The procedure for determining the amount of advances according to the tax assessment

The main document defining the key points of calculation and procedure for making payments for pollution is the Law “On Environmental Protection” dated January 10, 2002 No. 7-FZ. It provides for the obligation for legal entities that are not classified as small and medium-sized businesses to pay advance payments for negative environmental impact (NEI) during the current year. At the end of the year, the amount of these payments will reduce the total amount of fees accrued for the year in the tax return.

Who should pay for the negative impact on the environment in 2019-2020, see here.

Advance payments are required to be accrued and paid 3 times a year, at the end of the 1st, 2nd and 3rd quarters, before the 20th day of each month occurring after the end of the corresponding quarter (Clause 3, Article 16.4 of Law No. 7-FZ).

How to determine the amount of advance payment? Since 2020, there are three such methods. The advance can be determined as:

- ¼ of the fee for the tax assessment payable for the previous year;

- ¼ fee calculated based on the volume or mass of emissions (discharges) of pollutants within the limits of standards, temporarily permitted emissions (discharges) or limits on the disposal of production and consumption waste;

- the product of the payment base, which is determined on the basis of industrial environmental control data on the volume or mass of emissions (discharges) or on the mass of disposed production and consumption waste in the previous quarter, and the corresponding payment rates for environmental waste using the coefficients provided by law.

https://youtu.be/zG08879ncHY

Basic Concepts

Negative impact on the environment is the impact of economic and other activities, the consequences of which lead to negative changes in the quality of the environment. Business entities have a negative impact on the environment through the disposal of production and consumption waste, emissions of pollutants from stationary sources and discharges into water bodies.

Production and consumption waste

Production and consumption waste (waste)

- substances or objects that are generated in the process of production, performance of work, provision of services or in the process of consumption. These wastes are disposed of, intended to be disposed of, or to be disposed of. This is stated in the law “On Production and Consumption Waste”.

Disposal of waste, both on the territory of the natural resource user and at landfills, is paid. Entities that dispose of waste are required to pay a “Negative Environmental Impact Fee” (NVOS fee) to the state budget.

Waste disposal means its storage on the territory of the subject or landfill and burial at the landfill without further disposal.

Emissions of pollutants from stationary sources

A pollutant release

is the release of a pollutant into the atmosphere from a source of air pollution.

Sources of pollution are divided into stationary and mobile. Stationary - sources of pollution whose location is tied to specific coordinates and which can be moved using a mobile source of pollution. It is the users of stationary sources of pollution who are required to pay for the negative impact on the environment. For example, this is a boiler room, a waste dump, a welding station, a tank with petroleum products, and more. Mobile sources - for example, a car and a diesel locomotive - any vehicle with an engine.

Stationary sources are divided into organized and unorganized sources. An organized source refers to sources whose emissions enter the atmospheric air through special technical devices (pipes, for example). If the power and volume of emissions can be determined at a source using special instruments and equipment, then it is an organized source. For unorganized sources, the rate and volume of release are determined, as a rule, by calculation methods.

Discharges into water bodies

Discharge

is the entry into water bodies with wastewater of pollutants that worsen the quality of water, limit the use or negatively affect the condition of the bottom and banks of water bodies.

Like emissions, discharges are divided into organized and unorganized. Organized sources include those from which discharges enter water bodies through special technical devices, such as a pipe. A sign that the source is organized is the ability to determine power (in liters per second) and volumes (in cubic meters per year) using special equipment. For unorganized sources, the rate and volume of discharge are determined, as a rule, by calculation using, if necessary, control and analytical methods.

How to calculate fees for 2020

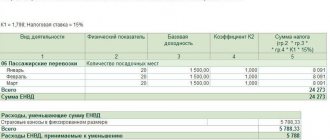

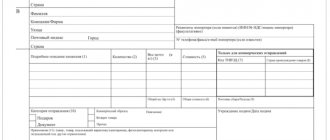

The calculation of the pollution fee for the year is made in the declaration, which includes:

- title page;

- a section with summary results of calculations, in which accrued amounts are reduced due to expenses that reduce the negative effect of polluting impacts, and due to advances paid during the year;

- 3 special sections (according to the number of main types of pollution sources), each of which is a table with the parameters necessary to calculate the payment for the corresponding pollution source, and is filled out only if the payer has such a source.

Calculation in special sections occurs according to the rules described in detail in the order of the Ministry of Natural Resources of Russia dated 01/09/2017 No. 3 (in the notes to the declaration form) and in the Decree of the Government of the Russian Federation dated 03/03/2017 No. 255. Both of these documents also contain the necessary values used in the calculations coefficients

For more information about the parameters involved in the calculations, read the article “Calculation of fees for environmental pollution - 2020 - 2020”.

Advance payments of the NVOS fee

Advance payments for environmental impact assessments are a special procedure for calculating and making payments for negative impacts on the environment, provided for by law for legal entities - large business entities that are not classified as small or medium-sized businesses.

Advance payments for the new tax assessment are accrued and paid three times, during the current year - at the end of the first, second and third quarters, before the 20th day of each month occurring after the end of the corresponding quarter (clause 3 of article 16.4 “Procedure and deadlines for payment fees for environmental assessment" of Law No. 7-FZ "On Environmental Protection"). At the end of the year, the amount of these payments is deducted from the total amount of fees accrued for the year in the tax return. Each payment is equal to one-fourth of the total volume of payments for NVOS paid for the previous year. Companies often experience cases of overpayment. In this regard, the government authorities decided to develop a flexible approach to this issue. The result was two alternative methods for calculating advance payments:

1. The advance payment is recognized as equal to the amount of payment for environmental impact assessment calculated for the actual negative impact on the environment in the past quarter of the current or last calendar year based on industrial environmental control data;

2. The advance payment is calculated in the amount of 1/4 of the payment amount, calculated on the basis of established standards for permissible emissions, discharges of pollutants, temporarily agreed upon emissions, temporarily agreed upon discharges and limits on the disposal of production and consumption waste in the current year.

At the same time, the current method of calculating the advance payment is also preserved. This way, payers have the opportunity to choose and must indicate, as part of the tax return payment declaration, which payment calculation method they intend to use next year.

In addition to the declaration of payment for the IEE, the organization also provides a report to the appropriate authority. This report details how the NVOS fee was calculated at this facility. Contents of the report:

1. Title page;

2. Section with the summary results of calculations, in which accrued amounts are reduced due to expenses that reduce the negative effect of polluting impacts, and due to advances paid during the year;

3. Three special sections (according to the number of main types of pollution sources - “Emissions of pollutants into the atmospheric air by stationary objects”, “Discharges of pollutants into water bodies”, “Disposal of production and consumption waste”), each of which is a table with parameters , necessary to calculate the payment for the corresponding source of pollution, and is filled out only if the payer has such a source.

Calculation in special sections occurs according to the rules described in detail in the order of the Ministry of Natural Resources of Russia dated 01/09/2017 No. 3 (in the notes to the declaration form) and in the Decree of the Government of the Russian Federation dated 03/03/2017 No. 255. Both of these documents also contain the necessary values of the coefficients used in the calculations.

When calculating the fee for the NVOS, the following data is used:

1. Standards for maximum permissible pollution and limits for waste disposal (approved by Rosprirodnadzor separately for each organization).

2. Standards for temporarily agreed emissions/discharges of pollutants.

3. Standards for payment for environmental pollution from Government Decree N 344.

4. Inflation coefficients and environmental significance of the region.

5. Actual mass of emissions/discharges of pollutants and disposed waste.

6. An increasing coefficient, which is applied if the actual mass of pollutants or waste exceeds the maximum permissible values (coefficient value - 5.0).

