If the cashier in the institution is absent for good reasons (vacation, illness) or such a position is not provided at all, since the enterprise is still small, then the duties of this employee can be assigned to the accountant. To do this, a corresponding document must be prepared and signed. It is called “Order on assigning cashier duties to an accountant.”

FILES

In addition, to comply with all the nuances, some changes will be required in the job description and employment contract. One or two papers must indicate the amount that the employee is entitled to for the additional workload.

Attention! It should not be less than the amount of additional payments prescribed in the Labor Code (in particular, Article 151).

What will you need besides the order?

Paper alone is not enough for the full legality of ongoing processes.

There are several options that the head of an organization can resort to if it is necessary to perform the duties of one employee by another.

First option. An order is drawn up, signed, and then an agreement on full swearing is concluded with the employee. responsibility, is certified, then changes are made to the employment contract of the accountant (or the chief accounting specialist in the organization, depending on the circumstances), which provide for him to perform all the functions of a cashier. This option is more logical.

Second option. An order and an agreement are formed and signed, as in the first option, plus amendments to the acting status are made. cashier in the accounting job description.

Answer

The head of the organization is obliged to entrust the maintenance of accounting to the chief accountant or other official or enter into an agreement on the provision of accounting services, and the head of the credit organization is obliged to entrust the maintenance of accounting to the chief accountant (Clause 3 of Article 7 of the Federal Law of December 6, 2011 No. 402-FZ). That is, the presence of a chief accountant on staff is mandatory only for a credit institution, and the heads of small and medium-sized businesses have the right to conduct accounting personally. If the position of chief accountant is not included in the staffing table, and the head of the organization has assigned the responsibilities of the chief accountant to himself, then the fact of accounting by the head of the organization must be reflected in the order on the accounting policy of the organization. When assigning the duties of the chief accountant to the manager, an order is issued, for example, with the following content: “In accordance with the decision of the general meeting of founders of the Limited Liability Company Albatross (Albatross LLC), I, Ivan Ivanovich Ivanov, assume the position of General Director on March 3, 2020 year to March 3, 2020. Due to the absence of the position of chief accountant in the staffing table of Albatros LLC, I assign his responsibilities to myself. Reason: minutes of the founders’ meeting.”

The duties of a cashier can also be assigned to the head of the organization. In this case, a similar order is issued for the head of the organization to perform the duties of a cashier due to the fact that such a position is not provided for in the organization’s staffing table. It should be noted that the position of cashier provides for full individual financial responsibility - this position is provided for in the list of positions, approved. Resolution of the Ministry of Labor of Russia dated December 31, 2002 No. 85. Consequently, an agreement on full individual financial responsibility can be concluded with the cashier. It is worth paying attention to the fact that the financial responsibility of the cashier and the chief accountant is different. The financial responsibility of the chief accountant consists of compensation only for direct actual damage that arises due to his negligence in his official duties, for example, payment of a fine for late submission of reports (Article 238 of the Labor Code of the Russian Federation). The chief accountant is not responsible for the lack of money, since this position is not included in the list, approved. Resolution of the Ministry of Labor of Russia dated December 31, 2002 No. 85. Therefore, even if the positions of chief accountant and cashier are performed by one person, then it is recommended to conclude an agreement on individual financial responsibility, it is concluded according to the position of cashier.

Read in the electronic magazine:

The electronic magazine is available to subscribers, as well as .

Its design will not take you much time.

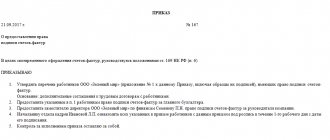

Algorithm for drawing up a document

At the top of the paper there is a header in which the name of the document and the date of its preparation are written. Then, after the title, the reasons for the absence of the employee as such are indicated. These reasons may be:

- dismissal of a previous employee;

- going on leave (to care for a child, etc.);

- business trip of the main employee;

- the enterprise is small, and the position itself is not provided, and other reasons.

This is what it should look like:

After the introductory part, the wording (as in any other order) “I order” is required, followed by a colon. Then comes a list of what needs to be done: authorize an employee (with full indication of full name and position) to perform work with one of the types of cash registers.

