Recovery of damages

The amount of assessed damage during the performance of his work activity by an accounting employee is assessed in accordance with the provisions of Art. 246 Labor Code of the Russian Federation. General conditions for determining the amount of damage:

- The amount of damage is taken into account based on the market value of the damaged property (amount);

- Depreciation of property is taken into account

- If the accountant does not agree, then it is possible to involve an independent appraiser

If the damage was caused in the form of a breakdown of this or that equipment or other corporate property, then the amount is estimated solely taking into account depreciation and wear and tear for the period that this company owns the property (based on the market value of similar purchase offers on the secondary market) .

https://www.youtube.com/watch?v=https:accounts.google.comServiceLogin

A financially responsible person is an employee who is entrusted with material assets and is fully responsible for them.

Financial liability is regulated by Chapters 37, 39 of the Labor Code of the Russian Federation. The list of financially responsible persons under the Labor Code is established by Art. 244, art. 277.

It must be said that all employees are responsible for damage and loss of the organization’s property within the framework of the average monthly salary; such responsibility is partial. The average salary is calculated based on wages for the previous 12 months.

Otherwise, the financially responsible person is responsible for the obligations. Such responsibility is imposed on the team (team) or personally. Team responsibility is introduced when its members carry out activities together, and it is not possible to isolate the share of participation of each. To avoid team responsibility, a person will have to prove his own innocence with evidence.

If the financially responsible person goes on vacation or resigns, a complete inventory of the property entrusted to him is carried out (Part 3 of Article 11 402-FZ of December 6, 2011).

Management has the right to claim damages from the employee; claiming lost income is prohibited by the legislator. The amount of damage is calculated based on average market prices, but not less than the value indicated in the documents, taking into account wear and tear. The legislator may provide another way to determine damage. The need to prove the extent of the damage lies with the person to whom it was caused.

There are four ways out of the situation depending on the circumstances.

- Management has the right to forgive the damage in full, part of it. The owner has the right to impose restrictions. The decision may be influenced by: the amount of damage, the degree of guilt of the worker, his or her reaching the age of majority, the existence of an agreement on full liability. The right not to be used in favor of some, to the detriment of others.

- When the damage does not reach the average monthly salary, compensation is deducted by order of management. This must be done within a month after the damage was determined.

- When the time has expired, the worker refuses to compensate for damage that is more than the average monthly salary; compensation can only be obtained through the court.

- The employee has the right to offer compensation, either partial or full.

The administration has the right to provide an installment plan: the culprit undertakes in writing to compensate for the damage, and a payment schedule is drawn up. If someone who undertakes to compensate for the damage, but refuses, is fired, then it will be possible to recover only through the court.

With the consent of the administration, the employee compensates for the damage with his property and repairs what is broken.

What is the responsibility?

So, the Labor Code defines the following aspects of the employer’s financial liability:

- If his actions or inaction led to the fact that the subordinate is unable to work - Art. 234;

- If the employee’s belongings (property) were damaged – Art. 235;

- If there are unreasonable delays in any payments due to a subordinate or their absence at all - Art. 236;

- Moral damage has been caused - Art. 237.

Now more details.

- The inability to work means quite a lot of concepts. Some of the most common are illegal, i.e., without reason, dismissal or transfer to another position (most often, demotion). Of course, we are not talking about cases provided for by the Labor Code of the Russian Federation.

- Since each employee has personal belongings at the workplace - a telephone, clothes, accessories, a car or a great-great-grandmother’s favorite mug, the manager is also responsible for their safety, because his responsibilities include creating comfortable and safe working conditions for employees. If an incident occurs with damage to any property, the employee must initially contact his superiors in writing with a request for compensation for the damage caused in monetary terms (the amount of compensation depends on the current market prices for an item with the same characteristics) or replacement of the damaged property with the same, but whole. If there is no response within 10 days or if a compromise solution is not found peacefully, you will have to go to court.

- When it comes to wages, the most common violation on the part of directors is delaying wages to employees. By law, workers must receive wages twice a month. Specific numbers are most often regulated by internal acts of the organization. The main thing is that the break between payments does not exceed 15 days.

Vacation pay (when it comes to annual paid leave) is issued no later than 3 working days before the start of the vacation. Sick leave is paid no later than 10 days after providing a document confirming the illness. Payment for maternity leave occurs on the nearest day of payment of wages.

Child care benefits are issued monthly on the day the salaries are transferred to other employees. Upon dismissal, an employee must receive all payments due to him on his last working day.

