Why do you need a product report?

The report is necessary so that the accounting department can make sure that all goods are supplied with the necessary accounting papers, as well as verify inventory balances. Since it reflects complete information about the movement of inventory items with the attachment of all the documents specified in it in a specific area of the enterprise, the reconciliation takes place in the shortest possible time. The report is also convenient because information about goods is entered into it in the form of specific amounts, which makes it possible to quickly calculate the final financial data on incoming and outgoing goods.

How to fill out a product report correctly

The report is drawn up in two copies by the financially responsible person, indicating the number, date of receipt and expenditure documents. Both copies are signed by the accountant and the financially responsible person. One copy with attached documents is sent to the accounting department, the second remains with the financially responsible person.

Note!

If an error is made when entering data in the report, corrections are made as follows: the incorrect entry is crossed out, then corrected text or numbers are written above it indicating the date of correction. The correction must be indicated by the inscription “corrected” and confirmed by the signature of the responsible person and the accountant.

Report writing rules

To date, there is no single, unified sample of such a report, so organizations and enterprises can use their own template or write it in free form. However, most companies prefer to continue to use the TORG-29 form, which has convenient and understandable sections and includes all the necessary information. In particular, it contains

- company information,

- the structural unit for which the report is being prepared,

- information about the financially responsible person.

In addition, there are tables in which information is entered

- on documents accompanying the movement of goods,

- their numbers,

- dates of compilation and other parameters.

Moreover, the inflow and outflow of inventory items are distributed across different tables. Documents recorded in the report include invoices, acceptance certificates, receipts, expenditure documents, etc.

Types of liability

Managers of retail trade enterprises and financially responsible persons need to know that the preparation and storage of product reports is a strictly mandatory procedure

– this procedure is regulated by the Tax Code of the Russian Federation.

If such facts are revealed, the responsible person may be held administratively liable:

- In case of errors that arose due to incorrect accounting.

- Failure to comply with the established procedure for handling and storing documents.

- When disposing of reporting documentation before the end of their mandatory storage period.

Separately, it is worth noting that the absence of primary documentation is not considered by the Code of Administrative Offenses.

Fill out the form without errors in 1 minute!

Free program for automatically filling out all documents for trade and warehouse.

Business.Ru - quick and convenient filling out of all primary documents

Connect for free to Business.Ru

It is used in trade organizations to record trade documents for the reporting period, which is approved by the head of the organization. As a rule, a report in the TORG-29 form is prepared using the balance method of accounting for goods.

The unified form was approved by the Decree of the State Statistics Committee of the Russian Federation dated December 25. 98 No. 132.

(Submit documents without errors and 2 times faster by automatically filling out documents in the Class365 program)

Rules for preparing a product report

The document can be written either by hand or printed on a computer; it is drawn up in two copies, both of which must be signed by the responsible person.

If errors are made, they can be corrected. To do this, just carefully cross out the incorrect information, and write the corrected version on top, then enter information about the person who made the corrections and put the date. However, if there are too many errors, it is better to simply create a new document.

It is not necessary to put a seal on the report, since since 2020 legal entities have the right not to certify their papers with seals and stamps. Next, one copy of the report is transferred to the specialists of the accounting department (together with the originals of all documents included in it), and the second remains with the compiler.

The report is regular, and its frequency is approved by the head of the enterprise in accordance with his needs.

It largely depends on how active the trade turnover is in the company, and therefore how large the number of accompanying papers is. The numbering of product reports starts from the beginning of the year and ends at the end of the year, without transferring to the next reporting period. The document must be stored according to the standards that are legalized for this type of primary paper.

Corrections, accounting and storage

Making a correction if necessary has the following procedure:

:

Accounting and storage of commodity reports are carried out in accordance with the legislative framework governing the handling of accounting documentation, as well as the internal rules and procedures of the organization in which they were compiled and stored.

All commodity reports, according to their order of compilation (from each individual unit of the organization), are collected in one file and stored in this form for the required time

.

