Vehicles for which tax relief can be issued

The issue of providing benefits for the payment of transport tax is regulated by the Tax Code of the Russian Federation. For this purpose, certain categories of citizens are allocated subsidies from the federal and regional budgets.

Federal benefits are available to owners of the following types of vehicles:

- rowing boats;

- passenger cars equipped for disabled people;

- vessels used for fishing;

- ships transporting goods and people by sea and river (usually their owners are private or small state-owned companies that engage in transportation);

- agricultural machinery;

- transport that is used for operational, military or similar work;

- air transport belonging to medical and sanitary institutions.

About transport tax benefits from the point of view of legislation

The Tax Code specifies all the main norms for transport tax. But each region has the right to independently identify categories of citizens who are entitled to benefits and may be exempt from paying taxes.

As mentioned above, each region sets its own transport tax benefits, since this tax is regional in nature. Therefore, you should ask your local tax authorities about possible benefits.

On the website of the tax service (nalog.ru) you can find out on the basis of which regulations the payment of transport tax is regulated. To use this service, you must select the region, tax name and tax payment period on the website. The system will show the name of the regulatory act or law that contains information about the provision of benefits for this tax.

It is worth knowing that documents for a tax deduction must be submitted within three years from the moment the right to it arises. Any amounts that were paid in excess may be transferred to another tax account or may be refunded.

To get a refund of the excess amount paid, you must submit an application to the tax authorities at your place of registration. This application can be submitted within three years from the date of payment. The application will be reviewed within 10 days from the date of submission. If a positive decision is made, the refund will be made within 30 days to the payer’s account.

The benefit is not transferred by proxy, since it is personal. That is, if one family member is a beneficiary, and the car is registered to another person, then the benefit is not provided in this case.

Categories of persons entitled to benefits

List of persons who are granted transport tax benefits in 2020 at the federal level:

- participants in hostilities during the Second World War;

- heroes of the USSR and Russia;

- persons awarded Orders of Glory 1-3 degrees;

- disabled people and WWII veterans;

- disabled people and military pensioners who took part in hostilities in other periods (including participants in hostilities in Chechnya);

- legal guardians, trustees, adoptive parents or one of the natural parents of a disabled child;

- disabled people of group 2;

- owners of vehicles with an engine capacity of up to 70 liters. With.;

- one of the adoptive parents or parents in a large family;

- people who transport a disabled person in his car;

- liquidators of the consequences of man-made accidents - at the Chernobyl nuclear power plant, Mayak PA, as well as those exposed to radiation during testing of military, space equipment, and nuclear weapons.

Transport tax benefits for pensioners are not valid throughout Russia. In some regions, the subsidy has been significantly reduced, and in others it has been completely eliminated.

Video: Who has benefits when paying transport tax?

Regional benefits

The maximum tax amount and the composition of payers are set by the State Duma, and regional authorities have the right to introduce additional benefits and determine subsidy rates locally. Therefore, in two neighboring regions, the amount of fees may differ significantly.

Preferences that apply to a certain category of car owners in one part of the country do not necessarily apply in another.

You can find out about benefits on the tax office website in the “Electronic Services” section . To obtain information, you need to select the name of the tax, the region of interest and the tax period.

In response to the request, the service will provide information about the law, which contains information about benefits.

Tax benefits for large families

All benefits for large families (MCF) are established by regional authorities. At the federal level, they are entitled to only a very limited list of benefits, in terms of pensions or labor legislation. Benefits are available to only one parent, and only one car is exempt from taxation (with rare exceptions).

However, benefits are not available for every vehicle. The main criterion is its power, expressed in horsepower. Transport tax is usually not paid only for low-power cars, no more than 100-200 horsepower. But it depends on the region. For example, in the Moscow region, MDS can issue a tax incentive for a car with an engine power of up to 250 horsepower.

If a large family has more than one car that meets the criteria for receiving the benefit, the parents must themselves choose one vehicle to which it will apply. In this case, it is best to choose a more expensive and powerful car, as this will reduce the tax amount as much as possible.

The amount of transport tax in the city of Moscow 2020, as well as in other regions of Russia, for large families and all individuals is determined by the tax authorities themselves. And the tax must be paid before December 1 of the year following the previous tax period equal to the calendar year. Simply put, the transport tax for 2020 must be paid by December 1, 2020.

The transport tax depends not only on the power of the car and the tax rate adopted in the region, but also on increasing coefficients (for cars costing more than 3 million rubles), as well as on the period of actual use of the car in the previous tax year.

Who is completely exempt from transport tax?

Some citizens are not charged transport tax at all . According to Art. 358 of the Tax Code of the Russian Federation, these include owners of the following vehicles:

- low-power (up to 5 hp) and rowing boats;

- passenger cars converted for the needs of disabled people;

- machines with a power of no more than 100 hp. pp. received from social services;

- fishing vessels;

- drilling rigs, floating and fixed platforms;

- passenger ships owned by individual entrepreneurs (tax is not levied on an individual entrepreneur if passenger transportation is his main activity);

- ships that are registered in international registries;

- combines, tractors, special equipment used in agriculture;

- aircraft and helicopters of sanitary and medical services;

- cars that are reported stolen.

