What is a common system and who benefits from working on it?

The general system is the most complex and time-consuming. Under this regime, a large number of different taxes are calculated and paid, and a large number of reports are submitted. In addition, when using this system, the taxpayer is obliged to keep accounting thoroughly, in large quantities, for all events that occur in the life of the company .

You can choose to use the general system voluntarily and start working on it from the moment of registration of the organization (individual entrepreneur) or transfer it upon application from the new year.

In addition, firms and entrepreneurs who, for one reason or another, have lost the right to apply the special regime, for example when the amount of income for the period exceeds the amount, are starting to use the general system. Moreover, OSNO must be applied from the moment the right to use the special regime was lost.

There are a number of cases when working on a common system is quite profitable:

- When the majority of a company's counterparties work with VAT, it is possible to reduce the amount of tax that must be paid to the budget

- If an organization is engaged in export-import operations and imports goods from abroad

- When the bulk of transactions involves wholesale trade, the OSNO regime is also beneficial

- In addition, you can save on taxes if the organization has income tax benefits

| IMPORTANT! Upon state registration, all organizations and individual entrepreneurs automatically begin to apply the general system, unless an application for transition to a special regime has been submitted. |

It is worth noting the negative aspects of using this system:

- With OSNO, it is necessary to keep records, which are quite complex,

in full

- The system contains many tax objects

- Company documentation and all records must be kept in accordance with established requirements

- Additional contributions to the budget are possible

Insurance premiums for individual entrepreneurs for themselves

An individual entrepreneur does not have an employer, so he fulfills his responsibilities for his pension and health insurance independently. This means that the entire period of registration as a business entity must pay insurance premiums for yourself.

The fixed amount of insurance premiums is established by the Tax Code, and these figures are known in advance:

- for 2020 - 32,448 rubles for pension insurance and 8,426 rubles for medical insurance, a total of 40,874 rubles.

- for 2021 – 36,455 rubles for pension insurance and 8,763 rubles for medical insurance, a total of 45,218 rubles;

Contributions are required to be paid, i.e. they must be paid even in the event of losses, low income or complete absence of activity.

If an entrepreneur runs a business in parallel with being employed, he still has to pay his own contributions. It does not matter here that the employer, under an employment or civil law contract, also pays contributions from the salary.

In this case, the individual entrepreneur’s contributions for himself are summed up with the payments that the employer pays for him and accumulate in the account of the insured person. Theoretically, the pension of an entrepreneur who combines hired work and his own business should be higher. However, given the instability of the Russian pension system, this is difficult to say.

If an individual entrepreneur was opened by a pensioner or a disabled person receiving a pension, he does not have any benefits in paying contributions. There are only a few situations in which the calculation of insurance premiums for individual entrepreneurs for themselves is temporarily suspended:

- military service by conscription;

- maternity leave for up to one and a half years;

- caring for a disabled child, a disabled person of the 1st group, an elderly person over 80 years old;

- living with a spouse - a military serviceman under a contract or abroad with a spouse sent to diplomatic missions and consulates of the Russian Federation (in total, no more than five years).

Moreover, the mere presence of one of these circumstances does not exempt you from paying contributions. You must contact the tax office with documents confirming that the entrepreneur is temporarily not operating.

Thus, if you are interested in how much to pay for an individual entrepreneur, pay attention to the contribution figures indicated above. This is the minimum, less than which you cannot pay.

If your business generates income of more than 300,000 rubles per year, then you must additionally pay another 1% of income above this amount. For example, if you earn 830,000 rubles in 2020, then contributions will be 40,874 + (830,000 – 300,000) * 1%) = 46,174 rubles.

For those who were not registered from the beginning of the year, or were removed from tax registration before the end of the year, the required contribution amounts are reduced accordingly. So, if you registered an individual entrepreneur on July 1, 2020, then mandatory contributions will be only half of the full annual amount.

