The concept of “accounting form”, characteristics and types

Keeping accounting records in any organization involves recording business processes in books, journals, cards of various kinds, with data entered into them in various sequences.

In the process, a certain form of accounting is formed at the enterprise. An accounting form is a process of systematically recording information in the accounting registers of analytical and synthetic accounting in a certain sequence, using specific methods of entering data.

The forms of accounting that currently exist differ from each other in the set of accounting registers and the connections that exist between them.

The characteristic features of all forms are:

- reflection of accounting information using the double entry method;

- the need to confirm data with primary documents;

- be guided by the chart of accounts approved by the Ministry of Finance of the Russian Federation.

Each organization has the right to decide for itself what form of accounting to use, unless otherwise specified by law. Within one organization, one form of accounting can be used, which must be enshrined in the accounting policy of the enterprise.

The features that determine the form of accounting are:

- size and structure of the enterprise;

- used accounting registers and connections between them;

- automation of accounting processes;

- sequence of data entry.

The following forms of accounting are distinguished:

- Simplified form of accounting Simple form of accounting

- Form of accounting using accounting registers

A well-chosen form is one of the conditions for effective accounting at an enterprise. It provides a rational reflection of information and allows you to systematize it for the purposes of the organization.

https://youtu.be/UhUvUL3e_xE

How to put innovations into practice

Please note: the new opportunities provided by the commented order of the Russian Ministry of Finance are not mandatory. In other words, a company using simplified accounting methods has the right to refuse the changes and continue to account for fixed assets, inventories, intangible assets and R&D expenses as before.

If an organization decides to take advantage of innovations, it will have to decide at what point to begin using them. The easiest way to do this is from next year by enshrining new rules in the accounting policy for 2020. But there is another option - to make appropriate changes to the accounting policy approved for 2016. This will not be a violation, since the choice of a new method of accounting is the basis for adjusting the accounting policy (Clause 2, Part 6, Article 8 of the Accounting Law).

Please note that the new provisions can only be applied to expenses incurred after changing the accounting policy. Objects placed on the balance sheet earlier will be accounted for according to the “old” rules.

Simplified form of accounting

This form of accounting is recommended by Order of the Ministry of Finance of the Russian Federation dated December 21, 1998 N 64n “On Standard Recommendations for the Organization of Accounting for Small Businesses” for enterprises with a simple production process and a small number of accounting operations. Accounting for funds and sources of education is carried out in accounting registers for main accounts. At the same time, based on the approved Chart of Accounts, the enterprise draws up a working chart of accounts.

There are two forms of accounting: a simple form and a form of accounting using accounting registers.

Simple form of accounting

Small enterprises with no more than thirty business transactions per month can keep records using only the Business Activity Fact Book. It acts as a register of synthetic and analytical accounting. In addition, on the basis of it, it is possible to determine the availability of property and sources of education on a certain date and draw up financial statements. The book is maintained monthly in the context of accounts approved by the enterprise in the working chart of accounts.

In addition to the ledger, the company must maintain a payroll record sheet, which contains payments to personnel for wages, as well as calculations for personal income tax.

Scheme of a simple accounting form

Form of accounting using accounting registers

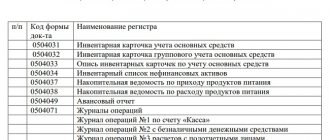

A small enterprise can use the following accounting registers to record financial and economic transactions:

- Statement of accounting of fixed assets, accrued depreciation charges - Form N B-1;

- Statement of accounting for inventories and goods, as well as VAT paid on valuables - form N B-2;

- Production cost accounting sheet - form N B-3;

- Statement of accounting of cash and funds - form N B-4;

- Statement of accounting of settlements and other transactions - form N B-5;

- Sales accounting sheet - form N B-6 (payment);

- Statement of accounting of settlements and other operations - form N B-6 (shipment);

- Statement of settlements with suppliers - form N B-7;

- Payroll record sheet - form N B-8;

- Sheet (chess) - form N B-9.

Each statement is kept about one of the accounting accounts. The amount of the business transaction is recorded simultaneously in two statements. Records are kept reflecting the opening and closing balances, as well as turnover for the period.

