Any organization or enterprise (including individual entrepreneurs) must have a manager. Based on this, the question may arise as to whether there should be an order for the appointment of an individual entrepreneur director in the personnel documentation? In this regard, a second question arises: who runs the enterprise and whether the individual entrepreneur himself should appoint himself to the position of manager and pay himself a salary.

There are other important issues. Does an individual entrepreneur who owns a business have the right to hire another person as a manager? What does an employment order for the position of IP director look like? We will try to answer these important questions in our publication today.

Who can appoint whom to a leadership position?

It is obvious that an individual entrepreneur, being the owner of a business, bears sole responsibility for his activities, including the financial and economic sphere, as well as reporting and accounting. Thus, the individual entrepreneur performs the duties of a manager.

In accordance with current legislation, registration of an individual entrepreneur as a director and payment of wages to oneself is not provided. That is, there is no need for an order to hire an individual entrepreneur for the position of director. All this, by law, implies the status of an individual entrepreneur.

It is worth paying attention to the fact that the current legislation contains a provision that an individual entrepreneur has the right to hire employees in accordance with production needs (and staffing schedule). Thus, an individual entrepreneur can appoint one of his employees to the position of manager.

For example, if an individual entrepreneur is going to retire and hires a director, then it is necessary to include a unit of management personnel in the staffing table (from the unified qualification directory). In this case, an employee cannot be hired as a general director.

The following leadership positions are suitable for this situation:

- Executive Director;

- Director of Commerce;

- director of the area;

- sales director;

- director of personnel;

- manager.

It is impossible to appoint a sole manager (the first person of the company) from among the employees due to the fact that he always remains the individual entrepreneur himself. The individual entrepreneur will bear full responsibility to the state.

Personnel records have been canceled for micro-enterprises and individual entrepreneurs

There is an opinion that the abolition of personnel records for small companies and individual entrepreneurs allows you to not think about it at all. However, this is not always true. Some entrepreneurs are required to draw up a number of documents. In this regard, it is important to carefully understand this issue.

When does an individual entrepreneur need to keep personnel records?

If an individual entrepreneur hires staff, he has the obligation to maintain personnel records. In cases where all activities are carried out solely by an individual entrepreneur, no additional documents will have to be completed.

When employees are hired, the relevant documents must be completed. In 2020, these do not necessarily have to be correctly completed work books. They can be replaced by an employment contract.

As soon as an employment contract is signed, small companies, as well as individual entrepreneurs, need to keep records. It is important to follow current legislation.

Failure to comply with its provisions, as well as the lack of necessary personnel documents, threatens the employer with prosecution, including criminal liability.

In this regard, the labor inspectorate has the right to conduct an appropriate inspection and request documents that must be maintained.

In the process of maintaining personnel records, an entrepreneur has rights and responsibilities. It is important for every entrepreneur to know which of them are the main ones. This will help avoid a number of problems and also make accounting easier.

Among the rights are the following:

- an entrepreneur can enter into both fixed-term employment contracts and for an indefinite period;

- issue orders that are based on signed agreements;

- conclude collective labor agreements;

- train employees in the basics of labor protection, and then monitor knowledge on this topic.

Despite the fact that today there is a law on simplifying personnel documents, the wording in it is quite vague. You should not count on a complete abolition of accounting, so it is important to accurately understand the responsibilities of an entrepreneur in this area:

- maintain work books and register them for those who got a job for the first time;

- provide employees with certificates confirming participation in pension insurance;

- adoption of local regulations containing information on relations with employees.

It is not enough for small organizations and individual entrepreneurs to know their rights and obligations. It is much more important to strictly comply with all conditions.

Mandatory HR documentation

Keeping records always involves drawing up primary documentation. Without this, it is impossible to competently conduct relations between an entrepreneur and his employees. Therefore, it is important to know what personnel documents an individual entrepreneur must have. You should not take this requirement lightly, because unpleasant consequences may occur.

To properly maintain personnel records for individual entrepreneurs, you will have to use three groups of documents:

- Internal regulations include work procedures, instructions, provisions on bonuses, work schedules, wages, and others. They help, if necessary, prove the employer is right in court.

