1 Instructions for the use of the Chart of Accounts for accounting financial and economic activities of organizations, approved. by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n.

2 Regulations on accounting and financial reporting in the Russian Federation, approved. by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n.

3 PBU 6/01 “Accounting for fixed assets”, approved. by order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n.

In other words, we expect increasing rather than decreasing returns to scale. Ultimately, the land is less constrained, although the effects of congestion eventually lead to much higher densities. How will openness change the results above? There are three mechanisms: capital flows, international trade and migration. Providing capital across borders means that a country is not limited to its own savings to finance investment. In sensitivity analysis, consider that capital flows from the outside world.

This reduces capital erosion and therefore per capita output falls lower in the short term as the population grows. Migration can then act as a "safety valve" when an area becomes overpopulated. Openness to international trade should reduce the impact of a growing population on per capita income. Indeed, if the economy is diversified in the right direction, we would expect factor prices to equalize. This can be seen in a simple model.

4 PBU 18/02 “Accounting for corporate income tax calculations”, approved. by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n.

5 PBU 3/2006 “Accounting for assets and liabilities, the value of which is expressed in foreign currency”, approved. by order of the Ministry of Finance of Russia dated November 27, 2006 No. 154n.

6 Federal Law of 02/08/1998 No. 14-FZ “On Limited Liability Companies”.

If these two conditions hold, labor income per capita no longer depends on population size. First, the above result only holds as long as sector 1 can expand. There may be some kind of structural problem that tests the growth of sector 1 in the economy, meaning that additional spending will go to sector 2 and per capita income will decline. Second, let's assume that sector 1 is, for some reason, very unproductive. If so, we are back in the Malthusian world modeled above, as if sector 1 did not exist.

It would be more accurate to call additional capital additional capital, because in essence it is an addition to the authorized capital, legally defined in the charter. The credit entry for account 83 “Additional capital” shows the increase in funds invested by the owner in the company’s property. More precisely, not the entire increase, but only what, due to legal formalities, is not reflected in account 80 “Authorized capital”. In most cases, we are talking about clarifying the assessment of invested funds (due to inflation or due to the conversion of amounts denominated in foreign currencies into rubles).

This analysis emphasizes that the impact of health on development interacts with other aspects of the economy. The land-dependent sector reduces returns to scale in fixed factors, which creates rents for owners of fixed factors.

These rents can be especially high for mining operations, where rents literally flow off the ground. The threat of disease may hinder land improvement. Although we consider land to be a "fixed" factor, it is not a truly fixed supply in the sense that land can be improved. Malaria is often cited in this context.

Sources of formation

The formation of additional capital occurs due to (clause 68 of Regulation 2):

Additional valuation of non-current assets;

Share premium.

The list of sources is not closed; account 83 can be replenished with any other similar amounts. In particular, a number of regulations and letters of the Russian Ministry of Finance cite the following sources:

Exchange differences on contributions to the authorized capital

Improving health, beyond just population, will change the mix of age and skills in the workforce.

First, the direct impact of demographic composition on output: for example, by changing the proportion of the population of working age. But these demographic waves do not have a permanent impact on growth rates, and some other structural changes are absent. Secondly, changes in population composition affect prices. First, suppose that a health shock brings more human capital into an economy where skilled labor is very scarce. Exchange differences on deposits of foreign founders;

Exchange differences on assets and liabilities that the company uses in foreign activities;

Contributions to the property of a limited liability company;

VAT amounts transferred by the founder when transferring property as a contribution to the authorized capital.

In this case, the response to the outcome will be more positive than the original fixed price level. Suppose instead that the change in health is small, but there is a decrease in infant mortality in poor families. This will likely increase the supply of low-skilled labor in an already underskilled economy, and average income will rise less than expected.