This rule does not apply to the additional 1% contribution. Suppose you had individual entrepreneur status for only two months, but during this time you earned 500,000 rubles. This means that contributions will amount to 6,812 rubles for two months plus (500,000 – 300,000) * 1%), i.e. 8,812 rubles.

But the good news is that paying your own insurance premiums can significantly reduce your business taxes. To understand the issue (and this is a direct saving of your business expenses), you need to know what taxes the individual entrepreneur pays.

Free tax consultation

Basic taxes when using the common system

If an organization uses the general system, it is faced with the calculation and payment of the following taxes.

| Tax | Tax rate | Payment deadline |

| Income tax | Total 20%: 3% to the Federal Budget 17% to the subject’s budget For taxpayers listed in Art. 284, 284.1, 284.3 of the Tax Code of the Russian Federation, a rate of 0% is used | You can transfer tax advances monthly - until the 28th day You can pay advance payments quarterly (clause 3 of Article 286 of the Tax Code of the Russian Federation) - until the 28th day of the month |

| VAT | There are 3 VAT rates: – 0% – 10% – 20% | A third of the total tax amount is paid every month, until the 25th |

| Organizational property tax | The tax rate is set at the local level, but cannot be more than 2.2%. The possibility of exemption from property tax is stated in clause 1.2 of Art. 373 Tax Code of the Russian Federation | Payment deadlines are regulated by local authorities |

Now let’s look at what taxes an individual entrepreneur calculates and pays if he uses the general system.

| Tax | Tax rate | Payment deadline |

| Personal income tax | 13%, 30% All income that will not be subject to tax is specified in Art. 217 Tax Code of the Russian Federation | Until July 15 of the following reporting year |

| VAT | Just like for organizations, 3 rates are allocated: – 0% – 10% – 20% | The tax must be paid monthly, before the 25th, 1/3 of the total tax amount |

| Property tax for individuals | The rate is set by local authorities and ranges from 0.1% to 2% depending on the region | Payment must be made by December 1 of the year following the reporting year. |

It is legally established that entrepreneurs do not pay income tax. Property tax is calculated and paid, but there is no obligation to file a declaration.

What are the different taxation systems?

You can choose from five taxation systems: one general taxation system (OSNO) and four special ones - simplified tax system, unified agricultural tax, UTII, PSN.

General taxation system (OSNO)

OSNO - general taxation system. It operates “by default” if, when registering an individual entrepreneur, you do not declare that you want to switch to one of the special modes.

OSNO is suitable for all types of business. With OSNO you need to pay value added tax (VAT) - it is more difficult to calculate and pay than taxes of other systems. OSNO is suitable for those who must pay VAT and those who have income tax benefits (for example, educational or medical organizations).

Do you need to pay VAT? Yes, if you plan to cooperate with organizations that pay VAT (budgetary organizations or manufacturing enterprises). Often it is much more profitable for them to buy goods/services only from those who also work under OSNO and pay VAT - so whether you have VAT can be critical for such partners.

According to OSNO they pay:

- income tax (20%);

- VAT (up to 20%);

- property tax (up to 2.2%);

- fixed insurance premiums for yourself (31.1% of the minimum wage for income up to 300 thousand rubles and 1% of income above this amount);

- insurance premiums for employees within the amount established by the tax code (from 15 to 30% - depending on the employee’s salary);

- Personal income tax for employees and for yourself (13%).

Simplified taxation system (STS)

She is a “simplistic” woman. The most common among individual entrepreneurs. The name corresponds to the content: it is easier to keep records and reports on it than on other systems. But the simplified tax system is not suitable for everyone: the income of an individual entrepreneur should not exceed 112.5 million rubles, and the number of company employees should not exceed 100. You cannot choose the simplified tax system if you produce goods with excise stamps (for example, tobacco or alcohol), or are engaged in insurance/banking services or your company has a branch.

