 Gcal/tce; η avg. – weighted average efficiency of boiler houses; Q cat i – thermal energy production of the boiler house, Gcal (clause 1 of the “Boiler house” form); ηcat. i . – efficiency factor of the boiler room. The column “Thermal energy consumption for the boiler house’s own technological needs” (clause 2) provides information on the actual amount of thermal energy used for fuel preparation (drying solid fuel, heating fuel oil, its atomization), chemical water treatment, preheating water, etc. . All remaining energy should be included in useful vacation and then assigned to the appropriate item. The column “Receipt of thermal energy from other ESPs” (clause 3) provides information on the amount of thermal energy received from other ESPs. For a more qualitative analysis of the data obtained on the supply of thermal energy within the region, it is necessary to provide information about thermal energy suppliers as an explanation. The column “Losses of thermal energy in heating networks” (clause 4) provides information about the actual amount of thermal energy that was lost through leaks and through thermal insulation in heating networks owned by the organization submitting the report. Information on the supply of thermal energy (clause 5). Information entered in the column “Useful supply of thermal energy to consumers” (clause 5) is defined as the amount of thermal energy generated by own boiler houses and purchased from third-party ESOs, minus heat consumption for the own needs of boiler houses and losses in heating networks. The useful supply of thermal energy is divided into the supply of heat to end consumers (clause 5.1) and the supply of heat to ESOs carrying out activities for its transfer and sale (clause 5.2). The column “Supply of thermal energy to final consumers, total” (clause 5.1) provides information on the amount of thermal energy supplied under contracts with individuals and legal entities who consume it for their own needs or for the needs of third parties, but do not have tariffs for the transportation and sale of thermal energy. The information given in clause 5 is formed on the basis of the supply of thermal energy to the following groups of consumers: - to the population (clause 5.1.1) , and information is presented only if the energy supplying organization has contracts for the supply of thermal energy directly to individuals, or housing cooperatives or to similar organizations and their payment for heat is made directly to the energy supply organization; - budgetary organizations of all levels (clause 5.1.2) , with breakdown by level of the funding budget - federal, regional, local, while information is presented only if the energy supplying organization has contracts for the supply of thermal energy directly to these organizations that pay for this service directly energy supply organization; — other business entities (clause 5.1.3) . The supply of thermal energy to end consumers also includes the organization’s own consumption, with subsequent assignment to the appropriate type (clauses 5.1.2 or 5.1.3) depending on the form of financing of the reporting organization. In the column “Thermal energy supply to adjacent ESOs carrying out activities for the transfer and sale of heat (centralized and distribution networks)” (clause 5.2) information is provided on the amount of thermal energy supplied to enterprises and organizations that carry out the functions of heat supply to individuals and legal entities and which have established tariffs for transportation and sale of thermal energy. For a more qualitative analysis of the data obtained on the supply of thermal energy within the region, as an explanation, it is necessary to decipher to which enterprise and in what quantity it was supplied. Reference data clauses 6, 7 are filled out if the organization has approved standards for thermal energy consumption for its own needs and thermal energy losses in heating networks, which makes it possible to analyze the organization’s activities in terms of energy saving for the reporting period. Due to the lack of high-quality heat supply schemes for certain territories, the organization submitting reporting data on the fuel and energy balance must fill out clause 8 “Length of its own heating networks in a two-pipe design (1 km of heating network is taken as 1 km of supply and 1 km of return pipelines) and clause 9 “ Volume of own heating networks” , which will allow a more reliable analysis of the received data on thermal energy consumption.

III .

Filling out section 2 “Information on the production and supply of electrical energy”

Column 10 “Production of electrical energy” provides information on the amount of electricity generated per year by all stations of this organization, broken down by type of production. Column 11 “Electric energy consumption for own needs of power plants” provides information on electricity consumption for own needs, including consumption for the production of electricity and heat. Column 12 “Electric energy supply from power plant buses” corresponds to the difference between the electricity produced and the consumption for the power plant’s own needs. Column 13 “Receipt of electrical energy from outside the region (balance flow)” provides information on the amount of electricity received from the wholesale market. Column 14 “Losses of electrical energy in electrical networks” provides information on the technological consumption of electricity for transmission through electrical networks. Column 15 “Supply of electrical energy to end consumers” provides information on the amount of electrical energy supplied under contracts with individuals and legal entities, in general and by groups of consumers: Column 16 “Supply of electrical energy outside the region (balance flow)” provides information on the amount of electricity supplied to the wholesale market.

IV . Filling out section 3 “Information on fuel receipt and consumption”

In this section it is necessary to indicate all types of energy fuels used by the organization: natural gas, liquefied gas, fuel oil, coal, diesel, heating oil, peat, firewood. In the case of using electrical energy to generate heat, data on its use should also be given in the table. If the table does not contain any of the fuels used, it is necessary to either supplement it or correct the name of any of the unused columns and enter the appropriate data. The basis for filling out is accounting documents for the reporting year. Information on all types of fuel is entered into the form in standard fuel, using the conversion formula: W.t.= Wt.t. × E; E = Q p n.t. / Q p a.t., where W.t. – amount of natural fuel, t; (for natural gas - thousand m3, for electricity thousand kW × h, due to the fact that the calorie coefficient is calculated based on these units of measurement); Watts – amount of standard fuel, tce; E – calorie equivalent; Q p n.t. – calorific value (lower operating calorific value) of natural fuel, taken according to passport data, quality certificates, according to the results of the analysis, kcal/kg b.w.; (or other generally accepted unit of measurement ) Q r.t. – calorific value of standard fuel equal to 7000 kcal/kg standard fuel. In the absence of data on the actual caloric content of burned fuel, the use of average caloric equivalents is allowed (see table).