- Organizational. These include all kinds of personnel records. Various documents are registered in them - orders, contracts, travel certificates, work books and others. This group also includes time sheets, vacation schedules, and staffing schedules.

- Accounting documents - employment contracts and books, employee cards, personnel orders, statements, explanatory notes and others.

On the one hand, accounting for individual entrepreneurs is carried out in a simplified form. On the other hand, personnel documents for micro-businesses have not been completely abolished. Other agreements may need to be formed.

Maintaining work books for individual entrepreneurs

If an entrepreneur hires a new employee, he, as an employer, is obliged to fill out the relevant documents: an employment order, as well as fill out a work book. Their registration is carried out on the basis of Russian legislation.

When employees are hired for a position by an individual entrepreneur, two situations may arise:

- When a future employee has a work book in hand, the entrepreneur must fill it out accordingly.

- If an employee is hired for the first time, the entrepreneur will have to provide him with such a document. Only after this can you make an appointment.

It is important to correctly reflect the relevant information in the work book: dismissal, hiring, transfer to another position must be indicated in it.

The introduction of simplified personnel records allowed individual entrepreneurs to use the standard form of an employment contract as an alternative to a traditional document. It turns out that in this case it is not necessary to keep work books; you can refuse to register them. However, such a substitution often leads to problems in the event of a lawsuit.

It is important to clearly determine which documents to use in accounting. After this, you should stick to the chosen strategy.

Entrepreneur's responsibility

It was discussed above that there are mandatory personnel documents for individual entrepreneurs. However, not everyone makes every effort to properly maintain personnel records.

Ultimately, the employer may face liability. For individual entrepreneurs in 2020, there are three groups of punishments: administrative, criminal, financial.

It is important for individual entrepreneurs to study all types.

Administrative liability is provided in several situations:

- In case of an unjustified refusal to conclude a collective agreement, the fine will be from three to five thousand rubles.

- Incorrect collection, storage, and use of information about an employee may result in a fine. You will have to pay from 500 to 1,000 rubles.

- Work without formalizing the employment relationship with an appropriate form of contract, as well as evading its conclusion, entails a fine of 5 to 20 thousand rubles. Repeated prosecution for such a violation will result in an increase in the monetary penalty. You will have to pay 30-40 thousand rubles.

- Illegal use of the labor of foreigners, refusal to notify the migration service about the employment of such citizens leads to the imposition of a fine. Its size depends on the qualifications of the foreign citizen and the place of activity.

Criminal liability may also arise in several cases:

- dismissal of a pregnant woman, as well as a woman with children under three years of age. In this case, you will have to pay a fine of up to two hundred thousand or work 180 hours;

- Delaying wages for more than two months for mercenary or personal purposes is punishable by a penalty of up to 500 thousand rubles.

Financial liability arises when wages are delayed. In this case, you will have to pay the employee overdue payments, calculated based on the refinancing rate - 1/300 for each day.

Outsourced HR accounting for individual entrepreneurs

Entrepreneurs often engage third-party organizations offering outsourcing services to maintain personnel records.

The reasons for this are:

- the high cost of hiring a competent staff member;

- lack of sufficient knowledge of office work among a full-time employee who is assigned additional responsibilities.

Involving an individual entrepreneur leads to cost optimization in combination with professional accounting. Thanks to the financial responsibility of third-party organizations, they guarantee that personnel documents will be maintained exclusively in accordance with the law.

Don't neglect the help of outsourcers. It is important to remember: despite the fact that full personnel records for micro-enterprises and individual entrepreneurs have been cancelled, some documents remain mandatory. Compiling them correctly will help you avoid facing serious liability.

Modern legislation contains provisions that entrepreneurs may not keep complete personnel records. However, it will not be possible to completely abandon it. Meanwhile, violation of accounting rules leads to serious liability. Therefore, it is important to understand what documents are needed and complete them correctly and in a timely manner.

