Collection for three cities

Theoretically, legislators have provided for the possibility of introducing a trade tax in the territories of any municipalities. Of course, provided that local authorities make an appropriate decision. This provision is directly enshrined in paragraph 1 of Art. 410 Tax Code of the Russian Federation.

But in practice, only Moscow, St. Petersburg and Sevastopol will be able to introduce a trade tax on their territories. The fact is that in paragraph 4 of Art. 4 of Federal Law No. 382-FZ of November 29, 2014 (hereinafter referred to as Law No. 382-FZ) states that a trade tax can be introduced in these cities no earlier than July 1, 2020. But in municipalities not included in these cities , a trade tax can be introduced only after the adoption of the corresponding federal law.

For whom will the tax burden increase?

Organizations and individual entrepreneurs carrying out trading activities in Moscow, St. Petersburg or Sevastopol, in respect of which the local authorities have established this fee, will have to pay the trade fee, using movable and (or) immovable property in the territory of these cities (clause 1 of Art. 411, paragraph 1 of Article 413 of the Tax Code of the Russian Federation). Individual entrepreneurs on the PSN, as well as taxpayers who have switched to the Unified Agricultural Tax (Clause 2, Article 411 of the Tax Code of the Russian Federation), are exempt from paying the fee.

What is trade...

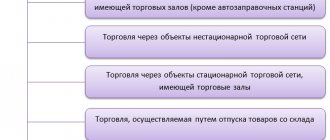

To better understand what types of businesses are subject to the payment of a trade tax, let’s immediately say what legislators understand by trade. The definition of trade is contained in sub. 2 clause 4 art. 413 Tax Code of the Russian Federation. So, trade is a type of business activity associated with retail, small wholesale and wholesale purchase and sale of goods. At the same time, legislators classified the following as trading activities (clause 2 of Article 413 of the Tax Code of the Russian Federation):

- trade through stationary retail chain facilities that do not have sales areas (with the exception of gas stations);

- trade through objects of a non-stationary trading network;

- trade through stationary retail chain facilities with trading floors;

- trade carried out by releasing goods from a warehouse.

Please note: for the purposes of this chapter, activities related to the organization of retail markets are equated to trading activities (clause 3 of Article 413 of the Tax Code of the Russian Federation). It refers to the activities of market management companies, determined in accordance with the Federal Law of December 30, 2006 No. 271-FZ “On retail markets and on amendments to the Labor Code of the Russian Federation.”

...and the object of trade

As we have already said, organizations and individual entrepreneurs carrying out trading activities using movable and immovable property are subject to the trade tax. Please note: in Chapter 33 of the Tax Code of the Russian Federation such property is called “objects of trade”. These include buildings, structures, premises, stationary or non-stationary retail facility or retail outlet (Clause 4 of Article 413 of the Tax Code of the Russian Federation).

Chapter 33 of the Tax Code of the Russian Federation does not say what movable property is meant for the purposes of paying the trade tax. The answer would be obvious if the new chapter of the Tax Code of the Russian Federation contained the concepts of stationary and non-stationary retail facility. But they are not in it.

In our opinion, to find an answer to the question, it is worth turning to Chapter 26.5 “Patent taxation system” of the Tax Code of the Russian Federation. The fact is that legislators tied the trade tax rate precisely to the amount of tax paid on the basis of the patent. In addition, Chapter 33 of the Tax Code of the Russian Federation contains references to Chapter 26.5 of the Tax Code of the Russian Federation for some definitions (for example, for the area of a trading floor).

So, according to sub. 10 clause 3 art. 346.43 of the Tax Code of the Russian Federation, a non-stationary trading network refers to a trading network operating on the principles of distribution and distribution trade, that is, using movable property (for example, cars or vans).

And one more important point: the list of trading objects does not directly mention vending machines. Therefore, it may appear that trading through them is not subject to the payment of the levy. We believe that this is not the case.