In this case, the period of their mandatory presence among the organization’s documentation is 5 years

. Responsibility for their integrity and safety usually lies with the chief accountant of the company.

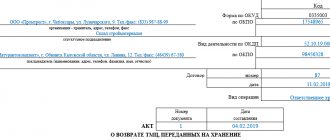

Example of filling out the TORG-29 form

Fill in the company data

At the beginning of the document write

- the full name of the company whose representative is writing the report,

- its code is OKPO (All-Russian Classifier of Enterprises and Organizations)

- and type of activity according to OKDP (analogue of the All-Russian Classifier of Types of Economic Activities)

– this information is available in the organization’s constituent papers. The structural unit in which the product report compiler works is also indicated here.

The table below includes

- Document Number,

- date of its preparation,

- reporting period (indicating specific start and end dates).

Then the author himself is entered here, he is also the financially responsible person :

- his position is written in the required lines,

- Full Name

- and personnel number.

Filling out the table of information about balances

The first table of the report contains information about balances at the time of drawing up the document - here the amount must match that indicated in the previous report. Data on the receipt of goods from all accounting documents are entered into this table carefully, strictly in compliance with chronology:

- Name,

- date and paper number,

- amount of goods and packaging.

The last column is for accounting notes.

It is impossible to combine goods from the same supplier using the same types of documents in any way - all information must be separated.

At the end of the table, the results are entered: two amounts, one of which is the total for this report, and the second is the total of the report plus the remainder.

Filling out the expense information table

The second table of the document includes information about the consumption of goods. It is filled out identically to the first one. If a product is returned, this must also be noted. At the end, sales are summarized and the balance at the time of drawing up the report is written.

Below the table is written (in words) the number of documents indicated in the report and documents attached to it, and at the end, the commodity report is signed by the financially responsible person, as well as the accountant who checked the document.

How to fill out a product report correctly

The report is drawn up in two copies by the financially responsible person, indicating the number, date of receipt and expenditure documents. Both copies are signed by the accountant and the financially responsible person. One copy with attached documents is sent to the accounting department, the second remains with the financially responsible person.

Note!

If an error is made when entering data in the report, corrections are made as follows: the incorrect entry is crossed out, then corrected text or numbers are written above it indicating the date of correction. The correction must be indicated by the inscription “corrected” and confirmed by the signature of the responsible person and the accountant.

Application and purpose

In any organization where the movement of goods takes place, it is imperative to register their receipt and decrease. For this purpose, in accounting, documentation of the receipt and release of goods is formed in special registers.

Reconciliation of balances and the reliability of the availability of shipping documentation is carried out on the basis of commodity reports submitted to the accounting department in the TORG 29 form. In it, the reporting employee summarizes all the information on the papers about the arrival and departure of his commodity mass. Thus, the report is, in its own way, a register of invoices, compiled into separate lists according to the documents received. Based on the reflected amounts, the final figures are calculated

separately about the amount of goods arrived and lost, as well as their balance at the beginning and end of the reporting period.

This form of report easily allows you to control the turnover of a separate area for which the responsible person is responsible. The main thing in this matter is not to make mistakes and carefully fill out the form, then everything will be in order at the enterprise.

If you have not yet registered an organization, then the easiest way is

This can be done using online services that will help you generate all the necessary documents for free: If you already have an organization and you are thinking about how to simplify and automate accounting and reporting, then the following online services will come to the rescue and will completely replace an accountant at your enterprise and will save a lot of money and time.

All reporting is generated automatically, signed electronically and sent automatically online. It is ideal for individual entrepreneurs or LLCs on the simplified tax system, UTII, PSN, TS, OSNO. Everything happens in a few clicks, without queues and stress. Try it and you will be surprised

how easy it has become!

Filling rules

The following step-by-step instructions will help you fill out the report:

- Product report forms are filled out and submitted within the period specified by the manager, which cannot be more than 10 days. It is possible to prepare a report twice during the reporting period approved by management, for example, when conducting an inventory.

- The document must be drawn up in 2 copies by the financially responsible employee who is entrusted with the management and storage of the products sold.