Source: https://tvoeip.ru/kadry/otmena-ucheta

Necessary orders for the main type of activity for individual entrepreneurs

The activities of the enterprise are subject to strictly established rules and involve the maintenance of a large amount of documentation. Regarding the latter, many questions arise, since all kinds of forms for individual entrepreneurs and the requirements for their preparation often change: the most useful thing that can be offered for individual entrepreneurs are samples of documents that one encounters in the process of work.

Most internal processes at an enterprise are initiated by administrative documents, the main one of which is the order. In the activities of organizations or individual entrepreneurs, an order is used to convey the will of management to employees.

The preparation of such a document occurs in several stages: templates of orders are studied, and after drawing up the document, the order is signed and the executors familiarize themselves with it.

The activities of collegial and management bodies, commissions or councils are reflected in the minutes.

The peculiarity of such a document is the presentation of actions in strict sequence and the compilation of an event that is recorded directly in the process.

The task of transmitting information within the company and displaying information important for its functioning is performed by information and reference documents: memos, certificates, letters, acts.

The latter are most often used to document the results of significant actions and checks. Acts are most often drawn up according to standard forms. If there is no template, it is important to indicate all the information required for this document.

The sphere of entrepreneurship, no matter what direction it is represented, is always characterized by a variety of contracts and agreements. Some contracts have a strictly established form, others are drawn up in any form, but in compliance with certain rules.

The main purpose of the document is to regulate the rights and obligations of the parties so as not to leave room for illegal actions.

A separate section of office work is HR documents, presented in a wide variety. For them, norms and standards provide for separate procedures and periods of storage and registration. Many of the personnel documents are compiled according to standard templates.

The method of transmitting this or that information is notifications. Most often they are used by official organizations to notify the person mentioned in the document about the beginning or end of any actions in relation to him.

There are often cases when a notification is sent to an authorized authority by an individual or legal entity, for example, in order to inform about the termination of the company’s activities, as well as to provide other documents for liquidation. When citizens apply to official authorities, forms of petition such as statements are used - such an appeal usually concerns the exercise of certain rights and interests.

In addition, the statement serves as confirmation that the person actually applied to the authorized organization, and as a guarantee that the citizen’s request will not be forgotten.

Submission of an application may in some cases be carried out by proxy, if the personal presence of the applicant is not required.

No matter how hard some of us try to avoid paperwork, everyone has to sign a variety of contracts.

Sample contracts for individual entrepreneurs and agents need to be studied in connection with their professional activities, but find out what a particular agreement looks like.

Documentary recording of facts and events related to economic activities is carried out using acts. Despite the variety of areas of application of this document, there is a generally accepted model of the act. Its composition is typical.

An order is an administrative official document that is issued for the purpose of implementing management tasks and is its act.

Sample orders represent a documented decision of an individual entrepreneur or the head of a legal entity. Orders are mandatory: failure to comply is regarded as

An application is a document addressed to an authority or business entity, containing: a request for assistance in realizing legitimate interests; legally significant message; information about violations of the law; criticism of the activities of organizations or individual officials.

Unlike large companies, individual entrepreneurs are unjustifiably neglected. Characteristics are an official document expressing the opinion of the administration of an educational institution, employer or trade union about a student, student, or employee.

Issued at the request of a citizen for presentation at the place of demand. Contains a description of his business, moral and ethical qualities. Usually the document is prepared.

The law provides for the obligation of a business entity to notify the authorities, its counterparties or founders of the occurrence of certain circumstances.

Untimely requests, unsuccessful notification templates and methods of sending them can lead to negative consequences. Obligation to report legally significant matters.

A protocol is an official written document that, in a certain format, records actions that have already occurred or are ongoing, extending over time. There are different types of protocols, they depend on the essence of the event being displayed: meeting; meeting; administrative offense; interrogation Conditions for drawing up The only purpose of the protocol is to be complete and truthful.

A power of attorney is used by business entities to vest representatives with part of their own powers. There is no standard standard for a power of attorney.

The entrepreneur has the right to draw it up in any form. Concept The relations of commercial representation are regulated by Ch. X Civil Code. According to Art.

How many times a week does a person have to deal with documents - receipts, checks, charters?