They are followed in frequency by incorrect or missing entries in work books, which prevent a person from getting another job. This also includes the delay in issuing documents - the same book, income certificate, F 2-NDFL certificate and other documentation that is requested when accepting another place of work.

For such misconduct, the head of the organization must compensate his former employee. Moreover, the daily amount of compensation is equal to the average daily earnings of the dismissed person.

In addition, if the director lost a labor dispute in court, the Court’s decision has entered into force, and no one is in a hurry to implement it, then the employee also has the right to count on monetary compensation.

Of course, not all delays are directly the fault of the employer. But for the law this no longer matters. A penalty is charged for each day of delay, starting from the moment when the settlement should have occurred, ending with the day when it actually occurred.

During the trial, the date the decision entered into force does not matter; the penalty will continue to accrue until the employer directly fulfills its obligations.

When calculating the amount of compensation, 1/300 of the current refinancing rate of the Central Bank of the Russian Federation will be taken as a basis.

All violations by the employer of the employee's rights inevitably entail all sorts of moral suffering for the latter. Therefore, it is possible to talk about moral harm caused by the head of an organization to his employee. Compensation for moral damage is possible only by going to court and its amount is determined by the same body.

https://youtu.be/60e2LTHjpFE

Limited liability of an accountant

There are two concepts of an accountant's financial responsibility to his employer.

- The first type is full liability, which involves compensation for the entire amount of damage that was caused to the company or its employees by the accountant.

- The second type is limited liability, which occurs in accordance with the standards of the Labor Code of the Russian Federation.

Limited liability occurs for unintentional violations of labor instructions that lead to material damage. According to the law, the amount of compensation from the accountant in this case is set in the amount of his monthly salary.

| ★ Best-selling book “Accounting from Scratch” for dummies (understand how to do accounting in 72 hours) purchased by {amp}gt; 8000 books |

Selecting the type of responsibility

By default, the employee bears limited MO. In cases other than those listed in the first paragraph of Article 243 of the Labor Code, damages are recovered in the amount of no more than the average monthly salary in accordance with Articles 241 and 81 of the Labor Code.

If a full mat agreement is concluded. liability or clauses about it are in the employment contract, the chief accountant compensates for losses in full. This is confirmed by the Post. Sun 11/16/2006 No. 52, paragraph 10, appellate decision. courts of the Arkhangelsk region. 05/30/2013, case No. 33-3149/13.

A similar MO in such cases is borne by the accountant-cashier, from whom, in addition to the amount of the shortage, the fines paid by the organization under Articles 14.1, 15.1 of the Code of Administrative Offenses are fully recovered. Other accountants are liable (except for that stipulated in Article 243 of the Labor Code, clause 1) only in an amount not exceeding the average monthly salary.

Judicial practice also recognizes an intermediate option as legitimate, when in the employment or civil contract of the chief accountant the parties independently establish the limit of his liability (resolution of the Volga District FAS 02/26/2010, case No. A06-2797/2009).

When applying for a job in a large business organization, it is logical for an applicant for the position of chief accountant to insist on precisely this version of the agreement.

It makes sense to extend these restrictions to sanctions under the Code of Administrative Offences, which in the practice of a large company can be frequent.

The manager must understand that losses can be recovered from an honest employee only within the limits allowed by his official income for a reasonable period, and sanctions on the enterprise can be imposed in amounts that are unrealistic for an individual.

Everything that is said above in relation to the chief accountant applies to a person working under a civil contract for the provision of consulting services on accounting, including legal (Chapter 39 of the Civil Code).

It is advisable to provide for the limits of liability of such a person in the contract from the moment of its conclusion. The courts consider it legitimate to impose fines on such counterparties for the consequences of their recommendations (Resolution of the Federal Antimonopoly Service of the Moscow District of July 18, 2012, case No. A40-4373/12-27-38).

List of materially responsible positions

- he is given full responsibility;

- a shortage of valuables was discovered, the administration drew up a document according to which the worker received these valuables;

- harm was caused with intent, while in a state of intoxication, as a result of the use of alcohol, toxic, narcotic substances, property was damaged or lost as a result of a crime, administrative violation;

- information has been disclosed, the non-disclosure of which is protected by law;

- the worker did not fulfill his duties.

Those who have not reached the age of majority bear full responsibility in the third case listed above.

