What is returnable waste?

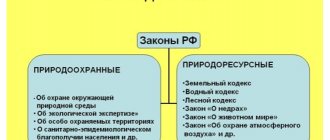

There is no definition of this concept in current regulations. The definition of the concept of “waste” is described in Federal Law No. 89 (dated July 20, 1998) “On production and consumption waste.” Waste refers to leftover materials and finished products whose original consumer properties have been lost.

The following types of waste are distinguished:

- Irrevocable - not processed to obtain recyclable materials.

- Returnable – suitable for re-use and resale.

The concept is further defined in accounting-related documents. In the Tax Code of the Russian Federation, waste refers to residual resources that are deprived of their original properties and qualities and are not suitable for use for their intended purpose.

Properties of returnable waste

The presented category of solid waste has its own characteristics. Due to this, they are assessed as an object of accounting and tax accounting.

Properties:

- Formed during production processes

- This is a material resource

- Actual properties differ from those of the raw materials

- After processing, they can bring income or other benefits

Classification of returnable waste

In enterprise management, it is customary to distinguish 2 categories of returnable balances.

These include:

- Used. Waste suitable for reuse in production for its intended purpose - participation in the main or auxiliary technological process.

- Unused. Resources consumed for purposes other than their intended purpose.

Recyclables do not include residues formed during irreversible reactions (volatilization, evaporation, drying). The described category of solid waste does not include waste used as feedstock in other production processes.

Types of waste

In the course of the activities of any company, waste is generated—remnants of materials that have lost or partially lost their useful properties. One part is sent back to work or sold, while the other part is not subject to further use. They are divided into two types: returnable and non-refundable.

Returnable waste refers to inventory items, semi-finished products and other material resources. Their properties:

- They have a material form.

- Their properties are lost or lower than those of the original raw materials.

- They are formed during the production of any product.

- Their continued use brings financial benefits in the future.

They are divided into used and unused. The first category includes those that will be useful in the future for the manufacture of the main product. The latter refers to waste that is used for household needs, as fuel or resold.

How to account for returnable waste?

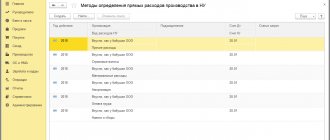

In accounting, the assessment of used balances occurs in the same way as ordinary materials. Account 10 “Materials” and subaccounts 10.1 “Raw materials and materials”, 10.12 “Returnable waste” are used.

We recommend reading: Methods for dewatering sewage sludge

The procedure for accounting for returnable balances includes the following steps:

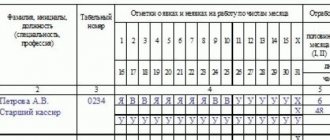

- Determination of quantity. When waste is removed from the process, the necessary measurements are taken to evaluate it. Residues are assessed by determining volume or mass. They are weighed or counted individually (if we are talking about finished products).

- Registration of the invoice. Based on such a document, the receipt of solid waste, its storage and subsequent processes take place. An invoice is drawn up in the form TORG-13. Allowed by issuing an order in form M-4 or invoice M-11.

- Transfer to warehouse. The waste is transferred to the storekeeper or other authorized person responsible for storing materials.

- Issue from warehouse. For further use, the remains are taken from the warehouse. In this case, a new invoice is issued - in the form M-15 or TORG-12.

Recognition of returnable waste

A specific feature of returnable balances is the moment when they are excluded from the cost of production and are accounted for as an independent object, affecting the tax base.

Accounting is implemented in two ways:

- At the time of acceptance of waste for reuse or resale

- At the moment of formation

Each option has advantages and disadvantages. In the first case, the remains are easier to evaluate, but control over their safety is partially lost. In the second case, it is easier to determine the amount of residues, but the assessment is difficult due to the fact that it is not known when the raw materials will be reused.

What documents are used to document waste in a warehouse?

Those wastes that are identified during the manufacture of products must be:

- counted and weighed;

- delivered to the warehouse.

