Definition and formula for calculating capital productivity

The calculated capital productivity ratio will indicate what return each ruble invested in fixed assets brought in as a share of revenue from the sale of finished products. This indicator will clearly demonstrate whether equipment, other equipment and fixed assets are used effectively.

The formula for calculating capital productivity (CR) is as follows:

FO = VP / OSsg,

Where:

VP - revenue from sales of finished products (less value added tax and excise taxes);

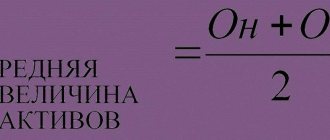

OSsg is the average annual cost of fixed assets at the beginning of the year.

If we use balance sheet data, this formula will take the following form:

FO = line 2110 in form 2 / ((line 1150 Bng + line 1150 Bkg) / 2),

Where:

Bng and Bkg are lines in the balance sheet at the beginning and end of the year, respectively.

When using the average annual cost of fixed assets (hereinafter referred to as fixed assets) in calculating capital productivity, a more accurate result is obtained. However, in most cases, the residual value of the asset is used to obtain a one-time indicator.

Explanation of the indicator

Capital productivity is an indicator of a company's business activity, which demonstrates the efficiency of using the company's fixed assets.

The value of the indicator indicates how many products are produced and services provided for each ruble of financial resources invested in fixed assets. It is calculated as the ratio of sales volume (revenue) to the average annual amount of fixed assets. The residual amount of the cost of fixed assets is taken into account. Using this indicator, you can understand the efficiency of using the company's fixed assets.

Related materials

- Relative indicators of business activity (turnover)

- Accounts payable turnover ratio

- Inventory turnover ratio

- Working capital turnover ratio

- Asset turnover ratio

How are capital productivity and capital intensity of fixed assets related?

Like capital productivity, capital intensity is an indicator indicating whether fixed assets are being used effectively. Only in contrast to capital productivity, capital intensity shows what share of investment in fixed assets falls on each ruble of output.

If the efficiency of equipment use increases (product output increases with a smaller amount of costs for machinery and equipment), then capital intensity falls and capital productivity increases.

You can read about the analysis of other such assets in our article “Procedure for analyzing non-current assets”.

When assessing the financial condition of an enterprise, it is also necessary to calculate other indicators - more about one of them in the article “Audit of the efficiency of using equity capital.”

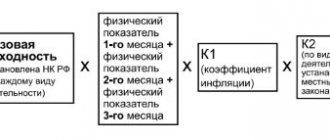

Factor analysis of capital productivity

To determine the strength of influence of various economic factors on the level of capital productivity, factor analysis is used in practice. Let's consider a two-factor, four-factor and seven-factor model of capital productivity.

Two-factor model of capital productivity

The two-factor model shows how the value of the capital productivity ratio is influenced by the structure of production assets.

Where:

Fa – active part of fixed production assets; N – volume of manufactured and sold products of the enterprise; F – fixed production assets.

Seven-factor model of capital productivity

The model makes it possible to assess the degree of interaction between the level of capital productivity of an enterprise and seven factors: the structure of fixed production assets, the structure of machinery and equipment in active assets, the shifts of machines and equipment, the average cost of a unit of equipment, the duration of a machine shift, and the efficiency of equipment operation. The formula looks like this:

Where:

Fmash – average cost of operating machines and machine tools; Tcm – number of machine shifts; с – average cost of equipment; Qd – number of machines and machines; I – duration of the period under consideration; Tch – the number of hours worked by machines and machines.

Four-factor model of capital productivity

This model allows us to determine the nature of the interaction between the level of capital productivity of the enterprise and the level of specialization, the coefficient of average capacity of the enterprise, the structure of fixed production assets and the turnover of the active part of production assets.

where: Noc – the company’s main products; W – average annual capacity of the enterprise.

The value of the capital productivity indicator

The standard value of capital productivity is established for each industry, i.e. there is no standard. Thus, for industries with a large number of machinery and equipment, the coefficient will be lower than in less capital-intensive industries.

It is recommended to analyze this indicator over a number of years. An increase in the value of the capital productivity indicator over time will indicate an increase in the efficiency of using equipment and mechanisms.

To increase capital productivity, it is necessary either to increase production through more efficient use of equipment, or to sell/liquidate those assets that are little or inefficiently used. Increasing the efficiency of using existing equipment is achieved through:

- replacing equipment with more modern and high-performance ones;

- increasing the number of shifts;

- improving the professional training of equipment maintenance personnel.