- All product reports must be numbered consecutively, starting from the beginning of the year. An exception is the case when a new financially responsible person is appointed. In such circumstances, the numbering begins anew from the moment he takes office.

- The most often used is a unified form for a commodity report under No. TORG-29, consisting of two pages separately for incoming and outgoing papers. In chronological order, each document is recorded in a separate line, first from the receipt documents, and on the next page, in the same order, the consumables are recorded.

- Before you start entering data from invoices and cash (receipt and expense) orders, you need to fill out the information in the header of the form. In this part, you must enter the full name of the organization, for example, “Limited Liability Company “Alexandria”. Below you enter data about the structural unit, for example, a warehouse.

- After information about the organization and department or site, enter information about the materially responsible person: his individual data, position, personnel number.

- Start filling out the table from where you indicate the balance at the beginning of the check. The balance at the beginning of the period must be the same as the balance at the end of the previous product report form. Then enter line by line in chronological order the data from receipt documents and invoices: name, date, number, amount of goods, cost of packaging. Please note that all parameters of each document are entered separately. Even if invoices are from the same supplier and goods are delivered on the same day, they cannot be summed up. After filling out all receipt documents, the total receipt amounts for the reporting period are displayed at the end.

- We move on to the next stage of reporting: fill out page two, in which you need to reflect all the information about the expense. The tabular data in the expenditure form is filled out in the same way as the receipt register of documents on the first sheet. At the end, the total expense amounts are indicated. Note! Don’t forget to also include information about goods returned to suppliers in your expense list.

- They finish filling out the form by indicating in the “Appendix” section the number of shipping papers and in the indicated place the financially responsible person puts his signature.

- The completed TORG 29 form is submitted to the accounting department, where it is checked immediately on the day of submission. If the report coincides with the accounting data, then after reconciling them, the accountant must put his marks in columns 6 and 7, as well as his signature.

Torg 29 in 1s 8.3 accounting. Procedure and rules for preparing a product report

In this article, we will look in detail at all the main operations when maintaining retail trade records in the 1C Accounting 8.3 program, including sales at non-automated retail outlets.

Often, before goods purchased from a supplier are transferred to retail, they first arrive at a wholesale warehouse. If you do not have such a practice, for example, you do not have a wholesale warehouse and all goods are immediately shipped to a single retail outlet. You can safely bring them to the retail warehouse.

In our example, we will create a , which is located in the “Purchases” menu. Our operation type will be “Goods (invoice)”.

We will not show in detail how to fill out this document within the framework of this article. Please note that when reflecting receipts to a wholesale warehouse, the warehouse itself must have the “Wholesale warehouse” type.

The figure below shows an example of filling out a receipt document for the wholesale warehouse of the “Complex” trading house from the “Products” database.

Setting prices

So, we have already purchased all the necessary goods from the supplier and are ready to sell them to the end buyer. But before we do this, we need to set retail prices - those at which we will begin to sell these goods.

They are located in the “Warehouse” menu, but to simplify the example, we will create it based on the receipt of goods. Of course, this option is not always convenient, but it is used quite often.

The created document automatically included goods from the receipt. Let’s fill in the prices for each item and indicate the price type (in this case, we created it ourselves in the directory and called it “Retail”). Now the document can be posted. These prices will be valid from the date indicated in the header of the document.

Moving goods to a retail warehouse

If you first received the goods at the wholesale warehouse, then you will need to transfer them to the retail warehouse or to a manual point of sale. The latter refers to points such as a stall, a market tent and others where it is not possible to keep records due to the lack of a PC or electricity.

First we will create these warehouses. They will be practically no different from the wholesale one except for the type.

As a result, we will get a sales area of store No. 23 with the “Retail store” type.

Let's call the non-automated retail outlet “Stall at the railway station.” She will have a different type.

In our example, both warehouses use the same type of prices, but you can set different ones. Then you will have to create two “Setting Item Prices” documents for each of these price types.

In order to reflect the transfer of purchased goods from our wholesale warehouse to the store and stall created above, we will create a document “”. You can find it in the “Warehouse” menu.