Important! If it is not possible to count and weigh the resulting waste, a calculation method is used: the quantity of products is multiplied by the standard of expenditure approved by documents.

For delivery and registration of arrival at the warehouse and sale, the following documents are used:

| Form name | Document |

| MX-18 | Invoice for transfer of products to the warehouse |

| M-4 | Warehouse receipt order |

| M-11 | Requirement-invoice, which records the release upon re-entry into production |

| TORG-13 | Invoice for the transfer of goods, containers when moving within the company |

| TORG-17 | A journal that records the safety and movement of products within warehouses |

| M-8 | Limit-fence card for releasing when re-using in the manufacture of products |

| M-15 | Invoice for shipment to the third party when releasing to another organization |

| TORG-12 | Sales invoice |

Important! These documents are the basis on which costs and expenses are reduced in accounting and tax accounting, respectively. The storekeeper does not indicate the value of the capitalized assets; this is subsequently done by the accounting department by filling out the appropriate columns based on the calculation of the cost of expenses incurred.

All accounting documents must contain information about expenses.

Such data includes:

- Amount of waste;

- Units in which they are measured (pieces, kg, m, sq.m);

- Price.

Important! Since 2013, organizations can use documents developed by them independently, but subject to their mandatory approval by the manager and indication of the necessary details - those that comply with the requirements of accounting legislation.

Valuation of returnable waste for tax accounting

Since waste is classified as materials, it is received during generation, subsequent receipt at the warehouse and at the time of issue. At the same time, the cost of the raw materials from which they are composed is reduced, since they are subsequently reused.

The option for assessing residues depends on how they are reused:

- When reused in the production process at your own enterprise, the cost of raw materials is equal to the cost of use

- When resale of raw materials, the purchase price is indicated in the report

Tax accounting data often differs from accounting estimates. The reason for this phenomenon is different calculation methods. To adjust the indicators, additional postings are applied.

There are some peculiarities in rationing the consumption of material and energy resources in the production of plastic and rubber products.

The consumption rates of raw materials for products are determined on the basis of the net mass of the finished product without taking into account the mass of the fittings of technological return waste that is not used in a given technological cycle, but can be used in other production processes (at this enterprise or at others) technological losses. [p.99] Returnable waste used in other production processes is a secondary resource. Losses also occur during additional operations when preparing waste for use. These losses are included in the consumption rate. [p.99] The technological rate of consumption of raw materials, taking into account the use of returnable waste in the same technological process, is calculated as follows [p.100]

Return waste (subtracted) mother liquors of lemon 0.045 0—03 0.045 0-70 0-03 1055 690—00 [p.250]

Raw materials, basic materials (less returnable waste) Auxiliary materials Fuel from outside Energy from outside Basic and additional wages Social insurance contributions Depreciation of fixed assets Other cash expenses 16598 2357 848 1 452 2850 290 2738 1321 18 189 2400 945 1 473 2880 291 2887 1 400 [p.259]

Returnable waste (subtracted) [p.254]

Waste is classified according to various criteria (type, form, place of generation, etc.). We are interested in one feature - the possibility of their further use, since this feature is related to the economy and organization of production. Returnable waste suitable for use has both use value and value. [p.40]

The use of returnable waste results in the cost of raw materials being spread over a larger number of products. If fsd is the consumption of raw materials per unit of finished product, a Qp and QnT are, respectively, the amount of returnable waste and inevitable losses P is the net weight of the product g is the coefficient of actual use of returnable waste (of the total amount of returnable waste) Z is the cost of raw materials necessary for production products taking into account all waste 7SD - the cost of raw materials per unit of finished product with full or partial use of returnable waste, then [p.41]

By-products and returnable waste from the plant, spent on production, are shown in planned calculations under the section Semi-finished products of own production. [p.301]

The costing items are 1. Raw materials and supplies. 2. Purchased components, semi-finished products and services of cooperative enterprises. 3. Returnable waste (subtracted). 4. Fuel and energy for technological purposes. 5. The main infection [p.136]

