Agency agreement: types and rules

The essence of an agency (intermediary) agreement comes down to the presence between the 2 parties to the transaction (seller and buyer) of a third party (intermediary), whose role can be:

- commission agent;

- agent;

- attorney.

For a sample agreement, see the material “Agency Agreement - Sample Completion for Legal Entities.”

The activity of an intermediary is to carry out legally significant actions on its own behalf or on behalf of the guarantor (principal, principal, principal), leading to the consequences of these actions for the guarantor.

Despite the fact that in the Civil Code of the Russian Federation (Chapter 52) the agency agreement is distinguished as an independent type, it, in fact, combines two types of agreements:

- instructions (Chapter 49), when an agent acts on his own behalf and he also acquires rights/obligations under the transaction;

- commissions (Chapter 51), when the agent acts on behalf of the guarantor and the rights/obligations under the transaction arise directly from the guarantor.

The following features of agency agreements are important for accounting:

- income and expenses from intermediary transactions arise from the guarantor;

- the income of the intermediary becomes the agency fee paid to him by the guarantor;

- The money and property of the guarantor received by the intermediary in connection with the order assigned to him are only means for executing the order and are not reflected in the income/expenses of the intermediary;

- the intermediary's costs associated with the execution of the agency agreement and reimbursed to him by the guarantor do not constitute the income/expenses of the intermediary;

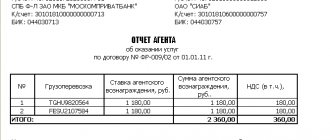

- the volumes of functions performed by the intermediary and the reimbursable costs incurred by him, confirmed by documents, are reflected in the intermediary’s report, which is the primary accounting document for the guarantor and is considered accepted if he has no objections to it.

Ready-made solutions from ConsultantPlus will help you check the agency agreement for risks:

Get free access to K+ and go to the Ready-made solution for the principal.

And this link will take you to the Ready Agent Solution if you have access to K+. If you don't have it, you can get trial access for free.

There are two main schemes of actions passing through an intermediary:

- sales;

- purchases.

When concluding agency agreements, accounting should be organized using postings through account 76 with details of the types of calculations for analytics. The intermediary’s income, depending on the accounting policy, can be generated either on account 90 or 91.

See also “How to correctly make entries under an agency agreement.”

Features of tax accounting

As can be seen from the above data, commercial transactions between the agent and the customer are subject to VAT. In addition, income is included in the tax base for income tax and simplified tax, like other income from the activities of the company. Expenses are divided into those included in the tax base and those not included in it. According to Art. 252 of the Tax Code of the Russian Federation (clause 1), the taxpayer has the right to reduce the base for it by the amount of confirmed costs, except for those listed in Art. 270 (9). In particular, the costs of the agent under the contract with the principal are also mentioned here, if they are reimbursed by the latter.

The amount that he transfers to the customer under the contract is not included in the agent’s income. At the same time, if the customer does not reimburse the costs according to the contract, then they are included in the tax base, in accordance with Art. 252 of the Tax Code of the Russian Federation.

Main

- An agent under an agreement with a principal can act both on his behalf and on his own, providing intermediary services.

- Accounting for such transactions and movements on them is based on taking into account all significant clauses of the agreement.

- The agent's remuneration is paid based on his report on the work done.

- Amounts under an agency agreement are subject to VAT on both sides; income, similarly, is included in the calculation of profit for the period and in the calculation under the simplified tax system.

- Reduction costs can only be included to the extent that they are not reimbursed by the other party. An agent whose expenses are reimbursed by the customer does not have the right to include these amounts in the tax calculation.

Accounting for sales through an agent

Acting on behalf of the guarantor, the agent essentially provides him with the service of finding a buyer. Documents for the buyer are drawn up by the actual seller, and he also generates income/costs for the transaction:

- the implementation is shown: Dt 62 Kt 90;

- VAT is charged under an agency agreement on sales: Dt 90 Kt 68;

- the agent's services and expenses reimbursed to him are taken into account: Dt 20 (26, 44) Kt 76;

- is allocated and accepted for deduction of VAT on the agent’s services and expenses reimbursed to him:

- Dt 19 Kt 76;

- Dt 68 Kt 19;

For information about the procedure for settlements with an agent, see the article “Procedure for payment of remuneration under an agency agreement.”