| Values of average caloric equivalents for individual types of fuel. | |||

| Electricity | 0,123 | Petrol | 1,49 |

| Natural gas | 1,14 | Coal | 0,765 |

| Liquefied gas | 1,57 | Peat fuel | 0,34 |

| Fuel oil | 1,37 | Peat briquettes | 0,6 |

| Diesel (heating) fuel | 1,45 | Firewood | 0,266 |

Information on the receipt of fuel (clauses 17, 18, 19, 20) The column “Fuel balance at the beginning of the year” (clause 17) provides information on the quantities of the specified types of fuel remaining from the previous period at the beginning of the reporting year. The “Extraction” column (clause 18) is filled in by enterprises in the region that extract natural resources that can be used as energy fuel. The column “Receipt of fuel within the region” (clause 19) provides information on the quantities of the specified types of fuel received under contracts in which the supplier is enterprises and organizations registered in the region. In order to expand the list of organizations participating in monitoring and for a better analysis of the data obtained on the supply of fuel within the region, it is advisable, as an explanation, to provide information about fuel suppliers. The column “Receipt of fuel from outside the region” (clause 20) provides information on the quantities of these types of fuel received under contracts in which the supplier is enterprises and organizations registered in the territory of other constituent entities of the Russian Federation. Separately, it is necessary to consider the procedure for filling out the “Weighted average cost” and “Natural gas supply” tables. The weighted average cost of individual types of fuel is determined as follows. In accordance with the accounting documents for payment for fuel, the total amount of costs (excluding VAT) for the purchase of a specific type of fuel is determined (taking into account supply and sales services and transportation). The resulting value is divided by the total amount of a specific type of fuel (in physical terms) received during the reporting period. The weighted average prices determined in this way are entered into the corresponding entries in the “Weighted Average Cost” table. Due to the fact that supplies of natural gas to enterprises are strictly limited, information on the composition of its supply is of great importance for analyzing its consumption. For this purpose, the table “Natural gas supply” has been introduced into the fuel and energy balance form (clauses 33, 34, 35, 36). To correctly fill out this table, you must select the following information based on contracts and accounting documents for gas payment: - volume of natural gas supplies (in conventional equivalent) within the provided limit, i.e. supplied at wholesale prices; — volume of natural gas supplies (in conventional equivalent) in excess of the provided limit in the summer, i.e. when an increasing factor of 1.1 is applied to wholesale prices; — volume of natural gas supplies (in conventional equivalent) in excess of the provided limit in winter, i.e. when an increasing factor of 1.5 is applied to wholesale prices; — volume of natural gas supplies (in conventional equivalent) at unregulated prices. This information must be entered into the relevant articles of the table, and the sum of the volumes of natural gas received must correspond to the total amount of natural gas received given in clause 19 or clause 20. Information on fuel consumption (clauses 21, 22, 23, 24). The column “Fuel consumption, total” (clause 21) is filled in by end consumers of fuel (ESO, small consumers using fuel for space heating, industrial boiler houses); it provides the actual consumption of the specified types of fuel for the reporting period with a breakdown by item of use (clauses 21.1, 21.2, 21.3, 21.4): - clause 21.1 provides the actual consumption of the specified types of fuel for the production of electrical energy; — clause 21.2 provides the actual consumption of the specified types of fuel for the production of thermal energy; — clause 21.3 provides the actual consumption of the specified types of fuel for heating the premises of small household consumers with fuel consumption from 10 to 25 tce. in year; — clause 21.4 provides the actual consumption of the specified types of fuel for other needs, including technology consumption. Column 21 is filled in by end consumers of fuel. The column “Fuel supply within the region” (clause 22) provides information on the quantity of the specified types of fuel sold to enterprises and organizations registered in the region; Leave to the public is indicated in a separate column. The column “Fuel supply outside the region” (clause 23) provides information on the quantities of the specified types of fuel sold to enterprises and organizations operating in the territory of other constituent entities of the Russian Federation. The column “Fuel balance at the end of the year” (clause 24) provides information on the quantities of the specified types of fuel that were not used during the reporting period and remained in warehouses.

V. _

Filling out section 4 “Annual form Boiler room” The annual form “Boiler room” is filled out separately for each of the boiler houses owned by the organization. “Registration Information” section provides the following information: - name and address of the boiler room; — OKATO code of the locality on whose territory the boiler house is located; - year of construction of the boiler room, as well as in case of reconstruction, the year of its implementation; — availability of chemical treatment equipment, passport, fuel storage, control metering devices. Column 1 “Annual thermal energy production, total” (fill in the actual value and the planned value for regulated organizations) provides information on the total thermal energy production of the boiler house with a breakdown of heat production by type of fuel used (clause 1.1). When more than one type of fuel is used at a boiler house, the production of thermal energy at each of them is determined in proportion to the share of each type of fuel in the total fuel consumption in conventional equivalent. Information is entered according to the readings of verified metering devices (if any) or based on calculations. The formulas for calculating output are similar to those given in section 1. The standard specific fuel consumption for thermal energy production (clause 1.2) is determined as the weighted average of the passport specific consumption for each type of boiler room equipment depending on the operating time. In the absence of passport data, the standard specific consumption can be calculated using the formula: b specific. normal = 142.86 / η set.., where b specific. normal – standard specific fuel consumption for thermal energy production for a given installation (boiler), kg equivalent fuel/Gcal; 142.86 – specific fuel consumption for the production of thermal energy for a given installation (boiler) based on its efficiency of 100%, kg equivalent fuel/Gcal; η mouth – efficiency factor of a given installation (boiler) when operating on this type of fuel. The actual specific fuel consumption for thermal energy production (clause 1.3) is determined by the formula: b specific. fact. = In i t u.t.. / Q vyb. i , where b is specific. fact. – actual specific fuel consumption for thermal energy production for a given installation (boiler), kg equivalent fuel/Gcal; Q out. i – thermal energy production using this type of fuel, Gcal; In i t.t. is the consumption of this fuel in conventional equivalent, t.t., (clause 21.2 of section 3 “Information on the receipt and consumption of fuel”).

Column 2 “Fuel consumption for the production of thermal energy, total” (fill in the actual value and the planned value for regulated organizations) provides information on the total consumption of all types of fuel in conventional terms (an explanation of consumption by type of fuel is given in section 1.4). Column 3 “Electric energy consumption for the production and transmission of thermal energy” (fill in the actual value and the planned value for regulated organizations) shows the total annual electricity consumption for the production and transmission of thermal energy. Column 4 “Water consumption for the production and transmission of thermal energy” (fill in the actual value and the planned value for regulated organizations) shows the total annual water consumption for the production of thermal energy and compensation for material losses (recharge) during transmission through heating networks. Column 5 “Thermal energy losses in heating networks” shows the amount of thermal energy lost with the coolant and through thermal insulation during transmission through heating networks. Column 6 “Losses of thermal energy for own technological needs” (fill in the actual value and the planned value for regulated organizations) provides information on the actual amount of thermal energy used for fuel preparation (drying solid fuel, heating fuel oil, its spraying), chemical water treatment, water preheating etc.. Column 7 “Installed capacity of the boiler house” provides information on the power of all equipment installed in the boiler house, taking into account mothballed, decommissioned, but not dismantled, in storage, etc. Column 8 “Operating power of the boiler house” provides information about the power that is actually generated by the equipment installed in this boiler house. Column 9 “Connected load” provides information on the estimated hourly volumes of thermal energy supplied to consumers, with a breakdown by type (DHW, heating, etc.) of the connected load (clause 9.1) and the duration (hours per year) of thermal energy consumption for one or another type of load during the year (clause 9.2). When preparing information about the connected load, it should be taken into account that the total maximum connected load should not exceed the operating capacity of the boiler room. Column 10 “Maximum actual load of the boiler room” provides information on the possible maximum load of the boiler room. Column 11 “Boiler house efficiency” provides information about the overall efficiency of the boiler house as a whole. (see this item in the attached file in its original form)

Column 12 “Length of own heating networks in two-pipe design” provides information on the length of heating networks from the boiler room to consumers. In this case, 1 km of the heating network is taken as 1 km of supply and 1 km of return pipelines. Column 13 “Current tariff” shows the tariff for thermal energy established by the Regional Tariff Service of the region.

