Transport tax is established by the Tax Code of the Russian Federation, but it is a regional tax, and is regulated by the legislation of the constituent entities of the Russian Federation and is paid not to the federal budget, but to the budget of the constituent entities of the Russian Federation. According to the legislation, the tax rate is established within the limits established by the Tax Code of the Russian Federation, and the terms and procedure for payment are the same as in the Tax Code of the Russian Federation. Subjects have the right to establish additional tax benefits. It is important to timely and correctly transfer the tax to the budget, otherwise arrears arise, for which penalties and fines are assessed. Let's look at how to fill out a transport tax payment form.

Transport tax rates

Rates are regulated by regional legislation and can be increased or decreased, but not more than tenfold. Organizations calculate themselves:

- advance payments every quarter

- tax payable to the budget at the end of the year

Advance payment = 1/4 * tax base * tax rate * increasing factor

Tax at the end of the year = tax base * tax rate * increasing coefficient - the amount of advance payments paid.

It is allowed to establish differentiated tax rates for each category of vehicles, as well as taking into account the number of years that have passed since the year of production of the vehicles and (or) their environmental class.

Deputy Director of the Department of the Ministry of Finance of the Russian Federation V.V. Sashichev

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

What you need to know to pay ↑

To pay transport tax, individuals must provide the following information:

All this information must be available to the car owner who wishes to pay transport tax. TIN, KBK and document index are present in the notification received by the person who owns the equipment.

Also, when paying through a bank terminal, you may need a driver's license number and passport information.

This is a prerequisite when making payments through an ATM or other similar method.

A receipt for payment of transport tax using a TIN makes it possible to make a payment knowing only the taxpayer identification number, which is very convenient.

Many banks have special reading devices installed. They allow you not to enter data manually, but to make payments automatically - all the necessary information will be obtained from the barcode.

The tax base

The tax base for various types of vehicles equipped with an engine running on electricity or gasoline is power.

It can be indicated in the following units of measurement:

It is on the basis of this characteristic that the tax base is calculated. For those vehicles that are not equipped with their own engine, or the gross power is not subject to determination, the tax base is the unit of equipment itself.

These types of technical means include:

- landing stages;

- floating cranes;

- dredging equipment moving on water.

- number of months of ownership;

- engine power;

- engine toxicity class;

- age of the car or other equipment.

Amount to be paid

The entire amount of tax that must be paid is calculated based on the following data:

The amount to be paid must have documentary justification. All issues related to the payment of transport tax are regulated by Article No. 52 and Article No. 54 of the Tax Code of the Russian Federation.

The amount of transport tax in different regions for the same car often varies quite significantly. In addition, the cost per unit of power (hp or kW) is updated every year.

It is especially important to follow these changes for those who are involved in calculating the tax in question on their own (legal entities).

Since an advance not paid in full may result in a penalty or a serious fine.

When?

The deadlines for payment of transport tax for individuals are established by current legislation. For the previous year, the entire amount is paid by the last day of November.

If payment has not been made, then for each day of delay a penalty will be charged in the amount of 1/300 of the refinancing rate of the Central Bank.

For legal entities, the deadlines for paying transport tax are set by regional authorities.

There is one important nuance: according to clause 3, article No. 363.1 of the Tax Code of the Russian Federation, payment should not be made earlier than February 1 of the year following the reporting year.

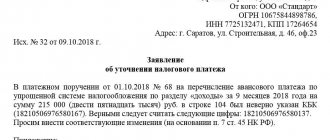

KBK in the payment for transport tax

In the payment form, KBK is reflected in field 104.

The BCC is necessary for the transfer to go to the correct account of the body administering this budget income.

If the BCC, which is reflected in field 104 in the payment, is incorrectly reflected, the payment will be credited for the wrong purpose and will be an arrears of transport tax and this will result in penalties and interest.

Important! For each type of payment and BCC, a separate payment order is generated: tax, fine, penalty.

For transport tax on organizations, the following BCCs are provided:

| Income | KBK |

| principal payment amount | 182 1 0600 110 |

| penalties | 182 1 0600 110 |

| interest | 182 1 0600 110 |

| amounts of penalties (fines) | 182 1 0600 110 |

Results

In the payment order for the payment of transport tax for 2020, you must indicate the amount of tax from line 030 of section 1 of the declaration, the current BCC, the tax period (in the format ГД.00.2019) and other details required for tax payments. A payment order with errors must be clarified by submitting an application to the Federal Tax Service. Failure to timely issue a payment order for the transfer of transport tax may result in penalties.