Definition of capital productivity indicator and what it characterizes

The capital productivity indicator , as one of the indicators of the use of a company's fixed assets, reflects the success of financial investments in the form of the resulting economic effect. If we simplify the formulation, then by calculating the capital productivity ratio , we will obtain the amount of ruble income attributable to each ruble of the cost of the enterprise’s assets used.

Fixed assets are understood as all material resources of the company that are not mobile in nature:

- buildings and premises;

- cars and equipment;

- energy routes and various pipelines;

- motor transport;

- intellectual property, etc.

Income is the company's sales revenue received in the process of selling products and services.

To calculate the capital productivity ratio, indicators of revenue and cost of resources of the enterprise at the end of the reporting period are used. The choice of revenue as the main parameter is due to the fact that it is the primary and obvious result of the activities of any commercial organization and is easy to account for. In some special situations, the calculations use not revenue, but sales profit (for example, when the cost of production is relatively low and amounts to less than 30% of revenue). As for the cost of fixed assets, you can take into account all of it, or only the active part that is involved in production processes.

The capital productivity indicator characterizes the turnover of funds invested in funds, which is an indirect reflection of the success of financing activities.

The study of the capital productivity ratio should be carried out in dynamics, using data from several reporting periods, which makes it possible to increase the accuracy of the results and obtain a more objective analysis of the situation.

In addition to the capital productivity indicator , in the process of assessing the quality of use of material resources, the capital intensity , the value of which will be discussed further.

Proper provision of an enterprise with funds and means is an important part of a successful business organization. To determine the amount of investment in the project, download from our website a full-fledged ready-made business plan, including calculations of important economic and financial indicators. Or order an individual “turnkey” business plan, taking into account all the specifics of the company being opened, depending on the chosen field of business.

Results

The capital productivity ratio will clearly indicate how efficiently the equipment is used.

Analysis of the indicator over time will allow us to draw conclusions about whether there is progress in the utilization of production capacity. And if the indicator continues to grow, it means that it is necessary to make a decision to replace the equipment with more high-performance equipment or to increase its load. You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

How to calculate capital productivity - formula

The calculation looks like this:

Capital productivity = Revenue / Fixed assets

By revenue here we mean the price of products when they are sold, and not profit, since the main goal of the indicator is to demonstrate the effectiveness of converting fixed assets into goods.

Using the capital productivity formula, you can calculate how much goods an enterprise produces per unit of labor. The ratio is often considered the main indicator of the quality of a company's fund management. Its calculation is necessary when comparing production efficiency in different companies. Return on assets shows the ability of managers to ensure the rational use of assets if the ratio is high. Low performance signals ineffective management.

The balance sheet indicator is calculated in the new reporting system as follows:

Capital productivity = Line 2110 ⁄ (line 1150 n. - line 1150 k.) ⁄2,

where: Page 2110 - line 010 from form No. 2, information about revenue received for the period under study; Page 1150 N. — line 120 from form No. 1, which indicates the total cost of fixed assets at the beginning of the reporting period; Page 1150 k. - a similar indicator of the cost of the operating system at the end of the period.

Capital productivity management

You can manage capital productivity based on managing the size of fixed assets and company revenue.

An increase in capital productivity is achieved through the following activities:

- Increase in labor and equipment productivity,

- Carrying out production automation;

- Increased equipment load;

- Development of a distribution network;

- Improving the quality and competitiveness of goods;

- Introduction of new technologies and innovations into the production process.

Some nuances of calculation

You can calculate the capital-labor ratio both for the entire enterprise and for a specific department or workshop. You can calculate the coefficient for the year, but measurements for each quarter will be more indicative. In addition, you can take into account both all employees, including managers and service personnel, and vice versa, exclusively “producing” workers.

A smart solution would be to track the indicator using several calculation options in order to understand how changes in staffing and the introduction of new machinery and equipment affect the economic characteristics of the enterprise.

Why is capital productivity needed?

Capital productivity demonstrates the practical return of material resources that corresponds to their investments and, in fact, is one of the main criteria for the effectiveness of investment policy in production . If we try to explain it even more simply, capital productivity shows what level of profit accrues for each ruble invested in production.

Fixed assets are production (usually non-mobile) property owned by an enterprise (this may include structures, buildings, technical units (for example, electrical lines), vehicles, patents or licenses, etc.).

Nowadays, such calculations do not carry any deep economic meaning, but imply a constant recalculation of the real cost of production assets /

Indicators: what are they measured in?

When calculating capital productivity, profit refers to income or revenue received from the sale of goods produced by the enterprise.