Annex 1

“Additional OKVED” are codes that define the types of activities of enterprises or organizations as subjects of the fuel and energy sector of the region. This column was included in the form in order to expand the capabilities of the information and analytical system for maintaining the fuel and energy balance in terms of sampling monitoring data for subsequent analysis. Unlike the main OKVED code, which is indicated in registration documents, “Additional OKVED” may not be indicated in registration documents. In this case, it must be selected from the table below.

| Code | Name |

| 10 | MINING OF HARD COAL, LOWN COAL AND PEAT |

| 10.3 | Extraction and agglomeration of peat |

| 10.30 | Extraction and agglomeration of peat |

| 10.30.1 | Peat extraction |

| 23 | PRODUCTION OF COKE, PETROLEUM PRODUCTS AND NUCLEAR MATERIALS |

| 23.2 | Petroleum products production |

| 23.20 | Petroleum products production |

| 40 | PRODUCTION, TRANSMISSION AND DISTRIBUTION OF ELECTRICITY, GAS, STEAM AND HOT WATER |

| 40.1 | Electricity generation, transmission and distribution |

| 40.10 | Electricity generation, transmission and distribution |

| 40.10.1 | Power generation |

| 40.10.11 | Electricity production by thermal power plants |

| 40.10.12 | Hydroelectric power generation |

| 40.10.13 | Electricity production by nuclear power plants |

| 40.10.14 | Electricity production by other power plants and industrial block stations |

| 40.10.2 | Electricity transmission |

| 40.10.3 | Electricity distribution |

| 40.10.4 | Activities to ensure the operability of power plants |

| 40.10.41 | Activities to ensure the operability of thermal power plants |

| 40.10.42 | Activities to ensure the operability of hydroelectric power plants |

| 40.10.43 | Activities to ensure the operability of nuclear power plants |

| 40.10.44 | Activities to ensure the operability of other power plants and industrial block stations |

| 40.10.5 | Activities to ensure the operability of electrical networks |

| 40.2 | Production and distribution of gaseous fuels |

| 40.20 | Production and distribution of gaseous fuels |

| 40.20.1 | Production of gaseous fuels |

| 40.20.2 | Gas fuel distribution |

| 40.3 | Production, transmission and distribution of steam and hot water (thermal energy) |

| 40.30 | Production, transmission and distribution of steam and hot water (thermal energy) |

| 40.30.1 | Production of steam and hot water (thermal energy) |

| 40.30.11 | Production of steam and hot water (thermal energy) by thermal power plants |

| 40.30.12 | Production of steam and hot water (thermal energy) by nuclear power plants |

| 40.30.13 | Production of steam and hot water (thermal energy) by other power plants and industrial block stations |

| 40.30.14 | Production of steam and hot water (thermal energy) by boiler houses |

| 40.30.17 | Production of chilled water or ice (natural from water) for cooling |

| 40.30.2 | Transfer of steam and hot water (thermal energy) |

| 40.30.3 | Distribution of steam and hot water (thermal energy) |

| 40.30.4 | Activities to ensure the operability of boiler houses |

| 40.30.5 | Activities to ensure the operability of heating networks |

| 51 | WHOLESALE TRADE, INCLUDING TRADE THROUGH AGENTS |

| 51.12 | Activities of agents in the wholesale trade of fuels, ores, metals and chemicals |

| 51.12.1 | Activities of fuel wholesale agents |

| 51.18.26 | Activities of agents in the wholesale trade of electricity and heat (without their production, transmission and distribution) |

| 51.51 | Wholesale trade in fuel |

| 51.51.1 | Wholesale trade of solid fuel |

| 51.51.3 | Wholesale trade of other liquid and gaseous fuels |

| 51.56.4 | Wholesale trade of electrical and thermal energy (without their transmission and distribution) |

| 52 | RETAIL TRADE, EXCEPT TRADE OF MOTOR VEHICLES AND MOTORCYCLES |

| 52.48.35 | Retail trade in household liquid boiler fuel, bottled gas, coal, wood fuel, peat fuel |

How are day trips counted?

Business trips can’t always be long – there are trips that last only 24 hours or less. Most often, in this case, payment of daily allowances is not provided and is not carried out. At the same time, there is a corresponding decision approved by the Supreme Court, according to which even one-day trips should be paid.

If the business trip ends early

One of the issues related to business trips is the problem of early interruption of a business trip and changes in payments. Such business trips are interrupted only by special order from the company management. It must indicate the reason for the employee’s recall, but then the document itself and the text of the agreement are drawn up in any form. If the business trip is reinstated, all documents will have to be filled out again.

What documents are required to confirm expenses?

While on a business trip, you should be very careful in collecting documents. So, be sure to have with you:

- official assignment (it is also called a prescription for the purposes of the entire trip);

- all necessary travel documents;

- special travel certificate;

- specially created and most detailed expense reports.

All data on the past business trip must be recorded in office notes, and also supplemented with checks and other financial documents. Moreover, all documents must be completed no later than 3 days after the trip.

Business travel is an important part of modern business. After all, it allows you to develop labor activity far beyond the territory of your region. Therefore, an employee is remunerated for working outside the home. Such activities are associated not only with the traveling nature of the work, but also with the fact that the employee is forced to leave home and his family due to work needs.

There are no strictly established standards (payment of daily allowances, travel allowances), according to which travel (per diem) expenses should be calculated in Russian legislation, since they may differ for different enterprises and under different circumstances. In this option, a lot depends on the cost of travel and accommodation. In some cases, entertainment expenses may also be required, which will also be included in the compensation amount. Therefore, the law cannot regulate such provisions.

However, for both commercial and budgetary organizations for the current year, one rule remains unchanged in the new edition of the Federal Law of the country (hereinafter referred to as the Federal Law of the Russian Federation), as well as the Labor Code (hereinafter referred to as the Labor Code of the Russian Federation) - payments must correspond to the provided checks or other payment documents. There are also certain limits (valid subject to the expenditure of funds from the federal budget, i.e., state employees) that must be observed.

Reimbursement for business travel expenses: 100% refund or less?

In most cases, travel (per diem) expenses are reimbursed in full, subject to legal limits, unless otherwise agreed between the employer and employee. In this option, the employee must have documents from the employer confirming the fact of the agreement (in case he has to prove it in court or otherwise). Recent news for the current year confirms that this situation remains unchanged. The law determined special spending norms for public sector employees.

Accommodation and rules for using benefits at the expense of the company

Each employee sent by an enterprise to resolve official issues outside the organization has the right to receive back the spent funds. The amount of daily allowance (travel allowance) may vary (depending on the employee’s status, assigned functions and resolution of issues for which he was sent on a business trip). In addition, it is allowed:

- using a taxi;

- reimbursement of expenses for fuel and lubricants, provided that you travel by your own car/other transport;

- accommodation in a hotel or rented apartment;

- meals at the expense of the company, etc.

In commercial organizations, the company's management can independently regulate the limits on the amount, however, for public sector employees, the law has defined clear standards, beyond which it is not advisable to go. The latest news for the current year confirms that these provisions for payment of daily allowance (travel allowance) have been left unchanged.