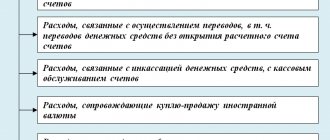

In this case, the model of the cash register must be clearly stated. It could be:

- AMC 100K – if the organization sells food products;

- autonomous cash registers with ECLZ and fiscal memory type ORION-100K or MERCURY-180K;

- mobile payment terminals with a modem and battery type YARUS C2100;

- printers that do not work without a computer or terminal (they are called fiscal registrars) like FPrint -5200PTK and the like;

- receipt printers (they do not have built-in memory, which means they do not need to be registered with the tax office) of the types Shtrikh 600, MPRINT R58 USB, etc.

In short, regardless of the model, the cash register must be registered.

In addition to appointments, the order prescribes the employee’s authority to keep a journal, draw up the necessary reports, and sign cash documents from the official “cashier” or “administrator.”

The text should also contain information about the employee’s familiarization with such a document as the Procedure for Conducting Cash Transactions. This review will require an additional signature of the employee who assumes the rights and responsibilities of the cashier.

Footnote to the agreement on mat. responsibility will also be useful. Without it, the order will also be valid, but it will need to be supplemented with an annex in the form of this agreement.

At the end of the text of the document there must be at least two signatures: the accountant-cashier and his manager. The date is already at the beginning.

Assignment of cashier duties to the chief accountant, order if there is no rate in the state

Important! The order for combining positions must include the period of combining, the date of acceptance and transfer of cases, and the amount of additional payment for combining. Who will keep accounting records for an enterprise is usually determined when it is created. The director has the right to assign accounting responsibilities to himself if the following is created:

- small and medium-sized enterprise;

- non-profit organization;

- organization participating in the Skolkovo project.

In practice, individual entrepreneurs and directors of organizations using the simplified tax system quite often use this right, conduct their own accounting and calculate taxes, and do not include the position of chief accountant in the staffing table.

Order on assignment of duties: subtleties of the issue

- Assign his duties to another employee, and he must also do his job.

- You can temporarily transfer one of your colleagues to the position of a currently absent employee.

- Invite someone from outside. He will temporarily replace the main employee.

There are several reasons why an employer decides that a certain range of responsibilities will be performed by another employee in the future:

- The employee combines work in different professions.

- It is necessary to perform duties corresponding to a position (profession) that is not in the staffing table.

- The main employee is currently absent for a valid reason (vacation, business trip, etc.).

In each of these cases, the following actions must be performed in turn: To resolve such an issue without creating conflicts, it is necessary to follow a strict sequence of these actions.

Is it possible to assign cashier duties to the chief accountant?

Question: We pay salaries through the cash register. But until recently, the Regulation on Chief Accountants was in force, approved by Resolution of the Council of Ministers of the USSR of January 24, 1980 N 59 (hereinafter referred to as the Regulation).

The chief accountant did not have the right to perform duties related to financial responsibility for funds and material assets (clause 7 of the Regulations). The chief accountant was prohibited from accepting goods on behalf of the company, receiving money from checks, or issuing them to employees.

The chief accountant could not combine the position of cashier.

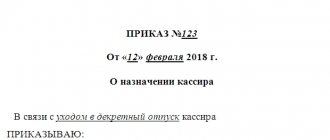

Order on assigning the duties of the chief accountant to the general director

After registering the company with the tax office, 2 main positions are created in the company, such as the general director and the chief accountant.

As a rule, in the absence of a position in the staff list of the chief accountant, his responsibilities are assigned to the general director.

This order assigning the duties of the chief accountant to the general director is called Order No. 2; it is an internal document that does not entail the drawing up of a separate employment contract and a corresponding entry in the work book.

Limited Liability Company "Romashka" Legal address: Russian Federation, 121111, Moscow, Leningradskaya street, building 7, office 46.

Can the chief accountant perform the duties of a cashier?

In the new Rules, this norm is excluded, and it is noted that if in organizations where there is no cashier position in the staffing table, then the responsibilities for performing cash transactions are assigned to another employee (employees) based on the order of the manager. So, do the heads of non-budgetary (private) organizations have the right to instruct a chief or accounting accountant to carry out cash transactions?

As follows from the Regulations on the procedure for part-time work and combining professions and positions 3: combination is permitted, as a rule, within the same category of personnel (clause 21); the deadline for performing additional work, its content and volume are established by the employer with the written consent of the employee (clause 22); an additional payment is made for combinations (clause 23); its size is determined by agreement of the parties, unless otherwise provided by the internal labor regulations (clause 24) 4.

Order on assigning cashier duties to an accountant

In addition, to comply with all the nuances, some changes will be required in the job description and employment contract. One or two papers must indicate the amount that the employee is entitled to for the additional workload.

