Composition and structure of the report

The document is divided into 3 parts, each of which has a tabular form. Despite the fact that there are established sample forms for reporting, an enterprise can independently edit the document until it obtains the desired form. Nevertheless, it must consistently contain information by section:

- I – “Movement of capital”.

- II – “Adjustments due to changes in accounting policies and corrections of errors.”

- III – “Net assets”.

The contents of the statement of changes in capital fully reflect events occurring with the enterprise's own sources. The first section is devoted to the capital structure and transactions carried out with it. The second consists of at least three, and if it is necessary to reflect changes in other items of capital, then more parts. The third section contains information on the values at the end and beginning of the period of net assets. The statement of changes in capital (Form 3) must be drawn up on the basis of data for 3 years: the reporting year and the two preceding it.

Report structure

The report consists of a title page and three tables in which accounting data will be reflected.

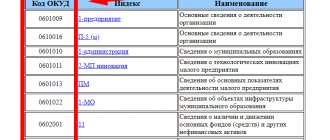

- The title page contains registration information about the reporting economic entity. Here you should indicate the reporting period, the full name of the organization, its INN, KPP, type of economic activity (code) and OKPO, register the organizational and legal form, and also indicate the form of ownership.

- The first table, “Capital Movements,” contains information grouped by type of capital and by methods of change in recent years. In this section it is necessary to reflect systematic information on turnover and capital balances in the accounting accounts.

- The second table “Adjustments due to changes in accounting policies and correction of errors” provides information on changes in the amount and structure of capital. Moreover, in the second block of the reporting form, not all changes should be indicated, but only those that are due to adjustments to the company’s accounting policies, which resulted in the recalculation of indicators. This block also reflects errors identified in accounting, the correction of which also adjusted the organization’s financial capital indicators.

- The third table, “Net Assets,” represents the value of the financial assets of the enterprise (for example, company property), which will remain at the disposal of the economic entity after the repayment of all debt obligations and debts. Read more about the procedure for calculating this indicator in the article “Net assets on the balance sheet”.

Note that the second table is filled in only if there is appropriate data to reflect.

https://www.youtube.com/watch?v=ytpressen-GB

The document is divided into 3 parts, each of which has a tabular form. Despite the fact that there are established sample forms for reporting, an enterprise can independently edit the document until it obtains the desired form. Nevertheless, it must consistently contain information by section:

- I – “Movement of capital”.

- II – “Adjustments due to changes in accounting policies and corrections of errors.”

- III – “Net assets”.

The content of the statement of changes in capital fully reflects events occurring with the enterprise's own sources. The first section is devoted to the capital structure and transactions carried out with it. The second consists of at least three, and if it is necessary to reflect changes in other items of capital, then more parts.

Requirements for the content of the report

The report on changes in capital (Form 3) must be prepared in accordance with the requirements of the Ministry of Finance of the Russian Federation. The contents indicate:

- net profit and loss values;

- each item of profit/loss, income/expenses in monetary terms and their amount;

- the effect of the accumulation of changes in accounting policies and the adjustment of errors considered in accordance with IFRS;

- capital transactions;

- changes in additional and reserve capital, as well as the condition and value of the company’s shares.

The data must be presented in the report itself or in an appendix to it. If you comply with the rules for maintaining accounting and financial records, it is not difficult to fill out Form 3 “Report on changes in capital”, a sample form of which can be found in the recommendations of the Ministry of Finance of the Russian Federation for the preparation of mandatory financial statements.

Report writing rules

This report has a unified standard form recommended for use. The form can be expanded and supplemented based on the needs of the enterprise. The document contains:

- Company details,

- detailed information on the movement of three types of capital:

- additional,

- reserve,

- statutory,

- data on the share of the company's own shares,

- adjustments caused by changes in the company's accounting policies,

- information on changes in the amount of retained income and uncovered losses of the organization, etc.

