Placing money on deposit - what is it?

If an organization generates free funds, then so that they do not lie like a dead weight on the current account, the organization can make them work. Thus, money not involved in circulation can generate additional income. One of the ways to obtain such income is to place funds on deposit.

A deposit account is an account in a banking institution in which a person places available funds, and the bank, according to the terms of the signed agreement, accrues interest on them in the established amount. Typically, deposit agreements are concluded for a specific period. Upon expiration, the funds are returned to their owner. Funds can only be credited to this account as a deposit.

IMPORTANT! The deposit account is not intended for settlements with third parties.

Bank deposit agreement

The accountant works with an existing contract, while paying attention to a number of significant points:

- For what period is the deposit placed?

- Will the deposit be replenished?

- What is the mechanism for calculating interest upon early termination. Usually these conditions are stipulated in the text of the agreement, but if such information is not available, you should be guided by the norm of the Civil Code of the Russian Federation (Article 837 - 5), according to which the amount of interest is equal to that of similar demand deposits.

- Terms and procedure of payments. Interest begins to accrue from the next day after the placement of funds until the date of return of these funds to the organization (Civil Code of the Russian Federation, Article 839, paragraph 1), and is paid according to the periods specified in the agreement. As a rule, this is a month or a quarter. If the condition is not specified, the quarter is taken into account by default. Interest not claimed by the organization is added to the deposit amount, on which new interest is calculated (Civil Code of the Russian Federation, Art. 839, paragraph 2).

It is also important to know the method of calculating interest. With simple interest, the amount invested is taken as the basis, on which interest is calculated. The base amount does not increase. Payment is made according to periods. With compound interest, interest is added to the deposit amount and interest is charged on the newly formed amount. Paid on the day the deposit is returned in one amount.

Let's look at both situations with an example. Let 20,000 rubles be invested at 9% per annum for a period of 2 years.

Simple interest. In the first year you will receive 20,000 * 9% = 1800 rubles and the same amount in the second year. The total deposit amount with interest will be 20,000+1800+1800 = 23,600 rubles.

Compound interest. In the first year you will receive 20,000 * 9% = 1,800 rubles. In the second year:

- 20000+1800=21800 rubles – basic amount.

- 21800*9% = 1962 rubles – interest.

The total amount (with interest) will be 20000+1800+1962 = 23762 rubles.

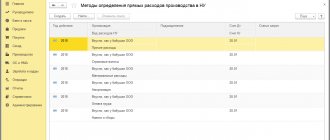

Which accounts are involved in accounting entries for accounting for deposit transactions?

The deposit account refers to the so-called special accounts in the bank, for the accounting of which account 55 is intended in the accounting department. The Chart of Accounts (approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n, as amended on November 8, 2010) provides for several sub-accounts for this account. Deposits are accounted for in subaccount 55.3 “Deposit accounts”.

Since deposits are recognized as financial investments in accordance with clause 3 of PBU 19/02, they can also be taken into account in account 58 “Financial investments” by opening the corresponding sub-account.

NOTE! The organization establishes the method of accounting for the movement of money on deposit in its accounting policy.

Accounts 55 and 58 are active, so an increase in funds on deposit will be by debit, and a decrease in the deposit account or returned to the owner to the current account will be by credit.

As for the entries on the receipt of interest on the current account and, accordingly, their accrual, account 91 “Other income and expenses” will be involved in them. Subaccount 1 to this account “Other income” is intended to reflect various income, including interest received, from activities not related to the main one.

The terms of the bank deposit agreement may affect taxes and accounting for the depositor. Find out how to check the wording of the contract from the Transaction Guide from ConsultantPlus. Get trial access to the K+ system and study the material for free.

Bank agreement with depositor

When funds are received into a deposit or deposit, an agreement is concluded with the depositor. The agreement is drawn up in writing in two copies, one of which is issued to the client. Depending on the duration of the agreements, the amount of deposits and the conditions for their return, the bank can differentiate its interest rates.

At the same time, it must indicate and agree on the procedure for paying interest on the deposit (with capitalization, without capitalization) and terms (day, month, quarter, year.). In the absence of these conditions in the agreement, interest is paid quarterly, and unpaid interest increases the amount of the deposit (capitalization), on which interest is then charged.