Scheme of the accounting form using accounting registers

Fund balances on individual statements must be verified with the data of the primary documents, the results on the statements are summarized in a checkerboard statement in form No. B-9, then a turnover sheet and balance sheet are drawn up.

Changes in fixed asset accounting

A significant addition has been made to PBU 6/01 “Accounting for Fixed Assets” regarding the determination of the initial cost of fixed assets. As a general rule, the initial cost of a fixed asset is the totality of the actual costs of its acquisition, construction and production. This includes the purchase price and the amount paid to bring the property into a usable condition. In addition, the initial cost includes the delivery price, customs duties, amounts paid to intermediaries, and some other costs (clause 8 of PBU 6/01).

Thanks to the commented amendments, organizations using simplified accounting methods have an alternative opportunity. They received the right to determine the initial cost of the operating system in a different way.

For items purchased for a fee, the initial cost may be the supplier's price plus installation costs (if these are not included in the price). For constructed and manufactured objects, the initial cost may be the amount paid under a contract or other agreements concluded for the purpose of acquiring, manufacturing or constructing a fixed asset. All other expenses (for example, customs duties or intermediary fees) can be written off as current costs for ordinary activities. This is enshrined in the newly created clause 8.1 of PBU 6/01.

There are also changes regarding depreciation. In general, depreciation deductions must be made monthly in the amount of 1/12 of the annual depreciation amount. But with a simplified accounting method, it is allowed to depreciate fixed assets differently: either once a year as of December 31, or regularly throughout the year for periods established by the organization itself. Thus, the company has the right to depreciate fixed assets as often as it sees fit: once a year, once every six months, once a quarter or more often. This follows from the new edition of paragraph 19 of PBU 6/01.

Memorial order form of registration

The appearance of the memorial-order form of accounting dates back to 1928-1930. Its basis is the separation of systematic and chronological records. Data from primary documents are reflected in memorial orders, which in turn are registered in chronological order in the registration journal and systematic entries are made in the general ledger.

Homogeneous primary documents are entered in chronological order into the accumulative sheet, then, on the basis of such statements, memorial orders are drawn up, reflecting amounts and transactions. Memorial orders are drawn up a month in advance and are maintained, depending on the size of the organization, by the chief accountant or accountant. The list of orders is approved by the head of the organization for the reporting year.

Synthetic accounting in this form is kept in the general ledger, analytical accounting in rolls or books.

The general ledger, also called the control sheet, is the basis for drawing up the turnover sheet. It is compiled divided into debit and credit transactions.

There is an option for using this form in small enterprises, it is simpler and instead of memorial orders, a statement is drawn up for each type of accounting: a statement of wages, fixed assets, etc. On their basis, a checkerboard and then a revolving statement are compiled.

A diagram of the memorial order form is presented below. The dotted lines indicate the reconciliation of account totals.

The Italian methodology taken as the basis for this form has the following advantages:

- maintaining the consistency of accounting for business transactions;

- reflection of a large volume of operational information allows you to obtain detailed information in the context of analytics, using standard register forms;

- the ability to delegate operational work to less qualified employees;

- accessibility and ease of use of accounting equipment.

However, there are also significant disadvantages:

- this form is designed to a greater extent for manual labor, and therefore is poorly suited to automation;

- duplication of accounts makes this form of accounting labor-intensive, the number of errors increases, the search for which also takes a lot of time;

- the lack of cross-maintenance of analytical and synthetic accounting does not allow for the control function;

- low information content; additional sampling is required to conduct a detailed analysis.

To summarize, we can say that in modern realities this form is more acceptable in small enterprises with low turnover.

Simplified accounting for small businesses

Let's start with the fact that all organizations must maintain accounting; this obligation has nothing to do with what tax regime they apply. The simplified accounting option can only be used by those legal entities that meet the parameters of a small business. We have already written about the criteria by which business representatives are classified into small, medium and large enterprises.

Let us remind you of some changes, namely: from July 2020, the maximum revenue for each group was increased exactly 2 times, and in 2020 the concept of “revenue” was replaced by the concept of “income from business activities.” Also read about the criteria for small and medium-sized businesses.

Therefore, it still makes sense for small legal entities to analyze the performance indicators of their company and determine what type of business it belongs to. With the increase in revenue limits for small firms from 400 to 800 million rubles, your organization may well fall into this group.