The simplified tax system is regulated by Art. 346.12 Tax Code of the Russian Federation.

There are two types of simplified taxation system:

- income taxation;

- taxation of the difference between income and expenses.

According to the simplified tax system they pay:

- tax (from 6% on income and 5–15% on the difference between income and expenses, or 1% of income in case of loss - the rate depends on the region in which you registered the individual entrepreneur);

- fixed insurance premiums for yourself (31.1% of the minimum wage for income up to 300 thousand rubles and 1% of income above this amount);

- insurance premiums for employees within the amount established by the tax code (from 15 to 30% - depending on the employee’s salary);

- Personal income tax for employees (13%). To report, you need to submit an annual declaration by April 30 and pay tax advances according to the simplified tax system every quarter.

Patent tax system (PTS)

The only system that does not require filling out and submitting a tax return - easier paperwork, less bureaucracy. When registering as an individual entrepreneur, you will have to purchase a patent. A patent gives the right to a specific type of activity for a limited time - from 1 to 12 months.

Essentially, you pay tax when you buy a patent. It is not necessary to buy for a year at once; you can buy a patent for a month. The amount of tax does not depend on your income, but on the potential annual income of the business - it varies in different regions. The price of a patent per year (that is, the amount of annual tax) is 6% of this amount. Fixed insurance premiums do not reduce it (as is the case with OSN, simplified tax system and UTII).

You can calculate the tax when purchasing a patent on the Federal Tax Service website.

For example, the annual tax for a hairdresser in Moscow is 59,400 rubles per year. The tax for a hairdresser in Barnaul is 43,920 rubles for the year. The difference is fair, because the company’s profit in Moscow is expected to be higher.

Who is the patent system suitable for?

Entrepreneurs from the sphere of goods and services with an annual income of no more than 60 million rubles and a small staff of no more than 15 people. You can also choose such a system for a new small business - if you want to understand whether there will be demand, you can buy a patent for 1-2 months and understand the prospects.

PSN is regulated by Art. 346.43 Tax Code of the Russian Federation.

According to PSN they pay:

- 6% of potential income;

- fixed insurance premiums for yourself (31.1% of the minimum wage for income up to 300 thousand rubles and 1% of income above this amount);

- Pension Fund insurance contributions for employees - 20% of their salary (in exceptional cases, for example, small shops and cafes - 30%);

- Personal income tax for employees (13%).

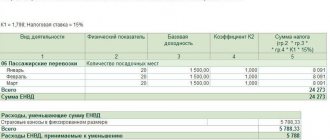

Unified tax on imputed income (UTII)

The so-called “imputation”. This tax is paid not on real income, but on imputed—potentially possible income. The rate - from 7 to 15% - depends on the region in which the business is registered.

Potential income is calculated according to certain indicators: if you have a business, then you should receive income. That is, you will pay a fixed amount of tax, regardless of how your affairs are in reality.

UTII is regulated by Art. 346.26 Tax Code of the Russian Federation.

UTII will cease to be valid in 2021 (it is no longer valid in some regions, for example, in Moscow). The list of activities for UTII is limited. In particular, UTII is suitable for the service and trade sectors - small shops and retail outlets with an area of less than 150 sq.m and with a staff of no more than 100.

According to UTII they pay:

- UTII from 7 to 15% - depends on the region in which the business is registered;

- fixed insurance premiums for yourself (31.1% of the minimum wage for income up to 300 thousand rubles and 1% of income above this amount.);

- insurance premiums for employees within the amount established by the tax code (from 15 to 30% - depending on the employee’s salary);

- Personal income tax for employees (13%).

To report under this scheme, the UTII declaration must be submitted every quarter - no later than the 20th day of each month following the reporting quarter.

Unified Agricultural Tax (USAT)

According to this system, a low tax rate is more profitable than the tax under OSNO and even the simplified tax system, but it is not suitable for everyone. It is important that your enterprise does not just process or sell agricultural products, but produces them.

