Taxpayers are represented by individuals and various companies. They must work and function solely on the basis of numerous norms contained in Russian legislation. At the same time, they must pay taxes on all income received. Additionally, fees are assigned for property or other valuables. Each taxpayer has not only responsibilities, but also certain rights, so you should carefully understand the existing features. The rights of taxpayers and the responsibilities of taxpayers should be studied by every person and head of the company. Let's talk about them in more detail in this article.

Types of taxpayers

Both individuals and companies that are legal entities are required to pay taxes.

Individuals include not only citizens working for employers, but also individual entrepreneurs.

Each taxpayer must regularly pay various fees, and also has the need to generate specific reporting.

Individual

They are represented by standard citizens working officially for different employers, as well as individual entrepreneurs. In the latter case, an entrepreneur can pay taxes under various taxation regimes, since they can be simplified or standard.

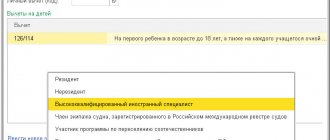

When calculating tax, it is taken into account whether taxpayers are residents or non-residents of the Russian Federation. The rights of taxpayers and the responsibilities of taxpayers represented by individuals are numerous and depend on the status of the citizen.

Legal entity

They are represented by numerous companies, and they can open different branches. If the division is large and also has its own full-time accountant, then such a branch acts as an independent taxpayer.

In tax law, the rights and obligations of taxpayers represented by legal entities also depend on whether the company is Russian or foreign.

A peculiarity of different joint-stock companies is that, based on the norms prescribed in the Constitution, they can use different information related to individuals.

All firms can be ordinary, small or using simplified tax regimes. All taxpayers should be aware of all these types. The concept of the rights and obligations of a company is enshrined in the Tax Code. Moreover, they require the payment of various taxes and the submission of numerous declarations and reports. At the same time, organizations can defend their rights.

Topic 20. Rights and obligations of the taxpayer

1. Taxpayers are subjects of tax relations who are required by law to pay taxes at their own expense.

Based on this definition, the following characteristic features of taxpayers can be identified.

1) Taxpayers are subjects of tax law, which may not coincide with the concept of subjects of other branches of law.

Traditionally, taxpayers are individuals and legal entities, whose status is determined by civil law. However, other categories of taxpayers are provided for exclusively by tax legislation. These include separate divisions of organizations, including branches and representative offices that independently sell goods, work, services, and permanent representative offices of foreign legal entities. At the same time, the determination of the tax status of a permanent establishment of a foreign legal entity is quite conditional and depends on various conditions. According to the general rule, a permanent establishment of a foreign legal entity is understood as any place where activities are regularly carried out to perform work, provide services, or sell goods.

The draft Tax Code proposes to establish a consolidated group of taxpayers as an independent taxpayer.' This means that a group of affiliated organizations will pay consolidated taxes, which will avoid taxation of funds and property moved within this group (for example, a concern). Currently Art. 13 of the Law of the Russian Federation of November 30, 1995 “On financial and industrial groups”^ provides that participants in a financial and industrial group engaged in the production of goods, works, and services can be recognized as a consolidated group of taxpayers.

In addition, according to the legislation of some foreign countries, the family as a whole, and not a specific citizen, may act as taxpayers.

2) Taxpayers are obligated entities whose main responsibility is to pay taxes.

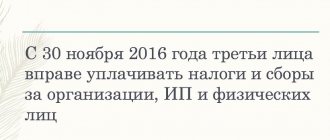

3) Taxpayers are persons who pay taxes at their own expense.

In this case, it is meant that taxes are paid from funds belonging to the taxpayer. This is possible by withholding tax at source of income or directly by the taxpayer himself. In this regard, the taxpayer should be distinguished from the bearer of taxes. The concept of “tax bearer” is used mainly in the economic aspect - this is a person who bears the burden of taxation, i.e., ultimately, the tax to the budget is paid at the expense of this person. Thus, the bearer of indirect taxes is the final consumer of the product (work, service).

2. Taxpayers can be classified on various grounds. The first, largest division is made in relation to individuals and legal entities.

As noted above, the taxpayer can be one person, and in some countries, a group of individuals - a family. Individuals can be differentiated into “ordinary” citizens and citizen-entrepreneurs.