The ability to conduct a simplified version of accounting is reserved for small businesses by the Law “On Accounting” No. 402-FZ of December 6, 2011 and other legislative norms approving amendments to it. The law does not contain descriptions of specific points that small organizations can take advantage of. To understand what small businesses may not do, you should study other regulations governing accounting.

First, it should be noted that small businesses may not apply a number of PBUs or some of their provisions. For example, small businesses (SMB) may not apply standards such as PBU 18/02 (on income tax) and PBU 8/2010 (on contingent assets/liabilities, estimated liabilities). SMP has the right to write off interest on loans as other income, regardless of the item of expenditure; other representatives of the business, according to PBU 15/2008 (on loan costs), must separately take into account loan funds spent on the acquisition of investment assets.

For SMP, in accordance with PBU 22/2010 (on detection and correction of errors), it is allowed to correct all detected errors in the current period, and it does not matter what the nature of the error is - whether it is significant or not. There is also no need for retrospective recalculation of indicators.

What does simplified accounting itself mean? SMP can not apply all the accounts of the existing chart of accounts - in other words, enlarge some accounts, discarding the extra ones. The simplest example: for those involved in production, cost accounting can be kept on account 20, and, if necessary, subaccounts can be provided for it - if for the purposes of company management it makes sense to obtain more detailed information. The remaining accounts of this group - 23, 25, 26, 28 and 29 - are simply superfluous for the SMP, so they can be removed. Similarly, you can revise the accounting accounts used to record other transactions.

Journal-order form of accounting

It appeared as a result of the transformation of the memorial-order form of accounting, and it received its name from the main accounting register - the order journal.

In the journal-order form of accounting, two accounting registers are usually used:

- journal-order;

- auxiliary (cumulative) statement.

A journal order is an accounting register in which chronological records are made in the context of synthetic and analytical accounting. Data is entered as primary documents are received on a credit basis (for example, order journal No. 1 for account 50; order journal No. 2 for account 51 “Current accounts”).

An auxiliary (cumulative) statement is a register, the functional purpose of which is to systematize the data of primary documents on a debit basis (for example, statement 1 for the debit of account 50 “Cash”).

All order journals are opened for a month separately for each synthetic account or several interconnected accounts, and each of them has its own permanent number. The results of the order journals are transferred monthly to the general ledger, which is maintained throughout the year.

The general ledger is an accounting register reflecting the opening and closing balances on synthetic accounts and turnover during the reporting year.

Below is a diagram of the journal-order form of accounting. The dotted lines indicate the reconciliation of account totals.

The advantages of this form of accounting are:

- there is a basis for the division of labor between accounting workers;

- the reporting process is less labor-intensive;

- the connection between synthetic and analytical accounting is more significant.

The disadvantages of this form of accounting are identified as follows:

- difficulty in constructing order journals;

- significant manual labor costs.

The journal-order form of accounting is currently the most common and effective for use in practice. It is this that is most often used as the basis for creating accounting automation software products.

Changes in accounting for intangible assets and R&D

According to PBU 14/2007 “Accounting for intangible assets,” intangible assets should include objects that do not have a tangible form and that satisfy a number of conditions. Thus, the object must have the ability to bring economic benefits in the future, and its useful life must exceed 12 months. Another condition is the ability to isolate (or separate) the object from other assets and reliably determine its actual value. The full list of conditions is given in paragraph 3 of PBU 14/2007.

But for organizations that use simplified accounting methods, special rules have been established. Even if the object fully meets all the criteria for intangible assets, the costs of its acquisition or creation can be immediately written off as current expenses for ordinary activities. This is stated in the newly created paragraph 3.1 of PBU 14/2007.

PBU 17/02 “Accounting for expenses for research, development and technological work” has also undergone changes. As a general rule, R&D costs should be written off evenly throughout the year in the amount of 1/12 of the annual amount. Whereas with simplified accounting, it became possible to write off these expenses immediately as they arise (new edition of clause 14 of PBU 17/02).

Automated form of accounting

One of the most promising areas of modern development of accounting is the increasing introduction of an automated form - the use of computers in accounting work.