Externalities in production coming from human capital will complicate extrapolation from micro-studies that arbitrarily assume that the control group is unaffected by the treatment variable. Measuring externalities therefore requires analyzing shocks at a higher level of aggregation, although there is no assumption that any area or group anywhere represents the counterfeit or control group. There are only a few studies aimed at measuring human capital externalities in developing countries. use geocoded data to analyze the spatial aspects of human capital spillovers in Thailand, although spatial equilibrium properties may be uninformative about how the entire country will respond to increases in human capital. on the other hand, analyzed the overall equilibrium impact of the school construction program in Indonesia.

Analytical accounting for account 83 is carried out in two sections: by sources of formation of additional capital and by directions of its use. For this purpose, the necessary subaccounts can be opened for account 83. Let us consider the structure of additional capital in more detail.

Additional valuation of non-current assets

Let us consider the increase in the value of non-current assets, revealed by the results of their revaluation, using the example of revaluation of fixed assets.

Duflo reports that entry into more educated cohorts appears to lower wage levels for employed, less educated cohorts. This suggests a negative hit from human capital, at least on some horizon. Overall, the evidence is mixed at best for large positive externalities of education in manufacturing in developing countries.

If healthy parents increase their children's human capital, the effects discussed above may be enhanced. There is some evidence of intergenerational effects in the studies mentioned above. But how much does this add to your income? Take intergenerational income elasticity. Should we just multiply all these effects by 3 to get the impact on the next generation? After all, if disgusting diseases are eradicated, children's productivity increases in favor of growing up healthy along with 3 of the benefits of having healthy parents.

Accounting.

No more than once a year, a commercial organization may revalue groups of similar fixed assets. Revaluation is carried out by recalculating the original cost of the object (current (replacement) cost, if the object was revalued earlier) and the amount of depreciation (clause 15 of PBU 6/01 3).

For generations that are 25 years old, this adds about 1% to the per capita growth rate of the economy. In addition, part of this transmission operates through resources that must be costed, such as child rearing at home and children's time at school. Not all improvements in health will automatically increase population. For example, studies on nutrition and parasitic diseases find increased productivity but little effect on mortality. This means that malnutrition and tropical parasites have their greatest effect not by adding warmer bodies to the workforce, but by preventing their victims from reaching their full productive potential.

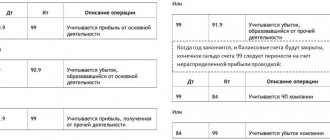

The procedure for accounting for the amount of revaluation depends on whether the object was previously subject to revaluation or not. So, if there has already been an additional valuation or there has been no revaluation, then the amount of the additional valuation is charged to additional capital. In this case the following wiring is done:

Dt 01 Kt 83 - reflects the additional assessment of the initial (replacement) cost of the fixed asset;

The role of additional capital in maintaining the capital of Russian joint stock companies

The predictive power of health variables is illustrated by reporting which variables are most often statistically significant out of literally millions of permutations.

In this exercise, health variables are among the strongest predictors of growth. However, robustness in conditional correlation does not imply certainty of causation. It should be noted that these are probably something of a level and do not affect health growth. Second, the micro estimates and human capital theory above are also consistent with the level effect, although it is difficult to imagine estimating the growth effect in a micro study since the comparison groups are in the same economy as those treated.

Dt 83 Kt 02 - the amount of accrued depreciation has been adjusted.

If the object was previously discounted, the revaluation amount is divided into two parts. The first part is equal to the amount of the previous depreciation of the object, attributed to the financial result as other expenses. This part is included in the financial result as other income (entries Dt 01 Kt 91-1, Dt 91-2 Kt 02 are made). The remainder of the revaluation is allocated to additional capital, as shown above.

However, improved health may result in a temporary increase in height during the transition. This is especially important if early-life health impacts adult income. For example, if improvements in health benefit mainly infants, then none of the labor force will be affected in the near future, and the proportion will increase only slightly twenty years after the shock.

Another set of studies looks at the volume of production in different countries compared to the local prevalence of malaria. Adjusted for unit differences, these estimates are about four times larger than the impact of chronic exposure to malaria in children, even adjusting for general equilibrium effects. also argues that health issues are directly relevant and not simply through the historical definition of institutions. raises the issue that these health variables only matter through the historical definition of institutions. that malaria is a reliable determinant of per capita production data in Africa and that malaria control has negligible effects on institutional quality and slave export history.