Legal entities are independent taxpayers. At the same time, their separate divisions, as well as a group of legal entities, can also act as taxpayers. A foreign legal entity as a taxpayer primarily acts as a permanent establishment.

It is necessary to take into account that the rights of legal entities as associations of citizens are guaranteed by the Constitution in the same way as the rights of individuals. Thus, the Constitutional Court of the Russian Federation indicated that joint-stock companies (partnerships, limited liability companies) are essentially associations that were created by citizens to exercise such constitutional rights as the right to freely use their abilities and property for entrepreneurial and other activities not prohibited by law.

Based on size, taxpayers are divided into ordinary and small. For example, citizen entrepreneurs are divided into ordinary entrepreneurs and persons who have switched to a simplified taxation system. Legal entities are divided into ordinary organizations, small enterprises and organizations that have switched to a simplified taxation system. It must be taken into account that only Russian legal entities can be small enterprises.

Income tax legislation divides all citizens, depending on their permanent residence, into persons who have a permanent residence in Russia and persons who do not have a permanent residence.

The most specific classification of taxpayers for tax purposes is the division of entities into commercial and non-profit organizations. Depending on the receipt of one or another status, organizations under equal economic conditions will have different taxation mechanisms. For example, the profit of educational institutions is reduced by amounts aimed at developing the educational process.

Rights and obligations of taxpayers

1. The rights and obligations of taxpayers are established in the Law on the Fundamentals of the Tax System. It can be noted that the basic rights and obligations of taxpayers are the same and do not depend on the types of taxpayers. At the same time, certain groups of subjects have additional (specific) rights and obligations. For example, enterprises employing the work of disabled people have the right to refuse to apply VAT benefits; individual small businesses have the right to switch to a simplified taxation system, and therefore they have additional responsibilities.

2. Determining the scope of the taxpayer’s responsibilities is of great importance, since the application of liability to the taxpayer is due precisely to the violation of any of the obligations established by law. On the other hand, the taxpayer’s protection of his rights is based primarily on proof of the fact that he does not have one or another obligation or the fact that he fulfilled this obligation properly.

The first and main responsibility of the taxpayer is timely and full payment of tax. It arises due to his tax liability. In this regard, this obligation is universal and applies to all taxpayers. If the tax is paid directly by the taxpayer (and not by a tax agent), the legislation establishes additional requirements. Thus, taxpayers are required to submit payment orders to the relevant bank institutions for the transfer of tax to the budget before the payment deadline.

The remaining responsibilities of taxpayers can be considered optional, since they do not apply to all taxpayers. At the same time, they are aimed at the proper fulfillment by the taxpayer of his main responsibility.

1) The obligation to keep accounting records, draw up reports on financial and economic activities, ensuring their safety for at least five years. This responsibility applies to enterprises and organizations. I would like to note that in order to calculate tax, in many cases it is necessary to maintain special tax accounting, which does not coincide with accounting. At the same time, accounting is the basis for organizing tax accounting.

2) The obligation to submit to the tax authorities the documents and information necessary for the calculation and payment of taxes.

This obligation is rather conditional, since tax legislation does not establish the procedure for determining these documents and information. If no ambiguities arise with regard to documents, then in practice complications sometimes arise with regard to information. Formally, the taxpayer is obliged to provide only the information that he has available, i.e., to obtain which it is not necessary to perform any additional actions. Otherwise, the duty should be not only to provide, but also to receive information.

In practice, many tax authorities require enterprises to provide a certificate of correctional entries made at the enterprise. However, it should be noted that accounting for correctional entries made at the enterprise is not provided for by any regulatory documents. Therefore, to obtain this information, the enterprise must independently carry out additional actions, which is not the responsibility of the taxpayer. Thus, if an enterprise does not independently keep records of correctional entries made (that is, this information is not available at the time of the request), then it is not obliged to provide this information.

3) The obligation to make corrections to the financial statements in the amount of hidden or understated income (profit) identified by tax authorities.

This obligation stems from the specific construction of the norm of the Law on the Fundamentals of the Tax System, which provides for the application of financial sanctions. When concealing (not accounting for) objects of taxation other than income, profit, there is no great need to make any corrections in the amount of this object in order to pay the tax, since the amount of tax is directly collected as part of financial sanctions. In case of concealment of profit, the amount of tax is not collected as part of the sanctions. Therefore, it is necessary to amend the financial statements and increase taxable profit.

4) The obligation, in case of disagreement with the facts stated in the inspection report, to provide written explanations of the reasons for refusing to sign this act. This duty of the taxpayer does not mean that he must sign the audit report, since initially signing the act is the right of the person. At the same time, when refusing to sign, the taxpayer must state in writing the reasons for the refusal.

5) The obligation to inform the tax authorities within ten days about the decision made on the liquidation (reorganization) of a legal entity. This responsibility is of fundamental importance, since the ability of the tax authorities to conduct a final audit of the enterprise, establish tax obligations and carry out all measures to repay them depends on it. If this obligation were not established, then the interests of the budget would depend on chance. The draft Tax Code of the Russian Federation proposes to establish additional responsibilities that will fill the currently existing gaps.' For example, it provides for the establishment of obligations to register for tax purposes, to maintain tax records, etc.

The taxpayer's rights are not as numerous as his responsibilities. The legislation provides for the following types.

1) The right to enjoy tax benefits on the grounds and in the manner established by legislative acts.

The question of whether the use of benefits is a right of the taxpayer was discussed in Chapter. 8 (Procedure for calculating tax). In the case where the benefit is truly a right of the taxpayer, it is necessary to take into account the established procedure for its application. In addition, since the tax is calculated for a certain period, this right can also be used or waived within the tax period.

2) The right to submit documents to the tax authorities confirming the right to tax benefits is derived from the first. At the same time, it is independent in nature, since the tax authorities do not have the right to refuse the taxpayer 8 to present the specified documents.

3) The right to get acquainted with the reports of inspections carried out by tax authorities is a guarantee of the right to defense, since a qualified appeal against decisions of tax authorities is possible only after familiarization with the violations identified during the inspection.

4) The right to provide tax authorities with explanations on the calculation and payment of taxes and on reports of inspections carried out makes it possible to resolve controversial issues at an early stage, without bringing the matter to an administrative or judicial appeal.

5) The right to appeal the decisions of tax authorities and the actions of their officials in accordance with the procedure established by law is the main guarantee of the protection of the rights of the taxpayer.

The legislation also establishes other rights of taxpayers, for example, the right of an individual to clarify the data declared in this declaration within a month after submitting an income declaration to the tax authority.

What rights do taxpayers have?

The rights of taxpayers and the obligations of taxpayers are enshrined in the Tax Code, and all of them may differ slightly for citizens and firms with different statuses.

Fundamental rights include:

- The possibility of receiving various consultations or explanations orally from tax office employees, if the information relates to the application of various tax regimes, to the preparation of reports, the calculation of fees or the rules for filling out numerous documentation.

- The right to receive written explanations on all issues that are interesting and important to the taxpayer.

- Preparation of consultations regarding taxes and reporting.

- Opportunity to receive reference or information support from tax officials.

- Providing already correctly completed declarations and other documents, which are then used as a sample.

- The use of numerous benefits if the taxpayer meets the requirements for citizens, entrepreneurs or firms entitled to a reduction in the tax burden.

- Generating reconciliation reports to ensure that tax officials have correctly calculated the amount of taxes for various fees.

- Taxpayers have the right to offset overpayments against various fees. Overpaid funds may be returned if the cause of this situation was negligence and incorrect calculation on the part of employees of the Federal Tax Service.

- Citizens and entrepreneurs can provide explanations regarding the calculations carried out for various taxes and funds transferred to the budget.

- Taxpayers can directly participate in the process of numerous tax audits or other actions on the part of the Federal Tax Service, which are related to the study of the financial activities of citizens and firms.

- There is an opportunity to defend your rights and point of view if there is evidence that the results of the audit are false and incorrect, for which it is important to use official documents.

Only if they know their capabilities can each payer correctly calculate and pay taxes. The rights and obligations of taxpayers are strictly enshrined in legislation, therefore violation of rights is punishable by the Federal Tax Service.

What rights do tax authorities have?

Participants in tax legal relations are not only payers who are obliged to pay taxes and fees on time, but also the tax authorities themselves. Within the framework of the Tax Code and other regulatory legal acts, they are assigned certain rights and obligations.

Since the tax authorities represent an interconnected and centralized system for monitoring the implementation of tax legislation, which is prescribed in Article 30 of the Tax Code, they are entrusted with a number of certain rights within the framework of which they carry out their activities.