Sources:

- Tax Code of the Russian Federation

- Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Error when changing company location

Organizations have the right to determine their location, incl. and a subject of the Russian Federation, while the issue of transport tax remains controversial.

An organization, changing its location, is obliged to pay transport tax to the Federal Tax Service at its location (clause 1 of Article 363 of the Tax Code of the Russian Federation), because in that region and uses the roads. But to do this, you need to submit information to the State Traffic Safety Inspectorate (Article 357 of the Tax Code of the Russian Federation), otherwise the Federal Tax Service at the previous location has the right to demand payment of tax and this requirement can only be protested in court.

Therefore, you should re-register the vehicle with the traffic police, which will report information about registration to the Federal Tax Service within 10 days from the date of registration and before February 15 - information as of January 1 of the current year.

Purpose of payment in the payment order: payment according to the invoice or according to the agreement?

There are no clear requirements in the legislation. From personal practice:

1. If we pay on an invoice basis, write: “For transport services on invoice 125 dated 05/31/2016, incl. VAT 9000 rub.”

2. If we pay without an invoice, write: “For transport services under agreement 17 dated 04/01/2016, incl. VAT 9000 rub.”

You can write “in accordance with agreement 17 dated 04/01/16, invoice 125 dated 05/31/16, incl. VAT 9000 rub.”

The wording depends on how you reflect everything in your accounting. It is important to reflect the main details of the base document (date, number, amount, VAT), and briefly but clearly the subject of payment.

What the experts say:

Quote (Portal “Tax-Tax” 02/01/2016): We correctly indicate the purpose of the payment in the payment order

The purpose of payment in a payment order plays an essential role for proper accounting. But the correct filling of this detail in the payment slip is still of greater importance for tax accounting: it is very important to correctly indicate for what exactly the funds were transferred.

In accordance with clause 1.7.2 of the Bank of Russia Regulation No. 385-P dated July 16, 2012, the owner of a bank account is required to indicate the purpose of the payment in his payment orders. All payment documents must disclose the essence of the transaction being carried out, and correctly filled in field 24 (payment purpose) will help to do this. When filling out this column, you should keep in mind that the maximum number of characters is set for it - 210. Such information is contained in Appendix No. 11 to Bank of Russia Regulation No. 383-P dated June 19, 2012 “On the rules for transferring funds.” According to Appendix No. 1 to Regulation No. 383-P, attention should be paid to indicating the purpose of payment in the payment order. Thus, the name of works, goods, services, details of contracts, invoices, invoices or other primary documents can be given here. If there is a payment (prepayment) for the sale of goods and materials or services, it is important to indicate the necessary VAT information. If a payment is made to the budget, field 24 may indicate the type of tax (insurance contribution), period, as well as other information important for the fiscal authorities.

Current form to fill out

First of all, let us remind you that through penalties the timely payment of mandatory payments is ensured. At the same time, a penalty is not a sanction, but an interim measure.

Read more about tax penalties in this article.

You can calculate penalties using our calculator.

A payment order for penalties has both similarities with a payment order for the main payment (it states the same status of the payer, indicates the same details of the recipient, the same income administrator), and differences. Let's look at the latter in more detail.

So, the first difference is KBK (field 104). For tax penalties, there is always a budget classification code, in the 14th–17th digits of which the income subtype code is indicated - 2100. This code is associated with a significant change in filling out payment orders: since 2015, we no longer fill out field 110 “Payment Type” .

Previously, when paying penalties, the penalty code PE was entered in it. Now we leave this field empty, and the fact that this is a penalty can be understood precisely from the KBK.

ATTENTION! Since 2020, the procedure for determining the BCC is regulated by a new regulatory legal act - Order of the Ministry of Finance dated 06/08/2018 No. 132n. Order No. 65n dated July 1, 2013 has lost force. But this will not affect the general procedure for assigning penalties to BCC.

If you pay the fine yourself, enter 0 in fields 108 “Document number” and 109 “Document date”.

