document

Notes. 1. When leaving for several points, notes on arrival and departure are made separately in each of them.

2. If a business traveler is provided with paid or free accommodation, a representative of the organization makes a corresponding note indicating the days, which is signed and sealed. The same if it was not provided.

- Calculation: samples (Full list of documents)

- Search for the phrase “Calculation” throughout the site

- “Calculation of travel expenses.”doc

- Documents downloaded

Entered into the database

Corrections have been made to

- Treaties

- All documents

- Holidays and weekends calendar for 2019

- Small business registration is useful

- How to draw up a contract yourself

- OKVED code table

On our website, everyone can find a contract or a sample document of interest for free; the database of contracts is updated regularly. Our database contains more than 5,000 contracts and documents of various types. If you notice an inaccuracy in any agreement, or the impossibility of the “download” function of any agreement, please contact us using the contact information. Have a good time!

Today and forever

— download the document in a convenient format! A unique opportunity to download any document in DOC and PDF absolutely free of charge. Only we have many documents in such formats. After downloading the file, click “Thank you”, this helps us form a rating of all documents in the database.

Average earnings during a business trip in 2020

So, the first payment that a seconded worker is entitled to is his average earnings.

Calculation formula

Average daily earnings are determined by a simple formula: income accrued for the billing period is divided by the number of days in the same period.

| Average daily earnings | = | Income accrued for the billing period | Number of days in the billing period |

Let us examine in more detail the elements of this formula.

Billing period

As a general rule, the billing period includes the previous 12 calendar months.

Example

The employee is going on a business trip from February 10, 2020. The billing period is from February 1, 2020 to January 31, 2020.

If the employee has not yet worked for the company for a full year, then all months worked are taken into account. And if a newly registered employee travels on company business, instead of the average earnings, he is paid a salary.

What is and is not included in the calculation of average earnings

The amount of income for the billing period does not include all accruals in favor of the employee. And only those that are related to his work activity:

| Included in the calculation of average earnings | Not included in the calculation of average earnings |

|

|

Number of days in the billing period

For average earnings during a business trip, working days for the previous 12 months are taken into account. The days when the employee received payments that are not taken into account in the average earnings are subtracted from the total. For example, days of illness or child care.

Step-by-step instruction

Knowing the initial data, calculating average earnings comes down to simple steps:

| Step | What to calculate | How to calculate |

| Billing period | 12 previous months | |

| Total earnings | Salary, allowances, additional payments, labor bonuses | |

| Settlement amount | Check that your total earnings do not include excluded amounts | |

| Number of days in the billing period | Calculate the number of working days, subtract the days for which excluded amounts were accrued | |

| Average daily earnings | Divide the amount obtained in step 2 by the number of days obtained in step 4 | |

| Accrual for the period of business trip | Multiply the amount received in step 5 by the number of days of travel |

Additional payment before salary

The calculated average daily earnings may be significantly lower than the employee’s normal daily salary. An employment contract or local act of the company can provide for a condition for additional payment before salary. This additional payment is fully included in income tax expenses (clause 25 of Article 255 of the Tax Code of the Russian Federation, letters of the Ministry of Finance dated December 3, 2010 No. 03-03-06/1/756 and dated September 14, 2010 No. 03-03-06/2/ 164).

Example

The employee goes on a business trip from February 17 to February 20, 2020, for a total of 4 days. The billing period is from February 1, 2020 to January 31, 2020. There are excluded days:

- 11 days of newsletter,

- 28 days of annual leave.

During the billing period, the employee received payments:

- Salary – 718,000 rubles,

- Vacation pay - 48,000 rubles,

- Sick leave – 22,000 rubles.

We calculate the average earnings for the travel period:

- Billing period – from February 1, 2020 to January 31, 2020, a total of 247 working days,

- Total earnings – 718,000 rubles,

- Number of days of the billing period - from 247 days we subtract 11 days of sick leave and 28 days of vacation, we get 208 days,

- Average daily earnings – 718,000 / 208 = 3,451.92 rubles,

- Accrual for the duration of the trip – RUB 3,451.92. * 4 days = 13,807.68 rubles.