Step by step instructions showing columns

When filling out, be sure to indicate the reporting period : from July 1 to November.

From 1 to 4

In the first, you will have to list the data that is subject to recalculation and recording. The 2nd column automatically contains the serial number of the positions. The third column is characterized by the unit of measurement for each data from the first column. In the 4th, OKEI classification codes are introduced.

№5

Important! Starting from this column, information is entered in more detail: lines from 01 to 68 list data on housing and communal services objects that are on the balance sheet of the organization, but without taking into account the form of ownership (provided that the object is not of federal purpose).

The total amount in lines No. 03, No. 05 and No. 07 should be equal to line No. 01. And the total amount of data from No. 04, No. 06 and No. 08 is equal to No. 02.

- Columns No. 01, No. 03, No. 05, No. 07 indicate quantities that fit the unit of measurement “house”. These are apartment buildings in which people live who own residential premises of different sizes in different forms of ownership. They will be in municipal ownership until the creation of the HOA.

- Lines No. 07 and No. 08 summarize the number of all habitable houses that are in the housing and communal services plans for preparation for winter (this is any house where people live, including the private sector).

- Outdated but functioning thermal, as well as water supply, electrical and sewer networks (lines No. 15, No. 31, No. 41 and No. 45) are taken into account in lines No. 13, No. 29, No. 39, No. 43, columns numbered 5,6,7 ,8 and 9.

- Line No. 21 combines water intakes (a well or a group of wells) that were created to provide residents and businesses with water.

- No. 23 summarizes the number of all pumping units at water intakes (except for those wells that are equipped with special submersible pumps) and the external water supply network.

- In line No. 53, pipelines on bridge structures.

- Line 59 indicates the total length of gas pipelines (not counting intra-house ones), which are owned by the given constituent entity of the Russian Federation and ensure the operation of the given housing and communal services facilities, including the residential sector.

- Lines No. 60-63 indicate the fuel supply (in tons) that is stored for the entire heating period, this also includes liquefied gas in underground gas storage facilities. Liquid fuel to support the activities of housing and communal services, including oil, diesel, fuel oil and others, are calculated in line No. 62.

Reference. Data on lines No. 15, No. 16, No. 31, No. 32, No. 41, No. 42, No. 45 and No. 46 are filled in in accordance with the actual data on the length of dilapidated networks.

Dilapidated networks include all networks that received this “title” after a certain degree of wear and tear was identified during the property inventory , which arose by the beginning of the reporting period (preparation for the heating season).

Data in line No. 64 is entered for the total number of non-traditional sources (in units). In lines No. 65-68, the total power must be indicated in kW/hour.

In lines No. 69-78, the funds (calculated in millions of rubles) that will be necessary to prepare the farm for the heating season should be calculated. Under No. 69 and No. 74, all financial costs that will be allocated for preparation for the winter winter season (including loans), as well as funds (line No. 74) allocated only for capital and current repair work related only to preparation for cold weather are summarized.

Data on lines No. 80-85 “Debt of housing and communal services enterprises for previously consumed fuel and energy resources” are filled in column 5 “Total” as of the 1st day of the month following the reporting one.

№6

In column No. 6 “Preparation task” in lines No. 1-59, No. 64-68, the number of planned works is recorded, including in lines No. 15, No. 16, No. 31, No. 32, No. 41, No. 42, No. 45 and No. 46 “dilapidated networks.”

- Lines No. 60-63 are written in accordance with the task of preparing for the beginning of the cold season (that is, for 45 days for coal and 30 days for liquid fuel, etc.). The authorities in a certain region can regulate this indicator. If this is so, then column No. 6 indicates exactly this data.

- Lines No. 69-78 indicate the amount of money that is planned to be spent in preparation for the cold weather.

- Line No. 79 contains data on those amounts that may be additionally allocated by the state.

№7

Statistical information in column No. 7 “Prepared for work in winter conditions for the reporting period” by rows under:

- No. 1–48, No. 59 information is recorded after the completion of the planned work on the specified date.

- No. 49-58, No. 64-68 - in accordance with the acts of readiness.

- No. 60-63 after fuel storage acts have been concluded or it has been delivered to local warehouses.

- No. 69-79 after the allocated funds are put into operation.

№8

The data in column No. 8 “Major repairs, reconstruction, replacement work completed” is filled in according to the lines:

- No. 1-58 when performing major repairs, reconstruction and modernization work.

- No. 59 – how many of them are used for the construction of new gas pipelines, major repairs, reconstruction and modernization of existing ones.

The data in column No. 8 is also recorded in column No. 7, so the results must match.

№9

The lines of this column are needed to indicate the work completed as a percentage, in relation to the planned ones (column No. 6, where the data for the starting point is indicated: the tasks set before starting preparation for sub-zero temperatures of the winter period).

Attention! From the indicators in column No. 5, the data in column No. 7 (where the actual work performed is indicated) is subtracted. As a result, we will receive the amount of work completed at the time of filling out the form and what indicator of plans remains to be completed.

Travel expenses per diem in 2020

Payment of daily (travel) expenses is regulated by several regulatory legal acts of the country, the main one of which is the Labor Code of the Russian Federation (regulated by letters of the Ministry of Finance and the Ministry of Labor and the Decree of the Government of the Russian Federation). The latest news informs that no special changes have been made to the body of the legislative act in this regard, with the exception of the indexation of amounts.

According to the law of the Russian Federation for the current year, the employer is obliged to independently calculate compensation, according to the documents presented (ticket, check, etc.). Payment of daily allowances is made upon the employee’s return from a business trip, unless otherwise agreed between the employer and employee. Please note that payment of daily allowance does not cancel the accrual and payment of earnings (average) and advance payment to the employee (must be issued at the enterprise's cash desk). These provisions are the same for public sector employees and commercial organizations.

In budgetary organizations, daily business trips: payment

Payment of travel expenses in 2020 in budgetary institutions is regulated by the Labor Code of the Russian Federation. Latest news confirms the following daily allowance limits for public sector employees for the current year:

- for business trips outside the city – 100 rubles per day (except for Moscow and St. Petersburg);

- with the same interpretation, but in Moscow or St. Petersburg – 300 rubles/day, but not more than 700 rubles per day;

- foreign business trips – 2.5 thousand rubles/day.

If the amount exceeds, the enterprise (public sector employees) will be required to pay insurance premiums, as well as personal income tax. Also, public sector employees have additional expenses (according to KOSG), which the enterprise can set independently (a sub-item that takes into account additional expenses for the purchase of goods/equipment, etc.). In any case, the employee is obliged to present the employer with supporting documents (payment documents), according to which payments will be made; without confirmation of expenses, the employer has the right to refuse to pay the daily allowance.

Business trip abroad: payment calculator

In addition to standard payments, if an employee needs to travel outside the country, travel allowances include expenses for obtaining a foreign passport, visa and other travel documents, as well as airport and other fees. The company's accountant is obliged to calculate the daily allowance payment, taking into account all these nuances, independently according to the estimate (all amounts must be reflected in the posting and subsequently written off). Recent news for the current year confirms the validity of these provisions for both public sector employees and private companies.