Payment for emissions and discharges is made to the budget at the location of the source of pollution; for disposed waste - where this waste is disposed of (Clause 1, Article 16.4 of Law No. 7-FZ). Consequently, OKTMO for payments made for different types of NVOS objects may turn out to be different. This must be taken into account not only when drawing up a declaration, but also when making advance payments. The report is provided both in paper and electronic form. If an organization has several objects in different regions, then a separate report is compiled for each of them. The payment deadline is no later than March 1 of the period following the reporting year.

There are certain penalties if the payment for the IEE is not paid within the prescribed period. For each calendar day of delay you will have to pay a penalty. Its size is one three hundredth of the key rate of the Bank of Russia in effect on the day the penalty is paid, but not more than two tenths of a percent for each day of delay. Forced collection of debt is carried out in court. Also, according to the Code of the Russian Federation “On Administrative Violations” dated June 22, 2007, a fine is imposed for late payment: for individuals - from 3,000 rubles to 6,000 rubles, for legal entities - from 50,000 rubles to 100,000 rubles.

Obviously, calculating fees for the NVOS requires a very careful approach, a lot of time, and high qualifications. It must be carried out accurately and on time, taking into account all the nuances - this will ensure the avoidance of penalties.

will be happy to help you in correctly solving any environmental issues.

We are waiting for your call by phone: +7-978-9-830-830.

As always, consultations are free!

Deadlines for pollution charges

Legal entities obligated to make such payments make advance payments 3 times a year. Calculations for the year are completed with one more payment - payment of the total amount received in the section of the declaration allocated to summary data, as a result of arithmetic operations performed on the amount calculated in special sections.

Thus, there are two types of deadlines for payment.

- For advance payments - in 2020 they will expire on April 20, July 20 and October 20.

IMPORTANT! If the due date for payment for the tax assessment coincides with a weekend, the payment must be transferred the day before, since Law No. 7-FZ does not provide for the transfer of deadlines to the next working day (as in the Tax Code of the Russian Federation).

- For the final payment for the year, the deadline for this period corresponds to March 1 of the year following the reporting year, i.e. payment for 2020 will need to be made no later than February 28, 2020 (March 1 is a day off).

Those organizations that are not required to pay advances transfer payments to the NVOS once (at the end of the year), i.e., there is only one deadline for them (March 1).

Overpayments under the Tax Assessment can be offset or refunded. Since 09/07/2019, the procedure for credit/refund has been established by law.

Common to all legal entities, regardless of the scale of their business, is the deadline established for submitting a declaration on the NVOS, which expires on March 10 of the year following the reporting year.

For information on possible ways to submit a declaration on the NEE, read the material “How to submit a declaration on payment for negative environmental impact?”.

Who should pay the pollution fee?

Dangerous objects

New form for 2020.

Order of the Ministry of Natural Resources dated 03/09/2017 No. 3 approved the form for the declaration of negative impact on the environment. It must be submitted no later than March 12, 2020. .

Based on the results of 2020, all organizations and individual entrepreneurs who use facilities that have a negative impact on the environment as part of their business must pay for environmental pollution. Moreover, the obligation to pay the fee applies to all organizations and individual entrepreneurs applying any of the taxation systems provided for by the Tax Code of the Russian Federation (STS, UTII, OSNO, etc.).

Keep in mind that the obligation to pay a fee for environmental pollution does not depend on the ownership of the object of negative impact. Therefore, the fee for 2020 must be paid by those who actually operate such a facility (for example, tenants).

An organization or individual entrepreneur operating objects with a negative impact on the environment is required to register with the territorial branch of Rosprirodnadzor. To do this, for each object you need to submit an application in the form approved by order of the Ministry of Natural Resources of Russia dated December 23, 2020 No. 554.

Exception

The legislation of the Russian Federation provides for an exception for those who are not obliged to pay a fee for a negative impact (clause 1 of Article 16.1 of the Law of January 10, 2002 No. 7-FZ). It covers companies and individual entrepreneurs that operate only at sites of hazard category IV. These are objects on which:

- there are stationary sources of pollutant emissions, but the amount of emissions does not exceed 10 tons per year;

- there are no releases of radioactive substances;

- there are no discharges of pollutants that are formed when water is used for industrial needs, into sewers and into the environment (into surface and underground water bodies, onto the earth's surface).