The figure below shows an example of filling out a document for moving goods from the main wholesale warehouse to a kiosk at the railway station.

Retail sales report

If you have completed all the previous steps correctly, then your retail warehouse will already contain goods with completed sales prices to the final buyer.

Now we can move on to directly reflecting the sale of goods. From the Sales menu, select Retail Sales Reports. This document is necessary to reflect retail sales.

In the header of the document we indicated the organization and retail warehouse “Trading floor of store No. 23”. The cash register account, as expected, is 50.01. Also, for the purpose of additional analytics on management accounting, we indicated the DDS Item “Retail Revenue”.

Sales in manual retail outlets

Above we took into account sales in a retail store. Now let's move on to a non-automated point of sale - a “stall”.

Non-automated retail outlets in 1C are points where it is not possible to install a computer and establish a connection with a common database. Sales data is not entered regularly.

Cash receipt

The first step is to reflect the receipt of cash with the transaction type “Retail Revenue”. If in a retail store a buyer could pay for an item with a bank card, this is unlikely here.

An example of a completed document is shown in the figure below. If you have missing revenue, you simply won’t be able to report on retail sales.

Reflection of retail sales

Let's assume that our seller does not write down in a notebook how many of which goods he sold. In this case, it is most logical to obtain the sales volume by simply subtracting the balance from the previously transferred quantity of goods.

For such purposes, in the 1C: Accounting program there is a document “Inventory of goods”. It is located in the "Warehouse" menu.

In the inventory document we will indicate the organization, our warehouse “Stall at the railway station” and, if necessary, . For convenience, we will fill the goods according to the balances in the warehouse. After this, you need to indicate how many products actually remain in the “Actual Quantity” column.

As shown in the figure above, the “Deviation” column essentially reflects the quantity that was sold at this stall.

Now you can post this document and, based on it, create a report on retail sales.

The form of the created document opened in front of us, in which absolutely everything was filled out automatically. Please note that the “Quantity” column includes all the data from the “Quantity fact” column of the inventory document.

If you did not take into account the revenue received in the program, the program will not allow you to post the document and will display a message similar to the one shown in the figure below.

See also video instructions for reflecting such operations:

At enterprises involved in the trade sector, a commodity report in the TORG 29 form is used.

This form is ideal for those who use the balance method of accounting for goods.

Who should compile it? What rules should be taken into account when filling out this form? How often is it submitted to the accounting department? Here you will find answers and tips to all these questions.

Responsibility for the absence of these reports

Taxpayers will have to answer for the lack of reporting documentation under Article 120 of the Tax Code of the Russian Federation. This fact is a case of gross violations of the points specified in the rules for accounting for income and expenses when taxing organizations.

The law stipulates that the employee appointed responsible for recording the facts of the economic life of a retail facility is obliged to ensure the issuance of primary documentation for the timely entry of data into accounting.

But punishment can only be incurred for the following violations:

- errors made due to failure to comply with accounting rules;

- late submission of reports to the accounting department;

- failure to comply with the procedure or failure to maintain the established period for storing accounting documentation.

Only persons holding responsible positions in the organization are subject to punishment. This is described in Art. 15.11 Code of Administrative Offenses of the Russian Federation.

Please note that the Code of Administrative Offenses of the Russian Federation does not provide for punishment for the absence of primary documentation.

The rules for preparing a product report in 1C are outlined in the following video instructions:

https://youtu.be/kCVR-nsE3eo

Samples of the TORG 2020 - 2018 series

In practice, enterprises very often use invoices from the TORG series:

- 12 – for the transfer of goods, raw materials, equipment and other property assets to the counterparty (any legal entity or, less commonly, private individuals);

- 13 – for the transfer of valuables within one enterprise (both within one warehouse and between different separate divisions);

- 14 – to record the fact of release by small enterprises engaged in small retail trade.

They have a similar form, but the individual graphs are slightly different because they are used in different situations.

TRADE 12

In fact, since 2013, the single, previously valid form has been abolished. However, many enterprises continue to use the same old form, which is not at all contrary to the law. The document is drawn up when goods are sold to the buyer. In this case, most often the buyer is a legal entity, although it is acceptable to use the form when selling to individuals.

When filling out the column, it is important to understand that it will subsequently be used in accounting. Therefore, even the absence of one piece of information will no longer be valid, which may lead to sanctions if a deficiency is discovered during verification:

- title and date of compilation;

- Company name;

- Name;

- natural and monetary measurement of units;

- positions of the releasing and accepting person;

- signatures, transcripts of signatures;

- Stamp of the company.

The header indicates the document serial number, as well as:

- In the column “Consignor” the name of the company that sent the cargo is given. Usually the supplier itself acts as this company, so the content of the relevant information is duplicated.

- Information about the structural unit is recorded only in cases where the goods were shipped from a separate unit of the supplier.

- The “Consignee” column provides details of the company that received the cargo.

- In the “Payer” column - details of the company that paid for the purchase: contact details, legal address, bank account details and bank name, INN, BIC.

- The code is entered in accordance with the OKPO classifier.

- In the “Base” line, the wording “Agreement” is usually given, and “Invoice” is also allowed.

- They usually do not enter anything by type of transaction, but if the company has adopted an internal classification of types of business transactions, they provide the appropriate wording.

The rules for creating a list of goods are described in the table.

| columns | how to fill out |

| 1 | serial numbers in the list |

| 2 | full name of the item in accordance with the nomenclature system adopted by the company, as well as characteristics (grade, article, brand - separated by commas) |

| 3 | the field usually remains empty (or you can put a dash), however, if it is impossible to unambiguously identify one or another object by the name of the position, then an additional code is given |

| 4,5 | the unit of measurement is prescribed in the form of a code according to the OKEI system |

| 6 | in most cases, a dash is placed here; less often, “wooden box”, “cardboard packaging”, etc. are indicated. |

| 7,8 | Usually a dash is also placed in this field, and the total quantity is written in line 10 |

| 9 | gross mass should be indicated only if necessary; in most cases, the column is also crossed out |

| 10 | here the total quantity of all goods supplied is indicated in the units of measurement that are accepted |

| 11 | here is the exact price of one unit excluding VAT |

| 12 | here is the price for the entire lot, excluding VAT |

| 13,14 | the VAT amount and rates are given |

| 15 | here is the amount of the entire batch including VAT |

As a result, the total quantities are indicated:

- records (rows);

- places;

- cargo mass;

- masses;

- price.

Sign:

- Chief Accountant;

- the employee who authorized the leave;

- the employee who directly released the property.

TRADE 13

An invoice of this form is sent in all cases when goods are moved within the same company - for example, they move from the area of responsibility of one employee to the area of responsibility of another or simply change location. The registration procedure is essentially the same.

TRADE 14

This form of document is used in cases where product reports are not prepared:

- vendors in trays;

- from carts;

- from distributions;

- other small retail outlets.

For what purposes is it used?

The product report in organizations is used to perform the following functions:

- Carrying out registration and accounting of receipt of goods - registering them.

- To record expenses for the reporting period related to payment for goods, services, wages and others.

- To account for the write-off of funds associated with the return of goods to suppliers (without identifying the reason why this happened). In this case, this may be a return due to defects, by prior agreement to exchange an expired product for a more recent one, in the event of a break in business relations with a specific counterparty, etc.

- To be able to create a register of all receipts, expenditure invoices and other documentation that changes the organization’s inventory.

- To summarize the overall results for the reporting period - how much goods and funds were disposed of, how much was put on record.

- To be able to exercise control over individual positions, as well as over specifically limited areas of activity, for which certain employees are responsible.