Compensation under the law: what can a company employee count on?

A business traveler has the right to count on payment of daily allowance (for state employees, etc.):

- travel on public transport (bus, trolleybus, etc.), taxi or fuel and lubricants compensation for your car;

- accommodation in rented premises (hotel, apartment, etc.);

- nutrition;

- additional expenses that may relate to travel/accommodation/performing intended functions and assignments (the employer must decide whether to associate these expenses with the business trip or not).

The legislation of the Russian Federation prohibits sending pregnant women and persons under 18 years of age on business trips with production apprentices (apprenticeship agreement). These provisions are relevant for public sector employees and other enterprises. When sent on a business trip, the organization is obliged to provide the employee with a travel document upon application, on the basis of which payments will subsequently be made. Similar provisions apply in the Republic of Belarus, Ukraine, etc. A sample document can be seen on specialized websites (another source) or downloaded for free on our page.

Travel expenses - daily allowances in 2018-2019 are issued in accordance with current legislation. What documents need to be completed when sending an employee on a business trip? What is the daily allowance? What to do if the daily allowance is paid in excess of the established limit? Read our article about all the nuances of documentation and the rules for paying compensation due to an employee when going on a business trip.

Section II. Production and supply of thermal energy

Lines 35-38. Thermal energy produced per year

On line 35

the amount of thermal energy produced per year is indicated, including heat supply sources (boiler houses) with a capacity of up to 3 Gcal/h (

line 36

), from 3 to 20 Gcal/h (

line 37

) and from 20 to 100 Gcal/h (

line 38

) . It is determined by the amount and heat content of released thermal energy measured by measuring instruments.

On lines 35, 36, 40 - 45

includes the amount of thermal energy produced and released by special gas heating boilers with a capacity of up to 0.001 Gcal/h.

Row 35 data

should be equal to the sum of these

lines 36 - 38

or more due to heat supply sources (boiler houses) with a capacity of 100 Gcal/h or more.

For individual enterprises (organizations) that temporarily do not have measuring instruments for systematically determining the production or consumption of heat energy, with insignificant consumption of the latter, calculation methods established by regulatory and technical documents for the accounting of thermal energy and coolants can be used, as an exception. These indicators are determined by calculation based on the fuel consumption produced and the average efficiency factor (COP) of the boiler room. The weighted average efficiency of the boiler room should be determined on the basis of periodic thermal tests.

To determine the heat production based on the corresponding fuel consumption, use the table below.

| Boiler room net efficiency in - % | Consumption of equivalent fuel per 1 gigacalorie supplied - in kilograms of equivalent fuel/Gcal | Boiler room net efficiency in - % | Consumption of equivalent fuel per 1 gigacalorie supplied - in kilograms of equivalent fuel/Gcal |

| 60,0 | 238,10 | 80,0 | 178,57 |

| 62,0 | 230,41 | 82,0 | 174,22 |

| 64,0 | 223,21 | 84,0 | 170,07 |

| 66,0 | 216,45 | 86,0 | 166,11 |

| 68,0 | 210,08 | 88,0 | 162,34 |

| 70,0 | 204,08 | 90,0 | 158,73 |

| 72,0 | 198,41 | 92,0 | 155,28 |

| 74,0 | 193,05 | 94,0 | 151,98 |

| 76,0 | 187,97 | 95,0 | 150,38 |

| 78,0 | 183,15 |

Having data on fuel consumption in the boiler room for a year and knowing the efficiency of the boiler room, it is possible to determine the heat energy production by calculation. So, for example, if a boiler house of a plant, which supplies heat to the population, budget-financed organizations and enterprises, consumed 812 tons of Donetsk coal with a calorific equivalent of 0.723 during the reporting year with a boiler room efficiency of 72%, then the equivalent fuel consumption will be 587 tons (812 tons x 0.723) , since with a boiler house efficiency of 72%, the production of one gigacalorie will require, according to the table above, 198.41 kg of standard fuel, then the amount of heat energy generated will be 2959 Gcal:

(587 * 1000) / 198,41

Then, from the resulting volume of heat energy production, the heat spent on the boiler house’s own production needs (steam pumps, steam nozzles, blowers, etc.) is excluded.

If heat energy is recorded in tons of steam, then the amount of generated steam is recalculated in gigacalories based on the heat content of the generated steam, corresponding to its average pressure and temperature. So, for example, if a boiler room produces saturated steam at an average pressure of 4 kgf/cm2, then according to reference books, this pressure corresponds to a heat content of steam of 653.9 kilocalories per kilogram. In this case, it is necessary to take into account the temperature of the feed water. So, for example, if the feedwater temperature was 10 °C, then the amount of heat obtained with one kilogram of steam will be 653.9 - 10 = 643.9 kcal/kg.

Let us assume that the boiler house produced 1500 tons of steam in a month at the above average pressure of 4 kgf/cm2 and a feedwater temperature of 10 °C. Then the amount of heat generated will be 965850000 kilocalories (1500 * 1000 * (653.9 - 10), or approximately 966 gigacalories.

In exceptional cases, when there is no possibility of assessing the efficiency of the boiler, it is allowed for low-power boilers (less than 0.1 Gcal/hour) to take the consumption of equivalent fuel for the supply of one gigacalorie of heat on average equal to 200.0 kilograms of equivalent fuel (that is, considering that from One ton of standard fuel from such boilers can produce 5 Gcal of heat energy).

To convert the power of hot water boilers, measured in MW, into Gcal/hour, you should use the following ratio: 1 MW = 0.86 Gcal/hour.

Control according to form N 1-TEP:

p.35 ≥ line 36 + line 37 + line 38

Line 39. Received thermal energy from outside for the year

On line 39

shows the amount of heat energy received (purchased) from the outside, which is determined according to the invoices of heat suppliers presented for payment based on the readings of measuring instruments (or calculated).

Line 40. Thermal energy released - total

On line 40

the amount of thermal energy actually supplied for the reporting period to all categories of consumers (subscribers) is reflected, determined on the basis of data from measuring instruments, and in their absence - in the manner established by local governments and in accordance with regulatory and technical documents on the accounting of thermal energy and coolants.

The total amount of heat energy supplied does not include heat used for the heat supply source’s own production needs (boiler house).

Row 40 data

must be equal to the sum of the given

lines 41

and

46

.