Unified agricultural tax is suitable for individual entrepreneurs who:

- receive at least 70% of their total income from the sale of agricultural products that they themselves produced;

- do not produce products that require an excise tax (if you grow excellent tobacco or produce cider from your own apples, the Unified Agricultural Tax will not suit you).

The Unified Agricultural Tax is regulated by Art. 346.3 Tax Code of the Russian Federation.

According to the Unified Agricultural Tax they pay:

- Unified agricultural tax 6% on profit (the difference between income and expenses);

- fixed insurance premiums for yourself (31.1% of the minimum wage for income up to 300 thousand rubles and 1% of income above this amount);

- insurance premiums for employees within the amount established by the tax code (from 15 to 30% - depending on the employee’s salary);

- Personal income tax for employees (13%).

An annual declaration using a special form is sufficient for reporting. Tax advances must be paid every quarter.

Reports submitted by legal entities and individual entrepreneurs to OSNO

The main reports submitted by taxpayers on OSNO are as follows:

- VAT declaration. This is a quarterly report, compiled based on the results of a specific quarter before the 25th of the month. The form was approved by order of the Ministry of Finance of Russia No. 104n dated October 15, 2009.

| IMPORTANT! The declaration is submitted exclusively through transmission via telecommunication channels. This rule has been in effect since 2020 |

If the declaration is submitted in paper form, for example, sent by mail, then it will be considered not provided and liability will follow in accordance with Article 119 of the Tax Code of the Russian Federation.

- Income tax return. Such a declaration is drawn up on a cumulative basis for 1 quarter, half a year and 9 months. Available until the 28th of the month. The annual declaration must be submitted by March 28

- Personal income tax. Entrepreneurs submit 3NDFL declarations (once a year, before April 30) and 4NDFL declarations (by the 5th day of the month following receipt of income). Organizations submit annual 2NDFL and quarterly 6NDFL

- Property tax declaration. Rent on an accrual basis for 1 quarter, half a year and 9 months until the 30th of the month. The annual declaration must be submitted by March 30

- Single simplified declaration. Sometimes it happens that the activities of an organization or entrepreneur freeze for a certain period. In this case, it is possible to submit a single declaration

- Individual entrepreneurs must create and maintain a book of income and expenses. It is formed in order to determine the personal income tax base. You can fill out both paper and electronic forms.

Let's display the main reports for OSNO in the table.

| Declaration | The period for which it is formed and submitted | Submission deadline |

| VAT declaration | Quarterly | Until the 25th of the month |

| Income tax return | Depending on the reporting period established, it can be compiled and submitted every month or every quarter. The annual declaration is drawn up at the end of the year | Until the 28th of the month Annual - until March 28 |

| Organizational property tax | Rented once a year | Until March 30 |

The VAT return is submitted only electronically. Other reports can be submitted on paper.

Do not forget that starting from 2020, taxes on property that is not real estate are not calculated or paid. That is, if a company has, for example, a car, then it no longer needs to pay tax on it.

LLC on UTII

The main tax that an LLC pays under this system is a single tax on imputed income. In essence, it replaces the income tax.

UTII can be used by LLCs providing certain types of services. The tax rate is 15%. The tax is paid regardless of the income of the LLC in the reporting period. The tax amount is affected by physical indicators (area, number of vehicles, etc.) and special coefficients.

In general, LLCs do not pay VAT on imputation. VAT will have to be paid if the LLC allocates tax in the sales documents. You will have to pay VAT when importing goods, when working under a joint activity agreement or a property trust management agreement on the territory of the Russian Federation.

Property tax must be paid only on the cadastral value of objects.

Expert opinion

The supplier has shipped the goods to the buyer. After some time, the buyer returned part of the goods. It should be borne in mind that with such a return, if the buyer has not registered the goods, the seller must issue an adjustment invoice for the amount of the return.