In all other cases, in field 108, provide the document number - the basis for the payment (for example, a claim), and do not put the “No” sign.

In field 109, indicate:

- date of requirement of the Federal Tax Service - for the basis of payment TR;

- the date of the decision to bring (refusal to bring) to tax liability - for the basis of an administrative agreement.

All of the above-mentioned features of payments for penalties now also apply to the payment of penalties for insurance premiums (except for contributions for injuries), which have become payments to the tax office since 2020.

Learn about the procedure for processing payment orders for insurance premiums from this material.

However, these changes did not affect accident insurance contributions, and penalties for them, as well as these contributions themselves, are still paid to social insurance. When paying both contributions and penalties on them to the Social Insurance Fund, fields 106 “Basis of payment”, 107 “Tax period”, 108 “Document number” and 109 “Date of document” are entered as 0 (paragraphs

Owners of vehicles are payers of transport tax. Unlike legal entities that independently calculate taxes, citizens receive a notification-calculation from the Federal Tax Service, generated in accordance with the data of the authorities that register vehicles.

If there is no tax notice from the Federal Tax Service, then the individual must independently notify the tax authority about the presence of vehicles subject to taxation.

Read about the consequences of timely and untimely reporting of this in this material.

According to paragraph 1 of Art. 363 of the Tax Code of the Russian Federation, citizens must make timely payments for their cars before December 1 of the next year inclusive.

An individual entrepreneur has the right to use his current account to pay tax on a vehicle (VV), and in this case, he, like a legal entity, will use the payment order form in the form of Regulation 383-P.

Note that even when the payer uses the auxiliary interfaces of his personal account, the bank in which the current account is opened makes the payment in the form established by Regulation 383-P.

There is also an option (we will study it in more detail later in the article) in which the vehicle tax for the company will be paid by another person, as well as filling out the payment form.

When filling out the document in question, it is important not to make critical mistakes. Thus, the details of the recipient bank (field 13) and the recipient's account (field 104) must be indicated correctly, otherwise the payment will not be transferred by the Federal Treasury to the Federal Tax Service and arrears will arise (subclause 4, clause 4, article 45 of the Tax Code of the Russian Federation).

- place of registration of the vehicle - if the tax is paid for a water vessel (any except a small one);

- location of the company - if the vehicle is represented by an aircraft;

- location of the organization or its branch - if the vehicle is represented by any other object that is taxed.

Obviously, if a company has several vehicles located in different municipalities, then several payments will have to be made. But if all vehicles are located in the territory administered by one Federal Tax Service, then using one payment card you can pay tax on all vehicles.

If someone else pays the tax for the taxpayer company (this can be any third-party individual or legal entity), then the payment slip reflects:

- in field 8 (“Payer”) - full name of the citizen or name of the organization that actually makes the payment;

- in column 24 (“Purpose of payment”) - INN and KPP of the organization for which the transport tax is paid;

- in field 101 (“Payer status”) - payer status code (in this case, the “Organization” status with code 01 is indicated).

Otherwise, the payment form is filled out as if the company itself paid the tax.

It must be borne in mind that a person who has paid vehicle tax for a company does not have the right to demand the return of funds transferred to the budget (clause 1 of Article 45 of the Tax Code of the Russian Federation).

When filling out a vehicle tax payment, it is important to correctly determine the location of the vehicle. Based on it, determine which Federal Tax Service the payment is addressed to and, accordingly, determine the name of the bank serving the tax authorities and the account number of the payee. Payment of transport tax for a company by another person has specific features regarding the reflection of information in fields 8, 24 and 101 of the payment slip.

In 2020, all legal entities to which vehicles are registered are required to pay tax, as well as advance tax payments throughout the year. To avoid unclear transfers, you need to check the details in advance, and first of all check the KBK for transport tax, so as not to confuse the code for organizations with the code for “physicists”.

When filling out an order for the transfer of transport tax in 2020, you need to be guided by a reference book of codes. The procedure for using budget classification codes was established by the Ministry of Finance by order No. 65n dated July 1, 2013.

KBK transport tax for legal entities in 2018

Legal entities (organizations)

If you are late in paying your transport tax or advances, tax authorities will charge penalties and interest. Separate BCCs are provided for the transfer of penalties and fines for transport tax.