Control according to form N 1-TEP:

p.40 ≥ line 41; line 40 = line 41 + line 46

Lines 41-43. Thermal energy was supplied to its consumers, including: the population, budget-financed organizations

On line 41

shows the amount of heat supplied to its consumers (subscribers), including:

- to the population (when the cost of consumed heat is paid by the population, regardless of the form and method of payment) - line 42

; - budget-funded organizations, which include: educational institutions (schools, boarding schools, technical schools, colleges, institutes, etc.); medical and health institutions (hospitals, clinics, outpatient clinics, first-aid posts, sanatoriums, rest homes, etc.); sports facilities (stadiums and the like); cultural institutions (museums, parks, libraries, etc.); children's preschool institutions (kindergartens, nurseries); orphanages, children's health institutions; homes and boarding schools for the elderly and disabled; communal institutions (hotels, houses and hostels for visitors, which are on the balance sheet of budget-financed organizations); student dormitories, military units and other organizations financed in whole or in part from the budget of any level - line 43

;

Control according to form N 1-TEP:

line 41 = line 42 + line 43 + line 44 + line 45

Lines 44-45. Thermal energy supplied to its consumers, including: enterprises for production needs, other organizations

A military unit reflects only the supply of heat energy that it provides to the population (for example, to residential buildings located next to this military unit) and (or) to budget-financed organizations (schools, kindergartens, hospitals at military units). If a military unit receives heat energy exclusively for its own needs (provides heat to barracks, soldiers’ baths, a medical unit, etc.), then the data for such a military unit is not reflected in the uniform.

- enterprises for production needs ( line 44

);

Production needs should be understood as the needs of industrial enterprises engaged in the manufacture of products, processing of raw materials and materials, and so on.

- other organizations ( line 45

).

Other organizations include organizations of the non-governmental sector, trade, catering, entertainment and others.

Line 46. Sold to another company (reseller)

On line 46

the amount of heat energy supplied to other enterprises (resellers) for distribution to their consumers (subsubscribers) is shown.

Line 47. Number of accidents at heat supply sources, steam and heat networks

On line 47

The number of accidents at heat supply sources, steam and heating networks is shown.

Control according to form N 1-TEP:

line 47 ≥ line 48 + line 49

Line 48. Number of accidents on steam and heat networks

On line 48

shows the number of accidents on steam and heating networks, including hot water supply networks (from

line 47

).

Line 49. Number of accidents at heat supply sources

On line 49

The number of accidents at heat supply sources is shown.

An accident is considered to be a failure of elements of systems, networks and heat supply sources, resulting in the cessation of the supply of thermal energy to consumers and subscribers for heating and hot water supply for a period of more than 8 hours (Order of the Ministry of Regional Development dated April 14, 2008 N 48 “On approval of the Methodology for monitoring the implementation of production and investment programs of organizations communal complex" (registered by the Ministry of Justice of Russia on June 27, 2008 N 11891)).

Registration of orders for business trips in 2018-2019

Sending employees on a business trip for official reasons is regulated by a regulation approved by Government Decree No. 749 dated October 13, 2008. Clause 7 of this regulation states that a written order from the employer is the basis for sending an employee on a business trip. The specific form of this document is not given, so the company issues an order or instruction.

ATTENTION! To issue an order for sending on a business trip, you can use the unified forms No. T-9 (for sending 1 person on a business trip), No. T-9a (for sending several people on a business trip at once). In addition, each enterprise can independently develop the form of such an order, supplementing it with the necessary information.

The order for sending on a business trip should indicate the following information:

- full name of the enterprise;

- document number, date of preparation;

- personal data of the employee, position held;

- place of performance of the official assignment on a business trip;

- duration of the business trip (including the date of departure and date of arrival back);

- purpose of the business trip;

- a note on the use of transport on a business trip (personal, official, public, etc.);

- an institution that will reimburse the employee for expenses when sending him on a business trip.

The completed order for sending on a business trip is signed by the head of the organization or another authorized person. The HR employee is recommended to familiarize the employee with the order against a receipt, since only this will confirm the fact of familiarization in the event of a disciplinary sanction for failure to comply with this order.

For more information on the application of disciplinary sanctions, see the material

“Disciplinary liability of an employee and its types .

ATTENTION! The storage period for orders related to sending employees on business trips is 75 years. This rule was approved by order of the Ministry of Culture of Russia dated August 25, 2010 No. 558.

For more information about the storage periods for personnel documents, see the material

“What is the storage period for personnel documents in an organization?” .

I. General provisions

1. Statistical form No. 1-TEP is submitted by legal entities, their separate divisions (CHP, state district power station, enterprises (organizations) of thermal and electric heating networks, energy supply enterprises (organizations), etc., either on an independent balance sheet or included in diversified production associations housing and communal services, and on the balance sheet of enterprises (organizations), regardless of the organizational and legal form and form of ownership, supplying the population and public utility enterprises (organizations) with heat energy and hot water supply.

Enterprises (organizations) that are only heat producers, but do not directly supply consumers with heat, as well as enterprises (organizations) that supply heat energy and hot water only for the production and technological needs of enterprises (organizations) do not submit a report in Form No. 1-TEP.

2. When transferring an enterprise (organization) supplying consumers with heat energy from other departments to municipal ownership, i.e. under the jurisdiction of local executive authorities (and vice versa), reporting is prepared separately for the period before its transfer and for the actual time worked in the new system after the transfer. In the explanatory note to the report, it is necessary to indicate from which department the enterprise (organization) was accepted or to which it was transferred.

3. Statistical reporting in form No. 1-TEP is submitted with an annual frequency within the time limits specified on the form to the relevant structural units of the territorial body of state statistics in the constituent entity of the Russian Federation.

4. All report data in physical and monetary terms must be based on reliable primary accounting data.

The main requirement when filling out all sections of the report is the reliability of the data.

5. The official responsible for providing statistical information promptly submits reliable reporting data in Form No. 1-TEP.

6. In the case where the reporting enterprise (organization) serves settlements in urban and rural areas, two reports are drawn up separately for urban and rural areas.

7. In the address part of the form, the full name of the reporting organization is indicated in accordance with the constituent documents registered in the prescribed manner, and then in brackets - the short name.

The line “Postal address” indicates the name of the territory, legal address with postal code.

The code part of the code must include the code of the All-Russian Classifier of Enterprises and Organizations (OKPO) on the basis of the Notification of assignment of the OKPO code by state statistics bodies.

8. Data are presented in those units of measurement that are indicated on the form of the approved statistical reporting form.

9. Data from lines 01 - 15, 20, 42 - 45 are shown in whole numbers, the rest - with one decimal place.

Travel expenses - daily allowance in 2018-2019: we prepare an advance report, reimburse expenses

According to generally established rules, enshrined in Art. 168 of the Labor Code of the Russian Federation and clause 11 of Resolution No. 749, the following types of employee travel expenses are subject to reimbursement:

- for travel on a business trip in both directions;

- for renting accommodation on a business trip;

- daily allowance;

- other business trip expenses permitted by the employer.

The amount of travel expenses in 2018-2019 (per diem) for the enterprise on the basis of Art. 168 of the Labor Code of the Russian Federation is determined independently, fixing this condition in its accounting policy. However, the Tax Code of the Russian Federation indicates the norm for daily travel expenses in 2018-2019, within which expenses are not subject to personal income tax and insurance contributions:

- 700 rubles per day when going on a business trip in Russia;

- 2,500 rubles when going on a business trip abroad.