Thus, according to Article 31 of the Tax Code, tax authorities are legally vested with the following rights:

- demand from payers documents on the basis of which demands are made on the payer to pay fees and taxes;

- demand documents that confirm payment of taxes and fees imposed on payers;

- conduct scheduled and unscheduled inspections;

- demand correction of violations of tax law;

- collect debts, penalties, fines from payers on existing legal grounds;

- submit applications to judicial authorities with demands on payers;

- put forward demands for the cancellation of issued licenses for the activities of individuals, legal entities, as well as individual entrepreneurs;

- demand from banks documentation on the movement of the payer’s accounts (should be understood as confirmation of payment of taxes and fees in favor of the state budget);

- accrue and determine the amount of taxes and fees, penalties and fines that are subject to recovery from payers;

- seize the property of payer-debtors;

- demand suspension of transactions on the account of violating payers;

- send written notices to payers requiring them to appear at the tax authority to provide explanations on the payment of taxes and fees;

- temporarily confiscate documentation from payers if there are sufficient grounds for this (for example, proven intentions to destroy such documentation).

The rights and powers of tax authorities are very extensive, since they are responsible for monitoring the implementation of tax regulations.

At the same time, all decisions made and requirements of tax authorities can be canceled or changed by higher tax authorities.

For example, the requirement of the regional Federal Tax Service may be canceled by the regional Department of the Federal Tax Service if there are sufficient grounds.

However, the list of rights of tax authorities is not limited only to the Tax Code. Thus, a number of powers are prescribed in Law of the Russian Federation No. 943-1. According to this law, tax authorities have the right to:

- carry out inspections of documentation in the manner prescribed by law, which is not related to the payment of taxes and fees, arrears on them, penalties, but related to mandatory payments of payers;

- monitor compliance by entrepreneurs with tax legislation;

- demand execution of mandatory payments that do not relate to taxes, fees, penalties and fines for tax offenses;

- during the inspection, inspect the premises owned by the payer, including warehouses, offices, offices, retail outlets and other real estate;

- make informed decisions, the requirement of which is to hold violating payers accountable within the framework of tax legislation.

At the same time, the rights of tax authorities extend to filing claims on the following issues:

- on the liquidation of a company, organization, individual entrepreneur if there are sufficient grounds for this within the framework of Russian legislation;

- on the cancellation of transactions, declaring them illegal and invalid;

- on reimbursement to the state budget of funds received during illegal transactions;

- on declaring the registration of a specific legal entity or individual entrepreneur illegal and invalid;

- on the collection from payers of taxes, fees, penalties and fines not paid by them on time;

- on termination of an agreement on tax credits (should be understood as investment credits) before its expiration;

- o compensation for damage caused to the state budget as a result of untimely or unfulfilled obligations of the bank conducting an operation to write off funds from the payer’s account in favor of the state.

Only the heads of tax authorities, and in their absence, their deputies, can file lawsuits with the judicial authorities, make decisions on prosecution and collect debts on tax obligations.

Ordinary representatives of tax authorities do not have such powers, except in cases where they are not assigned this responsibility at the level of an internal order or power of attorney.

Controversial issues

Each taxpayer can demand that employees of the Federal Tax Service strictly follow the law when they carry out their main functions, represented by conducting an audit or other similar actions.

The rights and obligations of taxpayers and tax authorities coincide in most cases, but often controversial issues arise during audits or other actions. They have to be resolved through the courts.

The actions of various employees of the Federal Tax Service can be appealed in court, for which appropriate proceedings are carried out. If the taxpayer wins the case, he can count on compensation for the damage caused.

When are taxpayers released from liability?

The right to exemption from the duties of a taxpayer based on the results of an audit is obtained by citizens or firms on the basis of the norms specified in Art. 111 NK. This includes situations:

- Employees of the Federal Tax Service department provided illiterate advice to the citizen regarding the article under which he was charged as a violator.

- Tax officials provided incorrect information, which caused the taxpayer to act illegally.

It is taken into account that all information related to the payment of various taxes and fees is confidential and not subject to disclosure.

Rights of taxpayers and fee payers

Taxpayers are organizations and individuals who, in accordance with the Tax Code, are obliged to pay taxes.

Payers of the fee are organizations and individuals who, in accordance with the Tax Code, are obliged to pay fees.