The key basis of this form of accounting is a concept built on complex automation: from primary documents to reporting. Information of a reference nature is entered once at the beginning of work (a directory of nomenclature groups, etc.), current information is entered once as primary documents are received/generated and then used repeatedly. An accounting register is any document containing a chronological and systematic record.

The features of this form are:

- automation of the accounting process (collection, processing, transmission of information);

- reduction of labor intensity (one-time data entry, with repeated use);

- grouping turnover by accounts using double entry;

- automatic generation of accounting registers at the output;

- the ability to detail data at the request of users.

Currently, there is a wide range of computer programs used to solve specific user problems. However, software products based on 1C have taken accounting automation to a completely new level.

Magazine-Home

Used in small business organizations. All entries are separated from orders and recorded in the journal. It contains simplified memorial orders. This system combines chronological and systematic records. Transactions are recorded using correspondence accounts from primary documents or memorial orders. Data from primary documents is included in auxiliary registers or recorded in the Main Journal with postings and posting to accounts. All information related to the cash register is recorded in the cash book.

The advantages of this method are ease of use and clarity of records. Disadvantage: cumbersome.

New rules for simplified accounting

Order of the Ministry of Finance of Russia dated May 16, 2016 No. 64n “On amendments to regulatory legal acts on accounting” amended PBU 5/01 “Accounting for inventories”, 6/01 “Accounting for fixed assets”, 17/02 “Accounting expenses for research, development and technological work”, 14/2007 “Accounting for intangible assets”.

The new rules for simplified accounting are addressed to organizations that are allowed to use simplified accounting methods and submit simplified reporting.

Now such organizations are allowed to:

1) acquired inventories should be assessed at the supplier’s price, other costs directly related to the acquisition of inventories should be included in expenses for ordinary activities in full in the period in which they were incurred;

2) expenses for the acquisition of inventories, the cost of raw materials, supplies, goods, other costs for production and preparation for sale of products and goods can be recognized as expenses for ordinary activities in the full amount as they are acquired (implemented);

3) expenses for the acquisition of inventories intended for management needs are recognized as expenses for ordinary activities in the full amount as they are acquired (implemented);

4) micro-enterprises - recognize the cost of raw materials, materials, goods, other costs for production and preparation for sale of products and goods as expenses for ordinary activities in the full amount as they are acquired (implemented);

5) if the organization does not belong to micro-enterprises, recognize these costs as expenses for ordinary activities in full, provided that the nature of the activities of such an organization does not imply the presence of significant balances of inventories. At the same time, such balances are considered significant, information about the presence of which in the financial statements can influence the decisions of users of the organization’s financial statements;

6) do not create reserves for a decrease in the value of material assets - do not apply paragraph 25 of PBU 5/01. That is, the remains of raw materials, materials, fuel, work in progress, finished products, goods and other similar assets can be reflected in the statements at the cost determined in the accounting accounts, regardless of the obsolescence of these objects, their loss of their original quality, changes in their current market cost, selling price;

7) determine the initial cost of fixed assets when purchasing them for a fee - at the price of the supplier (seller) and installation costs (if there are such costs and if they are not included in the price), and for the construction (manufacturing) of fixed assets - in the amount paid for construction contracts;

do not include in the initial cost of fixed assets, but take into account in the period in which the following were incurred:

do not include in the initial cost of fixed assets, but take into account in the period in which the following were incurred:

- costs for delivering the object and bringing it into a condition suitable for use;

- expenses for information support associated with the acquisition of the OS;

- customs duties and fees, non-refundable taxes and state duties paid in connection with the acquisition of an asset;

- remuneration of an intermediary organization if an asset is acquired through it;

- other expenses that are directly related to the acquisition, construction or production of fixed assets;

9) accrue the annual amount of depreciation at a time as of December 31 of the reporting year, or periodically during the reporting year for periods determined by the organization, and not monthly;

10) charge depreciation of production and business equipment at a time in the amount of the initial cost of objects of such assets when they are accepted for accounting;

11) write off R&D expenses as expenses for ordinary activities in full as they are implemented;

12) recognize expenses for the acquisition (creation) of objects that are subject to acceptance for accounting as intangible assets as expenses for ordinary activities in the full amount as they are incurred.