If we again refer to Art. 346.43 of the Tax Code of the Russian Federation, then we will see that vending machines are classified as a stationary retail chain that does not have trading floors. And as we said earlier, Chapter 33 of the Tax Code of the Russian Federation classifies trade through the objects of a stationary retail chain that do not have trading floors as a trading activity. Thus, trading through machines will also be subject to payment of the trading tax.

As for the activities of organizing retail markets, the object of trade will be the real estate with the use of which the company managing the market carries out the specified activities.

BUSINESS -

Trade tax is a mandatory quarterly payment, payers of which are organizations and individual entrepreneurs operating under the general and simplified taxation system (OSNO and USNO)

Who pays the trade tax to Moscow

Article 413 of the Tax Code of the Russian Federation introduces the obligation to pay a trade tax in relation to the following types of trade:

- through stationary retail chain facilities that do not have sales areas (except gas stations)

- through objects of a non-stationary trading network

- through stationary retail chain facilities that have trading floors

- by releasing goods from the warehouse

The activities of organizing retail markets are also considered trading activities

Payment of trade tax in Moscow

The trade fee must be paid by the 25th day of the month following the taxation period (quarter)

Registration of trade tax payers

It is necessary to issue a notice of registration of an individual entrepreneur or LLC as a trade tax payer and submit it to the State Tax Inspectorate of the Russian Federation at the place of business. No more than 5 working days are allotted for submitting a notification to the Federal Tax Service from the date of commencement of trading

Trade tax and simplified tax system

If an individual entrepreneur carries out trading activities at the place of registration, he has the right to reduce the amount of tax according to the simplified tax system for the reporting tax period in the amount of the entire amount of the tax fee that was paid during the tax period (ground: clause 5 of Article 225 of the Tax Code of the Russian Federation).

If an individual entrepreneur is registered in one city, and trade activities and payment of the trade tax are carried out by him in another city, such an entrepreneur is deprived of the right to reduce personal income tax in the amount of the paid trade tax.

Trade fee and separate divisions

If there are separate divisions, the payment of the simplified tax system is carried out by the parent organization. Therefore, the key factor in reducing the amount of the single tax on the amount of trade tax is the presence of a parent organization in the city

Trade tax in Moscow and income tax

When conducting business on OSNO, organizations receive the right to reduce the amount of advance payments for income tax by the amount of the trade fee actually paid on the date of payment of the tax from the beginning of the tax period

Here the condition must also be met: income tax is credited to the budget of the city in whose territory the trade tax is valid (ground: clause 10 of Article 286 of the Tax Code of the Russian Federation).

It is important to note that in the case of separate divisions, income tax is paid at their location. In other words, such organizations operating on OSNO will be able (unlike the simplified tax system) to be guaranteed to reduce the amount of income tax by the amount of the trade fee

Trade fee reporting

Since we are not talking about a tax, but about a fee, reporting is not provided for it

Benefits for paying trade tax

1. The following types of trading activities are exempt from the trade tax

- retail trade carried out using vending machines

- trading at weekend fairs, specialty fairs and regional fairs

- trade through stationary and non-stationary trading network facilities located on the territory of retail markets

- retail retail trade carried out in buildings, structures, premises under the operational management of autonomous, budgetary and government institutions

2. Exempt from paying sales tax

- federal postal organizations

- autonomous, budgetary and government institutions

Fine for failure to provide notification to the Federal Tax Service

It is 10% of income (but not less than 40 thousand rubles). In addition, officials may be subject to an administrative fine of up to 3 thousand rubles on the basis of Art. 15.3 Code of Administrative Offenses of the Russian Federation

Call and we will help you

- prepare the necessary documents and register you with the Federal Tax Service as a trade tax payer

Collection object and period

The object of taxation is the use of a trade object for carrying out trading activities at least once during a quarter. In this case, the date of occurrence of the object of taxation is the date of the beginning of the use of the specified property for trading activities, and the date of termination of the object of taxation is the date of termination of the use of such property for trading activities (Article 412 of the Tax Code of the Russian Federation).