Attention! It should not be less than the amount of additional payments prescribed in the Labor Code (in particular, Article 151). If there is a need to carry out transactions with cash and draw up cash receipts and debit orders, the bank with which the institution cooperates will definitely inquire about the order.

In accordance with the law, if there are several accountants in an institution, then the duties of a cash desk employee can be assigned to anyone except the chief accountant. In the case where the chief accountant is the only one in the organization (and this most often happens), then these functions can be assigned directly to him.

Order on the appointment of the chief accountant to perform the duties of a cashier

Receives advance reports from accountable persons, checks them and prepares them in accordance with the current procedure. A fairly common situation is when a small enterprise does not have a cashier on staff or only one cashier position is indicated in the staffing table.

Simple solutions for complex clients Cozy clouds Easy transition to 1C:BukhService services And now more details... Maria Mukhina Maria Mukhina is the head of the 1C:BukhService department at the STATUS company.

How to correctly assign the duties of a cashier to an accountant?

It is impossible to include the duties of a cashier in the work function of an accountant, since these are completely different positions belonging to different categories of positions.

You can assign the duties of a cashier to an accountant in order to combine positions. To do this you need:

- arrange for the accountant, with his written consent, to combine the position of cashier: conclude an additional agreement and issue an order to combine positions.

- include the position of cashier in the staffing table (possible on a part-time basis);

According to Art.

60.2, art. 151 of the Labor Code of the Russian Federation, the assignment of additional work to an employee is possible only with his written consent and for an additional payment, the amount of which is determined by agreement of the parties. In the additional agreement, indicate:

- the work (position) that the employee will perform additionally, its content and volume;

Details in the materials of the Personnel System: 1.

Legal assistance from a lawyer

Responsibilities of a cashier My position was reduced and another was hired with the wording performing the duties of a cashier. I am a single mother. Is this legal?... Question to a lawyer: Lawyer's answer to the question: duties of a cashier Hello, Olesya.

It is not entirely clear from the question whether you were fired or not? If you were fired, under what article of the Labor Code of the Russian Federation? And the abbreviation is clause 2 of Art. 81 Labor Code of the Russian Federation.

And there is a lot more that you have that is NOT LEGAL.... Olesya, if there is a need, then, taking into account my answer, clarify your question.

You can PM me directly.———————————————————————— Lawyer’s answer to the question: duties of a cashier Within a month after your dismissal, you must file a claim with the court for reinstatement at work.——————————————————————— Question for a lawyer: There is no cashier position on the staff. Can a storekeeper perform the duties of a cashier? Lawyer's answer to the question: duties of a cashier Hello!

Yes, it can——————————————————————— Question for a lawyer: Assigning the duties of a cashier to another employee is formalized by whom Question for a lawyer: Is it possible to assign the duties of a cashier to the deputy director of the ACh? Lawyer's answer to the question: duties of a cashier Hello!

Source: https://152-zakon.ru/vozlozhenie-objazannostej-kassira-na-glavnogo-buhgaltera-prikaz-esli-v-shtate-net-stavki-12444/

Is it necessary to compile

Important! Even if the staffing table does not include the position of a cash register employee and there is a single job description indicating that all cashier functionality is included in the accountant’s list, an order assigning duties is required.

This is due to the fact that the vast majority of banks licensed in the Russian Federation clearly state the terms of interaction with individual entrepreneurs, LLCs or other legal entities. Under these conditions, cash transactions cannot be carried out by anyone other than a cashier, who is selected from the existing staff or hired separately.

CAN THE GENERAL DIRECTOR OF A JSC BE A CASHIER

The executive body of the company. Sole executive body of the company (director, general director) Guide to corporate disputes.

B. The employee, along with performing the duties of the general director, performs all the duties of the chief accountant.

As noted, the rights and responsibilities of the manager in most cases are regulated in detail in the constituent documents of the organization. For joint stock companies and limited liability companies, such a document is the charter. This document will save you from offensive fines and protect you from mistakes. The relevance is confirmed by Simplified experts. Register, download and immediately use it in your work!

In large organizations

If we are talking about an individual entrepreneur, then the employee’s written consent to assign duties is not required. If the company has a separate manager and he makes a decision on such a personnel change, then he is obliged to inform the superior manager about this in writing.

An employee who is preparing to perform new duties gives written consent that he has nothing against changing the job description, issuing an order and concluding a liability agreement.

Usually there is no difficulty with this, since the remuneration of such an employee increases in accordance with the Labor Code of the Russian Federation.