Also, the report must be signed by the head of the company indicating the date of its preparation.

When filling out the form, special attention should be paid to the following points: information on changes in capital must be entered both for the last reporting period and for the two previous ones.

In addition, when drawing up a report, we must not forget that subtracted or negative values are entered in parentheses, and the units of measurement can be either millions or thousands of rubles.

Today, a report can be created and submitted to the Federal Tax Service in electronic or paper form.

You cannot make mistakes in this document, so after filling it out you need to check it very carefully and, if some inaccuracy or oversight does occur, it is better to fill out a new form.

Characteristics of the first part of the report

Section I of the third form contains information on all changes in the elements of the enterprise’s equity capital for the period under review. It includes: authorized, additional, reserve capital, as well as data on retained earnings (uncovered losses), shares purchased from the owners of the enterprise.

In each part, relevant indicators are indicated that can be compared with data from previous years. If the company has not changed its accounting policies, then the values will coincide with those included in the reports for the past 2 years. In case of changes, it is necessary to make adjustments to the data and indicate the reasons for the discrepancy in the explanatory note to the report.

General requirements and header part of the report

The statement of changes in equity consists of three sections.

Section 1 is devoted to the movement of capital of the company. It should reflect data on the authorized, additional and reserve capital, as well as on own shares purchased from shareholders, and on the amount of retained earnings (uncovered loss).

The data in the form is indicated not only for the reporting year, but also for the two previous years. Thus, in the report for 2012, in addition to the data of the current reporting period, information is provided for 2011 and 2010.

The indicators of the reporting year and previous years, which are indicated in the report, must be comparable. This allows you to analyze them in dynamics. If the company’s accounting policy did not change significantly in the reporting year, then the indicators for the previous year will coincide with the data of the previous report. If the accounting policy has changed, then it is impossible to rewrite data from last year’s document into a new report. Adjustments need to be made. And the reasons for the discrepancies between the indicators relating to the previous year should be explained in the Explanatory Note.

Section 2 of the report contains information about adjustments that are associated with changes in accounting policies and correction of errors. Indicators are reflected both before and after adjustment.

Section 3 includes data on the company’s net assets in the reporting period and in the two previous periods.

The statement of changes in capital is signed by the head of the company and its chief accountant.

The header part of the report is formatted similarly to the header part of the balance sheet.

The tabular part of the report is filled out in thousands or millions of rubles (code 384 or 385).

Important

The rules for filling out a statement of changes in capital are described in detail in the book “Annual Report 2012″, edited by Vladimir Meshcheryakov.”

Along with the useful book, you will receive a free access code to the Internet portal in support of submitting the annual report www.buhgod.ru and will be able to use the book in electronic format.

Authorized capital: rules for filling out the column

The authorized capital of an enterprise is created upon formation of a legal entity through contributions from the founders. During the financial activities of the company, the volume of assets may change, which must be documented.

The statement of changes in capital begins with the first part “Authorized capital” of Section I. The data required to fill out is located on account 80, which is opened to account for the funds of the authorized capital. The column indicates:

- balance of initial capital as of December 31. reporting year and two previous years;

- the amounts by which capital was reduced or increased in one year.

Credit turnover on account 80 is indicated in the corresponding line of the report - increase in capital. If there are debit turnovers on the authorized capital account, fill out a column explaining the reason for its decrease. A change in the size of the authorized capital usually results from an increase or decrease in the number of shares and their par value, as well as the reorganization of the enterprise.

Net assets

In Sect. 3 of the report provides information on the size of the company’s net assets as of December 31:

- reporting year;

- previous (last) year;

- the year preceding the previous one (the year before last).

Net assets are determined by subtracting the amount of its liabilities from the sum of all assets of the company (with the exception of certain indicators of assets and liabilities).

In other words, net assets are the value of the enterprise’s current and non-current assets, secured by its own funds.

In addition to filling out the statement of changes in capital, the amount of net assets is also needed: