Most entrepreneurs have encountered the concept of a tax audit. According to the Tax Code of the Russian Federation, the relevant authorities must monitor compliance with mandatory payments. Tax control measures are applied in different cases. In order to identify violators, regulatory authorities are allowed to use any methods that do not contradict the Constitution. Situations often arise when inspectors do not have enough information to make a decision. In this case, additional tax control measures will be taken.

Tax audit

According to Art. 32 of the Tax Code of the Russian Federation, the relevant authorities are obliged to monitor the process of paying taxes, as well as compliance with adopted regulations. This provision is implemented through checks. Tax control is the activity of regulatory authorities to comply with relevant legislation and timely payment of mandatory payments by individuals and legal entities. This kind of control is carried out using tax audits, inspection of premises or territories that are used to make a profit, checking reports and other methods provided for by the Tax Code of the Russian Federation.

Tax control measures must be considered as a means to achieve the main goal - control. They are expressed in the actual actions of government bodies to identify defaulters. There are several types of such events:

- requesting the necessary information and documents;

- inspection of the territory and premises used to generate income;

- interrogation of a witness;

- expertise;

- engaging a specialist or translator;

- inventory.

Tax control activities are carried out during the implementation of relevant audits, which are divided into two types: desk and field.

https://youtu.be/5uyaxt44bA0

Additionally

Request for documents during a tax audit is a form of tax control used during a tax audit, which consists of providing the tax authority with certified copies or originals of the taxpayer’s primary accounting documents.

The questioning of a witness during a tax audit is regulated by Article 90 of the Tax Code of the Russian Federation (TC RF).

Any control involves carrying out a number of activities to determine the degree of compliance with current legislation, rules, regulations, and requirements. Tax control, first of all, is aimed at preventing entrepreneurs from incorrectly paying obligatory payments to the state budget. By checking all types of resources of organizations, paying special attention to cash flow, persons authorized to carry out inspections carry out a number of legally defined actions.

Let's consider what purpose tax control measures are pursued, what they are, how the main measures differ from additional ones, and what the result is in the end.

Desk tax investigation

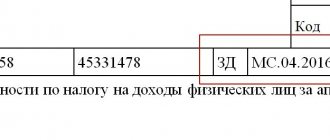

This type of control applies to those taxpayers, tax agents and other persons who are required to submit a declaration to the relevant authorities. The peculiarity of a desk audit is that it does not require confirmation from the head of the tax institution. The basis for this is the submitted tax return. The inspection is carried out at the location of the regulatory authority within three months from the date of submission of documents.

Every taxpayer must file a tax return with the appropriate agencies, unless otherwise provided by law. This situation is fixed in Art. 80 Tax Code of the Russian Federation. This obligation is not determined by the amount of payment, but by the condition of the law that the payer for a specific type of tax must submit a declaration. Lack of payment amount does not exempt you from this obligation.

Tax returns, as well as other documents that are submitted by the taxpayer or available to the relevant authority, are the basis for carrying out this type of investigation, such as a desk audit. Tax control measures are represented here by requesting documents, which is the main procedure, as well as interrogating a witness or conducting an examination.

Explanation

Additional tax control measures are carried out after the completion of the on-site tax audit, if it is necessary to obtain additional evidence to confirm the fact of violations of the legislation on taxes and fees or the absence thereof.

The procedure for carrying out additional tax control measures is determined by paragraph 6 of Article 101 of the Tax Code of the Russian Federation, as well as the Determination of the Constitutional Court of the Russian Federation dated May 27, 2010 N 650-О-О.

Additional tax control activities may continue for a period not exceeding one month (two months when checking a consolidated group of taxpayers).

As additional tax control measures, only the following procedures can be carried out:

— requesting documents in accordance with Articles 93 and 93.1 of the Tax Code of the Russian Federation (see Requesting documents during a tax audit)

Procedure for conducting DMNC

The procedure for conducting DMNC is regulated by clause 6.1. and 6.2. Article 101 of the Tax Code of the Russian Federation.

The results of the DMTC are recorded in an addendum to the tax audit report (clause 6.1, Article 101 of the Tax Code of the Russian Federation).