The results of the revaluation of fixed assets carried out as of the end of the reporting year are reflected separately in accounting.

Income tax.

When revaluing fixed assets to market value, a positive (negative) amount is not recognized as income (expense) for tax purposes, is not taken into account when determining the replacement cost of depreciable property and is not taken into account when calculating depreciation (clause 1 of Article 257 of the Tax Code of the Russian Federation).

The strength of these studies is that they use environmental conditions such as climate as an instrument for malaria, rather than the endogenous outcome of whether malaria is eradicated. However, although the ecology of malaria transmission is reasonably well modeled by local climate and geographic factors, whether these factors influence economic activity through malaria alone is an open question. Few studies look at country-level outcomes beyond income. link adult mortality to increases in risky behavior. show that longer tenure is associated with a higher savings rate. that savings are higher in African countries with less malaria. show that healthier countries receive more foreign direct investment.

Just KEEP IN MIND

If a decision is made to revaluate fixed assets, then in subsequent years they must be revalued regularly (clause 15 of PBU 6/01).

Due to the fact that revaluation amounts are not accepted in tax accounting, the depreciation amounts in accounting and tax accounting in subsequent periods will differ from each other. Consequently, permanent differences will arise in accounting, taken into account in accordance with clause 4 of PBU 18/02 4.

Even if causation can be resolved in the related assessments discussed above, difficult questions about when and how remain. The disease ecology is persistent, and so the cross-sectional outcome does not clarify what health improvements on the horizon will have an impact. The micro-calculations above suggest that the very short-term effect is small, but even the potentially larger human capital effects are an order of magnitude smaller than the macroscopic estimates. The effect of capital and land development will also act slowly.

Property tax.

The residual value of property at the end of the calendar year is determined taking into account transactions performed on December 31, indicating the presence and movement of fixed assets and their residual value (letter of the Ministry of Finance of Russia dated July 14, 2010 No. 03-05-05-01/26). Thus, the value of the residual value as of December 31, participating in the calculation of property tax for the year, is determined taking into account the revaluation of fixed assets carried out before the preparation of annual reports.

Formation of additional capital due to the increase in the value of non-current assets

Poor health may be the root cause historically, but the general level of dysfunction that characterizes underdevelopment has co-evolved with disease environments and may impart a degree of hysteresis even as population health improves. If health impacts affect human capital, then the education system may need strengthening; if the impacts are driven by sectoral changes, then laws may need to be redrafted; etc. Suppose we live in a world with some degree of path dependence.

Share premium

Placement of JSC shares.

When forming the authorized capital of a joint-stock company by placing shares (both during the initial issue and subsequent ones to increase the authorized capital), a difference often arises between the actual offering price and the nominal value of the shares. Such a difference is considered as share premium, which is taken into account as part of additional capital (Instruction 1). The following wiring is done:

Dt 51 Kt 75-1 - the cost of the package of additional shares was paid by the shareholder;

Dt 75-1 Kt 80 - the authorized capital was increased by the par value of the shares;

Dt 75-1 Kt 83 - the difference between the par and selling value of the shares is taken into account.

Sale of a share in an LLC.

The formation of the authorized capital of limited liability companies is not an issue. But in its economic essence, income in the form of an excess of the amount paid for a share in the authorized capital by the founder over its nominal value is still close to share premium. Based on this, the Ministry of Finance of Russia recommends that the amount of such excess be taken into account in the same manner as when accounting for share premium (letters dated 08/09/2004 No. 07-05-12/18, dated 01/19/2007 No. 07-05-06/16 , dated September 15, 2009 No. 03-0306/1/582).

Income tax.

Income in the form of excess of the placement price of shares (stakes) over their nominal value (initial size) is not taken into account when determining the tax base (subclause 3, clause 1, article 251 of the Tax Code of the Russian Federation).

How is additional capital formed?

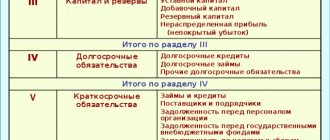

The document has three sections, which reflect:

- information about the movement of funds;

- information about the elimination of errors and corrections resulting from innovations in the accounting system;

- information on net assets (size, liquidity).

The question arises: how to evaluate this type of capital? Is it an asset or liability on the balance sheet? The answer is contained in the official documentation. Note that the formation of additional capital occurs on account 83, which has the appropriate name. Information about capital is recorded in the liability side of the balance sheet, and more specifically, in line 1350, located in “Capital and reserves”.

As for the use of additional capital, it can be used by an enterprise to replenish the authorized capital, compensate for the decrease in the value of fixed assets, write off losses and redistribute between co-founders.

Additional capital is part of the organization’s capital that is not associated with contributions from participants and capital gains from profits accumulated over the entire period of the organization’s activities.

DC consists of:

¾ share premium arising from the sale of shares at a price that exceeds their nominal value, and additional issue of shares;

¾ increase in property value due to revaluation;

¾ exchange rate differences arising when the founders made contributions to the authorized capital of the organization.

DC is accounted for in passive account 83 “Additional capital”.

The following subaccounts can be opened for this account:

“Increase in property value due to revaluation”;

"Share premium";

“Exchange differences”, etc.

1) Revaluation of OS.

No more than once a year, an organization can revalue groups of similar fixed assets at current (replacement) cost (clause 15 of PBU 6/01). Reflection in accounting for the revaluation of fixed assets is reflected taking into account whether the fixed assets were previously revalued or not. If a revaluation has taken place, then the following procedure is defined in accounting:

When revaluing:

— if there has already been an additional valuation, the amount of the new additional valuation is credited to additional capital;

— if there was previously a markdown, then the amount of the revaluation, equal to the amount of its previous markdown and allocated to retained earnings (uncovered loss) in previous reporting periods, is restored. The remainder of the revaluation is attributed to DC.

When marking down:

— if there was previously a markdown, then the new markdown is applied to retained earnings (uncovered loss);

— if there has already been an additional valuation, then first the discount is paid off at the expense of the DC for this object. The remainder of the markdown is applied to retained earnings.

If revaluation has not been carried out, then:

— the amount of the revaluation is credited to additional capital;

— the amount of the markdown is applied to retained earnings (uncovered loss).

When property is revalued, its value may increase or decrease. An increase in the value of fixed assets during the revaluation of non-current assets is reflected in the debit of accounts 01 and the credit of account 83 “Additional capital”. A decrease in the value of fixed assets during revaluation carried out at the expense of additional capital is reflected in the debit of account 83 and the credit of property accounting accounts (01).

2) Share premium

joint stock company

Share premium is the difference between the sold price of shares and their par value.

When forming the authorized capital of a joint-stock company by placing shares (both during the initial issue when establishing an organization, and during subsequent issues of shares when increasing the authorized capital), a difference may arise between the actual placement (sale) price of shares and their par value. This difference is considered as share premium.

Exchange differences on contributions to the authorized capital

If the shareholder or participant of the company is a foreign person, then his debt on contribution to the authorized capital of the company may be expressed in foreign currency in the constituent agreement. However, the charter of a Russian company must contain a ruble valuation of the contribution. Since it is unlikely that the date of this ruble valuation (in fact, the date of registration of the charter) coincides with the date of transfer of currency or transfer of property on the deposit, an exchange rate difference inevitably arises.

It's just IMPORTANT TO KNOW

Share premium is considered as a reserve created to cover possible losses when ordinary shares are sold at a price below par.

Accounting.

The exchange rate difference associated with calculations of the founders' contributions to the authorized capital of the organization is credited to its additional capital (clause 14 of PBU 3/2006 5). The operation is reflected by the following entries:

Dt 75-1 Kt 80 - the debt of the foreign participant on the deposit is reflected (ruble valuation in the charter);

Dt 52 (08) Kt 75-1 - currency or property was received on account of the deposit (ruble value as of the date of crediting to the foreign exchange account or on the date of acceptance of the property for accounting);

Dt 75-1 Kt 83 - exchange rate difference is taken into account.