Order of the Ministry of Finance of Russia dated May 16, 2016 No. 64n (hereinafter referred to as Order No. 64n) came into force on June 20, 2020.

note

To maintain accounting records, small businesses can reduce the chart of accounts approved by Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n. This is stated in paragraph 3 of Information of the Ministry of Finance of Russia No. PZ 3/2015.

The decision to apply simplified accounting methods provided for by Order No. 64n is made by the organization independently. Order No. 64n does not introduce any mandatory requirements for the use of such simplified methods (information letter of the Ministry of Finance of Russia dated June 24, 2016 No. IS-accounting-3).

When making a decision to start using a simplified method of accounting (from among those provided for by Order No. 64n), one should proceed from the fact that, in accordance with Part 7 of Article 8 of the Federal Law “On Accounting”, in order to ensure comparability of financial statements for a number of years, changes in accounting policy is made from the beginning of the reporting year, unless otherwise determined by the reason for such a change. In this regard, the organization has the right to decide to apply each of the simplified methods of accounting provided for by Order No. 64n in relation to financial statements both for 2016 and for any subsequent year.

Let us recall that entities that have the right to maintain simplified accounting (including simplified accounting (financial) statements) have the right to reflect changes in accounting policies prospectively, that is, without reflecting adjustments to financial reporting indicators for previous periods (clause 15.1 of PBU 1/2008 “Accounting Policies” organizations”, approved by order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n).

The information letter of the Ministry of Finance of Russia dated June 24, 2016 No. IS-accounting-3 explains what entries should be made when using new simplified accounting methods. Let's take a closer look at them.

Where to display all the information

For some small enterprises, it will be enough to keep only a book of records of economic activity facts - this is the simplest option, suitable in cases where the company has very few operations. If there are many transactions or if the company’s activities involve significant costs of material resources, then the Book should additionally provide special accounting registers for each group of property. When conducting accounting, SMP representatives should always remember two points:

- Accounting must be carried out to the extent that will allow for the display of account balances and the preparation of financial statements, plus provide management with the necessary amount of information.

- Any SMP facility can grow into a larger organization - life does not stand still, and the goal of any business is to expand its activities and increase profits. To avoid difficulties in the future with the preparation of real financial statements and ensuring the comparability of current indicators with the figures of previous periods, you cannot start accounting - it should be carried out efficiently.

For SMEs, there is another important point in the possibility of conducting simplified accounting: such legal entities can use the cash method, that is, recognize income / expenses upon payment. What's the advantage here? This is very convenient for those who use simplified. In this case, SMP will use the same method for both accounting and calculating the amount of tax.

SMPs can generate reporting accounting forms both according to standard rules (balance sheet + all appendices + explanations to it), and according to “simplified” ones - provide only two forms - balance sheet and financial performance statement. When choosing the last of the two options, the values of indicators in the tables of reporting forms are allowed to be shown enlarged, and applications can be filled out only when, in your opinion, they are very significant. Explanations are not required - they are also required only in exceptional cases when you have something to explain.

There are special simplified reporting forms for SMEs: special forms are provided for the balance sheet and profit and loss account. Their difference from standard forms is expressed in the fact that the indicators in them are enlarged even more. For example, the balance sheet consists of two short sections: the asset has 5 indicators, and the liability - 6. The forms are unified, they can be seen among the appendices to the Order of the Ministry of Finance No. 66n dated 07/02/2010.

There is a special concession for micro-enterprises : such companies can keep records in registers without using the standard double entry for accounting. But there are a couple of important limitations here. First, double entry is inextricably linked with the cash method of accounting. That is, if you choose the cash method, then in any case you keep double-entry accounting - there can be no other option. If you want to avoid double entry, you will have to use the accrual method of accounting. Secondly, the benefit of not using double entry should be used with great caution: the enterprise may grow, but restoring accounting for previous years will be very difficult both in terms of financial costs and in terms of labor resources.

Who has the right to simplified accounting?

Today, there are two groups of enterprises for which the rules for generating reliable financial statements are clearly established, but with varying degrees of information content for users:

- Companies to which the state has granted the right to use simplified accounting methods and prepare simplified financial statements (clause 4 of article 6 of law 402-FZ).

- Companies that cannot maintain simplified accounting.

Let's look at each group in more detail.