The estimated cost of research and development work includes all costs in calculation terms for performing this work. Expense items are 1) materials minus returnable waste, purchased products and semi-finished products 2) basic and additional wages of research and production personnel 3) social insurance contributions 4) special equipment, installations, instruments 5) scientific and production trips 6) payment for work and services that are performed by other organizations that are on their own balance sheet 7) funds for equipment of economic incentive funds, other direct expenses 9) overhead costs. [p.287]

Expense items are 1) materials minus returnable waste, purchased products and semi-finished products 2) basic and additional wages of research and production personnel 3) social insurance contributions 4) special equipment, installations, instruments 5) scientific and production trips 6) payment for work and services that are performed by other organizations that are on their own balance sheet 7) funds for equipment of economic incentive funds, other direct expenses 9) overhead costs. [p.287]

The cost estimate for economic elements includes the following cost items: 1) basic and auxiliary materials minus returnable waste, purchased products and semi-finished products 2) fuel and energy from outside 3) special equipment for scientific and experimental work 4) basic and additional wages 5 ) social insurance contributions 6) payment for work and services performed by third-party organizations and enterprises 7) funds for the formation of economic incentive funds, other cash expenses] J. [p.288]

other cash expenses] J. [p.288]

Returnable waste (subtracted) Auxiliary materials for technological purposes [p.344]

Returnable waste (subtracted - development of new technology [p.248]

Raw materials and basic materials (less returnable waste) [p.84]

Returnable waste (subtracted) [p.84]

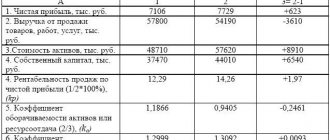

Costs for raw materials are reduced in the presence of returnable production waste, which is valued at prices approved by the head of the enterprise, based on its quality and cost [p.283]

Expenses associated with making a profit and determining the cost of products (work, services) consist of the cost of material costs (minus the cost of returnable waste), labor costs, social contributions, depreciation of fixed assets and other costs. [p.289]

Many enterprises may have excess returnable waste of raw materials, which can be sold or used for other purposes. If we compare their cost by the price of possible use and the cost of raw materials, we will find out by what amount the material costs included in the cost of production have increased. [p.192]

Sample costing items Raw materials (minus returnable waste) Total cost of marketable products Change (+,-) costs in product balances in warehouses and in shipment [p.167]

In the context of the spread of the principles of effective management to the internal divisions of the enterprise, prerequisites are created for the generation of information about deviations from the norms of consumption of raw materials, materials, semi-finished products of own production and purchased, returnable waste at the places of their origin. [p.324]

Raw materials and supplies (returnable waste is deducted) [p.273]

Material costs (less returnable waste) 7,800 Including [p.30]

The main costing items are raw materials and supplies, returnable waste (subtracted), purchased products and semi-finished products, fuel and energy for technological purposes, main and [p.469]

Costs for the items Raw materials and basic materials and Semi-finished products of own production are reduced by the amount of returnable production waste. The company sets prices for them based on their quality and costs of raw materials. Returnable waste includes alkaline waste, trap product, waste coke, bitumen, etc. Their value is characterized by the content of useful substances in them. [p.211]

III. Returnable waste (subtracted) is trap product, naphthenic acids, acid tar, waste bitumen, paraffin, coke obtained during the production of these products. [p.189]

Raw materials2 that are processed are reduced by the amount of returnable and irrecoverable waste (losses). The amount of returnable waste is determined by its actual weight, and non-returnable waste is determined by the difference between the weight of raw materials released for processing and the weight of the actual products received and returnable waste. Returnable waste (most often a trap product) is valued at the price of possible use, for example, at the price of heating oil, and its cost is excluded from the amount of raw materials costs. [p.197]

Let’s assume that 500 tons of desalted oil from the remainder were supplied to the direct distillation unit at 15.20 rubles. per ton in the amount of 7,600 rubles, from the current receipt of 20,000 tons at 15 rubles. in the amount of 300,000 rubles. The installation produced 2,000 tons of gasoline, 8,000 tons of diesel fuel, 10,000 tons of fuel oil and 300 tons of return waste (trap product) at 10 rubles. per ton in the amount of 3000 rubles. Therefore, irretrievable waste (losses) are equal to [p.197]