The period for taxation of trade fees is a quarter (Article 414 of the Tax Code of the Russian Federation).

Collection rates

Now let's move on to the most interesting part - the rates for the trading fee. They are established by local authorities in rubles per quarter, per one trade object or per its area (Clause 1, Article 415 of the Tax Code of the Russian Federation). The size of the rate will depend on the type of activity carried out (wholesale or retail), as well as on the area of the sales floor.

Small shops

In paragraph 1 of Art. 415 of the Tax Code of the Russian Federation states that the tax rate cannot be greater than the estimated amount of tax payable in Moscow, St. Petersburg or Sevastopol in connection with the use of a patent taxation system for the relevant type of activity on the basis of a patent issued for three months.

PSN can be used in relation to trading activities only for retail. In this case, the following is translated into PSN:

- retail trade carried out through a stationary retail chain with a sales floor area of no more than 50 sq. m for each object of trade organization (subclause 45, clause 2, article 346.43 of the Tax Code of the Russian Federation);

- retail trade carried out through objects of a stationary trading network that do not have sales floors, as well as through objects of a non-stationary trading network (subclause 46, paragraph 2, article 346.43 of the Tax Code of the Russian Federation).

Please note: in accordance with paragraph 2 of Art. 415 of the Tax Code of the Russian Federation in this case, for the purposes of determining the maximum rates of trade tax, restrictions on the use of PSN for retail trade are not taken into account. Let us remind you that they are provided for in sub-clause. 1 clause 3 art. 346.43 Tax Code of the Russian Federation. This norm of the Code states that the sale of:

- excisable goods specified in subparagraph. 6-10 p. 1 tbsp. 181 Tax Code of the Russian Federation;

- food and beverages, including alcohol, both in manufacturer’s packaging and packaging, and without such packaging and packaging in bars, restaurants, cafes and other public catering facilities;

- gas;

- trucks and special vehicles, trailers, semi-trailers, trailers, buses of any type;

- goods according to samples and catalogs outside the stationary distribution network (including in the form of postal items (parcel trade), as well as through teleshopping, telephone communications and computer networks);

- products of own production (manufacturing);

- transfer of medicines on preferential (free) prescriptions.

That is, for the purposes of paying the trade tax, all of the above types of activities will be recognized as retail trade.

Example 1

The company carries out retail trade in Moscow through a stationary retail chain with a sales area of no more than 50 sq. m.

For this type of activity, Moscow Law No. 53 dated October 31, 2012 “On the Patent Taxation System” established a potentially receivable annual income of 2,000,000 rubles. The tax amount for PSN for the year will be 120,000 rubles. (RUB 2,000,000 x 6%), and for three months - RUB 30,000. (RUB 120,000: 12 months x 3 months).

Consequently, the amount of the trading fee for the quarter for the specified type of activity will not exceed 30,000 rubles.

Large retail and wholesale

And what rates should companies and individual entrepreneurs who carry out retail trade through facilities with an area exceeding 50 square meters apply? m, or from a warehouse? The answer to this question is contained in paragraph 3 of Art. 415 Tax Code of the Russian Federation. For such payers, the rate is set per 1 sq. m of trading floor area. Please note: the collection rate cannot exceed the estimated amount of tax paid in connection with the use of PSN in Moscow, St. Petersburg and Sevastopol on the basis of a patent for retail trade carried out through a stationary retail chain with a sales area of no more than 50 square meters. m for each trade organization object, issued for three months, divided by 50.

Example 2

Let's slightly change the conditions of example 1. Let's assume that the company carries out retail trade in Moscow through a store with a sales area of 51 square meters. m.

Let's calculate the maximum possible amount of trading fee for this case. In example 1, we have already calculated the amount of tax for three months when applying PSN for retail trade through a stationary retail chain facility with a sales floor area of no more than 50 square meters. m. It amounted to 30,000 rubles.

To find out how much you will have to pay in sales tax per 1 sq. m in the example under consideration, we will divide 30,000 rubles. by 50. It will turn out to be 600 rubles.