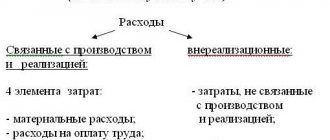

What applies to business travel expenses?

Most of the employee's duties must be performed directly at his main place of work. However, there are often situations in which it is necessary to send an employee to another location. For example, to submit reports to a higher authority, to undergo retraining, or to conclude an agreement. Regardless of the purpose of the trip, travel expenses must be paid by the employer and then reflected in the organization's accounting records.

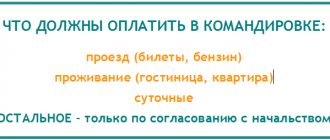

What is required by law (Article 168 of the Labor Code of the Russian Federation):

- The employee’s workplace, as well as the position, will be retained for the entire period of absence - being on a business trip.

- Average salary for all days of stay on a business trip. Let us remind you that days of downtime, days of departure and arrival, as well as days of travel are subject to payment.

- Travel and accommodation expenses. The employer is obliged to pay at his own expense for rented housing, as well as the employee’s transportation costs.

- Costs that compensate for the inconveniences associated with a specialist living outside his home, that is, outside his main place of residence. Such costs are also called per diem.

- Other expenses. For example, purchasing teaching aids or additional supplies. However, such expenses must be agreed upon separately with management. Otherwise, the employee will not be reimbursed.

Payment of wages instead of travel allowances

In some situations, the average salary that is maintained during an employee's work trip is less than his current salary. In this case, the employer has the right to pay the employee the existing difference.

According to labor legislation, while a person is on a business trip, he must retain his job, as well as his average salary. On those days when he is on business trips, by law the employer is obliged to pay him only the minimum payments, based on the number of days and the average salary.

However, according to the law, the employer does not have the right to worsen his situation, and there is no talk of improving it. So the employer has the right to compensate the employee for the difference between his salary and travel allowances, if such compensation is specified in the employee’s employment contract or in the work code of the company.

The Ministry of Finance supports this position of employers, therefore accountants have the right to take into account the costs of additional payments as part of the expenses that go towards employee salaries.

However, the accountant does not have the right to calculate only the employee’s salary. In any case, a specialist will have to calculate the average earnings for business trips in order to avoid mistakes. After all, if travel allowances are paid worse than the average salary of an employee, then this is not just a mistake, but also a violation of labor laws.

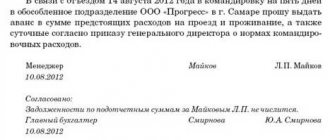

Example: claim for travel expenses

If an employee wishes to receive an advance in cash for travel expenses, an invoice does not need to be specified.

Please note that the application must be checked by the responsible accountant before being submitted to the manager. The accounting employee must verify the correctness of calculations for the number of days, according to the limits established by the institution and other conditions.

Then the manager endorses the application. Based on the document, you can immediately issue funds or draw up an order.

How to count trips abroad?

Many large organizations that cooperate with foreign partners often send their representatives to other countries on business trips. But what about calculating the funds that should cover the employee’s expenses during the trip?

Most often, the amount of daily allowance paid to an employee when traveling abroad is determined by management and specified in the employment contract. Also, the amount must be negotiated with the employee immediately before the business trip, especially if the employee is not going on such a business trip for the first time.

Option No. 1. Limits approved

If the institution has limits on business travel expenses in separate local regulations, then ask to provide this information. Calculate the amount of the requested advance using the formula:

Transport costs are rarely limited, since tickets (travel) are paid upon delivery. However, it should be borne in mind that the employer has the right to refuse reimbursement of expenses for travel on certain types of transport. For example, a taxi ride when there are regular flights (train, bus). They may also refuse to pay for a premium seat (business or first class ticket).