Correct indication of codes is a guarantee that problems with inspection can be avoided and payment will not have to be clarified.

The tax rate depends on the category of land. It is established by local authorities (clause 1 of Article 394 of the Tax Code of the Russian Federation). For example, in Moscow, rates are established by Law No. 74 of November 24, 2004. The Code defines only the maximum values: 0.3% - for agricultural land, plots of residential buildings, etc. For all others the rate is 1.5%. If local authorities have not established a rate, then the rates from the Tax Code of the Russian Federation apply.

For plots within the boundaries of intra-city municipalities of Moscow and St. Petersburg

For plots within the boundaries of urban districts

For plots within the boundaries of inter-settlement territories

For plots within the boundaries of rural settlements

For plots within the boundaries of urban settlements

For plots within the boundaries of urban districts with intra-city division

For plots within the boundaries of intracity districts

Land tax is local. Therefore, the terms and procedure for its payment for organizations are established by local authorities. For example, in Moscow, companies transfer advance payments. Deadline - no later than the last day of the month following the reporting period - quarter (Article 3 of the Moscow Law of November 24, 2004 No. 74).

The payment deadline for 2020 is February 1, 2020.

You can clarify the deadlines for paying taxes and advances on the Federal Tax Service website in the section Electronic services, Reference information on rates and benefits for property taxes.

For individuals, a single payment deadline is established - December 1 of the year following the reporting year. That is, you must pay tax for 2020 no later than December 1, 2020.

Land tax and advance payments for it must be paid to the Federal Tax Service at the location of the land plot (clause 3 of Article 397 of the Tax Code of the Russian Federation).

Have a question? Our experts will help you within 24 hours! Get answer New

Any tax is, first of all, a payment made by individuals and legal entities free of charge. Failure to pay a tax imposes a certain responsibility on the taxpayer; therefore, when the deadline to pay a particular tax approaches, it is necessary to do so.

Commercial structures are subject to heavy fines for failure to pay taxes, duties, and fees on time. There are a lot of taxes paid by Russians, and one of them is the transport tax. Let's find out what BCC in the transport tax in 2017, for organizations, is indicated in payments.

These are primarily cars, motorcycles, buses and any other vehicles that are registered to this organization. These also include the following types of transport:

- Tractors and land tracked vehicles.

- Air vehicle.

- Motor ships, sailing craft, yachts

- Boats with motors and snowmobiles.

In a word, the object is air, water and ground vehicles that are registered to the company in the manner prescribed by law. There are some vehicles that are exempt from payment, these are -

- Rowing and motor boats with an engine power of less than five horsepower.

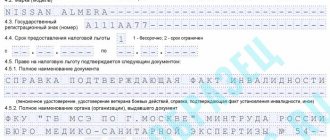

- Cars issued legally to persons with disabilities.

- Passenger cars with an engine power of less than one hundred horsepower, which were obtained through social authorities.

- Water transport, which is intended for fishing.

- All ships registered in the international registry.

- Air transport medical services

- Transport owned by federal authorities.

- Cars that have been stolen. This requires confirmation from law enforcement agencies.

- Companies or individual entrepreneurs that sell cars.

Organizations whose vehicles are subject to taxation are required to make payments in a timely manner, within certain deadlines established by law. As a rule, the tax period is set at one year, but this is for individuals. persons

- Federal Treasury account;

- KBK;

- name of the recipient's bank.

then the obligation to pay contributions is considered

Related publications

If penalties are due

All of the above-mentioned features of payments for penalties now also apply to the payment of penalties for insurance premiums (except for contributions for injuries), which have become payments to the tax office since 2020.

Learn about the procedure for processing payment orders for insurance premiums from this material.

However, these changes did not affect accident insurance contributions, and penalties for them, as well as these contributions themselves, are still paid to social insurance. When paying both contributions and penalties on them to the Social Insurance Fund, fields 106 “Basis of payment”, 107 “Tax period”, 108 “Document number” and 109 “Date of document” are entered as 0 (paragraphs

Why may a payment order not be executed?

General details

A payment order for the payment of transport tax to the budget is generated using the Payment order document in the Bank and cash desk section – Bank – Payment orders – Create button.