The taxpayer has the right, within fifteen days from the date of receipt of the addition to the tax audit report, to submit to the tax authority written objections to such addition to the tax audit report as a whole or to its individual provisions (clause 6.2 of Article 101 of the Tax Code of the Russian Federation).

clause 6.1. Art. 101 Tax Code of the Russian Federation:

The beginning and end of additional tax control measures, information about tax control measures carried out during the implementation of additional tax control measures, as well as additional evidence received to confirm the fact of violations of the legislation on taxes and fees or the absence thereof, conclusions and proposals of inspectors to eliminate identified violations and references to articles of the Tax Code, if the Tax Code provides for liability for these violations of the legislation on taxes and fees, are recorded in the addendum to the tax audit report.

An addition to the tax audit report must be drawn up and signed by officials of the tax authority carrying out additional tax control activities within fifteen days from the date of completion of such activities.

An addendum to the tax audit report with the attachment of materials obtained as a result of additional tax control measures must, within five days from the date of this addendum, be handed to the person in respect of whom the tax audit was carried out (his representative), against a signature or transferred in another way indicating on the date of its receipt by the specified person (his representative), unless otherwise provided by this paragraph.

When carrying out additional tax control measures in relation to a consolidated group of taxpayers, an addition to the tax audit report is handed over to the responsible participant of the consolidated group of taxpayers in the manner prescribed by this paragraph within ten days from the date of this addition.

An addition to the tax audit report is sent to a foreign organization (with the exception of an international organization, a diplomatic mission, a foreign organization subject to registration with the tax authority in accordance with paragraph 4.6 of Article 83 of the Tax Code of the Russian Federation) that does not carry out activities on the territory of the Russian Federation through a separate division, according to by registered mail to the address contained in the Unified State Register of Taxpayers. The date of delivery of this addition to the tax audit report is considered to be the twentieth day, counting from the date of sending the registered letter.

In this case, documents received from the person in respect of whom a tax audit was carried out are not attached to the addendum to the tax audit report.

If a person in respect of whom a tax audit was carried out (his representative) evades receiving an addition to the tax audit report, this fact is reflected in the addition to the tax audit report. In this case, the addition to the tax audit report is sent by registered mail to the location of the organization (separate division) or the place of residence of the individual and is considered received on the sixth day from the date of sending the registered letter.

Read more: In which court are administrative cases heard?

clause 6.2. Art. 101 Tax Code of the Russian Federation:

The person in respect of whom the tax audit was carried out (his representative), within fifteen days from the date of receipt of the addition to the tax audit act, has the right to submit to the tax authority written objections to such addition to the tax audit act as a whole or to its individual provisions.

Written objections to the addition to the tax audit report of a consolidated group of taxpayers (a foreign organization registered with the tax authority in accordance with paragraph 4.6 of Article 83 of the Tax Code of the Russian Federation) are submitted by the responsible participant of this group (a foreign organization registered with the tax authority in accordance with paragraph 4.6 of Article 83 of the Tax Code of the Russian Federation) within fifteen days from the date of receipt of such an addition to the tax audit report.

In this case, the person in respect of whom the tax audit was carried out (his representative) has the right to attach to written objections or, within the agreed period, submit to the tax authority documents (certified copies thereof) confirming the validity of his objections.

An example from judicial practice

An updated tax return submitted after the completion of an on-site tax audit and before the tax authority makes a decision may be a form of informing the tax authority about the taxpayer’s objections to the tax authority’s conclusions on the relevant tax set out in the audit materials.

During the period after the on-site tax audit, but before a decision was made on it, the entrepreneur submitted updated tax returns to the tax authority.

Based on the results of studying these declarations and documents accompanying them, the tax authority decided to assess additional taxes to the entrepreneur.

The entrepreneur appealed to the arbitration court with an application to invalidate this decision, citing a violation by the tax authority of the procedure for considering tax audit materials, since the increase in the amount of taxes collected was carried out not on the basis of the materials of the on-site tax audit, but during additional verification activities when studying the updated tax taxes submitted by the entrepreneur declarations and documents attached to them.