Cash deposits can be accepted on the terms of issuing the deposit on demand (demand deposit) or on the terms of returning the deposit after the expiration of a period specified in the agreement (time deposit). However, under a bank deposit agreement of any type, the bank is obliged to issue the deposit amount or part thereof upon the first request of the depositor. Moreover, this rule is imperative, i.e. the condition of the agreement on the citizen’s renunciation of the right to receive a deposit upon first demand is void.

The conclusion of a bank deposit agreement with a citizen and the deposit of funds by him can be certified by a savings book. A savings book is one of the forms of a bank deposit agreement. The peculiarity of registering a deposit in the form of a savings book lies, first of all, in the fact that this form is characteristic of the relationship between the depositor - a citizen and the bank. A savings book can be either registered or bearer, and a bearer savings book is a security. Both types of savings books must contain information about the bank and the status of the deposit. A registered savings book is essentially a document certifying the conclusion of a bank deposit agreement and the deposit of funds into deposits.

The absence of a personal savings book when the client appears at the bank is not an obstacle to the disposal of the deposit, since the obligatory legal relationship between the depositor and the bank arises from the bank deposit agreement signed by the parties. A personal savings book in case of its loss or damage can be replaced by the depositor upon his application. A bearer savings book is a security, a document certifying property rights, the exercise or transfer of which is possible only with its bearer (Article 142 of the Civil Code of the Russian Federation). A bearer savings book must not only formalize the citizen’s deposit of funds into a deposit account in a bank, but also certify all his rights as a depositor. Therefore, no other document than a bearer savings book can serve as a basis for the bank to issue a deposit, pay interest and execute other orders of the depositor. If the bank loses it, the bearer savings book cannot be replaced. Since the savings book is kept by the depositor, the deposit data indicated in it may not reflect the true state of the deposit (for example, in the case of replenishment of the deposit by a third party, interest accrual, etc.).

If entries are made in the personal account that are not in the savings book, when the depositor visits the bank, corresponding entries are made in his deposit book. Entries in the savings book reflect all incoming and outgoing transactions on the deposit (deposit), after each entry the balance of the deposit is displayed. All entries in the savings book are certified by authorized bank employees. The data reflected in the savings book is the basis for settlements between the bank and the depositor, unless proven otherwise. A personal account is opened for each depositor for each type of deposit. When performing transactions on a deposit account, it is mandatory to check the compliance of the signatures on the account documents with the depositor’s sample signature.

Interest accrued on the deposit - accounting entry and its significance for tax accounting

As we have already noted, the frequency of interest calculation, as well as their rate, is one of the mandatory conditions of the contract. When calculating interest from an organization that owns funds on the basis of bank documents, the following entry must be generated:

Dt 76 Kt 91.1.

Interest on deposits must be taken into account as non-operating income when calculating income tax if the organization applies the main regime, or a single tax under the simplified tax system as they are accrued (or received) - clause 6 of Art. 250 Tax Code of the Russian Federation.

Interest can be transferred to a person’s current account as it accrues, or it can accumulate in a deposit account and be paid in a lump sum only upon expiration of the contract. The transfer of interest to the current account will be reflected in correspondence:

Dt 51 Kt 76.

Accounting entries

Accounting for deposits of individuals is kept in passive account 423 “Deposits and other funds raised by individuals.” In the context of this account, balance sheet accounts of the second order are maintained according to the timing of raising funds:

- poste restante;

- for up to 30 days;

- for a period from 31 to 90 days;

- for a period from 91 to 180 days;

- for a period from 181 to 1 year;

- for a period from 1 year to 3 years;

- for a period of more than 3 years.

The opening of a deposit account for an individual is formalized by posting:

- Dt 20202 “Cash desk of credit institutions”

- Kt 423 “Deposits and other funds raised from individuals” - for the amount of the deposit received at the bank’s cash desk.

The return of the deposit amount is processed by reverse posting:

- Dt 423 “Deposits and other funds raised from individuals”

- Kt 20202 “Cash desk of credit organizations” - for the amount of the deposit paid from the bank’s cash desk.

When the deposit is returned, all interest accrued up to that time is paid.

In cases where a time deposit or another deposit, other than a demand deposit, is returned to the depositor upon his request before the expiration of the term or before the occurrence of other circumstances specified in the bank deposit agreement, interest on the deposit is paid in an amount corresponding to the amount of interest paid by the bank on demand deposits, or the bank has the right to provide in the agreement a reduced interest rate on deposits withdrawn early.