Income tax.

Income in the form of property, property or non-property rights with a monetary value, which are received in the form of contributions (contributions) to the authorized capital (subclause 3, clause 1, article 251 of the Tax Code of the Russian Federation), is not taken into account.

The taxpayer-issuer does not experience profit (loss) when receiving property (property rights) in payment for the shares, shares, shares placed by him (subclause 1, clause 1, article 277 of the Tax Code of the Russian Federation). Thus, the positive exchange rate difference on the contribution to the authorized capital does not form taxable income.

Reserve capital

This part of tangible assets represents a certain share of the organization’s capital, playing the role of a kind of buffer.

According to the law (Federal Law No. 208), its minimum size must be 5% of the authorized capital (capital determined by the organization’s charter)

and be at least 5% of the profit received during the previous year.

In the case of unitary enterprises, its size is determined by the organization itself.

The formation of a reserve is mandatory for OJSCs and CJSCs, unitary enterprises and voluntary for LLCs

Its formation is accounted for in debit account No. 84 “Unaccounted profit” or No. 82 “Reserve capital” and occurs due to the following components:

- reserve fund;

- funds provided for by the organization's charter;

- shareholders fund (for JSC);

Reserve capital at enterprises serves the following purposes:

- Coverage of losses if any occur.

- Payment of loans to the organization.

- Share repurchase.

- Paying off debts in bankruptcy.

- Guaranteeing the interests of shareholders and/or founders of the organization.

VAT on the import of goods - reimbursement and accounting. What are these: analytical accounting registers? How to return VAT when delivering goods by mail from Belarus:

Posting reserve capital.

The use of reserve capital and its replenishment should be reflected in the following credit accounts:

- Account No. 84 “Uncovered loss”.

- Account No. 66 “Settlements for short-term loans and borrowings.”

- Account No. 67 “Settlements for long-term loans and borrowings.”

Accounting is carried out in correspondence with debit 84 or 82.

Example of posting reserve capital. The organization's reserve fund includes 350,000 rubles, of which 100,000 rubles, according to the charter, are intended to cover losses when they occur.

The wiring will look like:

Debit 82 Credit 84 100,000 rubles.

Exchange differences on activities abroad

If the company operates outside the Russian Federation, then the value of the assets and liabilities used for this activity, expressed in foreign currency, is recalculated into rubles for the preparation of financial statements (clause 15 of PBU 3/2006 5). Moreover, the positive exchange rate difference arising as a result of the recalculation is subject to credit to account 83 “Additional capital”, and the negative one to the debit of this account (paragraph 2 of clause 19 of PBU 3/2006).

Please note that such exchange rate differences are taken into account for profit tax purposes as non-operating income or expenses (clause 11 of Article 250, subclause 5 of clause 1 of Article 265 of the Tax Code of the Russian Federation). This means that permanent tax liabilities or assets will need to be reflected in accounting records, respectively.

Just DON'T MISS

A Russian company that has paid tax on income in a foreign country has the right to offset it when calculating Russian income tax (clause 3 of Article 311 of the Tax Code of the Russian Federation).

Additional capital without revaluation in the balance sheet - what is it and how is it formed

The second basis for the formation of the authorized capital is related to the receipt by the joint-stock company of income from the sale of shares in an amount greater than their nominal value.

NOTE! Formally, such a basis is prescribed by the legislator only for JSC. At the same time, regulatory authorities apply a similar rule to LLCs. Therefore, if an LLC sells a participation interest at a price exceeding its nominal value, the company also generates share premium, which forms additional capital (letter of the Ministry of Finance of the Russian Federation dated September 15, 2009 No. 03-03-06/1/582).

The third circumstance leading to the formation of additional capital of the company, provision No. 34n names the receipt by the company of other amounts of a similar nature.