The capital productivity indicator characterizes the relationship, expressed in digital equivalent, between the amount of income and the amount of invested fixed production capacity , that is, to calculate it, you need to understand that, in essence, capital productivity is the ratio of profit to the used part of production assets.

Both revenue and the number of fixed assets are expressed in money (traditionally for Russia - in rubles), therefore the answer to the question of what “capital productivity” and “capital intensity” are can be in the ratio of rubles to rubles or, if the resulting figure is multiplied by 100 % is a percentage.

Thus, how capital productivity is measured depends on the desire of the accountant or on the requirements that are put forward in one form or another of reporting. Capital intensity is nothing more than an indicator inverse to capital productivity, therefore it is measured, accordingly, in the same units: in terms of rubles to rubles or as a percentage.

Calculation example

Above we examined the meaning of the capital-labor ratio, the purposes of its calculation and the features of interpretation. Next, a more specific example of the step-by-step calculation of this value will be presented.

- Calculation of the average annual value of the cost of means of production. It is known that the cost of all equipment at the beginning of the year was 10 million rubles, at the end - 15 million. Then the average is (10,000,000 + 15,000,000) / 2 = 12,500,000.

- Calculation of the capital-labor ratio for an enterprise with 240 employees: 12,500,000 / 240 = 52,083. 3.

Return on assets: what is it?

To begin with, we propose to examine the question of what capital productivity is. This indicator is used to display the amount of company income received through the sale of assets that belong to the fixed assets of the enterprise. The calculation of this coefficient allows you to obtain information about the effectiveness of the use of fixed assets. This group includes those assets whose value exceeds forty thousand rubles. It is important to note that these assets must be used in the production process for more than twelve months.

It is important to note that the indicator in question refers to dynamic values. This means that to obtain accurate data, you should study the company's activities over the past few years in detail. This step allows you to compare and identify the most effective methods of using the fixed assets. Many analysts, when making calculations, compare a particular company with its closest competitors. When conducting such events, it is very important that the selected firms are of a similar size.

According to experts, conducting an analysis of just one year of a company’s activity will not bring the desired result.

Using the capital productivity ratio allows you to determine the effectiveness of the operation of the main assets of the enterprise. When making calculations, you should take into account the market segment in which the company operates. In addition, economic indicators that can have a direct impact on the financial condition of the organization are taken into account. These indicators include:

- Inflation rate in a specific region.

- The level of demand for the product or service offered.

- The duration of each stage of economic cycles.

What is capital intensity

Another important coefficient characterizing the efficiency of use of means of production is called capital intensity. This indicator is considered opposite or inverse to capital productivity. Capital intensity shows how much of the cost of funds falls on 1 ruble of finished products.

We have already learned that capital productivity must increase, but capital intensity must decrease. It is the decrease in the coefficient, that is, the reduction in the cost of funds for products, that is a normative value, a positive trend. If the value of the indicator in the two periods being compared has increased, the enterprise is unreasonably planning the production process. If at the same time the capital productivity decreases (which is almost inevitable, since the indicators are inverse to each other), the risk of losses arises.

How to calculate the indicator

Now let's look at how to find this indicator and interpret the calculation results. The capital intensity formula is the reverse of capital productivity calculations and uses the same data.

Capital intensity = cost of fixed assets / revenue

or = ((value of funds at the beginning of the year + value of funds at the end of the year) / 2) / revenue.

However, calculations alone will not provide any information. They need to be interpreted in dynamics; the calculation results should decrease with each new reporting period. For example, let's calculate and analyze the data from the previous example:

- revenue - 2.5 million at the end of the first year and 3.1 million at the end of the second;

- the cost of funds is initially 450 thousand, at the end of the first year 420 thousand, at the end of the second 380 thousand.

We calculate the capital intensity:

- For the first year = ((450,000 + 420,000) : 2) : 2,500,000 = 0.174.

- For the second year = ((420,000 + 380,000) : 2) : 3,100,000 = 0.196.

Based on the results of the calculations, it became clear that the capital intensity has increased. This is an alarming indicator. This means that enterprises began to spend more means of production per 1 ruble of production. It is necessary to review the work process, identify the cause of inefficiency and eliminate it.

Brief information and capital intensity formula

Analysis of indicator dynamics: what you need to pay attention to

When carrying out analytical work regarding changes in the value of the indicator, it is important to carry out an analysis of individual elements, including changes in the share of production assets, changes in the structure of the general public fund and equipment productivity.