The bank is obliged to charge interest on the deposit amount, the amount and procedure for calculation of which are determined in the agreement for the relevant deposit. If the agreement does not contain a condition on the amount of interest to be paid, the bank is obliged to pay interest in the amount of the bank interest rate (refinancing rate) on the day of payment (clause 1 of Article 838 of the Civil Code of the Russian Federation).

The bank may provide in the agreement the right to unilaterally change the interest rate on demand deposits. Moreover, in the event of a reduction in the amount of interest, the new amount of interest is applied to deposits made by the depositor after a month from the date of notification, unless otherwise provided by the agreement. The form of the message is not regulated. These may be announcements in the media or on the premises of the bank, etc. The method of notifying the depositor may be stipulated in the agreement.

For deposits made by individuals, on the terms of its issuance after a certain period or upon the occurrence of circumstances stipulated by the agreement, that is, “time deposits”, the amount of interest on the deposit determined by the bank deposit agreement cannot be unilaterally reduced by the bank, unless otherwise provided by law .

Interest on the amount of a bank deposit is accrued from the day following the day it was received by the bank until the day before it is returned to the depositor or written off from the depositor’s account on other grounds (clause 1 of Article 839 of the Civil Code of the Russian Federation).

Unless otherwise provided by the bank deposit agreement, interest on the amount of the bank deposit is paid to the depositor upon his request at the end of each quarter separately from the deposit amount, and interest not claimed within this period increases the amount of the deposit on which interest is accrued.

Accrued interest must be reflected in the bank's accounting records at least once a month and no later than the last working day of the reporting month. Interest on attracted and placed funds is accrued by the bank on the balance of the principal debt accounted for in the corresponding personal account at the beginning of the operating day.

In this case, interest accrued for the last calendar days of the reporting month, falling on non-working days, must be reflected in the corresponding accounting accounts in the bank’s balance sheet on the first day of the month following the reporting one. Accounting entries for reflecting on the corresponding separate personal accounts the amounts due for payment (receipt) of interest must be made either on the last working day of the reporting month (in this case, interest for the last weekend days of the reporting month is accrued on the balance of the corresponding account at the end of the last working day of the reporting month ), or on the first working day of the month following the reporting one (directly when forming the balance on the 1st day of the month following the reporting one). The choice of the day on which the corresponding accounting entries are made is determined in accordance with the Bank's Accounting Policy.

Current interest accrued and paid on deposits within one month is recorded using the following entries:

- Dt 70606 “Expenses”

- Kt 423 “Deposits and other funds raised by individuals” - for the amount of interest paid by adding to the principal amount of the deposit;

- Dt 423 “Deposits and other funds raised by individuals”

- Kt 20202 “Cash desk of credit institutions”, 20207 “Cash in operating cash desks located outside the premises of credit institutions - when paying interest through the cash desk.

Reflection of accrued interest in the event that the start date of the interest accrual period and the date of payment of accrued interest fall on different months or if interest is not added to the deposit is recorded by posting:

- Dt 70606 “Expenses”

- Kt 47411 “Accrued interest on deposits” - for the amount of accrued interest.

The actual payment of interest by the borrower bank without violating the deadlines is accompanied by the following records:

- Dt 47411 “Accrued interest on deposits”

- Kt 423 “Deposits and other funds raised from individuals” – crediting accrued interest to accounts for recording deposits of individuals.

- Dt 423 “Deposits and other funds raised by individuals”

- Kt 20202 “Cash desk of credit organizations”, 20207 “Cash in operating cash desks located outside banks” - cash payment through the bank’s cash desk.

If the interest rate accrued on deposits (except for time pension deposits made for a period of at least six months) exceeds the refinancing rate of the Bank of Russia, and on deposits in foreign currency - 9%, then in part of the excess the amount is subject to income tax individuals. The tax rate for resident individuals is 35%, for non-residents – 30%.

The bank's obligation to withhold personal income tax from the amounts of accrued interest on deposits does not arise until the individual first applies to the deposit. The date of receipt of income in a calendar year is the date of payment of income (including advance payments) to an individual, or the date of transfer of income to an individual.