Raw materials and basic materials: electrical and structural steel, winding copper, electrical insulating and cable materials (less returnable waste). This cost element also includes purchased products and semi-finished products, such as semiconductor elements, integrated electronic circuits, insulators, electrical contacts, etc. [p.136]

The article Raw materials includes the cost of the materials from which this electrical product is made, as well as the cost of auxiliary materials for technological purposes (for-washing, flux for welding, chemicals for electroplating, etc.). The quantity of materials is established according to consumption rates, which are multiplied by the wholesale price of a unit of material according to the current price lists. Returnable waste (shavings, trimmings) is written off at the price of waste, taking into account the coefficient of their use. [p.138]

Returnable waste includes: juvenile product, alkaline waste, coke obtained from cleaning tube furnaces, bitumen waste, etc. [p.230]

Costs for raw materials are reduced in the presence of returnable production waste, which is valued at prices approved by the head of the enterprise, based on its quality and the cost of the outgoing raw materials of the process. Returnable waste includes trap product, alkaline waste, coke waste, bitumen waste, etc. Their value is characterized by the amount of useful substance they contain. [p.229]

Costs for raw materials are reduced in the presence of returnable production waste, which is valued at prices approved by the head of the enterprise, based on its quality and the cost of the outgoing raw materials of the process. Returnable waste includes trap product, alkaline waste, coke waste, bitumen, etc. Their value is characterized by the amount of useful substance they contain. The article Auxiliary materials takes into account the cost of consumed reagents, catalysts, solvents, initiators, packaging and filter materials. The amount of costs for auxiliary materials SV m (reagents, catalysts), completely used in one pass of raw materials, is determined by multiplying the amount of raw materials O or in petrochemicals - target products by the consumption rate I and by the planned procurement price c [p.312]

Accounting for returnable production waste in accounting

In accordance with paragraph 111 of the Methodological Guidelines for Accounting for Inventories, the cost of returnable waste corresponds to the price of raw materials in the form of scrap or scrap on the market. It is reflected at the lower price of the material resource or at the price of its use.

We recommend reading: What causes acid rain?

Often the expected sale price of returnable raw materials differs from the actual price. This happens at the moment of capitalization of the balances. In such situations, it is not advisable to make an adjusting entry so that the enterprise does not have other loss or income.

Accounting legislation provides entrepreneurs with the opportunity to independently choose the option of assessing the cost of returnable waste. The main condition is proper display in accounting documentation.

Samples of postings and calculations

As an example, LLC “name of the enterprise” is presented, which produces wooden furniture. Sawdust and shavings are a common type of residual raw material used for the production of particle boards. The waste is transferred to a workshop where chipboard is produced or resold.

Production costs for the current year – 1 million 500 thousand rubles. (excluding VAT). The price of sawdust and shavings is 180 thousand rubles. The cost of producing chipboard is 550 thousand rubles.

Returnable waste calculation options:

- In our own production. Production costs are reduced by the cost of raw material residues, which are reused at the company’s own enterprise as material. The initial volume of production costs is 1 million 500 thousand rubles. The cost of waste is taken away from them - 180 thousand rubles. Tax accounting reflects the amount of 1 million 320 thousand rubles. The deducted amount is indicated in accounting when issuing chipboards (550 thousand + 180 thousand = 730 thousand rubles).

- For resale. The cost is assessed at market value. For example, 1 ton of raw materials costs 800 rubles, and the company resold 300 tons of sawdust and shavings. 300 * 800 = 240 thousand - the amount excluded from total production costs.