The employee is sent to Tver for 11 days. The institution has the following limits:

- daily allowance - 200 rubles per day;

- accommodation - 700 rubles per day;

- actual travel.

Therefore, a specialist has the right to claim:

Daily allowance - 2200 (11 × 200 rubles), accommodation - 7000 (10 × 700) and 2000 for tickets at actual cost (1000 one way).

Option number 2. No limits

If the institution does not provide restrictions on who. expenses, estimates can be drawn up for a larger amount. However, you should not escape reality. All the same, the costs will have to be documented. In addition, a luxury hotel room and a business class flight are unlikely to be paid for using budget money.

How to plan costs correctly:

- Check the cost of tickets (train, bus, plane, etc.). Include the best travel option to your destination in your travel cost estimate.

- Book your hotel room. When making a reservation, immediately check the cost per day. Take this price into account in your calculations.

- Daily allowance. The amount of such costs should be agreed with management. Let us remind you that there are no restrictions in the legislation. However, if the amount exceeds 700 rubles per day when traveling within Russia and 2,500 rubles per day for foreign business trips, then the difference is subject to taxation (personal income tax and insurance contributions).

What documents are needed for a business trip?

Let's say the application for an advance payment is approved. What to do next?

First of all, draw up an order to send a specialist on a business trip. In the administrative act it is necessary to indicate not only the full name. and the position of the employee, but also the period of business trip, destination, purpose of the trip. It is acceptable to provide additional information about the job assignment. For example, write in the order “sent for submission of annual financial statements to the Ministry of Education.”

Use the unified order form No. T-9 (OKUD 0301022), approved by Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1.

The use of a unified order form is not necessary. The institution has the right to use a form developed independently. However, regardless of the chosen form of the document, it must be fixed in the accounting policy.

Final provisions

7.1.

To the employee in the manner established by Art. 192 – 193 of the Labor Code of the Russian Federation, a disciplinary sanction may be applied: – for late submission or execution of documents listed in clauses 7.1.7 – 7.1.8 of these Regulations;

– for the absence in the travel certificate of marks (signatures and seals) of the institution (institutions) to which the employee was sent.

7.2. For all other issues not regulated by these Regulations, the current labor legislation applies.

- Federal Law of December 6, 2011 No. 402-FZ “On Accounting”.

- Instructions for the use of the Chart of Accounts for accounting of budgetary institutions, approved. By Order of the Ministry of Finance of the Russian Federation dated December 16, 2010 No. 174n.

Example of filling out a unified document

In addition to the order to send on a business trip and pay an advance for travel expenses, the employer must issue a work assignment. This document contains a list of duties that the employee must perform while traveling. However, the formation of a job assignment is not mandatory. It is quite enough to list the duties and purposes of the trip in the order.

Just a couple of years ago, it was possible to confirm travel expenses only with a special document - a travel certificate. Other checks and receipts were considered secondary documents. Currently, legal norms have changed. Now you do not need to issue a special certificate. But many institutions continue to issue the canceled form. Why?

Firstly, the validity of the form was preserved. Officials only determined that the document has now become optional. However, it can be issued at the discretion of the company management. Secondly, the ID allows you to confirm your daily expenses. Thirdly, the form allows you to mark the receiving party. That is, confirm that the employee has arrived at his destination.

You can develop your own certificate form or use the unified form No. T-10 (OKUD 0301024), approved by Resolution of the State Statistics Committee of the Russian Federation No. 1 of 01/05/2004.

What do you need to know when calculating travel allowances?

It proudly bears the name of the most important document, because without it the trip will be anything but a business trip. This order will also be needed in order to include expenses for business trips as tax expenses. So, according to established tradition, a business trip order is prepared by an employee of the personnel department or another authorized person.

This means that you have the right to entrust the execution of official tasks in your own city, but in another company. But not everyone shares this opinion.