Surely more than once. What then can we say about entrepreneurs, agents and other people closely associated with the business world? And every document from which.

Both beginners and experienced entrepreneurs have to go through moments of crisis, constantly fight for a place in the sun - and, unfortunately, not everyone manages to gain a foothold in their niche.

And then the time comes to liquidate the company -. Ask a Question. Register Login.

Go to section. Other samples. Documents for liquidation.

IP 2020: the most important changes

We are talking about local regulatory documents that reflect management decisions on issues of production and economic activity, planning, reporting, financing, lending, sales of goods, etc.

As a rule, a local regulatory act is prepared by the structural unit whose activities are related to its implementation.

In the article we will provide sample orders for the main activities of the enterprise, which can be used in everyday work.

Timely and competent reporting is a prerequisite for the long life of any small and medium-sized business. What documents should an individual entrepreneur have? What kind of reporting should he keep as an entrepreneur and as an employer?

On approval of Recommendations on the list of documents mandatory for individual entrepreneurs and micro-organizations when regulating labor relations with employees. In pursuance of the item on measures to implement the provisions of the Directive of the President of the Republic of Belarus of December 31

Approve the attached Recommendations on the list of documents required for individual entrepreneurs and micro-organizations when regulating labor relations with employees. Recommendations on the list of documents required for individual entrepreneurs and micro-organizations when regulating labor relations with employees.

Recommendations on the list of documents required for individual entrepreneurs and micro-organizations when regulating labor relations with employees were developed in order to optimize and improve the work of conducting personnel records management by individual entrepreneurs and micro-organizations, simplify it, as well as create a more convenient system for maintaining personnel records records.

Mandatory list of personnel documents for each individual entrepreneur

Employment order form T-1 and T-1a. Staffing table form T Order on granting leave form T Vacation schedule form T Order on dismissal of an employee form T-8 and T-8a. Order for sending on a business trip, form T-9 and T-9a. Travel certificate form T. Official assignment for a business trip form Ta. Order on bonus payments to employees, form T and Ta.

What are orders for core activities

Personnel documentation of an individual entrepreneur. Labor relations are subject to documentation. Moreover, the responsibility for drawing up and maintaining documentation lies not only with employers-organizations, but also with employers - individual entrepreneurs.

In organizations, departments are created for this purpose, for example, a personnel department or a personnel department, or positions are simply introduced, for example, a personnel manager.

But individual entrepreneurs, for the most part, do not attach importance to the preparation of personnel documents or draw them up, but with significant violations of established requirements.

The activities of the enterprise are subject to strictly established rules and involve the maintenance of a large amount of documentation.

Evgeniy Sazhin Purchase book VAT examples of reflecting entries on invoices in the purchase book and sales book indicating the codes of types of transactions Sales book VAT Book of income and expenses and business transactions of an individual entrepreneur KUDiR Special tax regimes As a rule, the general tax reporting regime turns out to be simpler in understanding, but not always the most beneficial. Complete list of personnel documents Now you need to make a list of documents that must be in any organization.

Order on the appointment of the head of an individual entrepreneur

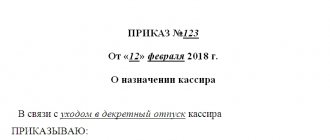

The personnel order (order for the main activity) must have a number. It is entered into the registration book of orders.

“Russian Federation” is written on the first line of the document, and “Individual entrepreneur Surname I.O.” is written on the second line.

On the third line, in small print, all the details of the individual entrepreneur are listed (OGRN, TIN, individual entrepreneur registration certificate number).

Below on the left indicate the date the document was filled out (with the originating number).

The line below indicates the subject of the order, for example, “On the appointment of a commercial director.”

The following outlines the essence of the order in a business style and without unnecessary details.

A detailed description of the director’s responsibilities is indicated in a document called the “Job Description.”

For example, the text of the order may look like this: “Appoint A.A. Ivanov to the position of commercial director. from March 3, 2020 with a salary according to the staffing table.” After this, the individual entrepreneur signs with the words “Individual entrepreneur Sidorov P.I” and certifies with a seal.