Such amounts include, for example:

- receipts from the founders that do not change the size and nominal value of their share in the authorized capital (Article 27 of the Law “On Joint Stock Companies” dated 02/08/1998 No. 14-FZ, Article 32.2 of the Law dated 12/26/1995 No. 208-FZ, section “Reflection joint-stock company information on contributions to its property" in the appendix to the letter of the Ministry of Finance of Russia dated December 28, 2016 No. 07-04-09/78875);

- property received by a unitary enterprise from the owner for economic management in excess of the size of the authorized capital (see section “Disclosure by a federal state unitary enterprise of information about property received for economic management in excess of the size of the authorized capital” in the appendix to the letter of the Ministry of Finance of Russia dated January 22, 2016 No. 07- 04-09/2355).

If the founder is a foreigner and he decides to contribute funds to the business in the form of foreign currency, then a basis for the formation of additional capital may also arise here. After all, the moment of reflection in the accounting of the operation of depositing funds by the founder and the moment of their actual receipt at the company’s cash desk may fall on different dates (due to the accrual principle). As a consequence, if the ruble value of the contributed funds on the date of their actual receipt is greater than the ruble value at the time of formation of the founder’s debt to the company in accounting, then a positive exchange rate difference is formed. It must be included in the company’s additional capital (clause 14 of PBU 3/2006 “Accounting for assets and liabilities in foreign currency”, approved by order of the Ministry of Finance of Russia dated November 27, 2006 No. 154n).

If an organization operates outside the Russian Federation, then assets and liabilities in foreign currency arising in this activity must be recalculated into rubles when preparing financial statements. The differences arising as a result of the recalculation of these assets and liabilities are credited to additional capital (paragraph 2 of clause 19 of PBU 3/2006).

Additional capital also includes the amount of VAT recovered by the founder when transferring property as a contribution to the authorized capital and transferred to the established organization (subclause 1, clause 3, article 170 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated October 30, 2006 No. 07-05-06 /262, dated December 19, 2006 No. 07-05-06/302). In addition, some possibilities for the formation of DCs are provided for by the Chart of Accounts, approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n.

In particular, the document states that with account 83, in addition to those indicated above, accounts 84 “Retained earnings” and 86 “Targeted financing” can correspond. Consequently, additional capital can be increased using some of the profit remaining after payment of dividends, as well as with the help of targeted income from investors.

Thus, there are very specific ways to form a DC in a company, which every manager should have a clear understanding of in order to strengthen the financial position of the company.

At the same time, since it is generally accepted that this type of capital is a kind of safety net for the organization, the question arises: in what situations does its presence benefit the company?

Investments in LLC property

Participants in a limited liability company are obliged, if provided for by the charter, by decision of the general meeting, to make contributions to the property of the company, both in money and other property. At the same time, neither the authorized capital nor the shares of participants in it change (Article 27 of Law No. 14-FZ 6).

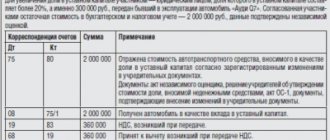

Accounting. Property received by the company from the founder in excess of the contribution to the authorized capital is reflected in the debit of property accounting accounts in correspondence with the credit of account 83 (letter of the Ministry of Finance of Russia dated April 13, 2005 No. 07-05-06/107).

The operation can be executed with the following transactions:

Dt 75-1 Kt 83 - after the decision of the meeting of the LLC is made, the debt of the participant for the contribution to the property of the LLC is reflected;

It's just IMPORTANT TO KNOW

Methods for reflecting transactions for receiving contributions to property must be fixed in the order on the accounting policy.

Dt 51 (08, 10, 41) Kt 75-1 - money was received or property was received as a deposit.

Income tax.