Also, transport tax, as a rule, is not levied on veterans' organizations that own a car used only for work purposes.

Disabled people using vehicles with a capacity of up to 100 horsepower are completely exempt from paying it With. , single parent in a large family, liquidators of the Chernobyl accident, spouses of military personnel who died in service, heroes of the USSR and socialist labor.

How is transport tax calculated for pensioners in Moscow?

The tax is calculated by multiplying the vehicle power indicator with a fixed tax rate for a specific type of transport. The liability is calculated only for the period of actual ownership of the property.

Example 1

A pensioner registered in Moscow owns a passenger car with a capacity of 120 hp. On July 22, 2020, the vehicle was sold and re-registered to a new owner. The tax in this case will be calculated and payable in 2020, and the annual amount of the liability will be divided between the owners in proportion to the periods of ownership of the taxable car.

Transport tax for pensioners in Moscow 2020 is calculated at the rates indicated in Art. 2 of Law No. 33. Applicable to passenger cars with a power range from 100 to 125 hp. a tariff of 25 rubles applies.

If a pensioner owned a car for a whole year, he would have to pay a tax of 3,000 rubles to the budget. (120 hp x 25 rub.). But the citizen sold the vehicle at the end of July, so his tax liability will be calculated for the period from January to July inclusive - July is included in the billing period as a full month, since the vehicle was deregistered after the 15th (clause 3 of Article 362 of the Tax Code RF).

The amount of a pensioner’s tax liability at the end of 2020 will be 1,750 rubles. (120 hp x 25 rubles x 7 months of ownership / 12 months of tax period).

Benefits for disabled people

The federal law establishes transport tax benefits for disabled people of group 2 . This is done to facilitate the movement of such persons.

You can take advantage of the preferences if two conditions are met: the car was purchased with funds from the guardianship authority, and its owner has a disabled person’s certificate.

Organizations and associations of disabled people who use transport for their work enjoy special benefits. They also apply to persons who became disabled after participating in the liquidation of the Chernobyl accident.

Benefits also apply to disabled people of group 1, but disabled people of group 3 cannot take advantage of them . This category of citizens needs social protection, since due to illness people are limited in a certain area of life activity.

Nevertheless, a person can take care of himself independently, albeit with the help of auxiliary means, and is legally capable. Therefore, there are no grounds for assigning benefits.

For large families

Federal law provides transport tax benefits for large families . The decision on their provision is made by the authorities of a particular region.

The status of a large family is assigned to a family with more than three children under 18 years of age (or 23 years of age if they are full-time students).

Only one parent can apply for social support.

He can independently choose a vehicle that is eligible for benefits.

This can be a passenger car with a power of up to 150 hp. s., motorcycle, scooter.

If a parent with many children is raising 3 or more children alone, he is usually completely exempt from paying transport tax.

Benefits for pensioners when paying transport tax

Whether older people are exempt from paying vehicle tax is determined by tax law. Unfortunately no. They also pay a set amount, but the government provides for subsidies for this category of citizens.

The law does not establish what exact amount each pensioner is entitled to. This is determined individually by the subjects of the state.

What benefits can be provided to pensioners:

- paying a little tax for the vehicle;

- reducing the amount of payments for domestic cars;

- Tax discounts depending on technical specifications.

Registering a car in the name of a pensioner is an indispensable condition for receiving transport tax benefits on a car.

Providing benefits by region for pensioners

Car tax for pensioners is required to be paid. But using the example of legislation in different regions, one can see that the amount of benefits for this category of people is ambiguous.

Table of benefits for transport tax by region for older people

| Region | Benefits provided | Kind of transport |

| Moscow | 100% | Ground vehicle up to 200 l/s |

| Metropolitan area | 50% – to combat veterans 100% – to WWII veterans | Light vehicle up to 150 l/s or bike up to 50 l/s |

| Saint Petersburg | 100% | Vehicles older than 15 years or with a power of up to 150 l/s |

| Leningrad region | 100% | Passenger vehicles up to 150 l/s |

| Rostov region | 100% | Vehicles up to 150 l/s |

| Voronezh region | 100% | By car up to 200 l/s |

| Novosibirsk region | 100% | Vehicle up to 150 l/s and bike |

| Orenburg region | 50% only for combatants | For 1 vehicle, power is not limited |

For example, in the Vladimir region, citizens who have retired are given an 80% discount on the tax for vehicles up to 150 horsepower. Half of the funds are paid for trucks and large equipment up to 85 horsepower. Combat veterans, heroes of the USSR and the Russian Federation, victims of the accident at the Chernobyl nuclear power plant do not need to pay road tax.