- the total amount of costs, which also includes the guarantor’s own expenses, reduces the income from sales: Dt 90 Kt 20 (23, 25, 26, 41, 43, 44).

In this case, the agent has in his records:

- income from services rendered will be reflected: Dt 76 Kt 90;

- VAT will be charged: Dt 90 Kt 68;

- Reimbursable costs for the provision of services will be taken into account: Dt 76 Kt 60;

- money will be received from the guarantor for the service and reimbursement of costs: Dt 51 Kt 76.

To learn about when an agent’s services are not subject to VAT, read the article “Which intermediary services are not subject to VAT .

When an agent acts on his own behalf, he draws up documents for the buyer himself and all payments go through him. However, the goods received for sale remain the property of the guarantor. The funds received from the buyer are also the funds of the guarantor. The agent, as a rule, withholds the remuneration intended for him from the amount received from the buyer before transferring it to the guarantor.

For such agency agreements, accounting is organized according to the following rules:

- The receipt of goods intended for sale by the agent will be reflected in the balance sheet by the entry: Dt 004;

- the shipment will be shown to them at the full sales price in the correspondence of the account of settlements with the buyer with the account of accounting for settlements with the guarantor: Dt 62 Kt 76;

- at the same time the goods will be written off from the off-balance account: Kt 004;

- money received from the buyer is taken into account in the usual manner (including advances): Dt 51 Kt 62.

Moreover, the obligation to charge VAT on advances received from the buyer falls on the guarantor.

Read how to correctly reissue invoices under an agency agreement here.

Through postings to account 76, the intermediary’s income and the amount intended for transfer to the guarantor are formed:

- The intermediary's remuneration is taken into account: Dt 76 Kt 90;

- VAT is charged on remuneration: Dt 90 Kt 68;

- the intermediary's expenses reimbursed by the guarantor are reflected: Dt 76 Kt 60;

- the total amount of debt to the guarantor is transferred to him: Dt 76 Kt 51.

The guarantor's entries for sales and cost accounting will be the same as when selling on his behalf, with the only difference being that the amount of shipment will correspond to that indicated in the documents drawn up in the name of the buyer by the intermediary, the entry for payment to the intermediary will disappear and additional accounting entries will appear shipment and payment from the buyer:

- the goods were transferred for sale to the intermediary: Dt 45 Kt 41 (43);

- at the time of sale of the transferred goods: Dt 90 Kt 45;

- receipt of money to the guarantor from the intermediary (minus his remuneration and reimbursable expenses): Dt 51 Kt 62;

- accounting in the funds due from the buyer for the amounts of remuneration and reimbursable expenses withheld by the intermediary: Dt 76 Kt 62.

For information on the rules for issuing invoices for sales involving an intermediary, read the material “How to issue invoices when selling goods through an intermediary?”

How to calculate VAT on intermediary agreements

Intermediary transactions include:

- under a commission agreement;

- under a contract of agency;

- under an agency agreement.

The procedure for calculating VAT on intermediary agreements depends on:

- who is the participant in the intermediary agreement - the customer (principal, principal or principal) or the intermediary (commission agent, agent or attorney);

- what order the intermediary performs for the customer - sells or buys goods (work, services).

In addition, a special procedure for calculating VAT must be applied:

- upon receipt of advances under intermediary agreements related to the sale of goods;

— when selling goods of foreign organizations that are not tax registered in Russia.

Selling goods through an intermediary

An intermediary agreement related to the sale of goods (works, services) may provide for two options:

— the intermediary participates in the settlements (i.e., the buyer pays the intermediary, and the intermediary transfers the proceeds to the customer minus the intermediary fee);

— the intermediary does not participate in settlements (the buyer pays directly with the customer, and the customer transfers the intermediary fee to the intermediary’s account).

In any settlement option, the intermediary - VAT payer must charge tax on the amount of his remuneration and any other income (for example, additional benefits) received during the execution of the intermediary agreement. This is stated in paragraph 1 of Article 156 of the Tax Code of the Russian Federation. The exception is remuneration received for intermediary services for the sale of goods (work, services) specified in paragraph 1, subparagraphs 1 and 8 of paragraph 2 and subparagraph 6 of paragraph 3 of Article 149 of the Tax Code of the Russian Federation. Among them are some medical goods, funeral services, and folk arts and crafts. When selling these goods (works, services), neither their owners nor intermediaries should pay VAT. This procedure is provided for in paragraph 2 of Article 156 of the Tax Code of the Russian Federation.