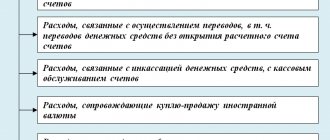

- cashiers, controllers;

- everyone working with deposits, bank cards and discount cards; carrying out expert assessment of banknotes and securities; involved in the circulation of money, securities and precious metals; servicing ATMs and clients who place valuables in vaults; collecting and transporting cash and other valuables; cash register attendants; forming and counting cash;

- employees of all levels of management of trade, food and service enterprises, and the hotel sector;

- management personnel in organizations engaged in the construction of buildings and structures, installation production;

- management staff of warehouses, pawnshops, storage rooms, supply managers, commandants, wardrobe maids, storekeepers;

- senior nurses of medical organizations;

- agents involved in procurement, delivery, forwarders;

- heads of pharmaceutical organizations, pharmacists, technologists and pharmacists;

- laboratory assistants, methodologists at universities, heads of libraries.

About

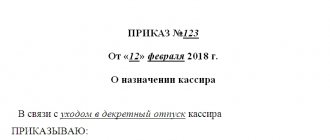

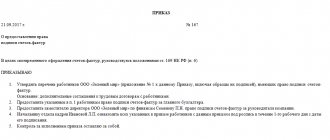

Order on financial responsibility

There is no legally approved sample order for the appointment of financially responsible persons; when drawing up, you can be guided by the generally accepted system of office work. The document is drawn up on company letterhead approved for organizational and administrative documents of the company.

The order contains:

- Name of the organization;

- title of the document (order);

- date and place (city) of publication;

- title (about the appointment of financially responsible persons);

- a preamble describing the purpose and basis of the appointment.

The contents indicate the full name and position of the employee who was appointed financially responsible. If we are talking about a group of people, then a list is drawn up. Next, the property for which compensation is assigned is listed, the full name and position of the employee who will monitor the execution of the order is indicated.

At the bottom, the manager signs with a transcript. Employees in respect of whom the order has been issued must familiarize themselves with it and sign it.

Main responsibilities

- protect the organization’s property and prevent its damage;

- promptly inform management about the threat of damage;

- keep records of values and compile reports;

- participate in checking the availability of property and its condition.

- provide the required environment for employee work and property preservation;

- familiarize the employee with laws, regulations, other documents relating to liability, local acts;

- check the availability of property and its condition.

About

Where is it reflected?

Labor relations are necessarily formalized by an employment contract. This document specifies the responsibilities of the parties to the contract. It is there, in the section “Rights and obligations of the parties. Responsibilities of the employer" and sets out the framework of obligations of the head of the enterprise in relation to employees.

Moreover, in contrast to the mandatory conclusion of an agreement on full financial responsibility with an employee, such a measure is not applied with the employer.

A separate document “Agreement on the financial responsibility of the employer to the employee” is not provided for by Labor Law and does not exist in principle.

In the agreement with the employee on financial responsibility there is also a mention of the obligations of the head of the organization - in the section “Responsibility of the Parties”. The form of this document is unified and recorded in the 85th Resolution of the Ministry of Labor.

The amount of financial liability can be determined not only by the Labor Code, but also by internal, local acts of the enterprise.

According to them, the amount of compensation payments may be higher than what is provided for by law. But if the acts to which the contract refers reduce the size, then they cannot be considered valid. And in the event of a dispute, the only applicable document is the Labor Code.

Agreement on financial liability with the director - sample.

https://youtu.be/zojD8VWLECw

List of materially responsible positions

There are differences in some norms and clauses of the employment contract between an ordinary accounting employee and a chief accountant. Thus, the full financial responsibility of the chief accountant can be carried out not according to the terms of a separate contract when hiring, but according to the written sections of the main document and job description.

Interpretation of the very concept of a chief accountant: this is an official who performs all functions to ensure timely, correct and high-quality financial accounting at the enterprise, taking into account all the norms of the current legislation of the Russian Federation.

According to the norms of Art. 10. 243 of the Labor Code of the Russian Federation, the chief accountant can be brought to full financial liability regardless of whether he received disciplinary, administrative, financial or criminal punishment for the violation he committed.

From this it should be concluded that the chief accountant legally bears full responsibility for the correct preparation of financial accounting of an enterprise or company, regardless of whether an agreement on full liability was drawn up with him. At the same time, the chief accountant is responsible by law for the correct process of carrying out all financial transactions, as well as for the activities of each accounting employee that is subordinate.

| Gross violation | Content | Base |

| rules for accounting for income and expenses and objects of taxation |

| Article 120 of the Tax Code of the Russian Federation |

| rules of accounting and presentation of financial statements |

| Article 15.11 of the Code of Administrative Offenses |

Collection forms

Can full liability be established?

At the same time, one of my subordinates made a mistake in filing a tax return. Can I be held administratively liable?