In this case, it is necessary to correctly indicate the type of transaction Tax payment, then the document form takes the form for payment of payments to the budget system of the Russian Federation.

You can also quickly generate a payment order using the Tax Payment Assistant:

- through the section Main – Tasks – List of tasks;

- through the section Bank and cash desk – Payment orders using the Pay button – Accrued taxes and contributions.

Please pay attention to filling out the fields:

- Tax – Transport tax of organizations, selected from the Taxes and Fees directory;

Transport tax of organizations is an element predefined in the Taxes and Fees directory. The following parameters are specified for it:

- corresponding KBK code;

- text template inserted into the Payment purpose field;

- tax account.

- Type of liability – Tax. The choice of the type of obligation affects the BCC, which will be indicated in the payment order;

- The order of payment is 5 Other payments (including taxes and contributions), filled in automatically, as for all tax payments to the budget paid on time (clause 2 of Article 855 of the Civil Code of the Russian Federation).

Since the recipient of the transport tax is the tax office with which the taxpayer is registered, it is its details that must be reflected in the Payment Order document.

- The recipient - the Federal Tax Service, to which the tax is paid, is selected from the Counterparties directory;

- Recipient's account – bank details of the tax authority specified in the Recipient field.

- The recipient's details are TIN, KPP and Recipient's name; these are the data that are used to print the payment order. If necessary, the recipient's details can be edited in the form that opens via the link.

The accountant needs to control the data that the program fills in using the link Payment details to the budget.

In this form, you need to check that the fields are filled in:

- KBK – 18210604011021000110 “Transport tax for organizations.” KBK is entered automatically from the Taxes and Contributions directory;

- OKTMO code is the code of the territory in which the Organization is registered. The value is filled in automatically from the Organization directory;

- Payer status - 01-taxpayer (payer of fees) - legal entity;

- UIN - because The UIN can only be specified from the information in tax notices or requests for payment of tax (penalties, fines);

- Basis of payment – TP payments of the current year, entered when paying tax on time;

- Tax period – GD-annual payment, since transport tax is paid for the tax period – year;

- The year is 2020, i.e. the year for which the tax is paid;

- Document number – , because the document on the basis of which the payment is made is a declaration, but it does not have the requisite Number;

- The document date is 02/01/2018, i.e. date of signing of the declaration.

Find out more about the details of payments to the budget in the article Payment order details.

- Purpose of payment – filled in automatically using a template from the Taxes and Contributions directory. The field can be edited if necessary.

Go to: At the birth of a child, how many days off is the father entitled

? In order to avoid unclear payments, it is very important to fill out the payment order correctly. Filling out a payment order is regulated by regulations, namely Regulation No. 383-P and Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107-N.

| Filling stage | Explanation |

| Payment order number, date | Indicate the serial number of the document, date in the format DD.MM.YYYY |

| Type of payment | “Urgent” – in this case, the transfer of funds will be carried out by means of urgent transfer. If the payment type remains blank, then such an order is classified as non-urgent using the appropriate means of transfer. |

| Status | It is necessary to indicate only when making a transfer in favor of the budget. Status codes are located in the previously mentioned Order No. 107-N. |

| Sum | Indicate the amount in words with a capital letter, while writing the words “rubles” and “kopecks” in full, but write the number of kopecks in numbers. Digital designation of the amount:

For example: seventeen thousand one hundred fifty rubles 17 kopecks (17150-17) |

| Payer |

|

| Recipient | See Payer, but the Recipient's details are entered |

| Type of operation | The payment is always coded 01 |

| Payment order | As a rule, stage 5 (tax deductions, insurance premiums, transfer of payments to counterparties) |

| Code | In the case of current payments, 0 is entered in the column. If the payment is made in accordance with the UIP, then its code specified in the document on the basis of which the payment order is generated is entered. |

| Purpose of payment | The number of the contract, invoice, etc. is indicated. If the payment is tax, then the cells located above the “Purpose of payment” cell are filled in in the following order: KBK; OKTMO; two-digit payment basis code; tax period (quarter, half-year, year, or simply indicate the date of tax payment): MS.03.2017, KV.01.2017, GD.00.2017, 03.20.2017; No. of the document on the basis of which the payment is made (in the case of tax payments, set to 0); the date of drawing up the document on the basis of which the payment is made (in the case of a tax payment, the date of signing the declaration is indicated); leave payment type blank. |