Intermediary fee

Intermediary fees and other income received during the execution of an intermediary agreement (for example, additional benefits) are subject to VAT at a rate of 18 percent. This follows from the provisions of paragraph 3 of Article 164 of the Tax Code of the Russian Federation and letter of the Ministry of Finance of Russia dated May 12, 2011 No. 03-07-11/122.

Situation: at what rate should the intermediary pay VAT on the remuneration received during the execution of the contract? The intermediary sells goods subject to VAT at a rate of 10 percent.

Services provided on the basis of intermediary agreements are subject to VAT at a rate of 18 percent (clause 3 of Article 164 and Article 156 of the Tax Code of the Russian Federation).

At the same time, the Tax Code of the Russian Federation does not contain any exceptions that would provide for the application of a 10 percent rate for intermediary transactions. Therefore, there is no connection between the rate at which goods sold by a commission agent (attorney, agent) are taxed and the rate used to calculate VAT for the sale of intermediary services (clause 3 of Article 164 of the Tax Code of the Russian Federation). The Russian Ministry of Finance adheres to the same position (see, for example, letter dated March 21, 2006 No. 03-04-07/04).

An example of reflecting in accounting transactions for calculating VAT on intermediary remuneration. Transactions with an intermediary

ZAO Alfa (committee), under a commission agreement, instructed LLC Torgovaya (commission agent) to sell a batch of milk powder (i.e., 10,000 bags). The selling price of one package (excluding VAT) is 30 rubles/package. Powdered milk (except skim milk) is subject to VAT at a rate of 10 percent (List approved by Decree of the Government of the Russian Federation of December 31, 2004 No. 908).

According to the terms of the agreement, the intermediary's commission (excluding VAT) is 15 percent of the transaction amount (excluding VAT). The intermediary is not involved in the settlements.

Hermes sold the entire batch of goods received on commission at the selling price established by the contract. The amount of commission (excluding VAT) was 45,000 rubles. (30 RUR/package × 10,000 packages × 15%). Despite the fact that the subject of the commission agreement is a product subject to VAT at a rate of 10 percent, the intermediary's remuneration is subject to VAT at a rate of 18 percent. Therefore, the amount of VAT that Hermes presented to Alpha as part of the commission amounted to 8,100 rubles. (RUB 45,000 × 18%). The total amount of commission including VAT was RUB 53,100. (RUB 45,000 + RUB 8,100).

The Hermes accountant made the following entries in the accounting (regarding commission): Debit 76 Credit 90-1 – 53,100 rubles. – commission accrued;

Debit 90-3 Credit 68 subaccount “VAT calculations” – 8100 rubles. – VAT is charged for payment to the budget on the amount of commission;

Debit 51 Credit 76 – 53,100 rub. – money was received from the principal in payment of a commission.

In practice, the intermediary's remuneration may be determined by:

- as a fixed amount fixed in the contract;

— as a percentage of the transaction amount;

- as the difference between the price of goods at which they were sold to customers and the price of goods at which they were transferred to commission.

The intermediary is obliged to charge VAT on the intermediary fee on the day when, according to the terms of the contract, the service is considered completed (clause 1 of Article 167 of the Tax Code of the Russian Federation). For example, on the day when the customer approved the intermediary’s report. The intermediary can independently withhold the accrued amount of remuneration from the customer’s proceeds (Articles 410 and 997 of the Civil Code of the Russian Federation).

An example of reflecting in accounting transactions for calculating VAT when selling goods under a commission agreement. Operations with a commission agent

ZAO Alfa (committee), under a commission agreement, instructed LLC Torgovaya (commission agent) to sell a batch of medical equipment in the amount of 220,000 rubles. (including VAT 10% - 20,000 rubles). According to the agreement, Hermes participates in the settlements. The commission is 35,400 rubles. (including VAT 18% - 5400 rubles).

Hermes sold the goods and independently withheld the commission from the principal's proceeds (35,400 rubles), and transferred the rest of the proceeds to Alpha's bank account.