Results

The company can place funds on deposit to receive additional income. In accounting, entries will appear using account 55 or 58, which will reflect transactions of transferring money to the deposit and their return, and account 91.1, where the interest accrued by the bank in favor of the owner of the funds will be recorded as part of other income.

The article presented the main accounting entries that should appear in accounting when reflecting transactions on deposit accounts.

Sources:

- Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n

- Civil Code of the Russian Federation

- Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Postings on deposits: placement, interest, return

If we reveal the meaning of this word using a translation from Latin, then a deposit is the storage of a specific thing. In the modern concept, such an object must necessarily be a value: cash or securities. One of the most common types of deposit is a deposit, hence the name “deposit”.

Deposits can be placed in the form of investments in banking institutions and commercial organizations. Depositors (investors) are both ordinary citizens and enterprises.

The main characteristics of any deposit are:

- It must return to its owner and this right must be guaranteed by contract.

- During the placement of a deposit, its owner must necessarily receive benefits in the form of interest accrual on the use of valuables.

The legislation of the Russian Federation considers all deposits under the guise of deposits, therefore the adopted laws and regulations use this name and decide:

Deposit (or deposit) – securities, funds, in foreign or national currency, placed for the purpose of maintaining or making a profit. At the first request of the depositor, the deposit must be returned in accordance with the concluded agreement.

Only Russian banks that have a license for this type of activity and participate in the all-Russian deposit insurance program have the right to accept deposits for storage.

Therefore, only banking institutions can guarantee the return of investments and timely implementation of agreements. Partnerships with non-banking institutions are considered quite risky; in this case, no one can fully guarantee the return of funds to the investor.

Accounts for deposits

A sum of money or deposit transferred to a bank account is considered a financial investment. When placed, these investments are reflected by postings in their original amount, which is equal to the amount of funds credited to the deposit account.

All funds that were placed for safekeeping in the form of a deposit can be displayed on the debit side of the following accounts:

- No. 55, special bank accounts;

- No. 55.03, deposit accounts;

- No. 58, deposit investments.

Accounting for interest on deposits in transactions

Interest on the deposit, which is accrued every month, is included in the section of other income of the organization. They must also be displayed in accounting on a monthly basis until the term of the banking agreement expires. According to the accounting regulations, “organizational income”:

- The accrual of interest on the deposit is reflected in the debit of account No. 76 “settlements with various creditors and debtors”.

- When creating a posting, account credit No. 91 “other expenses, income” or No. 91.01 “other income” is used.

For tax purposes, the amount placed in a deposit bank account will not be considered an expense of the enterprise, just as it will not be considered income when the money is returned to the depositor.

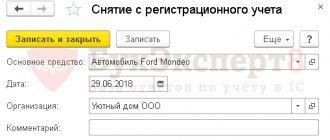

Displaying the return of the deposit to the depositor

If the deposit period has come to an end, the bank is guaranteed to return the deposit amount back to the owner of the funds. In this case, an entry is made opposite to the receipt of money when opening a deposit, that is:

- debit 51 (52) credit 55.03.

Deposit agreements may differ in terms and conditions. There are also deposits on which interest is paid after the expiration of the contract, upon return of the principal amount of funds. In this case, the accounting entries will differ from those when payments are made every month.

Account No. 55.03 is accounted for individually for each deposit. Since the deposit is recognized as an investment, accounting can also be kept in account No. 58 (“financial investments”).

Postings when placing a deposit, calculating interest and returning the deposit

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 55.03 | 51 (52) | Transfer of funds from the main or foreign currency account for storage | Deposit size | Bank statement |

| 76 | 91.01 | Accrual of bank interest for the use of deposit funds | Amount of accrued interest | Bank statement |

| 51 (52) | 76 | Actual receipt of interest on deposit | Amount of accrued interest | Bank statement |

| 51 (52) | 55.03 | Refund from deposit account | Deposit size | Bank statement |

| Postings for accrual of interest on deposit | ||||

| 55.03 | 76 | Transfer of funds from the main or foreign currency account for storage | Deposit size | Bank statement |

| 51 (52) | 55.03 | Receipt of interest from placing a deposit in a foreign currency or current account | The amount of accrued interest for the entire storage period | Bank statement |

| 51 (52) | 55.03 | Refund of a deposit | Deposit size | Bank statement |

Source: https://saldovka.com/provodki/kredity-i-zaymy/depozity.html