A payment order may not be executed for a number of reasons. So, in accordance with paragraph 4 of Art. 45 of the Tax Code of the Russian Federation, the obligation to pay tax is not considered fulfilled in the following cases:

- revocation by the person who submitted to the bank an order to transfer funds to the budget system of the Russian Federation to pay a tax, or the return by the bank to such person of an unexecuted order to transfer the corresponding funds to the budget system of the Russian Federation;

- revocation by the organization that opened the personal account, or return by the Federal Treasury (another authorized body that opens and maintains personal accounts) of the organization of an unexecuted order to transfer the corresponding funds to the budget system of the Russian Federation;

- return by the local administration, federal postal service organization or multifunctional center for the provision of state and municipal services to an individual of cash accepted for transfer to the budget system of the Russian Federation;

- incorrect indication by the taxpayer or other person who submitted to the bank an order to transfer funds to the budget system of the Russian Federation to pay the tax for the taxpayer, in the order to transfer the tax amount, the account number of the Federal Treasury and the name of the recipient's bank, which resulted in the non-transfer of this amount to the budget system of the Russian Federation Federation to the appropriate account of the Federal Treasury;

- there is not a sufficient balance of funds in the taxpayer’s personal account to satisfy the payment order requirement.

According to the Order of the Federal Tax Service dated July 25, 2020 No. ММВ-7-22/ [email protected] “On approval of the procedure for tax authorities to work with unclear payments”, the following payments will be classified as unclear payments:

- in the fields of payment documents in which information is not indicated or incorrectly indicated by the payer or credit institution when generating the EPD;

- which cannot be unambiguously determined for reflection in the information resources of the tax authorities.

Go General power of attorney for an apartment

Thus, if there is an error in the payment order or the payment itself is incorrect, this payment will be unclear and not subject to target accounting.

When filling out a payment order, you should be guided by:

- regulation No. 383-P;

- Order of the Ministry of Finance of Russia “On approval of the Rules for indicating information in the details of orders for the transfer of funds for payment of payments to the budgetary system of the Russian Federation” dated November 12, 2013 No. 107n - when drawing up payments for taxes, fees and contributions.

Let's present a short step-by-step instruction. In this case, we will focus on filling out the details of a paper order, although at present few people make payments simply on a form. As a rule, special accounting programs are used for this, and for electronic payments, software of the “Bank-Client” type is used.

Step 1. Indicate the number and date of the payment.

Payment orders are numbered in chronological order. The number must be non-zero and contain no more than 6 characters. The date in a paper document is given in the format DD.MM.YYYY. In an electronic order, the date is filled in in the format established by the bank.

Step 2. Specify the type of payment.

It can have the meaning “Urgent”, “Telegraph”, “Mail”. A different value or its absence is possible if such a filling procedure is established by the bank. In an electronic payment, the value is indicated in the form of a code established by the bank.

Step 3. Payer status.

It is indicated in field 101, but only for payments to the budget. The list of status codes is given in Appendix 5 to the order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n. The typical payer may find the following useful:

- 01 - taxpayer (payer of fees) - legal entity;

- 02 - tax agent;

- 06 - participant in foreign economic activity - legal entity;

- 08 - payer - a legal entity (individual entrepreneur) transferring funds for payment of insurance premiums and other payments to the budget system of the Russian Federation;

- 09 - taxpayer (payer of fees) - individual entrepreneur;

- 10 - taxpayer (payer of fees) - a notary engaged in private practice;

- 11 - taxpayer (payer of fees) - lawyer who established a law office;

- 12 - taxpayer (payer of fees) - head of a peasant (farm) enterprise;

- 13 - taxpayer (payer of fees) - another individual (bank client (account holder));

- 14 - taxpayer making payments to individuals;

- 16 - participant in foreign economic activity - an individual;

- 17 - participant in foreign economic activity - individual entrepreneur;

- 18 - a payer of customs duties who is not a declarant, who is obligated by the legislation of the Russian Federation to pay customs duties;

- 19 - organizations and their branches (hereinafter referred to as organizations) that have drawn up an order for the transfer of funds withheld from the wages (income) of a debtor - an individual to repay arrears in payments to the budget system of the Russian Federation on the basis of an executive document sent to the organization in in the prescribed manner;