If such expenses at the institution are paid in a larger amount, then the excess amount of travel expenses per diem in 2018-2019 is subject to personal income tax and contributions.

Payment of daily travel expenses in 2018-2019 is made in this order - based on the order to send on a business trip, the employee is given an advance, which consists of daily allowance for all days of the expected business trip and the approximate amount of additional expenses. After returning from a trip, the employee is required to draw up a memo indicating the actual period for which he was sent on a business trip.

ATTENTION! After being sent on a business trip, the memo is drawn up by the employee in any form, but this document is a tasty morsel for Federal Tax Service inspectors: it is in its design that they find many errors and contradictions. For ease of work, you can approve the form of a standard memo using an internal regulation or even return to the use of travel certificates by registering this aspect in the organization’s accounting policy in the paragraph dedicated to sending on a business trip.

To the compiled note, the employee attaches papers confirming the actual expenses incurred for travel on a business trip, depending on the type of transport used. The amount of daily travel expenses in 2018-2019 when using public transport will be confirmed by travel tickets, and in case of their loss - receipts for renting living space.

ATTENTION! Since October 21, 2015, the rules for the provision of hotel services when sent on a business trip have changed: now an agreement is concluded with each temporary resident upon provision of a passport. These changes were made by Decree of the Government of the Russian Federation dated October 09, 2015 No. 1085. In the case of renting an apartment from an individual, drawing up an agreement remains a mandatory condition, but the documents confirming payment for services on business trips will be different: the hotel will issue a receipt on a strict reporting form, and from The landlord, an individual, takes a receipt confirming receipt of funds to pay for the residential premises.

Quite often a question arises regarding electronic travel documents: is it possible to confirm travel expenses - daily allowances in 2018-2019 with their help? An exhaustive answer to this question is given in Resolution of the Ministry of Transport of Russia dated August 21, 2012 No. 322: paragraph 2 states that the control coupon of an electronic travel document issued to each passenger is confirmation of the purchase of a travel ticket, which is important for an employee sent on a business trip.

If you use air transport for travel, you can justify the amount of daily travel expenses in 2018-2019 using:

- e-ticket itinerary receipt;

- baggage receipt;

- boarding pass.

If you lose your boarding pass, you can obtain a certificate from the air carrier confirming the fact of the flight - it will become confirmation of the purchase of a plane ticket when sent on a business trip by air, as stated in letters of the Ministry of Finance of Russia dated 06/07/2013 No. 03-03-07/21187, dated 06/06. 2012 No. 03-03-06/4/61.

When using personal or official transport on a business trip, supporting documents will include travel and route sheets, invoices, receipts, cash receipts confirming the purchase of fuels and lubricants, and in case of their loss, the service note must contain notes from the receiving party about arrival and departure, similar to a travel certificate.

Within 3 days after returning from a business trip, the employee draws up an advance report, to which all documents on expenses incurred during the business trip are attached. After processing and approval of the advance report by the head of the organization, the accounting department of the enterprise makes the final calculation, taking into account the advance payment given to the employee before departure. There are 2 scenarios here:

- The employee's expenses did not exceed the amount of the advance payment - in this case, the employee returns the unused accountable funds.

- An employee sent on a business trip spent more money than he was given, then the company reimburses the employee for what was spent from his own funds.

For more information on preparing an advance report, see the material

“Advance travel report .

When is this document used?

Organizations engaged in trade can also provide commercial credit (Article 823 of the Civil Code of the Russian Federation). With it, the banking institution is not involved in the transaction. The buyer can pay the loan in installments (Article 489 of the Civil Code of the Russian Federation) or with deferred payment (Article 488 of the Civil Code of the Russian Federation).

The buyer’s employer company can deduct from his salary the amounts necessary to repay the loan and transfer them to the store. All conditions are specified in the contract. Also, at the same time, an order-obligation is drawn up in the form KR-2.

After filling out and signing all the papers, the buyer must be given the goods. In this case, an order is drawn up in form KR-4. It is compiled by the head of the department that completed the purchase of the goods. The goods themselves are issued by another structural unit on the basis of this order. After receiving the goods, the buyer signs the document.

For your information! The order in form KR-4 is drawn up in one copy.

How to arrange a business trip for an employee?

The procedure for sending an employee on a business trip has been simplified since 01/08/2015. Before this date, the employer had to draw up several documents at once when sending on a business trip: a job assignment, an order and a travel certificate. However, the entry into force of Decree of the Government of the Russian Federation dated December 29, 2014 No. 1595 from January 1, 2016 significantly reduced the document flow regarding business trips.

What are the main changes that have occurred when sending employees on business trips?

- 3 documents were canceled at once: the official assignment, the travel certificate and the business trip report (the employer is not obliged to require the employee to prepare a report on the completion of the official assignment). It is worth noting that many organizations have secured the specified documents related to sending on a business trip

in their accounting policies and continue to use them, which is not prohibited by law.

For more information on drawing up a job assignment, see the material

“Official assignment for a business trip - sample” .

- The keeping of log books for posted workers has been canceled in accordance with Decree of the Government of the Russian Federation dated July 29, 2015 No. 771. Previously, the employer kept 2 logs, in one making entries about departing workers, and in the other about arriving workers. Now it is not necessary to maintain these registers, but at the request of the institution it is possible by securing this aspect in the accounting policy of the organization.

- Resolution No. 771 also made adjustments to the mechanism for confirming the actual duration of a business trip, which is described above, namely the use for these purposes of travel tickets, official or personal transport, or a rental agreement for a hotel room or separate apartment, as well as drawing up a memo with notes on arrival and departure from an employee's business trip.

Thus, the main document for sending on a business trip remains the order, which was mentioned earlier, and upon return, an advance report and a memo with documents confirming expenses on business trips must be drawn up. Indeed, the document flow when sending employees on a business trip has been significantly reduced, this has simplified the work of HR officers, but at the same time complicating it for accountants, since the requirements of the Law “On Accounting” dated December 6, 2011 No. 402-FZ remained the same in terms of documentary evidence of expenses upon arrival from a business trip .

II. Filling out the indicators of form No. 1-TEP

10. Number of heat supply sources, their thermal power and number of boilers. Lines 01 - 04 show the number of heat supply sources (boiler houses) put into operation during the reporting year, including with a capacity of up to 3 Gcal/hour (line 02), from 3 to 20 Gcal/hour (line 03) and from 20 to 100 Gcal/hour (line 04). These lines 01 must be equal to the sum of these lines 02 - 04 or more due to heat supply sources (boiler houses) with a capacity of 100 Gcal/hour or more.

Lines 05 - 08 reflect the number of liquidated heat supply sources (boiler houses) for the reporting year, i.e. written off in the prescribed manner from the balance sheet of the reporting enterprise (organization), including with a capacity of up to 3 Gcal/hour (line 06), from 3 to 20 Gcal/hour (line 07) and from 20 to 100 Gcal/hour (line 08). These lines 05 must be equal to the sum of these lines 06 - 08 or more due to liquidated heat supply sources (boiler houses) with a capacity of 100 or more Gcal/hour.