Accordingly, the maximum amount of sales tax for a store with a sales area of 51 sq. m per quarter will be 30,600 rubles. That is, each “extra” square meter will cost companies no more than 600 rubles.

Please note: in paragraph 5 of Art. 415 of the Tax Code of the Russian Federation states that the area of the trading floor for the purposes of Chapter 33 of the Tax Code of the Russian Federation is determined in the manner established for PSN, that is, in accordance with subparagraph. 5 paragraph 3 art. 346.43 Tax Code of the Russian Federation. Let us recall that, according to the specified norm of the Code, the area of the sales floor is the part of the store, pavilion, occupied by equipment intended for displaying, demonstrating goods, conducting cash payments and servicing customers. This includes the area:

- cash registers and cash registers;

- service personnel workplaces;

- aisles for shoppers.

The area of the trading floor also includes the rented part of the trading floor area. The area of utility, administrative and amenity premises, as well as premises for receiving, storing goods and preparing them for sale, in which customer service is not provided, does not apply to the area of the trading floor. The area of the sales area is determined on the basis of inventory and title documents.

Table: fee rates 2020

Different areas of Moscow have their own sales tax rates. Here are the current sales tax rates in 2020 in Moscow.

The amount of the fee does not depend on how many days you traded and how much revenue you received (clause 1 of Article 412 of the Tax Code of the Russian Federation, letters of the Ministry of Finance dated 03.03.2016 No. 03-11-13/12306, Federal Tax Service dated 07.07.2017 No. SD-4- 3/13187). It doesn't matter whether you opened your store in January or March, your sales fee for the first quarter will be the same. There is no need to pay the fee only if you did not work for the entire quarter.

| City districts | Kind of activity | Trade tax rate (per quarter) |

| Moscow | What do you do | How much will you pay |

| Central Administrative District (CAO) | Trade through stationary retail chain facilities without trading floors (except gas stations) | 81,000 rub. for each retail facility |

| Trade through objects of a non-stationary trading network (except for delivery and distribution) | 40,500 rub. for each retail facility | |

| Trade through a stationary retail chain with sales areas up to 50 square meters. m inclusive | 54,000 rub. for each retail facility | |

| Trade through a stationary retail chain with sales areas of more than 50 square meters. m | 1200 rub. for every 1 sq. m of retail space within 50 sq. m | |

| 50 rub. for every full or incomplete 1 sq. m of retail space over 50 sq. m | ||

| Zelenograd, Troitsk and Novomoskovsk Autonomous Okrug | Trade through stationary retail chain facilities without trading floors (except gas stations) | RUB 28,350 for each retail facility |

| Trade through objects of a non-stationary trading network (except for delivery and distribution) | RUB 28,350 for each retail facility | |

| Trade through a stationary retail chain with sales areas up to 50 square meters. m inclusive | RUB 18,900 for each retail facility | |

| Trade through a stationary retail chain with sales areas of more than 50 square meters. m | 420 rub. for every 1 sq. m of retail space within 50 sq. m | |

| 50 rub. for every full or incomplete 1 sq. m of retail space over 50 sq. m | ||

| Southern Administrative District (SAD) | Trade through stationary retail chain facilities without trading floors (except gas stations) | 40,500 rub. for each retail facility |

| Trade through objects of a non-stationary trading network (except for delivery and distribution) | 40,500 rub. for each retail facility | |

| Trade through a stationary retail chain with sales areas up to 50 square meters. m inclusive | 30,000 rub. for each retail facility | |

| Trade through a stationary retail chain with sales areas of more than 50 square meters. m | 600 rub. for every 1 sq. m of retail space within 50 sq. m | |

| 50 rub. for every full or incomplete 1 sq. m of retail space over 50 sq. m | ||