Deputy Director of the Department of Tax and Customs Tariff Policy O.F. Tsibizova

The reporting that needs to be submitted for employees will also be reflected in the table.

| Report | The period for which it is formed and submitted | Submission deadline |

| 2 personal income tax | Annual | Until April 1 of the following reporting year |

| 6 personal income tax | Quarterly | Until the last day of the month following the reporting quarter |

| Calculation of insurance premiums | Quarterly | Until the 30th day of the month following the reporting quarter Annual - until January 30 |

| 4 FSS | Quarterly, cumulative | Until the 25th day of the month following the reporting quarter |

| Information on the average number of employees | Annual | Until January 20 |

| SZV – M | Monthly, submitted to the Pension Fund | Until the 15th |

| SZV – Experience | Annual, submitted to the Pension Fund | Until March 1 |

| IMPORTANT! Since 2020, an updated form of 2NDFL certificates has been used, regulated by Appendix No. 5 to Order of the Federal Tax Service of Russia No. ММВ-7-11/566 dated 10/02/2018. |

Types of mandatory payments

There are several expenses that almost every resident of our state makes every month:

- Utility bills - quarters, water, electricity, gas, heating and other services provided by the management company are paid by each homeowner. This payment is required, since evasion of payments will lead to you being disconnected from certain benefits, and may ultimately result in eviction or the arrival of bailiffs.

- Taxes and social contributions. Everyone knows firsthand about various extortions in Russia. When we receive wages, we pay personal income tax and also make payments to social funds. When paying for purchases in a store, we pay value added tax. Property owners pay property tax, and car owners pay transport tax, and so on.

- Loans. Today, about 55 million people have a debt to a credit institution, credit cooperative or microfinance organization. Each of them is forced to pay a certain amount of debt every month, which certainly affects the balance of funds in the wallet for everyday expenses.

Preparation of financial statements when using a common system

Accounting statements are the main set of reports that can tell everything about a company’s activities. This is the history of the company for the year.

Individual entrepreneurs, as a general rule, do not keep accounting records and, accordingly, do not prepare financial statements.

The composition and form of reporting depends on who provides it - a small enterprise or a large company, a commercial organization or a non-profit.

Small businesses are allowed to provide reporting in a simplified form. Fewer lines inside the report, only 2 forms. If desired, you can prepare an explanatory note for the reporting.

For large enterprises, it is required to fill out all forms of financial statements. There are 5 such forms in total. The level of detail is very specific.

If we are talking about non-profit organizations, then in addition to the balance sheet, it is necessary to provide a form on the intended use of funds. If such an organization has commercial activities, then a report on financial results is also prepared. The reporting package is submitted in a simplified form.

Individual entrepreneurs are luckier in this regard. The state has given them the opportunity not to conduct accounting, so financial statements may not be prepared.

The balance sheet and the forms attached to it can be used not only within the organization. If you need to take out a loan for business needs, the bank will, of course, require financial statements to see how the company is developing and how it lives. Moreover, the report will need to be provided for the quarter.

Unified agricultural tax

At its core, the Unified Agricultural Tax is very similar to the simplified taxation system Income minus expenses. Here the tax is also calculated from the difference between income and expenses, but the rate is not 15%, but only 6%.

However, only agricultural producers, fishing enterprises and those who provide them with certain services (field preparation, processing and sowing seeds, harvesting, maintaining and caring for farm animals) have the right to work for the Unified Agricultural Tax.

In addition, starting from 2020, Unified Agricultural Tax payers were required to pay VAT. But you can get an exemption from it if the entrepreneur’s income for three months does not exceed 2 million rubles.

Transition to a common system from simplified

Many entrepreneurs use the simplified system; it is a convenient system that allows you to save on taxes and not have to submit so many reports.

However, for one reason or another, sometimes a transition from a simplified system to a general one may occur.