Court decision in favor of the tax authorities:

The tax authority, having completed an on-site tax audit, must have complete information about the financial and economic activities of the taxpayer carried out in the audited period (including information on income and expenses for relevant taxes).

Thus, an updated tax return submitted after the completion of an on-site tax audit and before the inspection makes a decision may represent a form of informing the tax authority about the taxpayer’s objections to the tax authority’s conclusions on the relevant tax set out in the audit materials.

Therefore, when submitting an updated tax return after the completion of an on-site tax audit, but before making a decision on it, the tax authority, taking into account the volume and nature of the updated information, has the right to carry out additional tax control measures , guided by clause 6 of Art. 101 of the Tax Code of the Russian Federation, or, making a decision without taking into account the data of the updated tax return, schedule a repeat on-site audit regarding the updated data.

Definition N 310-KG16-5041

On-site inspection

This is a more specific type of control that is carried out in relation to one taxpayer for a certain tax. The basis for such a check may be doubts about the correctness of the calculation and timely payment of mandatory payments. On-site control is carried out on the payer’s territory. In cases where the premises or territory used for profit cannot be made available for inspection, the investigation is carried out at the location of the relevant authority. The decision to conduct control is made by the head of the tax institution or his deputy.

Tax control activities during tax audits, including on-site audits, may be carried out as follows:

- Requesting necessary documents. The taxpayer must familiarize the inspectors with the original papers and declarations related to the calculation and payment of taxes. This procedure is carried out on the payer’s territory.

- Carrying out inventory.

- Inspection of the necessary premises and territory used to generate income.

- Involvement of an expert if additional information is required.

- Interrogation of a witness who has information relevant to an on-site tax audit.

- Involvement of a translator or specialist.

Forms of additional control

Additional tax control activities are carried out in the form of certain actions, a closed list of which is enshrined in the Tax Code of the Russian Federation (clause 6 of Article 101 of the Tax Code of the Russian Federation):

The choice of action depends on the specific circumstances of the case, including within the framework of one additional inspection, several similar activities can be carried out, for example, several interrogations or examinations, as well as a combination of different actions.

It should be taken into account that if the taxpayer refuses to provide documents, including by evading such actions, the tax authorities have the right to seize the requested documents. This is possible provided that the materials provided are not sufficient to identify all the circumstances of the violation, or there is reason to believe that the original documents may be destroyed or reduced to a condition that does not allow establishing important circumstances. To carry out a seizure, a separate decision is made with a mandatory indication of the reasons for such an action. In all other situations, the inspector does not have the right to change the list of measures indicated in the decision to conduct additional control.

Why are additional events scheduled?

Nowadays, a situation often arises when the supervisory authority, during the inspection process, was unable to obtain the necessary information to make a decision. But this does not mean that inspectors can no longer obtain information about this enterprise, and after the investigation everything will end. For these purposes, additional tax control measures are used.

The main objective of these procedures is to confirm or refute the commission of an offense. Inspectors can collect missing information only within the framework of the taxpayer’s activities that were considered during the main audit. It is important to note that these activities are not aimed at detecting new violations, but at thoroughly investigating existing ones.

The payer learns about the appointment of such events during the review of the audit results or a few days after them. The implementation of additional procedures is an intermediate result of the investigation, during which it is necessary to find out whether an offense has been committed.

Additional tax control measures

During an on-site tax audit, many organizations are faced with so-called additional tax control measures. At the same time, tax authorities often exceed their powers.

Yu.S. Shemeleva, expert of AG "RADA"

Additional control measures are discussed in paragraph 2 of Article 101 of the Tax Code. According to it, the head of the tax inspectorate or his deputy, having reviewed the on-site tax audit report, may decide “to carry out additional tax control measures.” In fact, this means that the audit of the organization will continue.

As a rule, a decision on additional measures is made if the head of the inspection notices that the inspectors did not check some important issue or made a mistake.

Sometimes, with the help of additional measures, tax officials try to increase the audit time, since the deadlines for their implementation are not directly established in the Tax Code. For example, exporters often encounter this when recovering VAT.