| 1. Molzhaninovsky district of the Northern Administrative District 2. Northern region of NEAD 3. Eastern, Novokosino and Kosino-Ukhtomsky districts of the Eastern Administrative District 4. Nekrasovka SEAD 5. Northern Butovo and Southern Butovo South-Western Administrative District 6. Solntsevo, Novo-Peredelkino and Vnukovo CJSC 7. Mitino and Kurkino North-West Administrative District | Trade through stationary retail chain facilities without trading floors (except gas stations) | RUB 28,350 for each retail facility |

| Trade through objects of a non-stationary trading network (except for delivery and distribution) | RUB 28,350 for each retail facility | |

| Trade through a stationary retail chain with sales areas up to 50 square meters. m inclusive | RUB 18,900 for each retail facility | |

| Trade through a stationary retail chain with sales areas of more than 50 square meters. m | 420 rub. for every 1 sq. m of retail space within 50 sq. m | |

| 50 rub. for every full or incomplete 1 sq. m of retail space over 50 sq. m | ||

| 1. All districts of the Northern Administrative District (except Molzhaninovsky) 2. All districts of NEAD (except Northern) 3. All districts of the Eastern Administrative District (except for the districts of Vostochny, Novokosino and Kosino-Ukhtomsky) 4. All districts of the South-Eastern Administrative District (except for the Nekrasovka district) 5. All districts of the South-Western Administrative District (except for the Northern Butovo and Southern Butovo districts) 6. All districts of the closed joint-stock company (except for the districts of Solntsevo, Novo-Peredelkino and Vnukovo) 7. All districts of the North-West Administrative District (except for the Mitino and Kurkino districts) | Trade through stationary retail chain facilities without trading floors (except gas stations) | 40,500 rub. for each retail facility |

| Trade through objects of a non-stationary trading network (except for delivery and distribution) | 40,500 rub. for each retail facility | |

| Trade through a stationary retail chain with sales areas up to 50 square meters. m inclusive | 27,000 rub. for each retail facility | |

| Trade through a stationary retail chain with sales areas of more than 50 square meters. m | 600 rub. for every 1 sq. m of retail space within 50 sq. m | |

| 50 rub. for every full or incomplete 1 sq. m of retail space over 50 sq. m | ||

| Throughout Moscow | Delivery and distribution trade | 40,500 rub. for each retail facility |

| Organization of retail markets | 760.1 rub. (550 rubles × 1,382) for every 1 sq. m of market area. The rate was determined taking into account the deflator coefficient established for 2020 (clause 4 of Article 415 of the Tax Code of the Russian Federation, order of the Ministry of Economic Development dated October 21, 2019 No. 684). It is equal to 1.382. |

The remaining rates for medium and large stationary trade can be viewed in Moscow law dated December 26, 2018 here.

Let's register

No later than five days from the date of occurrence of the object of the trade tax, an organization or individual entrepreneur must submit to the tax authority a notification of registration as a tax payer (clauses 1, 2 of Article 416 of the Tax Code of the Russian Federation). The notification form will have to be developed and approved by the Federal Tax Service of Russia (clause 5 of Article 416 of the Tax Code of the Russian Federation). The notification can be submitted on paper or in electronic form via telecommunication channels using an enhanced qualified electronic signature (clause 6 of Article 416 of the Tax Code of the Russian Federation). The notice states:

- type of business activity;

- the facility in which trading activities are carried out;

- characteristics (quantity and (or) area) of the trade object.

If a real estate object is used for trade, then registration with the tax authority is carried out at the location of the object of trade. In other cases, you need to register at the location of the organization (place of residence of the individual entrepreneur). Moreover, if a company or merchant has several trading facilities in one city (Moscow, St. Petersburg or Sevastopol), but they are located in territories under the jurisdiction of different tax inspectorates, registration is carried out at the location of the facility whose information was received first (clause 7 of article 416 of the Tax Code of the Russian Federation).

Please note: carrying out activities for which a trade fee has been established without sending a notification to the tax authorities is equivalent to conducting activities without tax registration (clause 2 of Article 416 of the Tax Code of the Russian Federation). The question arises: will an organization or an individual entrepreneur be held accountable for this?