Heat supply sources (boiler houses) transferred to other enterprises or accepted on the balance sheet from other enterprises (organizations) are not shown as newly introduced or liquidated, but are reflected in the form on lines 09 - 12.

Line 09 shows the number of heat supply sources: thermal power plants, district, quarterly, group, local and individual boiler houses listed on the balance sheet of the enterprise (organization) at the end of the reporting year, including with a capacity of up to 3 Gcal/hour (line 10), from 3 to 20 Gcal/hour (line 11) and from 20 to 100 Gcal/hour (line 12). These lines 09 should be equal to the sum of lines 10 - 12 or more due to liquidated heat supply sources (boiler houses) with a capacity of 100 Gcal/hour or more.

Lines 13 - 15 indicate heat supply sources (boiler houses) listed on the balance sheet of the enterprise (organization) at the end of the reporting year, operating on solid fuel (line 13), liquid fuel (line 14) and gaseous fuel (line 15).

11. Line 16 shows the total power of heat supply sources (thermal power of heating boiler installations) at the end of the reporting year, which is determined by the sum of the nominal nameplate capacities of all boilers (power plants) installed in them and is shown in Gcal/hour, including capacity up to 3 Gcal/hour (line 17), from 3 to 20 Gcal/hour (line 18) and from 20 to 100 Gcal/hour (line 19). These lines 16 must be equal to the sum of these lines 17 - 19 or more due to heat supply sources (boiler houses) with a capacity of 100 or more Gcal/hour.

12. Line 20 shows the total number of boilers (power plants) installed in all available heat supply sources (boiler houses) and listed on the balance sheet of the enterprise (organization) at the end of the reporting year, regardless of whether they are in operation, reserve, repair, awaiting repair or downtime for other reasons.

13. Length of heating networks. Line 21 shows the total length of all water heating networks (including hot water supply networks) and steam networks in two-pipe calculation, listed on the balance sheet of the enterprise (organization) at the end of the reporting year, including those with a diameter of up to 200 mm (line 22), from 200 mm to 400 mm (line 23), from 400 mm to 600 mm (line 24). These lines 21 must be equal to the sum of these lines 22 - 24 or more due to the length of pipelines with a diameter of 600 mm or more.

The length of heating networks is determined by the length of its route, regardless of the installation method, with two pipelines laid in it: direct and return for the water network, a steam pipeline and a condensate pipeline for the steam network. The length of the water network must take into account the length of individual networks used for hot water supply.

Line 25 reflects heat and steam networks that need replacement (from line 21).

Line 26 reflects dilapidated networks that need to be replaced (from line 25).

Dilapidated networks are networks that, according to technical inventory data, are worn out over 60%.

Line 27 reflects the length of networks that were replaced during the reporting year.

Line 28 reflects the length of dilapidated networks that were replaced during the reporting year (from line 27).

14. Production and supply of thermal energy. Line 29 indicates the amount of thermal energy produced per year, including heat supply sources (boiler houses) with a capacity of up to 3 Gcal/hour (line 30), from 3 to 20 Gcal/hour (line 31) and from 20 to 100 Gcal/hour ( line 32) and is determined by the amount and heat content of released thermal energy measured by measuring instruments.

These lines 29 must be equal to the sum of these lines 30 - 32 or more due to heat supply sources (boiler houses) with a capacity of 100 Gcal/hour or more.

15. For individual enterprises (organizations) that temporarily do not have measuring instruments for systematically determining the production or consumption of heat energy, with insignificant consumption of the latter, calculation methods established by regulatory and technical documents for the accounting of thermal energy and coolants can be used, as an exception. These indicators are determined by calculation based on the fuel consumption produced and the average efficiency of the boiler room. The weighted average efficiency of the boiler room should be determined on the basis of periodic thermal tests.

To determine the heat production based on the corresponding fuel consumption, use the table below.

| Boiler house net efficiency - in % | Consumption of equivalent fuel per 1 gigacalorie supplied - in kilograms of equivalent fuel/Gcal | Boiler house net efficiency - in % | Consumption of equivalent fuel per 1 gigacalorie supplied - in kilograms of equivalent fuel/Gcal |

| 60,0 | 238,10 | 80,0 | 178,57 |

| 62,0 | 238,41 | 82,0 | 174,22 |

| 64,0 | 223,21 | 84,0 | 170,07 |

| 66,0 | 216,45 | 86,0 | 166,11 |

| 68,0 | 210,08 | 88,0 | 162,34 |

| 70,0 | 204,08 | 90,0 | 158,73 |

| 72,0 | 198,41 | 92,0 | 155,28 |

| 74,0 | 193,05 | 94,0 | 151,98 |

| 76,0 | 187,97 | 95,0 | 150,38 |

| 78,0 | 183,15 |

Having data on fuel consumption in the boiler room for a year and knowing the efficiency of the boiler room, it is possible to determine the heat energy production by calculation. So, for example, if a boiler house of a plant, which supplies heat to the population and for household needs, consumed 812 tons of Donetsk coal with a calorific equivalent of 0.723 during the reporting year with a boiler room efficiency of 72%, then the equivalent fuel consumption will be 587 tons (812 tons × 0.723 ), since with a boiler house efficiency of 72%, the production of one gigacalorie will require, according to the table above, 198.41 kg of standard fuel, then the amount of heat energy generated will be 2959 Gcal:

Then, from the resulting volume of heat energy production, the heat spent on the boiler house’s own production needs (steam pumps, steam nozzles, blowers, etc.) is excluded.

If heat energy is recorded in tons of steam, then the amount of generated steam is recalculated in gigacalories based on the heat content of the generated steam, corresponding to its average pressure and temperature. So, for example, if a boiler room produces saturated steam at an average pressure of 4 kgf/cm2, then according to reference books, this pressure corresponds to a heat content of steam of 653.9 kilocalories per kilogram. In this case, it is necessary to take into account the temperature of the feed water. So, for example, if the feedwater temperature was 10 °C, then the amount of heat obtained with one kilogram of steam will be 653.9 - 10 = 643.9 kcal/kg.

Let us assume that the boiler house produced 1500 tons of steam in a month at the above average pressure of 4 kgf/cm2 and a feedwater temperature of 10 °C. Then the amount of heat generated will be 965850000 kilocalories (1500 × 1000 × (653.9 - 10), or approximately 966 gigacalories.

In exceptional cases, when it is not possible to estimate the efficiency of a boiler, it is allowed for low-power boilers (less than 0.1 Gcal/hour) to take the consumption of equivalent fuel for the supply of one gigacalorie of heat on average equal to 200.0 kilograms of equivalent fuel (i.e., considering that from one ton of standard fuel, 5 Gcal of heat energy can be obtained from such boilers).

To convert the power of hot water boilers, measured in MW, into Gcal/hour, you should use the following ratio: 1 MW = 0.86 Gcal/hour.

16. Line 33 shows the amount of heat energy received (purchased) from the outside, which is determined according to the invoices of heat suppliers presented for payment based on the readings of measuring instruments (or calculated).