The Hermes accountant made the following entries in the accounting:

Debit 004 – 220,000 rub. – medical equipment was accepted from the principal under a commission agreement;

Debit 62 Credit 76 – 220,000 rub. – medical equipment accepted for commission was sold;

Loan 004 – 220,000 rub. – the cost of medical equipment sold under a commission agreement has been written off;

Debit 76 Credit 90-1 – 35,400 rub. – commission accrued;

Debit 90-3 Credit 68 subaccount “VAT calculations” – 5400 rubles. – VAT payable to the budget on commission remuneration is accrued;

Debit 51 Credit 62 – 220,000 rub. – payment received from the buyer;

Debit 76 Credit 51 – 184,600 rub. (RUB 220,000 – RUB 35,400) – revenue transferred to the principal (minus commission, including VAT).

The intermediary must issue an invoice to the customer for the amount of his remuneration (clause 3 of Article 168 of the Tax Code of the Russian Federation).

VAT at the customer

Customers determine the tax base for VAT in the same manner as organizations that sell goods (work, services) without resorting to the services of intermediaries.

VAT must be charged to the budget either on the day of shipment (transfer) of goods (work, services) or on the day of payment. It depends on which of these events happened first. This procedure is provided for in paragraph 1 of Article 167 of the Tax Code of the Russian Federation.

To calculate VAT, the customer needs to correctly determine the date of shipment (transfer) of goods (work, services). The customer ships (transfers) the goods (work, services) that need to be sold to the intermediary. Formally, this is the same shipment as when transferring goods (work, services) from the seller to the buyer. However, the customer should not charge VAT on shipment to the intermediary. This is explained by the fact that the seller is obliged to present the amount of VAT to the buyer (clause 1 of Article 168 of the Tax Code of the Russian Federation). But the intermediary is not a buyer in relation to the customer.

Thus, the customer must charge VAT at the moment when the goods (work, services) were shipped (performed, provided) to the buyer by the intermediary. Moreover, the date of shipment is considered to be the date of the first document issued to the buyer (carrier) (letter of the Federal Tax Service of Russia dated January 17, 2007 No. 03-1-03/58). The customer can find out when the goods (work, services) were shipped (performed, provided) from the intermediary’s report. Therefore, if possible, the intermediary should attach to its report copies of primary documents confirming the date of shipment of goods (work, services). The intermediary's report is drawn up in any form; there is no standard template for it.

For information on issuing invoices when selling goods through intermediaries, see How to issue invoices, an invoice journal, a sales ledger, and a purchase ledger during intermediary transactions.

The customer can deduct VAT on the intermediary fee after he receives or approves (depending on the terms of the contract) the commission agent’s report and the corresponding invoice. This procedure is provided for in Articles 171 and 172 of the Tax Code of the Russian Federation.

An example of reflecting in accounting transactions for calculating VAT when selling goods under a commission agreement. Operations with the principal

ZAO Alfa (committee), under a commission agreement, instructed LLC Torgovaya (commission agent) to sell a batch of medical equipment in the amount of 220,000 rubles. (including VAT 10% - 20,000 rubles). The book value of goods is 80,000 rubles. According to the agreement, Hermes participates in the settlements. The commission is 35,400 rubles. (including VAT 18% - 5400 rubles).

Hermes sold the goods and independently withheld the commission from the principal's proceeds (35,400 rubles), and transferred the rest of the proceeds to Alpha's bank account.

Alpha's accountant made the following entries in the accounting records:

Debit 45 Credit 41 – 80,000 rub. – goods were transferred for commission;

Debit 62 Credit 90-1 – 220,000 rubles. – revenue from the sale of goods is reflected based on the commission agent’s report;

Debit 76 Credit 62 – 220,000 rub. – reflects the commission agent’s debt, repaid at the expense of buyers’ funds;

Debit 90-3 Credit 68 subaccount “VAT calculations” – 20,000 rubles. – VAT is charged for payment to the budget on proceeds from the sale of goods;

Debit 90-2 Credit 45 – 80,000 rub. – the cost of goods sold under a commission agreement is written off;

Debit 44 Credit 76 – 30,000 rub. (RUB 35,400 – RUB 5,400) – commission accrued (excluding VAT);

Debit 19 Credit 76 – 5400 rub. – VAT on commission fees is taken into account (based on the commission agent’s invoice);

Debit 68 subaccount “Calculations for VAT” Credit 19 – 5400 rub. – accepted for deduction of VAT on commission fees (based on the invoice and the commission agent’s report);

Debit 51 Credit 76 – 184,600 rub. (RUB 220,000 – RUB 35,400) – revenue received from the commission agent (less commission).

Situation: is it necessary to charge VAT on revenue additionally received by the commission agent (agent)? According to the terms of the agreement, the remuneration increases by the entire amount of additional funds received.