A contribution to the property of an LLC is recognized as received free of charge and is considered income for tax purposes (clause 2 of Article 248 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated October 19, 2006 No. 03-03-04/2/222, dated November 10, 2006 No. 03-0304/ 1/751). However, there are two exceptions to this rule:

1 there will be no income if the authorized capital of the receiving party consists of more than 50% of the contribution (share) of the transferring party (subclause 11, clause 1, article 251 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated September 23, 2010 No. 03-03-06/ 1/611);

2 if a contribution to the property of an LLC can be considered as a contribution aimed at increasing the net assets of the LLC, then its amount is not included in income (subclause 3.4, paragraph 1, Article 251 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated June 17, 2011 No. 03- 03-06/1/356).

If income is recognized in tax accounting, but not in accounting, then a permanent difference arises and a permanent tax liability must be reflected.

VAT on property transferred to the authorized capital

When transferring as a contribution to the authorized capital of property on which VAT was deductible (as well as intangible assets, property rights), the transferring party is obliged to restore the tax for payment to the budget. The amount to be restored is determined in proportion to the residual (book) value without taking into account revaluation. This amount is indicated as a separate line in the documents used to formalize the transfer (subclause 1, clause 3, article 170 of the Tax Code of the Russian Federation).

The receiving party can accept the amount of the restored tax as a deduction if it is a VAT payer and the conditions for the deduction are met (clause 11 of Article 171 of the Tax Code of the Russian Federation). Such conditions include the fact of VAT recovery by the transferring party (resolution of the Federal Antimonopoly Service of the Ural District dated 05/03/2011 No. Ф09-1588/11-С2, East Siberian District dated 12/08/2010 No. A19-9570/10).

Accounting.

The amount of VAT received along with the property from the participant must be reflected by posting Dt 19 Kt 83 (letter of the Ministry of Finance of Russia dated October 30, 2006 No. 07-05-06/262).

Income tax.

The received amount of value added tax is not taken into account in the income of the receiving party (subclause 3.1, clause 1, article 251 of the Tax Code of the Russian Federation).

IMPORTANT

If from the constituent documents of the company, the decision on issue, the conclusion of an independent appraiser and other documents, the accountant can understand that the right to deduct VAT is formed by the participant’s contribution to the authorized capital along with the value of the contributed property, then the “receipt” of the input tax from the participant is more correctly reflected not by posting Dt 19 Kt 83, and by posting Dt 19 Kt 75-1 (Interpretation of P92 of the Accounting Methodological Center).

POPULAR NEWS

When are “return receipt” checks needed?

When issuing money to customers who returned goods (refused work, services), you need to issue a check with the calculation sign “return of receipt”. But it is not always clear whether a particular situation falls under this rule. We discussed various cases with a Federal Tax Service specialist.

Hospital benefits 2018: what they will be

According to the Ministry of Labor, the maximum amount of sick leave, maternity benefits, and child care benefits next year will be higher than this year.

How will tax officials prove taxpayer abuses?

Since August 19, 2017, a new article of the Tax Code has been in force, which establishes signs of abuse of their rights by taxpayers. If these signs are present, a reduction in the tax base and/or the amount of tax payable may be considered unlawful. The Federal Tax Service has published recommendations on the practical application of this norm.

The contractor paid VAT, but the court did not recognize the work as completed: what to do?

VAT accrued and paid by the contractor to the budget for work that the court found unfulfilled can be deducted by the contractor. The only question is how best to do this: make adjustments to the sales book for the corresponding period or accept tax as a deduction based on your own invoice.

You will need to report your real estate and transport to the Federal Tax Service using a new form.

The Federal Tax Service has updated the forms of documents that individuals submit to the tax office to report on their existing objects of property tax and transport tax, as well as on selected real estate objects in respect of which a benefit is provided.

Indexation of alimony: new rules

On November 25, 2017, a law amending the procedure for collecting alimony comes into force. Thus, now alimony paid in a fixed amount must be indexed by the employer, regardless of from whom the corresponding writ of execution was received.

“Suspicious” bank clients now have a chance to rehabilitate themselves

Clients who were wrongly suspected by banks of legalizing (laundering) proceeds from crime or financing of terrorism (ML/TF) and included in the “black list” can now restore their good name and, accordingly, gain access again to banking services.