1. Companies that have the right to conduct simplified accounting.

According to paragraph 5 of Article 6 of Federal Law No. 402-FZ, the right to conduct simplified accounting is given to representatives of small businesses that are not subject to mandatory audit.

Additions were made to this regulatory act, which are reflected in Article 11 of Federal Law No. 334 of November 4, 2014.

According to its provisions, a simplified system of accounting and preparation of financial statements has become available to such economic entities as:

- small businesses;

- companies whose activities are non-commercial;

- companies that have the status of project participants to carry out research, development and commercialization of their results. The regulatory document in this case is Federal Law No. 224 “On Innovation dated September 28, 2010.

These are mainly companies that:

- do not place their securities on the market;

- do not engage in attracting investors by any other methods.

The reporting of these companies is important only for its management and founders. Since there is no third party who could show interest in the activities of such companies, and, consequently, in their reporting documentation, the unreliability of documents cannot entail a violation of the rights of this party. This explains the existence of relaxations in the methodology for maintaining accounting records and preparing financial statements provided to such organizations by government bodies.

Taxes 2020. New taxes and changes in Russia in 2019:

These companies are not considered to be socially significant.

Our state is interested in increasing the total number of such companies. In order to substantiate this statement, it is enough to analyze the guarantee of stability of the status of a small business entity over a sufficiently long period of time.

Thus, four years ago the state increased the revenue limit required to classify an organization as a small business entity. In addition, the total number of staff of companies and the maximum share of capital participation for firms claiming to be small businesses, foreign entities and legal entities that are not small and medium-sized businesses were increased.

An extended guaranteed period was also introduced for those companies that exceeded the thresholds for the number of employees or financial turnover for the reporting period. In other words, the period required to exclude a company from the list of small businesses has been extended. Regulatory document – Federal Law No. 156 dated June 29, 2015 (subparagraph “c”, paragraph 2, article 5).

Simplified procedure for calculating depreciation of fixed assets

Organizations that maintain simplified accounting can accrue the annual amount of depreciation on fixed assets at a time as of December 31 of the reporting year or periodically during the reporting year for periods determined by the organization (clause 19 of PBU 6/01).

That is, not monthly in the amount of 1/12 of the annual depreciation amount, but, for example, once a quarter or once a year. The accrued amount of depreciation is reflected in accounting records, respectively, in the period to which it relates or in December of the reporting year. EXAMPLE OF SIMPLIFIED DEPRECIATION OF FIXED ASSETS

The fixed asset belongs to the fourth depreciation group, its initial cost is 325,000 rubles.

Depreciation on it is calculated using the straight-line method, its useful life is set to 6.5 years (78 months). In this case, the annual depreciation amount is 50,000 rubles. (RUB 325,000: 6.5 years) (paragraph 2 of clause 19 of PBU 6/01). According to the accounting policy, depreciation in accounting is accrued once at the end of the reporting year. On December 31, the accountant will make the following entry: DEBIT 20 CREDIT 02

— 50,000 rub. – depreciation of the fixed asset has been accrued.

For production and business equipment, it is allowed to charge depreciation at a time in the amount of the initial cost of objects of such assets when they are accepted for accounting (previously - only during the entire useful life of the object).

Industrial equipment includes technical items that are involved in the production process, but cannot be qualified either as equipment or as structures.

When applying this simplified method of accounting, the amount of accrued depreciation on these objects in the amount of 100% of their original cost is reflected in the debit of account 20 “Main production” (in the debit of other accounts for accounting for production costs - when using such accounts) and the credit of account 02 “ Depreciation of fixed assets” in the same reporting period in which the object was accepted for accounting.

In this case, the object is not written off from accounting until its actual disposal (cessation of use). EXAMPLE OF CALCULATING DEPRECIATION ON INVENTORY

An organization purchased production equipment worth RUB 60,000 in June.

(without VAT). According to the accounting policy, depreciation of production equipment is accrued in the amount of 100% in the period when the object is accepted for accounting. The accountant made the following entries: DEBIT 08 CREDIT 60

- 60,000 rubles.

– reflects the initial cost of production equipment; DEBIT 01 CREDIT 08

- 60,000 rub.

– production inventory is included in fixed assets; DEBIT 20 CREDIT 02

- 60,000 rub. – depreciation of production equipment has been accrued.