Answer: yes, it is necessary.

As a rule, the intermediary agreement determines in advance the price at which the commission agent (agent) must sell the goods (perform work, provide services) of the principal (principal). However, the intermediary can sell goods (perform work, provide services) at a higher price. In such a situation, the parties to the transaction receive additional revenue from sales. By default, it is divided equally between the customer and the intermediary. But the contract may also provide for other conditions. This follows from the provisions of Articles 992 and 1011 of the Civil Code of the Russian Federation.

Additional revenue received by the commission agent (agent) is subject to VAT from the principal (principal). This is explained by the fact that everything received by the intermediary at the expense of the customer (including money) is the property of the latter (clause 1 of Article 996, Article 1011 of the Civil Code of the Russian Federation). This means that additional revenue as part of the income from the sale of goods (performance of work, provision of services) belongs to the customer. This was stated, in particular, in the letter of the Department of Tax Administration of Russia for Moscow dated March 6, 2003 No. 24-11/13281.

Thus, the customer must charge VAT on the amount of additional revenue. But since this entire amount is included in the intermediary fee, after the intermediary’s report is approved, the customer will be able to deduct the amount of VAT on additional revenue. To do this, the intermediary (if he applies the general taxation system) must issue an invoice to the customer for the amount of his remuneration, increased by the amount of additional revenue (clause 1 of Article 156 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated May 12, 2011 No. 03-07 -11/122).

An example of calculating VAT on additional revenue received by a commission agent. According to the terms of the agreement, the amount of additional revenue is part of the commission

CJSC Alfa (committent) instructed LLC Torgovaya (commission agent) to sell a consignment of goods for 94,400 rubles. (including VAT – 14,400 rubles). The contract states that the commission is 5 percent of the sale price of the goods indicated by the principal, as well as the entire amount that the commission agent will receive by selling the goods at a higher price.

Hermes sold goods for 118,000 rubles. (including VAT – 18,000 rubles).

The additional benefit of Hermes is 23,600 rubles. (RUB 118,000 – RUB 94,400). Thus, the total amount of commission including VAT is equal to: RUB 94,400. × 5% + 23,600 rub. = 28,320 rub.

VAT on the commission amount is RUB 4,320. (RUB 28,320 × 18/118). This amount was presented to Alpha on the commission invoice issued by Hermes.

VAT accrued by Alfa for payment to the budget after the sale of goods amounted to 18,000 rubles. The principal accepted for deduction VAT on the commission amount in the amount of 4,320 rubles.

When calculating income tax, Alpha’s accountant took into account:

- income from the sale of goods in the amount of 100,000 rubles. (RUB 118,000 – RUB 18,000); — expense in the form of commissions (including additional income of the commission agent) in the amount of 24,000 rubles. (RUB 28,320 – RUB 4,320).

Purchasing goods through an intermediary

If the intermediary purchasing goods for the customer acts on his own behalf, the customer is not mentioned in the contracts concluded by him. Consequently, invoices, acts and invoices for purchased goods, works or services will be issued in the name of the intermediary. The intermediary records the invoice received from the seller only in the journal of received invoices.

Under the terms of the contract, goods purchased for the customer can be delivered to the intermediary’s warehouse. Since their owner is the customer, the intermediary records the goods on the balance sheet in account 002 “Inventory assets accepted for safekeeping.”

The intermediary is obliged to charge VAT on the intermediary fee on the day when, according to the terms of the contract, the service is considered completed (clause 1 of Article 167 of the Tax Code of the Russian Federation). For example, on the day when the customer approved the intermediary’s report.

An example of reflecting in accounting transactions for calculating VAT when purchasing goods under a commission agreement. Operations with a commission agent

LLC "Torgovaya" (principal), under a commission agreement, instructed CJSC "Alfa" (commission agent) to purchase household goods in the amount of 118,000 rubles. The commission is 11,800 rubles. (including VAT - 1800 rubles).

The principal transferred the amount under the contract to the commission agent. The commission agent, in turn, bought the necessary goods worth 118,000 rubles. (including VAT - 18,000 rubles) and notified the committent about this.