The order comes into force from the date of its signing. The employee begins work on the date specified in the document. At the request of the designated employee, he may be given a copy of the order.

Mandatory list of personnel documents for each individual entrepreneur

Most often, using the services of such organizations is much cheaper than hiring a separate personnel specialist, who will also need to organize a workplace, constantly pay wages and ensure that the employee performs his duties efficiently. The last point is always the most problematic, because no one is immune from making mistakes.

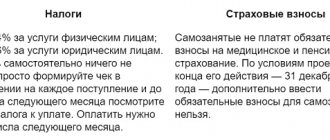

From 01/01/2017, insurance premiums are paid to the tax authority, in addition to the insurance premium for injuries, it also continues to be paid to the Social Insurance Fund.

As a rule, this can be in any form, but with mandatory display of data - the full name of the company, the vacancy for which the employee is applying, as well as the conditions of employment, if any.

I opened an individual entrepreneur a little over a year ago and faced great difficulties. And with your permission, dear readers, in this article I will comment on the advice of an experienced lawyer from the point of view of an ordinary entrepreneur who has already walked this path and cut his teeth.

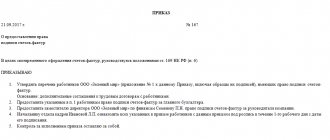

What to do after placing an order?

As mentioned above, the order for the appointment of a director of an individual entrepreneur is accompanied by a job description. The new employee should become familiar with it. After familiarization, he signs with the transcript.

After this, a standard employment contract is concluded with the director. It states:

- responsibilities;

- functions of a manager;

- requirements;

- work schedule;

- Areas of responsibility.

In order for the director appointed by the individual entrepreneur to be able to fulfill his duties, the individual entrepreneur issues him a power of attorney to carry out any actions (to manage the enterprise).

The director appointed by the individual entrepreneur and the entrepreneur go together to the bank to issue a card with sample signatures. After recording the sample signature of the director, the bank can accept payment documents signed by the new director for payment and crediting.

Documentation

You can download standard forms of documents discussed in this material from the links below:

Orders when creating an organization:

• On the organizational structure of the enterprise;

• On the appointment of those responsible: -for storing and maintaining the audit book; - for storing and maintaining a book of comments and suggestions; -for maintaining personnel records and movement of work books; - for maintaining personalized records and submitting personalized records; -for an electronic digital signature; - for fire safety; • On the development of labor protection instructions; • On the implementation of internal labor regulations; • About the timing of salary payment; • On the appointment of a commission to implement depreciation policy; • About strict reporting forms; • On the creation of a commission for the assignment of temporary disability benefits; (*if the organization has more than 15 people, then a commission of 3 people is created. If the organization has less than 15 people, then one person in charge is appointed.) • On assigning the authority to sign documents; (*if there is no GB on staff for cash transactions); • On assigning the duties of a cashier; (*if there is no cashier on staff).

This might also be useful:

- Procedure for paying sick leave in 2020

- Calculation of compensation for delayed wages

- Calculation of the average number of employees

- Do you need an accountant for an individual entrepreneur?

- Filling out the payroll slip according to form T-49

- Rules for filling out a payroll form T-53

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

Personnel and accounting documents of individual entrepreneurs in 2020, their storage period

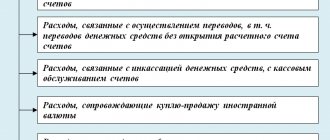

Accounting documents for individual entrepreneurs include:

- invoices;

- incoming and outgoing invoices;

- statements for accumulation;

- acts of acceptance and transfer;

- economic correspondence;

- accounting books;

- turnover statements;

- inventory lists;

- accounting policy;

- cash flow reports;

- sales receipts, bank statements;

- explanatory notes, etc.

The Labor Code established that a document confirming work for an individual entrepreneur is, in addition to the work book, an employment contract with an individual entrepreneur (if the employee is hired for a permanent job) or a civil law agreement (CLA). The employment contract between the individual entrepreneur and the employee, after its signing, is one of the documents for registering the individual entrepreneur as an employer. The agreement and order must be concluded only in writing. This rule is enshrined in article number 67 of the Labor Code of the Russian Federation.