03/20/2020 Practical work 9 “Procedure for compiling a product report”

INSTRUCTION CARD FOR PRACTICAL LESSON No. 9

Discipline "Retail trade of non-food products"

Course ___1__ group__923____ date __________

Specialty: 02/38/04. Commerce (by industry)

Subject:

“Procedure for preparing a product report”

Lesson objectives (for students):

familiarization with the types of financial liability, preparation of TORG-29,

Didactic:

—

systematization and generalization of new knowledge

-application of knowledge in practice in order to deepen and expand acquired knowledge

Educational

—

professional orientation;

- fostering responsibility when performing professional tasks.

Developmental:

—

development of cognitive activity;

Lesson methods: practical (reproducing exercises), solving problem situations.

Form of organization of activity: frontal, individual.

Formed competencies

: PC4.3. Monitor the safety of inventory items

Working time:

2 hours

| Lesson stages | Teacher's activities | Activity students | Form of interaction | Level of assimilation | time |

| Organizational part | Greets students, checks readiness for class, checks attendance | Greet the teacher and prepare writing materials | Verbal visual | 1 | 5 |

| Generalization and systematization of knowledge | Asks questions and corrects answers | They answer, listen, complement. | Conversation frontal survey | 2 | 10 |

| Message of the topic, objectives of the lesson | Announces the topic of the lesson, purpose, uses the board. Indicates a problem | Get to know the purpose of the lesson | Mental, written fixation | 2 | 5 |

| Explanation of new material | Presents the material, explains the procedure for completing the task Directs to solve the problem | Remembers the main points and writes them down | Mental written fixation | 2 | 15 |

| Consolidation Completing practical tasks | Correction of the obtained results, | Solving practical problems | written | 3 | 20 |

| Summarizing | Evaluates the level of preparation and work in class | listening | Verbal visual | 2 | 10 |

| Homework assignment | Sets homework | Listen and record | Written Verbal visual | 1 | 5 |

Theoretical information

“Types of financial liability and responsibilities of employees for the safety of commodity and material assets.”

Financial liability

is the obligation of an employee to compensate, in accordance with the procedure and amount established by law, direct actual damage caused through his fault to the enterprise with which he is in an employment relationship.

The store uses two types of training: individual and team.

Individual m/o

– valuables are handed over to the employee, who in case of shortage (damage, theft) bears personal property liability. It can be limited or complete.

Limited m/o – compensation for damage is made in its actual amount, but not more than 1/3 of a month’s salary (in some cases, no more than 2/3 of a month’s salary).

Full m/o - compensation for damage in full, in cases containing signs of a crime. Responsible for employees involved in servicing money and goods. A written agreement on full financial responsibility is concluded with them (only if there is an employment contract). The contract is valid from the moment of signing and applies for the entire time with the material assets of the enterprise entrusted to the employee.

The agreement is drawn up in 2 copies:

1st copy from the administration of the enterprise;

2nd copy from the employee with whom the contract was concluded.

Individual m/o is applied if the following conditions are met:

- inventory items are handed directly to the employee for reporting;

- the employee is provided with a separate, isolated room or appropriate place for storing and selling inventory;

- the employee independently reports to the accounting department for the valuables entrusted to him.

Brigade m/o

- this is when valuables are presented to a group (team) of store employees.

Introduced in stores with at least two salespeople. The team composition should not exceed 10 people. M/o for the brigade is assigned by an agreement

between the administration and the members of the brigade. The agreement is drawn up in two copies:

The first copy is kept by the administration;

The 2nd copy is kept by the foreman.

When team members leave or arrive, the contract is not reissued, but the date of departure or arrival is written against the last name and the recipient signs the contract. The contract is renewed in the event of the departure of 50% of the team and in the event of a change or departure of the foreman.

The brigade includes: head. departments, their deputies, salespeople, and in self-service stores also controllers, administrators and cashier-controllers.

As a rule, the senior leader is elected as a foreman.

The management of the brigade is entrusted to the foreman and his deputy, who are appointed by order of the head of the enterprise.

The team may NOT include: minors, junior service personnel, workers, packers, cleaners, and seller’s apprentices.

The brigade assumes full responsibility for all inventory items transferred to it, for shortages of goods in excess of the norms of natural loss, as well as for theft and damage to goods at retail prices.