The Alpha accountant made the following entries in the accounting: Debit 51 Credit 76 - 118,000 rubles. – money was received from the principal for the purchase of goods;

Debit 76 Credit 60 – 118,000 rub. – the debt to the supplier, repaid at the expense of the principal’s funds, is taken into account;

Debit 002 – 118,000 rub. – purchased goods are accepted for safekeeping;

Debit 60 Credit 51 – 118,000 rub. – money was transferred to the supplier of goods on behalf of the principal;

Debit 76 Credit 90-1 – 11,800 rub. – commission accrued;

Debit 90-3 Credit 68 subaccount “VAT calculations” – 1800 rubles. – VAT is charged on commission fees;

Loan 002 – 118,000 rub. – the goods were transferred to the consignor;

Debit 51 Credit 76 – 11,800 rub. – remuneration has been received from the principal.

The customer can deduct VAT on purchased goods no earlier than he fulfills all the conditions specified in Articles 171 and 172 of the Tax Code of the Russian Federation. Namely, he will receive the goods and receive the corresponding invoice.

An example of reflecting in accounting transactions for calculating VAT when purchasing goods under a commission agreement. Operations with the principal

LLC "Torgovaya" (principal), under a commission agreement, instructed CJSC "Alfa" (commission agent) to purchase household goods in the amount of 118,000 rubles. The commission is 11,800 rubles. (including VAT - 1800 rubles).

The principal transferred the amount under the contract to the commission agent. The commission agent, in turn, bought the necessary goods worth 118,000 rubles. (including VAT - 18,000 rubles) and notified the committent about this.

The Hermes accountant made the following entries in the accounting:

Debit 76 Credit 51 – 118,000 rub. – money is transferred to the commission agent for the purchase of goods;

Debit 41 Credit 76 – 100,000 rub. (RUB 118,000 – RUB 18,000) – the acquisition of goods is reflected at cost excluding commission (based on the commission agent’s notice);

Debit 19 Credit 76 – 18,000 rub. – input VAT on purchased goods is taken into account (based on the invoice received from the commission agent);

Debit 41 Credit 76 – 10,000 rub. (RUB 11,800 – RUB 1,800) – commission included in the price of goods (excluding VAT);

Debit 19 Credit 76 – 1800 rub. – VAT on commission fees is taken into account;

Debit 76 Credit 51 – 11,800 rub. – remuneration was transferred to the commission agent;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 19,800 rub. (RUB 18,000 + RUB 1,800) – accepted for deduction of VAT on purchased goods and commissions.

Continued >>

Accounting for purchases through an agent

If the agent acts on behalf of the buyer, he actually provides him with the service of finding a supplier. The seller will issue the documents directly to the guarantor, and the buyer will incur the costs of the intermediary’s services:

- goods (work, services) received: Dt 10 (20, 23, 25, 26, 41, 44) Kt 60;

- allocated and accepted for deduction of VAT on purchases:

- Dt 19 Kt 60;

- Dt 68 Kt 19;

- Dt 19 Kt 76;

- Dt 68 Kt 19;

In such a situation, the agent’s entries for recording income will be the same as when he was involved in sales on behalf of the guarantor.

An agent acting on his own behalf during procurement will receive purchase documents issued in his own name. However, neither the purchased goods nor the funds that he will receive from the guarantor to pay for the purchase will be his property.

The goods purchased by the agent for the guarantor will be reflected on the balance sheet: Dt 002.

In the balance sheet, the purchase will be shown to them at the full cost of the purchase in correspondence between the account for settlements with the supplier and the account for accounting for settlements with the guarantor: Dt 76 Kt 60.

Money received from the guarantor and transferred to the supplier will be included in the following entries:

- Dt 51 Kt 76;

- Dt 60 Kt 51.

When the goods are transferred to the guarantor, they will be written off from the off-balance sheet account: Kt 002.

The intermediary's remuneration and the amounts to be reimbursed to him by the guarantor will be formed as follows:

- The intermediary's remuneration is taken into account: Dt 76 Kt 90;

- VAT is charged on remuneration: Dt 90 Kt 68;

- the intermediary's expenses reimbursed by the guarantor are reflected: Dt 76 Kt 60;

- funds are received from the guarantor to pay for remuneration and reimbursable expenses (if they were not initially received in an amount greater than what had to be paid to the supplier): Dt 51 Kt 76.

The guarantor's purchase and cost accounting transactions will be the same as when purchasing on his behalf, with the only difference being that the purchase amount will correspond to that indicated in the documents drawn up in the name of the intermediary by the seller, and settlements for the purchase will not be made directly with the supplier, but through an intermediary:

- goods (work, services) received: Dt 10 (20, 23, 25, 26, 41, 44) Kt 76;

- allocated and accepted for deduction of VAT on purchases:

- Dt 19 Kt 76;

- Dt 68 Kt 19.