The rights of the taxpayer and the payer of fees are the same. The Tax Code specifies the following rights for these persons:

- right to information (subparagraph 1, 9, paragraph 1, article 21);

- to receive an official written explanation (subparagraph 2, paragraph 1, article 21);

- to manage your own tax payments (the right to carry out tax management) (subclauses 3, 4, clause 1, article 21);

- for the return of overpaid amounts of money in the process of implementing the tax legal relationship (subclause 5, clause 1, article 21);

- personally or through a representative to participate in tax legal relations (subclauses 6, 8, 15, clause 1, article 21, clause 1, article 26);

- give explanations about the nature of your own actions in the field of tax legal relations (subparagraph 7, paragraph 1, article 21);

- on the correct attitude on the part of other participants in tax legal relations (subclauses 10, 13, clause 1, article 21);

- not comply with illegal orders and requirements (subparagraph 11, paragraph 1, article 21);

- for appeal (subparagraph 12, paragraph 1, article 21);

- for compensation for unlawfully caused losses (subclause 14, clause 1, article 21);

- to protect violated rights and legitimate interests (Article 22).

The right to information means the taxpayer’s ability to freely receive information free of charge (including in writing) from the tax authorities at his place of registration. The taxpayer's established right to information also includes the procedure for this person to receive free of charge the necessary reporting forms and explanations on the procedure for filling them out. The taxpayer's right to receive the relevant forms and to request clarification on how to complete them now applies only to tax returns and tax calculations.

The right to receive an official written explanation means the ability of a taxpayer or fee payer to receive official written explanations from tax and other authorized state bodies on the application of legislation on taxes and fees.

The composition of the competent authorities to which the taxpayer has the opportunity to apply for clarification depends on the type of the regulatory legal act itself. He has the right to receive written explanations on the application of:

- legislation of the Russian Federation on taxes and fees - from the Ministry of Finance of Russia;

- legislation of the constituent entities of the Russian Federation on taxes and fees - from financial bodies created in the constituent entities of the Russian Federation by decision of the regional authorities;

- regulatory legal acts of local governments on local taxes and fees - from local governments.

A person who has violated the current legislation, following an officially received explanation from the competent authority, is not subject to liability for committing a tax offense.

The right to tax management presupposes the ability of a taxpayer (payer of fees) to manage his own tax payments, in particular:

- use tax benefits if there are grounds and in the manner established by the legislation on taxes and fees;

- change the deadline for paying taxes, fees, and penalties by obtaining a deferment, installment plan, or investment tax credit;

- fulfill the obligation to pay taxes ahead of schedule.

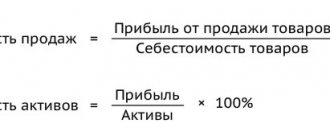

Tax management means: - a system for managing tax obligations and payments of the taxpayer, as well as the resources that make up its tax base;

- activities of the taxpayer aimed at increasing the efficiency of its interaction with the state taxation mechanism.

There are three basic components of tax management: tax logistics; tax optimization; tax minimization. Each of them is a type of tax management and has its own characteristics.

Tax logistics is an activity that involves managing taxpayer resources to achieve acceptable tax payments. The purpose of tax logistics is the initial organization of a certain area of activity of the taxpayer in order to legally achieve the level of tax payments at which the ongoing project or operation remains economically feasible. Tax logistics methods provide for the possibility of legal use by the taxpayer of all benefits and tax exemptions provided by law. The implementation of a set of measures during the implementation of these methods can take different forms and content depending on the specific stage at which they are carried out.

Tax optimization is a type of activity carried out by optimizing the scheme, order, size, timing (periods) of tax and other obligatory payments to budgets of various levels in order to create the most favorable model for the taxpayer to fulfill his tax obligations. Tax optimization consists of factual and analytical actions that allow optimizing the payment of tax payments without changing their amounts. This concerns reducing indirect costs when paying taxes, as well as creating the most convenient conditions for making tax payments. As a result of applying tax optimization techniques, taxes will be paid at the most convenient time for the taxpayer (taking into account the requirements of tax legislation).

Tax minimization is any purposeful actions of the taxpayer that allow him to reduce to the maximum extent the obligatory payments to the budget made by him in the form of taxes, fees and other payments. Its goal is to minimize the costs associated with paying tax contributions.

The right to a refund of overpaid sums of money in the process of implementing a tax legal relationship means a timely offset or refund to the taxpayer (payer of fees) of the amounts of overpaid or overcharged taxes, fees, penalties, fines.

The right to personally or through a representative participate in tax legal relations means the right of a taxpayer to participate in relations regulated by the legislation on taxes and fees, both personally and through his legal or authorized representative.

The right to give explanations about the nature of one’s own actions in the field of tax legal relations means the ability of a taxpayer (payer of fees) to provide tax authorities and their officials with explanations on the calculation and payment of taxes and reports of tax audits carried out.

The right to a correct attitude on the part of other participants in tax legal relations makes it possible for taxpayers (payers of fees) to demand from other participants in tax legal relations compliance with legislation on taxes and fees when they carry out actions in relation to a given taxpayer (payer of fees) and compliance with and preservation of tax secrecy.

The right not to comply with illegal instructions and requirements gives taxpayers (payers of fees) the opportunity not to comply with illegal acts and requirements of tax authorities, other authorized bodies and their officials that do not comply with the Tax Code or other federal laws.

The right to appeal means the ability of a taxpayer (payer of fees) to appeal acts of tax authorities in the prescribed manner; acts of other authorized bodies; actions (inaction) of officials of these bodies.

The right to compensation for unlawfully caused losses allows taxpayers (payers of fees) to fully compensate for losses caused by illegal decisions of tax authorities and illegal actions (inaction) of their officials.

The taxpayer’s right to protect violated rights and legitimate interests is specified by the provisions of Art. 22 of the Tax Code. It guarantees taxpayers (payers of fees) administrative and judicial protection of their rights and legitimate interests. The procedure for protecting the rights and legitimate interests of taxpayers (payers of fees) is determined by the Tax Code and other federal laws. Failure to fulfill or improper fulfillment of obligations to ensure the rights of taxpayers (payers of fees) entails liability provided for by federal laws.

What responsibilities do taxpayers have?

The rights and obligations of taxpayers of the Russian Federation must be respected both by the residents themselves and by various government bodies. Fee payers have numerous responsibilities. If they are not followed, this will be grounds for holding them accountable. These main responsibilities include:

- all taxpayers must be registered with the Federal Tax Service;

- they must independently calculate and transfer funds for payment of various taxes and fees, if the calculation is not carried out by tax inspectorate employees for various payments;

- they reflect in a timely manner all income and expenses that arise during work and business activities;

- it is required to submit various reports and other documents on taxes, insurance premiums or other payments to the required department of the Federal Tax Service in a timely manner, as well as prepare and submit accounting reports;

- legal entities are required to maintain accounting together with tax accounting, which will fully reflect the results of their activities;

- apply based on the terms of the CCP or BSO legislation;

- provide employees of the Federal Tax Service with the necessary information and documents, on the basis of which you can verify the correctness of the calculations of tax amounts.

Thus, the fundamental rights and obligations of taxpayers are truly numerous, and their violation becomes the basis for the proceedings of any case in court.

Taxpayer Responsibilities

Taxpayers are required to:

- pay taxes and fees established by tax legislation;

- register for taxes in a timely manner;

- keep records of income, expenses and taxable items;

- submit tax reports;

- submit annual financial statements (within three months after the end of the year);

- submit to tax inspectorates and their employees the documents necessary for tax audits;

- ensure the safety of accounting and tax accounting data for four years;

- within six working days, send to the tax office electronic receipts for receipt of documents sent by the inspectorate to the taxpayer in electronic form (for example, requests for the submission of documents). The taxpayer can submit such a receipt to the inspectorate either independently or through his authorized representative (letter of the Federal Tax Service of Russia dated April 22, 2020 No. ED-4-15/6906). Important: this obligation applies only to those taxpayers who must submit tax returns electronically.

A complete list of taxpayer responsibilities is given in Article 23 of the Tax Code of the Russian Federation.

Situation: how to ensure timely notification of the tax office about the receipt of documents in electronic form? The organization is required to submit reports according to the TKS.

Check the receipt of documents from the tax office daily and promptly respond to requests received.

From January 1, 2020, taxpayers who are required to submit reports electronically should be able to receive electronic documents from the tax office. Such documents may be, for example, requirements for the presentation of documents or explanations, notifications of a call to the inspectorate, etc. However, simply connecting to “electronic communication” with the Federal Tax Service Inspectorate is not enough. The organization must provide feedback and confirm that documents have been received with electronic receipts. Such a receipt must be sent to the inspectorate within six working days. This can be done by either a legal or an authorized representative of the organization. For example, if the deadline for transmitting a receipt expires and the Internet is turned off in the office, an accountant can send an electronic receipt from his home computer (letter of the Federal Tax Service of Russia dated April 22, 2015 No. ED-4-15/6906).

Important: count the six-day period not from the moment you received (opened) the electronic document, but from the day it was sent by the inspection. Missing such a deadline is risky - the inspection may block your bank account. Inspectors have 10 business days to make a decision to freeze the account after the six-day deadline for sending the electronic receipt has expired. That is, the account can be blocked on any of the days included in this 10-day period.

This follows from the provisions of paragraph 5.1 of Article 23 and subparagraph 2 of paragraph 3 of Article 76 of the Tax Code of the Russian Federation.

Therefore, if you want to avoid sanctions for sure, it is better to check daily for incoming messages from the tax office.

Advice: in practice, there may be situations when an organization will have to conduct correspondence with the tax inspectorate that goes beyond the normal electronic document flow. For example, if an organization received incorrectly executed electronic documents or mistakenly refused to accept them.

It happens that inspectorates send their requirements to taxpayers by regular email or mailing. You will not be able to automatically confirm or reject such a message. It will be among regular letters. To protect yourself from possible claims, compose and send a letter to the inspection via TKS. In this letter, explain that the inspection request was not sent in the established format. However, the organization is ready to fulfill it.

An organization may also accidentally reject an electronic claim or inspection request. In this case, also write a letter in which you admit your mistake and confirm that the demand (request) will be fulfilled within the prescribed period.

What should individual entrepreneurs or firms notify the Federal Tax Service about?

Taxpayers additionally have the obligation to notify the tax service in writing about various changes in their work. These include:

- opening or closing a bank account;

- formation of branches or divisions in different regions of the Russian Federation;

- vesting branches with various broad powers, which allows them to engage in their own financial activities;

- closure of existing units;

- investment in the capital of an enterprise by other companies, which may be Russian or foreign;

- the beginning of the bankruptcy process of the company;

- change of direction of the enterprise;

- change of residence of an individual entrepreneur or head of a company.

All this information must be provided in writing and in a timely manner, and severe penalties may be applied to the taxpayer for failure to notify.

Reporting storage

Taxpayer rights and responsibilities are broad, but every organization or individual entrepreneur must remember that they must maintain numerous financial records. It can be represented by a balance sheet, profit and loss statement, various declarations or other papers.

As a standard, they must be stored for five years, but some documents must be available to the enterprise throughout the entire period of its existence. These include a certificate of registration and registration in a specific branch of the Federal Tax Service.

Responsibilities of tax authorities

In addition to the freedom to perform certain actions within the framework of the law of the Russian Federation, these structures also have obligations to the state and the people inhabiting it. Let's look at them further.

In addition to rights, tax authorities also have multiple responsibilities of a wide variety of directions.

Responsibility No. 1 – compliance with tax laws

The primary responsibility of this body is to comply with the legislation on which all its activities are based. We are talking, of course, about regulations in the field of taxes and fees levied in favor of the state treasury.

Responsibility No. 2 - monitoring compliance with tax laws

The represented structures are obliged not only to follow the standards we outlined in the previous paragraph, but also to monitor compliance with them by other entities.

Responsibility No. 3 – maintaining tax records

Another duty of these bodies is to maintain tax records in accordance with the procedure established by law regarding:

- various organizations;

- individuals, which category includes both ordinary citizens and individual entrepreneurs.

Responsibility No. 4 – free information to taxpayers and tax agents

Representatives of the structure we are interested in also undertake obligations to inform citizens and tax agents free of charge, both orally and in writing, regarding the following information that is relevant for a specific period of time:

- taxes and fees;

- legislative acts;

- procedures for calculating and paying funds to the budget;

- powers of tax authorities and officials officially representing them;

- declaration forms submitted for consideration as reporting, etc.

Representatives of the service are also responsible for providing free information to the public.

Responsibility #5 - Use Treasury's written guidance as a guide

Tax structures are also obliged to follow the guidelines drawn up by the Ministry of Finance regarding the nuances of using in practice the legislative acts regulating their activities.