The brigade is exempt from registration in the event of a theft documented in accordance with the established procedure. Damage is compensated by all team members in direct proportion to the actual time worked and salary.

Administration responsibilities:

- familiarize employees with the current legislation on m/o;

- create conditions for work;

- introduce the procedure for storing and selling valuables;

- carry out inventory in the prescribed manner.

Responsibilities of employees:

- promptly inform the administration about all circumstances that threaten the safety of the entrusted property;

- keep records and provide, in the prescribed manner, commodity-money and other reports on the movement of valuables;

- compensate in full for the damage caused due to his fault.

1.Fill out the table

: types of financial liability.

| Applicable types of MO |

| Features of concluding an agreement on international defense |

| Deadlines for concluding an agreement on international defense |

| In what cases is the MOL exempt from the MO? |

| What are the main responsibilities of an employee who has taken over the MO? |

| Features of compensation for harm |

| Cases of re-registration of an agreement on international defense |

Control of safety of inventory items

Preparation of a product report

A commodity report is a summary statement of accounting for the receipt and disposal of goods and containers as a whole for a trading enterprise with the display of balances for goods and containers.

All documents reflecting the movement of goods and packaging in the store are entered into the commodity report in summarized terms, which is compiled by the manager. Department.

Within a strictly established time frame, according to the schedule, all documents and commodity reports are submitted to the accounting department of the trading enterprise (1-10 days), depending on the volume of goods received.

At the beginning of compiling the commodity report, the balances are entered for the amount of goods and containers on the date of compilation that were registered for the manager. department.

In the expense part of the commodity report, the amount of cash revenue for the day is first reflected, then the return of goods and packaging in the order of internal transfer and other disposals. And all consumable documents: an act on the revaluation of goods, an invoice, an act on the return of containers, goods on a tray, etc.

The product report calculates the totals for incoming and outgoing parts, then displays the balance of goods and packaging at the end of the day. The amounts of goods and containers on invoices are entered into the goods report of the head of the department, after applying the % trade markup, i.e. at retail prices.

In the product report, the amounts of goods and containers are recorded separately. The product report does not count the quantity of goods received, but only the amount.

After drawing up the commodity report, the head of the department attaches all the entered incoming and outgoing invoices in the sequence in which they are included in the commodity report and takes it to the chief accountant for verification. After checking all the documents, the amounts included in the product report, and the correctness of displaying balances for goods and containers, the chief accountant puts his signature on each copy.

1 copy - with documents he keeps for himself;

The 2nd copy is given by the head of the department with his signature.

From that moment on, the amounts of balances for goods and containers are considered correct, with which the actual balance is checked during inventory.

Prepare a material report based on the following data:

An agreement on collective (team) financial responsibility was concluded with the team of sales workers of Intensive Logistics LLC, in particular Store No. 1 “Romashkovoye Pole”. Deputy Director Polina Romanovna Lesnicheva was appointed as foreman. In Intensive Logistics LLC, a reporting period has been established for drawing up a product report - 5 days. Goods are accounted for at sales (retail) prices.

For the period from July 1 to July 5, 2020, Polina Romanovna Lesnicheva compiled a commodity report in the TORG-29 form. The commodity report was checked and accepted by the chief accountant E. S. Kostrikova.

| 1 | The balance as of 07/01/2018 is 20,365.00 | |

| 2 | 01.07.2018 | Received from Kazamet LLC under invoice No. 693 of goods in the amount of 28,965.40 |

| 3 | 01.07.2018 | Sold through the cash register at retail 18,236.85, according to cash order No. 789 |

| 4 | 02.07.2018 | Goods were received from warehouse No. 1 of Intensive Logistic LLC according to invoice No. 102 of goods in the amount of 18,963.50 |

| 5 | 02.07.2018 | Sold through the cash register at retail 3,265.98, according to cash order No. 932 |

| 6 | 03.07.2018 | Received from Severin LLC under invoice No. 10065 of goods in the amount of 45,986.00 |

| 7 | 03.07.2018. | Sold through the cash register at retail 9,658.30, according to cash order No. 988 |

| 8 | 04.07.2018 | Sold through the cash register at retail 11,658.90, according to cash order No. 1011 |

| 9 | 05.07.2018 | Sold through the cash register at retail 18,985.00, according to cash order No. 1123 |

1 Reply

Balance as of 07/01/2018-?