For information on whose invoices the guarantor will submit VAT for deduction, read the material “[VAT]: Deduction from the principal when purchasing goods through a chain of intermediaries”.

VAT for the agent on the sale of goods, works, services under an agency agreement

The method of registering VAT under an agency agreement with an agent when performing taxable transactions under a product sales agreement depends on the specifics of the action under the contract.

If the action under the agreement is performed on behalf of the principal, the accrual and invoicing is carried out only from the consideration, the invoice is recorded in the sales ledger in the usual manner. These are all the actions of a person as a representative. The principal then charges a fee on the products sold and issues invoices to consumers.

If the action is performed on one’s own behalf, then it is required to issue and register an invoice for the sold goods of the principal, who has the obligation to pay a fee upon receipt of an advance. A fee must be assessed and an invoice issued against the fee.

There is a certain algorithm for the actions of the intermediary when issuing and registering an invoice for products sold. First, documentation is issued for the buyer on his own behalf. Two copies are compiled, and a limited time is given for this - 5 days.

The document must necessarily reflect the account number, name of the person, address, TIN and KPP information. The allocated fee in the document to the buyer for the principal's products does not need to be included in the budget.

The buyer is given one copy of the document, the principal is given a copy of the invoice. The transfer period is not specified, but can be specified in the contract of assignment. The invoice issued to the buyer must be recorded in the accounting register. The received document is recorded in the second part of the accounting journal.

Upon receipt of an advance payment for products from the buyer, it is necessary to issue and register the relevant invoices in the manner applicable for the shipment of products.

Agency agreement with a foreign company - features of VAT payment

When a Russian organization enters into an agency agreement with a foreign company, it will have to pay VAT if intermediary services are provided on the territory of the Russian Federation. There is a separate letter from the Ministry of Finance of the Russian Federation dated December 2, 2011 No. 03-07-08/339 on this matter.

The essence of the explanations from the financial department is as follows: intermediary services under such agreements are considered to be provided in the place where the company providing them operates. In the above case, services are provided by a Russian organization in our country, and it is here that VAT should be applied at an 18 percent rate.

To learn about when a 0% rate can be applied, read the publication “Export through a foreign intermediary: is VAT subject to VAT and at what rate?”

If the principal works with VAT, issue an invoice

If you are selling goods on your own behalf to a principal who works with VAT, you will have to issue invoices for buyers and report to the tax office. At the same time, you do not need to pay VAT itself.

You issue an invoice for the client on your own behalf. In the seller's data you indicate your details, and in the buyer's data - the client's details. You give one copy of the invoice to the client, the second one you keep for yourself and send a copy of it to the principal. The principal will issue the same invoice on the same date, but in his own name, and give it to you. Both invoices must be recorded in the invoice journal. By the 20th day of the month following the quarter in which the invoices were issued, you must submit the tax journal in electronic form.

If you work on behalf of the principal, you won’t have to bother with VAT. You can, by proxy of the principal, issue an invoice on his behalf. Or the principal will do it himself. In this situation, you do not need to report to the tax office and pay VAT.

Results

Accounting for agency agreements has its own specifics and differs depending on whether the intermediary is involved in the calculations or not. Funds and property received by the intermediary in connection with the execution of the order are not taken into account by him in the balance sheet and do not become his income.

Sources: Civil Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Agency agreements: how an agent pays taxes on the sale of goods and services of the principal

An agent is an intermediary between the seller and the buyer who helps them complete the transaction. For example, you are a courier and deliver goods from online stores to customers. Or you take a product from a supplier and sell it in your store, receiving a commission for it. In these situations, money received from buyers passes through you and is not your income.

[motivationNew(30 days free of charge', subcaption: 'for new business', href: '/?utm_source=enq227'>)=The service will calculate taxes and prepare reports for individual entrepreneurs, LLCs and employees. You can do it even if you don't know anything about accounting.]

Definition

An agency agreement is a written agreement that authorizes an agent to perform legally significant actions on behalf of the principal for a fee. This type of transaction is always commercial and involves professional activity. In this case, the agent can act both on behalf of the principal and on his own behalf.