How to increase capital productivity

There are several real methods of increasing the indicator that really work:

- through changes in the structure of funds;

- increasing the value of the computer time utilization factor;

- reduction of total downtime at the enterprise;

- transition to the production of goods with high added value;

- general increase in productivity and event delivery.

Thus, the indicator is important for any industrial enterprise within the framework of its activities, informing management about the possibility of changes being carried out and modern technologies being used. When calculating the indicator, one has to deal with pitfalls; often companies end up using the services of third-party companies. Increasing this parameter may take a lot of time, but after it, the company will take a new path of development and increase profit indicators.

https://youtu.be/OKKqLkJk52c

Analysis of capital productivity ratios

In an internal analysis of an enterprise, the capital productivity indicator allows one to draw several important conclusions. A low value of the coefficient indicates that production volumes are insufficient for a given value of funds. To solve the problem, measures are being taken to increase sales volumes. If this is not possible, assets will have to be written off. High values indicate a need for a source of investment to expand production.

Among them are the turnover of certain groups of assets, such as inventories or accounts receivable. Such indicators are calculated by dividing revenue by the analyzed type of assets or liabilities.

Let's give an example: in 2008, OJSC Norilsk Nickel received revenue in the amount of 13,980 million, and the amount of the enterprise's funds amounted to 28,259.5 million rubles.

Capital productivity = 13,980 / 28,259.5 = 0.49

In the analyzed period, for every ruble of funds, 49 kopecks of revenue were received. Norilsk Nickel funds have returned 49%.

The dynamics of the company's asset turnover for 2005–2008 showed a decline. This indicates the ineffectiveness of the adopted policy for using funds owned by the enterprise. Since 2005, the growth rate of the amount of assets has been greater than the rate of increase in revenue of OJSC Norilsk Nickel: since 2007, the amount of funds has increased by 119%, and revenue - only by 44%. If negative dynamics continue, the company should revise its sales policy, attract investors, and eliminate unnecessary assets.

The influence of various factors on the capital productivity indicator

The success of a company is influenced by a number of factors, capital productivity is the first of them. But it is also influenced by various parameters, such as:

- armament and reconstruction;

- perfect use of available capacities;

- reduction in cost per unit of power;

- changes in the structure of funds;

- market development factors;

- quality of the goods offered.

The profitability of the company depends on these phenomena.

Calculation of capital productivity of an enterprise using an example

Let's calculate the capital productivity indicator based on the company's reporting data:

- Average annual cost of OS:

For 2020 – 1387 tr. ((1236 + 1538) / 2);

For 2020 – 1494 tr. ((1538 + 1450) / 2);

For 2020 – 1376 tr. ((1450 + 1302) / 2).

- Capital productivity of fixed assets:

In 2020 – 2.60 rubles. (3600 / 1387);

In 2020 – 2.54 rubles. (3800 / 1494);

In 2020 – 3.05 rubles. (4200 / 1376).

for 1 rub. The company's OS income received in 2020 was 2.60 rubles, in 2017 – 2.54 rubles, in 2020 – 3.05 rubles. Fluctuations in the capital productivity indicator - a decrease in 2020 and an increase in 2020 compared to 2020 - may indicate the introduction of new equipment or reconstruction of equipment in operation. This is evidenced by an increase in the cost of fixed assets and a slight decrease in the return on funds (to 2.54 rubles). Increasing the indicator to 3.05 rubles. in 2018 indicates an increase in output, labor productivity or rational use of operating systems (in a complex of factors or individually).

When a company has infrastructure facilities that are not used in production, but socially necessary, the economist will have to calculate the capital productivity minus the cost of these fixed assets in order to determine the capital productivity of fixed assets used in the production of goods.

Let's supplement the previous calculation with data: the average annual cost of unused fixed assets in 2020 is 320 tr., in 2020 - 302 tr., in 2020 - 284 tr.

Production capital productivity will be:

In 2020 – 3.37 rubles. (3600 / (1387 – 320));

In 2020 – 3.19 rubles. (3800 / (1494 – 302));

In 2020 – 3.85 rubles. (4200 / (1376 – 284)).

The trend of a decrease in the production capital productivity indicator in 2017 and an increase in 2020 continues, but the amount of income per ruble of the cost of fixed assets has increased. This indicator reflects income from operating assets directly involved in production.

To evaluate the performance of an enterprise, managers and analysts use the capital productivity indicator.

This is a financial ratio that determines the efficiency of a business. It shows the amount of revenue per unit cost of existing fixed assets (FPE). When analyzing turnover, capital productivity shows the ratio of revenue (volume of products sold) and the means of labor available to the company.