Duty No. 6 – report registration with the Federal Tax Service

Tax authorities have obligations to notify the audience regarding the registration of specific representatives of the audience, and to provide them with details of Federal Treasury accounts. In addition, in the future they will also have to inform payers about changes in these accounts.

Responsibility No. 7 – decide on the refund of the fee

The required authorities must also make decisions regarding the return to taxpayers and tax agents of monetary amounts paid to the treasury in excess. This category may include both basic payments to the budget and penalties, fines, etc. assigned in case of delay.

Representatives of these authorities also decide whether to return the funds to the payer in this or that case.

Responsibility No. 8 – maintaining tax secrecy

Tax secrets are information about the payer or tax payment agent, the disclosure of which could cause irreparable damage to the owner. At the same time, the information is necessary for the tax office to calculate the amount of payments and accounting, therefore, all employees admitted to it undertake to maintain tax secrets and not allow outsiders to access it.

Duty No. 9 – send copies of the inspection report and the authority’s decision

The presented structure undertakes to send taxpayers copies of:

- inspection reports;

- and decisions made on the said inspections.

In addition, tax notices or official demands for payment of fees must be sent.

Responsibility #10 – Conduct Joint Review

Another obligation of the structure is to conduct joint reconciliations with payers regarding the amounts of transferred payments, etc.

Duty No. 11 – issue copies of decisions

The tax service undertakes to issue copies of decisions made by it to entities requiring the required document.

The task of issuing copies of important documents lies in the list of responsibilities of the structure

What can taxpayers be held liable for?

The rights, obligations and responsibilities of taxpayers are enshrined in numerous articles of the Tax Code. If duties are not fulfilled, then this is the basis for applying various penalties to violators.

They are held accountable for the following violations:

- failure to comply with the instructions specified in the Tax Code;

- lack of timely payment of various taxes;

- violation of the procedure on the basis of which the enterprise must maintain tax or accounting records;

- the use of various tricks with the help of which taxes are underestimated, which leads to a decrease in the revenue side of the country’s budget;

- incomplete or untimely submission of reports to the Federal Tax Service.

The guilt of any taxpayer must be proven, otherwise he cannot be held accountable on the basis of Art. 109 NK.

Exemption from the duties of a taxpayer (payer of fees)

Taxpayers in the form of an individual or entrepreneur, as indicated by the Code, may be exempt from fulfilling obligations to pay taxes and fees. Exemption from taxes and fees is approved by Article 145 of the Tax Code of the Russian Federation. In this case, additional articles are

First of all, those payers whose total revenue for the previous three consecutive months did not exceed 2 million rubles (clause 5 of Article 145 of the Tax Code of the Russian Federation) are exempt from payment. From this rule, the Code excludes organizations and individual entrepreneurs selling excisable goods.

Persons applying for exemption from payment must submit to the tax office a written application and documents confirming the right to exemption (established in paragraph 6 of Article 145 of the Tax Code of the Russian Federation).

The specified documents must be provided no later than the 20th day of the month from which taxpayers claim exemption from payment. The application form for exemption from paying taxes and fees has been approved by the Ministry of Finance of the Russian Federation.

The Code establishes a right to exemption valid for 12 calendar months. After the expiration of this period, payers carrying out the payment of taxes and fees must provide the tax authorities with:

- documents on total revenue from the sale of goods and services for three consecutive calendar months;

- notification of the extension of the right to exemption over the next 12 calendar months or of refusal to exercise this right.

If during the period when the right to exemption was used, the revenue exceeded 2 million rubles or the payer sold excisable goods, then the right to exemption is lost from the 1st day of the month in which such an excess occurred (clause 5 of Article 145 of the Tax Code of the Russian Federation).

At the same time, concealment of this fact from the tax authorities entails the restoration of the tax amount and its payment to the budget in the prescribed manner, as well as the collection of appropriate tax sanctions and fines.

We will separately consider the issue of exemption from VAT. Exemption is made if organizations and entrepreneurs associated with small turnover provide legal certificates about the amount of revenue for the period.

It is believed that such entities may not pay VAT for 12 months and also not provide legal VAT returns. In addition, taxpayers who have received a VAT exemption may not determine the tax base and do not keep a ledger of income and expenses related to the activities of the companies.