A commission agreement is a written agreement, according to which the commission agent undertakes the obligation to fulfill the instructions of the principal to complete one or more transactions. Thus, both parties to the legal relationship are in a winning position.

Why should an agency agreement contain a remuneration clause?

Under the agency agreement, the principal is obliged to pay the agent remuneration (paragraph 1 of article 1006 of the Civil Code of the Russian Federation). In other words, the agency agreement is for a fee. This is an imperative rule: the parties cannot formulate a condition on the gratuitous nature of the contract. Thus, in one of its rulings, the Supreme Arbitration Court of the Russian Federation indicated that Article 1006 of the Civil Code of the Russian Federation does not provide for cases when agency fees are not paid (determination of the Supreme Arbitration Court of the Russian Federation dated October 13, 2008 No. 13250/08).

The lawyer of the organization acting as an agent must ensure that the agreement contains a condition on the amount of remuneration and a condition on the procedure for paying the remuneration. Only in this case will the agent’s interests be best protected.

If the contract does not contain such conditions, then this may lead to one of the following negative consequences.

1. The agency agreement will be considered concluded, but it will be difficult for the agent to receive remuneration.

Firstly, the agent will be able to claim it only after he submits to the principal a report on the actions performed (paragraph 3 of Article 1006 of the Civil Code of the Russian Federation). The principal is obliged to pay the award within a week from the receipt of such a report.

Secondly, the amount of remuneration will be calculated according to the rules of paragraph 3 of Article 424 of the Civil Code of the Russian Federation (paragraph 2 of Article 1006 of the Civil Code of the Russian Federation). This means that the agent will be able to receive the amount that, under comparable circumstances, would normally be charged for similar services. In the event of a dispute, the obligation to prove the amount of remuneration will lie with the mediator as an interested party (clause 54 of the resolution of July 1, 1996 of the Plenum of the Supreme Court of the Russian Federation No. 6, Plenum of the Supreme Arbitration Court of the Russian Federation No. 8 “On some issues related to the application of part one of the Civil Code of the Russian Federation"). As a result, the amount of the award may be significantly less than what the agent expected when concluding the contract. Thus, if the agency agreement does not include a remuneration clause, then the procedure for calculating and collecting funds will be difficult for the intermediary.

2. The agency agreement will be considered not concluded. This negative consequence will occur only if the condition of remuneration is an essential condition of the contract (clause 1 of Article 432 of the Civil Code of the Russian Federation, clause 1 of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated February 25, 2014 No. 165 “Review of judicial practice on disputes related to the recognition of contracts as not concluded”; hereinafter referred to as information letter No. 165).

An essential condition regarding the award is, for example, when a lawyer acts as an agent. According to the law, the condition of remuneration is an essential condition of the agreement on the provision of legal assistance (subparagraph 3, paragraph 4, article 25 of the Federal Law of May 31, 2002 No. 63-FZ “On advocacy and advocacy in the Russian Federation”). An agreement with a lawyer can be concluded in the form of an agency agreement using the model of a mandate agreement. Consequently, in such a situation, the court may consider the remuneration clause an essential condition of the agency agreement.

In addition, the remuneration condition is significant if, during negotiations, one of the parties to the contract proposed the wording of this condition or stated the need to agree on a reward. In such a situation, the contract will not be considered concluded until the parties agree on the remuneration condition or the party that proposed this condition or announced the agreement of the reward refuses its proposal (clause 11 of information letter No. 165).

In what cases and when is it necessary to withhold agent VAT?

Agency VAT is paid in cases where the place of supply of work or services is recognized as the Russian Federation, but the taxpayer company (in our case, the parent company) is not a VAT payer in our country. In such a situation, the customer (in our case, a subsidiary) when paying for services, independently withholds 18% of the remuneration amount and transfers it to the tax authorities on the same day when the remuneration is paid.

All situations where the Russian Federation is recognized as the place of sale of services are listed in Article 148 of the Tax Code of the Russian Federation. Determining the place of sale depends on what services are provided. The key document in which this should be spelled out is the contract. Therefore, in order to accurately determine the need to pay agency VAT, the services provided must be clearly and in detail specified in the contract.

For example, agency VAT must be paid if a non-resident company provides consulting, legal, accounting, auditing, engineering, advertising, marketing, and information processing services to a Russian company. It is also common for a non-resident company to provide services related to the property of its subsidiary in Russia, for example, assembly, installation or repair of equipment at a plant.