Wiring for operation at your own enterprise:

| Contents of operation | Debit | Credit | Sum |

| Transfer of raw materials for furniture manufacturing | 20 | 10.1 | 1 million 500 thousand rubles. |

| Transfer of raw materials for chipboard production | 20 | 10.1 | 550 thousand rubles. |

| Posting of returnable waste | 10.12 | 20 | 180 thousand rubles. |

| Transfer of raw materials to production | 20 | 10.12 | 180 thousand rubles. |

| Determining the cost of furniture | 43 | 20 | 1 million 320 thousand rubles. |

| Determining the cost of chipboard | 43 | 20 | 730 thousand rubles. |

Reflection of transactions in accounting

Costs for temporary facilities can be accumulated in account 97 “Future expenses” (clause 16 of PBU 2/2008, approved by order of the Ministry of Finance of Russia dated October 24, 2008 No. 116n), although this is not necessary.

Use of multi-turn components. A set of such components costs more than 40,000 rubles. should be considered as an independent item of fixed assets subject to depreciation.

Example 5. A contractor carrying out capital construction work purchased a set of 100 road slabs at a price of 900 rubles. per piece (excluding VAT) for the construction of an auxiliary facility - a temporary road. According to the project, the slabs have a threefold turnover. The accounting policy establishes that depreciation on them is calculated in proportion to the volume of work (clause 18 of PBU 6/01). Consequently, depreciation is accrued when the slabs are put into operation in the amount of 1/3 of their cost. Accounts will look like:

DEBIT 08 CREDIT 60

– 90,000 rub. (900 rubles/piece x 100 pieces) – a set of road slabs was purchased;

DEBIT 01 subaccount “Warehouse”

– 90,000 rub. – a set of slabs is included in fixed assets;

DEBIT 97 subaccount “Temporary road”

CREDIT 10 (70, 69. )

– 50,000 rub. – the costs of constructing a temporary road are reflected;

DEBIT 01 subaccount “Fixed assets in operation”

DEBIT 01 subaccount “Warehouse”

– 90,000 rub. – a set of slabs is laid in the road surface;

DEBIT 97 subaccount “Temporary road”

– 30,000 rub. (RUB 90,000 x 1/3) – depreciation has been calculated for a set of slabs;

DEBIT 20 subaccount “Construction site”

CREDIT 97 subaccount “Temporary road”

– 80,000 rub. (50,000 + 30,000) – included in the cost of construction work are the costs of constructing the road;

DEBIT 20 CREDIT 70 (69. )

– 20,000 rub. – the costs of dismantling the temporary road are reflected;

DEBIT 01 subaccount “Warehouse”

CREDIT 01 subaccount “Fixed assets in operation”

– 90,000 rub. – dismantled slabs were capitalized.

Use of consumables. If consumables are used to create a temporary structure, then the cost of such a structure is not included in the accounting.

Example 6. In accordance with the estimate, the contractor purchased boards in the amount of 10,000 rubles. (excluding VAT), from which a temporary fence was built around the construction site. It is not included in the estimate; upon completion of construction of the main facility, it is dismantled. The contractor capitalized the boards suitable for further use. In accounting, these transactions are reflected in the following entries:

DEBIT 10 subaccount “Building materials”

– 10,000 rub. – purchased boards;

CREDIT 10 subaccount “Building materials”

– 10,000 rub. – boards were used to build a fence;

DEBIT 20 CREDIT 70 (69. )

– 9000 rub. – other costs for the construction of the fence are taken into account (labor, etc.);

DEBIT 20 CREDIT 70 (69. )

– 8000 rub. – the costs of dismantling are reflected;

DEBIT 10 subaccount “Used building materials”

– 2000 rub. – boards were capitalized at the price of possible use.

In the estimate, the refundable amounts for fence boards correspond to the price of their possible use - 2,000 rubles.

VAT accounting is not considered in the example.

Irrevocable waste: definition and accounting

Irrevocable remains are those that are not suitable for reuse or for resale outside. They are not written off or assessed from the accounts of the main production and are included in the cost price.

We recommend reading: Morphological and component composition of waste

When accounting, it is of fundamental importance whether such waste is included in the cost standards. If there are regulatory documents, technical conditions or regulations, they are guided by them when accounting. Irrecoverable balances are not regarded as assets, since the company does not make a profit from them.