Total upon arrival -?

Total consumption -?

Balance as of 08/05/2018-?

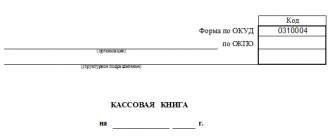

General filling requirements

The State Statistics Committee of Russia established the TORG-29 form by Resolution of 1998. Since 2013, it has ceased to be a mandatory unified version: enterprises have the right to develop their own versions, which must contain the same details.

This type of document is important in those organizations that use the balance method of accounting; it is also called operational accounting. With this option of document preparation, accounting of goods is carried out using cards filled out in warehouses; this data is periodically checked by an accountant and confirmed by his signature. At the end of each month, the warehouse manager records all the data from the accounting cards in the statement of balances, which is redirected to the accounting department of the enterprise.

To record the movement of goods, a commodity report is filled out in form TORG-29. This document must be completed by an authorized employee who is responsible for the material values. Most often, this role is played by the warehouse manager of the enterprise. The head of the enterprise determines the duration of the reporting period: it can range from several days to a month. At the specified frequency, the responsible employee fills out a product report. Here is the TORG 29 form, which you can download for free.

How to automate work with documents and avoid filling out forms manually

Automatic filling of document forms. Save your time. Get rid of mistakes.

Connect to CLASS365 and take advantage of the full range of features:

- Automatically fill out current standard document forms

- Print documents with signature and seal image

- Create letterheads with your logo and details

- Create the best commercial offers (including using your own templates)

- Upload documents in Excel, PDF, CSV formats

- Send documents by email directly from the system

- Maintain goods records and reporting

With CLASS365 you can not only automatically prepare documents. The free trading program CLASS365 allows you to manage an entire company in one system, from any device connected to the Internet. It is easy to organize effective work with clients, partners and staff, to maintain trade, warehouse and financial records. CLASS365 automates the entire enterprise.

Commodity report form TORG-29 is filled out by trading enterprises to provide data on trade turnover in one document. This form (unified type) of financial statements was confirmed by Decree of the State Committee of the Russian Federation on Statistics No. 132 on December 25, 1998 and remains valid today. In the article we will tell you about TORG-29 Product report and give recommendations for design.

Registration procedure

For convenience, this report is used in companies engaged in the sale of goods at retail, and accounting of activities upon their receipt and departure is carried out using the sales price. Convenient for those enterprises that use the cost method of accounting for goods, called the balance method.

The requirements for this document are:

- How many copies are made? It is submitted in two copies, one of which remains in the accounting department with the original documents attached to it, and the second remains with the responsible person.

- Which employees should report? The obligation to draw it up applies to financially responsible persons who receive and release goods. This employee submits the report to the accountant for verification. If everything is in order, then one copy of the two forms is endorsed by the inspector and returned to the responsible person.

- How is data entered into the report? Filling out the parameters from the turnover documentation received during the reporting period is done both electronically and manually using a pen with blue or black ink.

- What should this document confirm? All information reflected in the TORG 29 form is confirmation of the movement of goods: how much arrived and left, as well as what balance is available at the end of the reporting period.

- Grounds and procedure for using the TORG 29 form. The form is filled out by the financially responsible person, based on the availability of documents for the reporting period, approved by the chief manager of the organization. All documents are divided into 2 tables about the receipt and consumption of goods in accordance with the chronological order of their creation.

- The storage location for each copy of completed TORG 29 forms. One of them is stored in the archives of the accounting department of the trade organization, and the other is kept by the financially responsible person.

Now let's move on to filling out the report form itself.

Sample of filling out a product report (TORG 29 form). Page 1

Sample of filling out a product report (TORG 29 form). Page 2