Clause 2 of Art. 116 of the Tax Code of the Russian Federation provides for a fine for conducting activities by an organization or individual entrepreneur without registering with the tax authority on the grounds provided for by the Tax Code of the Russian Federation. Its size is 10% of the income received during the specified time as a result of such activity, but not less than 40,000 rubles. The grounds for tax registration are specified in Art. 83 Tax Code of the Russian Federation. Thus, organizations and individuals are subject to registration with the tax authorities at the location of the organization, the location of separate divisions, the place of residence of an individual, as well as at the location of the real estate and vehicles they own, and on other grounds provided for by the Tax Code. The case we are considering falls under other grounds. Thus, if an organization or businessman does not register with the tax authorities to pay the trade tax, they face penalties.

True, tax authorities can carry out registration themselves. This will happen if the body exercising the authority to collect, process and transmit to the tax authorities information about the objects of taxation provides the tax authorities with information that the company or businessman is conducting trading activities (clause 4 of Article 418 of the Tax Code of the Russian Federation). Note that such an authorized body must be determined by the laws of Moscow, St. Petersburg and Sevastopol (clause 2 of Article 418 of the Tax Code of the Russian Federation).

After receiving the notification, tax authorities must register the fee payer within five days. And they were given another five days to send him the corresponding certificate.

If an organization or entrepreneur stops carrying out activities that are subject to the payment of a trade tax, they must inform the tax authorities of this fact within five days by sending a notification to the tax authority. The tax authorities will remove the payer from the register. In this case, the date of deregistration will be the date of termination of activity specified in the notification (clause 4 of article 416 of the Tax Code of the Russian Federation).

We calculate the fee and transfer it to the budget

Trade tax payers must independently determine the amount of the fee for each taxable item. This must be done starting from the period in which the object of taxation arose. To determine the amount of the fee, you need to take the corresponding rate and multiply it by the actual value of the physical characteristics of the corresponding trade object (clause 1 of Article 417 of the Tax Code of the Russian Federation).

Thus, if the rate is set for an object, then it is multiplied by 1. And in the case when the rate is determined in relation to 1 sq. m of area of the trading floor (retail market), then it must be multiplied by the size of the area.

The fee must be transferred to the budget no later than the 25th day of the month following the expired quarter (Clause 2 of Article 417 of the Tax Code of the Russian Federation).

Please note: if tax authorities have registered an organization or entrepreneur independently based on the information they have, they will issue a requirement to pay the fee no later than 30 days from the date of receipt of the specified information. In this case, the inspectors themselves will calculate the amount of the fee based on the data provided by the authorized body. This procedure is established in paragraph 3 of Art. 417 Tax Code of the Russian Federation.

Related Amendments

In connection with the appearance of a new chapter in the Tax Code, the need arose to amend the existing provisions of parts one and two of the Tax Code of the Russian Federation.

Registration as a trade tax payer (notification)

To register as a trade tax payer, you must submit a special notification in the TS-1 form

to the tax office.

This document can be submitted in the following ways:

- in person in paper form;

- by mail as a registered item with a description of the contents.

- in electronic form via the Internet (under an agreement through an EDF operator or a service on the Federal Tax Service website).

Note

: Many tax offices have computers on which you can also fill out and print the notice.

The list of local taxes and fees has been expanded

The trade tax established by the new head of the Tax Code of the Russian Federation does not fit into the concept of a fee enshrined in the first part of the Tax Code of the Russian Federation. To make its existence legal, it was necessary to amend Art. 8 and 12 of the Tax Code of the Russian Federation.

The concept of “collection” is contained in paragraph 2 of Art. 8 Tax Code of the Russian Federation. Nowadays, a fee is understood as a mandatory contribution that is collected from organizations and individuals. Moreover, its payment is one of the conditions for the performance of legally significant actions in relation to fee payers by state bodies, local government bodies, other authorized bodies and officials, including the granting of certain rights or the issuance of permits (licenses). The law under commentary supplemented this concept with another basis for collecting a fee: its payment is conditional on the implementation of certain types of business activities within the territory in which the fee is introduced.

In addition, an amendment was made to Art. 12 of the Tax Code of the Russian Federation, which establishes the types of taxes and fees on the territory of the Russian Federation. Until today, the collection could only be federal. Thanks to the changes made to paragraph 4 of this Code norm, such a concept as a local fee appeared. Just like a local tax, a local fee is established by the Tax Code and regulatory legal acts of representative bodies of municipalities on taxes and fees. Local taxes can be introduced in their territories by the authorities of federal cities - Moscow, St. Petersburg and Sevastopol. When local fees are established by representative bodies of municipalities (legislative bodies of state power of the federal cities of Moscow, St. Petersburg and Sevastopol), the rates of fees are determined in the manner and within the limits provided for by the Tax Code. Benefits for paying fees, the grounds and procedure for their application may also be established.

And of course, the trade tax is included in the list of local taxes and fees established by Art. 15 Tax Code of the Russian Federation.

Trade tax introduced in Moscow

On July 1, a trade tax was introduced in Moscow. Entrepreneurs who trade will have to pay a fixed amount depending on what they sell and in what area. The city authorities expect to collect about a billion rubles for the budget, and businessmen are talking about an additional burden.

They decided to first test the idea of a trade tax in cities of federal significance: Moscow, St. Petersburg and Sevastopol. But this year only the capital decided to use this right. Entrepreneurs were indignant, collected signatures against the levy, and reminded of the promise not to increase the tax burden. But the fee was still introduced. According to city officials, the storm of indignation is explained by the fact that few people carefully read the law on trade fees, but only retell horror stories to each other. Komsomolskaya Pravda learned everything about the new collection.

WHO WILL PAY

Entrepreneurs engaged in trade will have to pay the fee. The exception is those businessmen who buy patents for trade or pay a single agricultural tax. Cinemas, theaters, museums, kiosks and religious organizations are exempt from the fee. Owners of hairdressing salons, laundries, dry cleaners and other consumer services, where trade is not the main source of income, will also not have to pay. Within five working days (until July 7), entrepreneurs are required to submit to the tax office a notice of registration as a trade tax payer. This can be done in person or online (an electronic signature will be required).

WHAT DO THE RATES DEPEND ON?

Collection rates depend on the retail space, and it does not matter whether it is owned or leased. For example, for a small store (up to 50 sq. m.) in the Central District of Moscow you will have to pay 60 thousand rubles every quarter, in other districts within the Moscow Ring Road - 30 thousand, for the Moscow Ring Road - 21 thousand. If the area is more than 50 sq. m. m., we add 50 rubles for each meter.

Markets will be charged 50 rubles per 1 sq. m. (all tax rates can be viewed on the website of the Moscow Department of Economic Policy depr.mos.ru).

IS THIS A NEW TAX?

“Trade tax is a separate type of tax, but in some cases it can be counted when paying other taxes,” comments Anton Sonichev, head of the legal tax practice. — So, for example, taxes on business income will be reduced by the amount of the fee: corporate income tax in terms of payments to the budget of the city in which the trade tax has been introduced, a single tax on payment of the simplified tax system, personal income tax for individual entrepreneurs. But those entrepreneurs who have chosen the patent form of taxation benefit the most, since they are generally exempt from paying trade taxes.

That is, if you paid a trading fee of 10 rubles, and the income tax was 100 rubles, then you must pay 90 rubles, since you already paid 10 rubles in the form of a trading fee.

But the question arises: why was it necessary to introduce this fee if it simply covers other taxes? The logic of the authorities is simple: there are many businessmen in the capital who do not pay taxes at all. It turns out that for conscientious entrepreneurs the fee will be deducted from taxes, but for those who do not pay, there will be nothing to deduct from.

— But it is unlikely that the levy will become an effective measure to combat non-payers - if someone allows himself not to pay some taxes, then what will force him to pay others? — says Anton Sonichev. — The obligation of tax payers to additionally register in this capacity with the tax office creates trouble for taxpayers, it would be good if this were not in vain and that the authorized bodies promptly monitor and punish those who evade paying taxes and fees, including trade taxes.

If a business has to incur additional expenses, it is clear that this will primarily affect prices, and therefore our wallets.

BUSINESS COMMENT

A crisis is not the time for experiments

“We, as business representatives, had a negative attitude towards this idea from the very beginning,” comments OPORA Russia Vice President Alexander Zharkov . “In the current economic conditions, when many businessmen are on the verge of survival, when the entire city is hung with “For Rent” and “Rent” banners, this is not the time to increase the tax burden. We asked to at least delay the introduction of the fee. The authorities met us halfway and prescribed the possibility of counting the fee against income tax and some other taxes. But the problem is that the mechanism for how this money will be counted has not yet been spelled out. In addition, many entrepreneurs may not have this profit, but they will have to pay a fee. In addition, there may be different interpretations of the law on how to calculate the square footage of a retail space, for example. But the Moscow government agreed to create a commission, which, I hope, will include business representatives. And this commission will resolve controversial issues. There is one more problem. Businessmen are poorly informed. But they need to register as a fee payer before July 7 - this is a very short period of time. We fear that many simply will not have time to do this and will be forced to pay fines.

Personal income tax

An amendment has been made to Art. 225 of the Tax Code of the Russian Federation, which establishes the procedure for calculating personal income tax. It has been supplemented with a new clause 5. It will be available to individual entrepreneurs who pay a trade fee. Based on the results of the tax period, they have the right to reduce the amount of tax calculated at a rate of 13% by the amount of the trade fee paid in this tax period.

But if businessmen themselves did not register for taxation, but paid the trade fee based on the tax collection requirement, then they will not be able to reduce the amount of personal income tax. This is directly stated in paragraph 5 of Art. 225 Tax Code of the Russian Federation.

Income tax and special regimes

Organizations that pay a trade tax will not be able to take it into account when calculating income tax as an expense. Such a prohibition is established in paragraph 19 of Art. 270 Tax Code of the Russian Federation. But there is no need to be upset. The amount of the trading fee can directly reduce income tax. The corresponding provision has been added to Art. 286 Tax Code of the Russian Federation.

The new clause 10 of this norm of the Code states that payers of the trade tax have the right to the amount of the tax (advance payment) calculated based on the results of the tax (reporting) period. At the same time, the profit tax payable to the budget of the constituent entity of the Russian Federation is reduced. You can reduce your income tax by the amount of the trade tax actually paid from the beginning of the tax period to the date of payment of the tax (advance payment).

And again, if the trade fee was transferred on the basis of a demand made by the tax authorities, then there can be no talk of any reduction in income tax.

Similar rules have been established for those companies and businessmen who use a simplified taxation system. Art. 8 was supplemented with the corresponding clause. 346.21 Tax Code of the Russian Federation.

But with UTII things are completely different. If a trade tax is introduced in the territories of Moscow, St. Petersburg or Sevastopol, then organizations engaged in retail trade will not be able to apply UTII for this type of activity. This change was made to clause 2.1 of Art. 346.26 Tax Code of the Russian Federation.

Who pays the trading fee

Now let's talk about who pays the trading fee. The fact is that this obligation is not established for all organizations and entrepreneurs who trade in Moscow. There is a direct dependence on the tax regime applied by the seller.

This payment is required only on the general (OSNO) and simplified (USN) taxation systems. The trade tax does not apply to the PSN and Unified Agricultural Tax regimes. In addition, you cannot combine the payment of the trade tax with UTII. However, in Moscow this regime has not been used for a long time, and from 2021 it will cease to apply altogether.

What is the result? Organizations cannot work on PSN, UTII does not operate in the capital, and Unified Agricultural Tax can only be used by agricultural producers and fishing enterprises (as well as those who provide them with certain services). This means that only individual entrepreneurs who have issued a patent for retail trade can be exempt from paying TC in Moscow.

Free tax consultation