And in the Krasnodar Territory from a citizen ( a person belonging to the permanent population of a given state, enjoying its protection and endowed with a set of political and other rights and obligations. Also a form of oral and written

) In retirement, tax on vehicles up to 100 revolutions of torque is not levied. But if you purchase another vehicle, you will have to pay the full cost of the tax established by the state.

A citizen can find out whether a pensioner is entitled to benefits in a certain region by contacting the branch of the Federal Tax Service. Thus, these examples demonstrate that the provision of mandatory benefits for pensioners in different regions of the country is diverse. Therefore, before claiming preferences, you need to familiarize yourself with the current Tax Code.

Example of transport tax calculation

To simply find out how much you need to pay, you can use the mandatory fee calculator.

Data you need to know to carry out calculations:

- engine power;

- the current tax rate;

- car cost coefficient;

- tax cost calculation period.

You can then perform calculations with this data and find out the tax amount.

Example of calculations: A citizen of K., who is a pensioner ( regular (monthly or weekly) cash payments to persons who: have reached retirement age (old-age pension), are disabled, have lost their breadwinner. Depending on the organization,

) at the age of 70, purchased a Lada car with a capacity of 90 horsepower. The tax rate for the area in which the citizen lives is 17. The following steps should be performed: 90 * 17 = 1460 rubles. The citizen will pay half - 730 rubles.

For combat veterans

Transport tax benefits for combat veterans have certain restrictions.

So, in Moscow there is a complete exemption from paying it, but only for one vehicle.

In most cases, only old cars manufactured before 1991 and whose power does not exceed 200 hp are eligible for social support. With.

Benefits for military service veterans also apply to low-power swimming equipment.

Their widows can also benefit from subsidies if they have not remarried.

For Chernobyl survivors

Now in most regions of Russia, Chernobyl victims do not have to pay transport tax.

This category of persons includes not only liquidators of the consequences of the accident and people whose health was seriously damaged due to their stay in the contaminated area. The law also includes persons who worked in the exclusion zone after the liquidation of the accident.

Not all Chernobyl victims receive such tax preferences . In Belgorod, Ryazan and some other regions there are no concessions for them. In Karelia, Chernobyl victims must pay 50% of the vehicle tax.

To apply for a benefit, a person must provide the tax office with a passport and a document confirming the purpose of the benefit. It is provided only on one basis chosen by a person.

You can submit documents within 3 years from the date of acquiring the right to the benefit. The entire amount of the overpayment can be used to pay off future payments or returned upon written request.

The procedure for obtaining tax benefits for transport tax

If a person begins to belong to a category that receives benefits for transport tax, this does not mean that from that moment the tax authorities will stop calculating the tax or will charge it with a discount provided. Before you start using the benefit, you must declare to the tax service that the taxpayer is entitled to it.

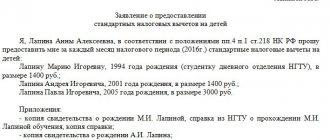

First, you need to write an application for a transport tax benefit.

After this, it is necessary to prepare the necessary package of documents that will confirm the existence of the right not to pay tax on transport. The required documents depend entirely on the basis on which the benefit will be provided. In other words, a pensioner will need to provide a pension certificate, a disabled person must bring an ITU certificate, a labor veteran must provide a labor veteran’s certificate or an order book.

In some cases, they may additionally require photocopies of transport documents - this is a vehicle title and a registration certificate. To clarify the required package of documents, the applicant will need to contact the tax authorities at the place of registration.

After this, the documents must be sent to the tax office at the place of registration.

The application can be sent in several ways: in person, through a legal representative or via registered mail with notification.

To clarify the correct address of the tax authorities to which documents will be sent, you can go to the official website of the tax authorities. After that, enter your residential address in the special search bar and click on the “Next” button. The necessary details of the tax authorities will appear on the next page.

Please note that the details provided will also show the name and number of the tax authorities. This information will be needed when the applicant applies for a transport tax benefit.

To obtain an application form, the applicant can contact the tax authorities and obtain it from them or download it from the official website of the tax service.

In order to fill out an application for a transport tax benefit, you must provide the following information:

- Indicate the number and name of the tax authorities to which the application is being submitted.

- A check mark is placed under the “Transport tax” column.

- In the “Based on” column, you must indicate the details of the document confirming the right to the benefit, that is, the name, series and number.

- Then information about the car for which the benefit is issued is indicated, that is, the make, state number and VIN code of the car.

- To fill out the “Taxpayer Data” block, you must use large block letters, and each letter must be indicated in a separate box.

- Then the period for which the benefit will be provided is selected, that is, a certain period or indefinitely.

- The “Accuracy and completeness of information” block is filled out only if the documents are submitted by a legal representative; when submitting documents in person, it is not required to be filled out.

- Also, the information is not indicated in the block “To be completed by a tax authority employee.”

- Finally, the application must include a signature and the date of submission of documents.

At this point, filling out the application is completed. Now you need to attach photocopies of the necessary documents and send them to the tax authorities. It is worth knowing that until the applicant submits documents for registration of the benefit, he will have to pay transport tax on a general basis.