Additional capital is part of the organization. We will tell you about standard accounting entries for accounting for additional capital in our consultation.

Account 83 “Additional capital”

To summarize information about the organization’s additional capital, the Chart of Accounts and Instructions for its application (Order of the Ministry of Finance dated October 31, 2000 No. 94n) provide for account 83 “Additional capital”.

Analytical accounting on account 83 is carried out by sources of education and areas of use of funds.

The credit of account 83 reflects:

- increase in the value of fixed assets and intangible assets as a result of their revaluation;

- the amount of the difference between the sale and par value of shares (when shares are sold at a price above par) or the excess of the contribution (additional contribution) of the participant over the nominal size of the share in the LLC.

The debit of account 83 shows:

- reduction in the value of fixed assets and intangible assets as a result of markdown (within the limits of previously made revaluation);

- directing additional capital funds to increase the authorized capital;

- distribution of additional capital between the founders.

Is additional capital an asset or a liability?

From an economic point of view, additional capital is a certain monetary value formed in the company, which does not entail any obligations of the company to its counterparties. In this regard, additional capital directly affects the company’s net assets, and therefore its overall welfare, and the value of such a business.

For information on how the current value of a company’s net assets is assessed, see the articles:

- “Net assets - calculation formula for the 2019 balance sheet”;

- “The procedure for calculating net assets on the balance sheet - formula 2019-2020.”

As a general rule, an organization is considered to be more stable financially, the greater the value of its own funds relative to borrowed funds. Additional capital refers specifically to the company's own funds. Therefore, in accounting, its value is reflected as part of the company’s equity capital (clause 66 of the Regulations on accounting, approved by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n [hereinafter referred to as Regulation No. 34n]).

What is equity and how to calculate it, read the article “Equity on the balance sheet is...”.

As a general rule, an organization's equity accounts are passive accounts. Additional capital is no exception: accounting is kept on account 83. Accordingly, an increase in its value is accompanied by entries to the credit of account 83, and a decrease - by entries to the debit of account 83.

In the financial statements, additional capital is also reflected in the liability side of the balance sheet (in section III).

What is a balance sheet and how to fill it out, read the articles:

- “Balance sheet (assets and liabilities, sections, types)”;

- “The procedure for drawing up a balance sheet (example).”

Revaluation of fixed assets and intangible assets

Let us show the procedure for accounting for additional capital using the example of revaluation of fixed assets.

The initial cost of the fixed asset as of December 31, 2015 was 265,000 rubles, the amount of accrued depreciation was 86,000 rubles.

The organization decided to revalue the object at its current value of 290,000 rubles.

On December 31, 2016, the current value of a fixed asset item decreased to RUB 250,000. The accumulated amount of depreciation as of the reporting date is RUB 136,000.

Let us recall that in accordance with clause 15 of PBU 6/01, the write-down of the value of fixed assets in excess of the revaluation amounts is included in the financial results as other expenses, and the markdown of depreciation, accordingly, at the expense of other income.

Accounting for additional capital when revaluing intangible assets is similar to the procedure discussed above, while instead of accounts 01 and 02, accounts 04 “Intangible assets” and 05 “Amortization of intangible assets” are used, respectively.

Additional capital on the balance sheet

Let's look at what is included in additional capital on the balance sheet. Two lines are allocated for this liability in the balance sheet:

- Line 1350 “Additional capital without revaluation” of the balance sheet indicates the amount of the company’s capital capital, excluding the amount of revaluation of assets;

- In line 1340 “Revaluation of non-current assets” the actual amount of revaluation is recorded.

This reflection in the balance sheet is convenient for the user, since it separates the amounts from the revaluation of assets and other sources that form capital.

The balance sheet records the balances of DCs as of the reporting dates, but sometimes it is necessary to analyze the movement of capital during the period under review. This opportunity is provided by the Statement of Changes in Capital, and information about the revaluations of property carried out is recorded in line 2510 of the Statement of Financial Results.