- 21 - responsible participant in the consolidated group of taxpayers;

- 22 - participant of a consolidated group of taxpayers;

- 24 - payer - an individual who transfers funds to pay insurance premiums and other payments to the budget system of the Russian Federation;

- 25 - guarantor banks that have drawn up an order for the transfer of funds to the budget system of the Russian Federation upon the return of the amount of value added tax excessively received by the taxpayer (credited to him), in a declarative manner, as well as upon payment of excise taxes calculated on transactions of sale of excisable goods for limits of the territory of the Russian Federation, and excise taxes on alcohol and (or) excisable alcohol-containing products;

- 26 - founders (participants) of the debtor, owners of the property of the debtor - a unitary enterprise or third parties who have drawn up an order for the transfer of funds to repay claims against the debtor for the payment of mandatory payments included in the register of creditors' claims, during the procedures applied in a bankruptcy case;

- 27 - credit organizations or their branches that have drawn up an order for the transfer of funds transferred from the budget system of the Russian Federation, not credited to the recipient and subject to return to the budget system of the Russian Federation;

- 28 - participant in foreign economic activity - recipient of international mail.

Go to Dismissal under a civil contract

General rules

All taxpayers, including budgetary and non-profit organizations, are required to pay a special road tax for each vehicle.

Moreover, not only cars, but also water, air and other types of vehicles are accepted for registration. The general list and characteristics of taxable objects are enshrined in Art. 358 Tax Code of the Russian Federation. It is worth noting that the obligation to pay the budget remains, even if the car is not used. For example, a car is broken and requires major repairs. You will still have to pay for it until the car is deregistered by the traffic police.

Payment (transport tax 2020) for legal entities is drawn up once a year, unless otherwise established by regional authorities. Let us immediately make a reservation that the frequency of toll payments is established by the legislative authorities of the region. If reporting periods and mandatory advance payments are approved in a constituent entity of the Russian Federation, then funds will have to be transferred to the budget quarterly. A ready-made sample payment slip for transport tax 2020 based on advance calculations is presented below.

Let us note that Russian President Vladimir Putin proposed abolishing the toll. Read about what will change this year in relation to transport fees in the article “Will the transport tax be abolished in 2020”.

What should you pay attention to when preparing a payment order?

When filling out a payment document, special attention should be paid to:

Payment type and BCC.

The BCC for payment of TN, penalties or fines on it are different. KBK for legal entities persons in 2020, see the table:

| Amount of payment | 18210604011021000110 |

| Penalty | 18210604011022100110 |

| Fines | 18210604011023000110 |

TN is paid at the location of the vehicles. For land vehicles, payment should be sent to the details of the Federal Tax Service, which services the area of legal registration. faces. If you fill out the receipt manually, you can find out the details of the desired tax office using the service on the Federal Tax Service website, where you need to enter your address to search.

Please indicate the tax payment period correctly. The finished receipt, which was obtained in our example, is intended for a one-time payment of TN. If you are going to make an advance, instead of line GD.00.2020 you should indicate:

for 1st quarter

for 2nd quarter

for 3rd quarter

In the line “Payment order” for tax payments, we always put “5”.

Remember that when paying auto tax and advances on it, you must adhere to certain deadlines. Find out until what date legal entities. persons are required to pay TN in your region, you can click here.

What is a payment order?

A payment order is a document in a prescribed form that regulates the account holder’s instructions to make non-cash transfers in favor of the recipient of funds.

The instruction has been sent to the bank that maintains the payer’s account. Funds are transferred from a deposit account. If for some reason the account does not have the required amount of money, but the agreement between the bank and the payer provides for an overdraft, the transfer will be carried out.

Individuals can also process payment orders without opening a bank account. In this case, an order to the bank from an individual can be drawn up in the form of an application, in which the following information must be indicated:

- payer details;

- details of the recipient of funds;

- bank details of the payer and recipient;

- amount of money;

- purpose or purpose of payment;

- other information established by the bank.

Based on the order, the bank employee generates a payment order.

When drawing up an order to the bank electronically, it is very important to correctly indicate the payer, recipient of the transfer, amount, and purpose of payment.