The exceptions are:

- deputy heads of the organization and the chief accountant - the condition for the full financial responsibility of these employees can be provided directly in the employment contract ();

- the head of the organization, since full financial responsibility is assigned to him by law (). That is, regardless of the presence or absence of an agreement on full financial liability or the corresponding condition in the employment contract, the manager bears full responsibility and will be obliged to compensate the damage caused to the organization in full ().

Can an accountant for fixed assets account for the financially responsible person for the same fixed assets?

Please how to respond to the chief accountant and justify your refusal to sign an agreement on full individual financial responsibility. I work as a forester. She very persistently asks to sign an agreement or provide a justified refusal.

Consequences for an employee of this position after dismissal

As for the responsibility of an accounting employee who is not a chief accountant under an employment contract, it occurs on the basis of the norms and sections of Art. 241 of the Labor Code of the Russian Federation and is limited, as described above, to the amount of one monthly salary (salary for the period from the first calendar day of the month to the last calendar day of the month is considered).

At the same time, do not forget about the exceptions that were described above. Each type of established violation leads to one of the types of liability (material, criminal, administrative or disciplinary).

https://www.youtube.com/watch?v=ytadvertiseru

If you intentionally commit a financial crime or conspire with another company employee to obtain material property, criminal prosecution may be opened. At the same time, the chief accountant is obliged to control the entire process of processing financial transactions of an ordinary accounting employee, and if illegal actions are detected, both may face liability (including criminal liability).

| Type of responsibility | Enterprise example |

| Limited liability | An ordinary accounting employee, I.V. Ivanov carried out an operation to sell a batch of sweets to one of the wholesale stores. Due to my mistake (carelessness), an incorrect figure was indicated in the weight of the sold candies. By decree of the director of the enterprise, the estimated amount of damage of 30,000 rubles is written off from wages. The amount of underpayment due to the fault of the accountant amounted to 30,000 rubles. His monthly salary is 32,500 rubles. In total, the amount of the salary for the current month for the accounting department employee was 2,500 rubles, taking into account financial liability under Art. 241 TKRF. |

| Full responsibility | An accounting employee provided deliberately false data to a number of employees, not accruing to them a lesser amount of wages in the current month than was allocated by the company and established in their employment contract. The accountant pocketed the difference personally. |

As can be seen from the second example, such a crime bears the full financial responsibility of an accounting employee up to and including the opening of criminal prosecution. Moreover, even if the accountant was fired, and errors in the reports for the period of his work or other damage were discovered after the termination of the contract, the manager has the right to make a claim for compensation for material damage from the already dismissed employee.

Features with the director of LLC and branches of organizations

Many questions are associated with the managers of LLCs and branches.

The LLC can be headed by either a simple director or a general director. It is the person occupying these positions who is responsible for the ongoing offenses against employees. If the organization has co-founders, then there is little demand from them, since in fact they are not employers and only the boss will have to take the rap.

As for the heads of branches, there are many pitfalls. According to the labor code, the employer is not the director of a division or branch, but the immediate superior of the entire organization. The person managing the structural unit cannot be financially responsible.

He only represents the interests of the immediate head. He is responsible only for actions or inactions committed directly by him, but for which he did not have the right, or which resulted in offenses against employees.

It is on this basis that the concluded agreement on the full financial responsibility of the employee with the director of the branch is invalid.

Another nuance exists in the labor relations between employees and the employer, if the company and, accordingly, its manager are foreign, that is, located outside the Russian Federation. The problem is that our legislation is different, and the Law may have different views on a particular labor dispute.

The only way out may be an employment contract, which spells out in detail not only the responsibilities of the employee, but also the employer, including the following aspects: who is responsible for what offenses, how and where (in which courts, in which country) the infringed rights will be restored and to whom make a complaint.

Financial responsibilities of the general director of the LLC:

https://youtu.be/VcHFTlCkRac

The employer's financial responsibility is an important point in labor relations. It is the key to safe and comfortable work for the employee, and also gives him guarantees for compensation not only for direct damage, but also for moral damage.

You can find out about other positions with responsibility here: salesperson, cashier, watchman, accountant, driver, military man, storekeeper, as well as supply manager and other specific positions.

When an employee is released from liability

- floods, hurricanes, earthquakes, other natural disasters, military actions;

- when there is a threat to the life of an employee, other citizens, or the state, and it was impossible to eliminate this danger in a different way;

- defense, if such defense was necessary;

- natural risk, when tasks cannot be performed in any other way, the worker acted in accordance with the experience and knowledge accumulated by society, performed duties as required;

- management did not create the required storage conditions.