This is the main legal document fixing the labor relationship of an individual entrepreneur with an employee. An employment contract defines the rights and obligations of both the employee and the employer, the working hours and the official salary. The employment contract is drawn up in two copies. One copy is given to the employee; it must bear the signature and seal of the employer.

Agreement

A sample employment contract for an individual entrepreneur is based on the requirements of Art. 57 of the Labor Code of the Russian Federation and must contain a mandatory mention that it is concluded between the employee and the individual entrepreneur. Moreover, the full name of the employer and employee is indicated. In addition, the agreement will have a standard form, that is, an example of a sample employment contract with an individual entrepreneur is any correctly executed standard agreement.

The agreement specifies the rights and obligations of the parties to the agreement, including:

- salary amount;

- payment schedule;

- describes the procedure for leave and dismissal.

The document acquires legal force if there are signatures of both parties.

According to the Labor Code of the Russian Federation, such an agreement is drawn up in two copies and handed over to the parties to the agreement. An employment contract can be indefinite, that is, the date of termination of work is unknown, or fixed-term, when the document indicates the exact date of dismissal from the position. In addition, a variation of the contract may be an agreement on part-time work.

The employer is obliged to indicate the presence or absence of a probationary period for the employee:

- During this period of time, the employer checks the compliance of professional qualities with the requirements of a specific position.

- The fact that there is a probationary period, information about which is not included in the contract, is a violation of the labor code.

- Also considered a gross violation is the employee’s ignorance or disagreement with the establishment of such a period. The Labor Code of the Russian Federation states that a probationary period is assigned only by mutual consent of the parties to the employment agreement.

- In addition, it is illegal to hire an employee for a probationary period and not have an order for his appointment.

- Also, a pregnant woman and a woman with a child under one and a half years old cannot be accepted and placed on probation.

- A fixed-term employment agreement for 2 months cannot contain a clause on a probationary period.

In addition to the special cases described in the code, an individual entrepreneur, when hiring an employee under a fixed-term contract of up to six months, does not have the right to assign a probationary period of more than two weeks.

The exception is managers, accountants and their deputies. So, the employment agreement concluded between the employee and the individual entrepreneur, regardless of the presence or absence of a period for testing professional qualities, will serve as the basis for drawing up an order for employment.

We recommend you study! Follow the link:

How to fill out an employment order

How to issue an order for employment

According to the current legislation of the Russian Federation, any citizen has the right to register as an individual entrepreneur if he is legally capable, has reached the age of majority and his activities have not been prohibited by the judiciary.

When conducting commercial activities, businessmen often have a question: how long to store individual entrepreneur documents?

According to paragraph 1 of Art. 2 of the Civil Code of the Russian Federation, the activities of individual entrepreneurs are systematic and aimed at making a profit from the sale of goods, performance of work or provision of services.

- It is systematic (if your work or services are repeated more than once a year).

The hiring of an employee is carried out, as always, by signing an employment contract, which will take into account all the rights and obligations of the applicant.

Entry in the work book when hiring an individual entrepreneur

Based on the order, indicating its number and date of publication, an entry is made in the work book. This line also contains information about the date of appointment and position. The entry must be made no later than 5 days from the date on which the employee began performing his work duties.

The responsibility for providing a work book lies with the employee; if he is employed for the first time and has no work experience, then he must purchase a blank form at his own expense.

Often participants in labor relations confuse documents such as orders and instructions. Individual entrepreneurs draw up a sample employment order in the form of an employment order.

The responsibility of the employer, whether it is an individual entrepreneur or an LLC, is to legally formalize labor relations. The terms of labor legislation govern the relationship between employee and employer. An individual entrepreneur can optionally request a completed employment application from a future employee. At the same time, the individual entrepreneur must necessarily conclude an employment contract indicating all the details of the position, since it is on the basis of the employment agreement that an internal order is issued, after which an entry is made in the employee’s book. All documents, or rather, the rules for writing and formatting them, are identical for individual entrepreneurs and large companies.