If an organization has decided to switch to OSNO, then this can only be done in the new year. In this case, before January 15, it is necessary to submit notification 26.2-3 of the refusal to apply the simplified tax system.

More often, situations arise when an organization or entrepreneur simply “flies” from the special regime due to non-compliance with the working conditions under it. For example, if income exceeded the established limit. In this case, the transition to OSNO occurs from the quarter in which the condition was violated.

Land tax

Land taxes must be paid by enterprises, and revenues are sent to local budgets. The use of land in the Russian Federation is paid. In this case, land tax, rent and the standard cost of land must be paid. Land owners and users are required to pay land tax every year.

For the acquisition of plots in cases provided for by the Land Code of the Russian Federation and for obtaining a bank loan secured by land, the standard cost of land applies.

The introduction of land payments is intended to create incentives for rational land development, equalization of socio-economic conditions for farming, increasing soil fertility, creating special funds for financing activities and infrastructure development.

The amount of land tax is influenced by the results of the economic activities of land owners.

Frequently encountered errors and questions on the topic

Mistake #1.

The organization has a mobile phone that employees use for work. Sometimes employees have personal conversations using it. In this case, only the amount of VAT on business calls can be deducted.

Mistake #2.

The organization bought the goods in another city. The delivery brought the purchase, and it was decided to send the documents by mail. The goods have been received and registered using a scan of the original document. Over time, the accountant never received the original. The tax office does not accept VAT as a deduction in such a situation, especially if there is nothing else to confirm the purchase.

Who pays for loans and how much?

The level of debt among the population has been actively growing in recent years. The fall in the Central Bank's key rate stimulated the growth of lending markets by lowering borrowing rates, and Russians went to banks to fulfill their pent-up demand for an apartment, car and other needs. As a result, according to the United Credit Bureau, 8 million Russians have driven themselves into almost credit bondage and pay about 50% of their income to the bank. The total number of borrowed people is about 55 million people.

Today, according to the Central Bank, the volume of debt of Russians to credit and other financial institutions is about 15 trillion rubles. And over the past 10 years, this figure has increased almost 4 times. On average, according to experts from the All-Russian Popular Front, each family has a debt of 260 thousand rubles. Depending on the terms of the loan and the type of loan, the encumbrance may be different. For example, in the case of a regular consumer loan, where the rate is around 17-20%, citizens will pay approximately 10 thousand per month if the loan is taken for 2 years.

Is it possible to pay counterparties in cash while using a common system?

All organizations and entrepreneurs who conduct cash payments are required to use cash registers (the deadline for installing cash registers is until July 1, 2020). With such calculations, the transaction amount cannot exceed 100 thousand rubles. If these conditions are met, then the organization can make cash payments without any problems.

It should be remembered that the general tax system is a rather complex regime; when working on it, many nuances and complex situations arise. Not all organizations, and especially entrepreneurs, can afford to work on such a system. Nevertheless, there are a large number of enterprises that use it quite successfully. There are situations when it is possible to work only on a common system, then there is no choice. Or the organization operates in such a way that the tax burden is not critical. Individual entrepreneurs using OSNO are still not common.

Tax refund for 2020 for self-employed citizens

Individuals who switched to paying tax on professional income will receive a refund of the tax they paid last year.

Let us remind you that the tax regime for the self-employed is an experiment that will last ten years: from January 1, 2020 to December 31, 2028 inclusive. Last year it operated in four regions: Moscow, Moscow and Kaluga regions, as well as in the Republic of Tatarstan. In the period from January to June 2020, NAP can be paid in another 19 regions. And starting from July 2020, NAP is allowed to be applied in all constituent entities of the Russian Federation without exception.

In addition, all self-employed citizens will be provided with “tax capital” in the amount of one minimum wage (RUB 12,130). According to the president, with this capital, self-employed persons this year will be able to “make tax payments without diverting their own funds, preserving their income.”

Fill out payments in the web service for individual entrepreneurs for free