But when performing work duties outside the enterprise, an employee of the company should not experience material losses.

Thus, sending an organization’s employees, for example, to a remote area of the city or a neighboring settlement should be considered as a business trip, regardless of the length of the employee’s stay in this place on behalf of the employer.

How to report travel expenses

Expenses incurred on a business trip must be reimbursed by the employer. Of course, within the established norm, in compliance with expediency and validity, as well as in the presence of supporting documents. So, how to confirm a specific type of cost:

- Transport. For this category of expenses, supporting documents are tickets, checks and taxi receipts, electronic receipts (for example, when issuing an electronic ticket).

- Housing. A receipt from a hotel or a rental agreement can confirm the rental of housing. Please note that when renting a home from third parties, it is necessary to check the correctness of the lease agreement. You should also be given a check, receipt or receipt indicating that you have received money to pay for the rent. Incorrectly completed documents cannot be accepted for registration.

- Daily allowance. It will not be possible to confirm this category of travel expenses with a special document. Previously, an identity card was used for this; now it is not necessary to use this form. You can confirm the number of days using your tickets.

- Other expenses. To receive reimbursement for other types of expenses while traveling, please attach receipts, sales receipts, receipts, invoices and other documents. Please note that such costs should be agreed upon with management in advance. Otherwise, you may be denied payment.

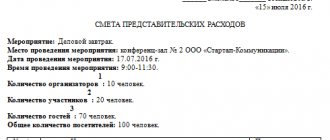

Sample estimate for hospitality

An estimate as a plan for upcoming expenses is one of the main documents that will help justify the expenses incurred for a representative event. Its form is not established . Therefore, taxpayers develop estimates themselves and approve them by order.

Typically, the estimate form contains the following information:

- the inscription “I approve” (the estimate is approved by the head or chairman of the commission, whose powers include making a decision on the validity and expediency of entertainment expenses);

- the name of the document itself;

- name of the proposed event;

- a tabular part in which the name of the upcoming expenses, the number of participants and the amount of expenses are indicated.

Further, from our website, using a direct link, you can get free estimates for entertainment expenses.

EXAMPLE OF ESTIMATE FOR REPRESENTATION COSTS

Features of accounting

In the accounting of a budgetary institution, travel expenses should be reflected in the appropriate account:

- to reflect daily allowances - 0 208 12 000 “Settlements with accountable persons for other payments”, according to KVR 112 and KOSGU 212;

- to reflect other costs - according to subaccount 0 208 26 000, according to KVR 112 and KOSGU 226.

New provisions have been in effect since 2020 (Orders of the Ministry of Finance No. 132n and No. 209n).

However, if the payment for housing is carried out by the organization itself, for example, an agreement for the provision of services has been concluded between the institution and the hotel, then such costs are reflected in account 0 302 26 000. And if payment for the hotel is carried out under an agreement between the organization and the hotel, but with accountable money through an employee, such costs We reflect on the account 0 208 26 000.

A similar procedure is provided for purchasing tickets. So, for example, if an employee himself bought a ticket for a train (bus, plane), then travel expenses for transport are reflected in account 0 208 26 000, according to CVR 112. If the institution entered into an agreement with a transport company and transferred money for the ticket from the current account , reflect the costs at 0 302 22 000, use KVR 244. But if the employee paid under such an agreement with accountable money, then reflect the transaction at 0 208 22 000, KVR 244, KOSGU 222.

Duration of business trips

2.1.

The duration of a business trip for an employee (workers) is determined by the head of the institution (other authorized person), and in relation to the head of the institution - by the founder, based on the goals and objectives that the employee (workers) have to solve. 2.2. Extension of the business trip of an employee (workers) is allowed in case of production necessity on the basis of an order from the head of the institution (other authorized person).

Cancellation of an upcoming business trip for reasons beyond the employee’s control is also formalized by order.

2.3. The early return of an employee from a business trip due to various reasons is agreed upon with the immediate supervisor.