How to find out whether an organization or individual entrepreneur must pay a fee for environmental pollution based on the results of 2020? Let me explain. Rosprirodnadzor assigns hazard categories when registering objects in the state register. Accordingly, if you do not know which category is assigned to your objects, contact Rosprirodnadzor and clarify information about the hazard class of your objects.

We recommend distinguishing between a fee for environmental pollution and an environmental fee - these are completely different non-tax payments.

Where and how to pay advances for NVOS

Regarding the place of payment, the pollution fee is linked as follows (Clause 1, Article 16.4 of Law No. 7-FZ):

- for emissions and discharges it is paid to the budget at the location of the source of pollution;

- for disposed waste it is paid where the waste is disposed of.

That is, OKTMO for payment carried out for different types of polluting objects may turn out to be different. And this must be taken into account not only when drawing up the declaration, but also when making advance payments.

Depending on the type of pollution source, the values of the BCC indicated in the payment document will also differ.

For information on the BCC values used for payments for new environmental impact materials, see the article “BCC for negative environmental impact.”

What distinguishes payments under NVOS from environmental payments?

In addition to payments under the NVOS, there is another payment of an environmental nature, which has the official name “environmental fee”. It is regulated by another regulatory act - the Law “On Industrial and Consumption Waste” dated June 24, 1998 No. 89-FZ.

It has many differences from pollution charges:

- the circle of payers represented by persons producing or importing products that require their disposal upon completion of use;

- tax base, defined as the volume of recycled goods, adjusted to the recycling standard;

- rate depending on the type of product being disposed of;

- the deadline established for payment and being the only one, coincides with the deadline for submitting collection reports and corresponds to the date of April 14 of the year following the reporting year (the law states “until April 15”, but in order to avoid disagreements with the regulatory authority, it is better to pay before the 14th inclusive ).

The legislation does not provide for advance payment of environmental fees. Thus, there is no need to make advance environmental payments in 2020.

Read more about the environmental fee in the material “Who should pay the environmental fee in 2020 - 2020?”

Results

Advances on payments for NVOS must be paid by legal entities that are not classified as small or medium-sized businesses. Such payments are made three times a year, upon completion of the 1st, 2nd and 3rd quarters, no later than the 20th day of the month following the end of the corresponding quarter. The amount of each advance is determined in one of three ways specified in Law No. 7-FZ.

Sources:

- Federal Law of January 10, 2002 No. 7-FZ

- Decree of the Government of the Russian Federation dated March 3, 2017 No. 255

- Order of the Ministry of Natural Resources of Russia dated 01/09/2017 No. 3

- Federal Law of June 24, 1998 No. 89-FZ

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Procedure and deadlines for paying fees for NVOS

Payment for the NWTP and advance payments are made in the same region where the stationary source of pollution is located. The reporting period is a calendar year. Payment must be made no later than March 1 of the year following the reporting period. That is, if you pay for 2020, then you need to transfer the money before March 1, 2017.

Next, before March 10, you must submit a declaration of payment for the NVOS to the local executive authority. The declaration form can be downloaded here. The law also provides for a certain procedure for making payments for the NVOS - advance payments.

Advance payments for NVOS are made quarterly no later than the 20th day of the month following the last quarter. There is no payment for the last quarter of the year. How do you know how much to pay per quarter? To do this, you simply take the total amount paid in the previous year and divide it by four. A quarter of what you paid last year is your current quarterly payment.

Based on the results of the fourth quarter, a final calculation is made based on the current year’s indicators, then the missing amount is paid.

There are certain penalties if the payment for the IEE is not paid within the prescribed period. For each calendar day of delay you will have to pay a penalty. Its size is one three hundredth of the key rate of the Bank of Russia in effect on the day the penalty is paid, but not more than two tenths of a percent for each day of delay.